Gottscho-Schleisner Fulton Market pier, view to Manhattan over East River, NY 1934

Luckily they’re TBTF. They don’t have to worry. We do.

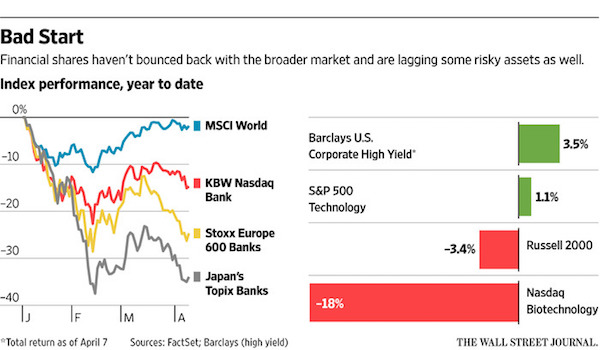

• US Bank Stocks Are Having A Terrible 2016 (WSJ)

Bank stocks are having a terrible 2016, as central-bank policies, which for years lifted asset prices, are hurting the financial sector. The impact of economic stimulus efforts on lenders will get a fresh airing this week, as big U.S. banks begin reporting their earnings for the first quarter. Trading revenue is expected to have taken a hit, but the more enduring problem will be visible in the lenders’ net interest margins, the basic measure of bank profitability that gets flattened by low interest rates. The broader U.S. stock market has shaken off a steep slump at the beginning of the year and is back in positive territory. But banks and other financial companies are lagging far behind. The divergence highlights the dilemma facing central banks. Easy-money policies have fueled a rally in risky assets.

They are also squeezing profits at financial companies, inflicting pain on a sector that is fundamental to the health of the economy. Earnings for S&P 500 financial companies during the quarter ended March are expected to be down 8.5% from the same period last year, according to FactSet. Analysts have cut their projections for almost three-quarters of the companies in the financial sector, including J.P. Morgan Chase and Bank of America, both of which are scheduled to release earnings this week. “At the end of the day, it’s just a more difficult earnings environment for financials,” said Jeremy Zirin at UBS Wealth Management Americas. Bank shares face an array of challenges. Low and in some cases negative interest rates globally have eroded banks earnings, while a steep decline in commodity prices at the start of the year raised concerns over lenders exposure to soured loans in the energy and mining sectors.

In Europe, the picture has been complicated further by concerns over nonperforming loans broadly, particularly in economically stressed Southern Europe. Financial companies are the worst performers in the S&P 500, down 7.6% in 2016 as the broader index has risen 0.2%. The KBW Nasdaq Bank Index of large U.S. commercial lenders has fallen 15% this year. Some big banks have done even worse. Morgan Stanley has fallen 25% this year, giving up roughly three years of stock-price gains in the process. Bank of America is in a similar position, with its shares down 23%. Citigroup shares have dropped 22%.

Very scary graph.

• BofA Warns “Europe Looks Frightening” (ZH)

"Europe looks concerning" warns BofAML's Stephen Suttmeier, pointing out, rather ominously that the broad European index – STOXX 600 – is trading like it did in 2001 & 2008.

The STOXX Europe 600 (SXXP) is trending below declining and bearishly positioned 26 and 40-week moving averages. ECB quantitative easing has not reversed this bearish trend. The 2016 set-up is similar to early 2001 and early 2008 with 350 important resistance and 300 important support. Both 2001 and 2008 saw rebounds into bearishly positioned and falling 26/40-week MAs that formed important lower tops in May.

We think this pattern could repeat or at least rhyme moving into May 2016. The breaks below 300 in September 2011 and June 2008 led to much deeper weakness and a similar break in 2016 could see the SXXP trend down toward 200.

Source: BofAML

“Some of the more exotic activities from major corporations of late make much more sense when considered against a landscape of deteriorating returns.”

It’s when a party’s been going on too long that it’s most at risk of getting out of hand. The more interesting guests fade away, leaving the field dominated by a sketchier crowd. Behavior considered beyond the pale earlier in the evening is excused to inject more vigor into flagging spirits.Financial markets, which former Federal Reserve Chairman William McChesney Martin once likened to a drunken debauch, exhibit similar dynamics. Seven years into the current global economic recovery, the punch bowl is almost drained. The remaining revelers are starting to raid the cupboards for stronger stuff. For evidence that the balloons are bursting and the dance-floor lights are coming up, take a look at the return on equity of the S&P 500 Index.

