Brassaï Couple on a bench, Paris 1932

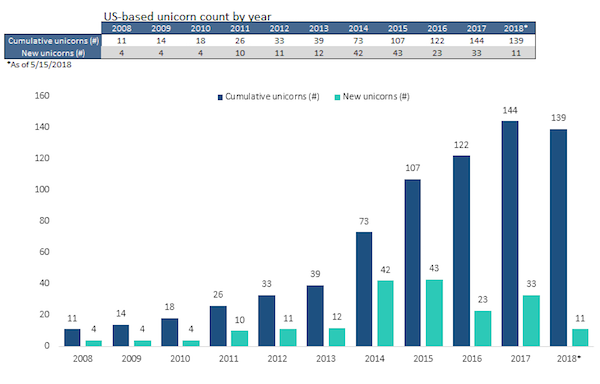

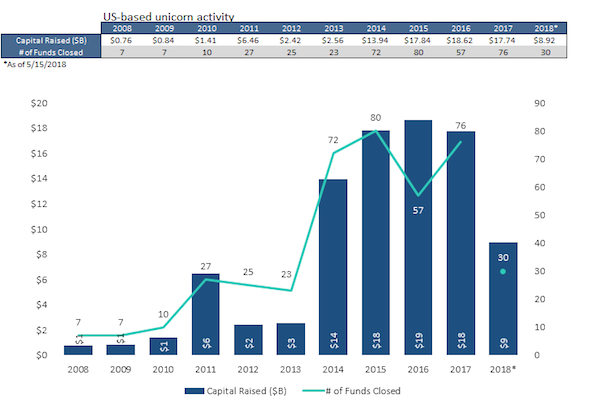

Unicorns as defined by venture capitalist Aileen Lee back in 2013: Privately-held startups valued at $1 billion or more.

• The End Is Nigh For The Biggest Tech Bubble Ever (CNBC)

In case you missed it, the peak in the tech unicorn bubble already has been reached. And it’s going to be all downhill from here. Massive losses are coming in venture capital-funded start-ups that are, in some cases, as much as 50% overvalued. The age of the unicorn likely peaked a few years ago. In 2014 there were 42 new unicorns in the United States; in 2015 there were 43. The unicorn market hasn’t reached that number again. In 2017, 33 new U.S. companies achieved unicorn status from a total of 53 globally. This year there have been 11 new unicorns, according to PitchBook data as of May 15, but these numbers tend to move around, and I believe the 279 unicorns recorded globally in late February by TechCrunch was the peak, where the start-up bubble was stretched to its limit.

A recent study by the National Bureau of Economic Research concludes that, on average, unicorns are roughly 50% overvalued. The research, conducted by Will Gornall at the University of British Columbia and Ilya Strebulaev of Stanford, examined 135 unicorns. Of those 135, the researchers estimate that nearly half, or 65, should be more fairly valued at less than $1 billion. In 1999 the average life of a tech company before it went public was four years. Today it is 11 years. The new dynamic is the increased amount of private capital available to unicorns. Investors new to the VC game, including hedge funds and mutual funds, came in when the Jobs Act started to get rid of investor protections in 2012, because there were fewer IPOs occurring.

The US Treasury two-year yield is 2.57% over 10 times higher than the Italian. Go Draghi!

• ECB’s Negative Interest Rate Policy The Funniest Monetary Joke Ever (WS)

