Martha McMillan Roberts Three sisters at Cherry Blossom Festival, Washington, DC” 1941

Not a freak incident, but a trend.

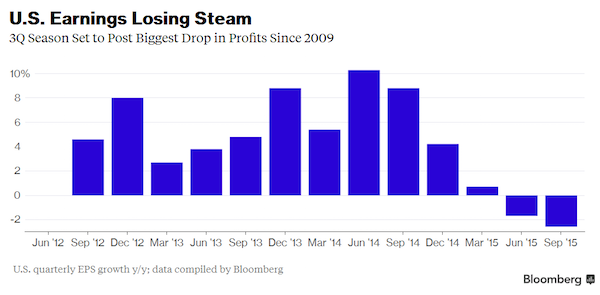

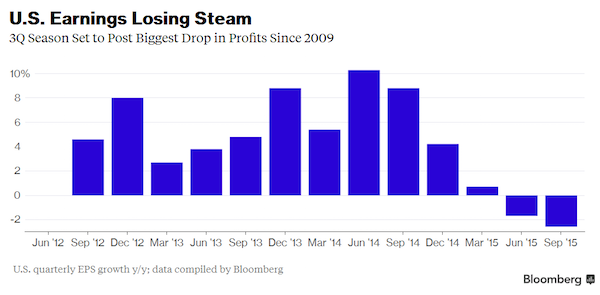

• This Is the Worst U.S. Earnings Season Since 2009 (Bloomberg)

This U.S. earnings season is on track to be the worst since 2009 as profits from oil & gas and commodity-related companies plummet. So far, about three-quarters of the S&P 500 have reported results, with profits down 3.1% on a share-weighted basis, data compiled by Bloomberg shows. This would be the biggest quarterly drop in earnings since the third quarter 2009, and the second straight quarter of profit declines. Earnings growth turned negative for the first time in six years in the second quarter this year. The damage is the biggest in commodity-related industries, with the energy sector showing a 54% drop in quarterly earnings per share so far in the quarter, with profits in the materials sector falling 15%. The picture is brighter for the telecom services and consumer discretionary sectors, with EPS growth of 23% and 19% respectively so far this quarter.

When compared with analyst expectations, about 72% of companies have beaten profit forecasts. That’s only because the consensus has been sharply cut in the past few months, Jeanne Asseraf-Bitton, head of global cross-asset research at Lyxor Asset Management says in a telephone interview. For the year as a whole, S&P 500 earnings are expected to fall 0.5%, data compiled by Bloomberg shows. For 2016, earnings growth is now seen at 7.9%, down from 10.9% in late July. Next year’s consensus is “still very optimistic,” Asseraf-Bitton says, citing the lack of positive catalyst seen for U.S. stocks in 2016 as well as the negative impact from the sharp slowdown in the U.S. energy sector. By contrast, the euro-zone is the only region worldwide where earnings are expected to “grow significantly” in 2015, according to a note from Societe Generale Head of European Equity Strategy Roland Kaloyan.

Read more …

Lower oil prices hurt where they were ‘supposed’ to heal.

• U.S. Posts Record Deficit in Manufacturing Trade (Bloomberg)

The U.S. trade deficit in manufacturing hit a record $74.7 billion in September, according to an analysis of new Census Bureau data by RealityChek, a reliable blog on manufacturing and trade. That could become fodder for debate in the presidential election, where candidates have been arguing over the plight of American factory workers. The record was spotted by Alan Tonelson, founder of RealityChek. Spotting records involves searching through historical trade data, since the Census Bureau doesn’t make comparisons in its news releases. The swelling of the manufacturing trade deficit is more evidence that while the overall U.S. economy has recovered from the 2007-09 recession, the manufacturing sector continues to lag. While overall employment is up 3% since the start of the recession, in December 2007, manufacturing employment is down 10%.

According to Tonelson, the previous high for the manufacturing trade deficit was $73 billion in August. He says the U.S. appears headed for an annual record deficit in manufacturing. The Alliance for American Manufacturing noted that U.S. imports from China hit a record of $45.7 billion in September, and President Scott Paul said the inflow is “killing America’s manufacturing recovery.” Thanks to the lowest oil imports in a decade, the overall U.S. trade deficit shrank in September to $40.8 billion from $48 billion in August, according to the Census Bureau. But the one-month dip masks a rising trend. “A weakening global economy, soaring dollar, and global petro-recession with an associated inventory overhang are hurting exports and widening the deficit despite the improvement once expected with the big drop in oil prices,” Action Economics said in a statement.

Read more …

It’s a global trend.

• German Factory Orders Unexpectedly Drop for Third Straight Month (Bloomberg)

German factory orders unexpectedly extended a series of declines in September amid a slump in demand for investment goods in the euro area, highlighting increasing risks for Europe’s largest economy. Orders, adjusted for seasonal swings and inflation, fell 1.7% from August, when they dropped 1.8%, data from the Economy Ministry in Berlin showed on Thursday. That’s the third consecutive decrease and compares with a median estimate of a 1% gain in a Bloomberg survey. Orders declined 1% from a year earlier. The Bundesbank said last month that an upward trend in economic activity in Germany continued in the third quarter, albeit less dynamically. While business confidence as measured by the Ifo institute fell in October for the first time in four months in response to weakening global trade, the slowdown in China in itself should only have a modest impact on the euro-area economy, according to the European Central Bank.