The measure dropped below 12% on March 21 – the first time it’s crossed the line in that direction since June 2008. The occasions prior to that were May 2001 and April 1991, and all three instances coincided closely with U.S. recessions. You see a similar pattern in the FTSE 100 Index. Just 11 trading days during the 2009 nadir of global markets saw returns on equity slip below the current level of 5.5%. In Asia, the Hang Seng Index, Shanghai Composite and CSI 300 have all touched their lowest levels since 2009 this year, and remain just a sliver above their rock-bottom points.Among major equity indexes, only the Nikkei, which is not far below its highest levels since 2008, and Europe’s Stoxx 50, which has been bumping along at low levels since 2011, break the pattern.

Some of the more exotic activities from major corporations of late make much more sense when considered against a landscape of deteriorating returns. Take inversions, where U.S. companies carry out reverse takeovers of foreign businesses in order to benefit from low corporate tax rates overseas.Such deals, which activist investor Carl Icahn estimates have exceeded half a trillion dollars in recent years, don’t come cheap. Pfizer, the global pharmaceutical giant that dropped its $160 billion attempt to hop into bed with Allergan after the U.S. Treasury promised to claw back the lost revenue, will pay a $400 million break fee to its spurned partner, people familiar with the matter said last week. There’s also an estimated $120 million to $150 million Pfizer will have to shell out for the work its own bankers and lawyers have done.

“The BoJ is soaking up the entire budget deficit under Governor Haruhiko Kuroda as he pursues QE a l’outrance.”

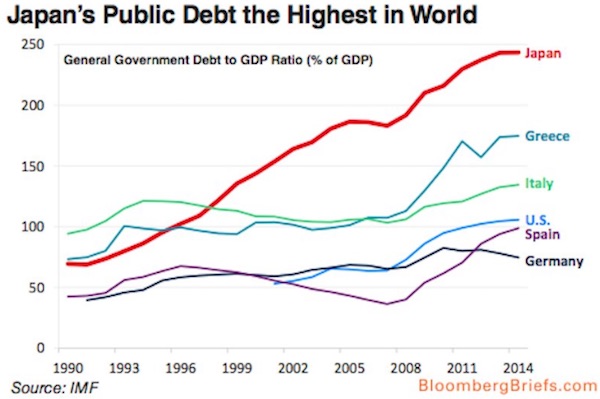

• Olivier Blanchard Eyes Ugly ‘End Game’ For Japan On Debt Spiral (AEP)

Japan is heading for a full-blown solvency crisis as the country runs out of local investors and may ultimately be forced to inflate away its debt in a desperate end-game, one of the world’s most influential economists has warned. Olivier Blanchard, former chief economist at the IMF, said zero interest rates have disguised the underlying danger posed by Japan’s public debt, likely to reach 250pc of GDP this year and spiralling upwards on an unsustainable trajectory. “To our surprise, Japanese retirees have been willing to hold government debt at zero rates, but the marginal investor will soon not be a Japanese retiree,” he said. Prof Blanchard said the Japanese treasury will have to tap foreign funds to plug the gap and this will prove far more costly, threatening to bring the long-feared funding crisis to a head.

“If and when US hedge funds become the marginal Japanese debt, they are going to ask for a substantial spread,” he told the Telegraph, speaking at the Ambrosetti forum of world policy-makers on Lake Como. Analysts say this would transform the country’s debt dynamics and kill the illusion of solvency, possibly in a sudden, non-linear fashion. Prof Blanchard, now at the Peterson Institute in Washington, said the Bank of Japan will come under mounting political pressure to fund the budget directly, at which point the country risks lurching from deflation to an inflationary denouement. “One day the BoJ may well get a call from the finance ministry saying please think about us – it is a life or death question – and keep rates at zero for a bit longer,” he said.

