Russell Lee Fun with fountain at 4th of July picnic, Vale, OR July 1941

There is not one single person I’ve learned more from than Jay Hanson, back when I was even younger than I am now. Jay is not the greatest writer in the world, his talent is that he has the right kind of unrelenting curiosity, needed to dig deep into the reasons we put ourselves where we do (it’s hardwired). This curiosity made put together the best library of information on ourselves and the world we live in that one can ever hope to find, at dieoff.org, much of it not published anywhere else. I took a month off 15 years ago and read it all back to back. The dieoff library was – mostly – finished by then. So it was a nice surprise to have someone send me the following piece, which is recent. It may look bleak and dark to you, but the challenge is to find where you think Jay goes wrong, and what you know better. That will not be easy, Jay’s a mighty smart puppy. I guess the essence is this: our brains are our destiny. That this leads to things we don’t like to acknowledge is something we will need to deal with. Walking away from it is neither a solution nor the best way to use the one part of us that may help find a solution. Which is also our brain.

Overshoot Loop:

Evolution Under The Maximum Power Principle

Jay Hanson: I have been forced to review the key lessons that I have learned concerning human nature and collapse over the last 20 years. Our collective behavior is the problem that must be overcome before anything can be done to mitigate the coming global social collapse. The single most-important lesson for me was that we cannot re-wire (literally, because thought is physical) our basic political agendas through reading or discussion alone. Moreover, since our thoughts are subject to physical law, we do not have the free-will to either think or behave autonomously.

We swim in “politics” like fish swim in water; it’s everywhere, but we can’t see it!

We are “political” animals from birth until death. Everything we do or say can be seen as part of lifelong political agendas. Despite decades of scientific warnings, we continue to destroy our life-support system because that behavior is part of our inherited (DNA/RNA) hard wiring. We use scientific warnings, like all inter-animal communications, for cementing group identity and for elevating one’s own status (politics).

Only physical hardship can force us to rewire our mental agendas. I am certainly not the first to make the observation, but now, after 20 years of study and debate, I am totally certain. The net energy principle guarantees that our global supply lines will collapse. The rush to social collapse cannot be stopped no matter what is written or said. Humans have never been able to intentionally-avoid collapse because fundamental system-wide change is only possible after the collapse begins.

What about survivors? Within a couple of generations, all lessons learned from the collapse will be lost, and people will revert to genetic baselines. I wish it weren’t so, but all my experience screams “it’s hopeless.” Nevertheless, all we can do is the best we can and carry on…

I am thankful for the Internet where I can find others bright enough to discuss these complex ideas and help me to understand them.

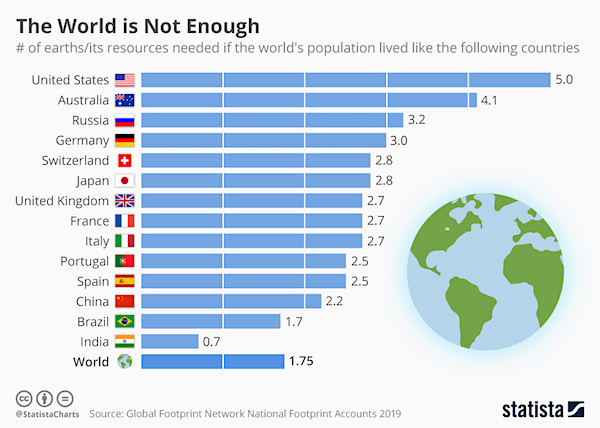

Today, when one observes the many severe environmental and social problems, it appears that we are rushing towards extinction and are powerless to stop it. Why can’t we save ourselves? To answer that question we only need to integrate three of the key influences on our behavior: biological evolution, overshoot, and a proposed fourth law of thermodynamics called the “Maximum Power Principle”(MPP). The MPP states that biological systems will organize to increase power[1] generation, by degrading more energy, whenever systemic constraints allow it[2].

Biological evolution is a change in the properties of populations of organisms that transcend the lifetime of a single individual. Individual organisms do not evolve. The changes in populations that are considered evolutionary are those that are inheritable via the genetic (DNA/RNA) material from one generation to the next.

Natural selection is one of the basic mechanisms of evolution, along with mutation, migration, and genetic drift. Selection favors individuals who succeed at generating more power and reproducing more copies of themselves than their competitors.

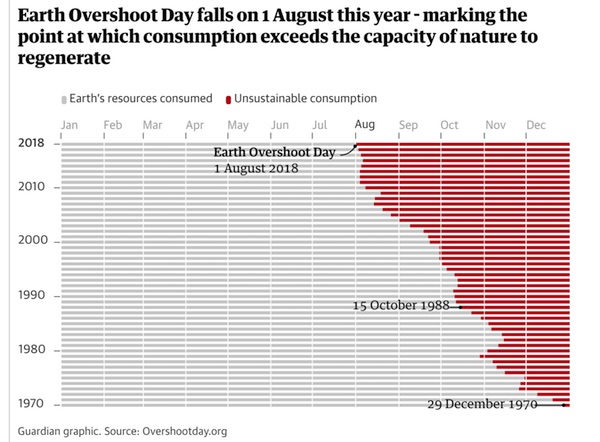

OVERSHOOT!

Energy is a key aspect of overshoot because available energy is always limited by the energy required to utilize it.

Since natural selection occurs under thermodynamic laws, individual and group behaviors are biased by the MPP to generate maximum power, which requires over-reproduction and/or over-consumption of resources[3] whenever system constraints allow it. Individuals and families will form social groups to generate more power by degrading more energy. Differential power generation and accumulation result in a hierarchical group structure.

Overshoot eventually leads to decreasing power attainable for the group with lower-ranking members suffering first. Low-rank members will form subgroups and coalitions to demand a greater share of power from higher-ranking individuals who will resist by forming their own coalitions to maintain it. Meanwhile, social conflict will intensify as available power continues to fall.

Eventually, members of the weakest group (high or low rank) are forced to “disperse.”[4] Those members of the weak group who do not disperse are killed,[5] enslaved, or in modern times imprisoned. By most estimates, 10 to 20 percent of Stone-Age people died at the hands of other humans. The process of overshoot, followed by forced dispersal, may be seen as a sort of repetitive pumping action—a collective behavioral loop—that drove humans into every inhabitable niche.

