Claude Monet Houses of Parliament, Sunset 1904

NOTE: Don’t miss John Day MD’s guide for COVID prevention and treatment that I published earlier today: Treat Your Own COVID.

It could save your life.

What happens when you bet everythig on red under emergency authorizations.

..preliminary data showed efficacy dropped to 22% against the South African variant..

• South Africa Halts AstraZeneca Vaccinations Over Variant Data (R.)

South Africa will put on hold use of AstraZeneca’s COVID-19 shot in its vaccination programme, after data showed it gave minimal protection against mild-to-moderate infection caused by the country’s dominant coronavirus variant. Health Minister Zweli Mkhize said on Sunday that the government would await advice from scientists on how best to proceed, after a trial showed the AstraZeneca vaccine did not significantly reduce the risk of mild or moderate COVID-19 from the 501Y.V2 variant that caused a second wave of infections starting late last year. Prior to widespread circulation of the more contagious variant, the vaccine was showing efficacy of around 75%, researchers said.

In a later analysis based mostly on infections by the new variant, there was only a 22% lower risk of developing mild-to-moderate COVID-19 versus those given a placebo. Although researchers said the figure was not statistically significant, due to trial design, it is well below the benchmark of at least 50% regulators have set for vaccines to be considered effective against the virus. The study did not assess whether the vaccine helped prevent severe COVID-19 because it involved mostly relatively young adults not considered to be at high risk for serious illness. AstraZeneca said on Saturday that it believed its vaccine could protect against severe disease and that it had already started adapting it against the 501Y.V2 variant.

Still, professor Shabir Madhi, lead investigator on the AstraZeneca trial in South Africa, said data on the vaccine were a reality check and that it was time to “recalibrate our expectations of COVID-19 vaccines”.

EXO-CD24

• New Israeli Drug Cured 29 Of 30 Moderate/Serious Covid Cases In Days (ToI)

A new coronavirus treatment being developed at Tel Aviv’s Ichilov Medical Center has successfully completed phase 1 trials and appears to have helped numerous moderate-to-serious cases of COVID-19 quickly recover from the disease, the hospital said Friday. Hailing a “huge breakthrough,” the hospital said Prof. Nadir Arber’s EXO-CD24 substance had been administered to 30 patients whose conditions were moderate or worse, and all 30 recovered — 29 of them within three to five days. The medicine fights the cytokine storm — a potentially lethal immune overreaction to the coronavirus infection that is believed to be responsible for much of the deaths associated with the disease.

It uses exosomes — tiny carrier sacs that shuttle materials between cells — to deliver a protein called CD24 to the lungs, which Arber has spent decades researching. “This protein is located on the surface of cells and has a well known and important role in regulating the immune system,” said researcher Shiran Shapira of Arber’s lab. The protein helps calm down the immune system and curb the storm. “The preparation is inhaled once a day for a few minutes, for five days,” Arber said. “The preparation is directed straight to the heart of the storm — the lungs — so unlike other formulas… which selectively restrain a certain cytokine, or operate widely but cause many serious side effects, EXO-CD24 is administered locally, works broadly and without side effects.”

The medicine will now move on to further trial phases, but hospital officials were already hailing it as a possible game-changer in fighting serious COVID-19 illness. Ichilov director Roni Gamzu, the former coronavirus czar, said the research “is advanced and sophisticated and may save coronavirus patients. The results of the phase 1 trial are excellent and give us all confidence in the method [Arber] has been researching in his lab for many years.” He added: “I am proud that at Ichilov we are… possibly bringing a blue and white remedy to a terrible global pandemic.”

Through Google Translate.

