Fred Lyon San Francisco cable car turnaround 1946

A nation divided.

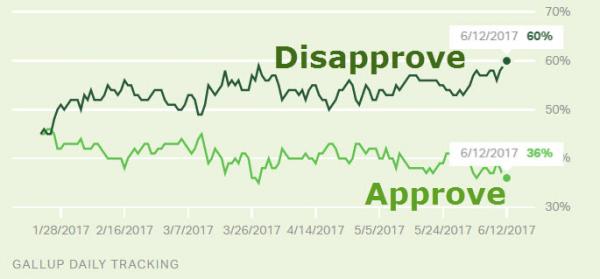

• A Record 60% Of Americans Disapprove Of President Trump (ZH)

Despite record high stock prices, 43-year lows in jobless claims, and near record-high optimism among small business owners, Gallup reports the percentage of Americans who disapprove of the job President Trump has risen to a record 60% this week. As Gallup details, despite the president’s claim on Monday at a Cabinet meeting that “Never has there been a president, with few exceptions – in the case of F.D.R. he had a major Depression to handle – who’s passed more legislation, who’s done more things than what we’ve done,” his administration has been roiled by controversies. Most recently, Trump ran into a buzz saw of criticism with his decision, announced June 1, to withdraw the U.S. from participation in the Paris climate accord.

He has also been under significant political scrutiny over the June 8 testimony of former FBI Director James Comey before the Senate Intelligence Committee. Those events coincided with the lower averages seen in the past two weeks. But, given that his averages were almost as low in the weeks leading up to them, it is difficult to establish direct causality between specific events and the president’s ratings.

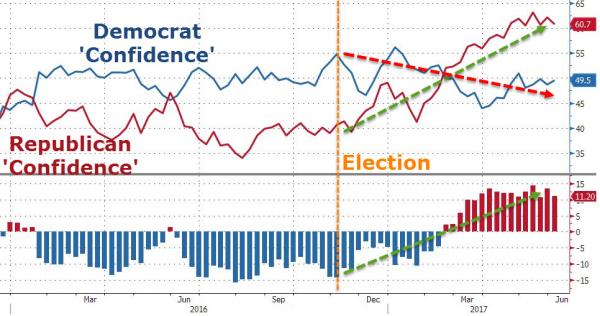

The highly polarized nature of Americans’ views of Trump (and Obama before him) have been well-documented, and that pattern continues: Trump’s 8% average approval rating among Democrats last week is right at his 9% average to date; His 83% approval among Republicans is three points lower than his average among that group; Among independents, his approval is 31%, five points lower than his average among that group; Notably the spread between Republican ‘confidence’ and Democrat ‘confidence’ (via Bloomberg) has not been this wide since before Barack Obama was elected…

Trump’s job approval ratings are the worst of his administration so far, and Trump continues to have the lowest ratings for a newly elected president in Gallup’s history of approval ratings. The previous low first-year approval rating in June for an elected president was Bill Clinton, with a 37% approval June 5-6, 1993. The approval ratings of all other presidents since 1953 in June (May in the case of Eisenhower) of their first year after being elected were above 50%.