Here is a synopsis of the behavioral loop described above:

Step 1. Individual and group behaviors are biased by the MPP to generate maximum power, which requires over-reproduction and/or over-consumption of natural resources (overshoot), whenever systemic constraints allow it. Individuals and families will form social groups to generate more power by degrading more energy. Differential power generation and accumulation result in a hierarchical group structure.

Step 2. Energy is always limited, so overshoot eventually leads to decreasing power available to the group, with lower-ranking members suffering first.

Step 3. Diminishing power availability creates divisive subgroups within the original group. Low-rank members will form subgroups and coalitions to demand a greater share of power from higher-ranking individuals, who will resist by forming their own coalitions to maintain power.

Step 4. Violent social strife eventually occurs among subgroups who demand a greater share of the remaining power.

Step 5. The weakest subgroups (high or low rank) are either forced to disperse to a new territory, are killed, enslaved, or imprisoned.

Step 6. Go back to step 1.

The above loop was repeated countless thousands of times during the millions of years that we were evolving[6]. This behavior is entrained in our genetic material and will be repeated until we go extinct. Carrying capacity will decline [7] with each future iteration of the overshoot loop, and this will cause human numbers to decline until they reach levels not seen since the Pleistocene.

Current models used to predict the end of the biosphere suggest that sometime between 0.5 billion to 1.5 billion years from now, land life as we know it will end on Earth due to the combination of CO2 starvation and increasing heat. It is this decisive end that biologists and planetary geologists have targeted for attention. However, all of their graphs reveal an equally disturbing finding: that global productivity will plummet from our time onward, and indeed, it already has been doing so for the last 300 million years.[8]

It’s impossible to know the details of how our rush to extinction will play itself out, but we do know that it is going to be hell for those who are unlucky to be alive at the time.

• To those who followed Columbus and Cortez, the New World truly seemed incredible because of the natural endowments. The land often announced itself with a heavy scent miles out into the ocean. Giovanni da Verrazano in 1524 smelled the cedars of the East Coast a hundred leagues out. The men of Henry Hudson’s Half Moon were temporarily disarmed by the fragrance of the New Jersey shore, while ships running farther up the coast occasionally swam through large beds of floating flowers. Wherever they came inland they found a rich riot of color and sound, of game and luxuriant vegetation. Had they been other than they were, they might have written a new mythology here. As it was, they took inventory. Frederick Jackson Turner

• Genocide is as human as art or prayer. John Gray

• Kai su, teknon. Julius Caesar

[1] Power is energy utilization for a purpose; proportional to forces x flows = work rate + entropy produced (Maximum Power and Maximum Entropy Production: Finalities in Nature, by S. N. Salthe, 2010). A surplus resource is stored power. Energy is a key aspect of overshoot because available energy is always limited by the energy required to utilize it.

[2] Originally formulated by Lotka and further developed by Odum and Pinkerton, the MPP states that biological systems capture and use energy to build and maintain structures and gradients, which allow additional capture and utilization of energy. One of the great strengths of the MPP is that it directly relates energetics to fitness; organisms maximize fitness by maximizing power. With greater power, there is greater opportunity to allocate energy to reproduction and survival, and therefore, an organism that captures and utilizes more energy than another organism in a population will have a fitness advantage (The maximum power principle predicts the outcomes of two-species competition experiments, by John P. DeLong, 2008).

[3] The best way to survive in such a milieu is not to live in ecological balance with slow growth, but to grow rapidly and be able to fend off competitors as well as take resources from others.

Not only are human societies never alone, but regardless of how well they control their own population or act ecologically, they cannot control their neighbors behavior. Each society must confront the real possibility that its neighbors will not live in ecological balance but will grow its numbers and attempt to take the resources from nearby groups. Not only have societies always lived in a changing environment, but they always have neighbors. The best way to survive in such a milieu is not to live in ecological balance with slow growth, but to grow rapidly and be able to fend off competitors as well as take resources from others.

To see how this most human dynamic works, imagine an extremely simple world with only two societies and no unoccupied land. Under normal conditions, neither group would have much motivation to take resources from the other. People may be somewhat hungry, but not hungry enough to risk getting killed in order to eat a little better. A few members of either group may die indirectly from food shortages—via disease or infant mortality, for example—but from an individual s perspective, he or she is much more likely to be killed trying to take food from the neighbors than from the usual provisioning shortfalls. Such a constant world would never last for long. Populations would grow and human activity would degrade the land or resources, reducing their abundance. Even if, by sheer luck, all things remained equal, it must be remembered that the climate would never be constant: Times of food stress occur because of changes in the weather, especially over the course of several generations. When a very bad year or series of years occurs, the willingness to risk a fight increases because the likelihood of starving goes up.

If one group is much bigger, better organized, or has better fighters among its members and the group faces starvation, the motivation to take over the territory of its neighbor is high, because it is very likely to succeed. Since human groups are never identical, there will always be some groups for whom warfare as a solution is a rational choice in any food crisis, because they are likely to succeed in getting more resources by warring on their neighbors.

Now comes the most important part of this overly simplified story: The group with the larger population always has an advantage in any competition over resources, whatever those resources may be. Over the course of human history, one side rarely has better weapons or tactics for any length of time, and most such warfare between smaller societies is attritional. With equal skills and weapons, each side would be expected to kill an equal number of its opponents. Over time, the larger group will finally overwhelm the smaller one. This advantage of size is well recognized by humans all over the world, and they go to great lengths to keep their numbers comparable to their potential enemies. This is observed anthropologically by the universal desire to have many allies, and the common tactic of smaller groups inviting other societies to join them, even in times of food stress.

Assume for a moment that by some miracle one of our two groups is full of farsighted, ecological geniuses. They are able to keep their population in check and, moreover, keep it far enough below the carrying capacity that minor changes in the weather, or even longer-term changes in the climate, do not result in food stress. If they need to consume only half of what is available each year, even if there is a terrible year, this group will probably come through the hardship just fine. More important, when a few good years come along, these masterfully ecological people will/not/grow rapidly, because to do so would mean that they would have trouble when the good times end. Think of them as the ecological equivalent of the industrious ants.