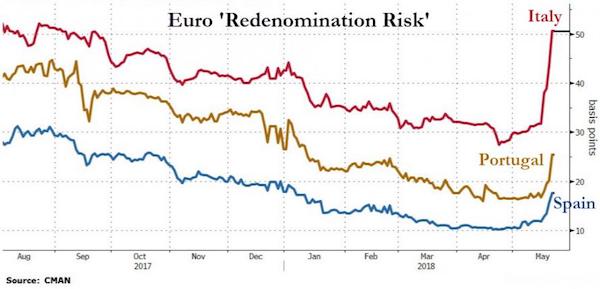

The distortions in the European bond markets are actually quite hilarious, when you think about them, and it’s hard to keep a straight face. “Italian assets were pummeled again on mounting concern over the populist coalition’s fiscal plans, with the moves rippling across European debt markets,” Bloomberg wrote this morning, also trying hard to keep a straight face. As Italian bonds took a hit, “bond yields climbed to the highest levels in almost three years, while the premium to cover a default in the nation’s debt was the stiffest since October,” it said. “Investors fret the anti-establishment parties’ proposal to issue short-term credit notes – so-called ‘mini-BOTs’ – will lead to increased borrowing in what is already one of Europe’s most indebted economies.”

This comes on top of a proposal by the new coalition last week that the ECB should forgive and forget €250 billion in Italian bonds that it had foolishly bought. The proposals by a government for a debt write-off, and the issuance of short-term credit notes as a sort of alternate currency are hallmarks of a looming default and should cause Italian yields to spike into the stratosphere, or at least into the double digits. And so Italian government bonds fell, and the yield spiked today, adding to the prior four days of spiking. But wait…Five trading days ago, the Italian two-year yield was still negative -0.12%. In other words, investors were still paying the Italian government – whose new players are contemplating a form of default – for the privilege of lending it money.

And now, the two-year yield has spiked to a positive but still minuscule 0.247% at the moment. By comparison, the US Treasury two-year yield is 2.57% over 10 times higher! [..] This is an over-indebted government that doesn’t control its own currency and cannot print itself out of trouble and whose new leadership – made up of the coalition of the Five Star Movement on the left and the League on the right – is proposing a haircut for its creditors to make the debt burden easier, and is also proposing the issuance of an alternate currency to give it more money to spend, even as it also promises to crank up government deficit spending and cut taxes too.

“As parallel currencies and debt-cancellation become serious discussion points for an Italian government, so European break-up risk is resurging.”

• The Italian Crisis Is Far From Over (ZH)

The Italian crisis is far from over and the concept of their ‘mini-BoT’ parallel currency is throwing up some very red flags about the future of the European Union… You just have to know where to look. As Bloomberg’s Tasos Vossos notes, a gauge of euro re-denomination risk (based on the so-called ‘ISDA Basis’ in Italy’s credit default swaps) blew out. What’s more, redenomination risks are spreading as the measure widened in Portugal, Spain, and in France to a lesser extent, according to CMAN data. As parallel currencies and debt-cancellation become serious discussion points for an Italian government, so European break-up risk is resurging.

Simply put, the higher this chart goes, the lower the market ‘values’ an Italian Euro relative to say a German Euro… and thus it is measuring the risk that the European Union – so long defended by Draghi et al. as indestructible – will break up. As Marcello Minenna, head of Quantitative Analysis and Financial Innovation at Consob – the Italian securities regulator, previously noted, “markets do not lie… Italy must avoid remaining with short end of the stick. I wonder if our leadership will rise to the challenge.”

Erdogan wants lower rates, but if this goes on, he’ll end up with the opposite.

• Turkish Lira Hits Record Low, Down 20% Against Dollar This Year (R.)

The Turkish lira weakened sharply against the dollar on Wednesday, bringing its losses to some 20% this year, as investors pushed it to fresh record lows on growing concern about President Tayyip Erdogan’s influence on monetary policy. At 0724 GMT, the lira stood at 4.7642 against the U.S. currency, paring its losses after touching an all-time low of 4.8450 in Asian trade overnight. It has lost as much as 21% of its value since the start of the year. The lira also fell sharply against the Japanese yen, amid talk of Japanese retail investors selling the lira as stop-loss levels were hit.

“The lira fall is now on the agenda of world markets and some are saying there is an increased risk of contagion in other emerging markets from the Turkey risk,” said GCM Securities analyst Enver Erkan. “The necessity of the Turkish central bank taking a significant step is increasing,” he said. A self-described “enemy of interest rates”, Erdogan wants borrowing costs lowered to spur credit growth and construction and said last week he would seek greater control over monetary policy after elections set for June 24.