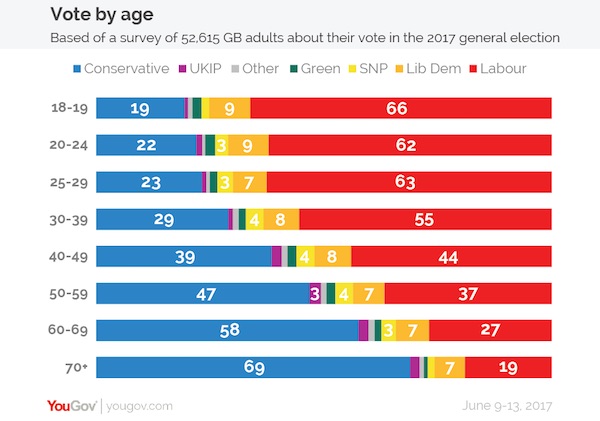

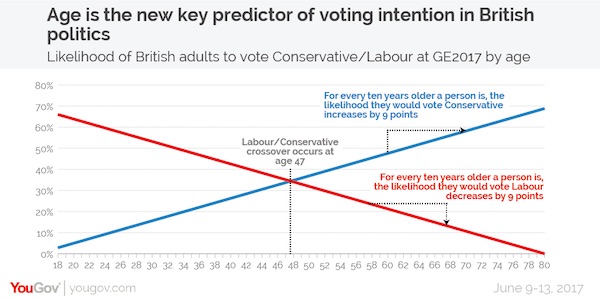

Another nation divided, but not along the same lines. Older people, especially pensioners, vote Conservative, and a much higher percentage of them actually vote.

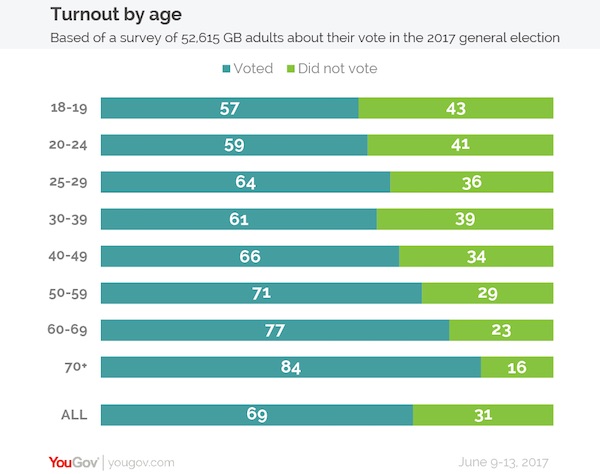

• Age Is The New Dividing Line In British Politics (YouGov)

Since last week’s election result YouGov has interview over 50,000 British adults to gather more information on how Britain voted. This is part of one of the biggest surveys ever undertaken into British voting behaviour, and is the largest yet that asks people how they actually cast their ballots in the 2017 election. The bigger sample size allows us to break the results down to a much more granular level and see how different groups and demographics voted on Thursday. In electoral terms, age seems to be the new dividing line in British politics. The starkest way to show this is to note that, amongst first time voters (those aged 18 and 19), Labour was forty seven percentage points ahead. Amongst those aged over 70, the Conservatives had a lead of fifty percentage points.

In fact, for every 10 years older a voter is, their chance of voting Tory increases by around nine points and the chance of them voting Labour decreases by nine points. The tipping point, that is the age at which a voter is more likely to have voted Conservative than Labour, is now 47 – up from 34 at the start of the campaign.

Despite an increase in in youth turnout, young people are still noticeably less likely to vote than older people. While 57% of 18 and 19 year-olds voted last week, for those aged 70+ the figure was 84%.

Corbyn growth territory.

• UK Low Income Families Forced To Walk ‘Relentless Financial Tightrope’ (G.)

Low-income families are going without beds, cookers, meals, new clothes and other essential items as they struggle to cope with huge debts run up to pay domestic bills, according to a survey highlighting the cost-of-living crisis experienced by the UK’s poorest households. Clients of the debt charity Christians Against Poverty (CAP) had run up an average of £4,500 in debts on rent or utility bills, forcing them on to what the charity described as a “relentless financial tightrope” juggling repayments and basic living costs, leaving many acutely stressed and in deteriorating health. The pressure of coping with low income and debt frequently triggered mental illness or exacerbated existing conditions, with more than a third of clients reporting that they had considered suicide and three-quarters visiting a GP for debt-related problems.

