Pieter Bruegel the Elder The Fall of Icarus 1558

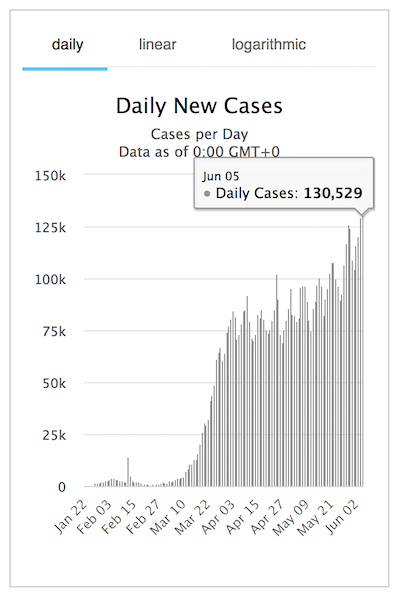

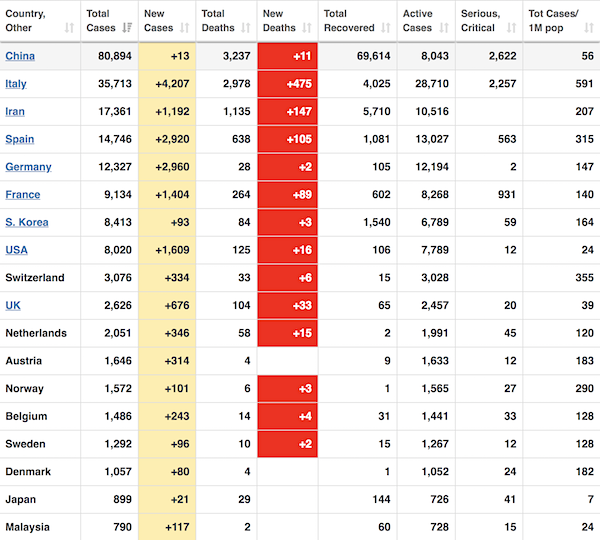

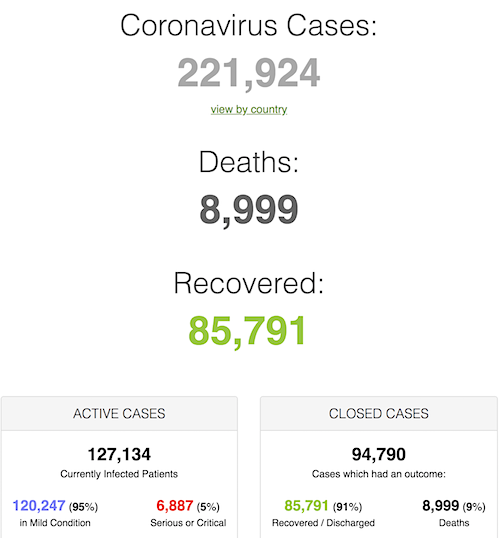

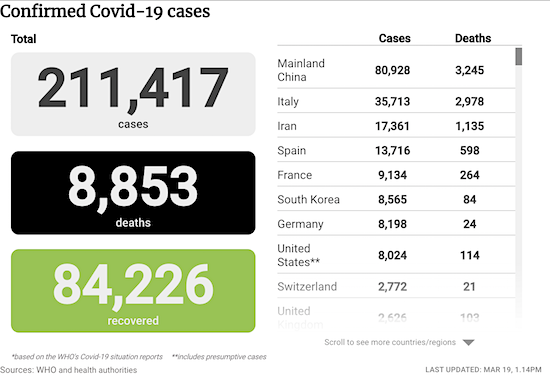

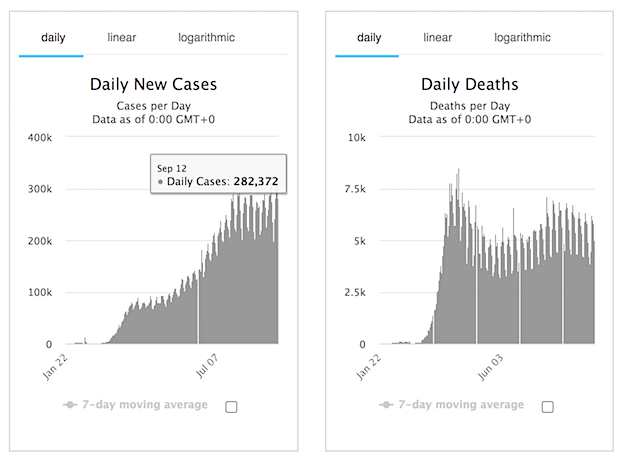

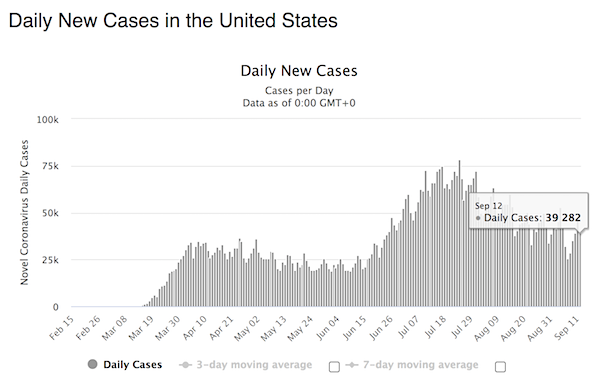

India will go above 100,000 new daily cases next week, one third of all global new cases. The US was never above 75,000.

Steve Martin

I always wear a mask when I go outside. But something about it was leaving me anxious and unsettled. I thought about the problem, addressed it, and here is the solution. pic.twitter.com/aUW4jHI3dX

— Steve Martin (@SteveMartinToGo) September 12, 2020

Wonder why it took the right wing so long to wake up to how Julian Assange is linked to the whole machine. Did they really need Tucker Carlson for that?

This is lawyer “sundance” at the Conservative Treehouse. The article has a lot more info, not just on Assange; he’s been digging for a long time. I know, it’s right wing media. But nobody else will cover this. And we want to get Assange released.

• What’s Behind The DOJ Aggression Toward Julian Assange (CT)

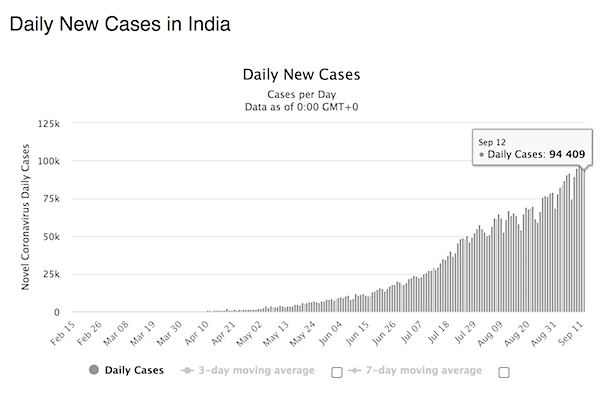

On April 11th, 2019, the Julian Assange indictment was unsealed in the EDVA. From the indictment we discover it was under seal since March 6th, 2018. On Tuesday April 15th more investigative material was released. Again, note the dates: Grand Jury, *December