Zao Wu-Ki Le soleil rouge 1950

Cavafy – Monotony

“The few who ventured near the Capitol were mostly somber, as if they were attending a vigil.” “It feels a little postapocalyptic..”

• Here Are the Superheroes To Come and Save Us (MPN)

We rely on the media to hold the powerful to account. But in its first hours in office, the corporate press has celebrated, rather than challenged, the new Biden administration. It began immediately during the 78-year-old Delawarean’s inauguration, with senior figures in the media barely able to contain their emotions watching what they saw. “As Lady Gaga sang the national anthem, the sky opened up and sunlight reflected off of the Capitol, illuminating the flag,” wrote Olivia Nuzzi, the New Yorker’s Washington correspondent. The New York Times was in a similarly poetic mood. “Whether or not related to the former president’s absence, a bipartisan lightness seemed to prevail across the stage at President Joe Biden’s inauguration. Snow flurries gave way to sun,” ran its subheadline.

If it were not clear enough that corporate media intends to spend the next four years propping up, rather than scrutinizing President Biden, then senior CNN figures spelled it out. “Trump—>Biden. Lies—>truth. Ignorance—>knowledge. Amorality—>decency. Cruelty—> empathy. Corruption—>public service” wrote CNN’s White House correspondent John J. Harwood on Twitter, attributing several extremely positive (and questionable) qualities to the incoming president. Meanwhile, the company’s head of strategic communications, Matt Dornic, was in an even more bombastic mood. Sharing a picture of fireworks exploding over the Washington Monument, he remarked that, “This team truly understands optics. These images will inspire our friends and shake our foes.”

Leaving aside why some colorful pyrotechnics would terrify Russia, China or any nation, Dornic’s rhetoric worried many who felt the nation’s top journalists should see themselves as the government’s adversaries, rather than their allies. “Note how this CNN imperial stenographer fearmongers about foreign bogeymen with his “foe” rhetoric. The real foe of average working-class Americans isn’t any foreign nation; it’s the parasitic capitalist oligarchs who control everything and their lackeys in politics and the media,” replied Ben Norton of The Grayzone. Perhaps the most adulatory coverage of the inauguration came from MSNBC, however, with analyst John Heilemann depicting the senior politicians present as almost mythical ubermensch. “What was to me so striking about today was that comforting sense,” he said.

“The sight of the Clintons and the Bushes and the Obamas — The Avengers, the Marvel superheroes back up there together all in one place with their friend Joe Biden.” He later went on to compare Biden’s speech to Abraham Lincoln’s second inaugural address of 1865 after the union victory in the American Civil War and claimed there was a deep sense of relief washing over the nation’s capital.. This sentiment was apparently not shared by ordinary people on the street. Even as it was praising Biden, the New York Times reported that “The few who ventured near the Capitol were mostly somber, as if they were attending a vigil.” “It feels a little postapocalyptic, to be honest,” one told them.

How is this not the thought police?

”..algorithms and recommendations that breed extremism and undermine the sense of “objective reality.”

• Dems Demand Social Media Stop ‘Polluting Minds Of American People’ (RT)

Democrats in the US Congress have urged major social media platforms to eliminate algorithms and recommendations that breed extremism and undermine the sense of “objective reality.” Representatives Anna Eshoo and Tom Malinowski wrote letters demanding change to Facebook CEO Mark Zuckerberg and Twitter CEO Jack Dorsey. A similar letter was sent to the CEO of Google, Sundar Pichai, and Susan Wojcicki, the CEO of YouTube, which is owned by Google. “For years, social media companies have allowed harmful disinformation to spread through their platforms, polluting the minds of the American people,” Eshoo tweeted. The lawmakers argued that social media platforms allow content which reinforces “existing political biases, especially those rooted in anger, anxiety, and fear.”

They said the algorithms used by Big Tech “undermine our shared sense of objective reality” and “facilitate connections between extremist users,” which lead to violence in real life, like the storming of the US Capitol in Washington, DC on January 6. Twitter was urged to “immediately make permanent changes to limit the spread of misinformation and other forms of harmful content.” Facebook and YouTube were similarly asked to tweak their recommendation systems in order not to promote “dangerous conspiracy theories” among users. The Democrats and many in the media accused former President Donald Trump of inciting the crowd of his supporters to seize the Capitol in hopes of overturning the results of the 2020 presidential election.

