George N. Barnard Nashville, Tennessee. Rail yard and depot 1864

“..We now exist in an environment where the financial system as a whole has been flipped upside down just to make it function…”

• This is The Biggest Fraud In The History Of The World (SHTF)

The stock market may be hovering near all-time highs, but according to Greg Mannarino of Traders Choice that doesn’t mean the valuations are actually real: We exist, beyond any shadow of any doubt, in an environment of absolute fakery where nothing is real… from the prices of assets to what’s occurring here with regard to the big Wall Street banks, the Federal Reserve, interest rates and everything in between. …All of this is being played in a way to keep people believing, once again, that the system is working and will continue to work:

President Obama has suggested that people like Greg Mannarino who are exposing the fraud for what it is are just peddling fiction. And just this week the President argued that he saved the world from a great depression and that the closing credits of the 2008 crash movie “The Big Short” were inaccurate when they claimed that nothing has been done to fundamentally curb the fraud and fix the system under his administration. But as Mannarino notes, the President and his central bank cohorts are making these statements because the system is so fragile that if the public senses even the smallest problem it could derail the entire thing:

“Let’s just look at the stock market… there’s no possible way at this time that these multiples can be justified with regard to what’s occurring here with the price action of the overall market… meanwhile, the market continues to rise. … Nothing is real. I can’t stress this enough… and we’re going to continue to see more fakery… and manipulation and twisting of this entire system… We now exist in an environment where the financial system as a whole has been flipped upside down just to make it function… and that’s very scary. … We’ve never seen anything like this in the history of the world… The Federal Reserve has never been in a situation like this… we are completely in uncharted territory where the world’s central banks have gone negative interest rates… it’s all an illusion to keep the stock market booming.

… Every single asset now… I don’t care what asset… you want to look at currency, debt, housing, metals, the stock market… pick an asset… there’s no price discovery mechanism behind it whatsoever… it’s all fake… it’s all being distorted. … The system is built upon on one premise and that is confidence that it will work… if that confidence is rattled the whole thing will implode… our policy makers are well aware of this… there is collusion between central banks and their respective governments… and it will not stop until it implodes… and what I mean by implode is, correct to fair value.”

And when that confidence is finally lost and the fraud exposed – and it will be as has always been the case throughout history – the destruction to follow will be one for the history books. In a previous interview Mannarino warned that things could get so serious after the bursting of such a massive bubble that millions of people will die on a world-wide scale:

“It’s created a population boom… a population boom has risen in tandem with the debt. It’s incredible. So, when the debt bubble bursts we’re going to get a correction in population. It’s a mathematical certainty. Millions upon millions of people are going to die on a world-wide scale when the debt bubble bursts. And I’m saying when not if… … When resources become more and more scarce we’re going to see countries at war with each other. People will be scrambling… in a worst case scenario… doing everything that they can to survive… to provide for their family and for themselves. There’s no way out of it.”

“..credit growth is probably running at about 25-30%, or about twice as fast as official data suggest, and roughly four times the growth in money GDP..”

• China’s Debt Reckoning Cannot Be Deferred Indefinitely (Magnus)

[..] there is a bit of folklore about the topping out of skyscrapers: the builders’ ceremonial placing of the final beam often heralds the onset of grim economic news, coinciding with the end of a credit cycle that has funded a frenzy of lending for ever-bigger projects. And indeed, as the economy slows markedly, China is increasingly dependent on credit creation. The share of total credit in the economy is approaching 260% and, on current trends, could surpass 300% by 2020 – exceptional for a middle-income country with China’s income per head. The debt build-up must sooner or later end — and when it does it will have a significant impact on the global economy.

Back in 2008, as the western financial crisis spread, China tried to insulate itself with a big credit stimulus programme to counter factory closures and an accompanying return of millions of migrants to the countryside. By 2011 the growth rate had peaked. Its decline was led by a fall in investment in property, then manufacturing. Subsequent stimulus measures have not altered the trend for long but one constant is a relentless build-up in the indebtedness of property companies, state enterprises and local governments.� Conventional measures of credit, however, do not fully reflect the growth of total banking assets. Local and provincial governments have been allowed to issue new bonds on yields a bit below bank loans, bought by banks — but they have not paid down more expensive earlier debts to banks as planned.

