Arthur Rothstein Accident on US 40 between Hagerstown and Cumberland, Maryland Nov 1936

” .. the Chicago Mercantile Exchange reported a huge increase in the number of investors hedging on crude hitting $40.

• OPEC And American Shale Keep The Oil Price Spiralling Downwards (Guardian)

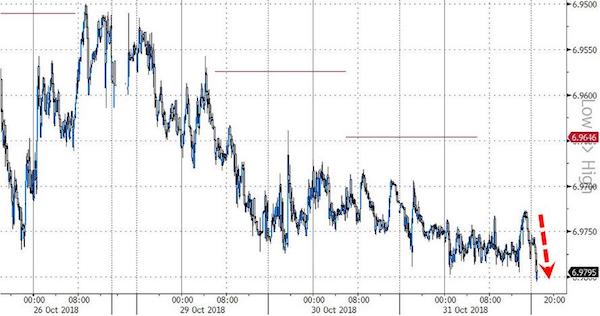

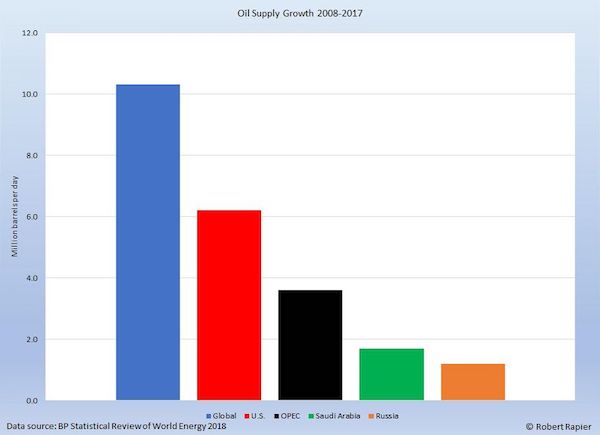

Oil prices were back near five-year lows – below $70 per barrel – at the end of last week as commodity traders, analysts and governments struggled to come up with new forecasts for 2015. The benchmark, Brent blend, had recovered from a major drop in the aftermath of last month’s meeting of the oil producers’ cartel, Opec. However, it was back down at $69.17 on Friday as the market bet on a prolonged low in prices. Igor Sechin, Russia’s most senior oil official, warned that Opec’s unwillingness to cut production could push oil down to $60, while the Chicago Mercantile Exchange reported a huge increase in the number of investors hedging on crude hitting $40. Forecasting the future price of oil has always been fraught.

There were few warnings in the first half of the year that prices were set to plunge by 40% from a June high of $115. Analysts at Citi are now expecting Brent to average $80 over the next 12 months, while their counterparts at Natixis believe it could fall as low as $74 – and that the US benchmark, West Texas Intermediate, will slump below $70. Standard Chartered described Opec’s decision to keep the production target unchanged as “extremely negative for oil prices for 2015” and has cut next year’s Brent price forecast by $16 a barrel to $85. The reasons for the cuts are faltering growth in demand as the global economy continues to stutter, plus soaring production from the shale fields of Texas and Pennsylvania.

Lower prices have also been supported by a relatively benign geopolitical environment, because energy supplies have not been endangered by the Russian stand-off with the west over Ukraine or Islamic State’s advances in Syria. A divided Opec is now hoping that falling prices will be devastating for higher-cost US frackers, forcing them to shut down output and gradually bring balance to the wider oil markets. But according to Paul Stevens, oil expert at Chatham House, a similar strategy in the late 1980s did not encourage North Sea and other producers to halt production and the price continued to slide downwards.

Read more …

“We’re way oversold in both Brent and WTI, not to mention the products, and the market’s not responding ..”

• Oil Poised to Extend Drop After Hitting Five-Year Low (Bloomberg)

West Texas Intermediate and Brent crudes are poised to decline from the lowest closing levels in more than five years after shrugging off a sign that the market has dropped too fast. The 14-day relative strength index (BCOM) for WTI slipped to 27.0364 yesterday, according to data compiled by Bloomberg. Investors typically start buying contracts when the reading is below 30. The 14-day RSI for Brent slipped to 23.6843. The move highlights the extent of the bear market in the face of technical support. “We’re way oversold in both Brent and WTI, not to mention the products, and the market’s not responding,” Bob Yawger, director of the futures division at Mizuho Securities said by phone yesterday. “A market that ignores these bullish signals is heading much lower.”

Futures fell 1.5% in New York and 0.8% in London yesterday. State-run Saudi Arabian Oil extended its discount for Arab Light sales to Asia next month to $2 a barrel below a regional benchmark, according to a company statement Dec. 4. That’s the lowest in at least 14 years. The slide in prices accelerated as the dollar surged to a five-year high, curbing the appeal of commodities as a store of value. WTI for January delivery dropped 97 cents to $65.84 a barrel on the New York Mercantile Exchange yesterday. It was the lowest settlement since July 29, 2009. Prices are down 33% this year.

Read more …

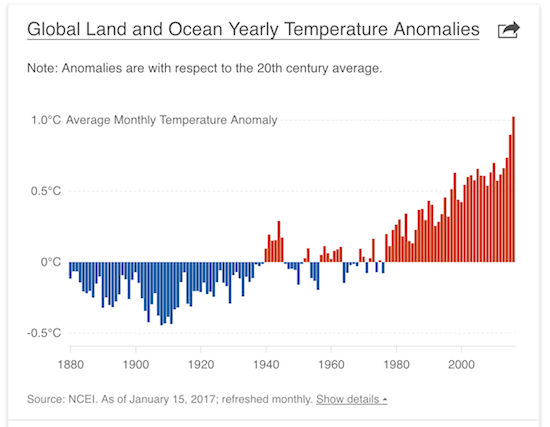

There’s a lot of uncertainty about how and to what extent climate agreements will result in stranded assets. Investment in fossil fuels carries a lot of risk, for yet another reason.