“The risk of fiscal dominance, leading eventually to high inflation, is definitely present. I would not be surprised if this were to happen sometime in the next five to ten years.” Arguably, this is already starting to happen. The BoJ is soaking up the entire budget deficit under Governor Haruhiko Kuroda as he pursues quantitative easing a l’outrance. The central bank owned 34.5pc of the Japanese government bond market as of February, and this is expected to reach 50pc by 2017.

But the mob owns the house..

• Smash The Mafia Elite, Treat Offshore Wealth As Terrorist Finance (Mason)

Amid the cobbled passageways and tumbling tenements of the Italian city of Perugia, it’s possible to daydream you are in the middle ages. You are surrounded by medieval art and architecture. And then you think: hold on, what happened to the Renaissance? Sure, there are some imposing private palaces from the period 1300-1500, and sure Raphael left half a fresco in a tiny chapel. But it’s not Florence. The money was clearly here at some point but, some time after 1300, the artistic, cultural and scientific riches moved somewhere else. By 1500, the city was “smaller, poorer and politically narrower” than 200 years before, writes historian Sarah Rubin Blanshei. Why? Because the rich did not pay their taxes.

The Perugian elite became a closed stratum of mafiosi, earning their money from mercenary work abroad, jealously guarding their family inheritance, stifling social mobility. Sound familiar? As David Cameron’s fiasco over the Panama Papers collides with George Osborne’s over the budget, the danger is that we frame these merely as political scandals. In fact, the Panama Papers point to a deeper sickness. Globalised capitalism has become an organised and legalised form of corruption, in which the work of the manager, the inventor and the entrepreneur come second to that of people whose wealth “works for them” – preferably in a jurisdiction nobody can see. If you listen to Cameron’s defenders, their logic follows three contours: he did nothing illegal, nothing unparliamentary and nothing wrong.

I do not doubt his decision to invest in an offshore fund was legal. That he failed to register his shares in Blairmore on becoming an MP, and lobbied for the protection of offshore trusts while being an undeclared beneficiary of one, does merit investigation by Parliament. But it’s the insistence by the apopleptic right that he should not be criticised over tax avoidance – that “everybody does it” – that we should register as a kind of collective Marie Antoinette moment for the UK’s social elite.

MO: “..the acquisition of defaulted debt at a discount..”

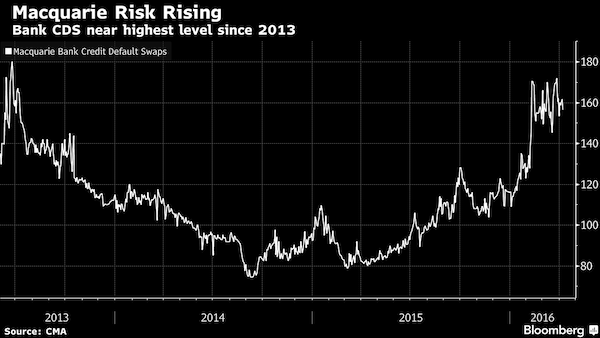

• Aussie Hazards From Mortgages to Mines Lift Bond Risk (BBG)

Those Australians struggling with mortgage payments and the possibility of damage from the global commodity price slump are helping to inflate bond risk for Macquarie Group’s banking unit. The cost of insuring Macquarie Bank notes against non-payment climbed to as much as 172 basis points last month, the highest since June 2013, after the lender flagged a rise in overdue home loans. The Sydney-based bank’s credit-default swaps have increased 39 basis points in 2016, the second most in the benchmark Markit iTraxx Australia index, and were at 155 basis points April 8. While Macquarie Group is predicted to post a record full-year profit, there’s increasing speculation about how well Australia’s lenders will cope with a mining downturn that’s already causing some resource-related firms to default on loans.

Large gyrations in global markets in the first quarter helped drive out credit spreads for banks, and there’s concern that home-loan books will be hurt by a stuttering Australian housing market. “Macquarie’s CDS was caught up in the February selloff with the big four banks and whilst the latter have regained ground in March, Macquarie remains at wides,” said Simon Fletcherat National Australia Bank. “This is likely to be in part due to some market nerves” after Macquarie revealed an increase in overdue loans in one of its recent regulatory filings, he said. While Macquarie’s total impaired mortgages fell in the final three months of 2015 compared with the previous quarter, the lender on Feb. 19 flagged an increase in overdue loans over the same timeframe. The bank’s 90-days-plus overdue residential mortgages almost doubled to A$476 million ($360 million) in the quarter ended Dec. 31. The main “driver” of the increase was due to the acquisition of defaulted debt at a discount, the lender said in a statement on its website last month.