of 2017* This means FBI investigation prior to…. The FBI investigation took place prior to December 2017, it was coordinated through the Eastern District of Virginia (EDVA) where Dana Boente was U.S. Attorney at the time. The grand jury indictment was sealed from March of 2018 until after Mueller completed his investigation, April 2019. Why the delay? What was the DOJ waiting for? Here’s where it gets interesting…. The FBI submission to the Grand Jury in December of 2017 was four months after congressman Dana Rohrabacher talked to Julian Assange in August of 2017: “Assange told a U.S. congressman … he can prove the leaked Democratic Party documents … did not come from Russia.” [..]

Knowing how much effort the CIA and FBI put into the Russia collusion-conspiracy narrative, it would make sense for the FBI to take keen interest after this August 2017 meeting between Rohrabacher and Assange; and why the FBI would quickly gather specific evidence (related to Wikileaks and Bradley Manning) for a grand jury by December 2017. Within three months of the grand jury the DOJ generated an indictment and sealed it in March 2018. The EDVA sat on the indictment while the Mueller probe was ongoing. As soon as the Mueller probe ended, on April 11th, 2019, a planned and coordinated effort between the U.K. and U.S. was executed; Julian Assange was forcibly arrested and removed from the Ecuadorian embassy in London, and the EDVA indictment was unsealed.