Banks, moreover, have also increased their lending, often through instruments such as securitised loans, to non-banking financial intermediaries, such as insurance companies, asset managers and security trading firms. When this is taken into account, credit growth is probably running at about 25-30%, or about twice as fast as official data suggest, and roughly four times the growth in money GDP, the cash value of national output. For now, China’s credit surge seems to have stabilised the economy after a sharp slowdown around the turn of the year. The property market has picked up, attracting funds from a stock market that has fallen out of favour with investors after pronounced instability in the middle of last year and early in 2016. The volume of property transactions has risen and prices have rebounded, especially in the biggest cities.

Timing the end of a credit boom is more luck than judgment. There is no question that lenders own bad loans, reckoned unofficially by some banks and credit rating agencies to amount to about 20% of total assets, the equivalent of around 60% of GDP. These will have to be written off or restructured, and the costs allocated to the state, banks, companies or households. Yet in a state-run banking system, where loans can be extended and there are institutional obstacles to realising bad debts, the day of reckoning can be postponed for some time. More likely, the other side of the lenders’ balance sheets, or their liabilities, is where the limits to the credit cycle will appear sooner.

“..Uncle Sam has gotten $4 trillion of “something for nothing” during the last 16 years, while the Washington politicians and policy apparatchiks were happy to pretend that the “independent” Fed was doing god’s work..”

• The Cult Of Central Banking Is Dead In The Water (Stockman)

The Fed has been sitting on the funds rate like some monetary mother hen since December 2008. Once it punts again at the June meeting owing to Brexit worries it will have effectively pegged money market rates at the zero bound for 90 straight months. There has never been a time in financial history when anything close to this happened, including the 1930s. Nor was interest-free money for eight years running ever even imagined in the entire history of monetary thought. So where’s the fire? What monumental emergency justifies this resort to radical monetary intrusion and repression? Alas, there is none. And that’s as in nichts, nada, nope, nothing! There is a structural growth problem, of course. But it has absolutely nothing to do with monetary policy; and it can’t be fixed with cheap money and more debt, anyway.

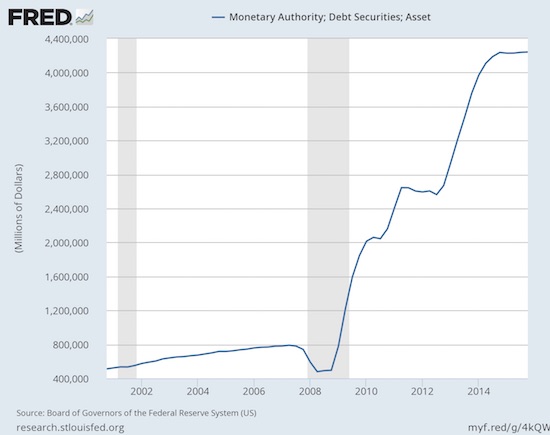

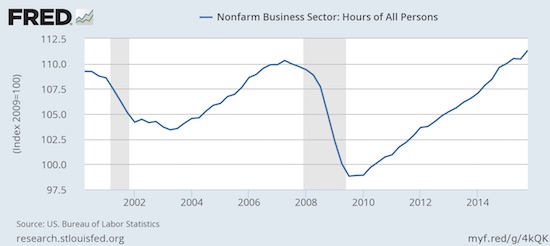

By contrast, there is no inflation deficiency – even by the Fed’s preferred measure. Indeed, the very idea of a central bank pumping furiously to generate more inflation comes straight from the archives of crank economics. The following two graphs dramatize the cargo cult essence of today’s Keynesian central banking regime. Since the year 2000 when monetary repression began in earnest, the balance sheet of the Fed has risen by 800%, while the amount of labor hours used in the US economy has increased by 2%. At a ratio of 400:1 you can’t even try to argue the counterfactual. That is, there is no amount of money printing that could have ameliorated the “no growth” economy symbolized by flat-lining labor hours.