“We are in a sort of left-wing version of the Corleone “Godfather” cinema family “taking care of business” all at once.”

• New McCarthyism Will Prove An Orwellian Mistake – Hanson (K.)

The efforts of “Big Tech” to ban Trump and many of his supporters, while Apple, Google etc in concert made it almost impossible for a conservative site like Parler to exist, are reflections of a Salem Witch trial madness sparked by the trifecta of Trump’s loss, the Capitol violence, and the Republican loss of the Senate. Hysteria reigns as books by conservatives are now canceled, thousands kicked off social media, radio hosts fired etc. We are in a sort of left-wing version of the Corleone “Godfather” cinema family “taking care of business” all at once. Yet this new McCarthyism will prove an Orwellian mistake, and constitute one of the greatest political blunders in modern US history.

Think of the Ayatollah Khamenei calling for the destruction of Israel on Twitter with impunity or Antifa announcing planning sessions for their next riot, on Facebook with impunity – juxtaposed to social media banning those who merely showed up in Washington at a peaceful rally and did not join the violent splinter group who stormed the halls of Congress. In contrast, again, the current Vice President Harris earlier had called for the more protests this summer. Many were violent and occasionally lethal, resulting in mass looting, death and arson by Antifa and BLM. She worked to bail out those arrested for street violence. The public is tiring of such asymmetries. US publishers all the time publish books like “In Defense of Looting” – a manifesto supporting the mass theft from stores this summer. So there is no consistency in the current violations of free speech.

And the effort to remove Trump before his tenure not only failed, but showed his opponents as small-minded and vindictive and further divided a 50/50 divided country. The attempt to coordinate Big Tech to destroy the conservative opposition’s means of communicating with the public came by design on the eve of the most revolutionary moments in modern history to come: Very soon the Left plans to end the 180-year Senate filibuster, the 234-year Electoral College, the 60-year 50-state union (by adding Puerto Rico and Washington DC), and the 150-year-old nine-person Supreme Court – and now will have its critics de-platformed from social media or afraid to express objections in fear of being banned.

“..When 13-year-olds are entrusted with cellphones and Snapchat accounts, they can use them to bring shame on innocent children and even destroy their lives. Often, this involves spreading false rumors about the person or discrediting them for something they espouse, like their religion, their political beliefs or their sexual identity. Tell me how this is different from what Twitter, Facebook and YouTube have done to Donald Trump..”

• Big Tech, Big Brother, & The End Of Free Speech (RCP)

In George Orwell’s “Nineteen Eighty-Four,” members of the Outer Party of Oceania engage in the Two Minutes Hate ritual against Emmanuel Goldstein, who is supposed to be the enemy of the people but may actually just be a fabricated symbol to distract the people from their real enemy — Big Brother. In Nancy Pelosi’s “Twenty Twenty-One,” members of the Democratic Party engage in the Two Hours Hate against Donald Trump, who is supposed to be the enemy of the people, but may actually just be a fabricated symbol to distract the people from their real enemy — Big Tech. Two hours of hate — er, debate — was held in the House of Representatives last Wednesday for the avowed purpose of removing a president of the United States. That’s all it took. Two hours. That should tell you everything you need to know about the state of democracy in our country.

[..] In a sense, Big Tech has taken cyberbullying to its logical conclusion. When 13-year-olds are entrusted with cellphones and Snapchat accounts, they can use them to bring shame on innocent children and even destroy their lives. Often, this involves spreading false rumors about the person or discrediting them for something they espouse, like their religion, their political beliefs or their sexual identity. Tell me how this is different from what Twitter, Facebook and YouTube have done to Donald Trump and, by extension, the more than 74 million people who voted for him. This group of post-pubescent cyberbullies in Silicon Valley doesn’t like Donald Trump. They feel justified in calling him names like white supremacist and Nazi and racist. They don’t care whether it hurts him or not. They don’t care whether it is true or not. They are strangely enlivened by what they perceive as their ability to hurt him, to weaken him.