As a person who has researched this three year fiasco; including the ridiculously false 2016 Russian hacking/interference narrative: “17 intelligence agencies”, Joint Analysis Report (JAR) needed for Obama’s anti-Russia narrative in December ’16; and then a month later the ridiculously political Intelligence Community Assessment (ICA) in January ’17; this timing against Assange is just too coincidental. It doesn’t take a deep researcher to see the aligned Deep State motive to control Julian Assange because the Mueller report was dependent on Russia cybercrimes, and that narrative is contingent on the Russia DNC hack story which Julian Assange disputes. This is critical. The Weissmann/Mueller report contains claims that Russia hacked the DNC servers as the central element to the Russia interference narrative in the U.S. election. This claim is directly disputed by WikiLeaks and Julian Assange, as outlined during the Dana Rohrabacher interview, and by Julian Assange on-the-record statements.

The predicate for Robert Mueller’s investigation was specifically due to Russian interference in the 2016 election. The fulcrum for this Russia interference claim is the intelligence community assessment; and the only factual evidence claimed within the ICA is that Russia hacked the DNC servers; a claim only made possible by relying on forensic computer analysis from Crowdstrike, a DNC contractor. The CIA holds a massive conflict of self-interest in upholding the Russian hacking claim. The FBI holds a massive interest in maintaining that claim. All of those foreign countries whose intelligence apparatus participated with Brennan and Strzok also have a vested self-interest in maintaining that Russia hacking and interference narrative. Julian Assange is the only person with direct knowledge of how Wikileaks gained custody of the DNC emails; and Assange has claimed he has evidence it was not from a hack.

I understand it takes 3 hours to wipe an iPhone by getting the password wrong 10 times in a row (because delays are built into the process). That’s all I personally need to know.

The term “accidental” doesn’t fit anywhere in the narrative. And destroying this sort of evidence is a criminal offence.

• Senate Chairman Asks DOJ IG To Open Probe Into Wiped Mueller Phones (JTN)

Wisconsin Sen. Ron Johnson on Friday asked Department of Justice Inspector General Michael Horowitz to open an investigation into the dozen-plus phones belonging to associates of the Robert Mueller special counsel that had been wiped of data prior to being surrendered to investigators. Government documents released this week listed multiple phones belonging to members of Mueller’s Russia collusion probe as having been cleared of all data before they were handed over to Horowitz’s office. Many of the phones, according to the documents, were purged of data after the users entered incorrect passwords too many times.

In his letter, Johnson—the chairman of the Senate Committee on Homeland Security and Governmental Affairs—said the missing data “raise[s] concerns about record retention and transparency.” The senator asked Horowitz’s office to “open an investigation into this matter to determine what, why, and how information was wiped, whether any wrongdoing occurred, and who these devices belonged to.” Johnson also asked Horowitz to explain “when and how [his] office was made aware of this matter,” what steps the office took to “confirm whether information on these phones had been wiped,” whether or not the phones in question had “text message capabilities,” and if Horowtiz’s office has “the capability to retrieve the information from these phones?” The letter asks for a response “no later than September 18, 2020.”

Paul Craig Roberts knows the machinery.

• The United States & Its Constitution Have Two Months Left (PCR)

Bob Woodward writes that Trump’s Secretary of Defense, General James Mattis, and Trump’s Director of National Intelligence, Dan Coats, spoke together about taking “collective action” to remove President Trump from office. General Mattis said Trump is “dangerous. He’s unfit.” This is the same thing that the Generals and the CIA said about President John F. Kennedy. When Generals and the CIA say that a president is unfit and dangerous, they mean he is dangerous to their budget. By “unfit” they mean he is not a reliable cold warrior who will keep hyping America’s enemies so that money keeps pouring into the military/security budget. By serving defense contractors instead of their country, generals end up very wealthy.

Both Kennedy and Trump wanted to normalize relations with Russia and to bring home US troops involved in make-war operations overseas that boost the profits of defense contractors. To stop Kennedy they assassinated him. To stop Trump they concocted Russiagate, Impeachgate, and a variety of wild and unsubstantiated accusations. The presstitutes repeat the various accusations as if they are absolute proven truth. The presstitutes never investigated a single one of the false accusations. These efforts to remove Trump did not succeed. Having pulled off numerous color revolutions in which the US has overthrown foreign governments, the tactics are now being employed against Trump. The November presidential election will not be an election. It will be a color revolution.