Owing to the recency bias that dominates mainstream news and commentary, the massive expansion of the Fed’s balance sheet depicted above goes unnoted and unremarked, as if it were always part of the financial landscape. In fact, however, it is something radically new under the sun; it’s the footprint of a monetary fraud breathtaking in its magnitude. In essence, during the last 15 years the Fed has gifted the US economy with a $4 trillion free lunch. Uncle Sam bought $4 trillion worth of weapons, highways, government salaries and contractual services but did not pay for them by extracting an equal amount of financing from taxes or tapping the private savings pool, and thereby “crowding out” other investments.

Instead, Uncle Sam “bridge financed” these expenditures on real goods and services by issuing US treasury bonds on a interim basis to clear his checking account. But these expenses were then permanently funded by fiat credits conjured from thin air by the Fed when it did the “takeout” financing. Central bank purchase of government bonds in this manner is otherwise and cosmetically known as “quantitative easing” (QE), but it’s fraud all the same. In essence, Uncle Sam has gotten $4 trillion of “something for nothing” during the last 16 years, while the Washington politicians and policy apparatchiks were happy to pretend that the “independent” Fed was doing god’s work of catalyzing, coaxing and stimulating more jobs and growth out of the US economy. No it wasn’t! What it was actually doing was not stimulating the main street economy, but falsifying and inflating the price of financial assets.

“ZIRP has enabled corporate CEOs to game the stock market to massively increase their own pay while encouraging them to cut worker salaries and shift higher paying jobs overseas.”

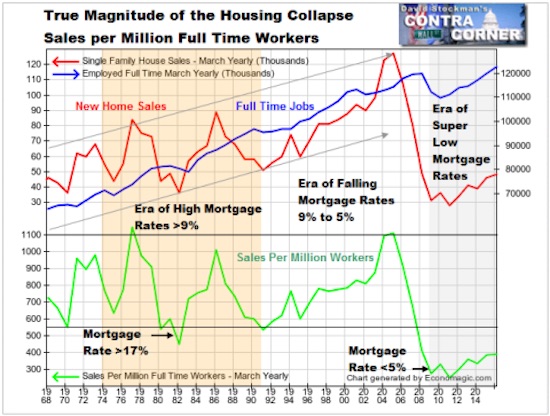

• The Real Story Behind US New Home Sales Collapse (Adler)

Comparing the growth in the number of full time jobs versus the growth in new home sales starkly illustrates both the horrible quality of the new jobs, and how badly ZIRP has served the US economy. Growth in new home sales has always been dependent on growth in full time jobs. For 38 years until the housing bubble peaked in 2006, home sales and full time jobs always trended together, subject to normal cyclical swings. With the exception of 1981-83 when Paul Volcker pushed rates into the stratosphere, new home sales always fluctuated between 550 and 1,100 sales per million full time workers in the month of March. But in the housing crash in 2007-09 sales fell to a low of 276 per million full time workers. Since then the number of full time jobs has recovered to greater than the peak reached in 2007. In spite of that, new home sales per million workers remain at depression levels.

With 30 year mortgage rates now at 3.6% sales are lower today than they were when mortgage rates were above 17% in 1982. Sales have never reached 400 sales per million workers in spite of the recovery in the number of jobs, in spite of ZIRP, in spite of mortgage rates often under 4%. ZIRP has actually made the problem worse. It has caused raging housing inflation which has caused median monthly mortgage payments for new homes to rise by 20% since 2009. ZIRP has enabled corporate CEOs to game the stock market to massively increase their own pay while encouraging them to cut worker salaries and shift higher paying jobs overseas. That leaves the US economy to create only low skill, low pay jobs that do not pay enough for workers to be able to purchase new homes. The perverse incentives of ZIRP are why the housing industry languishes at depression levels.