More than half were subsequently prescribed medication or therapy. “The crippling reality of living in poverty and debt is still unashamedly evident in every home we visit, and year on year we see financial difficulty taking a tighter grip,” said Matt Barlow, the UK chief executive of CAP. Experts said the survey highlighted the extreme hardship faced by the “new destitute” – people on low incomes who might in the past have been able to rely on a welfare safety net to help them through financial shocks but who now were forced to go into debt to survive, leaving them struggling to afford even the basics. Debt had a crushing effect on living standards, the CAP survey found, with one in 10 clients unable to afford to buy or repair a bed, washing machine, TV, sofa or fridge. Roughly the same proportion could afford to acquire furniture only on punitive rent-to-buy terms, for example paying £6 a week to acquire a bed and mattress over a set three-year period.

The impact on family life was severe, with a quarter of clients saying debt caused relationship breakdowns, and more than two-thirds saying they felt unable to cater for their children’s needs. A sixth said they could not afford to feed their children three meals a day. A third feared eviction. A tiny handful of clients – predominantly single mothers – reported that they had turned to prostitution to make ends meet. Prof Suzanne Fitzpatrick, of Heriot Watt University, the co-author of groundbreaking research into destitution, told the Guardian: “The new destitute are citizens who would previously have managed to avoid absolute destitution with the help of the welfare safety net. But the level of working age benefits is now so low that people barely managing to get by can easily find themselves in a position where they can’t afford even the basic essentials to eat, stay warm and dry, and keep clean.”

“If you’re a trader or a speculator, I think you should be raising cash today, literally today..”

• Gundlach Says DC Establishment Wants to ‘Wait Trump Out’ (BBG)

DoubleLine Capital’s Jeffrey Gundlach said the establishment in Washington is trying to undermine President Donald Trump by running out the clock on his administration. “They’re really just trying to wait Trump out, trying to obstruct his agenda as much as possible,” Gundlach, one of the few money managers to predict Trump’s election, said during a webcast Tuesday. “Small change is what they’re looking for.” Gundlach, manager of the $53.9 billion DoubleLine Total Return Bond Fund, spoke during televised Senate testimony by Attorney General Jeff Sessions, which the money manager called “a sideshow or entertainment.” He called the U.S. political conflict “rope-a-dope,” a strategy used by boxer Muhammad Ali to wear out opponents.

Among Gundlach’s other observations:

• There’s a low probability of a recession.

• The days of low volatility markets are probably numbered.

• Expect higher bond yields and lower stock prices this summer.

• Yields on 10-year Treasuries are likely to end 2017 roughly in the 2.7% to 2.8% range, from about 2.2% currently.The Dow Jones Industrial Average and the S&P 500 Index closed at record highs Tuesday prior to Gundlach’s talk. Futures trading implies a 98% probability the Federal Reserve will raise interest rates by 0.25% when it meets Wednesday. “If you’re a trader or a speculator, I think you should be raising cash today, literally today,” Gundlach said. “If you’re an investor, I think you can sit through a seasonally weak period.” The Total Return fund was up 2.7% this year through June 12, beating 84% of its peers, according to data compiled by Bloomberg.

Yves Smith’s piece is too long and comprehensive to do justice here. Click the link.

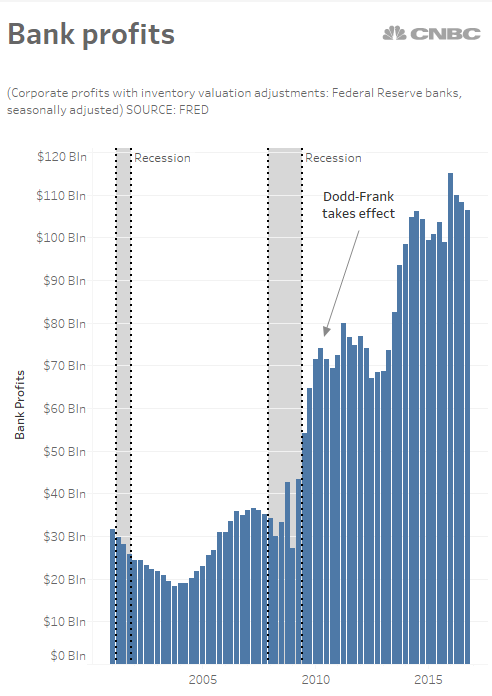

• Trump Administration Welshes on “Repeal Dodd Frank” Promise (NC)

