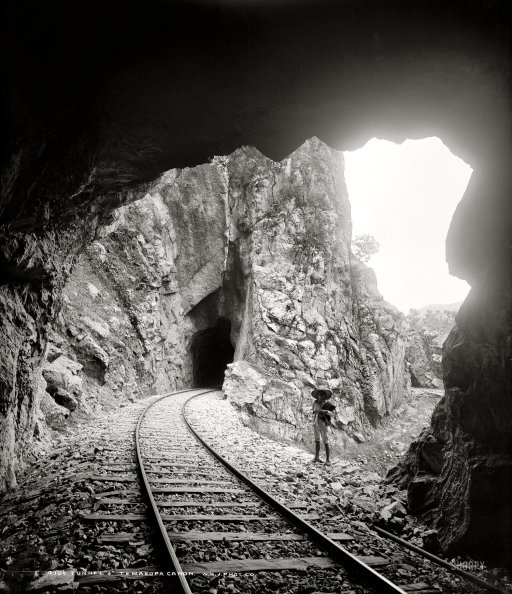

William Henry Jackson Tunnel 3, Tamasopo Canyon, San Luis Potosi, Mexico 1890

The entire formerly rich world is addicted to debt, and it is not capable of shaking that addiction. Not until the whole facade that was built to hide this addiction must and will come crashing down along with the corpus itself.

Central banks are a huge part of keeping the disease going, instead of helping the patient quit and regain health, which arguably should be their function. In other words, central banks are not doctors, they’re crack dealers and faith healers. Why anyone would ever agree to that role for some of the world’s economically most powerful entities is a question that surely deserves and demands an answer. But no such answer is forthcoming.

Instead, we all pretend Yellen, Kuroda and Draghi are in fact curing us of our ailments. Presumably because that feels better. That our health deteriorates in the process is simply ignored and denied. But then, that’s what you get when you allow for a bunch of shaky goalseeked economic rules to be taken as some sort of gospel. People one thought leeches healed too, or bloodletting, exorcism, burning at the stake, you name it. Same difference, just a few hundred years later.

What’s happening today is that central bankers start to find that their goalseeked ideas are no longer working. What might work for one may backfire for another. That this might be the direct result of their own mindless policies will never even cross their minds. And so they will continue making things worse, until that facade they operate on cannot hold any longer.

The EU started its braindead QE program yesterday. If it gets to purchase the entire €1.14 trillion in bonds it aims for, that will be a bad thing. If it doesn’t, that will be an arguably worse thing. Draghi should have stayed away from this heresy, but it’s too late now: the die is cast.

Why banks and funds would sell their long maturity bonds, with a relatively high yield, to him, is not clear. On the other hand, that many funds will compete with the ECB for the few bonds that are available, is clear. Draghi simply attempts to turn the sovereign bond market into casino with zero price discovery. Whether he will succeed in that is not clear. To get it done, though, he will have to make some very peculiar moves. That again is clear. Durden:

Presenting The Buyers Of Over 100% Of New German And Japanese Bond Issuance

Back in December, when the total amount of annual ECB Q€ was still up in the air and and consensus expected a lowly €500 billion annual monetization number, we calculated that based on Germany’s capital key contribution of about 26%, the ECB would monetize some €130 billion of German gross issuance, or about 90% of the total scheduled issuance for 2015. Subsequently, the ECB announced that the actual amount across all ECB asset purchasing programs, will be some 44% higher, or €720 billion per year (€60 billion per month). So what does that mean for the revised bond supply and demand across two of the most important developed markets?

Well, we already know that the Bank of Japan will monetize 100% or just over of all Japanese gross sovereign bond issuance (source). As for Germany, on a run-rate basis, and assuming allocation based on the abovementioned capital key, it means that for the next 12 month period, assuming no major funding changes in Germany, the ECB will swallow more than a whopping 140% of gross German [Bund] issuance! Or, said otherwise, the entities who will buy more than all gross German and Japanese issuance for the next 12 months, are the ECB and the Bank of Japan, respectively.

