Felix Vallotton On the beach 1899

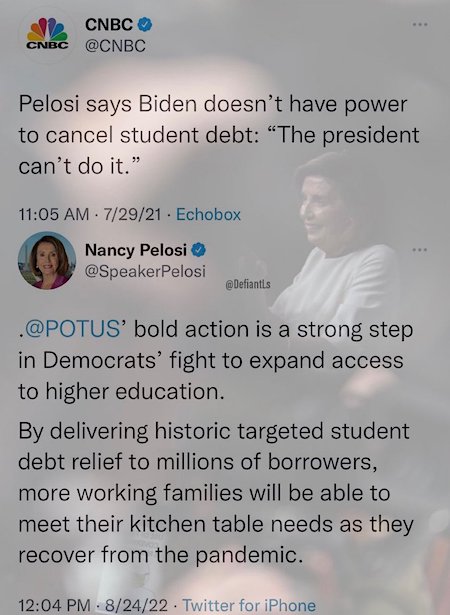

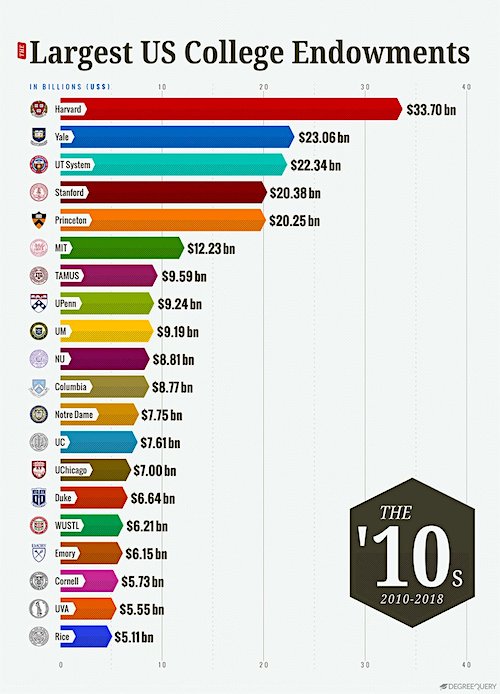

Biden’s student debt cancellation plan, estimated at $300-$400 billion, has nothing for those who didn’t want that kind of debt. Or for those who did, and worked 2-3 jobs to pay it off ASAP. Or anyone else who’s in dire straits. But the colleges are sure sitting pretty.

Glenn Beck

ONE DAY before Trump left the White House, he issued a memo to declassify all the RussiaGate documents. Is THAT what the FBI was looking for at Mar-a-Lago? Because there are some very 'convenient' coincidences in the timeline… pic.twitter.com/nHH6xEAGPP

— Glenn Beck (@glennbeck) August 25, 2022

Slaughterhouse. Günther, where’s your mask? Mr. Butcher, Günther’s not wearing a mask!

“The advances along the enormous 1,800-mile front are relentless, highly systematic and inserted in a Greater Strategic Picture.”

• Geopolitical Tectonic Plates Shifting, Six Months On (Escobar)

Russia broke the spell. But Moscow’s strategy is way more sophisticated than leveling Kiev with hypersonic business cards, something that could have been done at any moment starting six months ago, in a flash. What Moscow is doing is talking to virtually the whole Global South, bilaterally or to groups of actors, explaining how the world-system is changing right before our eyes, with the key actors of the future configured as BRI, SCO, EAEU, BRICS+, the Greater Eurasia Partnership. And what we see is vast swathes of the Global South – or 85% of the world’s population – slowly but surely becoming ready to engage in expelling the FIRE Mafia from their national horizons, and ultimately taking them down: a long, tortuous battle that will imply multiple setbacks.