Like the mob that they have attempted to link the president to, these bullies act in mindless concert, emboldened by each other to see who can strike the deeper blow, who can make the victim hurt more. And over what? Differences of opinion, for the most part. Strong border or no border? Mask or no mask? Globalism or Americanism? Carbon credits or fracking? Abortion or no abortion? And then the last straw — fair election or fraudulent election? These should be legitimate subjects for debate in a free society. But not anymore. Big Tech has banned debate about government policy on the coronavirus, and any discussion of election fraud is treated as if it were a crime. But wait? It’s only a crime to question the government in a totalitarian system, like that in communist China or Orwell’s fictional Oceania, right?

In America, we have the right and obligation to question our government, don’t we? Because, if we don’t have that right any longer, then what are they afraid of? What are they hiding? Bottom line: At some point in some election, the allegations of election fraud have to be real. It can’t always just be the figment of some right-wing president’s imagination. And if we aren’t allowed to have free speech, then how do we fight back? If Big Tech and Big Government have their way, we don’t. Just keep your head down and your nose clean — and never ever question what you are told.

“..not a bad or even a terrible plan, but literally a “nonexistent” plan, despite the fact that 36 million vaccines had already been delivered..”

• The Echo Chamber Era (Matt Taibbi)

Blue-state audiences didn’t ask for accounting for those official warnings for the same reason Trump voters never asked what happened to those three million undocumented votes Hillary Clinton supposedly won in 2016: audiences don’t demand explanations for puffed-up claims about other groups. People like Sullivan would have you believe that “balance” is a mandate to give voice to clearly illegitimate points of view, but it’s really about not falling so completely in love with your “values” that you stop caring to avoid mistakes about those who don’t share them, or even just mistakes generally. By any standard, the press had a terrible four years, from the mangling of dozens of Russiagate tales to scandals like the New York Times “Caliphate” disaster and the underappreciated Covington High School story fiasco.

Still, many in the business can’t see how bad it’s been, because they’ve walled themselves off so completely from potential critics. Coupled with the enhanced aggressiveness of Silicon Valley in removing dissenting accounts across the spectrum — Facebook is taking down six Socialist Workers Party accounts in Britain as I write this, a day after zapping a series of Antifa accounts — reporters at places like the Post, the Times, and CNN every day have less and less to worry about in terms of audience blowback, and they know it. Just in the first few days of the Biden administration, we’ve seen editorial decisions that would never have been attempted once upon a time. The Post just tried to remove seven paragraphs of their own archived article about Vice President Kamala Harris, which contained a cringeworthy scene of Harris and her sister joking about prisoners begging for water, only to restore it after an outcry.

CNN meanwhile ran a story that incoming Biden officials had to “build everything from scratch” with regard to Covid-19 policy because the Trump administration had no plan for vaccine distribution at all — not a bad or even a terrible plan, but literally a “nonexistent” plan, despite the fact that 36 million vaccines had already been delivered. In this rare case, rival media organizations cried foul, with reporters from both Politico and the Washington Post blasting the report as untrue and a “gambit to lower expectations” by the incoming administration. In an atmosphere where editors really feared discontent from outside demographics or rival party politicians, a story like that, with an over-the-top-to-impossible premise, would never even be tried.

COVID is not a one-dimensional issue, but it keeps being treated as such. “500,000 children under 18 in England, with no previous problems, will need mental health care..”

• 500,000 More British Kids Face Mental Health Issues (Wilson)

The gloom is infectious, as a study out today from the Universities of Birmingham and Oxford confirmed. Formerly freewheeling, high-spirited online chats have morphed into muted complaints and low moods as the novelty of school in the kitchen wore off long ago. The wide, everchanging schoolyard social networks of our children have disappeared, replaced by social contact with whoever happens to be online at the same time they are. Boredom encourages bickering and the subtleties of personal relationships are forced to rely on broadband speed, What’s App chat emojis and access to a shared computer. It is not healthy in any way. We now risk destroying our children’s love of learning while creating a mental health crisis that has struck half a million previously healthy kids across the nation already, according to the Centre for Mental Health.

