Andrei Rublev Trinity 1411

47

I’ve never seen 47 so pissed

This is going to end really bad…. for them. pic.twitter.com/D6H9GiytRX

— johnny maga (@_johnnymaga) October 4, 2023

RFK Housing

I have a plan that will lock home loans in at 3% interest for first-time homebuyers, lowering your mortgage payments by $1,000 a month — and it won’t cost the government a cent. Check it out. #Kennedy24 pic.twitter.com/4rwA0vNTXg

— Robert F. Kennedy Jr (@RobertKennedyJr) October 5, 2023

Matt Gaetz: “I agree with all of these reforms.”

The American people believe Congress is broken.

What is needed is not just a change of speaker, but also a bold reform plan to clean up the mess.

Ban PAC and lobbyist money, ban stock trading, enact term limits, and ban members of Congress from becoming lobbyists. pic.twitter.com/jnBZobIjPK

— Rep. Ro Khanna (@RepRoKhanna) October 4, 2023

Letitia

Some never-before-seen clips of New York Attorney General (@NewYorkStateAG) Letitia James (@TishJames). Forgive me, but if your sole purpose is to send a man to prison and you have said these things about him, how can this be a quest for justice? WATCHpic.twitter.com/GZCSlC75Yy

— Simon Ateba (@simonateba) October 5, 2023

Orban

Hungarian PM Orbán didn’t hold back

He calls out Biden, Soros, and the EU for trying to push their agenda on Hungary

He says his country will not fund an endless war Ukraine, turn into a migrant ghetto, or allow gender ideology in schools

— End Wokeness (@EndWokeness) October 4, 2023

Orban

#Brussels is creating an Orwellian world in front of our eyes. They buy and supply weapons through the #EuropeanPeaceFacility . They want to control the media through the #MediaFreedomAct . We didn’t fight the communists to end up in 1984!

— Orbán Viktor (@PM_ViktorOrban) October 5, 2023

“This is America today as misgoverned by Democrats, hard left security agencies, and a Woke military establishment. Don’t expect them to allow themselves to be overthrown by an election.”

• The Police State Targets Trump and Trump Americans (Paul Craig Roberts)

In the Democrats ongoing efforts to interfere in the upcoming election the Criminals Have Set the FBI after Trump Supporters and the IRS on Trump Donors. The presstitute Newsweek Magazine reports that “Exclusive: Donald Trump Followers Targeted by FBI as 2024 Election Nears” Zero Hedge reports that the IRS has brought five audits against Mike Lindell’s company, MyPillow. The Newsweek story reads like one handed to presstitute William M. Arkin by the FBI itself. In Newsweek’s opening lines, Arkin sets up Trump Supporters as “domestic terrorists.” “The federal government believes that the threat of violence and major civil disturbances around the 2024 U.S. presidential election is so great that it has quietly created a new category of extremists that it seeks to track and counter: Donald Trump’s army of MAGA followers.”

But not so quietly as to keep it from Newsweek. Arkin adds: “the vast majority of its current ‘anti-government’ investigations are of Trump supporters, according to classified data obtained by Newsweek.” If you doubt the narrative, you are anti-government. Where is the ACLU and Congress when freedom of speech is being criminalized? An anonymous FBI official cries on Arkin’s shoulder, explaining that the FBI simply has to prevent domestic terrorism and insurrections by Trump supporters, but by doing so “runs the risk of provoking the very anti-government activists that the terrorism agencies hope to counter.” In other words, the FBI is going to create the threat it warns about. According to Newsweek, Homeland Security and the FBI are discussing whether to employ against MAGA Republicans “the methods of counterterrorism developed over the past decade in response to Al-Qaeda and other Islamist groups.”

In other words, mass roundups, suspension of habeas corpus and due process, execution on suspicion alone. Bush/Cheney/Obama put these unconstitutional rules in place by presidential edicts. They built the foundation for the police state that is springing up around us. To be sure we get the message that Trump supporters are even a greater threat to Washington than Russia, China, and Iran combined, Arkin quotes the FBI: “”The threat posed by domestic violent extremists is persistent, evolving, and deadly.” Have you seen this threat? Where is it? What building has the threat blown up? What person has the threat assassinated? What city’s business center has it looted and burnt down? All the domestic violence has been committed by Black Lives Matter and Antifa and the Democrats gave them a pass. Instead of arrests, blue cities awarded the real domestic terrorists millions of dollars for being arrested for violating curfews.

According to Arkin, the FBI now officially recognizes “Trump and his army of supporters” as “a distinct category of domestic violent extremists.” This makes clear why the FBI created the January 6 “Insurrection” hoax and why the presstitutes hyped it to the hilt. Not even Gobbles could have turned a couple hundred unarmed people into an Insurrection, but the US media did. This orchestrated “Insurrection” is the basis for the demonization of Trump and half or more of US voters as “domestic extremists.” [..] This is America today as misgoverned by Democrats, hard left security agencies, and a Woke military establishment. Don’t expect them to allow themselves to be overthrown by an election.

“..the collapse of support for Ukraine will be attributable to the true collapse of American political culture..”