After having promised banks to get rid of Dodd Frank, which was never a strong enough bill to have a significant impact on profits or industry structure, Trump didn’t even back the House version of the bill to crimp Dodd Frank. But you’d never know that from the cheerleading from bank lobbyists upon the release of a 147 page document by the Treasury yesterday, the first of a series describing the gimmies that the Administration seeks to lavish on banks. As we’ll touch on below, the document repeatedly asserts that limited bank lending post crisis to noble causes like small businesses was due to oppressive regulations. We wrote extensively at the time that small business surveys showed that small businesses then overwhelmingly weren’t interested in borrowing and hiring. Businessmen don’t expand operations because money is cheap, they expand because they see a commercial opportunity.

But the even bigger lie at the heart of this effort is the idea that the US will benefit from giving more breaks to its financial sector. As we’ve written, over the last few years, more and more economists have engaged in studies with different methodologies that come to the same conclusion: an oversized financial sector is bad for growth, and pretty much all advanced economies suffer from this condition. The IMF found that the optimal level of financial development was roughly that of Poland. The IMF said countries might get away with having a bigger banking sector and pay no growth cost if it was regulated well. Needless to say, with the banking sector already so heavily subsidized that it cannot properly be considered to be a private business, deregulating with an eye to increasing its profits is driving hard in the wrong direction.

[..] So if it wasn’t Dodd Frank, what was led the banks to focus so much on high FICO score borrowers? It was mortgage servicing reforms, which made it hard to foreclose due to stopping abuses, like dual tracking (continuing to foreclose even when supposedly considering a mortgage modification). To look at the bigger picture, it’s hard to take bank complaints about oppressive regulation seriously in light of this:

But the domestic echo chamber makes that hard to do.

• Tillerson Says Allies Pleading With US To ‘Improve Russia Relations’ (RT)

All of America’s allies and partners have been calling on Washington to improve its relations with Russia, Secretary of State Rex Tillerson acknowledged after the US Senate reached a bipartisan deal to boost sanctions against Moscow. “I have yet to have a bilateral, one-on-one, a poolside conversation with a single counterpart in any country: in Europe, Middle East, even South-East Asia, that has not said to me: please, address your relationship with Russia, it has to be improved,” Tillerson said on Tuesday during testimony before the Senate Appropriations Committee on Foreign Operations. Tillerson added that the countries urging the US to review its Russian policy “believe worsening this relationship will ultimately worsen theirsituation.” He added: “People have been imploring me to engage and try to improve the situation, so, that was our approach anyway.”

Earlier, Tillerson warned that the US Senate’s bipartisan deal on new set of restrictive measures against Moscow might further worsen relations with Russia and hinder existing efforts on joint US-Russia progress to fight terrorism in Syria. “There are efforts under way in Syria specifically, those are, I would say, progressing in a positive way,” America’s top diplomat said on Tuesday during testimony to the Senate Foreign Relations Committee. Despite the relationship between US and Russia being “at an all-time low,” according to Tillerson, the “objective is to stabilize that” rather than deteriorate it further. Washington is “engaged” and working with Moscow “in a couple of areas,” including on such issues of international importance as the Ukrainian and Syrian crises. “We have some channels that are open, where we are starting to talk, and I think what I wouldn’t want to do is close the channels off,” Tillerson told the Senate committee, warning that to establish “something new… will take time.”

Yes, they are.