“Manufacturing orders are experiencing a hard time at the moment, which relates primarily to weak demand from outside the euro area,” the ministry said in the statement. “Domestic demand and from within the euro area continue to point moderately upward and supports manufacturing. Sentiment in the industry remains good.” Factory orders dropped 2.8% in the third quarter from the previous one, according to the report. Demand from within the country increased 0.3% and was up 0.9% for the euro area. Non-euro-area orders fell 8.6% in the July-to-September period. In September, orders for investment goods from the euro area fell 12.8%, reflecting a drop in demand for big-ticket items. Excluding bulk orders, demand fell 0.4%.

Read more …

There are over 93 million Americans not in the labor force. How can you write about this issue and leave out that number? Wolf says ‘just’ 12% of US men “were neither in work nor looking for it.”

• America’s Labour Market Is Not Working (Martin Wolf)

In 2014, 12% — close to one in eight — of US men between the ages of 25 and 54 were neither in work nor looking for it. This was very close to the Italian ratio and far higher than in other members of the group of seven leading high-income countries: in the UK, it was 8%; in Germany and France 7%; and in Japan a mere 4%. In the same year, the proportion of US prime-age women neither in work nor looking for it was 26%, much the same as in Japan and less only than Italy’s. US labour market performance was strikingly poor for the men and women whose responsibilities should make earning a good income vital. So what is going on? The debate in the US has focused on the post-crisis decline in participation rates for those over 16. These fell from 65.7% at the start of 2009 to 62.8% in July 2015.

According to the Council of Economic Advisers, 1.6 percentage points of this decline was due to ageing and 0.3 percentage points due to (diminishing) cyclical effects. This leaves about a percentage point unexplained. Princeton’s Alan Krueger, former chairman of the council, argues that many of the long-term unemployed have given up looking for work. In this way, prolonged cyclical unemployment causes permanent shrinkage of the labour force. Thus unemployment rates might fall for two opposite reasons: the welcome one would be that people find jobs; the unwelcome one would be that they abandon the search for them. Happily, in the US, the former has outweighed the latter since the crisis. The overall unemployment rate (on an internationally comparable basis) has fallen by 5 percentage points since its 2009 peak of 10%.

In all, the proportion of the fall in the unemployment rate because of lower participation cannot be more than a quarter. Relative US unemployment performance has also been quite good: in September 2015 the rate was much the same as the UK’s, and a little above Germany’s and Japan’s, but far below the eurozone’s 10.8%. US cyclical unemployment performance has at least been decent by the standards of its peers, then. Yet as the 2015 Economic Report of the President notes, the UK experienced no decline in labour-force participation after the Great Recession, despite similar ageing trends to those in the US. Even on a cyclical basis, the decline in participation in the US is a concern. It is, however, the longer-term trends that must be most worrying. This is particularly true for the prime-aged adults.

Back in 1991, the proportion of US prime-age men who were neither in work nor looking for it was just 7%. Thus the proportion of vanished would-be workers has risen by 5 percentage points since then. In the UK, the proportion of prime-aged men out of the labour force has risen only from 6% to 8% over this period. In France, it has gone from 5 to 7%. So supposedly sclerotic French labour markets have done a better job of keeping prime-aged males in the labour force than flexible US ones. Moreover, male participation rates have been declining in the US since shortly after the second world war.

Read more …

This nonsense keeps on going. Whoever follows it deserves what they get.

• Yellen Signals Solid Economy Would Spur December Rate Hike (Bloomberg)

Fed Chair Janet Yellen said an improving economy has set the stage for a December interest-rate increase if economic reports continue to assure policy makers that inflation will accelerate over time. “At this point, I see the U.S. economy as performing well,” Yellen said on Wednesday in testimony before the House Financial Services Committee in Washington. “Domestic spending has been growing at a solid pace” and if the data continue to point to growth and firmer prices, a December rate hike would be a “live possibility,” she said in response to a question from Representative Carolyn Maloney, a New York Democrat. The Federal Open Market Committee in its October statement said it will consider raising interest rates at its “next meeting,” citing “solid” rates of household spending and business investment.

“There are pretty good odds that the Fed will hike rates in December as long as employment perks back up and the unemployment rate slips further, which is what we are looking for,” said Mark Vitner, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina. “She is trying to keep the Fed’s options open in December.” No decision has yet been made on the timing of a rate increase, Yellen cautioned. Yellen appeared before the House Financial Services Committee to testify primarily on the Fed’s supervision and regulation of financial institutions. “What the committee has been expecting is that the economy will continue to grow at a pace that’s sufficient to generate further improvements to the labor market and to return inflation to our 2% target over the medium term,” she said.

Read more …

But that wouldn’t make the 1% nearly as much money…

• David Stockman Explains How To Fix The World -In 7 Words- (Zero Hedge)

While we are used to David Stockman’s detailed and lengthy “nailing” of the real state of the world, the following brief clip of an interview with Fox Business, in which David explains how to ‘fix’ so many of our problems, can be summarized perfectly in just seven short words: “Replace The Fed with the free market.” Enjoy 4 minutes of refeshing honesty… as the Fox anchor just cannot fathom who or what would “control” rates if there was no Fed…

Read more …

“He and colleagues at Fathom reckon its growth rate has slowed to about 3% a year..”