• Divine intervention and The End of The War in Ukraine (Doctorow)

CNN, EuroNews, the BBC: their broadcasts this morning were all about the vote yesterday in the U.S. House of Representatives to “vacate” the position of the Speaker, meaning the removal of Kevin McCarthy. Specialists on U.S. constitutional law have been given the microphone to explain what the duties and powers of the Speaker are, to tell us how this is unprecedented, the first time in U.S. history that a Speaker has been removed from office. Political analysts have spoken on air at great length on who were the eight who precipitated the vote that brought down the Speaker. They have been described as trouble makers, rabble rousers who want only to obstruct the working of the federal government.

Some have taken this line of conduct back to the Tea Party rebels within the Republican Party, and to the later emergence of the most fervent Trump supporters who sought to overthrow the consensus of America’s ruling elites. There is a lot of truth in these characterizations, but they do not consider the positive side to the removal of the House leader and effective shutdown of the legislative branch of government. I will try to address that here. The most positive element is that it all validates the “checks and balances” notion of governance that was a guiding principle of the nation’s founders. The whole country has been run under successive Democratic administrations as if there is no alternative, as if “checks and balances” were not applicable to those who are the heralds of progressive humanity, meaning themselves.

All of those who have disagreed with the Democratic party positions on everything and anything are, in the apt words of candidate Hilary Clinton in 2016 “deplorables.” Well, yesterday the deplorables had their day in court and they won. Why am I saying all of this in a newsletter that is dedicated to foreign policy issues? Because the net result of the removal of Mr. McCarthy yesterday is to halt for an indefinite time all substantive work to restore to the federal budget the $6 billion or so of the total $24 billion for 2024 that was deleted from the compromise budget bill that passed Congress this past weekend and was signed by the President to finance the working of the federal government for the coming 45 days. I take “indefinite time” to be rather prolonged, given that the internecine war going on within the Republican party on Capitol Hill is fierce and uncompromising.

This creates the real possibility that there will be no stratagem, no dirty trick that Biden and his fellow war criminals in power can turn to continue assistance to Ukraine. Absent this oxygen, the Ukrainian war effort will shut down rather swiftly. Europe will be aghast but is unable to fill in for the missing American contribution. The irony of these developments is that the Ukrainian war may end for entirely arbitrary reasons within the U.S. power structure. All the efforts of Jeffrey Sachs and John Mearsheimer that brought to the attention of millions of youtube watchers the guilt of the West for this supposedly “unprovoked” war will have played no role in the denouement. Nor will one even be able to say that those in Congress who opposed further aid to Ukraine did so not because they are peace-niks but because they prefer to do battle with China. No, the collapse of support for Ukraine will be attributable to the true collapse of American political culture.

“We have stoked so much provocation in this, so much anxiety, overthrowing governments, starting multiple wars, pushing NATO enlargement, abandoning nuclear agreements, and then saying, ‘Oh, he doesn’t want to negotiate..’”

• Ukraine’s Backers Blinded By Russia Hate – Jeffrey Sachs (RT)

Kiev’s globalist and neo-conservative supporters in the West are so driven by their hatred of Russia that they completely disregard the hundreds of thousands of Ukrainians who are dying in a futile effort to defeat Moscow’s forces, US public policy analyst Jeffrey Sachs has argued. Sachs, an award-winning economist who advised the Russian and Ukrainian governments following the breakup of the Soviet Union, made his comments in an interview posted on Thursday by US podcast host Andrew Napolitano. Asked how the US and its NATO allies can ignore the catastrophic destruction of Ukraine while prolonging the conflict and making false claims of battlefield successes, Sachs said they are “blinded” by their hatred of Russia.

“They are not counting the Ukrainian dead,” the analyst said. “They have lied to the public all along about the military situation . . . . They want so much to fight Russia and have someone else do the fighting and the dying that they want another massive recruitment of the remaining Ukrainian young men that can be grabbed off the streets and be thrown into the killing fields.” More than 83,000 Ukrainian troops have been killed during a Donbass counteroffensive that began in June, according to an estimate released by the Russian Defense Ministry last month. Despite knowing that the Ukrainians have no chance of making major gains on the battlefield amid Russia’s air superiority and artillery dominance, Kiev’s benefactors have shown a “grotesque” disregard for the heavy casualties, Sachs said.

He argued that the UK, in particular, has championed the counteroffensive because of London’s centuries-long and deeply embedded desire to crush Russia. sSachs, now a UN adviser and director of the Center for Sustainable Development at Columbia University, has argued that NATO’s expansion into Eastern Europe helped trigger the current crisis. He said Washington and its allies missed many opportunities to avoid the current conflict, then kept it going by discouraging Ukrainian President Vladimir Zelensky from finalizing a peace deal with Russia in March 2022. Responding to claims by former US Secretary of State Hillary Clinton that critics of Washington’s Ukraine policy are “siding with” Russian President Vladimir Putin, Sachs argued that he’s showing concern for the Ukrainian people.

“I don’t want Ukraine to be completely destroyed by these neocons, by their fantasy world, by their desire to throw Ukrainians by the hundreds of thousands to their deaths,” he said. He added, “This isn’t siding with Putin or siding with anybody. This is trying to protect Ukraine from American zealots.” Sachs claimed that US President Joe Biden must reach out to Putin to negotiate an end to the bloodshed, which would involve ruling out adding Ukraine to NATO, as well as addressing Russia’s legitimate security concerns. “We have stoked so much provocation in this, so much anxiety, overthrowing governments, starting multiple wars, pushing NATO enlargement, abandoning nuclear agreements, and then saying, ‘Oh, he doesn’t want to negotiate,’” the analyst said.