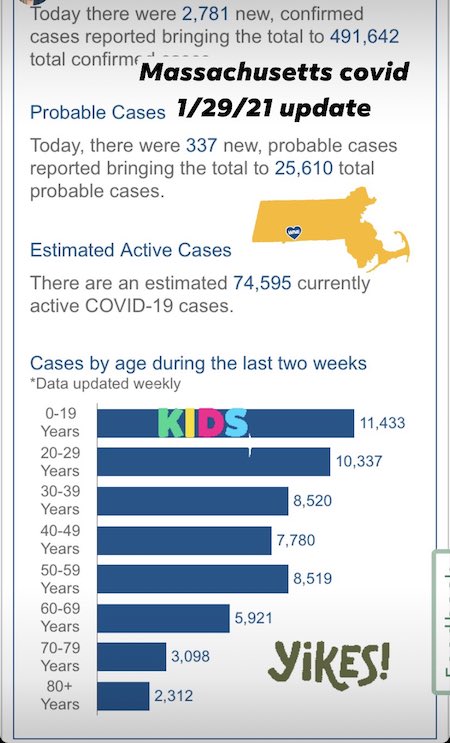

10% of the village of Corzano Flag of Italy has the #B117 variant—10% of all residents! 60% of cases are kids from kindergarten and primary school, other 40% are their parents.

• In Corzano 10% Of Population Positive For English Variant (ANSA)

10% of the population of Corzano, a town of 1400 people in the province of Brescia, is positive for covid. “We have 140 positives and 60% are elementary and kindergarten students who in turn infected their families”, the mayor of the town Giovanni Benzoni, also positive, explained to ANSA. “Three out of four have covid at home,” he said. According to the analyzes of Ats Brescia, the population is infected by the English variant of Covid. The mayor has closed schools until February 8. “But the ordinance will be extended – he specified – because the recall swabs begin today and therefore we will have to wait for the results”. The authorities would be considering the possibility of closing the country in and out. “I didn’t know anything, but I can say that in the last few hours we have had only one more case. All the families are in solitary confinement and we expect the curve to go down again,” commented the mayor.

How much of the good news is due to adjusting PCR testing cycles?

• Even ‘Scientist’ Models Now Forecast COVID Scourge Ending By Summer (ZH)

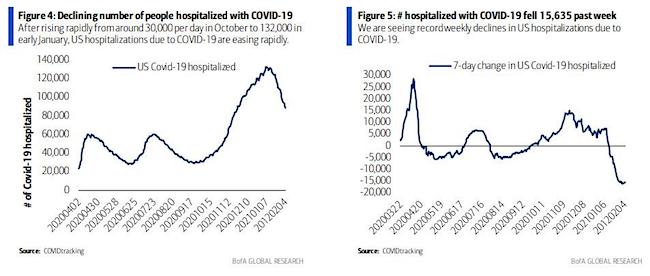

The covid pandemic was front and center today in economic news, when its impact was felt throughout the January payrolls report (if not to the same extent as December payrolls), whose disappointing +49k reading could be easily explained by continued job losses in the Leisure & Hospitality sector due to COVID-19 outbreaks and associated lockdown measures and restrictions. However, as BofA’s Hans Mikkelsen writes, “given that the US COVID-19 situation is improving rapidly – for example the number of people hospitalized is down one-third over the past month – and restrictions are lifted in many large states like California, it is straightforward to expect much stronger payrolls going forward.” Indeed, the latest Covid data shows that absent any major shocks – such as a mutant strain that is fully immune to any existing vaccines – the pandemic should be a thing of the past relatively soon.

Here are the latest facts: the number of people hospitalized with COVID-19 in the US has declined dramatically to 88,668, or 43,806 – one-third – off the peak which occurred on January 5th (Figure 4) – a rapid turn in the crisis (Figure 5). The decrease is broad-based (48 states+DC, except for AK, MT and VT that saw minimal 1, 1 and 7 person increases over the past week, respectively).