We have reached the point in the demise of our country that a simple statement of obvious truth is not believable. As a number of carefully researched and documented books, some written by insiders, have proved conclusively, the CIA has controlled the prestige American media since 1950. The American media does not provide news. It provides the Deep State’s explanations of events. This ensures that real news does not interfere with the agenda. The German journalst, Udo Ulfkotte, wrote a book, Bought Journalism, in which he showed that the CIA also controls the European press. To be clear, there are two CIA organizations. One is an agency that monitors world events and endeavors to provide more or less accurate information to policymakers.

The other is a covert operations agency. This agency assassinates people, including an American president, and overthrows uncooperative governments. President Truman publicly stated after he was out of office that he made a serious mistake in permitting the covert operations branch of the CIA. He said that it was an unaccountable government in inself. President Eisehnower agreed and in his last address to the American people warned of the growing unaccountable power of the military/security complex. President Kennedy realized the threat and said he was going “to break the CIA into a thousand pieces,” but they killed him first.

It would be easy for the CIA to kill Trump, but the “lone assassin” has been used too many times to be believable. It is easier to overthrow Trump’s reelection with false accusations as the CIA controlls the American and European media and has many Internet sites pretending to be dissident, a claim that fools insouciant Americans. Indeed, it is the leftwing that the CIA owns. The rightwing goes along because they think it is patriotic to support the military/security complex. After the CIA overthrows Trump, they will use Antifa, Black Lives Matter, and their presstitutes to foment race war. Then the CIA will ride in on the Pale Horse, and the population will submit.

“…5 or 6% is a lot in this country. That’s a big, big, big victory. And if he doesn’t get that…”

• Bill Maher Mocks Dems: ‘You Guys Are Whistling Past The Graveyard’ (Fox)

“Real Time” host Bill Maher wasn’t nearly as confident about a Joe Biden victory in November as his guests were on Friday night. Maher began by citing what he called “frightening” finds from electoral analyst Nate Silver, who recently determined that if Biden wins the popular vote by less than 1%, he’ll have only a “6 percent chance” of becoming president through the electoral college. Similarly, if Biden wins the popular vote by 1 or 2%, he’ll have a “22% chance” of being elected in addition to the “46% chance” with a 2 to 3% popular vote margin. “So he could win by 3 percent and he still has less than half a chance of winning the election,” Maher said. “You’ve got to get up to 5 or 6% before he has a 98% chance of winning the election. That’s a f—ed up country.”

Author Jessica Yellin, a former CNN correspondent, dismissed any reason for panic among Democrats, pointing to Biden’s “unbelievably steady” polling throughout the year, stressing that he’s been “consistently up 6 points” against President Trump, and adding that the numbers don’t indicate the “worst-case scenario” like they did in 2016. Vanity Fair contributor Peter Hamby cited Trump’s weak polling among independents and women, insisting that a “fundamental shifting” among voters “would take something overwhelmingly dramatic.” “The whole ‘What about 2016?’ thing, it’s just not 2016,” Hamby insisted. “People have had four years of Donald Trump. A verdict has more or less been rendered since he’s taken office … and Joe Biden is just not Hillary Clinton. He’s not.”

“I know,” Maher responded. “But what Nate Silver is seeing, it doesn’t matter. Because 5 or 6% is a lot in this country. That’s a big, big, big victory. And if he doesn’t get that — and races tighten at the end! You sound like the panels I used to have on right before the last election. … You guys are whistling past the graveyard.” Yellin doubled down, telling Maher she thinks it’s “very hard” to see Trump convince the rest of undecided voters to support him, pointing to polling that shows his “law and order” messaging has not improved his standing among voters. “So far. Right now,” Maher told Yellin. “You think it’s going to shift?” Yellin replied. “It could,” Maher said. “People generally don’t like violence in the streets. I mean, yes, you’re right.

When he says, ‘I’m the one who’s going to protect you,’ they’re not getting that. They’re not buying that. What they’re saying is ‘Joe Biden is a healer and we need healing right now.’ But this could change.” Maher has previously expressed doubt about Biden’s chances for a November victory. Last month, he told MSNBC’s Joy Reid he was feeling “very nervous” following the conclusion of the Republican National Convention. “I am feeling less confident about this — maybe it’s just their convention bump got to me, but I’m feeling less confident than I was a month ago,” Maher said. “I feel very nervous, the same way I did four years ago at this time.”