Is support for Ukraine waning? Jeffrey Sachs pic.twitter.com/u1eoUpZll3

— Ignorance, the root and stem of all evil (@ivan_8848) October 5, 2023

“Francis Fukuyama’s triumphalist post-Cold War vision of liberal democracy — published in 1989 — had a major blindspot. It omitted history.”

• No ‘End of History’ in Ukraine (Scott Ritter)

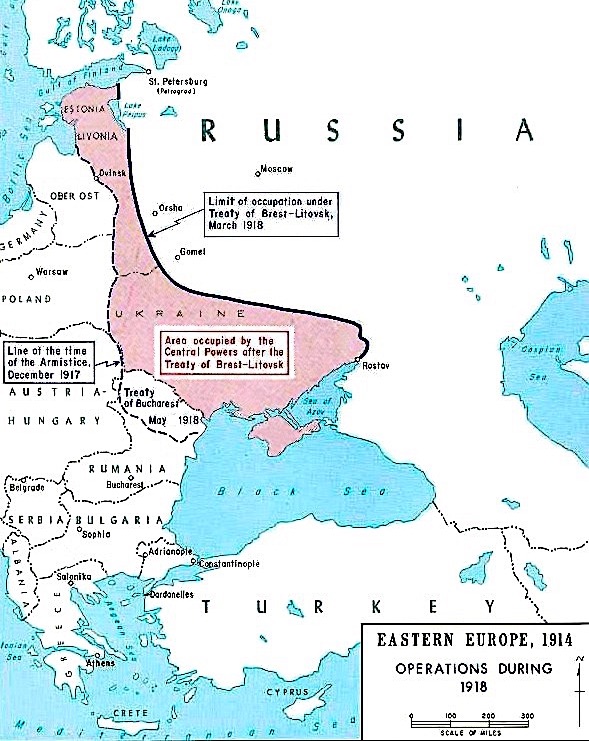

Of the many points of conflict occurring in the world today, one stands out as a manifestation of the ongoing fascination liberal democracy adherents have with the victory over communism, which they thought was won more than three decades ago, namely, the ongoing conflict between Russia and Ukraine. Political scientists in the Fukuyama “end of history” school view this conflict as being derived by the resistance of the remnants of Soviet regional hegemony (i.e., modern-day Russia, led by its president, Vladimir Putin) over the inevitability of liberal democracy taking hold. But a closer examination of the Russian-Ukraine conflict points to the present conflicts being born of not simply the incomplete divorce of Ukraine from the Soviet/Russian orbit that occurred at the end of the Cold War, but also the detritus from the collapse of previous ruling systems, especially the Tsarist Russian and Austro-Hungarian Empires.

Indeed, the current conflict in Ukraine has nothing to do with any modern-day manifestation of the Cold War bipolarity, and everything to do with the resurrection of national identities which existed, however imperfectly, centuries before the Cold War even began. To understand the roots of the Ukrainian-Russian conflict, one needs to study German actions after the 1918 Treaty of Brest-Litovsk, the rise and fall of Symon Petliura and the Polish-Soviet War — all of which predated the Molotov-Ribbentrop Pact and the dissection of Galicia that took place in 1939 and 1945. These actions were all triggered by the collapse of Tsarist and Austro-Hungarian power, and then united by violent efforts to allow local realities to shape the final disposition of a region frozen in place by the rise of Soviet power.

The dislocation felt by many Ukrainians today from all things Russian can be traced to the failed attempt at forming a nascent Ukrainian nation in the chaotic aftermath of the First World War and the collapse of both Tsarist Russia and the Austro-Hungarian Empire – all prior to the consolidation of both Polish and Bolshevik power. The Ukrainian People’s Republic, led by the nationalist Symon Petliura, proclaimed its independence from Russia in January 1918. It did so backed the German army, which occupied the Republic after the Central Powers, led by Germany, signed the Brest-Litovsk Treaty with Ukraine in February 1918. (Russia and the Central Powers signed a separate Brest-Litovsk Treaty in March 1918). The German military occupiers then dissolved the socialist, Ukrainian People’s Republic in April 1918, replacing it with the Ukrainian State, also known as the Second Hetmanate. (The First Hetmanate was a Ukrainian Cossack State that existed in the Zaporizhian region from 1648 until 1764).

But the Ukrainian State survived only until December 1918, when forces loyal to the deposed Ukrainian People’s Republic, led by Petliura, overthrew the Second Hetmanate, and reclaimed control over Ukraine. During this time the physical dimensions of the Ukrainian People’s Republic was in constant flux. In the short first tenure of the Ukrainian People’s Republic, two territories claimed as Ukrainian — centered round Odessa and Kharkov — declared their independence from the Ukrainian People’s Republic, and instead opted to join Russia [as four regions today have similarly opted to join Russia].

And fast.