On the ground in soon-to-be rump Ukraine, Khinzal hypersonic business cards – launched from Tu-22M3 bombers or Mig-31 interceptors – will continue to be distributed. Piles of HIMARS will continue to be captured. TOS 1A Heavy Flamethrowers will keep sending invitations to the Gates of Hell. Crimean Air Defense will continue to intercept all sorts of small drones with IEDs attached: terrorism by local SBU cells, which will be eventually smashed. Using essentially a phenomenal artillery barrage – cheap and mass-produced – Russia will annex the full, very valuable Donbass, in terms of land, natural resources and industrial power. And then on to Nikolaev, Odessa, and Kharkov.

Geoeconomically, Russia can afford to sell its oil with fat discounts to any Global South customer, not to mention strategic partners China and India. Cost of extraction reaches a maximum of $15 per barrel, with a national budget based on $40-45 for a barrel of Urals. A new Russian benchmark is imminent, as well as oil in rubles following the wildly successful gas for rubles. The assassination of Darya Dugina provoked endless speculation on the Kremlin and the Ministry of Defense finally breaking their discipline. That’s not going to happen. The advances along the enormous 1,800-mile front are relentless, highly systematic and inserted in a Greater Strategic Picture.

What happens when you get it all backwards.

• Putin Bets Winter Gas Chokehold Will Yield Ukraine Peace – On His Terms (R.)

Cold winters helped Moscow defeat Napoleon and Hitler. President Vladimir Putin is now betting that sky-rocketing energy prices and possible shortages this winter will persuade Europe to strong arm Ukraine into a truce — on Russia’s terms. That, say two Russian sources familiar with Kremlin thinking, is the only path to peace that Moscow sees, given Kyiv says it will not negotiate until Russia leaves all of Ukraine “We have time, we can wait,” said one source close to the Russian authorities, who declined to be named because they are not authorised to speak to the media. “It’s going to be a difficult winter for Europeans. We could see protests, unrest. Some European leaders might think twice about continuing to support Ukraine and think it’s time for a deal.”

A second source close to the Kremlin said Moscow thought it could already detect faltering European unity and expected that process to accelerate amid winter hardship. “It will be really tough if it (the war) drags into the autumn and winter. So there’s hope they (the Ukrainians) will ask for peace,” said the source. There was no immediate response from the Kremlin, which denies Russia uses energy as a political weapon, to a request for comment. Ukraine and its staunchest Western backers say they have no plans to fold and U.S. officials, speaking on condition of anonymity, say they so far see no signs of support for Ukraine wavering. European Commission President Ursula von der Leyen, in a tweet to Ukrainians on their national day, said: “The EU has been with you in this fight from the very beginning. And we will be for as long as it takes.”

Backed by billions in U.S. and other Western military aid, training and shared intelligence, and with a series of morale-boosting attacks on high-profile Russian targets behind it, Kyiv thinks it has a chance of changing the facts on the ground.”In order for negotiations with Russia to become possible, it is necessary to change the status quo at the front in favour of the Armed Forces of Ukraine,” Mykhailo Podolyak, a Ukrainian presidential adviser, told Reuters. “It is necessary that the Russian army suffer significant tactical defeats.” Ukrainian forces thwarted Russian attempts to capture the capital Kyiv and the second city Kharkiv; have regularly destroyed and disrupted Russian supply lines, and sank the Moskva, the flagship of Russia’s Black Sea Fleet, as well as inflicting major damage on a Russian air base in annexed Crimea.

Kyiv has also long been talking about a major counter-offensive to retake the south, though Russia has been busy building up its own forces there, and it’s unclear if and when that will materialise. The geopolitical standoff has sent energy prices to record highs. The European Union banned Russian coal and approved a partial ban on Russian crude oil imports to punish Moscow for the “special military operation” it launched exactly six months ago on Feb. 24. And Russia struck its own blow, sharply cutting gas exports to Europe. European governments have sought to increase resilience to energy pressures this winter by seeking alternative supplies and pushing through energy saving measures, but few energy specialists believe they will be able to cover all their needs.

There are even people who want to see it dismantled.