At WHAT point does WHO become a currency manipulator? The US issued a warning, also to Japan, this week. But Tokyo is being taken to task by the markets. The question becomes: what will seal the fate of Abenomics? A high yen or a low one?

• Recent Rise In Yen ‘Extremely Worrying’: Japan Finance Minister (AFP)

Japan’s finance minister said late Saturday the recent sharp rise in the yen is “extremely worrying”, adding Tokyo will take action when necessary. The remarks, which suggest Tokyo’s possible market intervention, came after the Japanese unit surged to an 18-month high against the dollar in New York Friday. It extended the previous day’s rally, which was boosted by a surprising monetary decision made by the BoJ. On Thursday, the central bank shocked markets by failing to provide more stimulus, confounding expectations it would act after a double earthquake and a string of weak readings on the world’s number three economy. The dollar tumbled to 106.31 yen in New York Friday, its lowest level since October 2014, from 108.11 yen. The greenback had bought 111.78 yen in Tokyo before the BoJ announcement on Thursday.

“The yen strengthened by five yen in two days. Obviously one-sided and biased, so-called speculative moves are seen behind it,” Japanese Finance Minister Taro Aso told reporters. “It is extremely worrying,” he said. The finance minister left on a trip, which will also take him to an annual Asian Development Bank meeting in Germany. “Tokyo will continue watching the market trends carefully and take actions when necessary,” he added. A strong currency is damaging for Japan’s exporting giants, such as Toyota and Sony, as it makes their goods more expensive overseas and shrinks the value of repatriated profits. Aso has reiterated that Japan could intervene in forex markets to stem the unit’s steep rise, saying moves to halt the currency’s “one-sided, speculative” rally would not breach a G20 agreement to avoid competitive currency devaluations.

You don’t say… Who figured that out?

• UK ‘Is In The Throes Of A Housing Crisis’ (G.)

David Cameron’s pledge to build a property-owning democracy is called into serious question by a landmark survey revealing that almost four in 10 of those who do not own a home believe they will never be able to do so. According to an exclusive poll for the Observer on attitudes to British housing, 69% of people think the country is “in the throes of a housing crisis”. A staggering 71% of aspiring property owners doubt their ability to buy a home without financial help from family members. More than two-thirds (67%) would like to buy their own home “one day”, while 37% believe buying will remain out of their reach for good. A further 26% think it will take them up to five years. With affordable homes in short supply and demand for social housing rising, more than half of Britons cite immigration and a glut of foreign investment in UK property as factors driving prices beyond reach.

The findings cast doubt on the prime minister’s claim before last year’s general election that Tory housing policies would transform “generation rent” into “generation buy”. In April last year, as he launched plans to force local authorities to sell valuable properties to fund new “affordable homes”, Cameron said: “The dream of a property-owning democracy is alive and well and we will help you fulfil it.” The poll – which found that 58% of people want more, not less, social housing as a way to ease the crisis – comes as the government’s highly controversial housing and planning bill returns to the Commons on Tuesday. The bill will force councils to sell much of their social housing and curb lifelong council tenancies, introducing “pay to stay” rules that will force better-off council tenants to pay rents closer to market levels.

Described by housing experts as the beginning of the end of social housing, the bill has been savaged by cross-party groups in the Lords. They have inflicted a string of defeats on ministers and forced numerous concessions. The government’s flagship plan for “starter homes” has also been widely attacked on the grounds that the properties – which in London will cost up to £450,000 – will not be affordable. With local elections and the London mayoral election on Thursday, ministers now face the dilemma of whether to back down and accept many of the Lords’ amendments to the bill or face legislative deadlock.

There is no credible news about Russia left in the west.