• Americans Souring On Military Aid To Ukraine – Poll (RT)

A growing number of Americans are opposed to supplying additional military aid to Ukraine, according to a new Reuters-Ipsos survey, with Democratic support taking a nosedive since the start of Kiev’s counteroffensive in June. Published on Thursday, the poll shows just 41% of respondents agreed that the US government “should provide weapons to Ukraine,” while 35% said they disagreed and the rest stating they were “unsure.” The figures mark a sharp decline compared to a prior Reuters poll conducted in June, which showed 65% support for further arming Ukraine. While Democrats have been more vocal in backing arms shipments to Kiev, support appears to be waning within the party. A slim majority of 52% said they still supported military aid in the latest poll – a steep drop from the 81% recorded in June, around the time Ukrainian forces began a major counter-offensive.

Some 35% of Republican respondents said they backed weapons transfers in the new survey, down from 56% in June. Continued aid to Kiev has become a political flashpoint in the US Congress, as lawmakers battle over a long-term spending package to avert a government shutdown before November 17. Though a stopgap measure was originally slated to include billions in aid for Ukraine, Republicans successfully pushed to remove that funding from the legislation. Despite assurances from the Pentagon that a federal budget crisis would not impact US aid to Ukraine, senior administration officials have indicated otherwise, sounding alarms over a potential “lapse in support” in the event of a shutdown.

“As the Congress works through its various mechanisms and procedures, we cannot under any circumstances allow America’s support for Ukraine to be interrupted,” US State Department spokesman Vedant Patel told reporters on Wednesday, adding that even a brief delay could “make all the difference in the battlefield.” President Joe Biden has suggested that officials are looking for “workaround methods” to keep the aid flowing should lawmakers fail to reach a deal by their November deadline. On Wednesday, he said he would address Congress on the importance of continued support for Kiev, insisting that it is “overwhelmingly in the interests of the United States of America that Ukraine succeed.”

Washington has supplied more than $45 billion in direct military aid to Ukraine since the conflict with Russia escalated in February 2022, including tanks, artillery, air defense systems, drones and munitions. Moscow has repeatedly condemned foreign arms transfers, arguing they would do little to deter its military objectives and only prolong the fighting. Commenting on the budget impasse in the US, Kremlin spokesman Dmitry Peskov said the dispute was merely a “temporary phenomenon,”suggesting Washington would remain deeply involved in the conflict going forward.

Creative accounting. It won’t be nearly enough.

• Biden Weighing Use of State Department Grants to Afford Ukraine Aid (DeMartino)

A critical feature of the US government is the balance of powers. A major part of Congress, known as the legislative branch, is deciding what does, and does not, get funded. The Biden administration is considering using a State Department grant to send aid to Ukraine after the president’s funding request failed to get through Congress as part of the stopgap bill that temporarily averted a partial government shutdown. The new findings come from two anonymous US officials speaking to a US media outlet. While making remarks on student loan aid on Wednesday, Biden promised a “major speech” on funding the Kiev regime and hinted he had “another” way to get funding to Ukraine without congressional approval. “There is another means by which we may be able to find funding for that. But I’m not going to get into that now,” Biden said while promising more details during the speech.

According to one of the officials, the Biden administration is considering using a State Department program that provides financing for foreign governments buying US-made weapons known as the Foreign Military Sales (FMS) program. It typically provides loans or grants to foreign governments. The State Department has allocated $4.65 billion for the FMS program to support Ukraine and other countries impacted by the conflict. According to a State Department factsheet dated September 21, roughly $650 million of that allotment remains. One official added that even if the Biden administration uses this method, they will still ask Congress for additional funding. Last month, Biden requested $24 billion in additional funding for Ukraine. A smaller package was initially put into a stopgap funding bill intended to keep the government open while Congress debates a full funding bill.

But that bill was unable to pass in the House of Representatives until the Ukraine funding was stripped out of it. Rumors spread around Washington that then-House Speaker Kevin McCarthy (R-CA) made a “secret side deal” with Democrats on Ukraine funding to get the funding bill passed, which led Rep. Matt Gaetz (R-FL) to launch a successful motion to vacate the speakership. As such, no bills, for funding Ukraine or otherwise, will be taken up until a new speaker is selected. House Republicans are expected to meet on October 11, when they are expected to discuss potential replacements. Sometime after that, a formal vote will be held in the House.

Borrell is stuck.

• EU Can’t Compensate Ukraine For Missing Us Aid – Borrell (RT)

The EU cannot fully replace US support for Ukraine even if it boosts its aid programs, the bloc’s foreign policy chief, Josep Borrell, has said. The warning comes after the US Congress declined to include Ukraine assistance in a stopgap spending bill last week. “Ukraine needs the support of the European Union, which will certainly be increased, but also the support of the United States,” the senior official said on Thursday as he arrived at the European Political Community summit in Granada, Spain. He stressed that Europe could not fill the gap left by the US and expressed hope that Washington would reverse the situation. The flow of American funding was disrupted last week after a Republican push to reduce budgetary spending. A 45-day temporary budget, which was adopted as a compromise solution, allocated no money for Ukraine at all.