It says 500,000 children under 18 in England, with no previous problems, will need mental health care due to the devastating economic, health and family pressures caused by the ongoing coronavirus crisis. This has manifested itself in children as young as five reporting self-harm and suicidal thoughts to counsellors and a tripling in the number of eating disorders reported by adolescents. An Ofsted report in November discovered that more than two months of lost schooling last spring had resulted in children regressing in basic skills such as reading and writing. And –as always– it is the poor who suffer worst. It’s estimated 1.1m kids have no computer at home, making attending online lessons impossible. The Institute for Fiscal Studies found that, in the last lockdown, better-off children spent 30 per cent more time on remote learning than disadvantaged ones. The attainment gap between rich and poor pupils will grow markedly.

A survey by England’s Mental Health of Children and Young People survey found that more than a quarter of children aged five to 16 reported disrupted sleep, one in five did not have somewhere quiet to work, and girls had the highest prevalence (27.2 per cent) of probable mental health issues. This is all shocking news. Our children are facing serious problems with their mental health in numbers never seen before and yet with no end date in sight they are expected to sit in front of a screen five hours a day, five days a week. It’s not helping, and it is clear that keeping schools shut is doing immense and lasting damage to our children.

We had a discussion in yesterday’s Debt Rattle thread about the first real-world analysis of the Pfizer/BioNTech vaccine. Which answers some questions, and leaves new ones. The 33% efficacy after two weeks raises alarms. Even if it rises afterwards.

I still have many questions about what exactly constitutes the efficacy. If all it does is keep people from getting more severely ill, that is fine, but at least be open about it.

• Israel Analysis Of COVID Vaccine Raises Questions About UK Strategy (Sky)

The first real-world analysis of the Pfizer/BioNTech coronavirus vaccine suggests it is matching its performance in clinical trials, but raises serious questions about the UK’s decision to delay the second dose. Scientists in Israel – which is leading the COVID-19 vaccination race – have told Sky News that they are “very hopeful” having studied preliminary data from 200,000 vaccinated people. But crucially they say their results do not show efficacy at a level close to that used by the UK to justify delaying the second dose of the Pfizer/BioNtech jab. Professor Ran Balicer is a physician, epidemiologist and chief innovation officer for Clalit, the largest health care provider in Israel. He is also an adviser to the WHO. “We compared 200,000 people above the age of 60 that were vaccinated. We took a comparison group of 200,000 people, same age, not vaccinated, that were matched to this group on various variables…” Prof Balicer said.

“Then we looked to see what is the daily positivity rate… And we saw that there was no difference between vaccinated and unvaccinated until day 14 post-vaccination. “But on day 14 post-vaccination, a drop of 33% in positivity was witnessed in the vaccinated group and not in the unvaccinated… this is really good news.” However, UK scientists said in December that trial data had suggested it would be 89% effective after one dose. A document issued by the UK government’s vaccine advisers, the Joint Committee on Vaccination and Immunisation, to justify delaying the second dose for up to 12 weeks said: “Using data for those cases observed between day 15 and 21, efficacy against symptomatic COVID-19 was estimated at 89%, suggesting that short term protection from dose 1 is very high from day 14 after vaccination.”

This is much more optimistic than the new real-world Israeli data suggests. Responding to the UK government strategy, Prof Balicer said: “The data and estimates I gave are what we have. “We could not see 89% reduction in the data we reported. Further data and analyses will be released in peer reviewer scientific format.” He added: “The practice in Israel is to provide the second vaccine at three weeks. “And so it is impossible for us to tell what would be the impact of not providing the second dose…” Israel is following Pfizer/BioNtech protocol in giving the second dose of the coronavirus vaccine three weeks after the first. It has a smaller population and a regular supply from Pfizer/BioNtech. In return it’s providing detailed data to Pfizer.

And this is just incredibly weak: “If vaccines are effective at preventing infections, then their indirect benefit — protecting unvaccinated people — will be visible only once enough people have been immunized..”