Do let it sink in: “With total household sector liabilities at $2.2 trillion dollars as of 2015, Q4, Australians are so indebted that the majority of principal will never be repaid.”

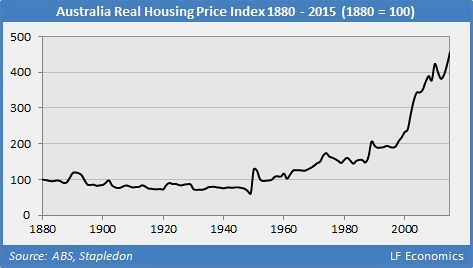

• Australia’s Housing Bubble And The Road To Private Serfdom (Soos)

Over the last 20 years, housing has developed a reputation as a risk-free and high-gain asset. Property remains a coveted asset and can now be purchased with a small deposit; the rest borrowed from banks. It certainly is an attractive investment: since 1996, housing prices, adjusted for inflation and quality, have soared by 141% through to 2015.

Many global housing markets corrected after the GFC, but Australia’s continued to boom, especially in Sydney and Melbourne. This resilience is attributable to the vested interests: the FIRE (finance, insurance and real estate) sector, numerous Federal and state government interventions, and leveraged home owners and investors, who believe housing price inflation benefits them.Almost every residential owner wants the gravy train to continue running to escape the drudgery of wage labour and achieve the coveted status of property baron.

Australia has one of the world’s most expensive housing markets, but unlike an Olympic gold medal, the nation should feel shame rather than pride in achieving this dubious feat. Residential property is so highly leveraged that even a small fall in its value would have adverse consequences, placing heavily-geared owners in the position of negative equity. Falling prices and credit defaults can reverberate throughout the economy, leading to a recession or worse. After all, a real estate slump drove other wealthy economies into a major downturn during the GFC, not the other way around.

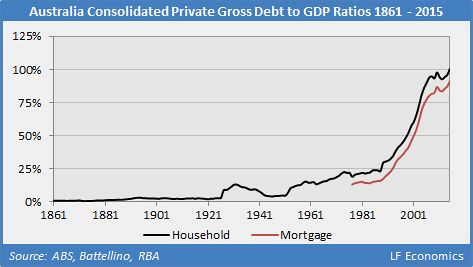

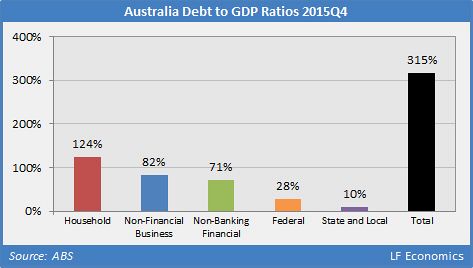

The largest and most important purchase the average person will make is not even financed with their own money. Relative to GDP, the Australian household sector vies with Switzerland for accumulating the largest debt burden globally. As of 2015, Q4, this amounts to 124%, which is much higher than what many other nations peaked at before the bursting of their housing bubbles.

This massive indebtedness is ignored by both political parties, who endlessly claim we need to transition the Federal Government budget back to surplus as this represents “fiscal responsibility”. The reason is because nobody wants the value of their properties to sink and, instead, is supposed to repeat the hysteria about the “budget emergency”, “runaway public debt”, “record deficit” and so on. Public debt peaked in 1932 at 173% of GDP, when the economy was far less productive. Today, it is low compared to historical and global trends. With total household sector liabilities at $2.2 trillion dollars as of 2015, Q4, Australians are so indebted that the majority of principal will never be repaid. With nominal rent growth now turning negative and wage growth at record lows, it will become increasingly difficult to finance repayments, especially for first home buyers.