In August, the administration of US President Joe Biden asked lawmakers to provide an additional $24 billion to support Kiev. Amid the congressional deadlock, the White House sought to ensure that the flow of cash would not be interrupted. The crisis in the US was exacerbated this week when Kevin McCarthy was ousted as House speaker. Rep. Matt Gaetz introduced a motion to remove him from the position over an alleged secret deal with the Biden administration to keep Ukraine assistance flowing. Meanwhile, the EU is also struggling to maintain a consensus on sending money to its eastern neighbor. Last week, Hungary suggested splitting a proposed €50 billion ($52.4 billion) aid package in the bloc’s long-term budget into two installments, with the second half pending further evaluation, Bloomberg reported on Tuesday.

Budapest has been blocking €500 million in military aid for Ukraine since May. The European Commission is reportedly willing to release billions of euros in funds for Hungary in order to get the country on board. The funds were frozen last December over rule-of-law criticisms. Borrell announced that Brussels was seeking to add €5 billion in multi-year defense assistance when he met Ukrainian Foreign Minister Dmitry Kuleba on Monday. He also vowed to maintain the assistance regardless of what happens in Washington. EU leaders are meeting in Granada to discuss the bloc’s future spending and plans for future expansion. A reform supported by Germany and France would introduce a multi-tier membership system to accommodate candidates based on their merits. Ukraine, which aspires to become a member, has insisted on full-fledged participation, saying it cannot accept anything less.

“..We have had bad experiences with some so-called new members, for example when it comes to the rule of law. “This cannot be repeated again..”

• Ukraine ‘Corrupt at All Levels’, ‘Not Eligible’ to Join EU – Juncker (Sp.)

Ukraine in its current state is corrupt to the core and absolutely ineligible to join the European Union, former European Commission president Jean-Claude Juncker has said. “One mustn’t make false promises to the people of Ukraine who are up to their necks in suffering. I am very angry about the presence of some voices in Europe who are telling the Ukrainians that they can become members immediately,” Juncker said in an extensive interview with German media on Thursday. “That would not be of any good for the EU nor for Ukraine. Anyone who has anything to do with Ukraine knows that this is a country that is corrupt at all levels of society. Despite its efforts to date, it is not eligible to join, and needs massive internal reforms. We have had bad experiences with some so-called new members, for example when it comes to the rule of law. “This cannot be repeated again,” the politician, who served as EC chief between 2014 and 2019, and dealt with Ukraine-related matters repeatedly over that time, added.

“The European prospects for Moldova and Ukraine, which is defending itself so virtuously and defending European values, must be maintained, but must not be linked to a hope that this can be achieved overnight at the push of a button,” Juncker said. Instead, he proposed, countries like Ukraine should be able to “take part” in projects aimed at partial integration. “We should work toward making something like partial accession possible, or an intelligent form of near-enlargement,” Juncker proposed, without elaborating. The former European Commission boss, who warned during his time in office that Ukraine would “certainly not become” an EU member over the next “20 to 25 years,” and that the country was “not European in the sense of the European Union,” repeatedly dashed the hopes of the Euromaidan coup plotters, who overthrew Ukraine’s government in 2014 and launched a civil war in the Donbass to try to set the country on a path to Europe.

The crisis escalated into a full-on NATO-sponsored proxy war on Ukrainian territory in 2022 as Moscow attempted to preempt plans by Kiev to reabsorb the Donbass by force. Juncker is the latest high-level European politician to put a damper on Ukraine’s EU prospects amid reports that bloc leaders are planning to initiate formal accession talks before the end of the year, despite the ongoing largescale conflict in the country. Late last month, European Parliament President Roberta Metsola warned that the “economic model” that the bloc has today would not survive enlargement, and proposed a number of stopgap integrative processes short of membership, such as telephone and internet roaming, the lifting of trade barriers, access to some EU funds, Ukrainian access to European universities, etc. European Council President Charles Michel also hinted this week that Ukraine could become a member of the EU no sooner than 2030, and even then only if “both sides do their homework.”

“The first front in any war is the home front, where it is imperative the battle is won. And those running the war in Ukraine are slowly but surely losing on this side of the conflict.”

• Depleted Ukrainium (Patrick Lawrence)

In results announced in Bratislava Sunday, a leftist party whose primary platform plank is opposition to the war in Ukraine won 23 percent of the vote. On Monday the Slovakian president, Zuzana Caputova, formally asked Robert Fico, who leads the SMER party, to form a government. It looks like he will do so in a coalition with either Voice, a social-democratic party that took 15 percent of the vote, or with Progressive Slovakia, a liberal-centrist party that finished with 18 percent of the vote. Fico is an interesting figure. He has served as prime minister twice over the course of a decade, during which time he proved sufficiently European to bring Slovakia into the euro. To one or another extent, his likely coalition partners favor keeping Slovakia as a card-carrying member of the Western coalition supporting Ukraine.

But they did not win the election: Fico did. And Fico is all business in his opposition to Slovakia’s support for the U.S. proxy war tearing Ukraine and its people to pieces. SMER’s platform assigns the West and Ukraine equal responsibility for the war—a purposeful rip into the “unprovoked” charade—and promises an immediate end to all Slovakian arms shipments to the war effort. Speaking after the election results were announced, Fico pointedly pledged to press Kiev and its backers to begin peace talks with Moscow. “More killing is not going to help anyone,” he declared. There are two things to say about Robert Fico’s return to the top of Slovakian politics. One, we find once again that the U.S. is a victim of its old, Manichean habit of dividing the whole of humanity into good guys and bad guys.