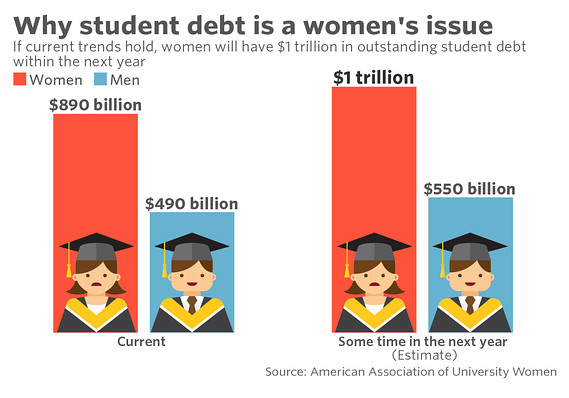

Almost twice as much as men. And then they get paid less at the jobs they find.

• American Women’s $1 Trillion Burden (MW)

Student debt is on its way to becoming a universally American problem, but there’s more evidence to indicate that it’s a particularly acute challenge for women. The gap between the amount of debt shouldered by male and female graduates has nearly doubled in the past four years, according to a report released Monday by the American Association for University Women. On average, female bachelor’s degree recipients graduated with $2,700 more in debt in 2016 than their male counterparts. That’s up from about a $1,400 gap in 2012. If trends continue on their current trajectory, Kevin Miller, a senior researcher at AAUW and the author of the report, estimates that the outstanding student debt held by women alone could reach $1 trillion over the next year.

If the ratio of debt owed by women versus men stays the same, then men hold about $550 billion at that time. “We’ll be keeping a watch on it,” he said. The data adds to the growing body of evidence — much of which has been published by AAUW — that student debt is a women’s issue. Although they make up just 56% of American college students, women hold nearly two-thirds of America’s outstanding student debt, or about $890 billion, and take longer to pay it off. There are a variety of reasons why this is the case, according to Miller.

For one, women typically have to rely more on loans to finance college because they earn less from their work before they enter college (if they have a job before they start) and while they’re in school. And once women graduate college, the gender pay gap continues to play a role. Women working full-time with college degrees earn 26% less than their male colleagues, according to AAUW, delaying their efforts to repay their loans.

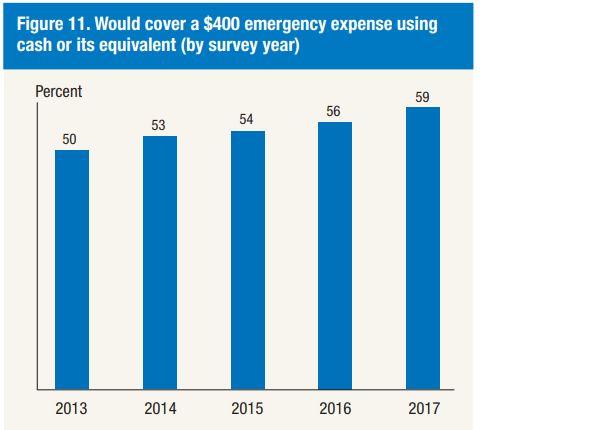

Small part of a large survey.

• 22% Of Americans Can’t Pay Bills; 41% Have Less Than $400 In Cash (ZH)

Almost nine years into an economic recovery, 41% of adults in 2017 are unable to afford an unexpected $400 expense without borrowing money or selling something, down from 44% last year. When faced with a hypothetical expense of only $400, 59% of adults in 2017 say they could easily cover it, using entirely cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). Even without an unexpected expense, the report reveals, 22% of adults expected to forgo payment on some of their bills in the month of the survey. “One-third of those who are not able to pay all their bills say that their rent, mortgage, or utility bills will be left at least partially unpaid.” Altogether, one-third of adults are either unable to pay their bills or are one modest financial setback away from financial hardship, slightly less than in 2016 (35%).