• The Bear Case for China Sees PBOC Following Fed to Zero Rates (Bloomberg)

Danny Gabay “bows to nobody” in his pessimism about China’s economy. Gabay, a former Bank of England economist, says the world’s second-biggest economy is barreling toward a hard landing. He and colleagues at Fathom reckon its growth rate has slowed to about 3% a year – less than half the official estimate of 6.9% for the year to the third quarter and the 6.5% the government is aiming for over the next five years. That means desperate measures are in store, he says. The People’s Bank of China will eventually follow its western counterparts by cutting its benchmark interest rate to zero from the current 4.35% and begin buying assets. Politicians will ease fiscal policy and step in to support banks. By cutting so deeply, the PBOC’s main rate will next year fall below that of the Fed for the first time since 2001.

It has already lowered its benchmark six times in a year and devalued the yuan by 3% against the dollar in August. “They will try to do it stone by stone, step by step,” says Gabay, a director and co-founder of Fathom. The authorities also will need to let the yuan slide further, probably by between 2% and 3% a quarter for the next two years and ultimately by about 25% overall to stop it from choking the economy even more. “The rope the Chinese have is currently around their neck and they need to let it go,” said Gabay. “It’s going to hurt.” Fathom’s case conflicts with that of Ma Jun, the PBOC’s chief economist. He said on Tuesday that some market participants are “too bearish” on the economy, where a recovery in property sales alongside recent stimulus should support expansion. The PBOC has repeatedly said it won’t need to do quantitative easing.

Underpinning Gabay’s pessimistic view is his argument that China is no special case and that its policy makers are no better equipped that those elsewhere to prop up a faltering economy. Like the U.S. and U.K. before it, China needs to face life with excess debt.

China’s total government, corporate and household debt load as of mid-2014 was equal to 282% of the country’s total annual economic output, according to McKinsey. “They will be no more adept at stopping an asset price bubble from bursting than the rest of us,” said Gabay. Its banks are now on perilous ground with non-performing loans totaling more than 20% of gross domestic product, more than the level witnessed in Japan in the 1990s before its economy entered deflation, according to Gabay. “We haven’t yet had the final shoe drop,” he said. “There could be a larger further fall in Chinese activity if we’re right and the banking system implodes.”

Read more …

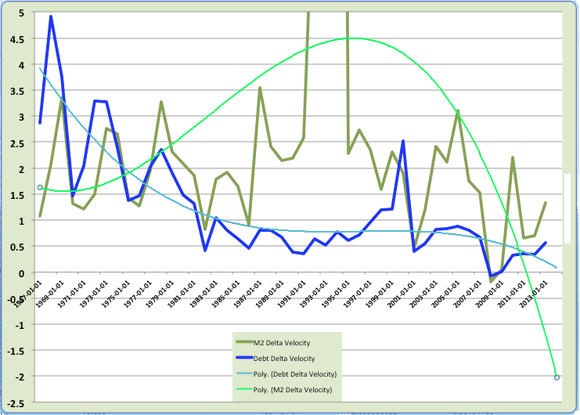

Ambrose notes the rise in money supply, but fully ignores that means nothing is it is not spent. A curious oversight.

• I’ll Eat My Hat If We Are Anywhere Near A Global Recession (AEP)

The damp kindling wood of global economic recovery is poised to catch fire. For the first time in half a decade of stagnation, government policy has turned expansionary in the US, China and the eurozone at the same time. Fiscal austerity is largely over. The combined money supply is surging. Such optimistic claims are perhaps hazardous, given record debt ratios in most areas of the world and given that we are six-and-a-half years into an aging economic cycle that might normally be rolling over at this stage. It certainly feels lonely. Citigroup’s Willem Buiter has issued a global recession alert. Professor Nouriel Roubini from New York University joined him this week, warning that the odds of a fresh slump have doubled to 30pc. Mr Roubini’s gloom is unsettling for me.

We saw the world in almost exactly the same way in the lead-up to the Lehman crisis, when it seemed obvious to both of us that sharply rising interest rates would prick the US housing bubble and the EMU credit bubble. This time I dissent. Years of fiscal retrenchment and balance sheet deleveraging have prevented the current global economic recovery from gathering speed, and have therefore stretched the potential lifespan of the cycle. The torrid pace of worldwide money growth over recent months is simply not compatible with an imminent crisis. A combined gauge of the global money supply put together by Gabriel Stein at Oxford Economics shows that the “broad” M3 measure grew by 8.1pc in August, and by almost as much in real terms. This is the fastest rate in 25 years, excluding the final blow-off phase of the Lehman boom.

The index has since fallen back slightly as the US settles down but the pattern is clear. It bears no relation to the monetary implosion in early to mid-2008 before the collapse of Fannie Mae and Freddie Mac, the twin mortgage giants that in turn brought down the banking system. It is, of course, possible that money signals have lost their meaning in our brave new world of zero rates and secular stagnation, but the current pace of growth would typically imply a flurry of economic activity over the following year or so. “It is a very benign picture for the world. We should see above trend growth over the next year,” said Tim Congdon from International Monetary Research. Mr Congdon said the expansion of broad money in China has accelerated to an annual pace of 18.9pc over the past three months, thanks in part to equity purchases by the central bank (PBOC), a shot of adrenaline straight to the heart – otherwise known as quantitative easing with Chinese characteristics.