The headline on CNN’s report on the elections reads, “Pro–Russian politician wins Slovakia’s parliamentary election.” The New York Times head is, “Unease in the West as Slovakia Appears Set to Join the Putin Sympathizers.” Tell me, which of these is more pathetic? “Pro–Russian?” “Putin sympathizers?” This is infantile—apart from being false, I mean. Fico simply articulates an independent, perfectly sound position on the war. CNN and The Times are infantilizing their viewers and readers as they reduce this position to the simplistic binary of a Saturday-morning cartoon. The insidious thing here, and let us be ever vigilant on this point, is that these media are inserting into our brains the thought that any deviation from the Russophobic orthodoxy amounts to support for the Kremlin’s demonized occupant.

Two, “unease” is too mild a word for the reigning sentiment among the war-mongering elites in Washington and the European capitals. An incipient panic is closer to the reality as public support for the war—and here and here official support—ever more visibly wobbles and wanes. The first front in any war is the home front, where it is imperative the battle is won. And those running the war in Ukraine are slowly but surely losing on this side of the conflict.

“..that Americans, particularly in Washington, make these terrible mistakes is because they do not see that the world has changed around them already..”

• Putin’s Valdai Speech: Multipolar Future Has Arrived (Sp.)

Russian President Vladimir Putin delivered a speech on October 5 at the plenary session of the 20th meeting of the Valdai International Discussion Club in Sochi emphasizing the tectonic and irreversible shifts taking place in the global order. [..] The moment of truth has come, and US hegemony is fading in front of our eyes while a new multipolar world is emerging, per Professor Joe Siracusa, political scientist and dean of Global Futures, Curtin University. “In many, many ways, the future that Mr. Putin is talking about has already arrived,” Siracusa told Sputnik. “What he’s kind of saying between the lines is it’s already here. Now we have to see it. The world has changed. And the reason he thinks that the Americans, particularly in Washington, make these terrible mistakes is because they do not see that the world has changed around them already. The world, the future is changing in front of them and they fail to see it. He thinks that might be the cause of the conflict.

During his Valdai speech, Putin outlined six principles Russia wants to adhere to and offers other nations to join it.

• “First, we want to live in an open, interconnected world, in which no one will ever try to erect artificial barriers to people’s communication, their creative realization, and prosperity. There must be a barrier-free environment,” Putin said.

• The second principle is the diversity of the world, which should not only be preserved, but should also be the foundation of universal development.

• The third principle, according to the Russian head of state, is maximum representativeness: “No one has the right or can rule the world for others or on behalf of others. The world of the future is a world of collective decisions,” the president emphasized.

• Fourth is universal security and lasting peace that takes into account the interests of great states and small countries equally. To achieve this, it is important to free international relations from the bloc mentality and the dark legacy of the colonial era and Cold War, according to Putin.

• The fifth principle is justice for all: “The era of exploitation of anyone – I have already said this twice – is a thing of the past. Countries and peoples are clearly aware of their interests and capabilities and are ready to rely on themselves, and this multiplies their strength. Everyone must be provided with access to the benefits of modern development,” Putin emphasized.

• The sixth principle is equality: no one should be forced to obey those who are richer or more powerful at the cost of their own development and national interests, according to the Russian president.“The ‘civilizational model’ referred to in Putin’s speech seems anchored on ‘principles’ – such as non-colonial relations; non-patronizing attitudes; respectful of diversity rooted in the diverse traditions – that will require a huge work to generate new shared international norms,” Paolo Raffone, a strategic analyst and director of the CIPI Foundation in Brussels, told Sputnik. “The Western ‘rules-based liberal international order’ is unilateral, and it could be imposed in a specific time in history leveraging on the power and prominence of a small group of colonial powers that after the liberal model crisis and civil war (1914-1945) has been inherited by a distant but super-powerful country (US). In a nutshell, I can say that the ‘civilizational model’ approach probably aims at structuring a shared world ‘software,’ while the ‘liberal rules-based order’ has been aiming at building an imposed ‘hardware’ defended by ‘rules’ serving the financial and military hegemony.”

“Without a speaker, the impeachment process is halted. ”

“Follow your heart, but take your brain with you. The American people expect us to govern. I also advise my House colleagues to be sure and take your meds..”

• MAGA Power Rocks The US Establishment (Blankenship)

Acting Speaker Patrick McHenry adjourned the House, since pretty much the only thing he can do is form a session to specifically vote for a new speaker (this has never happened before and the rules are vague). With the House adjourned, no congressional hearings can happen, subpoenas can’t go through, and committees can’t convene. This is telling because the same Republicans who ousted McCarthy are also leading an impeachment inquiry against President Joe Biden. Without a speaker, the impeachment process is halted. Given this, it was foolish for these lawmakers to vote out McCarthy. And that’s especially the case when it took nearly two months of negotiations to install him in the first place back in January. Now, there’s no telling where things will go or how long it will take to cut deals and find a new speaker.