• Are Public Pensions A Thing Of The Past? (CNN)

New teachers and state workers will no longer get a traditional pension in Pennsylvania. Governor Tom Wolf signed a bill Monday, making it the ninth state to replace the pension with a “hybrid” retirement plan. It goes into effect in 2019. The new plan combines elements of a traditional pension and a 401(k)-style account. Overall, new workers will contribute more of their salary, work longer, and likely receive a smaller payout in retirement than under the current system, according to a report from the state’s Independent Fiscal Office. But Pennsylvania’s pension system is currently one of the most underfunded in the country and is in need of reform. The bill had bipartisan support. “It’s a win for Pennsylvania taxpayers and fair to Pennsylvania’s workforce,” Wolf said at a press conference Monday.

The reform will build upon previous legislation to help fully fund the pension system and preserve a path to retirement for public workers, said Greg Mennis, a director at Pew Charitable Trusts. “Our research indicates that this would be one of the most – if not the most – comprehensive and impactful reforms any state has implemented,” he wrote in a letter urging state lawmakers to pass the bill. Over the past 10 years, Rhode Island, Virginia, Tennessee and Georgia have created plans similar to Pennsylvania’s. They require workers to contribute some of their salary to a pension-like plan that guarantees a certain payout based on their salary. Workers also contribute to a 401(k)-style plan that they can take with them if they leave public service. The state will make contributions to both plans on their behalf.

In Pennsylvania, workers will be defaulted into a hybrid plan, but there will be two other versions they could opt into. Under the default, workers will have to contribute a total of 8.25% of their salary. (Teachers currently contribute 7.5% and other public workers pay 6.25%.) Most will have to work until 67, instead of 65, in order to get their full payout in retirement. A state employee who works for 35 years and earns a final salary of $60,000, currently receives an estimated $40,000 a year in retirement. Under the reformed system, that same worker would receive $34,1048, according to the Independent Fiscal Office report. [..] Like pension plans in other states, Pennsylvania’s was badly hurt by the Great Recession. It also took a hit because of retroactive benefit increases made before the market took a dive. The pension fund went from a nearly $20 billion surplus in 2000 to a $70 billion deficit in 2015.

ZIRP machines have taken over.

• Death Of The Human Investor: Just 10% Of Trading Is Regular Stock Picking (C.)

Quantitative investing based on computer formulas and trading by machines directly are leaving the traditional stock picker in the dust and now dominating the equity markets, according to a new report from JPMorgan. “While fundamental narratives explaining the price action abound, the majority of equity investors today don’t buy or sell stocks based on stock specific fundamentals,” Marko Kolanovic, global head of quantitative and derivatives research at JPMorgan, said in a Tuesday note to clients. Kolanovic estimates “fundamental discretionary traders” account for only about 10% of trading volume in stocks. Passive and quantitative investing accounts for about 60%, more than double the share a decade ago, he said.

In fact, Kolanovic’s analysis attributes the sudden drop in big technology stocks between Friday and Monday to changing strategies by the quants, or the traders using computer algorithms. In the weeks heading into May 17, Kolanovic said funds bought bonds and bond proxies, sending low volatility stocks and large growth stocks higher. Value, high beta and smaller stocks began falling in a rotation labeled “an unwind of the ‘Trump reflation’ trade,” Kolanovic said. “Upward pressure on Low Vol and Growth, and downward pressure on Value and High Vol peaked in the first days of June (monthly rebalances), and then quickly snapped back, pulling down FANG stocks” — Facebook, Amazon.com, Netflix and Google parent Alphabet, the report said.

Told you those output cuts wouldn’t go anywhere.

• OPEC Oil Production Jumps In May Despite Output Cuts Deal (CNBC)

OPEC’s oil production jumped in May, despite the exporter group agreeing last month to extend its six-month deal to cap output into 2018. Production across OPEC rose by about 336,100 barrels per day to 32.1 million bpd, according to secondary sources, led by increases from Libya and Nigeria, which are exempt from the deal, and Iraq. Output from Libya surged by more than 178,000 bpd to 730,000 bpd as the country’s rival factions moved toward reconciliation, and supplies disrupted throughout years of conflict remained on line. In Nigeria, production was up more than 174,000 bpd to 1.68 million bpd as supplies sidelined by militant attacks on energy infrastructure last year came back into operation. With the gain, Nigeria reclaimed the title of largest African producer in OPEC from Angola, where output fell by 54,000 bpd, the biggest drop among the 13 members in May.