This also means that to fulfill its monthly purchase mandate, the ECB will have to push the price to truly unprecedented levels (such as the -0.20% yield across the curve discussed previously, or even lower) to find willing sellers. That said, please don’t tell your average Hinz and Kunz that more than all German bond issuance in 2015 will be monetized. It will bring back some very unpleasant memories.

Japan’s Abenomics are a huge failure, and so it looks like another double or nothing is in the offing. They’ll keep doing it until they can’t, because that’s their whole repertoire. Though it is a little weird to see Bill Pesek, and BoJ chief Kuroda, claim that Japan’s QE failed because it wasn’t big enough. Seen Japanese debt numbers lately, Bill? Not big enough yet?

Three Reasons Japan Will Get More Stimulus

With annualized growth of 1.5% between October and December after two straight quarters of contraction, Japan is hobbling out of recession far more slowly than hoped. A third dose of quantitative easing is almost certain. Here are three reasons why.

First, the initial rounds of QE weren’t potent enough. “In order to escape from deflationary equilibrium, tremendous velocity is needed, just like when a spacecraft moves away from Earth’s strong gravitation,” Kuroda recently explained. “It requires greater power than that of a satellite that moves in a stable orbit.”

Although the Bank of Japan managed to lower the value of the yen by more than 20% beginning in April 2013, that clearly hasn’t provided enough of a boost to the economy.

Maybe you can’t boost the 20-year coma the Japanese economy has been in by hammering the currency? Just a thought, Bill. And sure, Kuroda’s spacecraft metaphor is mighty cute, but what tells you economies are just like rocket ships? I like this piece from Deutsche Welle much better:

On Monday the European Central Bank begins its long-anticipated program to buy sovereign bonds on secondary bond markets – i.e. previously issued government bonds held by institutional investors like banks or insurance funds. In central bankers’ jargon, this is called “quantitative easing,” or QE. The ECB’s plan is to pump €60 billion euros into the financial markets each month, by trading central bank reserve money (a form of electronic cash) for bonds. That’s set to continue until at least September 2016, which means at least €1.1 trillion will be put into the hands of investment managers – who will have to find some alternative investments to make with the money.

On Thursday last week, at the ECB’s governing board meeting in Nicosia on Cyprus, the central bank revised its projections for both GDP growth and inflation in the eurozone upward: The inflation rate is projected to go up to 0.7% for this year, and GDP growth from 1.0 to 1.5%. But are the new projections just a case of whistling in the dark? There are in fact serious doubts as to whether the ECB will actually be able to meet its targets, or if, instead, the bond-purchasing program will have effects that will make a structural recovery of the eurozone more difficult.

For a start, many observers doubt whether the ECB will even be able to find willing sellers for €60 billion a month of bonds. Sovereign bonds – especially those of the core eurozone member states, like Germany – may soon become rather scarce on secondary markets. Neither domestic banks and insurance funds, nor foreign central banks, will have much incentive to sell their government bond holdings to the ECB. The older bonds with long maturities and decent interest rates, in particular, will probably be held rather than sold. Moreover, experts question whether a flood of central bank reserve money, pumped into the hands of players in secondary financial markets, can generate a stimulus at all.

It probably won’t lead to any boost in their lending activities to real-economy businesses or households, for two reasons: First, banks have recently been obliged to increase their core capital reserves – the amount of shareholders’ money, including retained earnings, which is available to cover possible loan losses – and they’re still adjusting their balance sheets accordingly. That means they’re being cautious about lending.

That’s the basic question, isn’t it? “..whether a flood of central bank reserve money, pumped into the hands of players in secondary financial markets, can generate a stimulus at all.” But how do we answer it? Lots of people will want to point to the ‘success’ story of the US and the Fed, but there’s no way we can have any confidence in the numbers coming from the US. As for the EU and Japan, the failures are more obvious, but that may be because they’re less skilled in ‘massaging’ the data. All in all, the evidence, if it exists at all, is flimsy at best.