If it takes even the same amount of time as before, then a government shutdown would be inevitable. That level of dysfunction from the GOP is not only poor governance but also bad politics, since it would allow Democrats to look good by contrast. “Follow your heart, but take your brain with you. The American people expect us to govern. I also advise my House colleagues to be sure and take your meds,” Louisiana Senator John Kennedy, a Republican, said to the press after McCarthy was booted. At the same time, this situation demonstrates quite clearly that the establishment – especially during a period of intense partisan divide – is not truly safe. Even powerful figures such as McCarthy can be dethroned by a small contingent of representatives. That shows that people like Jimmy Dore, a well-known YouTube personality, are unfortunately correct for once.

The so-called comedian called on progressives to refuse to vote for Nancy Pelosi as speaker when Democrats controlled the House until a vote was taken on Medicare for All. It turns out he was completely correct on that. If ‘The Squad’ (a team of relatively young Democratic lawmakers who got into the House on a super-progressive platform) had any backbone, as Gaetz and his gang of rebels have shown, they could have forced a vote on that important issue and many others. They certainly have squeezed out concessions from Pelosi and the political establishment, making her understand that her position on the pedestal is contingent on the support of progressives and not the other way around. The fact that they, who are supposed to be more savvy and calculated than the MAGA mutineers, didn’t do that indicates, at the very least, a lack of commitment to the values that got them elected.

For their part, the MAGA wing of the Republican Party is making waves: they have made Ukraine funding a hot-button issue, censured Rep. Adam Schiff (a mortal enemy of their cause), put ‘the border’ and fake allegations of election fraud front and center, shouldered out establishment Republicans such as Liz Cheney and Mitt Romney, and they’re building their own media ecosystem. Even though their self-imposed speaker debacle clearly lacks any serious intent, MAGA is flexing its muscles – even if, at times, for nothing. Will those who are supposedly fighting for the working class in Congress ever exert the same pressure? Doubtful, and it’s also doubtful if these people have any serious commitment to doing that in the first place, since they have the very same tools as Gaetz and his friends yet refuse to wield them. Undoubtedly, however, the political situation in the US is getting a whole hell of a lot more interesting.

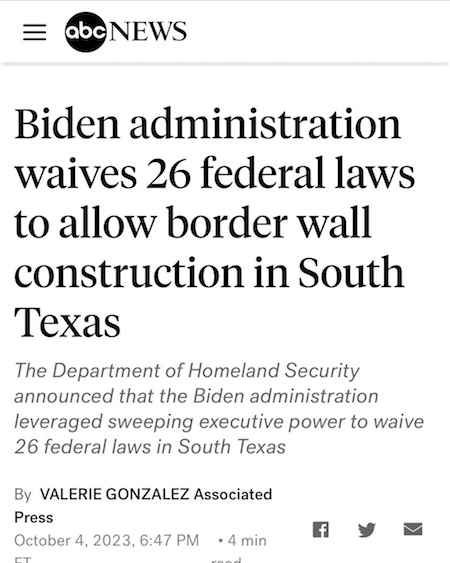

Not long ago, the Biden admin sold $300 million worth of wall building material for $2 million. Now they have to buy more.

• Trump Slams Biden’s Border Crisis, Says ‘Our Country is Being Invaded’ (Sp.)

About 210,000 migrants were apprehended in the US in September for crossing the country’s southern border illegally, a record for 2023, according to preliminary government data, as the Biden administration continues to flounder in its attempts to handle the raging crisis. Donald Trump has pummeled the Joe Biden administration over the ongoing crisis on the US-Mexico border that the current occupant of the White House has failed to get under control. The only reason the Democratic POTUS was suddenly ready to embrace the border wall project – and idea from the Trump era – was because of the relentless surge of illegal migrants, said the former president in a US media interview. “Biden sees our country is being invaded… What is he going to do about the 15 million people from prisons, from mental institutions, insane asylums, and terrorists that have already come into our country?.. What has happened to our country?” the 45th POTUS fumed, as he called upon the Biden administration to “go back to Trump policies”.

Trump’s signature border wall construction had been brought to a screeching halt on 20 January 2021, when Joe Biden ordered a pause on all wall-related efforts at the southern US border. The commanding frontrunner for the 2024 Republican presidential nomination seized upon the recent remarks by Department of Homeland Security Secretary Alejandro Mayorkas, who said that “high illegal entry” required urgently waiving dozens of federal laws to allow for the construction of a border wall in south Texas. As more than 245,000 migrant encounters have been recorded in the Rio Grande Valley Sector this year, Trump slammed his successor for having reversed many of his policies and thus caused the crisis at the southern border. “He has to reinstate Remain in Mexico and Title 42… He has to do all of the other things that we were doing,” said Donald Trump.

A Trump campaign spokesman was quick to endorse his leader: “President Trump is always right. That’s why he built close to 500 miles of a powerful new wall on the border and it would have been finished by now… Instead, crooked Joe Biden turned our country into one giant sanctuary for dangerous criminal aliens.” Earlier, Mayorkas said that he would use his authority to waive 26 federal laws, including the Clean Air Act, Safe Drinking Water Act and Endangered Species Act, to allow for construction in Starr County in the Rio Grande Valley (RGV) sector. An announcement about this was posted on Wednesday on the US Federal Register by the Department of Homeland Security. “There is presently an acute and immediate need to construct physical barriers and roads in the vicinity of the border of the United States to prevent unlawful entries into the United States in the project areas pursuant to sections 102(a) and 102(b) of [the Illegal Immigration Reform and Immigrant Responsibility Act of 1996],” Mayorkas said.