• Are COVID Vaccination Programmes Working? (Nature)

The results from Israel are among the first to report the impact of vaccines administered to people outside clinical trials. They provide an early indication that the two-dose RNA-based vaccine developed by Pfizer–BioNTech can prevent infection or limit its duration in some vaccinated people. In a preliminary analysis of 200,000 people older than 60 who received the vaccine, compared with a matched group of 200,000 who did not, researchers found that the chances of testing positive for the virus were 33% lower two weeks after the first injection. “We were happy to see this preliminary result that suggests a real-world impact in the approximate timing and direction we would have expected,” says Ran Balicer, an epidemiologist at Israel’s largest health-care provider, Clalit Health Services, in Tel Aviv.

He expects to get more conclusive results several weeks after people receive their second shot. Another analysis, by Maccabi Healthcare Services, found a similar trend, although neither study has been peer-reviewed. Clinical trials of the Pfizer–BioNTech vaccine show it to be around 90% effective at preventing COVID-19, and the preliminary data suggest it can also provide some protection from infection. But it will take longer to establish whether vaccinated people no longer spread the virus to unvaccinated people, says Balicer. As more than 75% of older people in Israel have been vaccinated, Balicer says he expects to see a drop in hospitalizations among vaccinated older people over the coming weeks.

Most countries are prioritizing COVID-19 vaccinations for people who have a high risk of getting severe disease and dying. So, the first evidence that shots are working in those countries will probably be reductions in hospitalizations, and then in deaths, says Alexandra Hogan, an infectious-disease modeller at Imperial College London. If vaccines are effective at preventing infections, then their indirect benefit — protecting unvaccinated people — will be visible only once enough people have been immunized, says Natalie Dean, a biostatistician at the University of Florida in Gainesville. Israel will probably be the first country to see this kind of population-wide impact, say researchers. This is because it is using a high-efficacy vaccine and aiming for wide coverage with the explicit goal of achieving herd immunity, when enough people are immune to a virus for its spread to be controlled.

Yeah, but effective at what? Not at protecting others, that much is clear now.

• One Dose Of Pfizer Vaccine Could Be Less Effective Than Expected (BMJ)

Concerns have been raised over how much protection a single dose of the Pfizer BioNTech covid-19 vaccine provides, following reports from Israel that it is much lower than expected. Israel, which, like the UK, is currently in its third national lockdown, has so far vaccinated more than 75% of its older people with at least one dose. Early reports from the vaccine rollout have suggested that the first dose led to a 33% reduction in cases of coronavirus compared with efficacy of at least 52% reported in clinical trials. A preliminary report from the Clalit Research Institute compared the infection data of 200.000 people aged 60 and over who were not vaccinated with the infection data of 200.000 people of the same age group who received one vaccine dose and were monitored for at least 11 days from the date of vaccination.

On day 14 there was a significant decrease of about 33% in the rate of positive tests for the coronavirus among those who had been vaccinated. This decrease remained the same between days 15 and 17. The report has raised concerns, as published results have suggested that the efficacy of the Pfizer vaccine was 52.4% between the first and second dose (spaced 21 days apart), and data assessed by Public Health England indicated it could be as much as 89% protective from day 15 to 21. The Clalit Research Institute stressed, however, that its results included only people aged 60 and over whereas Pfizer trials also included younger people and that the findings have not yet been peer reviewed. Additionally, the Clalit study identified those infected according to laboratory tests of those who chose to be tested, while Pfizer’s studies only referred to the appearance of symptomatic disease.

In the UK, the vaccine policy prioritises getting as many at risk people vaccinated with one dose over ensuring people get two doses within the time specified in clinical trials. While there are data to suggest the chosen 12 week interval between the two doses is effective for the Oxford AstraZeneca vaccine, there are no data to support this interval for the Pfizer vaccine. As such, a leading statistician has written to UK health secretary Matt Hancock urging him to investigate the effects of the decision to extend the gap between the first and second dose of the Pfizer BioNTech vaccine.

“Unfortunately, the EU purchases vaccines very slowly, so Hungary continues negotiations with Israel, Russia, and China,” Orban said.”