The usual suspects.

• When There are No Consequences for Anything (Kunstler)

We’re informed hours ago, for instance, that the top lawyers in Robert Mueller’s Special Counsel operation wiped all the records from their cell phones before the DOJ Inspector General could collect evidence of their communications from the SC team’s three-year exercise in overthrowing a president. How is that not an obstruction of justice, and who will answer for it?

That’s on top of many other bits of essential evidence in the RussiaGate coup and other perfidious acts mysteriously gone missing — Special Agent Joe Pientka’s original “302” document from the Flynn interrogation, thousands of Strzok-and-Page’s text messages, official verifications of the Steele Dossier submitted to the FISA court, communications between the FBI “small group” (Comey, McCabe, Priestap, Carlin, McCord, Baker, et al.) plus CIA Chief John Brennan and DNI James Clapper with Senators Burr and Warner on the Senate Intel Committee, communications between “whistleblower” Eric Ciaramella, Col. Alexander Vindman and House Intel Committee chair Adam Schiff, records of CIA prop Stephan Halper’s doings with the Pentagon’s Office of Net Assessment, all communication records between State Department official Jonathan Winer and British ex-spy Christopher Steele….

And now, like a fever building to climax, comes the news right out-front that the Democratic Party intends to foment insurrection if the election goes against them. They’re supporting the coming siege of Lafayette Square set to kick off fifty days of “protest” across from the White House beginning Sept 17 as a warm-up for anarchy in the streets across the nation following the Nov 3 vote. Behind us is the summer of riots, arson, and looting, and who paid to support all that? Who paid for flying Antifa and BLM personnel from city to city, feeding and housing them, paying for their “commercial-grade” fireworks, pallets of bricks, gas masks, lasers, bullhorns, black riot outfits? Why is it hard to find out who bought the plane tickets, booked the hotels? Months have gone by since all that started. Is someone in the DOJ following the money? And following their communications (especially considering the crimes against property they’ve committed)?

Yes, the Lancet, world no. 1 medical journal, said the vaccine is 100% effective. Questions?

• Russia Dispatches First Batches Of COVID19 Vaccine To All 85 Regions (RT)

Russia has sent out the initial batches of the world’s first registered coronavirus vaccine to all parts of its vast territory, as authorities test the delivery system of the much-needed drug. The formula is expected to be delivered on Monday, said Russia’s Health Minister Mikhail Murashko. “The first small batches have already been shipped,” Murashko said, explaining that the government is testing the supply chain to ensure a robust delivery system across the country’s 85 regions. As well as testing the efficacy and safety of the vaccine itself, the government believes it is paramount to ensure the efficient distribution to citizens, especially to those at high risk. Russia’s homegrown Covid-19 formula is currently in the third and final stage of clinical trials, in which 40,000 Muscovites will take part.

While three-quarters will receive the jab, another quarter will be given a placebo. On Wednesday, Moscow’s Deputy Mayor Anastasia Rakova announced that testing had begun, and over 35,000 residents had applied. “Clinical trials have begun in Moscow,” Murashko said, adding that the ministry had also created “the world’s first mobile application” that allows participants to “report on their condition” throughout the lengthy trial period. [..] The vaccine’s development process has been criticized by some Western countries for its supposedly unsafe rapid development and improper testing. However, earlier this month, the respected British medical journal The Lancet published the Russian Ministry of Health’s Sputnik V study, showing the vaccine to be 100% effective, producing antibodies in all 76 participants of early-stage trials.

Halloween

For Halloween I’m going to go as a normal person with no mask since that seems to scare the shit out of everyone.

— Jordan Sather (@Jordan_Sather_) September 12, 2020

We are curious.

• Chinese Virologist Vows To Provide Proof COVID19 Was Made In Wuhan Lab (JTN)

A Chinese scientist who reportedly fled her home country out of fear for her safety has said that she intends to release evidence proving that SARS-Cov-2 did not arise in nature but was actually manufactured in the Wuhan Institute of Virology. Virologist Li-Meng Yan claims to have done some of the earliest work on COVID-19 when it first emerged in China last year. She has said she left China in April and that she is currently in hiding in the U.S. On the British ITV television show “Loose Women” on Friday, Yan said she intends to release evidence showing “why this has come from the lab in China, why they are the only ones who made it.”