Protests against Macron are becoming massive.

• French Unemployment Rises To 9.2% In First Quarter (MW)

French unemployment rose in the first quarter of the year, the latest indication that the surging eurozone recovery of 2017 is losing momentum in 2018. The unemployment rate in France–the eurozone’s second-largest economy–rose to 9.2% in the first quarter from 9% at the end of 2017, national statistics agency Insee said Wednesday. The deterioration in French unemployment comes as economic growth slowed abruptly in the first quarter of the year after a sharp acceleration at the end of 2017.

The soft economic data and lower business confidence are adding to uncertainty over whether the eurozone is on the cusp of a broad slowdown or just catching its breath before resuming stronger growth. The French government has said unemployment remains in a downward trend despite fluctuations from one quarter to another. In the first quarter of 2017, unemployment stood at 9.6%. France’s statistics agency said Wednesday that increases in unemployment were particularly strong at the start of 2018 and youth unemployment remained above 20%. Long-term unemployment was unchanged in the first quarter from the end of 2017.

Everybody knew this would happen. But May has nothing else.

• EU Rejects May’s Plan For Northern Ireland Border (Ind.)

Brussels has rejected Theresa May’s new customs proposal less than 24 hours after the prime minister set it out in a bid to placate Brexiteers in her cabinet. European Commission officials told The Independent Ms May’s plan would be unacceptable and would go back on previous commitments made by British negotiators. A day earlier the prime minister had said the “backstop” plan to avoid a hard border in Northern Ireland – which keeps Britain in alignment with the single market and customs union if no other agreement is reached – would be time limited. The move was an attempt to assuage Brexiteers such as Boris Johnson, who fear that it would become a backdoor way to keep Britain tied indefinitely to the EU through the customs union and single market.

The controversial fallback arrangements look increasingly likely to come into play, with no other plan for the Northern Ireland border in sight and Ms May’s cabinet deadlocked on what Britain’s future customs relationship with the EU should be. European Commission officials close to the talks told The Independent that British negotiators had already made written commitments for the backstop to apply “unless and until” another solution was found in Northern Ireland, and that there was no way it could be time limited. Facing a backlash over the plan from her pro-Brexit ministers, the prime minister sought to calm their fears, telling reporters on Monday: “If it is necessary, it will be in a very limited set of circumstances for a limited time.”

They blame it on competition.

• Nationwide’s UK Mortgage Lending Slumps By A Third (G.)

Nationwide has reported declining profits for the second year in a row, as net mortgage lending slumped by a third amid intense competition. The UK’s largest building society reported a 7.3% drop in statutory profits to £977m for the year to 4 April, down from £1.05bn the previous year. Profits include the £116m cost of buying back debt. Net mortgage lending fell from £8.8bn to £5.8bn, and Nationwide’s share of the market nearly halved, from 25.4% to 13.0%. Even so, it said it remained the UK’s second-biggest mortgage lender, behind Halifax. The Swindon-based mutual blamed fierce competition that forced it to lower mortgage rates, hurting profit margins, and said there was no sign of a let-up.

Mark Rennison, the Nationwide chief financial officer, said: “Our view is price competition will continue, which is good news for customers.” Nationwide has been hit by the end of the Bank of England’s term funding scheme, which was launched after the Brexit vote to provide cheap finance to enable banks to lend at lower interest rates. Rennison said competition had increased because the big five banks had returned to the market after ringfencing their high street banking operations from the riskier parts of their businesses.

Two words: Glass-Steagall.

• House Votes To Ease Bank Rules And Send Bill To Trump’s Desk (CNBC)

The House voted Tuesday to pass the biggest rollback of financial regulations since the global financial crisis. The margin was 258-159, with 33 Democrats supporting the legislation. The bill will now go to President Donald Trump’s desk. He is expected to sign it into law. The Senate already passed the legislation with bipartisan support. The bill makes good on Republican promises to cut red tape they say hurts businesses, but does not go nearly as far as some GOP lawmakers had hoped. It also appeases some Democrats who argue financial rules passed following the financial meltdown unnecessarily hamstrung small and mid-sized lenders.