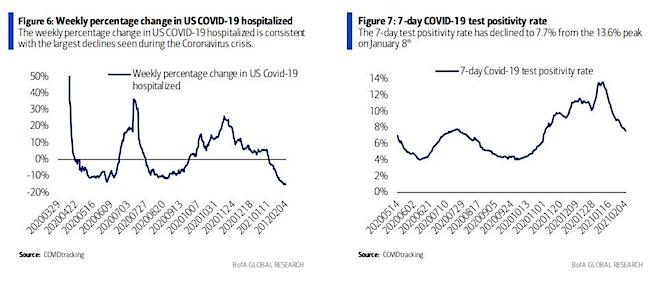

The weekly percentage change in US COVID-19 hospitalized is consistent with the largest declines seen during the Coronavirus crisis (Figure 6). Moreover the 7-day test positivity rate has declined to 7.6% from the 13.6% peak on January 8th (Figure 7).

Since hospitalizations are lagged relative to time of infection the US Corona outbreaks peaked back in the second half of December. Finally, the vaccine rollout continues in the US at a rapid pace of around 1mn doses per day and a cumulative 35.2mn doses administered through February 2rd.

And now we’ll never know.

• WaPo Says COVID Lab Accident “Plausible”, “Must Be Investigated” (ZH)

Exactly one year ago today, Zero Hedge was ‘enjoying’ our suspension by Twitter after we pointed out that scientists from the Wuhan Institute of Virology had been experimenting on bat coronaviruses, and that investigators trying to determine the origins of the COVID-19 outbreak might want to have a word with them. We later reported that the same scientists had been using ‘gain-of-function’ research to make bat coronaviruses more transmissible to human beings – for which they were roundly criticized in 2015. Thus, it seemed only logical that the possibility of a lab escape at ‘ground zero’ was at least non-zero, and should be investigated alongside the ‘natural origin’ theory which posits that the virus jumped from bats to an intermediary species, which then infected a cluster of people at a Wuhan wet market.

According to a study published in The Lancet, 66% of patients admitted to Wuhan hospitals (27 out of 41) as of January 2nd, 2020 had been exposed to the Huanan seafood market. Since then, the lab leak hypothesis has gained traction – and has been elevated to let’s at least investigate status by legitimate bodies. Three weeks ago, the US State Department announced that while they haven’t determined whether the COVID-19 pandemic “began through contact with infected animals or was the result of an accident at a laboratory in Wuhan, China,” the US government “has reason to believe that several researchers inside the WIV became sick in autumn 2019, before the first identified case of the outbreak, with symptoms consistent with both COVID-19 and common seasonal illnesses.”

And in late January, A World Health Organization (WHO) adviser who previously worked under President Clinton and then-Senator Joe Biden said that COVID-19 was most likely an accidental lab leak. Which brings us to the Washington Post, whose editorial board on Sunday suggested that the lab leak hypothesis was “plausible” and “must be investigated.” “Many scientists have speculated that the virus leaped from animals, such as bats, to humans, perhaps with an intermediate stop in another animal. This kind of zoonotic spillover has occurred before, such as in the West Africa Ebola outbreak in 2014. But there is another pathway, also plausible, that must be investigated. That is the possibility of a laboratory accident or leak. It could have involved a virus that was improperly disposed of or perhaps infected a laboratory worker who then passed it to others.”

I would like to see them try, and then get stiffed in court.

• UK Vaccine Minister Says Gov’t Is Not Planning Covid Vaccine Passport (RT)

Covid-19 Vaccine Deployment Minister Nadhim Zahawi denied claims that the UK government is planning to introduce a “vaccine passport” detailing which Brits have been vaccinated and which haven’t, calling the idea “discriminatory.” Asked during an interview with Sky News on Sunday whether the government is looking at the possibility of creating a vaccine passport, as has been speculated, Zahawi said, “No we are not.” The minister explained that those who receive their first dose of the vaccine get “a card from the NHS with their name on it,” the date they received their first dose, and the date of the second dose, and that this is all the government is currently supporting.