• Hungary First EU Country To Get Russia’s Sputnik V Covid19 Vaccine (RT)

Shortly after becoming the first EU country to approve Russia’s Sputnik V vaccine, Hungary has agreed on a three-stage supply deal with Moscow. Budapest will receive its first delivery of doses in February. The contract between the Russian Direct Investment Fund (RDIF) and the government in Budapest was made on Friday, in a meeting between Russian Minister of Health Mikhail Murashko and Hungarian Minister of Foreign Affairs Péter Szijjártó. According to Murashko, Hungarian experts visited the Gamaleya Institute, where the formula was invented, and conducted a thorough examination of vaccine production sites. The scientists also had the opportunity to review clinical trial results. “Many countries today approve the use of the Russian Sputnik V, and we are actively cooperating with the World Health Organization,” Murashko told the press.

In response, Szijjártó called the announcement of the agreement “a great honor,” assuring Hungary’s citizens that experts from the country’s own National Institute of Pharmacology and Food Safety reviewed the entire process themselves. On Thursday, it was revealed that Budapest had approved Sputnik V for emergency use, despite it not yet being deemed safe by the European Medicines Agency (EMA). On January 8, Hungarian President Victor Orban complained that the European Union was being too slow to make any decisions, putting citizens’ lives at risk. “Unfortunately, the EU purchases vaccines very slowly, so Hungary continues negotiations with Israel, Russia, and China,” Orban said. Two weeks later, his country approved Sputnik V for use.

Branch Covidians.

• Overall Mortality Is Around Normal For This Time Of Year (RT)

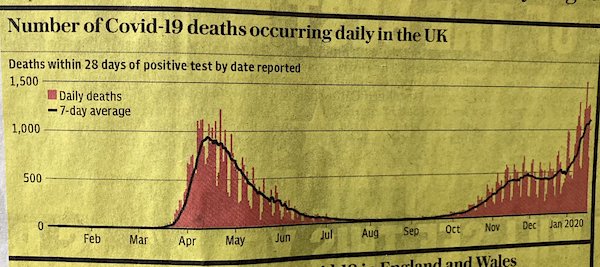

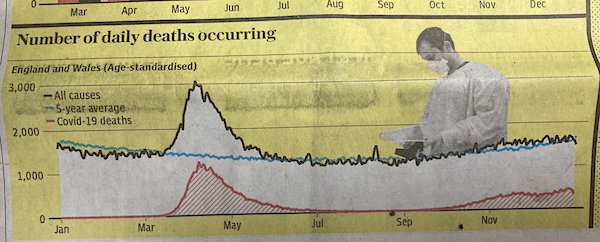

Although the numbers of deaths attributed to the virus in the UK are higher than they’ve ever been, in total, not many more people are dying than in any other cold season. Is the mainstream media finally waking up to this?

A recent article in the Telegraph is one of the first in a mainstream outlet to even suggest a challenge to the official coronavirus narrative. These days, that narrative claims that the ‘second wave’ is actually deadlier than the first. (Recently, some Branch Covidians have been claiming a ‘third wave’, but there is not yet a united front on that.) The basic reasoning of the article is sound, even if it is long overdue. It laments how every day, the media solemnly reports the latest figures on Covid deaths. Presenting this figure in isolation results in graphs such as this one, which does indeed seem to show that we are at the height of a second, worse phase of a pandemic.

But, like any statistics, daily death numbers are meaningless without context, which the media rarely provides. They do not provide context because, if they did, the public might see a graph such as this one, from the Telegraph article.

It quite clearly shows the spring spike in overall mortality, which was caused by Covid (plus lockdowns). After that ends in summer, we see… nothing. Overall mortality ever since, even through this winter, hovers at around the five-year average. And overall mortality, as I’ve repeatedly pointed out, is the only true way to know whether you are in a pandemic or not – all other figures can easily be fiddled. So, why are the excess death data and the Covid deaths data so out of whack? And why isn’t Covid killing lots and lots of people this winter, as it did in spring? Even if you ascribe all excess deaths to Covid and none to lockdown, there really does not seem to be anything out of the normal variation in total deaths from year to year. And surely, by now, the toll of unnecessary deaths caused by untreated cancer, heart disease, depression and so on, has at least begun to register.

You mean it was’t all Trump’s fault?

• How US CDC Missed Chances To Spot COVID’s Silent Spread (R.)

