Tamara de Lempicka The refugees 1937

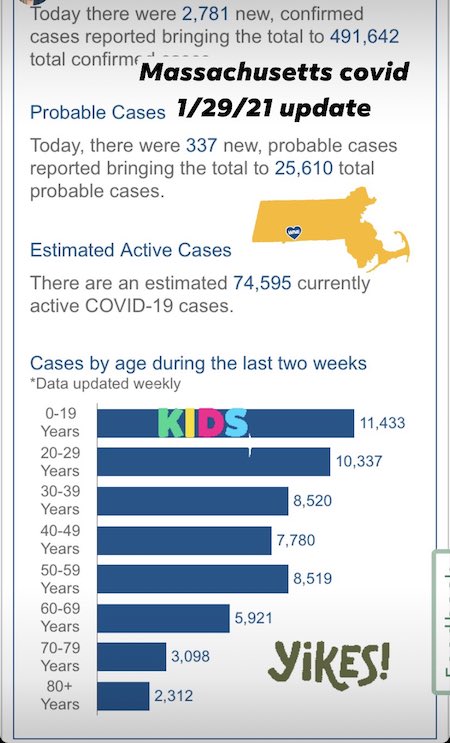

Most infections are among the youngest. That doesn’t sound good.

Long John Silver.

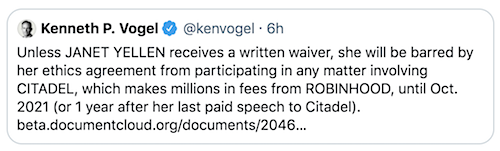

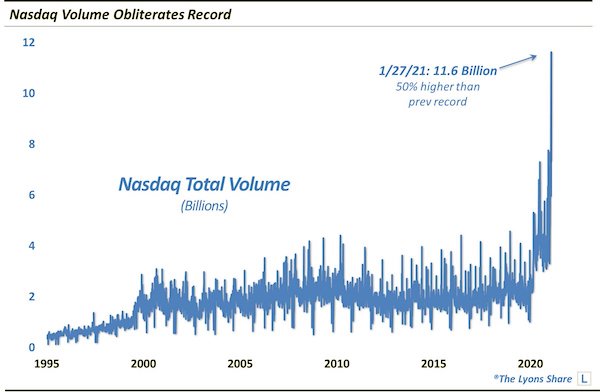

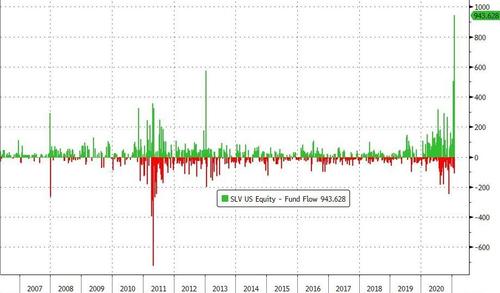

• Reddit Preparing To Unleash “World’s Biggest Short Squeeze” In Silver (ZH)

While all eyes have been focused on GameStop and a handful of other heavily-shorted stocks as they exploded higher under continuous fire from WallStreetBets traders igniting a short-squeeze coinciding with a gamma-squeeze, the last few days saw another asset suddenly get in the crosshairs of the ‘Reddit-Raiders’ – Silver. On Thursday, we asked “Is The Reddit Rebellion About To Descend On The Precious Metals Market?” … One WallStreetBets user (jjalj30) posted the following last night: “Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know billion banks are manipulating gold and silver to cover real inflation. Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

Inflation adjusted Silver should be at 1000$ instead of 25$. Link to post removed by mods. Why not squeeze $SLV to real physical price. Think about the Gainz. If you don’t care about the gains, think about the banks like JP MORGAN you’d be destroying along the way. Tldr- Corner the market. GV thinks its possible to squeeze $SLV, FUCK AFTER SEEING $AG AND $GME EVEN I THINK WE CAN DO IT. BUY $SLV GO ALL IN TH GAINZ WILL BE UNLIMITED. DEMAND PHYSICAL IF YOU CAN. FUCK THE BANKS. Disclaimer: This is not Financial advice. I am not a financial services professional. This is my personal opinion and speculation as an uneducated and uninformed person.”

…and judging by the unprecedented flows into the Silver ETF (SLV) they just got started… SLV saw inflows of almost one billion dollars on Friday, almost double the previous record inflow for this 15 year-old ETF.

Rainman Sacks

https://twitter.com/i/status/1355368285592715265

There are more candidates.