The second group, on the other hand, is just the opposite—it consists of ecological dimwits. They have no wonderful processes available to control their population. They are forever on the edge of the carrying capacity, they reproduce with abandon, and they frequently suffer food shortages and the inevitable consequences. Think of this bunch as the ecological equivalent of the carefree grasshoppers. When the good years come, they have more children and grow their population rapidly. Twenty years later, they have doubled their numbers and quickly run out of food at the first minor change in the weather. Of course, had this been a group of “noble savages who eschewed warfare, they would have starved to death and only a much smaller and more sustainable group survived. This is not a bunch of noble savages; these are ecological dimwits and they attack their good neighbors in order to save their own skins. Since they now outnumber their good neighbors two to one, the dimwits prevail after heavy attrition on both sides. The “good” ants turn out to be dead ants, and the “bad” grasshoppers inherit the earth. The moral of this fable is that if any group can get itself into ecological balance and stabilize its population even in the face of environmental change, it will be tremendously disadvantaged against societies that do not behave that way. The long-term successful society, in a world with many different societies, will be the one that grows when it can and fights when it runs out of resources. It is useless to live an ecologically sustainable existence in the “Garden of Eden unless the neighbors do so as well. Only one nonconservationist society in an entire region can begin a process of conflict and expansion by the “grasshoppers” at the expense of the Eden-dwelling “ants”. This smacks of a Darwinian competition—survival of the fittest—between societies. Note that the “fittest” of our two groups was not the more ecological, it was the one that grew faster. The idea of such Darwinian competition is unpalatable to many, especially when the “bad” folks appear to be the winners.[pp. 73-75] (Constant Battles: Why we Fight, by Steven A. LeBlanc, St. Martin, 2004)

The Slaughter Bench of History, by Ian Morris, THE ATLANTIC, April 11, 2014

[4] “Dispersal” is important in biology. Many amazing biological devices have evolved to ensure it, such as the production of fruits and nectar by plants and the provision of tasty protuberances called elaiosomes by seeds to attract insects. Often a species will produce two forms:

(1) a maintenance phenotype (the outcome of genes and the structures they produce interacting with a specific environment) that is adapted to the environment in which it is born,

and (2) a dispersal phenotype that is programmed to move to a new area and that often has the capacity to adapt to a new environment.

According to the present theory, humans have developed two dispersal phenotypes in the forms of the prophet and the follower. The coordinated action of these two phenotypes would serve to disperse us over the available habitat. This dispersal must have been aided by the major climatic changes over the past few million years in which vast areas of potential human habitat have repeatedly become available because of melting of ice sheets.

The dispersal phenotypes might have evolved through selection at the individual level, since the reproductive advantage of colonizing a new habitat would have been enormous. They would also promote selection between groups. This is important because selection at the group level can achieve results not possible at the level of selection between individuals. One result of the dispersal phenotype includes ethnocentrism (the tendency to favor one’s own ethnic group over another) and the tendency to use “ethnic cleansing.” The other result, as previously noted, is selection for cooperation, self-sacrifice, and a devotion to group rather than individual goals. Factors that promote selection at the group level are rapid splitting of groups, small size of daughter groups, heterogeneity (differences) of culture between groups, and reduction in gene flow between groups. These factors are all promoted by the breaking away of prophet-led groups with new belief systems.

One of the problems of selection at the group level is that of free-riders. These are people who take more than their share and contribute to the common good of the group less than their proper share. Selection at the group level gives free-riders their free ride. They potentially could increase until they destroy the cooperative fabric of the group.

However, the psychology of the free-rider, which is one of self-aggrandizement and neglect of group goals, is not likely to be indoctrinated with the mazeway of the group. Nor is it likely to be converted to the new belief system of the prophet. Therefore, theoretically one would predict that cults and New Religious Movements should be relatively free of free-riders. Such an absence of free-riders would further enhance selection at the group level. Moreover, this is a testable theoretical proposition.

Cult followers have been studied and found to be high on schizotypal traits, such as abnormal experiences and beliefs. They have not yet been tested for the sort of selfish attitudes and behavior that characterize free-riders. If a large cohort of people were tested for some measure of selfishness, it is predicted that those who subsequently joined cults would be low on such a measure. Predictions could also be made about future cult leaders. They would be likely to be ambitious males who were not at the top of the social hierarchy of their original group. If part of why human groups split in general is to give more reproductive opportunities to males in the new group, it can also be predicted that leaders of new religious movements would be males of reproductive age. Female cult leaders are not likely to be more fertile as a result of having many sexual partners, but their sons might be in an advantageous position for increased reproduction.

Conclusion: The biobehavioral science of ethology is about the movement of individuals. We have seen that change of belief system has been responsible for massive movements of individuals over the face of the earth. Religious belief systems appear to have manifest advantages both for the groups that espouse them and the individuals who share them. It is still controversial whether belief systems are adaptations or by-products of other evolutionary adaptive processes. Regardless of the answer to this question, the capacity for change of belief system, both that seen in the prophet and also that seen in the follower, may be adaptations because they have fostered the alternative life history strategies of dispersal from the natal habitat.

Moreover, change of belief system, when it is successful in the formation of a new social group and transfer of that group to a “promised land,” accelerates many of the parameters that have been thought in the past to be too slow for significant selection at the group level, such as eliminating free-riders, rapid group splitting, heterogeneity between groups and reduction of gene transfer between groups. Natural selection at the group level would also favor the evolution of the capacity for change of belief system, so that during the past few million years we may have seen a positive feedback system leading to enhanced cult formation and accelerated splitting of groups. This may have contributed to the rapid development of language and culture in our lineage. (The Biology of Religious Behavior, Edited by Jay R. Feierman, pp. 184-186)

[5] The results of the study are striking, according to Robbins Schug, because violence and disease increased through time, with the highest rates found as the human population was abandoning the cities. However, an even more interesting result is that individuals who were excluded from the city’s formal cemeteries had the highest rates of violence and disease. (Violence, Infectious Disease and Climate Change Contributed to Indus Civilization Collapse , Science Daily, January 17, 2014)

[6] My discussion will revolve around two basic propositions regarding long-term human population history: 1) the near-zero growth rates that have prevailed through much of prehistory are likely due to long-term averaging across periods of relatively rapid local population growth interrupted by infrequent crashes caused by density-dependent and density-independent factors; and 2) broad changes in population growth rates across subsistence modes in prehistory are probably best explained in terms of changes in mortality due to the dampening or buffering of crashes rather than significant increases in fertility (Subsistence strategies and early human population history: an evolutionary ecological perspective, by James L. Boone, 2002).

