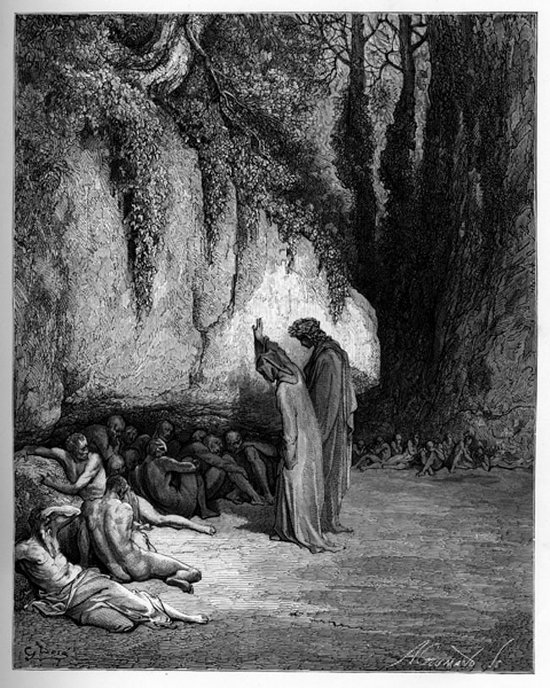

Gustave Doré Dante and Virgil among the late penitents 1868

We’re doing something a little different. Nicole wrote another very long article and I suggested publishing it in chapters; this time she said yes. Over five days we will post five different chapters of the article, one on each day, and then on day six the whole thing. Just so there’s no confusion: the article, all five chapters of it, was written by Nicole Foss. Not by Ilargi.

This is part 2. Part 1 is here: Global Financial Crisis – Liquidity Crunch and Economic Depression

The Psychological Driver of Deflation and the Collapse of the Trust Horizon

The collective mood shifts rapidly from optimism and greed to pessimism and fear as the bubble bursts, and as it does so, the financial system moves from expansion to contraction. Financial contraction involves the breaking of promises right left and centre, with credit instruments drastically revalued downwards in the process. As the promises that back them cease to be credible, value disappears extremely rapidly. This is deflation and the elimination of excess claims to underlying real wealth.

Instruments once regarded as money equivalents will lose that status through the loss of confidence in them, causing the supply of what retains sufficient confidence to still be regarded as money to collapse. The more instruments lose the confidence that confers value upon them, the smaller the effective money supply will be, and the more confidence will become a rare ‘commodity’. Being grounded in psychology is the primary reason that deflation cannot be overcome through policy adaptations which are inherently too little and too late. Nothing moves as quickly as a collective loss of confidence in human promises, and nothing destroys value as comprehensively.

The same abrupt change in collective mood will also drive contraction in the real economy, but more slowly, since the time constant for change in the real world is much slower than in the virtual world of finance. This process will also result in broken promises as structural dependencies fracture when there is no longer enough to go around. There will be wage and benefit cuts, layoffs, strikes, strike-breaking, breaches of contract, business failures and more on a huge scale, and these will fuel further fear, anger and the destruction of trust.

In the political realm, trust, such as it is, will be an early casualty. Political promises have been regarded as highly suspect for a long time in any case, but considering that the electorate tends consistently to vote for whomever tells them the largest number of comforting lies, this is not particularly surprising. Our political system selects for mendaciousness by design, since no party is normally elected by telling the truth, yet we have still collectively retained some faith in the concept of democracy until relatively recently. In recent years, however, it has become increasingly clear that the political institutions in supposedly democratic nations have largely been bought by big capital. More often than not, and more blatantly than ever, the political machinery has come to serve those special interests, not the public interest.

The public is increasingly realizing that ‘representative democracy’ leaves them unrepresented, as they see more and more examples of austerity for the masses combined with enormous bailouts guaranteeing that the large scale gamblers of casino capitalism will not take losses on the reckless bets they made gambling with other people’s money. In the countries subjected to austerity, where the contrast is the most stark, a wave of public anger is is already depriving national governments, or supranational governance institutions where applicable (ie Europe), of political legitimacy. As more and more states slide into the austerity trap as a result of their unsustainable debt burdens, this polarization process will continue, driving wedges between the governors and the governed which will make governance far more difficult.