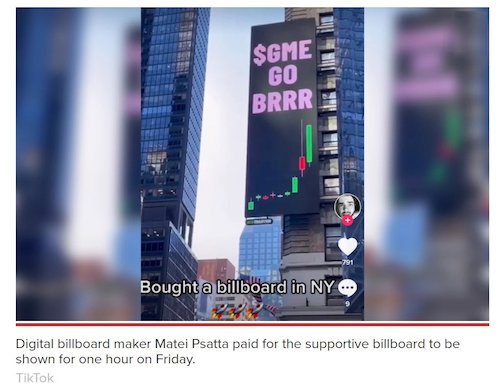

• Bitcoin Could Be About To Become The New GameStop (F.)

Bitcoin has surged this week, climbing after Tesla TSLA -5% chief executive Elon Musk gave the cryptocurrency a tacit endorsement. Musk sent the bitcoin price sharply higher as a long-running battle between bullish retail traders organised via Reddit’s WallStreetBets forum and Wall Street hedge funds that have long been shorting GameStop shares reached its climax—with regulators and brokerages trying to calm frantic markets with heavy-handed restrictions. Now, data has revealed hedge funds are short bitcoin to the tune of more than $1 billion, even as retail traders pile into bitcoin and other cryptocurrencies. Hedge funds have been increasing their bitcoin short positions—effectively bets that the price of an asset will fall—since the bitcoin price began climbing in October, data from crypto news and analysis company The Block showed.

The net short position in bitcoin futures is now the biggest it has ever been, according to the CFTC’s latest Traders in Financial Futures report. The bitcoin price has soared around 200% since October, surging to over $40,000 per bitcoin before falling back slightly. The blistering bitcoin rally has largely been put down to institutional investors warming to the cryptocurrency and payments giants such as PayPal adding their support—though bubble fears have emerged. As hedge funds increasingly bet against the bitcoin price, to some extent covering their long positions, retail traders empowered by apps and bored by lockdowns are speculating on bitcoin and everything else.

“Being stuck at home due to pandemic lockdowns and restrictions seems to have spurred an influx of day traders,” Frédérique Carrier, head of investment strategy at RBC Wealth Management, wrote in a note. “Investor attitudes are being shaped by the headline-making gains of some high-profile issues. For example, the 35% gain made by bitcoin in the first nine days of 2021, on the heels of a fivefold surge in price from March to December 2020; or the more-than-sixfold increase in GameStop shares in less than two weeks to January 26; or even Tesla, now the fifth-largest stock in the S&P 500 by market capitalisation, with a market cap larger than that of the major U.S., European, and Japanese automakers combined.”

Encouraging, but too early to draw conclusions.

• Just 0.04% Of Israelis Caught COVID19 After 2 Shots Of Pfizer Vaccine (JPost)

A total of 371 out of 715,425 Israelis who passed at least a week after receiving two doses of the Pfizer coronavirus vaccine have contracted the virus – 0.04%, with 16 being sent to the hospital – according to a Health Ministry report released on Thursday. Immunity to COVID-19 is supposed to kick in a week after receiving the second dose of the Pfizer vaccine. According to the studies conducted by Pfizer, the vaccine had an efficacy of about 95%, which is considered very high. The Israeli data appear to confirm the inoculation’s effectiveness, showing an even more promising result.

Later in the day, Maccabi Healthcare Services – one of the country’s four health maintenance organizations – released the first results of the vaccination campaign of its members, with the organization also comparing the data to a control group that did not get inoculated. Some 248,000 Maccabi members were already a week after the second shot as of Thursday. Of those, just 66 got infected with the virus, the majority of them over the age of 55 and about half of them with preexisting conditions. All those infected experienced only a mild form of the disease, and none were hospitalized.

Over the same period of time, some 8,250 new cases of COVID-19 emerged in the control group of some 900,000 people having a diverse health profile. Those who were not inoculated were therefore 11 times more likely to get the disease than those who were immunized, showing 92% effectiveness. “The fact that seven to 18 days after receiving the second dose the vaccine shows a 92% efficacy is very encouraging data,” according to Dr. Anat Aka Zohar, head of Maccabi’s Information and Digital Health Division. “We will continue to monitor the situation to see if the number increases and reaches the 95% demonstrated during the Pfizer study.”

“We pretended we could live with this virus and that vaccines would save the day. We were wrong. Dead wrong.”