Critics have widely asserted that the CDC fumbled key decisions during the coronavirus scourge because then-President Donald Trump and his administration meddled in the agency’s operations and muzzled internal experts. The matter is now the subject of a congressional inquiry. Yet Reuters has found new evidence that the CDC’s response to the pandemic also was marred by actions – or inaction – by the agency’s career scientists and frontline staff. At a crucial moment in the pandemic when Americans were quarantined after possible exposure to the virus abroad, the agency declined or resisted potentially valuable opportunities to study whether the disease could be spread by those without symptoms, according to previously undisclosed internal emails, other documents and interviews with key players.

Soon after balking at testing the returnees from Wuhan, the agency delayed testing asymptomatic passengers among 318 evacuees from the Diamond Princess, a contaminated cruise ship in Japan. In addition, the agency failed at that time to make effective use of outside experts and appeared at times unprepared for the crisis on the ground, lacking adequate personal protective gear and ignoring established protocols, Reuters found. “Yes, they were interfered with politically,” said Lawrence Gostin, director of the O’Neill Institute for National and Global Health Law at Georgetown University, referring to alleged meddling by the Trump administration. “But that’s not the only reason CDC didn’t perform optimally during COVID-19. There are a lot of things that went wrong.”

Four top public health experts or ethicists told Reuters that the question of whether to test or engage in research on detained people has always been a sensitive topic. But all said the CDC should have proceeded given the fast-moving public health emergency. Moreover, the CDC finalized rules in 2017 providing that medical testing was expressly allowed in quarantine, as long as participants were given the opportunity to give “informed consent” or opt out. Informed consent means giving people adequate information to understand the risks and benefits of a test or procedure. Gostin said the CDC’s argument against testing was “unreasonable” under the circumstances. “You are asking for consent and not imposing any harm,” he said. “There is a good reason to do it.”

It’s difficult to know whether more aggressive early testing among asymptomatic people would have significantly altered the trajectory of the pandemic in the United States, which has infected 24 million people and killed more than 400,000. The CDC was not the only agency that struggled with this issue. Notably, an official with the World Health Organization called asymptomatic spread “very rare” in June, only to say a day later “we don’t actually have that answer yet.” In recent months, the WHO has said infected people without symptoms can be contagious, but “it is still not clear how frequently this occurs.”

The circus is in town.

• McConnell Lays Out Trump Impeachment Trial Timeline (ZH)

While the left is split between wanting to hammer the final nail in Trump’s coffin (through the Senate impeachment trial) and tending to its aggressive agenda of new laws, spending, and government control, U.S. Senate Republican Leader Mitch McConnell (R-KY) issued a statement today regarding his proposed timeline for the first phases of an impeachment trial of former president Trump. “I have sent a proposed timeline for the first phases of the upcoming impeachment trial to Leader Schumer and look forward to continuing to discuss it with him. “Senate Republicans are strongly united behind the principle that the institution of the Senate, the office of the presidency, and former President Trump himself all deserve a full and fair process that respects his rights and the serious factual, legal, and constitutional questions at stake.

“Given the unprecedented speed of the House’s process, our proposed timeline for the initial phases includes a modest and reasonable amount of additional time for both sides to assemble their arguments before the Senate would begin to hear them. “At this time of strong political passions, Senate Republicans believe it is absolutely imperative that we do not allow a half-baked process to short-circuit the due process that former President Trump deserves or damage the Senate or the presidency.” Specifically, Leader McConnell shared the following proposed pre-trial timeline with the Republican Conference today: “When the articles arrive, the House Managers would exhibit (read) the articles to the Senate, Senators would be sworn in the Members as the Court of Impeachment, and would issue a summons to former President Trump.

“While we do not know what day the Managers will choose, Leader McConnell has asked for this to occur on Thursday, January 28. Former President Trump would have one week from that day to answer the articles of impeachment (February 4). The House’s pre-trial brief would also be due then. The President would then have one week from the day he submits his answer to submit his pre-trial brief (February 11). That means former president Trump has fourteen total days from when we issue the summons to write his pre-trial brief. The House would also submit its replication on this date. The House would then have two days to submit their rebuttal pre-trial brief (February 13). This approach tracks the structure of the Clinton and Trump pre-trial processes. The periods between due dates are longer than in 1999 or 2020, but this is necessary because of the House’s unprecedented timeline.