• Nord Stream 2 ‘Only Sensible’ Solution To Gas Crisis – German MP

The launch of Russia’s Nord Stream 2 gas pipeline could help solve the growing energy crisis in Europe, Bundestag MP Steffen Kotre told the TASS news agency on Wednesday. “Even if the gas storage facilities are full, there will be enough for about three months this winter. And then what? Ideology has to give way to a real fact-oriented policy… The only sensible solution is to launch Nord Stream 2,” Kotre, who is a member of the German parliamentary committee on energy and climate protection, believes. In recent weeks the German government has insisted that there are no plans to launch the Nord Stream 2 pipeline, which was completed last year but never went into operation due to Berlin’s reluctance to grant it certification.

However, many politicians have been urging the Bundestag to change its stance and make use of the pipeline, which has an annual capacity of 55 billion cubic meters, to help Germany cope with energy shortages stemming from reduced gas flows from Russia via the Nord Stream 1 pipeline. Supply through the pipeline recently dropped to 20% of total capacity due to technical setbacks and sanctions.

2032.

• Belgian PM: “Next 5-10 Winters Will Be Difficult” As Energy Crisis Worsens (ZH)

Belgian Prime Minister Alexander De Croo might have spilled the beans about the duration of Europe’s energy crisis. He told reporters Monday, “the next 5 to 10 winters will be difficult.” “The development of the situation is very difficult throughout Europe,” De Croo told Belgium broadcaster VRT. “In a number of sectors, it is really difficult to deal with those high energy prices. We are monitoring this closely, but we must be transparent: the coming months will be difficult, the coming winters will be difficult,” he said. The prime minister’s comments suggest replacing Russian natural gas imports could take years, exerting further economic doom on the region’s economy in the form of energy hyperinflation.

Europe faces a historic energy crisis exacerbated by Russia’s war in Ukraine (and Western sanctions that have backfired). The continent heavily relies on Russia for its energy needs, importing about 40% of NatGas. At just 20% capacity with risks of going to zero next month, Russian supplies via Gazprom’s Nord Stream 1 have sent NatGas and power prices to record highs this week. European NatGas prices soared to a record high of 277 euros per megawatt-hour on Monday, about 15 times the average summertime price. Leon Izbicki, a commodity analyst at Energy Aspects Ltd., told Bloomberg if NS1 flows come to a halt in September, prices could rise to 400 euros per megawatt-hour.

Hollowing out.

• Exploding Prices Will Impact Trade Balance More Than 1970s Oil Shocks (K.)

The impact of high natural gas prices on Greece’s trade balance will be more severe than the 1974 and 1979 oil shocks and the trade deficit will grow by at least 4.3% of GDP, making Greece one of the most vulnerable European Union countries, according to a study by London-based research firm Capital Economics.Other EU members will also be heavily impacted, says the report, noting that both oil shocks in the 1970s were followed by a recession. National gas futures (also known as TTF for Title Transfer Facility) in Europe have skyrocketed from 20 euros per megawatt-hour before the Covid-19 pandemic to €280/MWh currently, a 14-fold increase. By comparison, the price of Brent crude oil tripled during the first oil shock and doubled during the second.

To determine the size of the natural gas shock on each country’s trade balance, the research firm took account of the fuel mix – oil and gas – used by the countries under study and the fact that some are producers, not importers, of one and/or the other. It also based its scenario on an average gas price of €200/MWh for 2022. The research focused on seven eurozone countries – Austria, France, Germany, Greece, Italy, the Netherlands and Spain – adding Canada, the UK and the US. It concludes that Greece and Italy will face the steepest impact on their trade balances, much bigger than during the two oil shocks. Among the countries under study, the impact of the oil shocks on trade balance ranged from 1.6%-2.8% of GDP.

The impact of the rising gas prices will range from 1.9% in France to 4.4% in Italy, putting Greece in second place among the most vulnerable economies. Only France and the Netherlands will manage to contain the damage at levels better than during the 1970s, and that’s assuming the study’s gas price estimate is correct. The first oil shock had increased Greece’s trade deficit by almost 2% of GDP and the second by 2.5%. Capital Economics warns that the final impact could be even higher, as gas price rises have exceeded all assumptions. At present levels, and assuming no further rise, the impact would be 25% higher.