The eurozone is no longer hurtling into a 1930s deflationary vortex. A trifecta of cheap money, cheap oil and a cheap euro have entirely changed the landscape, and now the European Central Bank seems curiously determined to push stimulus yet further by doubling down on QE. Central banks are strange animals, pro-cyclical by nature.

Read more …

“VW has now lost €32.4bn, or 40% of its value,..”

• VW Could Face Billions In Car Tax Repayments Over Latest CO2 Scandal (Guardian)

Volkswagen could have to repay billions of pounds of tax credits to European governments after finding irregularities in the levels of carbon dioxide emitted by its cars. Shares in the embattled carmaker slumped by 10% on Wednesday, wiping €5bn off the value of the company, as analysts warned that the consequences of rigging CO2 and fuel consumption tests could be worse than the initial scandal around diesel emissions tests. VW has now lost €32.4bn, or 40% of its value, since admitting in September that it installed defeat devices into 11m diesel vehicles. The scandal is dragging down sales of new VW cars, according to industry figures due to be released in Britain on Thursday. Sales data for October from the Society of Motor Manufacturers and Traders is expected to show that VW sales fell by more than 8% year-on-year, with Seat and Skoda also down.

The latest admission about CO2 tests dramatically widens the scandal that VW is facing. Germany, Britain and other countries set vehicle tax rates based on their CO2 emissions. This means that if VW artificially lowered CO2 emissions during testing then its vehicles will have contributed far less in tax than they should have. VW has said that at least 800,000 cars are affected by the CO2 discovery and estimated the economic risks at €2bn. This works out at €2,500 per car, far more than the €609 per car put aside for the cost of the 11m cars involved in the diesel emissions scandal, which was €6.7bn in total. Analysts said these costs were likely to relate to repaying tax credits in Europe rather than customer compensation. [..]

VW could also face compensation claims from motorists over the misstatement of their vehicle’s fuel economy. According to BNP Paribas, the cost of compensation to governments and customers could reach €4bn, on top of the estimated €12bn cost of rigging nitrogen oxide tests. UBS said the total costs of the scandal, including legal claims, could reach €35bn. The discovery about the irregularities in CO2 data emerged from VW’s investigation into the diesel emissions scandal. This found that figures for CO2 and fuel consumption were set too low during CO2 tests. VW is yet to confirm which models are involved or how the misstatement occurred. The majority of the cars have a diesel engine, but petrol vehicles have been dragged into the scandal for the first time.

Read more …

The whole world.

• VW Scandal Widens Again as India Says Vehicles Exceeded Emission Rules (BBG)

India sought a response from Volkswagen after probes into four car models showed diesel-fuel emissions exceeding permissible limits, and variations in results between on-road tests and those done in laboratories. Investigations into the Jetta, Vento, Polo and Audi A4 marques showed significant variations and about 314,000 vehicles are potentially affected, Ambuj Sharma, an additional secretary in India’s Heavy Industries Ministry, said in an interview in Mumbai. If cars have defeat devices that cheat tests, the matter would become criminal, he said.

Emissions exceeding India’s Bharat Stage IV standards were detected, and VW has 30 days to reply to the findings, Sharma said. The notice adds to Volkswagen’s woes after the automaker admitted in September to cheating U.S. pollution tests for years with illegal software, prompting a plunge in its shares and a leadership change. India’s standards for controlling pollution from exhaust fumes lag behind those in Europe by several years. The company said yesterday it will present its results on the diesel-engine emissions issue by the end of November, and that it’s co-operating fully with the Indian government.

Read more …

Merkel is way late on this issue too.

• Germany Ups Pressure On VW As Scandal Takes On New Dimension (Reuters)

German officials stepped up the pressure on Volkswagen to clean up its act on Wednesday after it revealed it had understated the fuel consumption of some vehicles, opening a new front in the crisis at Europe’s biggest carmaker. The company said late on Tuesday it had understated the level of carbon dioxide emissions in up to 800,000 cars sold in Europe, and consequently their fuel usage. This means affected vehicles are more expensive to drive than their buyers had been led to believe. The revelations add a new dimension to a crisis that had previously focused on VW cheating tests for smog-causing nitrogen oxide emissions. They are the first to threaten to make a serious dent in the firm’s car sales since the scandal erupted as they could deter cost-conscious consumers, analysts said.

The latest admission provoked some of the strongest criticism yet from the German government of Volkswagen, which is part of an auto industry that employs over 750,000 people in the country, has been a symbol of German engineering prowess and dwarfs other sectors of the economy. Transport minister Alexander Dobrindt said the latest irregularities had caused “irritation in my ministry and with me”. Chancellor Angela Merkel’s spokesman, Steffen Seibert, said the carmaker had to take steps to prevent this happening again. “VW has a duty to clear this up transparently and comprehensively,” he added. “It’s important (for VW) to create structures to avoid such cases.” The latest revelations, which led to Volkswagen adding €2 billion to its expected costs from the scandal, are also the first time gasoline cars have been drawn into the scandal.

Read more …

It’s becoming a valid question: can VW survive this?