The measure eases restrictions on all but the largest banks. It raises the threshold to $250 billion from $50 billion under which banks are deemed too important to the financial system to fail. Those institutions also would not have to undergo stress tests or submit so-called living wills, both safety valves designed to plan for financial disaster. It eases mortgage loan data reporting requirements for the overwhelming majority of banks. It would add some safeguards for student loan borrowers and also require credit reporting companies to provide free credit monitoring services.

Republicans have argued the post-crisis regulations held down lending and economic growth. On Tuesday ahead of the vote, House Speaker Paul Ryan promoted the bill as a boon for community banks — though it boosts medium-sized and regional institutions, as well. “This is a bill for the small banks that are the financial anchors of our communities. … It addresses some of Dodd Frank’s biggest burdens to ease the regulatory costs on these small banks — costs which are ultimately transferred on to consumers,” the Wisconsin Republican said.

It makes wars useless.

• How Russia and China Gained a Strategic Advantage in Hypersonic Technology

The development of hypersonic weapons has been part of the military doctrine that China and Russia have been developing for quite some time, driven by various motivations. For one thing, it is a means of achieving strategic parity with the United States without having to match Washington’s unparallelled spending power. The amount of military hardware possessed by the United States cannot be matched by any other armed force, an obvious result of decades of military expenditure estimated to be in the range of five to 15 times that of its nearest competitors. For these reasons, the US Navy is able to deploy ten carrier groups, hundreds of aircraft, and engage in thousands of weapon-development programs.

Over a number of decades, the US war machine has seen its direct adversaries literally vanish, firstly following the Second World War, and then following the collapse of the Soviet Union. This led in the 1990s to shift in focus from one opposing peer competitors to one dealing with smaller and less sophisticated opponents (Yugoslavia, Syria, Iraq, Afghanistan, international terrorism). Accordingly, less funds were devoted to research in cutting-edge technology for new weapons systems in light of these changed circumstances. This strategic decision obliged the US military-industrial complex to slow down advanced research and to concentrate more on large-scale sales of new versions of aircraft, tanks, submarines and ships.

With exorbitant costs and projects lasting up to two decades, this led to systems that were already outdated by the time they rolled off the production lines. All these problems had little visibility until 2014, when the concept of great-power competition returned with a vengeance, and with it the need for the US to compare its level of firepower with that of its peer competitors. Forced by circumstances to pursue a different path, China and Russia begun a rationalization of their armed forces from the end of the 1990s, focusing on those areas that would best allow them the ability to defend against the United States’ overwhelming military power.

[..] After sealing the skies and achieving a robust nuclear-strategic parity with the United States, Moscow and Beijing begun to focus their attention on the US anti-ballistic-missile (ABM) systems placed along their borders, which also consist of the AEGIS system operated by US naval ships. As Putin warned, this posed an existential threat that compromised Russia and China’s second-strike capability in response to any American nuclear first strike, thereby disrupting the strategic balance inherent in the doctrine of mutually assured destruction (MAD).

This story will be getting bigger fast.

• Former Trump Adviser Makes Claim About A Second Informant (DC)

Former Trump campaign adviser Michael Caputo had much to tell on Monday night when he claimed on Fox News he was approached by a second government informant during his stint on President Donald Trump’s team. “Let me tell you something that I know for a fact,” Caputo said on “The Ingraham Angle” with host Laura Ingraham. “This informant, this person [who] they tried to plant into the campaign … he’s not the only person who came at the campaign. And the FBI is not the only Obama agency who came at the campaign.” “I know because they came at me. And I’m looking for clearance from my attorney to reveal this to the public. This is just the beginning.”