So as the trade balance worsens, subsidies soar. Sounds like a long term plan.

• The Electricity Subsidy Shock (K.)

A significant rise in the price of electricity announced by state-controlled Public Power Corporation (PPC) for September forced the government to raise its electricity subsidy for September to 1.9 billion euros, from €1.1 billion in August. The subsidy level inevitably follows the PPC’s pricing policy, since it is the dominant player in the market, with 63% of consumers choosing it. While PPC had the lowest price of all electricity providers in August (€0.48 per kilowatt-hour) it raised its September price to €0.788 for those consuming up to 500kWh per month and €0.80 for heavier consumers. In order to stick to its commitment for an actual charge to consumers between €0.14-0.17 per kWh the government had to adjust its subsidy level accordingly, raising it by over 72%.

A positive effect of this policy is that, for some lucky consumers, bills this month may come very low, even negative, just for the power consumption part, before other charges are factored in. Critics of the government’s calculation of the subsidy say that it puts a heavy burden on the budget and, therefore, on taxpayers, gives a wrong impression to consumers about the real cost of electricity and does not provide enough of an incentive to providers to cut prices or, at least, contain them. Among the consumers set to benefit the most are those who signed up with electricity provided Heron’s generous pricing program. At €0.75 per kilowatt-hour, it also provides, like some of its competitors, a 20% discount to those who pay their bills on time, thus lowering for them the price to €0.60/kWh.

When the state subsidy kicks in, customers will pay just €0.111/kWh and the really good payers will be charged a negative rate (-€0.039/kWh). The discount will be credited in the bill after the one in September.After deducting the subsidy, customers of provider Fysiko Aerio will pay €0.04/kWh and half that if they pay on time. Elpedison’s rate falls to €0.044/kWh, Zenith’s to €0.048/kWh, Elin’s to €0.06 and NRG’s to €0.109. PPC, as we have mentioned, has the highest net rate, at €0.149 and €0.161 for heavy consumers, followed by Watt+Volt (€0.145) and Protergia (€0.131).

Marie Antoinette.

• ‘Weary’ Europeans Must ‘Bear Consequences’ Of Ukraine War: EU’s Borrell (ZH)

EU high representative and foreign policy chief Josep Borrell gave a surprisingly blunt assessment of the Ukraine war and Europe’s precarious position in an AFP interview published Tuesday, admitting that Russian President Vladimir Putin is betting on fracturing a united EU response amid the current crisis situation of soaring prices and energy extreme uncertainty headed into a long winter. Borrell’s words seemed to come close to admitting that Putin’s tactic is working on some level, or at least will indeed chip away at European resolve in the short and long run, given he chose words like EU populations having to “endure” the deep economic pain and severe energy crunch. He cited the “weariness” of Europeans while calling on leadership as well as the common people to “bear the consequences” with continued resolve.

Borrell explained to AFP that Putin sees “the weariness of the Europeans and the reluctance of their citizens to bear the consequences of support for Ukraine.” But Borrell suggested that Europe will not back down no matter the leverage Moscow might have, particularly when it comes to ‘weaponization of energy’ – and called on citizens to continue to shoulder the cost. Who will blink first? …appears to be the subtext here. He urged: “We will have to endure, spread the costs within the EU,” Borrell told AFP, warning that keeping the 27 member states together was a task to be carried out “day by day.”

And yet, as some like Hungary’s Viktor Orbán have consistently argued since near the start of the Feb.24 invasion, it is inevitable that some will be forced to bear the “costs” much more than others. Already this is being seen with initiatives out of Brussels like rationing gas consumption, which has further led to scenarios like German towns and even residences being mandated to switch off lights or resources for designated periods at night. “More cold showers” – many are also being told. As we round the corner of fall and enter the more frigid months, we are likely to only see more headlines like this: “German cities impose cold showers and turn off lights amid Russian gas crisis.”

“..avoid “demagogy..”