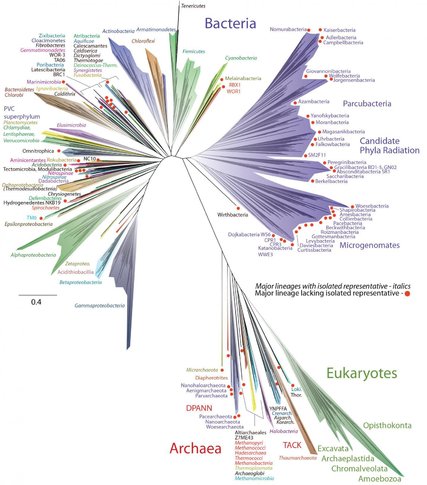

“The “great Tree of Life,” he said, “fills with its dead and broken branches the crust of the earth, and covers the surface with its ever branching and beautiful ramifications.”

• Scientists Unveil New ‘Tree of Life’ (NY Times)

A team of scientists unveiled a new tree of life on Monday, a diagram outlining the evolution of all living things. The researchers found that bacteria make up most of life’s branches. And they found that much of that diversity has been waiting in plain sight to be discovered, dwelling in river mud and meadow soils. “It is a momentous discovery – an entire continent of life-forms,” said Eugene V. Koonin of the National Center for Biotechnology Information, who was not involved in the study. The study was published in the journal Nature Microbiology. In his 1859 book “On the Origin of Species,” Charles Darwin envisioned evolution like a branching tree. The “great Tree of Life,” he said, “fills with its dead and broken branches the crust of the earth, and covers the surface with its ever branching and beautiful ramifications.”

Ever since, biologists have sought to draw the tree of life. The invention of DNA sequencing revolutionized that project, because scientists could find the relationship among species encoded in their genes. In the 1970s, Carl Woese of the University of Illinois and his colleagues published the first “universal tree of life” based on this approach. They presented the tree as three great trunks. Our own trunk, known as eukaryotes, includes animals, plants, fungi and protozoans. A second trunk included many familiar bacteria like Escherichia coli. The third trunk that Woese and his colleagues identified included little-known microbes that live in extreme places like hot springs and oxygen-free wetlands. Woese and his colleagues called this third trunk Archaea.

[..] The scientists needed a supercomputer to evaluate a vast number of possible trees. Eventually, they found one best supported by the evidence. It’s a humbling thing to behold. All the eukaryotes, from humans to flowers to amoebae, fit on a slender twig. The new study supported previous findings that eukaryotes and archaea are closely related. But overshadowing those lineages is a sprawling menagerie of bacteria. Remarkably, the scientists didn’t have to go to extreme places to find many of their new lineages. “Meadow soil is one of the most microbially complex environments on the planet,” Dr. Hug said.

How crazy it can get is anybody’s guess.

• How Kim Kardashian Gets Elected President (Jim Kunstler)

[..] It must be obvious that the next occupant of the White House will preside over the implosion of all these arrangements since, in the immortal words of economist Herb Stein, if something can’t go on forever, it will stop. So the only individuals left seeking the position are 1) An inarticulate reality TV buffoon; 2) a war-happy evangelical maniac; 3) a narcissistic monster of entitlement whose “turn” it is to hold the country’s highest office; and 4) a valiant but quixotic self-proclaimed socialist altacocker who might have walked off the set of Welcome Back Kotter, 40th Reunion Special. These are the ones left standing halfway to the conventions. Nobody else in his, her, it, xe, or they right mind wants to be handed this schwag-bag of doom.

On Saturday, the unstoppable Democratic shoo-in Hillary lost her 7th straight contest to the only theoretically electable Vermont Don Quixote, Bernie Sanders. This was a week after it was reported in The Huff-Po that her campaign crew literally bought-and-paid for the entire 50-state smorgasbord of super-delegates who will supposedly compensate for Hillary’s inability to otherwise win votes the old-fashioned way, by ballots cast. Wonder why that didn’t make nary a ripple in the media afterward? Because this is the land where anything goes and nothing matters, and that’s really all you need to know about how things work in the USA these days.