Oh, and then there’s China:

China’s ‘Money Garrote’ May Choke Us All

In this new era of all-powerful central banks, it is hard for investors to look past who will be next to take out the big gun of quantitative easing. This week, all eyes are on the ECB, which follows the Bank of Japan as the latest of the major monetary-policy makers to embark on its own aggressive bond-buying program. In contrast, China appears to be entering a “new normal” era, in which its central bank only has a pea-shooter [..] the benchmark money-supply growth target of 12% was the lowest in decades. Another part of China’s new normal is not just lower growth, but also an era where the central bank is no longer able to magically speed its money-printing presses.

Conventional wisdom holds that the People’s Bank of China (PBOC) has a gargantuan monetary arsenal, given that the country has the world’s largest stash of foreign reserves at $3.89 trillion [..] according to some analysts, this reserve accumulation is merely a byproduct of another form of quantitative easing. Rather than strength, its size indicates just how staggeringly large China’s domestic credit expansion has become in recent decades. According to strategist Albert Edwards at Société Générale, such foreign-reserve accumulation — which typically takes place in emerging markets — is equivalent to quantitative easing.

The PBOC’s historic mass-printing of money to buy foreign currency and depress the yuan’s value is little different from what the Federal Reserve and others have done, Edwards said. [..] the recent reversal in such reserve accumulation points to a significant turning point in monetary conditions. Indeed, Joe Zhang, author of “Inside China’s Shadow Banking System,” argues that China’s credit expansion has in fact been far more aggressive than the QE attempted in the U.S. or Europe.

Zhang, a former PBOC official, calculated that China’s money supply is already 372% of what it was at the beginning of 2006. And if you add up official data between 1986 and 2012, China’s benchmark M2 money supply has grown at a compound rate of 21.1%. While 7% economic growth is slow for China compared to the double-digit rates of the past, such data makes 12% money-supply growth looks positively measly. Another reason to believe that China is at the tail end of a huge monetary expansion is found in a recent study by McKinsey. They estimated that total credit in China’s economy has quadrupled since 2008, reaching 282% of GDP.

But now the conditions that enabled this debt habit have turned. Edwards argues that foreign-exchange accumulation by central banks is the key measure of global liquidity to pay attention to — and it is currently in free-fall. [..] while markets are focusing on the ECB’s easing announcement, they are missing this Chinese liquidity garrote that is strangling the global economy. Data from the IMF shows that central-bank foreign-reserve accumulation has been declining rapidly. China is at the center of this, with a $300 billion annualized decline over the last six months

The stress point for China is now its currency, which has fallen to a 28-month low against the dollar. The dilemma facing the PBOC is how to keep growth and liquidity sufficiently strong, while also maintaining its loose currency peg to a resurgent dollar. As China defends its currency regime, it must do the opposite of printing new money: using foreign reserves to buy yuan, contracting the money supply in the process.

The People’s Bank of China is a crack dealer with a client that no longer can afford its fix. Or perhaps it’s more accurate to say that all central banks are now crack dealers with such clients, and the PBOC is the first one that’s forced to admit it. And it now looks as if perhaps it can’t win back its market without spoiling it. And that is all about the dollar. A lot is about the dollar, and the looming shortage of them. And there’s nothing (central) banks can do. Not that they won’t try, mind you. Durden:

The Global Dollar Funding Shortage Is Back With A Vengeance

[..].. one can be certain that the current fx basis print around – 20 bps will most certainly accelerate to a level never before seen, a level which would also hint that something is very broken with the financial system and/or that transatlantic counterparty risk has never been greater. Unlike us, JPM hedges modestly in its forecast where the basis will end up:

.. different to previous episodes of dollar funding shortage such as the ones experienced during the Lehman crisis or during the euro debt crisis, the current one is not driven by banks. It is rather driven by the monetary policy divergence between the US and the rest of the world. This divergence appears to have created an imbalance in funding markets and a shortage in dollar funding. It is important to monitor how this dollar funding shortage and issuance patterns evolve over time even if the currency implications are uncertain.