• Macron Warns Of ‘End Of Abundance’ (RT)

France is headed toward the “end of abundance” and “sacrifices” have to be made during what is a time of great upheaval, President Emmanuel Macron told his cabinet on Wednesday upon returning from summer break. The country has faced multiple challenges lately, ranging from the ongoing conflict between Russia and Ukraine to the unprecedented drought that has battered the whole European continent this summer. Yet, Macron believes that the crisis is actually of a much bigger scale and that structural changes are imminent.“Some could see our destiny as being to constantly manage crises or emergencies. I believe that we are living through a tipping point or great upheaval. Firstly, because we are living through… what could seem like the end of abundance,” he said.

The country and its citizens must be ready to make “sacrifices” to meet and overcome the challenges they are facing, he continued. “Our system based on freedom in which we have become used to living, when we need to defend it sometimes that can entail making sacrifices,”Macron added. “Faced with this, we have duties, the first of which is to speak frankly and very clearly without doom-mongering,” Macron stressed. The president called upon his cabinet to show unity, be “serious” and “credible” and urged ministers to avoid “demagogy.” “It’s easy to promise anything and everything, sometimes to say anything and everything. Do not give in to these temptations, it is demagoguery,” the president said, adding that such an approach “flourishes” today “in all democracies in a complex and frightening world.”

“Washington expects Ukrainian forces “to fight for years to come..”

Timeline is eerily similar to the energy crisis one.

How many Ukrainians will be left when they’re done?

• ‘Months Or Years’ Before US Arms Reach Ukraine – Media (RT)

Years could pass before some of the weapons in the upcoming “largest ever” package of US military assistance to Kiev actually reach Ukraine, according to Western media reports. On Tuesday, a number of mainstream media outlets cited anonymous US officials as describing the impending announcement of a $3 billion package of military aid to Ukraine. If confirmed, it would be the largest of its kind so far. Washington is by far the biggest supplier of military hardware to Ukraine as it fights against Russia. However, some of the promised equipment “will not be in the hands of Ukrainian fighters for months or years,” according to NBC News, one of the outlets that reported the upcoming package. Included in the package are advanced weapons that are still in the development phase, it explained.

The same caveat was cited by the Associated Press, which said that it may take “a year or two” for the arms to reach the battlefield, according to its sources. Washington expects Ukrainian forces “to fight for years to come,” US officials told the AP. The AeroVironment Switchblade 600 drone is an example of a weapon system that was promised to Ukraine months ago but has yet to be delivered. Defense News said this week that the Pentagon plans to sign the contract necessary for sending 10 of the so-called “kamikaze drones” within a month. Last month, Ukrainian Defense Minister Aleksey Reznikov called on foreign suppliers of arms to use his country as a testing ground for new weapons. He pledged to provide detailed reports about the experiences of Ukrainian soldiers with the prototypes provided to them.

“Thank you. You did not need to show us the storage room, but we appreciate it. Now it all makes sense..”

• FBI Mar-a-Lago Warrant Had ‘No Legal Basis’: Constitutional Lawyers (ET)

Two constitutional lawyers who worked in the Bush and Reagan administrations say that the warrant used to search former President Donald Trump’s Mar-a-Lago residence had no legal basis. A former president’s right under the Presidential Records Act supersedes the statutes the Department of Justice and FBI used to carry out the raid earlier this month, wrote David Rivkin Jr. and Lee Casey, who both served under Presidents Ronald Reagan and George H. W. Bush. “The judge who issued the warrant for Mar-a-Lago has signaled that he is likely to release a redacted version of the affidavit supporting it. But the warrant itself suggests the answer is likely no—the FBI had no legally valid cause for the raid,” they wrote in the Wall Street Journal on Tuesday.