• VW Emissions Scandal Still Obscured By A Cloud (Guardian)

The surprise is that Volkswagen’s shares fell only 10% as the cheating affair deepened in several ways. First, the scandal now covers emissions of carbon dioxide, or CO2, not only nitrogen oxide. Second, some petrol engines are now involved. Third – perhaps most importantly for shareholders who hope VW can recover quickly – the company still seems incapable of giving a straightforward account of what its own investigation has uncovered. Tuesday evening’s statement contained the obligatory expressions of regret and commitment to transparency. Indeed, Matthias Müller, the executive shoved into the hot seat in the first week of the crisis, opted for pomposity overdrive. “From the very start I have pushed hard for the relentless and comprehensive clarification of events,” he declared.

“We will stop at nothing and nobody. This is a painful process, but it is our only alternative. For us, the only thing that counts is the truth.” What, though, did VW actually say beyond the confession that “based on present knowledge” 800,000 vehicles have been affected? Almost nothing. Were cheat devices attached to the vehicles, or were real CO2 emissions disguised by other means? How many petrol cars are affected? Does the phrase “present knowledge” mean most cars in VW’s fleet are in the clear, or that they haven’t yet been examined for CO2? And, since the word “irregularities” is so vague, how severely wrong is the published CO2 data? None of these issues were addressed. A little reticence is understandable while investigations continue but it is not unreasonable to expect VW to explain why it can’t answer questions that would occur to most readers of its statement.

More disgracefully from the point of view of shareholders, the company failed to explain how it derived its estimate that the latest revelations will cost “approximately €2bn”. Does that figure merely cover tax credits that now would appear to have been unfairly earned? Analysts assume so, in which case there could also be a wave of claims from consumers who were encouraged to buy VW vehicles on the basis of bogus claims about fuel efficiency. Analysts at Exane BNP Paribas, for example, added €4bn for recall and compensation costs for customers. That assumption sounds fair. The point, though, is that VW ought to be able to say what its €2bn covers and what it doesn’t.

Read more …

They should have done this two months ago, when the scandal broke.

• Germany To Retest VW Cars As Scandal Pushes Berlin To Act (Reuters)

Germany is to retest all Volkswagen car models to gauge their genuine emissions levels after new revelations from the carmaker six weeks into its biggest-ever corporate scandal pushed the government to act. Expressing his “irritation” with one of Germany’s biggest employers, Transport Minister Alexander Dobrindt said on Wednesday that all current models sold under the VW, Audi, Skoda and Seat brands – with both diesel and petrol engines – would be tested for carbon dioxide and nitrogen dioxide emissions. As the crisis deepened, VW said it had told U.S. and Canadian dealers to stop selling recent models equipped with its 3.0 V6 TDI diesel engine, while the Moody’s agency downgraded the firm’s credit rating.

The German government’s announcement followed a VW statement on Tuesday that it had understated the level of carbon dioxide emissions in around 800,000 cars sold mainly in Europe, and consequently their fuel usage. This means affected vehicles are more expensive to drive than their buyers had been led to believe. The revelations added a new dimension to a crisis that had previously focused on how Europe’s biggest carmaker cheated in U.S. tests on diesel cars for emissions of nitrogen oxide, which cause smog. Previously the government had said it would review only nitrogen dioxide emissions from VW diesel cars.

“We all have an interest that everything at VW is turned over and reviewed,” Dobrindt said, adding that the government wanted to force the company to pay the extra car taxes which would be incurred by the higher CO2 emissions levels. VW is Europe’s biggest motor manufacturer, employing over 750,000 people in Germany, and has been a symbol of the nation’s engineering prowess.

Read more …

Basque independence is not that strong now, but Catalunya may change that.

• Basque Secessionists Follow Catalans In Push For Independence (Guardian)

As the central government in Madrid squares off against secessionists in Catalonia, separatists in another Spanish region have begun formally laying the groundwork for their own push for independence. EH Bildu, a leftwing pro-independence party in the Basque country, has submitted a bill to the regional parliament that it hopes will pave the way for consultations to be held in the region. “The aim is to put the political, economic and social future of the Basque country in the hands of its citizens,” EH Bildu’s spokesman, Hasier Arraiz, said as he presented the legislation. The bill mirrors that passed by the Catalan parliament last year, which aimed to create legal cover for a consultation on independence in the region. Spain’s constitutional court suspended the regional law, but Catalonia pressed ahead with the consultation, rebranding it as a symbolic referendum.

The Catalan leader, Artur Mas, and two associates are under investigation for disobedience, abuse of power and obstruction of justice over their actions. Basque separatists have shied away from specifically mentioning independence, but they referred several times to Catalonia as they presented their bill. “It’s time to confront the state democratically. They are doing it in Catalonia and we want to do it in the Basque country,” Arraiz said. The Basque bill has little chance of being passed, because EH Bildu holds only 21 of the 75 seats in the Basque parliament. Its actions, however, confirmed worries in Madrid that any concessions made to secessionists in Catalonia may have to be extended to separatist movements across the country.

Read more …

Regurgitated ‘news’.

• US Presses Europe To Take Steps To Reduce Greece’s Debt Burden (Bloomberg)

The US is pressing euro-area countries to agree to an overhaul of Greece’s debt to give private-sector investors confidence that the nation’s borrowing burden is sustainable, a US Treasury official said. Europe needs to take action to lower Greece’s overall debt levels, said the official, who asked not to be identified because discussions are in progress. Participation by the European Bank for Reconstruction and Development would also be helpful to restore financial stability in Greece, the official said. The EBRD, which was created to help central and eastern European countries after the Cold War, could lend staff and contribute technical expertise to help the Greek banking system get on firmer footing, according to the official.