And to think the Fed’s cheerleaders couldn’t hold their praise for the ECB’s NIRP (as first defined on these pages) policy. Because little did they know that behind the scenes the divergence in Fed and “rest of the world” policy action is leading to two things: i) the fastest emergence of a dollar shortage since Lehman and ii) a shortage which will be arb[itrage]ed to a level not seen since Lehman, and one which assures that over the coming next few months, many will be scratching their heads as to whether there is something far more broken with the financial system than merely an arbed way by US corporations to issue cheaper (hedged) debt in Europe thanks to Europe’s NIRP policies.

If and when the market finally does notice this gaping dollar shortage (as is usually the case with the mandatory 3-6 month delay), the Fed will once again scramble to flood the world with USD FX swap lines to prevent the global dollar margin call from crushing a matched synthetic dollar short which according to some estimates has risen as high as $10 trillion.

Until then, just keep an eye on the Fed’s weekly swap line usage, because if the above is correct, it is only a matter of time before they are put to full use once again. Finally what assures they will be put to use, is that this time the divergence is the direct result of the Fed’s actions…

And then, again with Tyler, we return to Albert Edwards:

“Ignore This Measure Of Global Liquidity At Your Own Peril”

With all eyes squarely on the ECB as Mario Draghi prepares to flood the EMU fixed income market with €1.1 trillion in new liquidity starting Monday, Soc Gen’s Albert Edwards reminds us that “another type of QE” is drying up thanks largely to the relative strength of the US dollar. The printing of currency to buy US dollar denominated assets in an effort to prop up “mercantilist export-led growth models [is] no different to the Fed’s QE,” Edwards says, explicitly equating EM FX intervention with the asset purchase programs employed by the world’s most influential central banks in the years since the crisis. Via Soc Gen:

Clearly when the dollar is declining sharply, global FX intervention accelerates as the Chinese central bank, for example, needs to debauch its own currency at the same rate. Conversely, when the dollar rallies strongly, as is the case now, FX intervention rapidly dries up and can even reverse, exerting a massive monetary tightening on emerging economies,

.. and ultimately the entire over-inflated global financial complex… The swing in global foreign exchange reserves is one key measure of the global liquidity tap being turned on and off, with the most direct and immediate effect being felt in emerging economies.

The bottom line is that in a world of over-inflated asset values, the strength of the dollar is resulting is a rapid tightening of global liquidity as emerging economies (and indeed the Swiss) stop printing money to buy the US dollar. This should be seen for what it is a clear tightening of global liquidity. Traditionally these periods of dollar strength are highly disruptive to emerging markets and often end in the weakest links blowing up the entire EM and commodity complex and sometimes much else besides! Investors ignore this at their peril.

So: the ECB has started doing its painfully expensive uselessness , the Fed refuses to do anymore and even threatens to derail the whole idea by hiking rates, both Japan and its central bank are so screwed after 20 years of having an elephant sitting on their lap for afternoon tea that nothing they do makes any difference anymore even short term, and China is faced with the riddle that what it thinks it should do to look better in the mirror mirror on the Great Wall, only makes it look old and bitter.

But as Edwards rightly suggests, the first bit of this battle will be fought in, and lost by, the emerging markets. And there will be nothing pretty about it. They’re all drowning in dollar denominated loans and ‘assets’, and it gets harder and more expensive all the time to buy dollars as all this stuff must be rolled over. And the game hasn’t even started yet.

Home › Forums › Central Banks Are Crack Dealers and Faith Healers