[7] Sustainable Engineering: Resource Load Carrying Capacity and K≠phase Technology, by Peter Hartley, 1993

[8] pp. 118-119, The Medea Hypothesis: Is Life on Earth Ultimately Self-destructive? by Peter Ward, 2009

Never trust a central banker.

• Central Banks End Era Of Clear Promises, Return To ‘Artful’ Policy (Reuters)

The world’s major central banks are returning to a more opaque and artful approach to policymaking, ending a crisis-era experiment with explicit promises that they found risked their credibility and did not substitute for action. From Washington to London to Tokyo, the global shift from transparency to flexibility underscores the challenges central bankers face as they test the limits of what monetary policy can achieve. The return to a more traditional policymaking approach and nuanced statements will challenge the communication skills of central bankers who have been chastened in the last year after some too-specific messages confused and disrupted financial markets. Complicating things on the world stage, the U.S. Federal Reserve and the Bank of England are looking to telegraph plans and conditions for raising interest rates, while the European Central Bank and the Bank of Japan are heading the other way.

“Central banking used to be an art,” said a senior official of a G7 central bank. “It became less so once, globally, but with what’s happened at the Fed and the BoE, it may be back to being an art.” Both the Fed and BoE had promised to hold interest rates near zero until their jobless rates had fallen to a particular level. However, unemployment in the United States and Britain fell much more quickly than economists expected and both central banks scrambled to replace their suddenly outdated “forward guidance”. “Too much transparency may sometimes be counter-productive. The balance is always tricky,” the official said, requesting anonymity.

Read more …

• Draghi’s $1.4 Trillion Shot: Silver Bullet or Misfire? (Bloomberg)

Mario Draghi’s plan to end the euro area’s lending drought risks missing the target. While the European Central Bank president says a program to hand as much as €1 trillion ($1.4 trillion) to banks has built-in incentives to spur lending to the real economy, analysts from Barclays to Commerzbank have doubts on how well it will work. In fact, the measure allows banks to borrow cheaply from the ECB even without increasing credit supply. Draghi has identified weak lending as an obstacle to the euro area’s recovery and is committed to reversing a slump that has eroded more than €600 billion in loans to companies and households since 2009. The risk is that if the latest plan fails, the currency bloc slips closer to deflation and to the need for more radical action such as quantitative easing.

“It’s not the silver bullet,” said Philippe Gudin, chief European economist at Barclays in Paris. “Every incentive for banks to lend is a good thing, but I wouldn’t say I’m reassured that credit will pick up.” The ECB’s latest plan differs from its previous liquidity measures in the way it tries to nudge banks into lending more to the real economy. In contrast, three-year loans issued in late 2011 and early 2012 were used largely to buy higher-yielding government bonds, a practice known as the carry trade. Targeted longer-term refinancing operations will offer banks an initial total of as much as €400 billion this year that they can hold until 2016 with no strings attached. They can keep it another two years if they meet specific new lending targets set by the ECB, and they can borrow more funds starting in March if they exceed those thresholds. At his monthly press conference on July 3, Draghi said the total take-up could be €1 trillion.

Read more …

” … more repo trades are going uncompleted, or failing, because it’s either too difficult or expensive for the borrower to obtain and deliver Treasuries.”

• Bond Anxiety in $1.6 Trillion Repo Market as Failures Soar (Bloomberg)

In the relative calm that is the market for U.S. Treasuries, a sense of unease over a vital cog in the financial system’s plumbing is beginning to rise. The Federal Reserve’s bond purchases combined with demand from banks to meet tightened regulatory requirements is making it harder for traders to easily borrow and lend certain desired securities in the $1.6 trillion-a-day market for repurchase agreements. That’s causing such trades to go uncompleted at some of the highest rates since the financial crisis. Disruptions in so-called repos, which Wall Street’s biggest banks rely on for their day-to-day financing needs, are another unintended consequence of extraordinary central-bank policies that pulled the economy out of the worst financial crisis since the Great Depression. They also belie the stability projected by bond yields at about record lows.

“You have a little bit of a perfect storm here,” said Stanley Sun, a New York-based interest-rate strategist at Nomura, one of the 22 primary dealers that bid at Treasury auctions, in a telephone interview June 30. A smoothly functioning repo market is vital to the health of markets. The fall of Bear Stearns, which was taken over by JPMorgan in 2008 after an emergency bailout orchestrated by the Fed, and collapse of Lehman Brothers, whose bankruptcy in September of that year plunged markets into a crisis, was hastened after they lost access to such financing. In a typical repo, a dealer needing short-term cash often borrows money from another dealer, a hedge fund or a money-market fund, putting up Treasuries as collateral. The cash lender can then use the securities to complete other trades, such as to close out short positions where it needs to deliver bonds.

Negative rates happen when certain Treasuries are in such high demand or short supply that lenders of cash are actually paying collateral providers interest so they can obtain the needed securities. Traders said that is a big reason why repo rates on desired Treasuries have recently gotten as low as negative 3%. Now, more repo trades are going uncompleted, or failing, because it’s either too difficult or expensive for the borrower to obtain and deliver Treasuries. Such failures to deliver Treasuries have averaged $65.6 billion a week this year, reaching as much as $197.6 billion in the week ended June 18, Fed data show.

Read more …

Early warning sign?

• Sweden’s Stunning Rate Cut Seen Forcing Norges Bank to Act (Bloomberg)

Sweden’s surprise interest-rate cut last week will probably prompt a Norges Bank response to shield the economy from a strengthening currency, according to DNB, Norway’s biggest lender. Policy makers in Oslo now have to contend with record low rates in Sweden and in the euro area, the nation’s top trading partners, after the Riksbank lowered its benchmark to 0.25% on July 3, matching an all-time low. The European Central Bank reduced borrowing costs a month earlier, with both pledging to keep policy loose for a long time.