• Fossil Fuel Companies “The Sub-Prime Assets Of The Future” (Telegraph)

Investing in fossil fuels is becoming increasingly risky because global action to tackle climate change will curb demand, forcing companies to leave unprofitable reserves in the ground, Ed Davey, the energy secretary, has warned. Financial authorities must examine the risks posed by coal, oil and gas companies to prevent pension funds investing in what could become “the sub-prime assets of the future”, Mr Davey said. The comments are Mr Davey’s first intervention into the debate over the “carbon bubble”, the theory that the world’s existing fossil fuel reserves are overvalued because the majority must be left unburned in the ground if extremes of global warming are to be avoided.

Mr Davey told the Telegraph: “One has got to worry about the investments for pensioners. “If pension funds are investing in companies or banks have on their balance sheets huge amounts of assets in fossil fuels, and those assets don’t give the return that people expect – because of changes in technology where low-carbon becomes cheaper or because of the world having to take action against carbon emissions – one has got to protect those pensioners and those investments.”

Keeping global warming within 2C (3.6F), the level scientists say is necessary to prevent catastrophic climate change, will require the world to slash its carbon dioxide emissions, phasing out the unabated burning of fossil fuels for electricity. UN talks are ongoing in Lima this week with the aim of achieving a global emission reduction agreement next year. Mr Davey singled out coal – the dirtiest of the fossil fuels – as “the short-term biggest worry by a long way” as countries including China commit to cap their coal use. “Investing in new coal mines is going to get very risky,” he said.

Read more …

The timing is exquisite.

• Osborne Oversees Biggest Fossil Fuel Boom Since North Sea Oil (Guardian)

George Osborne has sparked the biggest boom in UK fossil fuel investment since the North Sea oil and gas industry was founded in the 1970s. Analysis of new Treasury data also shows investment in clean energy has plummeted this year and is now exceeded by fossil fuels, while road and airport building is soaring. After years of coalition infighting over green energy, the stark shift marks a major victory for the chancellor. But it conflicts with David Cameron’s recent statement that climate change is “a threat to our national security and to economic prosperity” and his 2010 pledge to the lead the “greenest government ever”. UK ministers are currently at UN climate talks in Peru arguing for strong action against global warming.

In Wednesday’s autumn statement, Osborne added £430m to the billions in tax breaks he has granted the fossil fuel sector since 2012. Taxpayers will also now fund seismic exploration to help companies find more oil and gas and will pay £31m for shale gas research drilling plus another £5m to “ensure the public is better engaged” with fracking. Osborne said the North Sea tax breaks “demonstrate our commitment to the tens of thousands of jobs that depend on this great British industry”. Joan Walley MP, who heads parliament’s environmental audit committee, said: “Taxpayers should not be propping up the fossil fuel industry in the 21st century.

Tax breaks should be used to support firms that come up with innovative clean energy solutions, not to keep us drilling for the fossil energy fuelling climate change.” Matthew Spencer, the director of the thinktank Green Alliance, whose experts performed the new analysis, accused Osborne of political manoeuvring before the general election. “A series of short-term tactical decisions have reversed what was a very encouraging picture for UK infrastructure. These stark figures show that you can’t focus on oil extraction and road building and expect to deliver a cleaner, leaner economy.”

Read more …

But all is well?!

• Delinquent US Car Loans Up 27% From Last Year (NY Times)

An increasing number of borrowers are falling behind on their car payments, even as the total amount of outstanding debt reaches new heights, according to the latest report by Experian, the credit and research firm. In a presentation on Wednesday, Experian said the balance of loans that were 60 days delinquent increased 27%, to roughly $4 billion, in the third quarter from the same period a year ago. Signs of trouble in the market come after a significant increase in lending to people with damaged credit and limited financial means. Analysts have warned that a loosening of underwriting standards for subprime auto loans could cause widespread losses in the financial system because much of the debt has been securitized and bought by investors around the globe. Some of the highest delinquency rates in the quarter are concentrated across the South in Mississippi, South Carolina and Alabama. North Dakota had the lowest delinquency rate.

Finance companies, which tend to focus more on subprime customers than traditional banks, had the largest increases in delinquencies in the third quarter. As the delinquencies have mounted, so has the regulatory scrutiny. Subprime auto lenders have faced an onslaught of scrutiny from regulators and prosecutors, worried that the high-cost loans take advantage of some of the nation’s most vulnerable borrowers. The examinations have touched on virtually every player in the broader subprime auto lending ecosystem from used car dealers to lenders. In the latest chapter, the American Honda Finance Corporation, a lending unit of the automaker, disclosed on Tuesday that the company was bracing for an enforcement action from the Justice Department and the Consumer Financial Protection Bureau over concerns that it gives more costly loans to minority borrowers. The authorities, the company said in a regulatory filing on Tuesday, notified the lender last month about the looming action.

Read more …

Here’s betting they’ll get it.