“The genome sequence [of the virus] is like a human finger print,” she told the talk show. “And based on this you can identify these things.” Yan said at the start of the pandemic she attempted to warn her supervisors of the threat the virus posed yet she was ignored. The scientist on the show declared it “critical” for the world to understand the virus’s origins, claiming: “We can not overcome it, it will be life-threatening for everyone,” though current epidemiological data indicate that the virus likely has a survival rate above 99%.

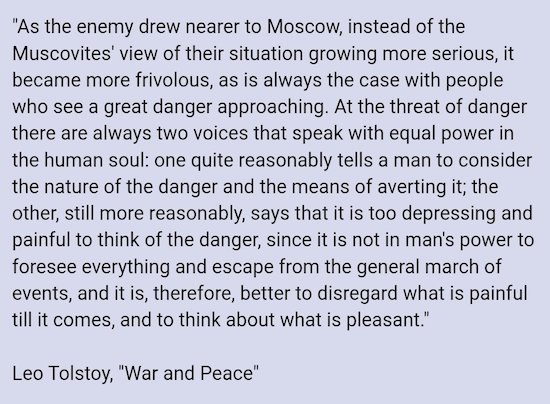

The wave appears slow in the distance; it won’t be as it gets nearer.

• The Coming Wave Of Defaults (Richard Vague)

With COVID-related income supplements and unemployment benefits now expired or reduced, we face a new wave of mortgage and rental delinquencies, many of which will come in the next few months. According to the Mortgage Bankers Association, as of June 30, mortgage delinquency in the U.S. had reached 8.2 percent, the highest since 2011 and almost double the 4.5 percent of a year earlier. With 53 million mortgages in the U.S., that means more than 4.3 million mortgages are delinquent. Add to that the fact that, per Black Knight mortgage analytics, almost 5 million homes have been in forbearance. With that, I estimate that at least 1 million to 2 million more of these loans will fall delinquent before the end of this year.

As for renters, the U.S. Census Bureau reports that, as of July, 18 percent were delinquent in their rent payments. That compares with less than 7 percent in prior years. With more than 43 million renters, that means more than 7.4 million are behind on their rental payments. With the loss of income and unemployment support, it is reasonable to believe that number will increase by several million over the next few months. Many of the resulting evictions that normally would have occurred have been forestalled by government mandate, and a major portion of the mortgage payments and apartment rental payments that would have been late have been staved off by the lifeline of the $1,200 checks from the CARES Act and augmented unemployment benefits.

Since this assistance has now expired, a new wave of delinquency is before us, and millions more Americans could go delinquent in the months immediately ahead. When people go delinquent on their mortgage or rent because of COVID-based job loss or income reduction, their lives often become a proverbial hell. Many resort to bankruptcy as a refuge. But that is just the start of what is a chain of impairment. For renters, their landlords are then hurt because of those missed rent payments, and so they in turn go into default on the loans they took out to buy the rental property, something felt especially by the small landlords who have little clout with their lenders. Then the lenders themselves — those that made mortgage loans to households and those that made property acquisition loans to the small landlords — suffer loss.

This all comes because the individuals who make up the first link in that chain can’t pay, often just temporarily. All can be protected — at least over the near term — by continued government support such as proposed in the HEROES Act now being debated in Congress. With that, individuals would be able to pay their rent and mortgages, and thus small landlords would be able to pay their loans, and community lenders could avoid major losses.

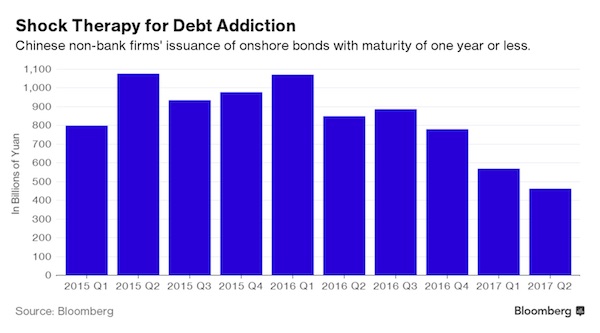

Overproduction. China can’t do without it.