Iraq, OPEC’s second-largest producer, contributed the third-biggest increase with a more than 44,000 bpd jump. Baghdad has yet to cut deeply enough to hit its quota of 4.35 million bpd under the output cut deal. In May, it produced 4.42 million bpd. Only four countries were producing at or below the levels they agreed to in November: Saudi Arabia, Angola, Kuwait, and Qatar. Last month, OPEC and other exporters extended an agreement to remove 1.8 million barrels a day from the market in order to shrink brimming global stockpiles of crude oil. In May, inventories in the OECD, a group of mostly wealthy countries, remained 251 million barrels above the five-year average.

More ground for shadow banks to take over.

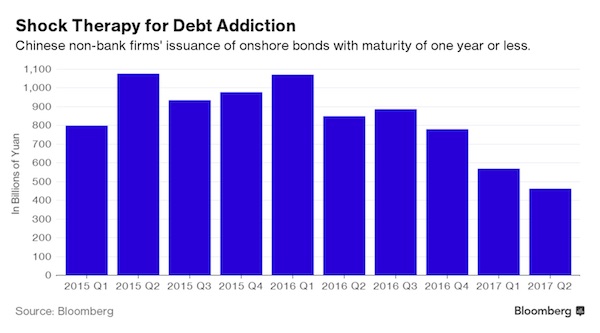

• China Defaults Feared as Firms Confront Short Debt Addiction (BBG)

China’s leverage crackdown is forcing local companies to confront their addiction to short-term bond sales that they use to roll over debt. The shock therapy is worsening the outlook for corporate defaults in the second half of this year after borrowing costs jumped to a two-year high. With yields surging, Chinese non-banking firms sold 131 billion yuan ($19.3 billion) of bonds with a maturity of one year or less in May, the least since January 2014 and less than half of the same month last year, according to data compiled by Bloomberg. About 87% of the short note sales last month will be used for refinancing, according to Bloomberg data.

The habit of relying on borrowing short-term money to repay maturing debt has pushed up such liabilities to a total of 5.2 trillion yuan on China’s listed non-financial companies’ balance sheets as of March 31, the highest on record, according to data compiled by Bloomberg. With no sign of an end to the government’s campaign against leverage, the average coupon rate for bonds maturing in one year or less rose to 5.5% in June, deterring issuers from raising money to roll over debt. “Small issuance of short-term bonds will be a normal phenomenon in the coming six months because cash supply will probably remain tight,” said Ma Quansheng at Fullgoal Fund Management. “Both default risks and the number of corporate bond defaults may increase.”

The loose funding environment last year helped Chinese companies raise enough money to withstand repayment pressure so far in 2017. There have been 13 onshore defaults in the public bond market in 2017, compared with 16 in the same period of 2016. The yield on one-year AAA rated company bonds averaged 4.19% this year, up from 2.97% in 2016. HFT Investment Management said more note defaults may come as the economy doesn’t look good. In the second half of this year, Chinese non-banking firms must repay 2.36 trillion yuan of bonds. “The current rising borrowing costs may have a big impact on companies’ operations and finance,” said Lu Congfan at HFT Investment Management. “What can you do when you must refinance to repay maturing debt while facing such high borrowing costs? That would be a question challenging many local companies in the second half or next year.”

Well, well… Let’s see it.