• Goldman Needs Volcker Delay to Avoid Private-Equity Losses (Bloomberg)

Goldman Sachs has $7 billion invested in private equity that it might have to sell at a loss. For Morgan Stanley, it’s $2.5 billion. The big sums explain why Wall Street has been lobbying regulators to delay a July deadline for complying with the Volcker Rule, which restricts banks from investing in private equity as part of a ban on making market bets with their own capital. Banks argue that if they dump holdings quickly, they will have to accept discount prices. Analysts and lawyers for the financial industry say Wall Street’s concerns have begun to make headway with the Federal Reserve, which plans to decide on an extension soon. “There’s considerable pressure the Fed is feeling in that they don’t want institutions to have a bloodbath trying to divest funds,” said Kevin Petrasic, a partner at Paul Hastings in Washington. “The Fed has been indicating flexibility.”

The Volcker deadline underscores the tension regulators face between enforcing rules meant to curb risk-taking and responding to banks’ complaints that many Dodd-Frank Act reforms aren’t workable. The Fed is deciding what to do after lawmakers lambasted it at congressional hearings last month for weak oversight of Wall Street. Before the 2008 financial crisis, banks purchased shares in thousands of private-equity and venture-capital funds. The money invested was used to buy stakes in private companies, meaning it’s locked up for years until the businesses are sold. When Congress included the Volcker Rule in the 2010 Dodd-Frank law, it realized banks might have difficulty dumping holdings. As a result, lawmakers authorized the Fed to put the deadline off for several years. Banks want an extension until 2022, which would allow them to keep their private-equity investments until they expire. Fed General Counsel Scott Alvarez told a conference of banking lawyers last month that the central bank will make a decision soon.

Read more …

Hardly a recovery, if there’s one at all, but banks are worth more than before the crisis. This is us. This is what we do.

• Wells Fargo Breaks Citigroup’s 2001 Record for Bank Value (Bloomberg)

Wells Fargo finished trading yesterday as the most valuable U.S. bank ever, surpassing Citigroup’s 2001 record. Wells Fargo closed with a market capitalization of $285.5 billion, based on 5.19 billion shares outstanding on Oct. 31, according to data compiled by Bloomberg. That beats the previous record set by Citigroup on Feb. 5, 2001, when its value reached $283.4 billion, the data show. Wells Fargo, which counts Warren Buffett’s Berkshire Hathaway as its largest shareholder, doubled its size in 2008 by outmaneuvering New York-based Citigroup to purchase Wachovia Corp. Chief Executive Officer John Stumpf made one of out every four U.S. mortgages last year and now oversees the most U.S. bank branches.

“Our focus is on doing what is right for our customers every day, and we are pleased our investors place their confidence in Wells Fargo,” Ancel Martinez, a bank spokesman, said in a statement. Wells Fargo rose 1% to $55.03 in New York, and the stock’s 21% gain this year tops the 7.7% advance for the KBW Bank Index of 24 U.S. lenders. Berkshire’s stake in the San Francisco-based bank is valued at more than $25 billion, according to data compiled by Bloomberg.

Read more …

Russia will act when it’s had enough of this.

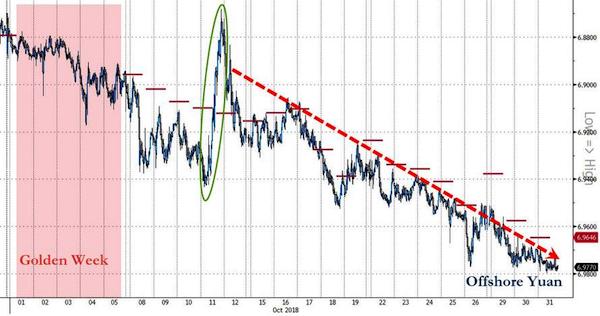

• Russia Braces For An Economic Winter (Observer)

A website that was going viral on Russian social networks last week shows the rouble-dollar exchange rate, the rouble-euro exchange rate and the price of Brent crude changing in real time against a backdrop of slowly breaking waves, as soothing music plays in the background. “Russian zen: meaningless and merciless”, reads the bottom of the page Zenrus.ru. It is a play on a famous quote that Russian revolt is “meaningless and merciless.” A zen-like calm is probably hard to come by for those watching the exchange rate and the price of oil: the rouble fell to new all-time lows of more than 54 to the dollar last week after the Opec oil producers’ group decided not to reduce production, which would have bolstered sinking oil prices. Russia is especially vulnerable to those prices, since energy exports make up half of its budget, and on Monday its currency recorded its largest single-day decline since the Russian financial crisis of 1998.

In all, the rouble has sunk by more than 40% this year as Russia has been buffeted by sanctions over its role in the Ukraine crisis and steep falls in the oil price. By the end of the week Brent was hovering below $70 a barrel, down from more than $105 at the start of the year. The picture of Russia’s economic future is grim, despite the rosy outlook President Vladimir Putin tried to put on it in his annual address to the federal assembly on Thursday. Inflation has been rising, and recession next year is all but certain. On Tuesday, the economic development ministry reduced its GDP growth forecast for 2015 from 1.2% to –0.8%. State-owned banks have sought help from the government after the Ukraine sanctions cut them off from the western financial industry and its cheaper credit.

According to Vladimir Tikhomirov, an economist at Russian bank BKF, the two main factors responsible for Russia’s economic woes – sanctions and a low oil price – probably won’t change any time soon. “Oil has a stronger effect on the economy than sanctions, and the oil price and sanctions are speeding up macroeconomic processes that were already there,” Tikhomirov says. “The economy was slowing down due to structural difficulties even when oil prices were high. I think that next year there won’t be new sanctions but the current sanctions will remain; I think next year the oil price will be around $80 a barrel; and I think that the economy will shrink.”