“It increases the pressure on Norges Bank to be more expansive in their monetary policy either by cutting or by keeping the rate low for longer,” Kjersti Haugland, an analyst at DNB, said in a July 4 interview. The central bank in western Europe’s largest oil producer signaled last month that it may also lower rates as it seeks to strike a balance between supporting growth and limiting krone strength. Policy makers kept the deposit rate at 1.5% on June 19, and pushed back the timing of tightening until the end of 2015, from a previous estimate of mid-year. Norges Bank said then that a further weakening of the economy may warrant a rate cut as it seeks to protect Scandinavia’s richest nation from a drop in oil investment.

Read more …

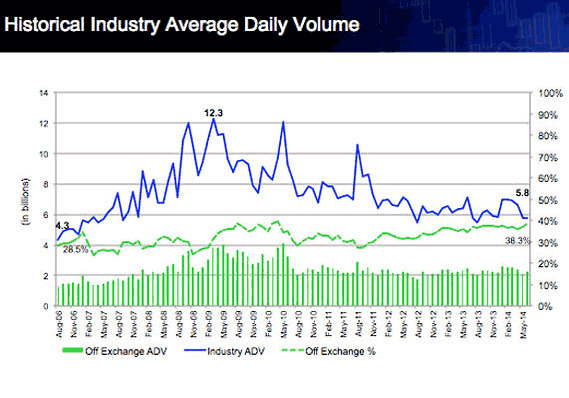

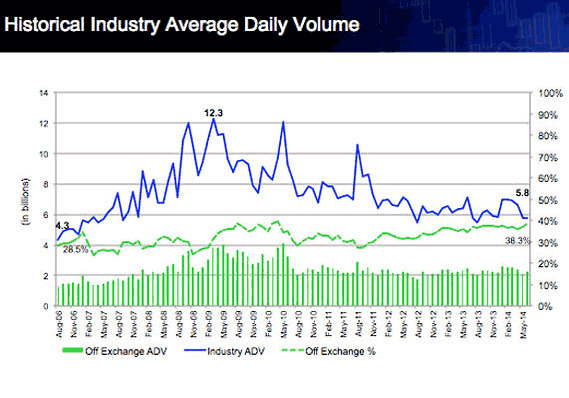

• Why Trading Volume Is Tumbling, In 5 Charts (MarketWatch)

Where have all the traders gone? That’s been a common refrain in the last few years for many market watchers. These folks worry that lower trading volumes for U.S. stocks might indicate a disturbing lack of confidence in the market, even as stock prices march higher and the Dow Jones Industrial Average cracks 17,000. “There seems to be no excitement in the market anymore,” said Peter Cardillo, chief market economist at Rockwell Global Capital. There certainly are far fewer shares trading hands than a few years ago, as shown in this chart. Average daily trading volume, tallied by month, was just 5.8 billion shares in May, less than half of the peak of 12.3 billion shares during the financial crisis. Financial pros point to other charts and statistics that shed light on the trend — and might even make you less fearful about the volume decline. Read on for five explanations.

Read more …

Bubbling under the surface?!

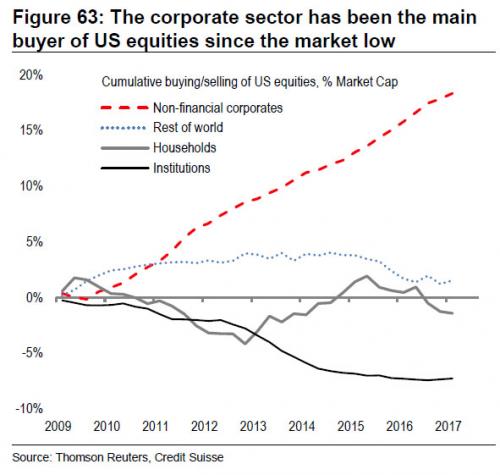

• Defensive Trading Comes Undone in $2 Trillion S&P 500 Rally (Bloomberg)

For the third straight year, rotating into defensive industries is proving to be a losing strategy in the U.S. equity market. Chip companies led by Micron Technology Inc. and consumer shares such as Netflix Inc. are driving gains since equities bottomed on April 11, replacing soapmakers and utilities that rallied as the economy slowed. The gains reflect projections that these cyclical stocks will deliver some of the strongest earnings growth in the Standard & Poor’s 500 Index this year, based on analyst estimates compiled by Bloomberg. The fleeting advance in defensive equities sounded a false alarm at the start of a year once again as the outlook for the U.S. economy improved.

While gross domestic product contracted 2.9% in the first quarter, the latest data on personal spending, manufacturing and inflation have exceeded analyst forecasts. Almost $2 trillion has been added to share values since April amid gains that pushed transportation stocks, industrials and small-cap shares to records. “We, like much of the industry, have been positioned, waiting and expecting some kind of pullback, and we got the pullback in the first quarter,” Chris Bouffard, who helps oversee $9 billion as chief investment officer at the Mutual Fund Store in Overland Park, Kansas, said July 2. “A lot of people were thinking, ‘oh, this might be the big one.’ Since then, the playbook resumed. We marched to new highs.”

Read more …

Is this where the cracks in the Truman dome will start to show?

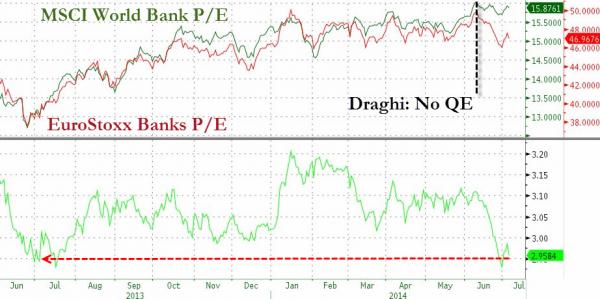

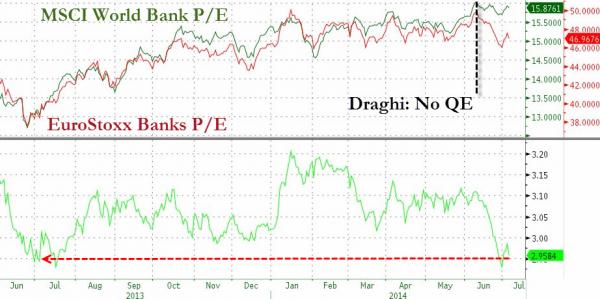

• European Banks Are In Trouble (Zero Hedge)