• No, Russia Is Not In Decline – At Least Not Any More And Not Yet (FT)

A survey of recent writings on Russia by western scholars reveals a widely-held view that the largest of the 15 post-Soviet republics has continued to decline in the 21st century. Yet an examination of the data suggests that Russia has actually risen in comparison with some of its western competitors. Neil Ferguson, the British, Harvard-based historian, wrote in 2011 that Vladimir Putin’s Russia was in decline and “on its way to global irrelevance.” His Harvard colleagues Joseph Nye and Stephen Walt hold similar views. “Russia is in long-term decline,” Nye wrote in April 2015; also last year, Walt wrote of Russia’s decline at least twice. Other western thinkers who have pronounced Russia’s decline in the 21st century include John Mearsheimer of the University of Chicago, Ian Bremmer of Eurasia Group, Nicholas Burns of Harvard University and Stephen Blank of the American Foreign Policy Council.

Others go further. Alexander Motyl of Rutgers University recently wrote of a “coming Russian collapse”. Lilia Shevtsova, a Russian scholar affiliated with the Brookings Institution, believes the collapse has already begun. But is Russia really in decline, as western scholars claim? A comparison of its performance with the world as a whole or with the west’s leading economies suggests that the claim that post-Communist Russia has continued its decline into the 21st century is highly contestable at the very least. I have compared Russia with the US, the UK, France, Germany and Italy – the west’s biggest economy, western Europe’s four biggest and all of the west’s nuclear powers – in the period 1999 to 2015 (with some exceptions when data is not available). I relied on data supplied by the World Bank, the Stockholm International Peace Research Institute and the World Steel Association, turning to data from national governments only in the absence of data from the three organisations.

One traditional way of measuring nations’ power relative to each other is to compare their GDP. By this measure, Russia gained economically on all of its competitors as well as on the world as a whole in 1999-2015. Russian GDP was equal to less than 5% of US GDP in 1999. That share grew to 6% in 2015, a 36% increase. Over the same period, Russia’s share of global GDP increased by 23%, from 1.32% in 1999 to 1.6% in 2015. Meanwhile, the US, UK, French, German and Italian shares in global GDP declined by 10%, 11%, 19%, 20% and 32%, respectively. It is well known that the Russian economy has been declining since 2014. According to the World Bank, it is poised to contract by 1% yet again in 2016 before it resumes growth. However, this projected decline will not erase the cumulative gains that the Russian economy has made since 1999 against those of the US, UK, France, Germany and Italy and against the world as a whole.

Germany doesn’t want a union, it wants a sales market.

• Germany Should Stop Whining About Negative Rates (Economist)

Germany and the Netherlands are usually great supporters of central-bank independence. In the 1990s Germany blocked France’s push for a political say over monetary policy in the new ECB. The Dutchman who first headed that bank, Wim Duisenberg, said that it might be normal for politicians to express views on monetary policy, but it would be abnormal for central bankers to listen to them. That was then. Now German and Dutch politicians are trying to browbeat Mario Draghi, the ECB’s current president, into ending the bank’s policy of negative interest rates. The German finance minister, Wolfgang Schäuble, accused Mr Draghi of causing “extraordinary problems” for his country’s financial sector; wilder yet, he also pinned on the ECB half of the blame for the rise of the populist Alternative for Germany (AfD) party.

Both countries’ politicians attack low rates as a conspiracy to punish northern European savers and let southern European borrowers off the hook. ECB autonomy was sacred when rates suited Germany; now that rates do not fit the bill, and are imposed by an Italian to boot, it is another matter. The critics are not just hypocritical. They are partly responsible—let’s say 50% to blame—for the mess. As Mr Draghi has pointed out, his mandate is to raise the euro zone’s inflation rate back towards 2%. It is currently at zero, and periodically dips into negative territory. There is a legitimate debate to be had about how far a negative-interest-rate policy can go. The banks are unwilling to pass on negative rates to depositors, which means their own earnings are dented. And yes, savers are undoubtedly suffering at the moment. But raising rates would squash the recovery, and with it any chance of a normalisation of monetary policy.