Read more …

Merkel herself has said it would be a bad thing if Russia goes into a financial crisis.

• Why A Moscow Meltdown Could Spread Around The Globe (Observer)

Russia matters. It mattered in 1998 when the shock waves from its debt default reverberated around the world. And it would matter again should the plunging oil price lead to economic collapse. That’s despite the fact that Russia is a massive land mass with a relatively small economy. It accounts for only 3% of global GDP and it is dominated by an energy sector that is responsible for 70% of exports. To an extent, the structure of Russia’s economy should mitigate contagion risks. Lacking a modern manufacturing sector, it is not vital for global supply chains and, in theory, any other energy producer could make good the disruption to oil and gas supplies in the event of a deep and damaging recession. But there are at least five ways in which a crisis for Russia could spread. Russia’s immediate problems have been caused by the sharp drop in the price of crude and it is not the only one to be suffering. Venezuela and Iran are finding it hard to cope with oil down at $70 a barrel. If Russia goes, it will be a case of: who’s next?

Second, Russia still has close economic links with eastern Europe, so a collapse would have serious consequences for countries such as Poland and an already imploding Ukraine. Western Europe, too, would be affected if for any reason gas supplies through Russia’s pipeline were cut off. Third, confidence would be hit. Germany’s weak economic performance since the spring can, in part, be attributed to the gloomier economic mood. The slowdown in the rest of the eurozone has probably had a bigger impact on German activity but the tension between Moscow and Kiev has certainly not helped. Russia might be enough to tip Germany into recession, which in turn would be enough to ensure that the European Central Bank began a quantitative easing programme.

Fourth, nobody is quite sure how Vladimir Putin, pictured, would respond to the most challenging economic circumstances since 1998. Any confidence effects from an economic crisis would be exacerbated by the knowledge that Russia is controlled by a president able to make felt his country’s still considerable geo-political and military clout. Finally, the assumption is that financial market exposure to Russia is relatively limited given that overseas banks had $209bn (£134bn) of loans to Russia when sanctions were imposed in March. On the face of it, western investors do not look all that vulnerable and have had time to get their money out. But that was also the assumption in 1998, when Barclays had to set aside £250m to cover its Russian losses. Financial trades are now so complex and leveraged, it is impossible to know for sure how big losses might be this time.

Read more …

Is Greece set to explode again?

• Clashes At Greek Protests To Mark Police Shooting (BBC)

Clashes have erupted in the capital of Greece during protests marking six years since police shot dead an unarmed teenager. At least 5,000 demonstrators marched in Athens on Saturday. Some attacked shops and hurled petrol bombs at riot police. Police officers used tear gas and a water cannon to disperse protesters. The demonstrators had been marking the anniversary of 15-year-old Alexis Grigoropoulos’ death. He was shot by an officer who has since been jailed. Mr Grigoropoulos’ killing on 6 December 2008 sparked violent riots across Greece, with cars being set alight and shops looted in a number of cities. Clashes have also broken out on previous anniversaries of his death. On Saturday, anti-establishment protesters attacked banks and damaged shops and bus stops.

At one point, demonstrators looted a clothes shop and set fire to the merchandise in the street, the Associated Press news agency reported. According to Reuters, police said they detained close to 100 protesters. Clashes primarily took place in Athen’s Exarchia neighbourhood, but violence was also reported in Thessaloniki, in northern Greece. No injuries were reported in either city. Protesters have also been expressing support for Nikos Romanos, a friend of Mr Grigoropoulos who witnessed his death. Romanos, 21, has been jailed for attempted bank robbery. He is currently on hunger strike, demanding study leave after he was accepted onto a university course.

Read more …

WHile the government can’t stop blabbing about respect for vistims and their families, the familes themselves say: “The Netherlands “has completely botched” the fact-finding investigation and the legal framework of the case..” “There is no coordination, there is no leadership whatsoever (by) Holland.”

• Angry Families Of MH17 Crash Victims Seek UN Investigation (Reuters)

Relatives of MH17 crash victims, angered by what they see as Dutch mishandling of inquiries into the disaster, want a special U.N. envoy to launch an international investigation. A letter sent to Prime Minister Mark Rutte on Friday, a copy of which was seen by Reuters, said Dutch officials had failed to build a case. They asked that inquiries by the Safety Board and prosecution service be handed over to the United Nations. Rutte should “request the U.N. to appoint a special envoy to take over,” said the letter written by Van der Goen Attorneys. Malaysia Airlines flight MH17 was downed on July 17 over eastern Ukraine, killing all 298 passengers and crew, two-thirds of them Dutch. Experts say the most likely cause was a ground-to-air missile fired from territory held by pro-Russian separatists. The Dutch launched the largest criminal investigation in their history after the crash. This week, trucks are carrying pieces of the plane home, but much of the wreckage still lies in Ukrainian fields.