Lowering interest rates and extending maturities can ease Greece’s debt burden, and the US and IMF have stopped short of calling for writing down the principal of the loans. Many euro-area nations have indicated that would be a “red line,” while indicating they might agree to better servicing terms. The US call to reduce Greece’s debt burden echoes the position taken by the IMF, which has said it won’t offer new money to Greece unless the euro area commits to a formal debt operation. The US is the largest shareholder in the Washington-based IMF, which lends to countries that run into balance-of-payments troubles. Germany and other creditor nations say bringing the IMF on board is an essential element of the €86 billion bailout that the currency bloc approved in August.

The bailout loans Greece has amassed over its three rescues are the focus in the debt-relief talks, since Greece’s private- sector debt was already restructured in early 2012. Greece’s borrowing outlook gained a boost over the weekend, when the European Central Bank found that capital shortfalls at the four biggest banks won’t require all of the money set aside for financial-sector assistance within the aid program. The banks need €14.4 billion, of which €10 billion is expected to come from the rescue coffers. The European Stability Mechanism said on Saturday that this means Greece won’t draw down the full bailout amount, since it doesn’t appear to need another 15 billion euros that had been earmarked for bank aid if needed. The banks are expected to raise 4.4 billion euros from private-sector sources.

Greek government officials say the EBRD, which took bank stakes in Cyprus, has indicated its willingness to take part in the Greek banks’ search for fresh capital. The EBRD is actively looking at the recapitalization plans of the Greek banks with a view to determining whether we can play a role in the process over the next few weeks, said Axel Reiserer, a spokesman for the London-based development bank. The EBRD has recently established a presence in Greece and is now building relationships and exploring options for investments, Reiserer said. The EBRD handles project finance and does not provide budget support or financial aid.

Read more …

Time warp.

• Fannie, Freddie May Need To Tap Treasury, FHFA Director Says (MarketWatch)

Fannie Mae and Freddie Mac are at risk of needing an injection of Treasury capital after the latter reported its first quarterly loss in four years, the director of the Federal Housing Finance Agency said Tuesday. FHFA Director Mel Watt issued a statement following mortgage-finance company Freddie Mac’s $475 million third-quarter loss, its first quarterly loss in four years. “Volatility in interest rates coupled with a capital buffer that will decline to zero in 2018 under the terms of the senior preferred stock purchase agreements with Treasury will likely make both Enterprises increasingly susceptible to the possibility of quarterly losses that could result in draws going forward,” Watt said. Freddie Mac said its loss was driven by interest rate changes that soured the value of derivatives it holds.

Watt, in his statement, pointed out that Freddie Mac didn’t report a decline in the credit quality of credit-related losses. The status of Fannie Mae and Freddie Mac has been left in limbo since the government took them under conservatorship in 2008. Efforts to reform the companies have stalled in Congress. But Treasury Secretary Jack Lew and his deputies have pushed back against the idea of privatizing Fannie Mae and Freddie Mac. So-called recap and release could raise the possibility of another bailout, the Treasury says. Freddie Mac has paid $96.5 billion to the U.S. Treasury in dividends. It won’t make any payments to the Treasury for the third quarter, but it won’t have to draw, either, due to the $1.8 billion in reserves.

Read more …

This is big. When the supply chain of the global economy starts sputtering, look out below.

• Maersk Line to Cut 4,000 Jobs as Shipping Market Deteriorates (WSJ)

The world’s biggest container-ship operator is altering course, slashing jobs and canceling or delaying orders for new vessels after years weathering a sharp downturn in the container-shipping market. Danish conglomerate A.P. Møller-Maersk A/S said Wednesday its Maersk Line container-shipping unit would cut 4,000 jobs from its land-based staff of 23,000. It is also canceling options to buy six Triple-E vessels, the world’s largest container ships, to cope with the deepest market slump in the industry since the 2009 global financial crisis. Maersk said it would also push back plans to purchase eight slightly smaller vessels. The decision to halt its fleet expansion represents a significant U-turn for the company, which had been investing heavily amid the downturn.

Counting on its market-share dominance and deep pockets, it aimed to expand as smaller competitors retrenched. But after issuing a surprise profit warning last month, Maersk signaled it, too, was no longer immune to a combination of slowing global growth and massive container ship overcapacity on many routes. The conglomerate said it would cut its annual administration costs by $250 million over the next two years and would cancel 35 scheduled voyages in the fourth quarter. That is on top of four regularly scheduled sailings it canceled earlier in the year. Maersk has already ordered 27 vessels this year, including 11 Triple-E behemoths, which can carry in excess of 19,000 containers. “Given weaker-than-expected demand, this will be enough for us to grow in line with our ambitions over the next three years or so,” said Maersk Line Chief Executive Søren Skou.

The Triple-E orders were placed at South Korean yard Daewoo Shipbuilding and included a nonbinding option to order six more ships. Maersk officials said that under the terms of the deal, the Danish company isn’t subject to any damages for canceling the option. DSME wasn’t immediately available for comment. Although such options aren’t included in the order books of shipbuilders until they become solid orders, a move like Maersk’s represents a psychological blow for the global shipbuilding industry as well. Ships like the Triple-E go for more than $150 million each, and orders for them have helped cushion the blow for dwindling orders for other ship types.