The ECB’s policies of ultra-low rates and quantitative easing (printing money to buy bonds) are the same as those used by other central banks in the rich world since the onset of the financial crisis. Even the Bundesbank, whose allergy to inflation largely explains why the ECB was slower to embrace unconventional monetary policy than its peers, has felt compelled to defend Mr Draghi from attacks in Germany. The fundamental reason for Europe’s low interest rates and bond yields is the fragility of its economy. Its unemployment rate is stuck at 10%. While the ECB has been doing what it can to press down the accelerator, however, the austerity preached by the likes of the German and Dutch governments has slammed on the brakes. For years, Mr Draghi has been saying that monetary policy alone cannot speed up the economy, and that creditworthy governments must use fiscal policy as well, ideally by raising public investment.

If Mr Schäuble wants higher yields for German savers, he should be spending more money. Instead, his government is running a budget surplus. A hesitation to spend might be understandable if it were difficult for the German government to find good investment opportunities. But Germany has suffered from low infrastructure spending for decades. Investment by municipalities has fallen by about half since 1991, according to a 2015 report by the German Institute for Economic Research; since 2003 it has failed even to keep pace with the deterioration of infrastructure.

Kaletsky’s dreaming in technicolor: “..The enormous programme of quantitative easing that Draghi pushed through, against German opposition, has saved the euro…”

• Could Italy Be The Unlikely Saviour Of Project Europe? (PS)

As the EU begins to disintegrate, who can provide the leadership to save it? German chancellor Angela Merkel is widely credited with finally answering Henry Kissinger’s famous question about the Western alliance: “What is the phone number for Europe?” But if Europe’s phone number has a German dialling code, it goes through to an automated answer: “Nein zu Allem.” This phrase –“No to everything” –is how Mario Draghi, the ECB president, recently described the standard German response to all economic initiatives aimed at strengthening Europe. A classic case was Merkel’s veto of a proposal by Italian prime minister Matteo Renzi to fund refugee programmes in Europe, North Africa, and Turkey through an issue of EU bonds, an efficient and low-cost idea also advanced by leading financiers such as George Soros.

Merkel’s high-handed refusal even to consider broader European interests if these threaten her domestic popularity has become a recurring nightmare for other EU leaders. This refusal underpins not only her economic and immigration policies, but also her bullying of Greece, her support for coal subsidies, her backing of German carmakers over diesel emissions, her kowtowing to Turkey on press freedom, and her mismanagement of the Minsk agreement in Ukraine. In short, Merkel has done more to damage the EU than any living politician, while constantly proclaiming her passion for “the European project”. But where can a Europe disillusioned with German leadership now turn? The obvious candidates will not or cannot take on the role: Britain has excluded itself; France is paralysed until next year’s presidential election and possibly beyond; and Spain cannot even form a government.

That leaves Italy, a country that, having dominated Europe’s politics and culture for most of its history, is now treated as “peripheral”. But Italy is resuming its historic role as a source of Europe’s best ideas and leadership in politics, and also, most surprisingly, in economics. Draghi’s transformation of the ECB into the world’s most creative and proactive central bank is the clearest example of this. The enormous programme of quantitative easing that Draghi pushed through, against German opposition, has saved the euro by circumventing the Maastricht Treaty’s rules against monetising or mutualising government debts. Last month, Draghi became the first central banker to take seriously the idea of helicopter money – the direct distribution of newly created money from the central bank to eurozone residents.

Germany’s leaders have reacted furiously and are now subjecting Draghi to nationalistic personal attacks. Less visibly, Italy has also led a quiet rebellion against the pre-Keynesian economics of the German government and the European commission. In EU councils and again at this month’s IMF meeting in Washington, DC, Pier Carlo Padoan, Italy’s finance minister, presented the case for fiscal stimulus more strongly and coherently than any other EU leader. More important, Padoan has started to implement fiscal stimulus by cutting taxes and maintaining public spending plans, in defiance of German and EU commission demands to tighten his budget. As a result, consumer and business confidence in Italy have rebounded to the highest level in 15 years, credit conditions have improved, and Italy is the only G7 country expected by the IMF to grow faster in 2016 than 2015 (albeit still at an inadequate 1% rate).