With Austrian bank contagion impacting European stocks on Friday, we thought it worth a look at the ‘recovering-out-of-the-crisis-all-is-well-and-stress-tests-will-prove-it’ European banks. It appears, having bid with both hands and feet for Europe’s peripheral debt – thus solidifying the very sovereign-financial-system linkages that were the cause of the European crisis contagion – Europe’s banks had the jam stolen from their donuts when Mario Draghi did not unveil a massive bond-buying scheme (by which they could offload their modestly haircut collateral at 100c on the euro, raise cash, take profits, and all live happily ever after). A TLTRO is no use to the banks who now know even the first sign of one dumping his domestic bonds will cause this illiquid monstrosity to collapse under its own weight. It is clear – as the following chart shows – that investors are quickly coming to that realization and exiting European bonds in a hurry. Since Draghi failed to unveil QE, European banks have collapsed to one-year lows relative to world banks…

Of course, some knife-catching Bill-Miller-ite will come to the rescue, buying-the-dip – but as BNP’s Ian Richards notes,

“The prospect of supporting material credit growth and better earnings revisions in the banking sector is further down the line than the market had hoped.”

Read more …

What, they want a stronger Euro?

• France Hits Out At Dollar Dominance In International Transactions (FT)

France’s political and business establishment has hit out against the hegemony of the dollar in international transactions after U.S. authorities fined BNP Paribas $9 billion for helping countries avoid sanctions. Michel Sapin, the French finance minister, called for a “rebalancing” of the currencies used for global payments, saying the BNP Paribas case should “make us realize the necessity of using a variety of currencies”. He said, in an interview with the Financial Times on the sidelines of a weekend economics conference: “We [Europeans] are selling to ourselves in dollars, for instance when we sell planes. Is that necessary? I don’t think so. I think a rebalancing is possible and necessary, not just regarding the euro but also for the big currencies of the emerging countries, which account for more and more of global trade.”

Christophe de Margerie, the chief executive of Total, France’s biggest company by market capitalization, said he saw no reason for oil purchases to be made in dollars, even if the benchmark price in dollars was likely to remain. “The price of a barrel of oil is quoted in dollars,” he said. “A refinery can take that price and using the euro-dollar exchange rate on any given day, agree to make the payment in euros.” One chief executive of a CAC 40 industrial group said he supported Mr Sapin’s push. “Companies like ours are in a bind because we sell a lot in dollars but we do not always want to deal with all the US rules and regulations,” he said.

Read more …

No more pump?

• China’s New Economy Stocks Selling Off With the Old (Bloomberg)

Last year’s most-profitable bets on the Chinese economy have turned into money losers in 2014 as policy makers send mixed signals on which industries will lead the country’s expansion. After surging at least 20% for the biggest gains in China’s stock market last year, gauges of technology, health-care and consumer shares have all lost more than 6%. The companies, tied to what analysts have dubbed China’s “new economy,” are now falling in tandem with “old economy” stocks in state sectors such as commodities and finance that fueled growth in the last decade. All 10 industries in the CSI 300 Index sank in the first half, the broadest losses in four years.

The declines suggest investors may be doubting China’s commitment to fostering a shift toward technology and services, putting at risk returns on smaller companies that have been the best in the past two years and the biggest among initial public offerings. While President Xi Jinping said in May the nation must adapt to a “new normal” pace of growth, in which innovation plays an increasing role, the government has also sped up state spending and eased credit curbs as the weakening property market puts its 7.5% expansion target at risk. “The market is now pricing in the risk that China won’t make a successful transition,” Wang Zheng, the Shanghai-based chief investment officer at Jingxi Investment Management Co., which oversees about $120 million, said by phone on July 4. The shift “will be much more difficult.”

Read more …

Starting to get messy now. Who does what, and what does it cost?

• PBOC Wades Into Fiscal Waters as China Boosts Stimulus (Bloomberg)

China’s central bank is seeking to support economic growth with unconventional tools that Credit Suisse and Everbright Securities say look more like fiscal policy. The People’s Bank of China this year started a 100 billion yuan ($16 billion) quota for relending earmarked for agriculture and small businesses. It offered another 300 billion yuan for low-income housing, China Business News said. Governor Zhou Xiaochuan is trying to carry out Communist Party orders to protect this year’s 7.5% economic-growth target without resorting to nationwide stimulus that stokes debt dangers.

While selective tools such as relending can bypass riskier industries including property, JPMorgan Chase & Co. says they lack transparency and contrast with the PBOC’s efforts to shift to market- from state-directed credit. “The central bank has invaded the field of fiscal policy,” said Xu Gao, chief economist at Everbright Securities in Beijing, who previously worked for the World Bank. “Fiscal policy hasn’t done its job – money that should have been spent wasn’t and projects that should have been financed weren’t, so the PBOC has had to inject liquidity.”

Read more …

Not exactly perfect.

• German Industrial Output Falls Third Month In A Row (Bloomberg)

German industrial output dropped for a third month in May amid signs Europe’s largest economy is taking a breather. Production, adjusted for seasonal swings, fell 1.8% from April, when it declined a revised 0.3%, the Economy Ministry in Berlin said today. Economists forecast output to remain unchanged, according to the median of 35 estimates in a Bloomberg News survey. Production rose 1.3% in May from the previous year when adjusted for working days. While Germany’s economic trend points “upward significantly,” growth probably slowed in the three months through June, the Bundesbank has said. Factory orders fell more than economists expected in May, Ifo business confidence dropped to a six-month low in June, and unemployment rose for a second month.

“There was a little dent in the second quarter,” said Jens-Oliver Niklasch, a fixed-income strategist at Landesbank Baden-Wuerttemberg in Stuttgart. “But generally speaking, the German economy is in quite good shape and there’s no reason for concern as growth rates will remain solid.” Manufacturing fell 1.6%, with intermediate-goods production dropping 3% and consumer-goods output down 3.5%, today’s report showed. Investment-goods production rose 0.3% and energy output was up 1%, while construction slumped 4.9%.