Stefan Halper, a Cambridge professor, has been identified as one FBI informant who approached campaign advisers Carter Page, George Papadopoulos and Sam Clovis. Halper, a veteran of three Republican administrations, approached Page in July 2016 and maintained a relationship through September 2017. Halper approached Papadopoulos on Sept. 2, 2016, with an offer to fly him to London and pay $3,000 for a policy paper on energy issues. Papadopoulos accepted the offer and met Halper several times in London. Halper asked Papadopoulos whether he knew about Russian hacks of Democrats’ emails.

Caputo did not say why he believes he was contacted by a second government informant; he declined to offer additional details, saying he needed clearance from his attorney. He did say the encounter occurred prior to Halper’s outreach to Page. “When we finally find out the truth about this, Director Clapper and the rest of them will be wearing some orange suits,” Caputo said on, referring to former Director of National Intelligence James Clapper.

The horror. The horror.

• Illegal Online Sales Of Endangered Wildlife Rife In Europe (G.)

The online sale of endangered and threatened wildlife is rife across Europe, a new investigation has revealed, ranging from live cheetahs, orangutans and bears to ivory, polar bear skins and many live reptiles and birds. Researchers from the International Fund for Animal Welfare (Ifaw) spent six weeks tracking adverts on 100 online marketplaces in four countries, the UK, Germany, France and Russia. They found more than 5,000 adverts offering to sell almost 12,000 items, worth $4m (£3m) in total. All the specimens were species in which trade is restricted or banned by the global Convention on the International Trade in Endangered Species.

Wildlife groups have worked with online marketplaces including eBay, Gumtree and Preloved to cut the trade and the results of the survey are an improvement compared to a previous Ifaw report in 2014. In March, 21 technology giants including Google, eBay, Etsy, Facebook and Instagram became part of the Global Coalition to End Wildlife Trafficking Online, and committed to bring the online illegal trade in threatened species down by 80% by 2020. “It is great to see we are making really significant inroads into disrupting and dismantling the trade,” said Tania McCrea-Steele at Ifaw. “But the scale of the trade is still enormous.”

Almost 20% of the adverts were for ivory and while the number had dropped significantly in the UK and France, a surge was seen in Germany, where traders developed new code words to mask their sales. “It is a war of attrition and we can never let our guard down,” said McCrea-Steele. The UK is implementing a stricter ban on ivory sales and the EU is under pressure from African nations to follow suit.

Internal Monsanto communications indicate they knew all along.

• Landmark Lawsuit Claims Monsanto Hid Roundup Cancer Danger For Decades (G.)

At the age of 46, DeWayne Johnson is not ready to die. But with cancer spread through most of his body, doctors say he probably has just months to live. Now Johnson, a husband and father of three in California, hopes to survive long enough to make Monsanto take the blame for his fate. On 18 June, Johnson will become the first person to take the globa; seed and chemical company to trial on allegations that it has spent decades hiding the cancer-causing dangers of its popular Roundup herbicide products – and his case has just received a major boost.

Last week Judge Curtis Karnow issued an order clearing the way for jurors to consider not just scientific evidence related to what caused Johnson’s cancer, but allegations that Monsanto suppressed evidence of the risks of its weed killing products. Karnow ruled that the trial will proceed and a jury would be allowed to consider possible punitive damages. “The internal correspondence noted by Johnson could support a jury finding that Monsanto has long been aware of the risk that its glyphosate-based herbicides are carcinogenic … but has continuously sought to influence the scientific literature to prevent its internal concerns from reaching the public sphere and to bolster its defenses in products liability actions,” Karnow wrote.

“Thus there are triable issues of material fact.” Johnson’s case, filed in San Francisco county superior court in California, is at the forefront of a legal fight against Monsanto. Some 4,000 plaintiffs have sued Monsanto alleging exposure to Roundup caused them, or their loved ones, to develop non-Hodgkin lymphoma (NHL). Another case is scheduled for trial in October, in Monsanto’s home town of St Louis, Missouri.