“It would be silly to buy a Mitsubishi car after this..”

• Future Of Scandal-Hit Mitsubishi Motors In Doubt – Again (AFP)

Sales are falling off a cliff. Its reputation is in tatters. And even its top executive is talking about whether the automaker will survive. Mitsubishi Motors’ future is hanging in the balance for the second time in a decade after a bombshell admission that it has been cheating on fuel-economy tests for years. The crisis is threatening to put the company into the ditch permanently, but some analysts think the vast web of shareholdings among Japanese firms may just save it from the scrap yard. “I really think the future of Mitsubishi Motors is grim,” said Hideyuki Kobayashi, a business professor at Hitotsubashi University, who authored a book about the company’s struggles with an earlier cover-up. “It would be silly to buy a Mitsubishi car after this (scandal). This isn’t the first time this has happened.”

In 2005, the maker of the Outlander SUV and Lancer cars was pulled back from the brink of bankruptcy after it was discovered that it covered up vehicle defects that caused fatal accidents. The vast Mitsubishi group of companies stepped in with a series of bailouts, saving the embattled firm. But it is not clear if they would be so willing to help this time around as the automaker faces possibly huge fines, lawsuits and customer compensation costs. The scandal has shone a light on the cozy relationships between Japanese firms – including the big equity stakes they hold in each other – which have come under renewed scrutiny in recent years.

Lowest common denominator.

• Trump Saves American TV (Brown)

My friends in the TV news business are in a state of despair about Donald Trump, even as their bosses in the boardroom are giddy over what he’s doing for their once sagging ratings. “It feels like it’s over,” one old friend from my television days told me recently. Any hope of practicing real journalism on TV is really, finally finished. “Look, we’ve always done a lot of stupid shit to get ratings. But now it’s like we’ve just given up and literally handed over control hoping he’ll save us. It’s pathetic, and I feel like hell.” Said another friend covering the presidential campaign for cable news, “I am swilling antidepressants trying to figure out what to do with my life when this is over.” I’ve been there, and I sure am sympathetic.

When I left cable news in 2010 after 14 years as a correspondent and anchor for NBC News and CNN, this kind of ratings pressure was a big reason why (and I don’t take for granted that I had the luxury of being able to walk away). I was not so interested in night-after-night coverage of Michael Jackson’s death or Britney Spears’ latest breakdown—topics that were “breaking news” at the time. And yes, as my friend reminded me, we did “stupid shit” to get the numbers up when it came to political coverage then, too. (Anyone remember the correspondent’s hologram that appeared on set during CNN’s 2008 election coverage?) But it was nothing like what we’re seeing today. I really would like to blame Trump. But everything he is doing is with TV news’ full acquiescence. Trump doesn’t force the networks to show his rallies live rather than do real reporting.

Nor does he force anyone to accept his phone calls rather than demand that he do a face-to-face interview that would be a greater risk for him. TV news has largely given Trump editorial control. It is driven by a hunger for ratings—and the people who run the networks and the news channels are only too happy to make that Faustian bargain. Which is why you’ll see endless variations of this banner, one I saw all three cable networks put up in a single day: “Breaking news: Trump speaks for first time since Wisconsin loss.” In all these scenes, the TV reporter just stands there, off camera, essentially useless. The order doesn’t need to be stated. It’s understood in the newsroom: Air the Trump rallies live and uninterrupted. He may say something crazy; he often does, and it’s always great television.

This must be such a relief for the TV executives managing a business in decline, suffering from a thousand cuts from social media and other new platforms. Trump arrived on the scene as a kind of manna from hell. I admit I have been surprised by the public candor about this bounty. A “beaming” Jeff Zucker, president of CNN Worldwide, told New York Times media columnist Jim Rutenberg, “These numbers are crazy—crazy.” But if their bosses are frank about the great ratings, some of my friends left at the cable networks are in various degrees of denial. “Give me a break,” one told me. “You can’t put this on us. Reality has changed because of technology. Look at the White House. They’re basically running their own news organization. They bypass us every day. We’re just trying to keep up.” And then there’s this attempt to put the best face on things, which is the most universal comment I hear: “At least this shows how much we still matter.”

