Hieronymus Bosch St. Jerome in Prayer 1482

Far too much power. And then you get inane stuff like: Fed Chair Janet Yellen has allowed the labor market to strengthen .. That means exactly nothing at all.

• Fed Says Balance-Sheet Unwind to Start ‘Relatively Soon’ (BBG)

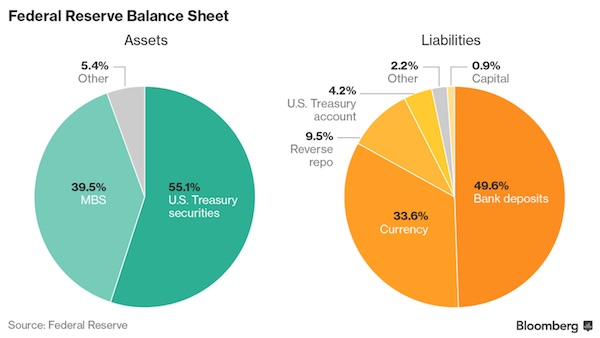

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal. The start of balance-sheet normalization – possibly as soon as September – is another policy milestone in an economic recovery now in its ninth year. The Fed bought trillions of dollars of securities to lower long-term borrowing costs after cutting the main interest rate to zero in December 2008. “Near-term risks to the economic outlook appear roughly balanced,” the Federal Open Market Committee said in a statement Wednesday following a two-day meeting in Washington. “Household spending and business fixed investment have continued to expand.”

Fed watchers had anticipated that the inclusion of the term “relatively soon” would signal the central bank could announce the timing of the balance-sheet reduction program at its next meeting, scheduled for Sept. 19-20. U.S. stocks rose slightly and 10-year Treasury yields fell following the Fed’s statement. “I expect an announcement of the onset of the balance-sheet reduction at the conclusion of the September meeting, effective on the first of October,” Carl Tannenbaum, chief economist at Northern Trust Corp. in Chicago, said after Wednesday’s statement. U.S. central bankers have raised the benchmark policy rate four times since they began removing emergency policy in December 2015, and project another increase before the end of this year.

In June, the FOMC outlined gradually rising runoff caps for maturing Treasuries and mortgage-related securities, and said the program would start “this year.” Fed Chair Janet Yellen has allowed the labor market to strengthen while inflation has remained lower than the 2% goal of officials, with price pressures declining in recent months. The target range for the benchmark federal funds rate was held at 1% to 1.25%. The FOMC said it’s “monitoring inflation developments closely.”

Also far too much power. It’s crazy to see the man’s babytalk endanger entire societies.

• Time Flies for Draghi and the Bumblebees (BBG)

Five years ago today, Mario Draghi was talking about bumblebees. The European Central Bank president’s speech in London on July 26, 2012, became instantly famous because of his pledge to do “whatever it takes” to save the euro. But for all the power and clarity of that phrase, he started his remarks more obliquely. “The euro is like a bumblebee. This is a mystery of nature because it shouldn’t fly but instead it does. So the euro was a bumblebee that flew very well for several years. And now — and I think people ask “how come?”– probably there was something in the atmosphere, in the air, that made the bumblebee fly. Now something must have changed in the air, and we know what after the financial crisis.”

At the time, the currency bloc was being buffeted by soaring bond yields in peripheral nations as speculators bet the union’s fundamental flaws would rip it apart. Draghi’s answer was to state unequivocally that the immediate crisis fell under the ECB’s responsibility and he would deal with it. “The ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” That pledge was followed by a program to buy the debt of stressed countries in return for structural reforms, and in that respect the words alone proved to be enough. Yield spreads collapsed even though the program has never been tapped.

The bumblebee metaphor tends to be forgotten, but Draghi’s point was this: even with many national governments and more than a dozen different languages dividing the labor force, the single currency can fly. He went further though, saying that it would fly better if European governments overhaul their economies and work more closely together. On that point, the ECB has less reason to be satisfied with the past five years. The institution has since become the regional banking supervisor but European-level integration has otherwise largely stalled, and Draghi has repeatedly lamented the sluggish pace of national economic reforms.

“The last great central banker that we had in the last 110 years other than Volcker was J.P. Morgan. The difference is, when Morgan tried to contain the 1907 crisis, he wasn’t using zeros and ones of imaginary computer money; he was using his own capital.”