Earlier this month, federal Magistrate Judge Bruce Reinhart unsealed the warrant and property receipt, showing that it allowed FBI agents to obtain all “physical documents and records constituting evidence, contraband, fruits of crime, or other items illegally possessed in violation of 18 U.S.C. §§793, 2071, or 1519.” And the materials that could be seized are “any government and/or Presidential Records created between January 20, 2017, and January 20, 2021,” which encompasses all of Trump’s presidential term. As a result, the two scholars said that “virtually all the materials at Mar-a-Lago are likely to fall within this category” but “federal law gives Mr. Trump a right of access to them.”

“His possession of them is entirely consistent with that right, and therefore lawful, regardless of the statutes the FBI cites in its warrant,” Rivkin and Casey wrote. “Those statutes are general in their text and application. But Mr. Trump’s documents are covered by a specific statute, the Presidential Records Act of 1978,” they said, adding that a Supreme Court decision in 1974 affirms their argument. “The former president’s rights under the [Presidential Records Act] trump any application of the laws the FBI warrant cites.”

[..] The former president, in a legal complaint filed earlier this week, wrote that agents visited his home in early June—about two months before the raid—and appeared to approve the installation of another lock. After one FBI agent saw the storage room, they told Trump’s team: “Thank you. You did not need to show us the storage room, but we appreciate it. Now it all makes sense,” according to the filing. “Counsel for President Trump then closed the interaction and advised the Government officials that they should contact him with any further needs on the matter,” it added.

“Joe Biden would not object to waiving his predecessor’s claims to executive privilege..”

Unbelievable.

• Biden White House Facilitated FBI Mar-A-Lago Raid (JTN)

Long before it professed no prior knowledge of the raid on Donald Trump’s estate, the Biden White House worked directly with the Justice Department and National Archives to instigate the criminal probe into alleged mishandling of documents, allowing the FBI to review evidence retrieved from Mar-a-Lago this spring and eliminating the 45th president’s claims to executive privilege, according to contemporaneous government documents reviewed by Just the News. The memos show then-White House Deputy Counsel Jonathan Su was engaged in conversations with the FBI, DOJ and National Archives as early as April, shortly after 15 boxes of classified and other materials were voluntarily returned to the federal historical agency from Trump’s Florida home.

By May, Su conveyed to the Archives that President Joe Biden would not object to waiving his predecessor’s claims to executive privilege, a decision that opened the door for DOJ to get a grand jury to issue a subpoena compelling Trump to turn over any remaining materials he possessed from his presidency. The machinations are summarized in several memos and emails exchanged between the various agencies in spring 2022, months before the FBI took the added unprecedented step of raiding Trump’s Florida compound with a court-issued search warrant. The most complete summary was contained in a lengthy letter dated May 10 that acting National Archivist Debra Steidel Wall sent Trump’s lawyers summarizing the White House’s involvement.

“On April 11, 2022, the White House Counsel’s Office — affirming a request from the Department of Justice supported by an FBI letterhead memorandum — formally transmitted a request that NARA provide the FBI access to the 15 boxes for its review within seven days, with the possibility that the FBI might request copies of specific documents following its review of the boxes,” Wall wrote Trump defense attorney Evan Corcoran. That letter revealed Biden empowered the National Archives and Records Administration to waive any claims to executive privilege that Trump might assert to block DOJ from gaining access to the documents. “The Counsel to the President has informed me that, in light of the particular circumstances presented here, President Biden defers to my determination, in consultation with the Assistant Attorney General for the Office of Legal Counsel, regarding whether or not I should uphold the former President’s purported ‘protective assertion of executive privilege,'” Wall wrote. “… I have therefore decided not to honor the former President’s ‘protective’ claim of privilege.”

How can the FBI work with Trump II after January 2025?

• FBI Brass Warned Agents Off Hunter Biden Laptop Due To 2020 Election (NYP)

FBI officials told agents not to investigate first son Hunter Biden’s infamous laptop for months — vowing that the bureau was “not going to change the outcome of the election again,” according to whistleblower claims made public Wednesday by Sen. Ron Johnson (R-Wis.) “These new allegations provide even more evidence of FBI corruption and renew calls for you to take immediate steps to investigate the FBI’s actions regarding the laptop,” Johnson wrote in a letter to Justice Department Inspector General Michael Horowitz. According to the senator, “individuals with knowledge” had told his office that “local FBI leadership” had slow-walked the laptop investigation after the computer was recovered from a Wilmington, Del. repair shop in December 2019.