• ‘Get to Zero’ or Face Catastrophe (Tyee)

Are you tired of COVID? I fucking am. But as a longtime science writer and the author of two books on pandemics, I have to report what you probably don’t want to hear. We have entered the grimmest phase of this pandemic. And contrary to what our politicians say, there is only one way to deal with a rapidly mutating virus that demonstrates the real power of exponential growth: Go hard. Act early. And go to zero. Last January, one strain of this novel virus began its assured global conquest, and since then our leaders have hardly learned a goddamn thing. So yes, I am angry, and I will not disguise my frustration with comfortable or polite language. In the last three months, several super-variants have emerged that are 30 to 70 per cent more infectious than the original Wuhan strain.

The old COVID-19 doubled its numbers every 40 days under a particular set of restrictions; under the same conditions, the variants double every 10 days. That means they can outrun any vaccination campaign.* That means if you haven’t eliminated — or almost eliminated — cases in your region, you are going to learn the meaning of grief. These highly-contagious variants have emerged in jurisdictions with high infection rates: the U.K., Brazil, South Africa and California. They became global tourists months ago, before you read about them. Meanwhile, governments still do not understand the threat at hand. To illustrate it, British mathematician Adam Kucharski recently compared a virus mutation that was 50 per cent more deadly with one that increased transmission by 50 per cent.

With a reproduction rate of about 1.1 and a death rate of 0.8 per cent, current strains of COVID-19 now deliver 129 deaths per 10,000 infections. A virus that is 50 per cent more lethal will kill 193 people in a month. A variant that is more transmissible wins the game with 978 deaths in just one month. The virus is finding its optimal configuration, its ideal form for contagiousness. And you thought this was over? Now don’t think of these variants as the same old COVID-19. That’s a big mistake. They actually represent an entirely new pandemic. In this new maelstrom, this complex coronavirus is just getting warmed up. It has the potential to become even more infectious than the current variants. We allowed this to happen by not taking the measures needed to go to zero, doing whatever was needed to eliminate COVID-19 in our province or country. We pretended we could live with this virus and that vaccines would save the day. We were wrong. Dead wrong.

This feels like the wrong fight.

• Germany Threatens Legal Action Over Vaccine Delivery Delays (G.)

In case you missed this earlier: Germany’s government on Sunday threatened legal action against laboratories failing to deliver coronavirus vaccines to the European Union on schedule, amid tension over delays to deliveries from AstraZeneca, AFP reports.“If it turns out that companies have not respected their obligations, we will have to decide the legal consequences,” economy minister Peter Altmaier told German daily Die Welt. There has been growing tension in recent weeks between European leaders and the British-Swedish pharmaceutical giant AstraZeneca, which has fallen behind on promised delivers of its Covid-19 vaccine.The company said it could now deliver only a quarter of the doses originally promised to the bloc for the first quarter of the year because of problems at one of its European factories.

Brussels has implicitly accused AstraZeneca of giving preferential treatment to Britain at the expense of the EU.The EU briefly threatened to restrict vaccine exports to Northern Ireland by overriding part of the Brexit deal with Britain that allowed the free flow of goods over the Irish border. It backed down after British prime minister Boris Johnson voiced “grave concerns”. AstraZeneca is not the only drugs company in the firing line. Last week Italy threatened legal action against US pharmaceutical firm Pfizer over delays. Top German officials are due to meet with the drugs manufacturers to thrash out the problems.On Friday the European Medicines Agency cleared the vaccine produced by AstraZeneca for use inside the EU, the third Covid vaccine it has approved after Pfizer-BioNTech and Moderna.

There goes small business.

• Mighty Amazon Looks All But Unassailable As Covid Continues (O.)

The earliest references to the “one-stop shop” emerged during the first decades of 20th century as the fast-growing US economy spurred rapid retail innovation. A single location for various products provides obvious benefits: removing the hassle of travelling around town to visit different stores. Jeff Bezos redefined that logic for the internet age, making Amazon a dominant (and perhaps ambivalent) force first in selling books, and then in pretty much everything else. Before 2020 Amazon was a phenomenon, but the coronavirus pandemic has made it all but ubiquitous. The numbers in its financial results for the last three months of 2020, to be published on Tuesday, will be even bigger than Amazon’s earlier instalments in the first pandemic year.