Anything the EU agrees to can be seen as inconsequential.

• Greece Concludes Agreement With Creditors On Sale Of NPLs (Kath.)

An agreement between Greece and its lenders will lead to the vast majority of non-performing loans (NPLs) linked to primary residences with a taxable value under 140,000 euros being protected from sale until 2018, Economy Ministry sources have said. The government said on Saturday that the framework for the sale to distressed debt fund of overdue bank loans had been agreed, a necessary condition for the current bailout review to be concluded. According to the Economy Ministry, income criteria will not apply to the primary residence-backed NPLs that will be excluded from sale.

When coupled with the 140,000-euro “objective value” ceiling, this means that 94% of mortgages linked to main homes will be exempt from sale, the government says. The ministry added that the homeowners whose loans will be sold by banks will not experience any major change. The organizations that buy the loans will be required to use debt collection agencies that are registered in Greece and which have been licensed by the Bank of Greece.

And on purpose too.

• EU Has Made A Mess Of Refugee Reception System In Greece: Oxfam (Kath.)

The EU is failing to deliver a fair and safe system for receiving people in Greece, according to charity group Oxfam. The Greek government’s limited capacity and the pressure to meet the terms of the EU-Turkey agreement has led to refugees and migrants being kept in poor conditions, stressed the humanitarian organization in a statement on Friday. “Europe has created this mess and it needs to fix it in a way that respects people’s rights and dignity,” said Giovanni Riccardi Candiani, Oxfam’s representative in Greece. “The EU says it champions the rights of asylum-seekers beyond its borders but these rights are not being respected within EU countries.” Oxfam highlighted problems at the hotspots on Lesvos, where there have been riots in the past few days.

“Moria center is now very overcrowded, holding more than 3,000 people. Non-Syrians are unable to access asylum processes and about 80 unaccompanied children are among those being held,” said the humanitarian organization. “Nearby Kara Tepe camp, which has freedom of movement and provides care for vulnerable people such as unaccompanied children, pregnant women and the elderly, is almost full, leaving people in need of special care and support stranded at Moria center,” added Oxfam. The organization said it is working at six sites across Greece: Kara Tepe on Lesbos island, and in Katsika, Doliana, Filipiada, Tsepelovo and Konista camps in North-West Greece. Oxfam suspended its presence at Moria after the EU-Turkey deal was agreed and the site was converted into a closed facility.

Europe’s shame continues.

• 84 Migrants Missing After Boat Sinks Off Libya’s Coast (AFP)

84 migrants are still missing after an inflatable craft sank off the coast of Libya, according to survivors cited by the International Organization for Migration (IOM) on Saturday. Twenty-six people were rescued from the boat which sank on Friday and were questioned overnight. “According to testimonies gathered by IOM in Lampedusa 84 people went missing,” IOM spokesperson in Italy Flavio Di Giacomo wrote on his Twitter feed. Di Giacomo told AFP that the survivors indicated 110 people, all from assorted west African states, had embarked in Libya. In an email, he added that the vessel “was in a very bad state, was taking on water and many people fell into the water and drowned”.

“Ten fell very rapidly and several others just minutes later.” Earlier Saturday, Italy’s coastguard said an Italian cargo ship had rescued 26 migrants from a flimsy boat sinking off the coast of Libya but voiced fears that tens more could be missing. The coastguard received a call from a satellite phone late Friday that helped locate the stricken inflatable and called on the merchant ship to make a detour to the area about four miles (seven kilometres) off the Libyan coast near Sabratha. Rough seas and waves topping two metres (seven feet) hampered attempts to find any other survivors.