“Who will step forward in his absence? Probably someone we haven’t heard from yet. That’s how these things work.”

• Rough Ridin’ with Biden (Kunstler)

As for Mr. Trump, he departed as he had arrived in 2016: stridently contemptuous toward the parasitical oligarchy that finally expelled him like a bladder-stone. The threatened impeachment trial will be a marvel of casuistry — a procedure for removing someone from office who is no longer in office — and also for the transparently flimsy charge of “inciting the insurrection” at the capitol. As if to underscore the absurdity of that, Antifa squads rioted in Portland and Seattle on inauguration night. Their banners expressed less-than-jubilant sentiment for the new regime. The Portland outfit broke windows and spray-painted the city’s Democratic headquarters, faking-out pols who had warned against an uprising of “white supremacists.”

Of course, all those arrested would be promptly released without charges — demonstrating just how serious the Wokester officials running those cities really are about criminal anarchy. The grannies swept into the capitol rotunda by Antifa incursionists January 6th won’t be so lucky. Neither did a much chattered-about military takeover happen during the tension-filled transition hours, though kibitzers on the web insist days later that it remains secretly underway. On his way out, Mr. Trump failed to pardon either Julian Assange or Edward Snowden, a disturbing failure, while he commuted the sentences of a couple of two-bit rap-stars, based on their contributions to advancing human dignity. And whatever Mr. Trump finally rooted out in the way of declassified FBI documents has already disappeared into the DC quicksand.

Much adored as he is for valiantly opposing everything swampish, it might be best now for Mr. Trump to just retire from the political scene and leave the battle to others. He made his point, colorfully and often bravely, considering the astounding bad faith of his adversaries, though he certainly could have articulated the stakes better and with more decorum. He leaves not merely a vacuum but a sucking chest wound of leadership opposing hysterical and tyrannical Wokery. Who will step forward in his absence? Probably someone we haven’t heard from yet. That’s how these things work.

Muhammad Ali once called Aaron “The only man I idolize more than myself.”

Aaron received the first dose of the Moderna vaccine on Jan 5.

I don’t normally do eulogies for athletes, but this is about so much more. I was thinking about the hardship people like Aaron and Jackie Robinson went through in America’s great national pastime.

Only when Muhammad Ali arrived did that really change. And he paid a big price for that.

• Home Run King Hank Aaron Dead At 86 (F.)

Aaron was born in Mobile, Ala., to Herbert Aaron, Sr. and Estella (Pritchett) Aaron in February of 1934. He and his seven siblings grew up poor, in a home without electricity or indoor bathrooms. Aaron didn’t have an opportunity to play organized baseball in high school because only white students had teams. He signed his first baseball contract, which paid him $10 a game, at the age of 17 with a local semi-pro team called the Mobile Black Bears. After a couple of seasons dominating the Negro Leagues, Aaron joined the Atlanta Braves in 1954. Over his incredible 22-year career, Hammerin’ Hank would tally 3,771 hits in 3,298 games played. Remarkably, Aaron still holds the all-time major league records for most RBIs (2,297), total bases (6,856) and extra-base hits (1,477). Yet, Aaron was best known for the long ball.

Despite measuring only six feet and weighing in at around 180 pounds in his prime, Aaron would finish his epic career with 755 career home runs, a mark that survived until Barry Bonds (reportedly with the help of steroids) broke it in 2007. Aaron was a first-ballot inductee into the National Baseball Hall of Fame in 1982. As he inched closer to passing Babe Ruth’s record of 714 home runs in the early 1970s, Aaron endured an avalanche of death threats from racists that did not want to see a Black man break Ruth’s revered record. In his 1991 autobiography, Aaron described how “when people finally realized I was climbing up Ruth’s back, the “Dear N——r” letters started showing up with alarming regularity. They told me no n——-r had any right to go where I was going.” In a 1992 interview with the Atlanta Journal, Aaron revealed he held onto all the hate letters he’d received. “I’m always going to keep them,” he said. “I don’t care what anybody says. It’s just like telling a Jewish family to forget about the Holocaust. If you’re not part of something, it’s easy to tell somebody to forget about it.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.