Christmas and Thanksgiving always make the final quarter of the year the strongest for Amazon. Christmas 2020 will mainly be remembered for locked-down celebrations, but analysts predict that it will also mark the first time Amazon’s revenue surpasses $100bn in one quarter. In fact, consensus estimates collated by S&P Global Market Intelligence are forecasting sales of about $120bn – 37% up on the same period in 2019. Profits before tax are pegged at $4.4bn – shy of the record $6.8bn it made in the three months to September, but higher than any single quarter before the pandemic. It was only in 2016 that single-quarter profits topped $1bn, but that’s because the Bezos strategy is to invest spare cash in relentless, ruthless expansion and innovation, so that rivals cannot creep up on it.

The story has been sold since 2010. CIA.

• Navalny Scam Sells Empty Concrete Shell As ‘Putin’s Luxurious Palace’ (MoA)

In 2010 some minor Russian businessman, Sergei Kolesnikov, who had pissed off people above his pay grade, resettled from Russia to Estonia. To make himself interesting, and likely to get financial support, he made up a story. David Ignatius, the CIA’s resident writer at the Washington Post, picked it up: You can see the sprawling, Italian-style palace on the Black Sea in satellite photos. There’s a fitness spa, a hideaway “tea house,” a concert amphitheater and a pad for three helicopters. It’s still under construction, but already the cost is said to total more than $1 billion. And most amazing of all, according to a Russian whistleblower named Sergey Kolesnikov, it was predominantly paid for with money donated by Russian businessmen for the use of Prime Minister Vladimir Putin.

The funds have come “mainly through a combination of corruption, bribery and theft,” charges Kolesnikov, a businessman who until November 2009 worked for one of the companies he alleges was investing money for Putin. In 2012 BBC Newsnight again picked up the story and made it into a nine minutes long anti-Putin segment. Putin’s Palace? A Mystery Black Sea Mansion Fit For A Tsar “On a thickly wooded mountainside overlooking Russia’s Black Sea coast, an extraordinary building has gradually taken shape. It is alleged to be a palace built for the personal use of Vladimir Putin, with massive and illegal use of state funds. Originally conceived, it is said, as a modest holiday house with a swimming pool, it now boasts a magnificent columned facade reminiscent of the country palaces Russian tsars built in the 18th Century. The massive wrought-iron gates into the courtyard are topped with a golden imperial eagle. Outside are formal gardens, a private theatre, a landing pad with bays for three helicopters, and accommodation for security guards.”

At the end of 2020 the ‘Putin’s palace’ story was recycled to promote the rightwing Russian nationalist and anti-corruption campaigner Alexey Navalny. Navalny was at that time in Germany’s Black Forrest area where he recovered from an alleged poisoning. A studio was needed to produce a video about the ‘palace’. A German producer couple who had recently opened a TV-studio received a request. As the German daily Badische Zeitung reported (my translation): “Early December a request arrived via email from a U.S. production company in Los Angeles. There was talk of a documentation. It was looking for adequate locations, people and equipment in southern Germany. The German producers did not know the company, even though they have good contacts in L.A., but the request made a very professional impression.

The studio was rented to create the ‘palace’ material for the Navalny campaign. “The studio was actually only rented for just under a week, but the filmmakers liked the location with its atmosphere and the cinematic possibilities so much that the shooting was extended to a total of two weeks and parts of the 20-person international crew from Berlin, where actually a last shoot was planned before the flight to Moscow came to Kirchzarten.” On January 17 Navalny flew back to Russia and was immediately arrested for having violated his probation in a case where he had been sentenced for funneling a company’s money into his own pockets. On January 19 Navalny’s anti-corruption campaign FBK uploaded a two hour long polemic in which Navalny repeats the decade old claim that there is a palace at the Black Sea that is actually owned by Putin. But none of the many documents he provides proves that Putin is in any way involved in the project.

Trump and his lawyers. A sordid tale all around.

• Trump’s Top Impeachment Lawyer Has Left His Team (Pol.)

Former President Donald Trump has lost his top impeachment lawyer just days before his trial is to begin, a person familiar with his legal strategy and two attorneys close to the team confirmed on Saturday night. Butch Bowers, a South Carolina lawyer who was reportedly set to play a major role in the Senate’s trial of the former president, is now no longer with the team. Deborah Barbier, another South Carolina lawyer, won’t be either. The person described it as a “mutual decision” and said new names will be announced shortly. In addition, CNN reported on Saturday night that a third member of Trump’s prospective legal team, Josh Howard, was also leaving. The network reported that the ex-president had wanted his lawyers to focus on erroneous arguments of mass election fraud rather than the constitutionality of impeaching an ex-president.