Dutch investigators, leading a case involving 11 countries, have not concluded how the plane was shot down or identified suspects. The Netherlands “has completely botched” the fact-finding investigation and the legal framework of the case, said the letter, sent on behalf of 20 relatives from Belgium, Germany, the Netherlands and the United States. Dutch prosecutors have been unable to access the crash site, in a war zone disputed by Ukrainian troops and Russian-backed rebels, or not met international requirements to secure evidence, the letter said. “Nobody knows who is doing what,” said Bob van der Goen, a spokesman for the law firm. “There is no coordination, there is no leadership whatsoever (by) Holland.” Rutte said on Friday the Dutch teams were returning to the Netherlands. “We have done everything we could. In view of the safety situation and the weather, we cannot do anything more right now,” he said. An international inquiry is the only way to identify who shot down the plane and ensure they are brought to court, the letter said.

Read more …

What a story, the recent – foreign – additions to the Kiev government.

• Ukraine’s Made-in-USA Finance Minister (Robert Parry)

Ukraine’s new Finance Minister Natalie Jaresko, a former U.S. State Department officer who was granted Ukrainian citizenship only this week, headed a U.S. government-funded investment project for Ukraine that involved substantial insider dealings, including $1 million-plus fees to a management company that she also controlled. Jaresko served as president and chief executive officer of Western NIS Enterprise Fund (WNISEF), which was created by the U.S. Agency for International Development (U.S. AID) with $150 million to spur business activity in Ukraine. She also was cofounder and managing partner of Horizon Capital which managed WNISEF’s investments at a rate of 2 to 2.5% of committed capital, fees exceeding $1 million in recent years, according to WNISEF’s 2012 annual report.

The growth of that insider dealing at the U.S.-taxpayer-funded WNISEF is further underscored by the number of paragraphs committed to listing the “related party transactions,” i.e., potential conflicts of interest, between an early annual report from 2003 and the one a decade later. In the 2003 report, the “related party transactions” were summed up in two paragraphs, with the major item a $189,700 payment to a struggling computer management company where WNISEF had an investment. In the 2012 report, the section on “related party transactions” covered some two pages and included not only the management fees to Jaresko’s Horizon Capital ($1,037,603 in 2011 and $1,023,689 in 2012) but also WNISEF’s co-investments in projects with the Emerging Europe Growth Fund [EEGF], where Jaresko was founding partner and chief executive officer.

Jaresko’s Horizon Capital also managed EEGF. From 2007 to 2011, WNISEF co-invested $4.25 million with EEGF in Kerameya LLC, a Ukrainian brick manufacturer, and WNISEF sold EEGF 15.63% of Moldova’s Fincombank for $5 million, the report said. It also listed extensive exchanges of personnel and equipment between WNISEF and Horizon Capital. Though it’s difficult for an outsider to ascertain the relative merits of these insider deals, they could reflect negatively on Jaresko’s role as Ukraine’s new finance minister given the country’s reputation for corruption and cronyism, a principal argument for the U.S.-backed “regime change” that ousted elected President Viktor Yanukovych last February.

Read more …

Small fish.

• Prosecutor Freezes Accounts Of Former Vatican Bank Heads (Reuters)

The Vatican’s top prosecutor has frozen €16 million in bank accounts owned by two former Vatican bank managers and a lawyer as part of an investigation into the sale of Vatican-owned real estate in the 2000s, according to the freezing order and other legal documents. Prosecutor Gian Piero Milano said he suspected the three men, former bank president Angelo Caloia, ex-director general Lelio Scaletti, and lawyer Gabriele Liuzzo, of embezzling money while managing the sale of 29 buildings sold by the Vatican bank to mainly Italian buyers between 2001 and 2008, according to a copy of the freezing order reviewed by Reuters. The money in the three men’s bank accounts “stems from embezzlement they were engaged in,” Milano said in the October 27 sequester order.

Milano’s investigation follows an audit of the Vatican bank by non-Vatican financial consultants commissioned last year by the bank’s current management. The Vatican bank earlier this year also filed a legal complaint against the three men. The men have not been charged. The Vatican spokesman on Saturday issued a statement confirming the freezing but gave no names, amounts or other details. The Vatican bank said in a separate statement that it had pressed charges against the three as part of its “commitment to transparency and zero tolerance, including with regard to matters that relate to a more distant past”. The bank statement also gave no details, citing “the ongoing judicial enquiry”.

Read more …

For starters.

• Australian Banks Seen Needing $25 Billion After Inquiry (Bloomberg)

Commonwealth Bank of Australia and its three main competitors may need as much as A$30 billion ($25 billion) after a government-commissioned inquiry called for “unquestionably strong” capital levels, analysts said. The shortfall is based on lenders needing to boost levels to within the top quartile of their global peers and set aside additional funds against potential losses on home mortgages, as recommended by the Financial Systems Inquiry report released today in Sydney by Treasurer Joe Hockey. Australia’s major lenders hold about 10% to 11.6% of their assets as Tier 1 capital compared with at least 12.2% at the world’s safest banks, the government’s first inquiry into the financial system since 1997 said. Given banks’ reliance on overseas investors for debt funding, the financial system must be robust, the report said,

“The onus on capital is in line with global changes and Australia has to fall in line,” John Buonaccorsi, a Sydney-based analyst at CIMB Group Holdings Bhd. said in a phone interview after the report was released. “I don’t expect a straight capital raising yet.” Australia’s largest banks are initially more likely to resort to dividend reinvestment plans, where investors swap all or part of their dividend for new shares, and limiting increases in payout ratios, he added. Buonaccorsi expects a shortfall between A$25 billion and A$30 billion. Omkar Joshi, who helps oversee A$1 billion as an investment analyst at Watermark Funds Management, estimated a A$15 billion to A$20 billion gap. Their predictions were based on an average mortgage risk weight of 25% to 30% and systemically important bank buffer of 2%.