Though in the past the Biden administration worked on shuttering gaps in the wall, Customs and Border Protection (CBP) announced in June that there were plans to build up to 20 miles (32 kilometers) of wall in the RGV Sector in June. The construction is funded by Homeland Security’s full-year 2019 appropriations bill.

Darien gap

Colombian news outlets are reporting a massive surge in migrants, mostly Venezuelans, crossing the Darien Gap in their trek northward to the United States.

Just a few years ago it was almost unheard of for anyone to try to get through the Gap. There are no roads, only jungle. pic.twitter.com/P4lnyNKMXS

— Dr. Benjamin Braddock (@GraduatedBen) October 4, 2023

“..more than 75,000 workers at Kaiser Permanente walked off the job this morning..”

• The Largest Healthcare Strike in U.S. History (Pappas)

The largest health care strike in U.S. history has begun, as more than 75,000 workers at Kaiser Permanente walked off the job this morning. The scheduled three-day labor stoppage comes after Kaiser failed to meet the demands of workers, continuing to prioritize their profits over patient care. The striking coalition includes eight unions representing health care workers from a variety of job descriptions and covers Kaiser facilities in California, Colorado, Oregon, Washington, Virginia, and Washington City. This represents about 40% of all Kaiser Permanente staff, according to spokeswoman Renee Saldana of the Service Employees International Union-United Healthcare (SEIU-UHW)—the largest union in the coalition.

The union’s contract with the company expired over the weekend, and workers are demanding a significant staffing increase, alleviation of grueling work hours, wage increases that outpace inflation, and benefits for retired staff in the industry. Additionally, they are noting that their poor working conditions lead to poor patient care. This represents a common theme for healthcare workers attempting to provide quality patient care in a capitalist healthcare system that continually puts profit over patient wellbeing. Healthcare workers are becoming increasingly fed up with the working conditions imposed by the U.S. healthcare system. They are tired of seeing the wellbeing of patients being sacrificed at the altar of profit. They are also tired of having their own well being destroyed by the continual exploitation they face under this system.

One healthcare worker preparing to picket outside a Kaiser Hospital location in North Hollywood said, “We just can’t go on with this staffing crisis.” Kaiser Permanente is the largest private hospital and healthcare management consortium in the United States, bringing together a broad spectrum of healthcare workers including nurses, X-ray technicians, pharmacists, optometrists, and other job titles. The company serves 12.7 million people in California, Washington, Oregon, Georgia, Hawaii, Washington DC, Maryland, and Virginia. The private health care corporation has reported more than $3 billion in profits in the first half of 2023 and has paid at least 49 corporate executives salaries in excess of $1 million a year. Despite these profits, the company continues to impose strenuous working conditions on staff, continually under-staffing and under-paying.

While this initial strike is planned for just three days, the SEIU-UHW union said the coalition is prepared to launch a “longer and stronger” strike in November, when another contract expires in Washington State. This could extend the stoppage to even more workers. Healthcare workers at Kaiser are joining a wave of strikes sweeping the United States—hundreds of thousands of workers have walked off the job. We are seeing worker action in sectors ranging from the auto industry—with the struggle of the 146,000 members of the UAW union against Ford, GM, and Stellantis—to Hollywood screenwriters and actors, to the 53,000 hotel workers in Las Vegas who voted last week to strike.

“..European countries are estimated to have spent additional 792 billion euros in the last year just on the status quo system to protect consumers from the effects of the energy crisis introduced by the conflict in Ukraine..”

• Europe Could Become Energy Self-Sufficient In $2 Trillion Push – Study (RT)

Europe could wean itself off fossil fuels and create a self-sustainable energy sector by spending around 2 trillion euros ($2.1 trillion) on solar, wind and other regenerative sources by 2040, according to a new study, Report informs via Reuters. The report, led by the Potsdam Institute for Climate Impact Research, said the continent would require annual investments of 140 billion euros by 2030 and 100 billion a year in the decade thereafter to get there. While most of the sum would be needed for onshore wind expansion, solar, hydrogen and geothermal resources would be additional pillars of a strategy that would enable Europe’s electricity needs to be powered exclusively from renewables by 2030.

It would take another decade to convert the entire energy system, including things such as heating currently powered by oil or gas, to renewables, according to the study, which was shared with Reuters. The study said that these figures are considerable, but it is important to remember that the European countries are estimated to have spent additional 792 billion euros in the last year just on the status quo system to protect consumers from the effects of the energy crisis introduced by the conflict in Ukraine.

Biden kicks dog

Here’s a video of Joe Biden kicking his dog.

.@JudicialWatch has also reported that Biden has “mistreated his dogs” and "he has punched and kicked his dogs." pic.twitter.com/et2wyujWKt

— Libs of TikTok (@libsoftiktok) October 6, 2023

Baby giraffe

Baby Giraffes are so under appreciated. pic.twitter.com/sjrW1RWD5R

— Nature is Amazing ☘️ (@AMAZlNGNATURE) October 5, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.