• China Steel Exports Hit By 15 New Anti-Dumping Probes So Far In 2020 (SCMP)

China’s steel exports have been subject to 15 new anti-dumping investigations in the first nine months of the year, more than all of last year, as experts warn that the US-China trade war and the coronavirus pandemic have hastened a trend towards global protectionism. The US, Britain, Australia and Thailand are among the countries that have initiated dumping probes into Chinese products, including steel plates, grinding balls, cylinders and strands, as well as galvanised wires. Last year, China faced 13 anti-dumping investigations into its steel exports, according to the China Trade Remedies Database. Thailand went a step further in August, slapping a 35.67 per cent anti-dumping tariff on Chinese hot-dipped galvanised coils and sheets.

China, the world’s biggest steel producer, has long been accused of flooding the international market with cheap, subsidised steel, primarily due to oversupply at home. It produced 996 million tonnes of crude steel last year, more than half of the world’s combined output of 1.8 billion tonnes, according to the World Steel Association. But against the backdrop of the coronavirus pandemic, many smaller steel producers in Asia have had enough and are doing everything possible to protect their domestic industries. Korrakod Padungjitt, a Thai steel manufacturer and secretary general of the Thailand Iron and Steel Industry Club, said his country’s latest anti-dumping tariff on Chinese steel would just be a drop in the ocean. Chinese steel started flowing into Thailand in the early 2000s and has increasingly squeezed regional manufacturers, Korrakod said.

The Chinese steel onslaught was so ferocious that in 2010, mainland producers mixed alloy in their steel products to circumvent existing tariffs, he added. The issue is now a regular feature of annual meetings between the Asean Iron and Steel Council and the China Iron and Steel Association. Thailand’s industrial sector has been hard hit by the pandemic, with both investment and consumption plummeting. In July, Thailand’s car production fell 47 per cent compared to the same time last year, which was a significant blow to the steel sector. Earlier this year, Thailand’s Department of Foreign Trade launched an anti-dumping investigation into Chinese hot-dipped galvanised coils and sheets, which are used largely in construction and manufacturing, and in August followed through with a 35.67 per cent duty.

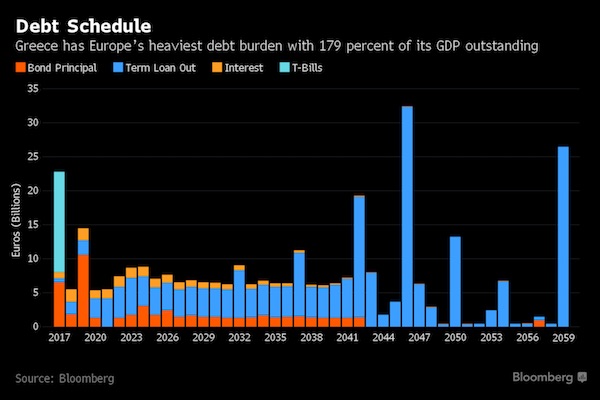

Money that should go to refugees and homeless. Not French arms dealers. But due to historic and geographical factors, Greeks take their army very seriously. They’re one of few countries that meet their NATO quota.

• Greek PM Announces Huge Military Spending To Counter Turkish Aggression (K.)

Greece will strengthen its armed forces by buying new weapons systems, Prime Minister Kyriakos Mitsotakis announced Saturday. Specifically, Greece will acquire 18 Rafale fighters, a full squadron’s strength, to replacing the aging Mirage 2000 planes; 4 new frigates, while refurbishing 4 existing ones; 4 Romeo naval helicopters; antitank weapons for the Army; torpedoes for the Navy and guided missile for its Air Force. It will also add 15,000 professional soldiers to its armed forces over the next five years, Mitsotakis said. The new weapons procurement program comes amid heightened tensions with Turkey over resources in the eastern Mediterranean. Its announcement dominated the first half of Mitsotakis’ speech on the grounds of the Thessaloniki International Fair (TIF).