• The Greater Moderation (DDMB)

In late June, the recently retired Robert Rodriguez, a 33-year veteran of the markets, sat down for a lengthy interview with Advisor Perspectives (linked here). Among his many accolades, Rodriguez carries the unique distinction of being crowned Morningstar Manager of the Year for his outstanding management of both equity and bond funds. He likens the current era to that of the nine years ended 1951, a period during which the Fed and Treasury held interest rates at artificially low levels to finance World War II. His main concern today is that price discovery has been so distorted by the Fed that the stage is set for a ‘perfect storm.’ His personal allocation to equities is at the lowest level since 1971. The combination of meteorological forces to bring on said storm, you ask? It may well be an act of God, an earthquake. It could just as easily be a geopolitical tremor the system cannot absorb; it’s easy enough to name a handful of potential aggressors.

Or history may simply rhyme with the unrelenting shock waves that catalyzed the subprime mortgage crisis, coupled per chance with a plain vanilla recession. We may simply and slowly wake to the realization that the assumptions we’ve used to delude ourselves into buying the most expensive credit markets in the history of mankind are built on so much quicksand. The point is panics do not randomly come to pass; they must be shocked into existence as was the case in advance of 1907 and 2007. One of Rodriguez’s observations struck a raw nerve for yours truly, who prides herself on being a reformed central banker: “The last great central banker that we had in the last 110 years other than Volcker was J.P. Morgan. The difference is, when Morgan tried to contain the 1907 crisis, he wasn’t using zeros and ones of imaginary computer money; he was using his own capital.”

It is only fair and true to honor history and add that Morgan’s efforts rescued depositors. Income inequality in the years that followed 1907 declined before resuming its ascent to its prior peak, reached at the climax of the Roaring Twenties. The Fed’s intrusions since 2007, built on the false premise of a fanciful wealth effect concocted using models that have no place in the real world, have accomplished the opposite. Income inequality has not only grown in the aftermath of The Great Financial Crisis and throughout The Greater Moderation; it has long since smashed through its former 1927 record and kept rising. The Fed’s actions have not saved the little guy; they’ve skewered him.

Oh so busy with no price discovery.

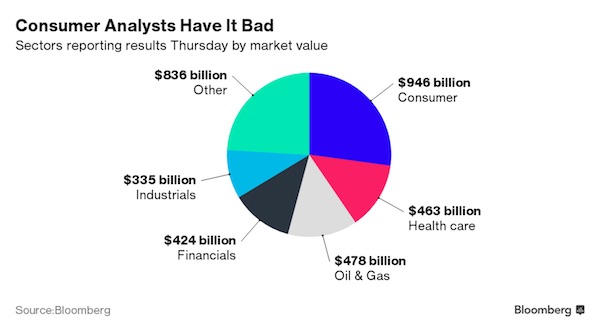

• Thursday Is the ‘Day From Hell’ for Europe’s Stock Watchers (BBG)

If you think your Thursday looks bad, spare a thought for James Edwardes Jones. The RBC analyst is bracing for what he calls the busiest earnings day he’s experienced in about 20 years covering the consumer-goods industry. Edwardes Jones plans to arrive at RBC Europe’s London offices along the River Thames about the time the world’s largest brewer, Anheuser-Busch InBev, reports results at 6 a.m. local time. Fifteen minutes later he has Nestle, followed by Danone at 6:30. Then come Diageo and British American Tobacco, along with a trading update from Britvic, all before the morning team meeting at 7:15 a.m. Next up are calls with executives of some of those companies at 8 a.m., 9:30 a.m., 1 p.m. and 2 p.m. Edwardes Jones has client notes to write before his final set of results from L’Oreal SA at 5 p.m. – 11 hours after the first batch.

Other retail or consumer-goods companies reporting Thursday include French grocer Casino, U.K. bookmaker Ladbrokes Coral and Paris-based luxury conglomerate Kering. “There has never been a day like that,” Edwardes Jones said. His recipe for getting through the day: “Maybe a quadruple espresso.” Across London’s financial district, analysts are readying themselves for what Martin Deboo at Jefferies called a “day from hell”: a bumper earnings session in which European companies worth more than $3 trillion are set to report results, according to data compiled by Bloomberg.