Read more …

“.. if the progress of our lives starts looking too much like a random walk, then we tend to start asking ourselves difficult questions, like “What’s it all about?” and drinking too much. And that causes our walk to get even closer to random. ”

• Minimum Viable Sociopathy (Dmitry Orlov)

If you simply wander aimlessly through life, breathing oxygen and eating and excreting organic matter, then you will still get somewhere. Statistically, a blind-drunk sailor who walks out of a bar will, on average, while stumbling along on his way to nowhere in particular, cover the distance of √n steps for every n steps he takes. This is known as a random walk, or Brownian motion, which is fine for molecules at anything above 0ºK, and perhaps for drunken sailors too, but most of us sentient beings want our lives to have a bit of meaning. And if the progress of our lives starts looking too much like a random walk, then we tend to start asking ourselves difficult questions, like “What’s it all about?” and drinking too much. And that causes our walk to get even closer to random. And therein lies a great danger, because this sort of downward spiral inevitably ends with somebody else telling you “What’s it all about” and what it is you have to do, supposedly for your own good, though it hardly ever is.

There is also the opposite danger. If you keep your eyes fixed on your goal and make a concerted effort to make n steps of progress in its direction for every n steps you take, then you will quickly happen upon a wall with a gate in it, and a guard at that gate will demand to see your permit, degree, qualification or certificate before letting you pass through that gate. And the process of you getting that permit, degree, qualification or certificate will end with somebody else telling you what your goal ought to be. The goal is, universally, to accumulate things: dollars or stripes on your uniform or publications and citations, or earwax. Details don’t matter, but what matters is that these things never have much of anything at all to do with your original goal.

Read more …

We need more people like Welby.

• Archbishop Calls For £150 Million State-Backed Food Bank System (Daily Mail)

A new row over food banks erupted last night after a report backed by the Archbishop of Canterbury called for a £150 million state-backed system to combat hunger in Britain. The Most Reverend Justin Welby appeared to be on course for a clash with David Cameron after calling on the Prime Minister to reverse his decision not to take European funds to boost UK food banks. Writing in today’s Mail on Sunday, Archbishop Welby makes a powerful call for more help to prevent families going hungry. The Archbishop is to launch a Parliamentary report in Westminster tomorrow, and calls on the Government to take ‘quick action’ to implement its recommendations in full. Separately, this newspaper has obtained details of the report’s radical proposals, which call for:

- A new publicly funded body, Feeding Britain, involving eight Cabinet Ministers, to work towards a ‘hunger free Britain’.

- Bigger food banks, called Food Banks Plus, to distribute more free food and advise people how to claim benefits and make ends meet.

- A rise in the minimum wage and the provision free school meals during school holidays for children from poor families.

- New measures to make it harder to strip people of benefits for breaking welfare rules – including soccer style ‘yellow cards’ instead of instant bans.

- Action to make supermarkets give more food to the poor.

The report by the All-Party Parliamentary Inquiry into Hunger in Britain comes amid an intense debate over welfare and poverty. Experts claimed that Chancellor George Osborne’s Autumn Statement last week would mean massive cuts in welfare in the coming years. Praising food bank volunteers who have rescued the poor from hunger, the Welby-backed report says they have achieved the ‘equivalent to a social Dunkirk.’ Notably, it adds: ‘This extraordinary achievement has been done without the assistance of central government. If the Prime Minister wants to meet his Big Society it is here.’

Read more …

The growing poverty in Britain is indeed a disgrace.

• Hunger in UK Shocks Me More Than Africa (Archbishop Of Canterbury)

In one corner of a refugee camp in the Democratic Republic of Congo was a large marquee. Inside were children, all ill. They had been separated from family, friends, those who looked after them. Perhaps, mostly having disabilities, they had been abandoned in the panic of the militia attack that drove them from their homes. Now they were hungry. It was deeply shocking but, tragically, expected. A few weeks later in England, I was talking to some people – a mum, dad and one child – in a food bank. They were ashamed to be there. The dad talked miserably. He said they had each been skipping a day’s meals once a week in order to have more for the child, but then they needed new tyres for the car so they could get to work at night, and just could not make ends meet. So they had to come to a food bank.They were treated with respect, love even, by the volunteers from local churches. But they were hungry, and ashamed to be hungry. I found their plight more shocking. It was less serious, but it was here.

And they weren’t careless with what they had – they were just up against it. It shocked me that being up against it at the wrong time brought them to this stage. There are many like them. But we can do something about it. Two weeks ago, people in churches up and down the land listened to the passage in St Matthew’s Gospel where Jesus describes who will enter the Kingdom of Heaven. When Christ returns, He will say: ‘Come, you that are blessed by my Father, inherit the kingdom… for I was hungry and you gave me food, I was thirsty and you gave me something to drink.’ The good people are surprised, they don’t remember helping anyone so powerful, and think He has mixed them up with someone else. Jesus tells them: ‘Just as you did it to one of the least of these… you did it to me.’ Those who did not give food to the hungry or a drink to the thirsty find out God has taken their lack of kindness into account too.