Zahawi said the major reasons why the government is not planning a vaccine passport is because “we don’t know the impact of the vaccines on transmission,” with vaccinated Brits currently being warned that they could still carry the virus, and that the practice “would be discriminatory.” “I think the right thing to do is to make sure that people come forward and be vaccinated because they want to, rather than it being made in some way mandatory through a passport. If other countries demand proof of vaccination for entry, he added, “then you can ask your GP, because your GP will hold the record.” Zahawi did acknowledge that technology companies have received funding from UK Research and Innovation to look at the creation of vaccine passport apps, but concluded, “We are not planning to have a passport in the UK.”

“I just want to repeat that because I’ve had a lot of it on my social media,” he explained, adding, “We are certainly not looking to introduce this as part of the vaccine deployment program.” A petition calling for the UK government to commit against rolling out a vaccine passport received nearly 60,000 signatures after reports indicated that it was looking at such a system to allow Brits to go abroad. The concept of a vaccine passport has become extremely controversial in the UK and elsewhere, with figures like former Prime Minister Tony Blair in support, but others arguing it would turn those who have not been vaccinated into ‘second-class’ citizens and essentially strongarm them into getting vaccinated against their wishes.

Nothing changes. Other than the window dressing.

• The World Welcomes Biden But Hedges Its Bets (Feffer)

The nightmare is over. The vanquished beast has crawled back to Mar-a-Lago to lick his wounds. The heroes are hard at work repairing the damage. As America returns to the international stage, the world heaves a collective sigh of relief. That, at least, is the story the incoming Biden administration is telling. “America is back, multilateralism is back, diplomacy is back,” as Linda Thomas-Greenfield, the administration’s nominee for U.N. ambassador, put it shortly after the election. According to this narrative of redemption, the globe’s Atlas shrugged off its burden during the four years of Donald Trump’s tenure but is now ready to reassume its global leadership responsibilities.

Don’t believe it, though. Much of the rest of the world seems visibly queasy at the prospect of sitting on America’s shoulders, since who’s to say that Atlas won’t shrug again? And perhaps Atlas wasn’t such a responsible fellow in the first place.

Over the last several decades, the United States has displayed all the hallmarks of a country suffering from a serious personality disorder characterized by mood swings of gargantuan proportions. From the compromised multilateralism of the Bill Clinton years, the United States pivoted to the aggressive armed unilateralism of George W. Bush. Then, after boomeranging back to the centrist (if still over-armed) internationalism of Barack Obama, it took the wildest of detours into MAGA-land with Donald Trump. In the latest case of foreign-policy whiplash, Joe Biden is now preparing to return the country to a “new and improved” version of Obama’s global liberalism (with a dash of anti-Chinese fervor thrown in). Americans are by now remarkably familiar with such side effects of twenty-first-century democracy. We’ve skimmed the fine print on the label more than once and become reasonably inured to the adverse consequences of our civic religion.

Much of the world, however, is not accustomed to such volatility. The Kim family has ruled North Korea from day one, while Paul Biya has run Cameroon since 1982. Over the last 30 years, China has settled into its predictable version of market Leninism. Putatively democratic countries like Russia and Turkey have had the same leadership for two decades, while a genuinely democratic country like Germany has had the same chancellor for 15 years. The rest of Western Europe has seen numerous changes in those who hold the reins of power, but oscillations in governance have generally stayed within a relatively narrow political spectrum. European Union policies have similarly remained on a remarkably even keel, despite disruptions like Brexit. These days, however, democrats and dictators alike are unsure, from one day to the next, whether the United States will be Dr. Jekyll or Mr. Hyde.

“Neither Obama nor Trump were able to reform this fundamentally broken UN agency that institutionally legitimizes human rights abusers. Biden must not only confront the Council’s systemic antisemitism, but its complicity in China’s human rights abuses.”

• US Moves To Rejoin UN Human Rights Council (AP)

The Biden administration is set to announce this week that it will reengage with the much-maligned U.N. Human Rights Council that former President Donald Trump withdrew from almost three years ago, U.S. officials said Sunday. The decision reverses another Trump-era move away from multilateral organizations and agreements. U..S. officials say Secretary of State Antony Blinken and a senior U.S. diplomat in Geneva will announce on Monday that Washington will return to the Geneva-based body as an observer with an eye toward seeking election as a full member. The decision is likely to draw criticism from conservative lawmakers and many in the pro-Israel community.