Everyone still thinks they’ll be able to get out in time.

• Market Hype Triggers ‘New Major Warning’ Sign For Stocks (CNBC)

With a fresh round of record-breaking highs in the stock market has come a surge in investor optimism, and that eventually could create problems. Bullishness in the most recent Investors Intelligence survey hit 60.2%, the highest level since late February. The survey comes from editors of market newsletters and thus provides a snapshot of what professional investors are thinking. Elevated levels of optimism often coincide with market dips. The last time the II survey hit this level, the S&P 500 proceeded to fall nearly 3%. John Gray, editor at II, cautions that the big spread between bulls and bears, who are at just 16.5%, is an indicator of potential danger ahead. “The latest sentiment is not encouraging for the rest of the year as markets rarely fulfill expectations,” Gray wrote.

“This is a new major warning calling for defensive measures to protect profits, renewing the same signal from earlier this year.” While there’s been plenty of talk in the market about elevated levels that could trigger a correction — or a 10% drop — II respondents don’t see it happening. Expectations for a correction dipped to 23.3% of respondents. By comparison, the correction reading was at a comparatively lofty 34% prior to the November presidential election — just before the market surged on hopes that President Donald Trump would usher in a new pro-business era in Washington. Since hitting the most recent bottom earlier in July, the market has been on what is just the latest leg higher. Defying expectations that stocks could see limited gains this year, the S&P 500 has climbed 10.6% on strength in tech, materials, health care and discretionary stocks.

Among the sampling of newsletter sentiment that II cited was a warning from Bert Dohmen’s Wellington Letter, which said the Fed could thwart the rally. “As long as Fed officials talk about hiking rates, it will enhance concerns about the Fed producing a recession,” Dohmen wrote. “We interpret each rate hike as another nail in the coffin for an economic recovery.” Ten of the last 13 Fed rate-hiking cycles ended with recession. Dohmen said that could be the case again, though he did not advocate that investors panic. “We are seeing warning signs, but not enough to run for the hills just yet. We have said for a number of months that the final phase in the bull market should be a noticeable spurt to the upside, forcing all skeptics into the market,” he wrote. “We haven’t seen that yet.”

The opposite of skin in the game.

• Financialization and Risk Asymmetry (CHS)

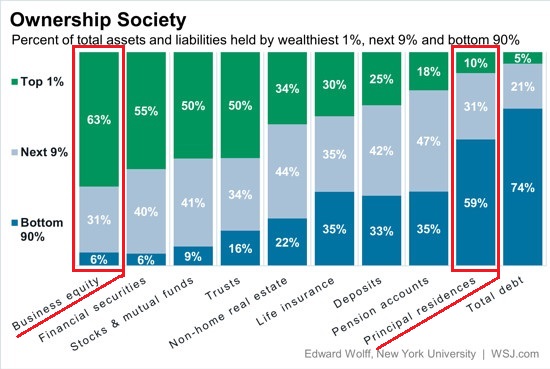

One of the most pernicious consequences of financialization is the shifting of risk from the top of the wealth-power pyramid to the bottom: those who benefit the most from financialization’s leveraged, speculative credit bubbles protect themselves from losses while those at the bottom of the pyramid (the bottom 99.5%) face the full fury of financialization’s formidable risk. Longtime correspondent Chad D. and I recently exchanged emails exploring how the higher debt loads and higher interest payments of financialization inhibits people at the bottom of the wealth-power pyramid (i.e. debt-serfs) from taking risks such as starting a small business. But this is only one serving of financialization’s toxic banquet of risk-related consequences.

Chad summarized how those at the apex of the wealth-power pyramid protect themselves from risk and losses. At the top levels of the pyramid, members in those groups collect way more interest than they pay out and at the very top, they get a ton of interest and pay little to none. The people at the top can take all sorts of risk, because of this dynamic and further, they also usually have a heavy influence on the financial/political machinery, so they get bailed out by taxpayers when their investments go bad. In addition, because their influence extends to the criminal justice system, they are able to commit fraud and at the same time neutralize regulators and prosecutors, thereby escaping any ramifications from their excessive risk taking and in many cases massive fraud.