Read more …

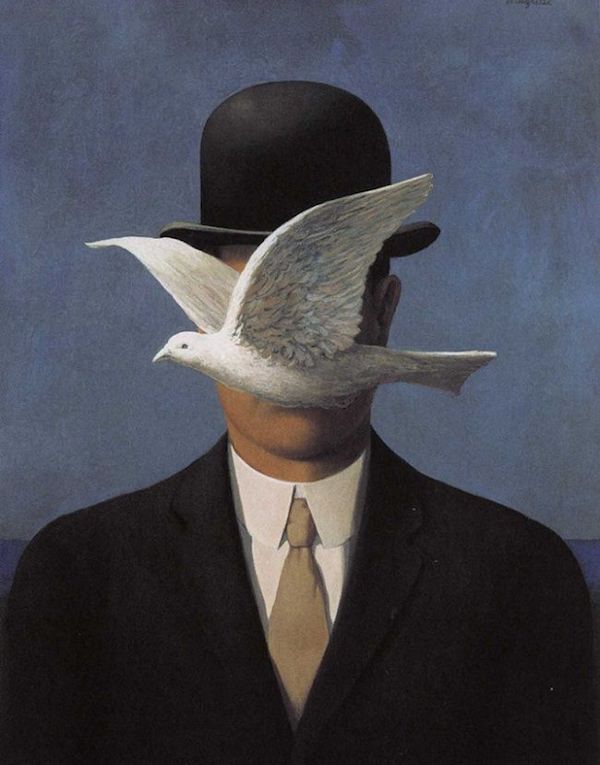

Art reflects society before society reflects upon itself.

• Has Modern Art Exhausted Its Power To Shock? (BBC)

Modern art’s desire to shock and to defy cliche has become a cliche in itself, and spawned a culture of fakery, argues Roger Scruton. “To thine own self be true,” says Shakespeare’s Polonius, “and thou canst be false to no man.” Live in truth, urged Vaclav Havel. “Let the lie come into the world,” wrote Solzhenitsyn, “but not through me.” How seriously should we take these pronouncements, and how do we obey them? There are two kinds of untruth – lying and faking. The person who is lying says what he or she does not believe. The person who is faking says what he believes, though only for the time being and for the purpose in hand. Anyone can lie. It suffices to say something with the intention to deceive. Faking, however, is an achievement. To fake things you have to take people in, yourself included. The liar can pretend to be shocked when his lies are exposed, but his pretence is part of the lie. The fake really is shocked when he is exposed, since he has created around himself a community of trust, of which he himself is a member.

In all ages people have lied in order to escape the consequences of their actions, and the first step in moral education is to teach children not to tell fibs. But faking is a cultural phenomenon, more prominent in some periods than in others. There is very little faking in the society described by Homer, for example, or in that described by Chaucer. By the time of Shakespeare, however, poets and playwrights are beginning to take a strong interest in this new human type. In Shakespeare’s King Lear the wicked sisters Goneril and Regan belong to a world of fake emotion, persuading themselves and their father that they feel the deepest love, when in fact they are entirely heartless. But they don’t really know themselves to be heartless – if they did, they could not behave so brazenly. The tragedy of King Lear begins when the real people – Kent, Cordelia, Edgar, Gloucester – are driven out by the fakes.

The fake is a person who has rebuilt himself, with a view to occupying another social position than the one that would be natural to him. Such is Molière’s Tartuffe, the religious impostor who takes control of a household through a display of scheming piety. Like Shakespeare, Moliere perceives that faking goes to the very heart of the person engaged in it. Tartuffe is not simply a hypocrite, who pretends to ideals that he does not believe in. He is a fabricated person, who believes in his own ideals since he is just as illusory as they are. Tartuffe’s faking is a matter of sanctimonious religion. With the decline of religion during the 19th Century there came about a new kind of faking. The romantic poets and painters turned their backs on religion and sought salvation through art. They believed in the genius of the artist, endowed with a special capacity to transcend the human condition in creative ways, breaking all the rules in order to achieve a new order of experience. Art became an avenue to the transcendental, the gateway to a higher kind of knowledge.

Read more …

At least.