Trump pulled out of the world body’s main human rights agency in 2018 due to its disproportionate focus on Israel, which has received by far the largest number of critical council resolutions against any country, as well as the number of authoritarian countries among its members and because it failed to meet an extensive list of reforms demanded by then-U.S. Ambassador to the United Nations Nikki Haley. In addition to the council’s persistent focus on Israel, the Trump administration took issue with the body’s membership, which currently includes China, Cuba, Eritrea, Russia and Venezuela, all of which have been accused of human rights abuses.

One senior U.S. official said the Biden administration believed the council must still reform but that the best way to promote change is to “engage with it in a principled fashion.” The official said it can be “an important forum for those fighting tyranny and injustice around the world” and the U.S. presence intends to “ensure it can live up to that potential.”

Cancel Culture.

• The Censorship Industry Suffers Several Well-Deserved Blows (Greenwald)

A new and rapidly growing journalistic “beat” has arisen over the last several years that can best be described as an unholy mix of junior high hall-monitor tattling and Stasi-like citizen surveillance. It is half adolescent and half malevolent. Its primary objectives are control, censorship, and the destruction of reputations for fun and power. Though its epicenter is the largest corporate media outlets, it is the very antithesis of journalism.

I’ve written before about one particularly toxic strain of this authoritarian “reporting.” Teams of journalists at three of the most influential corporate media outlets — CNN’s “media reporters” (Brian Stelter and Oliver Darcy), NBC’s “disinformation space unit” (Ben Collins and Brandy Zadrozny), and the tech reporters of The New York Times (Mike Isaac, Kevin Roose, Sheera Frenkel) — devote the bulk of their “journalism” to searching for online spaces where they believe speech and conduct rules are being violated, flagging them, and then pleading that punitive action be taken (banning, censorship, content regulation, after-school detention). These hall-monitor reporters are a major factor explaining why tech monopolies, which (for reasons of self-interest and ideology) never wanted the responsibility to censor, now do so with abandon and seemingly arbitrary blunt force: they are shamed by the world’s loudest media companies when they do not.

Just as the NSA is obsessed with ensuring there be no place on earth where humans can communicate free of their spying eyes and ears, these journalistic hall monitors cannot abide the idea that there can be any place on the internet where people are free to speak in ways they do not approve. Like some creepy informant for a state security apparatus, they spend their days trolling the depths of chat rooms and 4Chan bulletin boards and sub-Reddit threads and private communications apps to find anyone — influential or obscure — who is saying something they believe should be forbidden, and then use the corporate megaphones they did not build and could not have built but have been handed in order to silence and destroy anyone who dissents from the orthodoxies of their corporate managers or challenges their information hegemony.

Harley Bassman, creator of the MOVE index, aka the “VIX for bonds”.

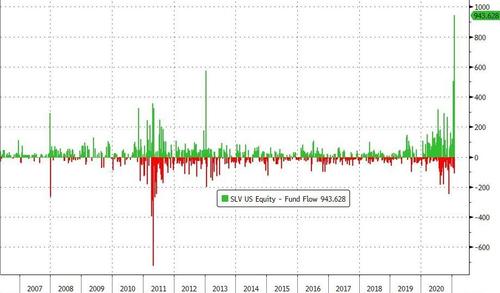

• The Coming “Monetary Hurricane” Is A White Swan (Bassman)

When one hears hoof beats, look for horses not zebras. There is no reason to ruminate over exotic possibilities when the problems we face are quite clear. Once again, ignore the merits of the public policy response – what is important is that there is wide support from both the Democrats and Republicans to offer significant Fiscal relief supported by massive Monetary expansion. Will this be inflationary – Yes; but it is unclear how soon. I made the case in my December 2, 2020 commentary, ”The Wages of Fear”, that demographics will set ablaze the dry kindling of printed money sometime between 2023 to 2025; and nothing has occurred to change that prediction. What is clear is that a financial bubble is being inflated, and there is risk on both sides of the distribution.