Read more …

Remember remember the 5th of November. Today Anonymous promised to ‘unveil’ 1000 American KKK members.

• 2015 Million Mask March: Anonymous Calls For Day Of Action In 671 Cities (RT)

Tens of thousands of activists disguised as Guy Fawkes are expected to the flood streets of over 671 cities as the Anonymous-led Million Mask March sweeps the globe. The hacktivist group and its followers will protest censorship, corruption, war and poverty. For the fourth year in a row the “Anonymous army,” as the group likes to call its activists, will rise up and take part in rallies and protests from Sydney to Los Angeles and Johannesburg to London. Hiding their faces behind stylized ‘Anonymous’ masks popularized by the “V for Vendetta” movie, they will come forward to make their voices heard. The Million Mask March is also about letting “various governments” know that “the free flow of information” will never be stopped.

“We now face a dilemma unfamiliar to any previous human civilization, we face this dilemma not simply as a community, nor a nation; rather collectively as a planet. We have something no previous generation has ever had, the internet,” Anonymous said in its 2015 promo video for the Million Mask March. Social media has been their major megaphone calling on people to unite in a global move. Just like last year, London expects one of the most massive marches on its streets. According to the demonstration’s page on Facebook, 18,000 people are going to join the Anonymous-inspired march. “The government and the 1% have played their hand, now it is time to play ours,” a Facebook statement reads. This year’s dress code for the London’s Million Mask March calls for “white judicial wigs, black robes & Anonymous masks for Order of Public Court.”

Activists will start gathering by the Ecuadorian Embassy “to free Robin Hood [Julian Assange]” at 9 am. The Metropolitan Police is bracing for 2015’s Million Mask March with thousands of extra police. Law enforcement will be on stand-by in case activists attack businesses or cause damage to property. Potential targets have been warned. The 2014 Million Mask March in London was marked by scuffles between activists and police. Meanwhile in Washington, the Million Mask March is expected to be attended by 25,000 people, according to Facebook’s number of “going” at the time of publication. Activists plan to meet by the Washington monument not far from the Capitol building and march towards the White House.

Read more …

Note how this piece is 180º different from the next one.

• Merkel Overwhelmed: Chancellor Plunges Germany Into Chaos (Sputnik)

Merkel’s recent statements about the need to keep German borders open in order to prevent military conflicts in Europe is causing panic and anxiety among the German population, DWN wrote. According to the newspaper, Merkel’s actions have surprised political observers as well, some of whom say that the German Chancellor is “overwhelmed” and that her era will soon come to an end. The author argued that Merkel’s statements about the possibility of a military conflict are causing fear and panic among Germans. “A warning of a war in Europe expressed by the German Chancellor in public is irresponsible,” the article said, adding that in this context Merkel’s statements about the need to keep the borders open sound confusing and ridiculous.

“The reaction of all ordinary people to such a threatening statement would be that they would want the borders to be closed quickly,” the author wrote. The situation in the country is extremely critical. There is aggression and a tense atmosphere between various groups in refugee camps that may lead to an explosion anytime. Some refugees do not view the German authorities as an obstacle and do not take into account the local legislation when initiating violent clashes. “Will Merkel send the Bundeswehr to the camps? The police have already called the Bundeswehr during violent clashes because otherwise they would lose control,” the newspaper wrote.

According to the newspaper, the catastrophic situation has its roots in Merkel’s irresponsible policy of open doors towards all refugees and migrants. Now at a time when the influx of newcomers is still increasing and the country’s authorities are completely overwhelmed, the situation may come out of control any time. Germany and other European countries have been struggling to resolve the refugee crisis for many months, but without much success. Hundreds of thousands of undocumented migrants continue to flee their home countries in the Middle East and North Africa to escape violence and poverty.

Read more …

Her power is more important than refugees’ lives.

• Merkel Reasserts Control as Rebellion Over Refugees Fades (Bloomberg)

German Chancellor Angela Merkel may have defused one of the biggest bust-ups of her third-term coalition after quelling a political revolt from her Bavarian allies over her handling of the refugee crisis. A nascent deal reached this week indicates Merkel is reasserting her control over the domestic political drift Germany has witnessed recently amid coalition sniping that put her chancellorship in question. While she has said many external factors will determine whether the flow of refugees can be stemmed – from government action in Turkey to a diplomatic solution to end the war in Syria – Merkel can also take heart from the latest polling that suggests her party’s sliding support has halted.

“There were some threats, but Merkel treated it quite calmly,” said Manfred Guellner, head of Berlin-based pollster Forsa, adding that her party’s poll numbers have probably reached the bottom. “As far as power brokers in Berlin are concerned, nobody at the moment wants to risk the coalition in any serious way.” The chancellor struck the agreement with her chief internal critic, Bavarian Premier Horst Seehofer, removing his threat of unilateral action to halt the influx of refugees. Merkel and Seehofer will meet Thursday with Sigmar Gabriel – head of junior coalition partner, the Social Democrats – to hammer out a final deal. All three have signaled in the last two days that they’re aiming to put the dispute behind them. “We will see if we can find common ground,” Merkel told reporters Wednesday in Berlin.