The Republican mandarins are apparently delirious over loose cannon Donald Trump’s flagging poll numbers in the remaining primary states. Should Trump fall on his face, do you think they’ll just hand Ted Cruz the Ronald Reagan Crown-and-Scepter set. (They’d rather lock Ted in the back of a Chevy cargo van with five Mexican narcos and a chain saw.) The GOP establishment insiders are already lighting cigars in preparation for the biggest smoke-filled room in US political history, Cleveland, July 20. But what poor shmo will they have to drag to the podium to get this odious thing done? Who wants to be the guy in the Oval Office when Janet Yellen comes in some muggy DC morning and says, “Uh, sir (ma’am)… that sucker you heard was gonna go down…? Well, uh, it just did.”

As for the Dems: they are about to anoint the most unpopular candidate of our lifetimes. The BLM mobs have promised to deliver mayhem to the streets of the party conventions and don’t think they will spare Hillary in Philary, no matter how many chitlins she scarfed down last month in Carolina. The action in Philly will unleash and reveal all the deadly power of President Obama’s NSA goon squads when the militarized police put down the riots, and Hillary will be tagged guilty by association. And that is how Kim Kardashian gets elected president.

The Troika always only intended to hang Greece out to dry.

• Greece, Troika Adjourn Bailout Review Till After IMF Spring Meet (R.)

Greece and its international lenders adjourned talks on a crucial bailout review early on Tuesday and will resume them immediately after this week’s IMF spring meeting, the Greek finance minister said. Lenders, who had been in Athens for just over a week, will return next Monday after the IMF spring meeting in Washington with a view to concluding an agreement by April 22, when eurozone finance ministers are scheduled to meet, Finance Minister Euclid Tsakalotos told reporters. “The Greek government and the four institutions agreed there was progress,” Tsakalotos said, referring to European institutions and the IMF.

Greece’s review of progress, under a bailout deal reached in July, has dragged on for months mainly because of differences among the lenders over its projected fiscal shortfall by 2018 – initially seen at 3% by the EU and 4.5% by the IMF – and resistance from Athens on unpopular measures. The differences among the lenders themselves remained. With Athens, divergences hinged on the depth of pension reform and regulating non-performing loans, particularly those involving primary home mortgages, sources close to the talks have said. “It would have been good to conclude on a deal today … we have made many concessions until now,” a Greek government official participating in the Athens-based talks said. A source close to the talks said ‘most issues’ remained open. A positive review will unlock up to €5 billion in aid. Athens needs the money to repay €3.5 billion to the IMF and the ECB in July, as well as unpaid domestic bills.

June 23: UK referendum.

• Ten Billion Risks in Greece’s Summer of Discontent (BBG)

Europe is gearing up for a summer of discontent. There’s the U.K. referendum on EU membership, a simmering refugee crisis and an increasingly desperate ECB. Taken together, this list gives reason enough to be fearful about the health of the European project in the coming months. But there is also Greece, which is caught in a spat between Germany and the IMF over debt relief as it seeks yet more bailout money. Greece – whose economic crisis already threatened to destroy the irrevocable nature of euro membership – still seems to be dragging its feet over state asset sales and pension reform. It is hemorrhaging cash from its banking system. Athens has to find more than €5 billion to meet its debts in June – and another €5 billion in July.

That’s €10 billion Greece doesn’t have; not, perhaps, a princely sum for a larger, healthier European state but that’s 20% of Greece’s annual tax income. Now, there’s an argument that with so much else going on in the European theatre, Brussels will be keen to fudge a solution just to get Greece off the agenda. IMF may not be so willing to oblige, however. If May comes and goes without a deal – be it because of German intransigence on debt relief, IMF stubbornness on budget targets, or Greek brinksmanship — Greece and its creditors may run out of time to avoid default. As Greece’s debt repayment deadlines approach, EU officials may be busy fighting fires kindled by Britain’s June 23 referendum on EU membership. The outcome of that vote is far from certain.

Bloomberg’s composite tracker of opinion polls puts votes to remain in the EU at 39 points, those wanting to leave at 38, with “don’t knows” holding the balance of power at 23. With Prime Minister David Cameron embroiled in a domestic row about his personal taxes in the wake of the so-called Panama Papers, government popularity is likely to take a hit. That can only help the anti-EU campaign; it won’t take many undecided voters to swing the outcome. The European Commission’s regular survey of attitudes to the EU, known as the eurobarometer, has already taken a turn for the worse, with the most recent poll showing rising discontent: The proportion of Europeans for whom the EU conjures up a negative image has risen to 23% (+4); before this, it had declined continuously in the four previous surveys.