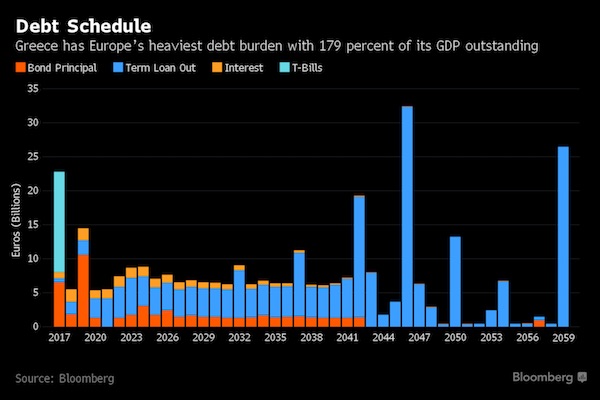

• Schaeuble Promises Greece Deal With Lenders On Thursday (R.)

German Finance Minister Wolfgang Schaeuble said on Tuesday he was confident that Greece and its international lenders will reach a compromise deal this week, a step that would unleash more loans for Athens. “We’ll manage it on Thursday. You’ll see,” Schaeuble said during a panel discussion in Berlin. Officials have said eurozone finance ministers and the IMF are likely to strike a compromise on Greece on Thursday, paving the way for new loans for Athens while leaving the contentious debt relief issue for later. IMF head Christine Lagarde suggested a plan last week under which the Fund would join the Greek bailout now, because Athens is delivering on agreed reforms, but would not disburse any IMF money until the euro zone clarifies what debt relief it can offer Greece.

Greeks don’t believe you, Wolfie…

• Greeks Promised Economic Boost Despair of Ever Seeing Debt Deal (BBG)

Alexis Tsipras has spent nearly two years telling Greeks that a debt deal and inclusion in the ECB’s quantitative-easing program will unleash an investment boom that salves the pain of austerity. The prime minister’s message hasn’t convinced Panagiotis Kouinis, a 60-year-old civil engineer in Corinth who says business has steadily dwindled through all of Greece’s eight-year crisis and has now ground almost to a halt. “What I know is they tell you pensions will be cut another 20%, wages down, and what is quantitative easing?” Kouinis said in an interview in his office near the city center. “Do we have to be economists so we can understand what they’re saying?” Across the country in places like Corinth, an industrial hub 80 kilometers west of Athens, Greeks have spent years treading water as news bulletins bombard them daily with reports of meetings and decisions in Brussels and Frankfurt that will determine their economic future.

In the meantime, as the ECB’s stimulus measures – including its asset-purchase program – buoy the rest of the euro-area economy, Greece’s output has been stagnant, leaving its people the most pessimistic in the region. Yet the ECB remains unlikely to include Greek bonds in its QE program in the foreseeable future, according to a person familiar with the matter. That’s because a meeting on Thursday of euro-area finance ministers, whose electorates are leery of debt relief, looks like delivering another fudge. There may be agreement to disburse more bailout loans but without easing repayment terms enough to satisfy the ECB and IMF. That would leave Tsipras high and dry.

[..] Despite some signs of an improvement in industrial output, Greece has been heavily reliant on consumers and a booming tourist sector to keep GDP – which shrank by a quarter in the early years of the crisis – from continuing its slide. While the economy hasn’t been in a recession since 2015, and grew 0.4% at the start of the year, it hasn’t strung together more than two quarters of consecutive expansion in more than a decade. Accountancy firm PWC said in March that infrastructure investment plunged during the crisis, leaving a backlog of planned and in-progress projects amounting to more than 21 billion euros. Near Corinth, that includes rail, waste management, road and marina developments. “With taxation what it is, not only will no-one come to invest here, but they’d need to be mad to,” said Kouinis, the civil engineer. “Growth needs to start from public works, because the private sector has been killed.”

Foreigners buy apartments in Athens to rent out to other foreigners on Airbnb. So wrong in so many ways.

• Foreign Buyers Snap Up Greek Property (K.)