“If we don’t find an agreement, we have to continue negotiating. That wouldn’t be the first time, but everybody wants us to find a logical solution.” [..] Seehofer, the chairman of the Bavarian sister party of Merkel’s Christian Democrat Union, was assuaged by the chancellor’s commitment to reduce the number of refugees. Merkel said that would involve a series of measures including a political agreement with Turkey to protect that country’s border and a resolution of the civil war in Syria, rather than shutting Germany’s frontier or setting upper limits on those who can come in. “No country in the world can accommodate a limitless flow of refugees,” Seehofer said earlier this week, responding to the numbers of refugees arriving in Bavaria from Austria, issuing the biggest challenge yet to Merkel’s open-door policy.

Speaking to business leaders in Dusseldorf Wednesday evening, Merkel reiterated the need to cut the number of asylum-seekers and tackle the refugee crisis at its source in Syria, warning that a restoration of border controls within the European Union would hit the free movement of goods and people. “We probably need a European border guard, agreements with our neighbors and a fair distribution” of refugees in Europe, the chancellor said. “That means we need a change to the existing asylum system, but a change that strengthens Europe and not a change that weakens Europe.”

Read more …

“..people will keep coming as long as the smugglers tell them to come, and the smugglers will keep attempting trips as long as the people are coming..”

• Rough Seas and Falling Temperatures Fail to Stop Flow of Refugees (NY Times)

The rubber dinghy rolled perilously on the waves and twisted sideways, nearly flipping, as more than three dozen passengers wrapped in orange life vests screamed, wept and cried frantically to God and the volunteers waiting on the rocky beach. Khalid Ahmed, 35, slipped over the side into the numbing waist-high water, struggled to shore and fell to his knees, bowing toward the eastern horizon and praying while tears poured into his salt-stiff beard. “I know it is almost winter,” he said. “We knew the seas would be rough. But please, you must believe me, whatever will happen to us, it will be better than what we left behind.” The great flood of humanity pouring out of Turkey from Syria, Afghanistan, Iraq and other roiling nations shows little sign of stopping, despite the plummeting temperatures, the increasingly turbulent seas and the rising number of drownings along the coast.

If anything, there has been a greater gush of people in recent weeks, driven by increased fighting in their homelands – including the arrival of Russian airstrikes in Syria — and the gnawing fear that the path into the heart of Europe will snap shut as bickering governments tighten their borders. “Coming in the winter like this is unprecedented,” said Alessandra Morelli, the director of emergency operations in Greece for the United Nations High Commissioner for Refugees. “But it makes sense if you understand the logic of ‘now or never.’ That is the logic that has taken hold among these people. They believe this opportunity will not come again, so they must risk it, despite the dangers.”

The surge means that countries throughout the Balkans and Central Europe already under intense logistical and political strain will not find relief — especially Germany, the destination of choice for many of the refugees. Hopes that weather and diplomacy would ease the emergency are unfounded so far, putting more pressure on financially strapped and emotionally overwhelmed governments to quickly find more winterized shelter. The influx also underscores the European Union’s failure to reach a unified solution to the crisis, leaving places like Lesbos struggling to deal with huge numbers of desperate people and raising questions about what will happen not just this winter, but in the spring and beyond.

Early this week, the number of people who had crossed into Greece from Turkey hit 600,000, after having passed 500,000 only a few weeks earlier. Both migrants and relief workers shrug when asked how far into the winter people will try to make the treacherous crossing. “Some of the smugglers, they tell the people who call them, ‘Yes, there will be more trips, you should come,’ and so the people keep coming,” said Abu Jawad, a 28-year-old Palestinian Syrian who works as a broker for Turkish smugglers, recruiting passengers from the crowds in Izmir, Turkey, and other coastal cities. “So what I think is that people will keep coming as long as the smugglers tell them to come, and the smugglers will keep attempting trips as long as the people are coming,” he said.

Read more …

Leggeri should be fired from framing the issue this way. But he won’t, because this is Europe’s new normal, this is how politics wants is framed. Still, under international law people fleeing war zones cannot be labeled ‘illegal’.

• 800,000 ‘Illegal Entries’ To EU In 2015, Frontex Chief Says (AFP)

Migrants have made some 800,000 “illegal entries” to the European Union so far this year, the head of the bloc’s border agency Frontex said in an interview with German newspaper Bild published Wednesday. Warning that the influx of migrants has probably not yet “reached its peak,” Fabrice Leggeri called for European states to detain unsuccessful asylum seekers so they can be “rapidly” sent back to their countries of origin. “EU states must prepare for the fact that we still have a very difficult situation ahead of us in the coming months,” added Leggeri. Last month, Frontex said that 710,000 migrants had entered the EU in the first nine months of the year but cautioned that many people had been counted twice. The agency said on October 13 that “irregular border crossings may be attempted by the same person several times.”

“This means that a large number of the people who were counted when they arrived in Greece were again counted when entering the EU for the second time through Hungary or Croatia,” explained the agency. According to the most recent figures from the UN refugee agency, more than 744,000 people have made the perilous journey across the Mediterranean this year, the majority to Greece. On Wednesday, the first set of 30 migrants was due to leave Athens for Luxembourg under an EU plan to redistribute people throughout the 28-member bloc in order to ease pressure on countries like Greece and Italy. The bloc hopes to transfer some 160,000 people under the plan.

Read more …