Read more …

Germany’s AAA status is no longer enough guarantee?!

• Germany Seeks Savings With First Collateral on Rate Swaps (Bloomberg)

Germany’s debt management agency is set to pledge collateral against some of its derivatives trades for the first time in a sign even Europe’s safest borrowers see scope to cut transaction costs with guarantees. The Federal Finance Agency, which manages the Finance Ministry’s budget and short-term liquidity funding, plans to increase savings on the interest-rate swaps it currently uses by offering collateral on as much as €8 billion ($10.9 billion) of the trades as early as next year, agency spokesman Joerg Mueller said July 5 by phone. The agency may at the same time opt to use a central derivative clearing house in London and appoint a company such as Eurex Clearing to settle the transactions, he said.

While Europe’s benchmark issuer has leaned on its AAA credit rating to avoid posting collateral on its debt in the past, buyers of one-way collateralized swaps and regulators are demanding more guarantees to limit risk. German lawmakers, in a revised 2014 budget on June 27, approved the backstops that can be transacted from next year. “The market would seem to be moving somewhat toward two-way contracts since the debt crisis, creating the bonus of added stability,” said Vincent Chaigneau, global head of rates and foreign-exchange strategy at Societe Generale in Paris, in a telephone interview on July 2. “The assumption is that Germany aims to pay less by posting collateral than not.”

Read more …

Yeah, right.

• Stiglitz: I’m ‘Very Uncomfortable’ With Current Stock Levels (CNBC)

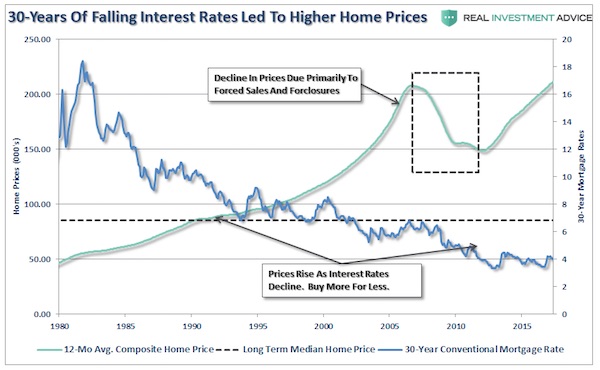

Nobel prize-winning economist Joseph Stiglitz said on Monday he is “very uncomfortable” with current stock market levels, arguing they do not equal a strong economic recovery in the United States. The Dow breached 17,000 points on Thursday before the U.S. markets closed for the long July 4 weekend. The jump came after the U.S. government reported the economy created a better-than-expected 288,000 jobs in June and the unemployment rate fell to 6.1%. “The reason the stock market is high, in part, is that interest rates are low, wages are low and the emerging markets are still growing much faster than the U.S. economy, let alone Europe,” Stiglitz said. He pointed to the fact that many U.S.-listed multinationals are increasingly getting a large chunk of their profits from emerging markets.

“These very strong stock market prices are in a sense a symptom of the weak economy, not a symptom that we are about to have a strong recovery to our real economy,” he said. Stiglitz, a professor of economics at Columbia University, said the recent stock market gains are not a sign that we are witnessing a recovery. Instead, we would see the continuation of a “North Atlantic malaise”, he said. “Remember, labor force participation is at very, very low levels, much lower than before the crisis. Real wage increases have been very weak, well below what they should be if we were having a robust recovery,” Stiglitz said. “There are lots if indicators that suggest this is a weak recovery.”

Read more …

Yeah, yeah.

• ECB: We’re Aware Of Asset Bubble Risk (WSJ)

European Central Bank executive board member Benoit Coeure says the bank’s current monetary policy of interest rates close to zero for a long period increases the risk of asset price bubbles. Mr. Coeure said the International Bank of Settlements is right to point at the risk that cheap money may generate exuberant rises in some asset prices in the euro zone posing a systemic crisis risk when eventually bursting. The International Bank of Settlements added to its warnings a call for interest-rate hikes though Mr. Coeure said the ECB wouldn’t answer any asset price bubble with higher rates.

“We are totally aware of this risk. We will have to deal with it and we are ready to deal with it with the other tools we have at our disposal,” Mr. Coeure said during a lecture in Aix-en-Provence where he attended the annual Rencontres Economiques business conference. Mr. Coeure’s comments echo what ECB’s chairman Mario Draghi said earlier this week that the best way to deal with financial instability should be in the priority use of new macroprudential tools and not monetary policy, such as changes in banking regulations, tightening the lending standards that commercial banks use, for instance. Mr. Coeure added the ECB’s commitment to keep its benchmark interest rate close to zero for a long period will eventually likely lead to a divergence with monetary policies in the U.S. and in the U.K.

Read more …

Scary.

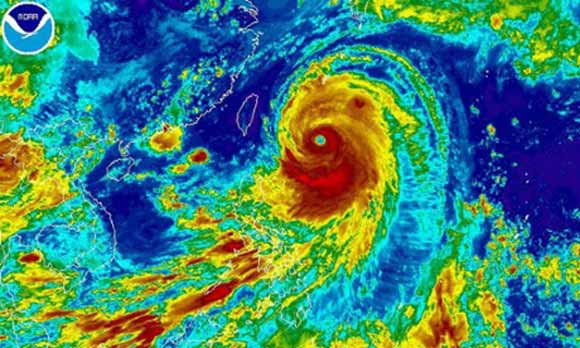

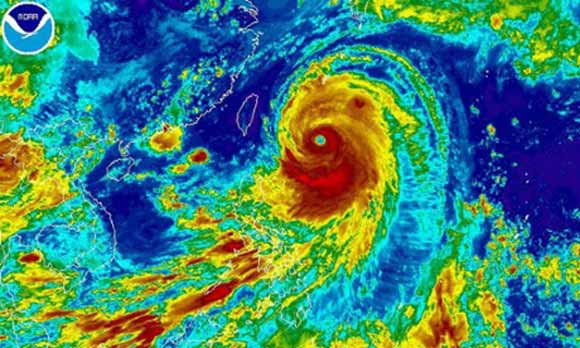

• Super-Typhoon Neoguri Approaches Japan’s Okinawa Islands (Guardian)

Super-typhoon Neoguri is approaching Japan’s Okinawa islands, bringing strong winds and torrential rains. Gusts of up to 270km per hour (160 miles per hour) are expected to slam into the southernmost subtropical island chain early Tuesday, and may reach mainland Japan by Wednesday. The storm could be one of the worst in decades, the national weather agency said. The typhoon was located some 600km (370 miles) south of Okinawa’s main island at 3am GMT on Monday, moving north/north-west at 25km (16 miles) per hour. The meteorological agency forecast that Neoguri, whose name means raccoon in Korean, would dump up to 80mm (three inches) of rain an hour on Okinawa as it pounded the archipelago.