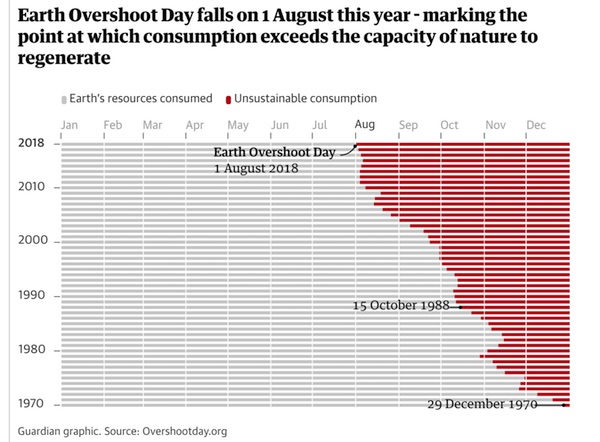

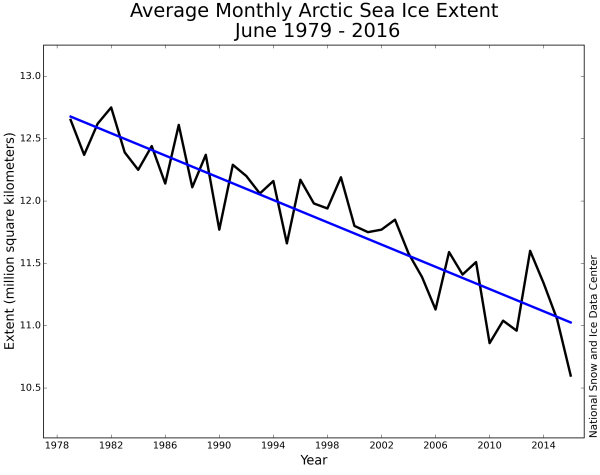

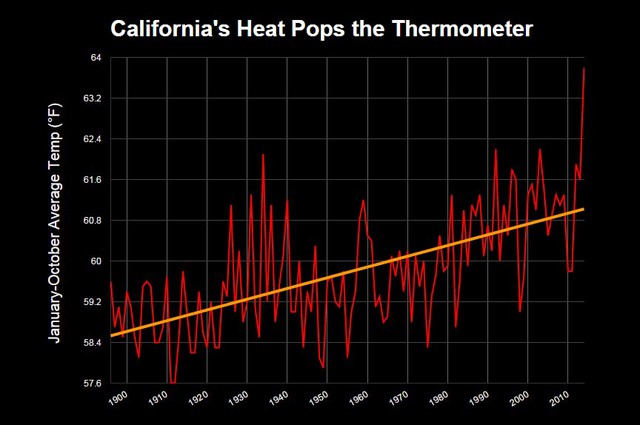

• California’s ‘Hot Drought’ Ranks Worst in at Least 1,200 Years (Bloomberg)

Record rains fell in California this week. They’re not enough to change the course of what scientists are now calling the region’s worst drought in at least 1,200 years. Just how bad has California’s drought been? Modern measurements already showed it’s been drier than the 1930s dustbowl, worse than the historic droughts of the 1970s and 1980s. That’s not all. New research going back further than the Viking conquests in Europe still can’t find a drought as bad as this one. To go back that far, scientists consulted one of the longest records available: tree rings.

Tighter rings mean drier years, and by working with California’s exceptionally old trees, researchers from University of Minnesota and Woods Hole Oceanographic Institute were able to reconstruct a chronology of drought in southern and central California. They identified 37 droughts that lasted three years or more, going back to the year 800. None were as extreme as the conditions we’re seeing now. One of the oddities of this drought is that conditions aren’t just driven by a lack of rainfall. There have been plenty of droughts in the past with less precipitation. (The drought of 1527 to 1529, for example, was killer.) What makes this drought exceptional is the heat. Extreme heat.

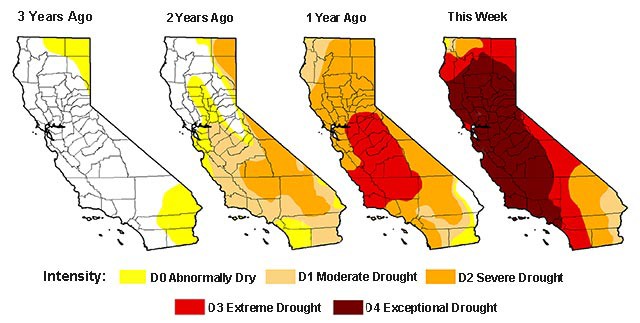

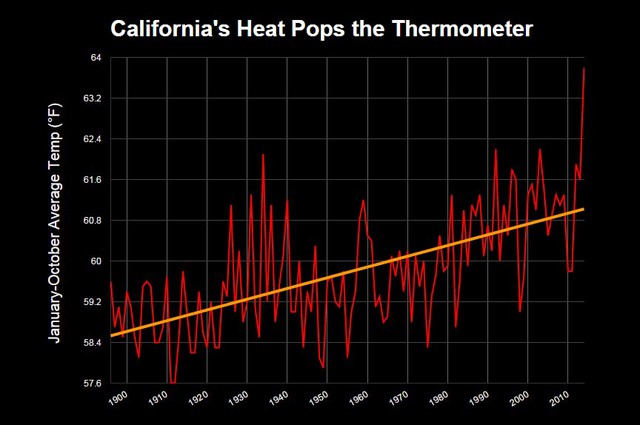

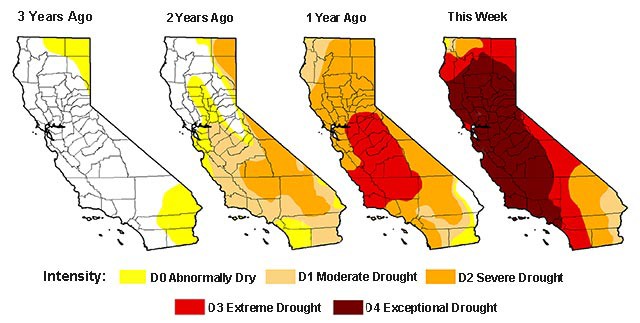

Higher temperatures increase evaporation and help deplete reservoirs and groundwater. The California heat this year is like nothing ever seen in modern temperature records. The chart above shows average year-to-date temperatures in the state from January through October for each year since 1895. California’s drought has withered pastures and forced farmers to uproot orchards and fallow farmland. It may cost the state $2.2 billion this year, with 17,100 jobs lost and 428,000 acres of land left unplanted. Tensions are still running high between farmers and salmon fishers, who rely on the same waters. Young salmon even qualified for migration assistance this year – via tanker truck – when river levels were too low to make the swim. The effects of prolonged drought are cumulative. Maps from the U.S. Drought Monitor below show the worsening of conditions over the last three years.

More than half of the state remains in “exceptional drought” (crimson). It’s a distinction marked by crop and pasture losses and water shortages that fall within the top two percentiles. Record rainfalls recorded across the state this week — including in San Francisco and Los Angeles — did little to overcome the state’s moisture deficit, the National Drought Mitigation Center reported yesterday.

Read more …