Johnson quoted FBI management as telling employees “You will not look at that Hunter Biden laptop” and promising the bureau would not alter the 2020 election outcome — a reference to the FBI reopening the investigation into Hillary Clinton’s private email server days before the 2016 election. “Further, these whistleblowers allege that the FBI did not begin to examine the contents of Hunter Biden’s laptop until after the 2020 presidential election,” the Republican added. sJohnson said the new whistleblower claims should be enough to prompt the inspector general to take prompt action. “While I understand your hesitation to investigate a matter that may be related to an ongoing investigation, it is clear to me based on numerous credible whistleblower disclosures that the FBI cannot be trusted with the handling of Hunter Biden’s laptop,” Johnson wrote.

He added that Horowitz should start “by obtaining the history of the investigative actions taken by the FBI on Hunter Biden’s laptop which should be available on the FBI’s case management system, Sentinel.” Johnson’s letter comes after “highly credible whistleblowers” accused the FBI and Justice Department last month of burying dirt on President Biden’s son by incorrectly dismissing the intelligence as “disinformation,” according to Sen. Chuck Grassley of Iowa.

Fauci will use this to play the victim.

• DeSantis Says ‘Little Elf’ Fauci Should Be ‘Chucked Across The Potomac’ (RT)

Florida Governor Ron DeSantis has responded after senior health official Anthony Fauci said he would leave his post at the end of the year, calling the White House adviser a “little elf”while suggesting somebody should toss him into DC’s Potomac River. Speaking at a ‘Keep Florida Free’ event on Wednesday as he campaigns for reelection, DeSantis tore into the outgoing Covid czar, saying he’s “just sick of seeing him.” “I know he says he’s going to retire. Someone needs to grab that little elf and chuck him across the Potomac,” the Republican governor said, drawing loud cheers from the crowd. Fauci, who has long served as the head of the National Institute of Allergy and Infectious Diseases (NIAID), has taken prominent positions in both the Donald Trump and Joe Biden administrations, effectively becoming the face of the White House’s Covid response.

On Monday, however, the official said he would resign his post at NIAID and leave the Biden administration in December, though noted he would not be “retiring,” but rather “moving on”from his current positions. Fauci has drawn heated criticism from Republicans and conservative critics throughout the pandemic, with many slamming his policy advice for officials, while others have pointed to potentially dangerous coronavirus research funded by Fauci’s agency before the global Covid outbreak. Though the official has insisted all funding was vetted and approved through the proper channels, GOP Senator Rand Paul of Kentucky has vowed to probe NIAID and Fauci in particular, calling for a “full-throated investigation into the origins of the pandemic”earlier this week.

Taiwan

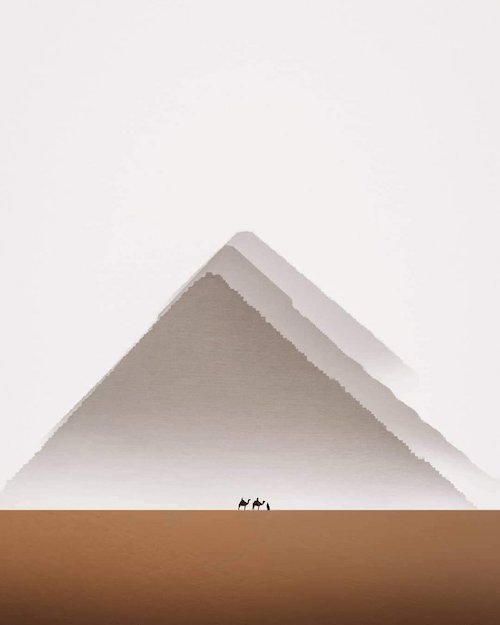

The Pyramids of Giza. Photo: Karim Amr

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.