Renewed concern about the European project is just starting to surface in the bond market. Investors are now charging Portugal 3.3 percentage points more for 10-year money than they demand from Germany, a spread that’s well above its six-month average of 2.2 points. Italy’s risk premium rose to 1.3 points last week, up from December’s low of 0.9 points, while Spain is at 1.4 points, up from 1.2 points a month ago. That’s not enough to ring alarm bells; but it’s odd at a time when the ECB is increasing its sovereign bond purchases.

But Europe won’t. So what’s next?

• ‘Europe Has To Change Course’: Greece and Portugal Unite To Lambast EU (Tel.)

Europe must move away from “self-defeating” austerity and embrace “progressive” reform, the prime ministers of Greece and Portugal have declared. Europe is at “a critical crossroads” and needs to decide whether to embrace “closer political, fiscal and social integration” or pursue fragmentation and “narrow national interest”, Greek prime minister Alexis Tsipras and his Portuguese counterpart António Costa said in a joint statement. Both Portugal and Greece have received bail-outs from the European Union following the crash of 2008. Portugal exited its €78bn bail-out programme in May 2014, while Greece is struggling to close a crucial review of its third bail-out in five years.

“We, as prime ministers of two countries with a similar policy experience in the context of their respective adjustment programmes, share the conviction that austerity-only policies are wrong and insufficient to overcome the existing challenges,” said Mr Tsipras and Mr Costa. They added: “Europe has to change course. Instead of merely adjusting to self-defeating competitiveness and austerity measures, our two countries take the decision to closely co-operate at all levels, bilateral and European, to put forward a progressive programme of democratic Eurozone Governance, economic revival, employment creation, centered on quality jobs, and socially just and environmentally responsible growth in Europe and in our countries.”

The prime ministers also criticised the response of some EU member states to the migrant crisis, with Mr Tsipras saying that the use of teargas and plastic bullets by Macedonian police during clashes with refugees at the Idomeni makeshift camp was a disgrace to European civilisation. The Portuguese prime minister is in Athens on an official visit. Speaking after his meeting with Mr Costa, the Greek prime minister slammed the role of the IMF in Greece’s bail-out talks. “In Greece wrong policies were applied and it is a paradox that those who recognized that there were wrong policies, admitting their mistake, insist on applying the mistake,” said Mr Tsipras.

Does Tsipras still have meaning?

• Tsipras Aiming For Debt Relief But Slams IMF (Kath.)

As negotiations between Greece and its quartet of lenders dragged on into Monday night, Prime Minister Alexis Tsipras again took aim at the International Monetary Fund for its “mistaken policies,” saying it was “time to get serious as the livelihoods of millions of people were at stake.” His remarks follow similar comments made by government officials last week to the effect that the IMF’s demands for more reforms were an obstacle to a deal. Tsipras said the Fund’s policies were damaging not only Greece but Europe as well. The stakes, he said, are too high for the third bailout program not to succeed, otherwise not just Greece but Europe will suffer as well – at a time when it is faced with three parallel crises – financial, security and refugees.

“And right before a crucial referendum [in Britain], I think what is most important is stability and recovery and the prospects of its [Europe’s] people.” But IMF chief Christine Lagarde was adamant on Monday that Greece must implement more reforms, even though she admitted that the Fund had made mistakes in its handling of the Greek crisis. “Greece cannot just continuously tag along and expect that things will be sorted out. The Greek leaders will need to take more ownership of re-establishing their country,” she said. The government is racing against time to complete the first review of its third bailout package by Easter so as to push for debt relief discussions at the IMF’s Spring Meeting in Washington this weekend.

According to the Greek government, last July’s bailout deal clearly stipulates that debt relief would be on the table for discussion once the first review was concluded. “[The deal] is absolutely clear: It says that after the successful conclusion of the first review, the discussion on the debt will begin without terms and preconditions,” Tsipras said during a joint press conference with his Portuguese counterpart Antonio Costa, who is on an official visit to Athens.