Property buyers from abroad are this year growing at the fastest pace in a decade, as booming Greek tourism has had a positive impact on the property market too. According to the latest data from the Bank of Greece, in the first quarter of the year the inflow of capital from abroad for real estate acquisitions increased by 61.7% on an annual basis. The March figures have signaled a further improvement, since in the first couple of months the yearly rise had come to 56.7%. If the existing growth rate is sustained throughout 2017, it is likely that by the end of the year more than 430 million euros will have been invested the Greek property market from other countries. The equivalent figure for the whole of 2016 had amounted to 270 million euros, up 45.3% on the 2015 inflow of 186 million euros.

The only time a similar growth rate had been recorded before was in the first quarter of 2007, when foreign investors spent 66.5% more money on property acquisitions than a year earlier. Real estate professionals say this uptick in foreign funds entering the local property market is particularly positive because it came during a period when transactions are usually sparse: Expressions of buying interest this year started in the winter months, not in the summer when demand typically peaks. This has bolstered optimism about an even better summer in terms of transactions, which may reach their high for the entire period since the outbreak of the financial crisis.

The major rise in inflows this year is due to the increase in demand for apartments in Athens, primarily in the city center and the southern suburbs. This mainly concerns flats eligible for short-term leasing through Internet platforms such as HomeAway, Airbnb and FlipKey. It also concerns luxury mansions that would fit the bill for the same type of online platforms as well as for the purpose of getting a Golden Visas (for buys of properties worth 250,000 euros or more by investors from outside the European Union). Besides those buyers aiming for the five-year residence permits, considerable buying interest is also coming from Italy, France, Switzerland, Germany and the Scandinavian countries.

It’s a miracle there are not many more victims.

• State Of Emergency Declared On Lesbos As 800 Left Homeless (AP)

Authorities in Greece have declared a state of emergency on the island of Lesvos after an earthquake left one woman dead and more than 800 people displaced. The 6.1 magnitude undersea quake on Monday occurred south of Lesvos but was felt as far as Istanbul, Turkey. Officials from the island’s regional government on Tuesday said homes in 12 villages in southern Lesvos had been seriously damaged or destroyed. The mostly elderly residents affected were being housed with relatives, in hotels or at an army-run shelter. The earthquake marked the second crisis to hit the island in the last two years, after hundreds of thousands of migrants and refugees, including many fleeing war in Syria and Iraq, crossed to Lesvos on boats from Turkey as they headed to Europe.

Brussels should be forced to take in 100,000. In their new swanky buildings.

• ‘Impossible And Risky To Take In More Migrants’ – Rome’s Mayor (RT)

Rome Mayor Virginia Raggi has asked the Italian Interior Ministry for stricter measures to be taken toward the influx of foreigners into the capital. A letter outlining the need for a “moratorium” on “the continued influx of foreign citizens” was sent by Raggi to Roman prefect Paola Basilone. “I find it impossible, as well as risky, to think up further accommodation structures,” she wrote in the letter, as quoted by La Repubblica on Tuesday. “This administration, given the high flows of unregistered migrants, hopes the assessments of new facilities take into account the evident migrant pressure on Roma Capitale [the City of Rome] and the possible devastating consequences in terms of social costs as well as for the protection of the beneficiaries themselves.”

In May, Raggi told RT that she was working to help accommodate refugees and asylum seekers in Rome, but also that she also has a responsibility to her constituents and other countries in the EU must do their part. “Let’s put it this way – Rome would be better off if European states didn’t build walls along their borders, but rather followed through on their obligations and respected the migrant quotas agreed upon by the EU,” she told RT’s Sophie Shevardnadze. “According to the law, the city of Rome must accept migrants, as Mayor – I have to follow the law and do everything in my power to make sure that people are granted a safe place to stay here. But if other European countries decide to finally follow through on their obligations, we will welcome that decision.” “As mayor of Rome, I have to accommodate migrants, but I am also responsible for the security of my city and its residents. We cannot ignore either issue.”