As Chad observed, the wealthy own the income streams from debt (bonds, etc.), while everyone else owes the interest and principal due on debt. As this chart shows, the wealthy own business equity and financial securities and have a modest slice of debt. The bottom 90% owe most of the debt, and their primary asset is the family home– an asset that doesn’t generate income while it generates interest income for those who own the mortgage. In other words, it’s less an investment than a form of consumption– especially when the current housing bubble deflates.

Moody’s is smoking the good stuff. What utter nonsense.

• China’s Banks Now Stable, ‘Shadow’ Banking Less Threatening – Moody’s (CNBC)

Moody’s Investors Service no longer takes a negative view on China’s banking system, raising its outlook to stable on Thursday as concerns over so-called shadow banking eased. “The government’s adoption of more coordinated policy measures to curb shadow banking will help mitigate asset risks for banks, and address some key imbalances in the financial system,” Yulia Wan, a Moody’s banking analyst, said in a statement on Thursday. Shadow banking is a broad category of banking-like services from non-traditional players; it can include loans from non-financial companies as well as investment products. It is outside the bounds of normal banking regulation, so it largely goes unregulated.

Earlier this month, Moody’s had noted that actions on shadow-banking had included the central bank changing its monetary policy setting in the last quarter of 2016 to “moderate neutral” from “moderate,” which raised market funding costs and refinancing risks for banks, reducing the return from supporting long-term investments with short-term market funds. In March and April, the China Banking Regulatory Commission also requested banks test whether their interbank liabilities would exceed the regulatory ceiling at one-third of total liabilities. Moodys’ noted in the Thursday report that there were signs of declines in outstanding wealth management products issued by the mainland’s banks and fewer investments in loans and receivables among the 26 listed banks.

But it added that profit growth would be limited by continued pressure on net interest margins and slower fee-income growth on higher funding costs and stricter shadow-banking regulations. [..] “Overall delinquency rates will stabilize as corporate profit continues to recover, helped by stable and solid economic growth, steady commodity prices and a slower increase in corporate leverage,” the Moody’s statement said.

In the present evironment, there’s no need to consider underlying value. Everything’s just a big leveraged bet on the Fed.

• Investor Howard Marks Says Bitcoin Is A ‘Pyramid Scheme’ (CNBC)

Howard Marks, one of the most respected value investors out there, starkly warned his clients to avoid high-flying digital currencies. “In my view, digital currencies are nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it,” Marks wrote in the investor letter Wednesday. Ethereum cryptocurrency is up more than 2,300% year to date through Wednesday, while bitcoin is up nearly 160% this year, according to data from industry website CoinDesk.

The co-chairman of Oaktree Capital is famous for his prescient investment memos, which predicted the financial crisis and the dotcom bubble implosion. The manager then went on to compare cryptocurrencies to the Tulip mania of 1637, the South Sea bubble of 1720 and the internet bubble of 1999. “Serious investing consists of buying things because the price is attractive relative to intrinsic value,” he wrote. “Speculation, on the other hand, occurs when people buy something without any consideration of its underlying value or the appropriateness of its price.”

“There are suspicions the US government is introducing the new sanctions against Russia to boost exports of American natural gas to the European market.”

• German Business Lobby Urges EU Action Against New US Sanctions On Russia (RT)

A US move to expand sanctions against Russia may have an adverse impact on Europe’s energy security, hurt the German economy, and appears to favor American firms, says Volker Treier, chief economist at the German Chambers of Commerce and Industry (DIHK). Treier has urged European authorities to address the new round of anti-Russian sanctions approved by the US House of Representatives on Tuesday. “The European Commission now must make efforts to shed light on the current situation, as well as resist the exterritorial effect of new US penalties. We get the impression the US pursues their own economic interests”, he told in an interview with TASS.

“If German firms are banned from participating in gas pipeline enterprises, very important projects in the energy supply security sector can be halted. In that case, the German economy will be discernibly influenced,” Treier said. The future of the Nord Stream-2 natural gas pipeline project from Russia to Germany is of particular concern to Europeans. Roughly a third of the European Union’s natural gas supply still comes from Russia. The proposed expansion would double the existing pipeline’s capacity and make Germany EU’s main energy hub. There are suspicions the US government is introducing the new sanctions against Russia to boost exports of American natural gas to the European market.