The trade fair itself has been canceled, due to the coronavirus pandemic, but Mitsotakis delivered the customary speech describing next year’s economic policy. The extra spending on defense did not prevent Mitsotakis from announcing a new €6.8 billion injection into the economy, in the form of payroll and other tax cuts, subsidies and payments of pension cuts restored by the courts. “A shift in priorities (toward defense spending) does not mean a change in goals,” Mitsotakis told a restricted audience of just 50, all wearing masks and maintaining social distancing. “Ankara is now adding to the provocations in the Aegean, the undermining of peace in the entire Mediterreanean,” Mitsotakis said. “It is threatening the eastern borders of Europe, and it is undermining security in a sensitive crossroads of three continents.”

Greece military boost

https://twitter.com/e_amyna/status/1304921950222004225

Wait. 200,000 Covid-19 rapid tests(?!) Which ones are those? Are they just PCR executed fast, or actual rapid tests?

• Greek Riot Police Fire Teargas At Refugees Campaigning To Leave Lesbos (G.)

Greek riot police fired teargas at protesting refugees clamouring to leave Lesbos as the situation on the island became more explosive days after devastating fires forced thousands to flee its notorious migrant camp. Tensions mounted as asylum seekers, desperate to make their way to other parts of Europe, watched authorities, including the Greek army, rush to replace the now gutted facility of Moria with a new holding centre. “Freedom, freedom,” demonstrators chanted under the watchful eye of riot police deployed to the Aegean isle from Athens. “We don’t need new camp … we want freedom,” proclaimed some of the crude handwritten placards held aloft by protesters on Saturday.

Witnesses reported teargas being fired after younger migrants began lobbing rocks at the police units. A series of overnight blazes starting on Tuesday razed Moria, Europe’s largest refugee camp, decanting close to 13,000 men, women and children into the surrounding countryside. With the exception of 406 lone migrant children who have been flown to the Greek mainland, the former residents have been left to fend for themselves, many making makeshift shelters out of tarps and bamboo reeds along the side of a main road leading to Mytilene, the island’s port capital. Others have camped in fields, olive groves, churches and even cemeteries.

Frustration, the insistence of Greek officials that transferal is out of the question and a growing realisation that any prospect of leaving is diminishing fast have helped create an increasingly toxic atmosphere. The destruction of containers housing the asylum service in Moria has further fuelled a prevailing sense of desperation among refugees. “The thought that they may be here for even longer now, the sight of the replacement camp and being stranded without proper shelter for days has, for many, become the tipping point,” said one aid worker requesting anonymity because she was not authorised to speak. Earlier, Greece’s alternate migration minister, Giorgos Koumoutsakos, told SKAI TV Lesbos was facing a public health emergency, “a triple challenge” that also involves “public order and national security”.

On Saturday a woman and her 20-month-old baby were flown to Athens where they will be hospitalised after testing positive for the virus. They were not among the original group, most of whom were described as asymptomatic carriers of Covid-19. With fears of infection rates increasing, some 200,000 Covid-19 rapid tests were flown into Lesbos on a specially chartered plane on Friday. “There are now real fears among our island’s residents of the virus spreading,” local journalist Yannis Sinanis told the Guardian. Officials were working around-the-clock to erect the new settlement, a collection of 500 tents with the capacity to accommodate six people each. Other asylum seekers are expected to be accommodated in a ferryboat and naval ships.

“..the Academy has plans to strip the award from over 95% of the winners and give them all to Brokeback Mountain.”

• Academy Strips ‘Schindler’s List’ Of Oscar Due To Lack Of Diversity (BBee)

The Academy of Motion Picture Arts and Sciences has stripped Schindler’s List of its Best Motion Picture award for not having enough LGBTQ+ characters, people of color, and other oppressed groups. “Schindler’s List would have been a great movie if it just had a dozen transgendered characters,” said Le’Jon de Froofroo, spokesperson for the Academy. “As it is, there are just a bunch of Jews and Germans — very privileged races.” “Also, the movie has Nazis — this is the current year, for goodness’ sake!” Steven Spielberg has been ordered by the Academy to re-release the film with an unnecessary LGBTQ+ side plot, a gay roommate for Schindler, and a song and dance number set to a Lady Gaga song over the end credits if he wishes to re-earn the Academy Award. Otherwise, it will be re-awarded to Brokeback Mountain. This is just the first Oscar winner to be stripped of its award, as the Academy has plans to strip the award from over 95% of the winners and give them all to Brokeback Mountain.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now an integral part of the process.

Thank you for your support.

Support the Automatic Earth in virustime.