Read more …

No comment.

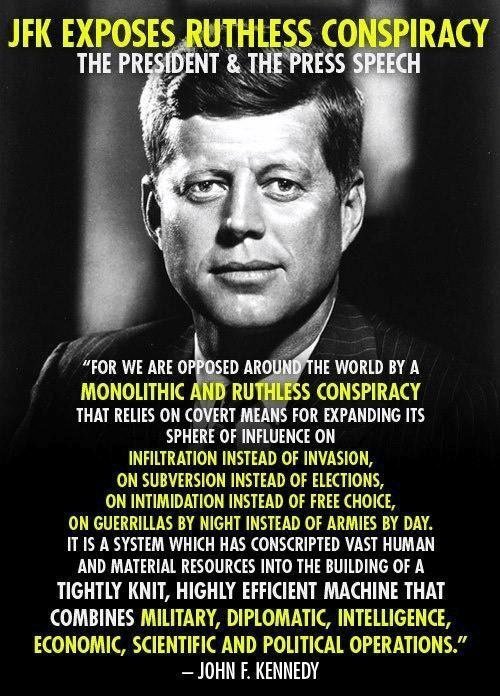

• In NSA-Intercepted Data, Ordinary Citizens Far Outnumber Targets (WaPo)

Ordinary Internet users, American and non-American alike, far outnumber legally targeted foreigners in the communications intercepted by the National Security Agency from U.S. digital networks, according to a four-month investigation by The Washington Post. Nine of 10 account holders found in a large cache of intercepted conversations, which former NSA contractor Edward Snowden provided in full to The Post, were not the intended surveillance targets but were caught in a net the agency had cast for somebody else. Many of them were Americans. Nearly half of the surveillance files, a strikingly high proportion, contained names, e-mail addresses or other details that the NSA marked as belonging to U.S. citizens or residents.

NSA analysts masked, or “minimized,” more than 65,000 such references to protect Americans’ privacy, but The Post found nearly 900 additional e-mail addresses, unmasked in the files, that could be strongly linked to U.S. citizens or U.S.residents. The surveillance files highlight a policy dilemma that has been aired only abstractly in public. There are discoveries of considerable intelligence value in the intercepted messages – and collateral harm to privacy on a scale that the Obama administration has not been willing to address. Among the most valuable contents – which The Post will not describe in detail, to avoid interfering with ongoing operations – are fresh revelations about a secret overseas nuclear project, double-dealing by an ostensible ally, a military calamity that befell an unfriendly power, and the identities of aggressive intruders into U.S. computer networks.

Read more …

There’s supposed to be huge gas reserves there, and they come up with zilch?

• Shell/Aramco Saudi Arabia Gas Comes Up Empty (Telegraph)

Royal Dutch Shell has admitted that its search for gas in Saudi Arabia has been a decade-long wild goose chase, dashing any hopes of gaining a prized upstream foothold in the kingdom. “We haven’t had a very successful exploration campaign,” Andrew Brown, director of upstream international business at Shell, told The Sunday Telegraph in an interview. “We aren’t conducting any operations there [at Rub al-Khali desert] at the moment.” Mr Brown declined to specify whether the failure of exploration in the desert – where sand dunes can tower 1,000ft high and temperatures can hit 122F – would force it to shutdown the South Rub al-Khali Company (SRAK), its joint venture with state-owned producer Saudi Aramco.

The announcement on its activities in the Rub al-Khali comes as Shell – Britain’s most valuable company by market value – aggressively cuts costs. In January, Shell said it aimed to raise about $15bn (£8.7bn) from asset sales and cut capital spending to $37bn this year from $46bn in 2013. No work has taken place in the area since the company said it had stopped drilling in February. Exploration has been plagued by delays and the cost of working in such an environment.

Read more …

Not unimportant.

• Sea Levels To Rise Faster With Accelerating Antarctic Winds, Ice Melt (SMH)

Sea levels may rise much faster than predicted because climate models have failed to account for the disruptive effects of stronger westerly winds, Australian-led research has found. Recent studies of Antarctica have suggested the giant glaciers of West Antarctica may have begun an irreversible melting that will raise sea levels by as much as 3 metres over 200-500 years. That estimate, though, may prove optimistic because models had failed to account for how strengthening westerly winds in the Southern Ocean would start to impinge coastal easterlies, upsetting a delicate balance of warm and cold waters close to the Antarctic ice sheets, said Paul Spence, an oceanographer at the University of NSW’s Climate Change Research Centre. “It’s the first time that I looked at my science and thought, ‘Oh my god, that is very concerning’!”, he said. “You hope it’s wrong and you hope it doesn’t happen.

“If you were buying land in Australia and wanting to pass it down to your kids or your grandchildren, I suggest it’s a couple of metres above sea-level,” Dr Spence said. The research, published in Geophysical Research Letters, found that the coastal temperature structure was more sensitive to global warming, particularly the changes to winds, than previously identified. “The dynamic barrier between cold and warm water relaxes, and this relatively warm water just offshore floods into the ice-shelf regions, increasing the temperatures by 4 degrees under the ice shelf,” he said. “If you look at how sensitive the coastal ocean is to these changing winds, you could put a lot more heat under these ice shelves than people have previously thought,” Dr Spence said. A study released earlier this year by UNSW’s Matt England – also an author on this new research – found westerly winds in the Southern Ocean had quickened 10-15%over the past 50 years, and shifted 2 to 5 degrees closer to the South Pole.

Read more …