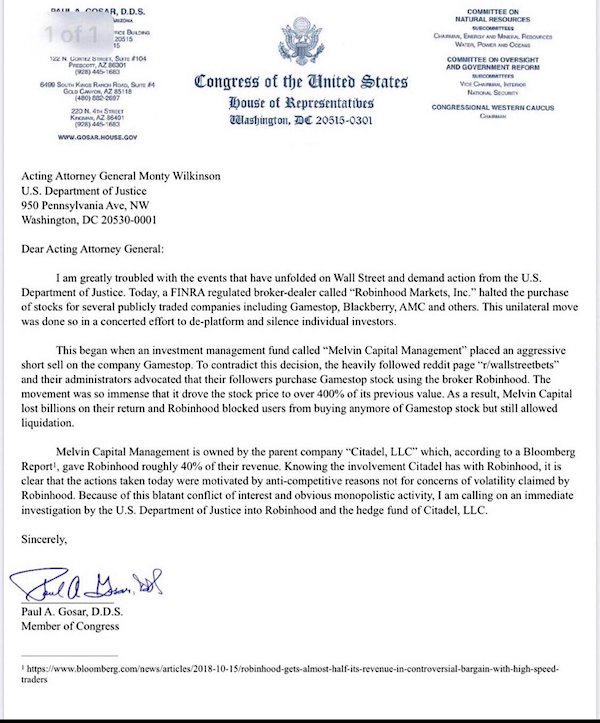

Ordinarily the bloviating pundits advise one to sell assets, or perhaps execute some sort of hedge such as buying puts or selling covered calls. They are looking in the wrong direction. While I am not a stomping bull, the approaching monetary hurricane could well make the “surprise” a further rally in equities. Printed money should elevate stocks; either via a continued flow into assets, or into the pockets of consumers who will spend it and thus increase corporate profits. (Yes, higher taxes could be an offset, but let’s save that for another Commentary.) As noted, inflation is an eventual certainty, so one should own real assets; and over the longest run stocks will hold their real value. Notwithstanding the Robinhood day traders, stock equity is an ownership right in a real company.

Weimar Germany is the nightmare scenario for inflation; but contrary to expectations, stockholders were protected. While the German Papiermark vs. USD exchange rate exploded (4.2 Trillion per USD), the German Stock Index, currency adjusted into USD, held its value. As such, when faced with nominal inflation – Do not sell call options.

Great interview. Must read.

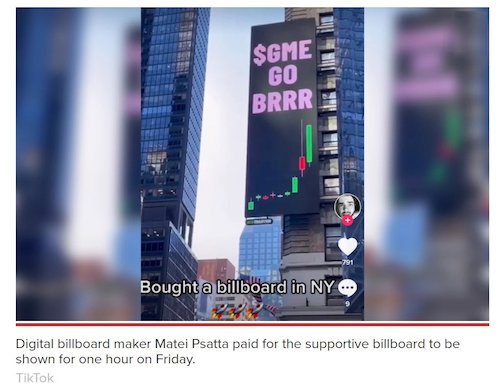

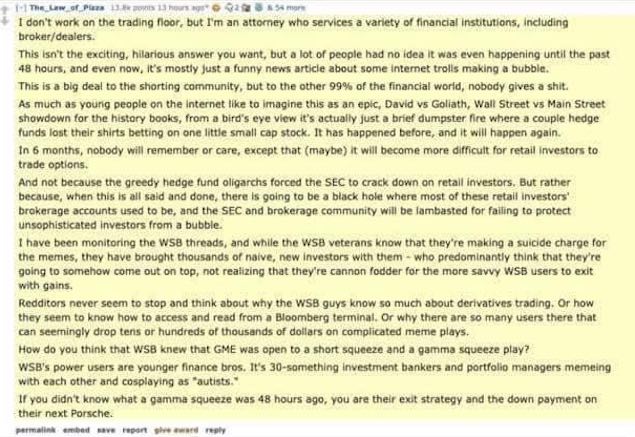

• “This Is For You, Dad”: Interview With An Anonymous GameStop Investor (Taibbi)