The decision by Bowers, Barbier, and Howard to not join the team raised immediate questions, both about what compelled them to part ways and who actually will play the role of lawyer to Trump when the impeachment trial starts in early February. Trump has had difficulty finding legal help for his second impeachment, with some of the lawyers who worked on his first trial saying they wouldn’t do the same this go around. Bowers’ hiring was first announced by Trump ally and South Carolina Sen. Lindsey Graham. A longtime Republican attorney, Bowers represented former South Carolina Govs. Mark Sanford and Nikki Haley, and had experience in election law.

News outlets in South Carolina also named trial attorneys Greg Harris and Johnny Gasser as part of Trump’s impeachment team, although aides to Trump never officially confirmed who would be representing the former president. Trump’s first legal filing in the impeachment trial is due this coming Tuesday. In a statement, Trump spokesperson Jason Miller did not address the uncertainty around the legal team but, rather, railed against impeachment itself, noting that the vast majority of Senate Republicans voted that convicting a former president is an unconstitutional act — a conclusion with which legal scholars disagree.

What do you mean Not The Onion?

• Ohio Lawmakers Want To Mark Trump’s Birthday As ‘Donald J. Trump Day’ (JTN)

Two Ohio lawmakers are reportedly seeking support from their fellow legislators to mark former President Donald Trump’s birthday in that state as “President Donald J. Trump Day.” State Reps. Reggie Stoltzfus and Jon Cross reached out to lawmakers in the Ohio House on Friday, asking them to “recognize the accomplishments of [Trump’s] administration, and [show] that the Ohio House believes it is imperative we set aside a day to celebrate one of the greatest presidents in American history.” The lawmakers are seeking to designate June 14, Trump’s birthday, as the holiday in question. The news was first reported in the Ohio Capitol Journal, which said it obtained the co-sponsor request sent by Stoltzfus and Cross. In addition to being Trump’s birthday, the United States also marks June 14 as Flag Day, commemorating the date in 1777 on which the Continental Congress officially adopted the flag of the United States.

Wonderful.

• The Secret Social Network Of Trees (SMH)

By the time she was in grad school at Oregon State University, however, Simard understood that commercial clear-cutting had largely superseded the sustainable logging practices of the past. Loggers were replacing diverse forests with homogeneous plantations, evenly spaced in upturned soil stripped of most underbrush. Without any competitors, the thinking went, the newly planted trees would thrive. Instead, they were frequently more vulnerable to disease and climatic stress than trees in old-growth forests. In particular, Simard noticed that up to 10 per cent of newly planted Douglas fir were likely to get sick and die whenever nearby aspen, paper birch and cottonwood were removed. The reasons were unclear.

The planted saplings had plenty of space, and they received more light and water than trees in old, dense forests. So why were they so frail? Simard suspected the answer was buried in the soil. Underground, trees and fungi form partnerships known as mycorrhizae: threadlike fungi envelop and fuse with tree roots, helping them extract water and nutrients like phosphorus and nitrogen in exchange for some of the carbon-rich sugars the trees make through photosynthesis. Research had demonstrated that mycorrhizae also connected plants to one another and that these associations might be ecologically important, but most scientists had studied them in greenhouses and laboratories, not in the wild.

For her doctoral thesis, Simard decided to investigate fungal links between Douglas fir and paper birch in the forests of British Columbia. Apart from her supervisor, she didn’t receive much encouragement from her mostly male peers. “The old foresters were like, “Why don t you just study growth and yield? ” Simard told me. “I was more interested in how these plants interact. They thought it was all very girlie.” Now a professor of forest ecology at the University of British Columbia, Simard, who is 60, has studied webs of root and fungi in the Arctic, temperate and coastal forests of North America for nearly three decades. Her initial inklings about the importance of mycorrhizal networks were prescient, inspiring whole new lines of research that ultimately overturned long-standing misconceptions about forest ecosystems.

By analysing the DNA in root tips and tracing the movement of molecules through underground conduits, Simard has discovered that fungal threads link nearly every tree in a forest – even trees of different species. Carbon, water, nutrients, alarm signals and hormones can pass from tree to tree through these subterranean circuits. Resources tend to flow from the oldest and biggest trees to the youngest and smallest. Chemical alarm signals generated by one tree prepare nearby trees for danger. Seedlings severed from the forest’s underground lifelines are much more likely to die than their networked counterparts. And if a tree is on the brink of death, it sometimes bequeaths a substantial share of its carbon to its neighbours.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.