What is happening to Italy’s sovereignty? And what do Italians think about that?

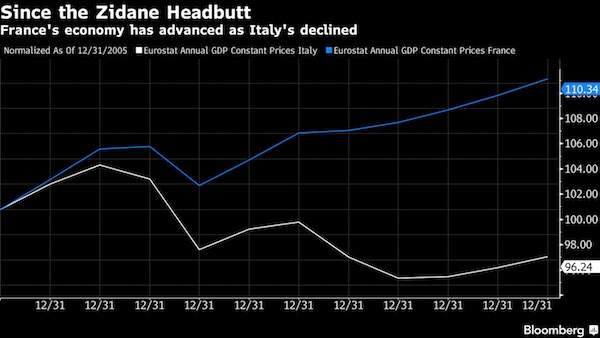

• Macron Unleashes a Decade of Italian Anger (BBG)

The 2006 World Cup final should have been a triumph for Italians, but all people remember now is the iconic French soccer captain Zinedine Zidane headbutting an opponent in the last minutes. The controversy overshadowed much of the glory for the winning team that night and the subsequent carping of French fans convinced many Italians that their bigger, richer neighbor will never give them the respect they deserve, whether the field is sports, business or politics. That resentment burst into the open on Wednesday when Finance Minister Bruno Le Maire said France is ready to nationalize the STX shipyard in Saint-Nazaire if its would-be Italian buyer Fincantieri SpA doesn’t accept his government’s conditions. Fincantieri stock plunged as much as 13% and Italian ministers erupted.

Italian Finance Minister Pier Carlo Padoan said there’s “no reason” why Fincantieri should accept only a minority stake and his colleague Carlo Calenda, in charge of economic development, told Ansa newswire that Italy is ready to walk away from the deal after Le Maire changed terms already agreed with the previous administration, citing the need to protect a key national asset from foreign influence. The Italians have struggled to accept that rationale, given STX’s previous owner was Korean. President Emmanuel Macron’s June election victory may have reinvigorated the Franco-German relationship at the heart of the European Union. But ties with Italy, the continent’s No. 3 economy, are going from bad to worse, suggesting that competition for jobs, security, and indeed glory, could quickly dampen hopes for tighter EU cooperation.

“This situation is not good for business and not good for European integration,” Alessandro Ungaro, a security and defense analyst at Rome’s Institute for International Affairs, said in a phone interview. “We were hoping for a more market-friendly and pro-European stance, but they’re rejecting a European ally and reasonable industrial project in favor of a possible nationalization.” Italian officials were already smarting when they woke up on Wednesday. The previous day Macron had snubbed their Prime Minister Paolo Gentiloni by leaving him out of peace talks in Paris with Libyan Prime Minister Fayez al-Serraj and Khalifa Haftar, leader of the country’s powerful eastern-based military force. Italy sees Libya, its former colony, as its sphere of influence. Privately many Italian officials blame French meddling for contributing to the collapse of the North African country’s institutions.

[..] On Wednesday, Italy’s front pages were filled with anger at the French. “Macron’s blitz overshadows Italy,” said La Stampa, later adding on its website, “Italy and France head for naval battle.” Il Messaggero went with “Libya deal without Italy.” In response, Gentiloni invited the Libyan leader al-Serraj to Rome and held his own press conference on television to reassert his influence. “This is getting a bit childish,” said Sofia Ventura, a professor of politics at the University of Bologna, whose father is Italian and mother is French. “The problem is individual countries are looking after their interests and not really keeping with the European spirit. Among the bigger nations, Italy is weaker, it can’t fully compete.”

IBM doesn’t look good either, I would say. Government ministers may not have the know-how, but IBM personnel does.

• Sweden Leaks Details Of Almost All Of Its Citizens (Ind.)

Sweden appears to have accidentally leaked the details of almost all of its citizens. And now it’s getting worse. The brewing scandal – based around a leak that actually happened in 2015 but only emerged last week – could see prominent members of Sweden’s government removed from their post. The leak allowed unvetted IT workers in other countries to see the details of people registered in Swedish government and police databases. It happened after the government looked to outsource data held by the Transport Agency, but did so in a way that allowed that information to be available to almost anyone, critics have claimed. The opposition is seeking to boot out the ministers of infrastructure, defence and the interior – Anna Johansson, Peter Hultqvist and Anders Ygeman, respectively – for their role in outsourcing IT-services for the Swedish Transport Agency in 2015.