Thursday, January 21st was a critical day in the story of the video game chain GameStop (ticker name: GME). Retail investors, including many subscribers to a Reddit forum called wallstreetbets, pushed the company’s stock from $6 to $43.03, but experts said playtime was over. It was time for the big shots to clean up. According to Citron Research, one of many funds that had bet on the brick-and-mortar store to fail, those investing in GME were “the suckers at this poker game,” and would soon be sorry when the stock went “back to $20 fast.” They were wrong. Instead of amateurs being shoved aside by hedge funds, it was the pros who had their backs broken, as GME soared to $65.05, beginning a steep ascent that would become an international news phenomenon.

It was the “We’re gonna need a bigger boat” moment for Wall Street. The pros had been sloppy. By late 2020, shares in GameStop were well over 100% short. A sudden rise in value would force shorts to pay exorbitant prices just to get out of the trade. By the afternoon of the 21st, all the “suckers” on Reddit had to do to beat them was nothing, and they did just that, behind the rallying cry “diamond hands,” signifying a determination to hold at all costs. Why hold? One of the millions of subscribers to wallstreetbets posted a note, explaining what the trade meant to him:

This is for you, Dad

I remember when the housing collapse sent a torpedo through my family. My father’s concrete company collapsed almost overnight. My father lost his home. My uncle lost his home. I remember my brother helping my father count pocket change on our kitchen table. That was all the money he had left in the world. While this was happening in my home, I saw hedge funders literally drinking champagne as they looked down on the Occupy Wall Street protesters. I will never forget that. My father never recovered from that blow. He fell deeper and deeper into alcoholism and exists now as a shell of his former self, waiting for death. This is all the money I have and I’d rather lose it all than give them what they need to destroy me. Taking money from me won’t hurt me, because I don’t value it at all. I’ll burn it down just to spite them. This is for you, Dad.

Don’t count on them bouncing back.

• Shark Deaths Have Left a ‘Gaping Hole’ in Ocean Life (SA)

Overfishing has wiped out over 70 percent of some shark and ray populations in the last half-century, leaving a “gaping, growing hole” in ocean life, according to a new study. Researchers found alarming declines in species ranging from hammerhead sharks to manta rays. Among the worst affected is the oceanic whitetip, a powerful shark often described as particularly dangerous to man, which now hovers on the edge of extinction because of human activity. Targeted for their fins, oceanic whitetips are caught up by indiscriminate fishing techniques. Their global population has dropped 98 percent in the last 60 years, said Nick Dulvy, the study’s senior author and a professor at Simon Fraser University (SFU).

“That’s a worse decline than most large terrestrial mammal populations, and getting up there or as bad as the blue whale decline,” he told AFP. Dulvy and a team of scientists spent years collecting and analysing information from scientific studies and fisheries data to build up a picture of the global state of 31 species of sharks and rays. They found three-quarters of the species examined were so depleted that they face extinction. These are “the most wide-ranging species in the largest, most remote habitats on the earth, which are often assumed to be protected from human influence”, the study’s lead author Nathan Pacoureau told AFP. “We knew the situation was bad in a lot of places but that information came from different studies and reports, so it was difficult to have an idea of the global situation,” added Pacoureau, a post-doctoral fellow at SFU’s department of biological science.

[..] For 18 species where more data was available, the researchers concluded global populations had fallen over 70 percent since 1970. Dulvy said the figure was likely to be similar, or even worse, for other oceanic sharks and rays, but gaps in data made it difficult to draw conclusions. The results were a shock even for experts, Pacoureau said, describing specialists at a meeting on shark conservation being “stunned into silence” when confronted with the figures.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Reddit’s 5 second SuperBowl ad.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.