Our friend Kostas and his Social Kitchen crew serve a lot of meals at Ellliniko, among other sites. The situation is fluent and volatile, but they keep trying every day.

• Greece Hopes To Move Refugees From Piraeus, But Tension At Elliniko (Kath.)

Authorities are hoping to convince hundreds of refugees and migrants to leave the unofficial camps at Idomeni and Piraeus in the coming days, as tension builds up at other facilities. The government aims to transport around 1,500 people from the camp at the Piraeus passenger terminal by the end of the week and said that four buses full of migrants had left Idomeni in northern Greece on Monday. The refugees from Piraeus will be taken to Skaramagas, west of Athens, where the army has created another temporary facility to house the migrants who have found themselves trapped in Greece. Officials are hoping the fact that some refugees have already moved to the camp and found conditions to be good will help them persuade others to leave the overcrowded site at Piraeus, where more than 4,100 people are currently camped.

However, concerns mounted on Monday over the situation at a reception center for refugees and migrants at the site of the capital’s old airport in Elliniko, southern Athens, where thousands of desperate people are living in cramped and tense conditions. In a letter to the Interior, Immigration and Defense ministries, the head of the real estate company designated to oversee the management of the Elliniko plot described the situation at the site as “out of control and harboring serious risks.” In the letter, Soultana Spyropoulou noted that a three-month agreement to host migrants at the site expired at the end of March and had envisaged 700 people, not the approximately 6,000 currently residing there. Police officers who have been assigned to guard the site report daily brawls between groups of migrants as well as thefts and even cases of rape.

Some 10% of whom are already lost. European values.

• 95,000 Unaccompanied Children Applied For Asylum In Europe In 2015 (EUO)

At least 95,000 unaccompanied children applied for asylum in Europe last year, four times the numbers for 2014. The huge increase was discovered by the Bureau of Investigative Journalism during an investigation into the level of migration among unaccompanied children, defined as those under 18 years old, in Europe and the stark inconsistencies in the way they are treated. From approaching 29 different governments for statistics, the investigators found that at least 95,070 applied for asylum in Europe in 2015, up from 23,572 in 2014. The figure is much higher than previous estimates, and provides the clearest picture yet of the actual scale of migration among unaccompanied minors during last year’s refugee crisis. Only 17 of the 29 countries provided data. Spain refused to cooperate, while France said publication of official data would be later this year.

Eurostat will also complete its own figures later this year. The children are treated very differently by national authorities, with some using controversial methods such as wrist bone X-rays to determine age. The numbers raise serious questions, not only for the ability of countries to cope with the influx, but also around the children’s welfare and their uncertain future. The UK-based Bureau of Investigative Journalism has been investigating the issues faced by unaccompanied minors for two years. The focus had been on the UK but was expanded to continental Europe late last year. It approached 27 EU member states for numbers, plus Norway and Switzerland. Almost all of the larger countries were among the 17 that provided details. Of those 17, Sweden registered the most asylum applications by lone children in 2015 – 35,369. This was followed by 14,439 in Germany, 9,331 in Austria and 8,804 in Hungary.

The Big Shift.

• Italy Rescues 1,850 Migrants In Strait Of Sicily (AFP)

The Italian coastguard Monday rescued 1,850 migrants in eight operations in the Strait of Sicily, as a wave of boats departing from the Libyan coast intensifies. Two small boats carrying a total of 740 people were intercepted by the coastguard ship Diciotti, while Italian Navy vessel Cigala Fulgosi came to the aid of two inflatable dinghies with 255 people on board, a coastguard statement said. A merchant ship was diverted to help another 117 people, while an EU naval force vessel picked up 738 migrants trying to cross on two barges and a small boat.

According to UN refugee agency data at the end of March, some 17,500 people have arrived in Italy since the start of the year. Two weeks ago nearly 1,600 migrants were rescued in the same area, adding to fears that calmer seas at the onset of spring are encouraging greater numbers of migrants to attempt the perilous crossing after a winter lull. There are also concerns that European efforts to shut down the migrant sea crossing from Turkey to Greece will encourage more people to attempt the more dangerous Mediterranean passage from Libya to Italy.