The minority government has said that contract process – won by IBM Sweden – was speeded up, bypassing some laws and internal procedures in a manner that may have led to people abroad, handling servers with sensitive materials. Prime Minister Stefan Lofven said on Monday his country and its citizens were exposed to risks by potential leaks as a result of the contract. The centre right opposition Alliance, comprising the Moderate, Centre, Liberal and Christian Democrat parties, has taken aim at the three ministers. “It is obvious (they) have neglected their responsibility. They have not taken action to protect Sweden’s safety”, Centre party leader Annie Loof told a news conference.

“America has failed itself and the world.”

• Armageddon Is Two and One-half Minutes Away (PCR)

Are you ready to die? You and I are going to die and not from old age, because our fellow Americans are so stupid, ignorant, and brainwashed that they believe the lies that are leading us to our certain destruction. This is what the Atomic Scientists tell us. And they are right. Can you comprehend the absurdity? President Trump is under full-scale attack from the military/security complex, the US presstitute media, the Democratic Party, and from many Republicans, such as Republican Senator from South Carolina Lindsey Graham and Republican Senator from Arizona John McCain simply because President Trump wants to reduce the dangerous tensions between the two major nuclear powers. What explains the total lack of concern for their own lives on the part of the populations in South Carolina and Arizona who send to the Senate and keep sending to the Senate two morons determined to provoke war between the US and Russia?

It should send shivers up your spine that you can ask this same question about all 50 states, and almost all congressional districts. You can ask the same question about the bordello known as “the American media.” There will be no one alive to post or to read the headlines of the war that they are helping to promote. The United States and the rest of the world with it along with all life on earth are being sent to their graves by the total failure of American leadership. What is wrong with Americans that they cannot understand that any “leader” who provokes war with a major nuclear power should be instantly institutionalized as criminally insane? Why do Americans sit night after night in front of the TV absorbing lies that commit them beyond all doubt to their deaths? America has failed itself and the world.

We are stardust from far away.

• Half Our Bodies’ Atoms ‘Formed Beyond The Milky Way’ (G.)

Nearly half of the atoms that make up our bodies may have formed beyond the Milky Way and travelled to the solar system on intergalactic winds driven by giant exploding stars, astronomers claim. The dramatic conclusion emerges from computer simulations that reveal how galaxies grow over aeons by absorbing huge amounts of material that is blasted out of neighbouring galaxies when stars explode at the end of their lives. Powerful supernova explosions can fling trillions of tonnes of atoms into space with such ferocity that they escape their home galaxy’s gravitational pull and fall towards larger neighbours in enormous clouds that travel at hundreds of kilometres per second.

Astronomers have long known that elements forged in stars can travel from one galaxy to another, but the latest research is the first to reveal that up to half of the material in the Milky Way and similar-sized galaxies can arrive from smaller galactic neighbours. Much of the hydrogen and helium that falls into galaxies forms new stars, while heavier elements, themselves created in stars and dispersed in the violent detonations, become the raw material for building comets and asteroids, planets and life. “Science is very useful for finding our place in the universe,” said Daniel Anglés-Alcázar, an astronomer at Northwestern University in Evanston, Illinois. “In some sense we are extragalactic visitors or immigrants in what we think of as our galaxy.”

The researchers ran supercomputer simulations to watch what happened as galaxies evolved over billions of years. They noticed that as stars exploded in smaller galaxies, the blasts ejected clouds of elements that fell into neighbouring, larger galaxies. The Milky Way absorbs about one sun’s-worth of extragalactic material every year. “The surprising thing is that galactic winds contribute significantly more material than we thought,” said Anglés-Alcázar. “In terms of research in galaxy evolution, we’re very excited about these results. It’s a new mode of galaxy growth we’ve not considered before.” The simulations showed that elements carried on intergalactic winds could travel a million light years before settling in a new galaxy, according to a report in the Monthly Notices of the Royal Astronomical Society.