Governments struggling with the loss of political legitimacy are going to find that people will no longer follow rules once they feel that the social contract has been violated, and that rules no longer represent the public interest. When the governed broadly accept that society functions under the rule of law, in other words that all are equally subject to the same rules, then they tend to internalize those rules and follow them without the need for negative incentives or outright enforcement. However, once the dominant perception becomes that rules are imposed only on the powerless, to their detriment and for the benefit of the powerful, while the well connected can do as they please, then general compliance can cease very quickly.

Without compliance, force would become necessary, and we are indeed likely to see this occur as a transitional phase as social polarization increases in a climate of increasing anger. The transitional element arises from the fact that force, especially as exercised technologically at large scale, requires substantial resources which are unlikely to remain available. Force produces reaction, straining the fabric of society, quite possibly to breaking point.

As contagion propagates the impact of financial and economic contraction, we will rapidly be moving from a long era of high trust in the value of promises to one of low trust. The trust horizon will contract sharply, leaving supranational and national governments lying beyond its reach, as stranded assets from a trust perspective. Trust determines effective organizational scale, so when the trust horizon draws in, withdrawing political legitimacy in its wake, larger scale entities, whether public or private, are going to find it extremely difficult to function. Effective organizational scale had been increasing for the duration of our long economic expansion, forcing an across the board scaling up of all manner of organizations by increasing the competitiveness accruing to large scale. As we scaled up, we formed structural dependencies on these larger scale entities’ ability to function.

While the scaling-up process was reasonable smooth and seamless, the scaling-down process will not be, as the lower rungs of the figurative ladder we climbed to reach this pinnacle have been kicked out as we ascended. Structural dependencies are going to fail very painfully as large scale ceases to be effective and competitive, leading to abrupt dislocations with ricocheting impacts.

Proposed solutions to our predicament that depend on the functioning of large-scale organizations operating in a top-down manner do not lie within viable solution space.

Instability and the ‘Discount Rate’

The pessimism-and-fear-driven psychology of contraction differs dramatically from the optimism-and-greed-driven psychology of expansion. The extreme complacency as to systemic risk of recent years will be replaced by an equally extreme risk aversion, as we move from overshoot in one direction to undershoot in the other. The perception of economic visibility is gong to change substantially, as we move from a period where people thought they knew where things were headed into an era where fear and confusion reign, and the sense of predictability evaporates abruptly.

This is an important psychological shift, as it affects an aspect known as the ‘discount rate’, which reflects the extent to which we think in the short term rather than the long term, or the extent to which we value the present over the future. The perceived rate of change is an important factor in determining the discount rate, and fear, being a very sharp emotion, causes the rate of change to accelerate markedly, driving the discount rate sharply higher in contractionary times.

True long term thinking is relatively rare. We manage an approximation of it at times when all immediate needs, along with many mere ‘wants’, are met and we are not concerned about this condition changing, in other words at times when we take a comfortable situation for granted. At such times, the longer term view is a luxury we can afford, and we find it relatively simple to summon the presence of mind to think abstractly and constructively, and to ponder circumstances which are are neither personal nor immediate. Even at such times, however, it is not particularly common for humans to transcend mere contemplation and actually act in the interests of the long term, especially if it involves aspects beyond the personal, or perhaps familial.

As the financial bubble bursts, and we rapidly begin to pick up on the fear of others and feel the consequences of contagion in our own lives, our collective discount rates are going to sky-rocket. In a relatively short period of time, a large percentage of the population is going to begin worry about immediate needs, let alone wants, not being met. A short time later those worries are likely to transition into reality, as has already happened in the countries, like Greece, in the forefront of the bursting bubble. As discount rates go through the roof, the luxury of the longer term view, which is always quite ephemeral, is likely to disappear altogether.

Where people have no supply cushions and find themselves abruptly penniless, cold, thirsty, hungry or homeless, the likelihood of them considering anything much beyond the needs of the day at hand is very low. Under such circumstances, the present becomes the only reality that matters, and societies are abruptly pitched into a panicked state of short term crisis management. This of course underlines the need to develop supply cushions and contingency plans in advance of a bubble bursting, so that a greater percentage of people might be able to retain a clear head and the ability to plan more than one day at a time. Unfortunately, few are likely to heed advance warnings and we can expect society to shift rapidly into a state of short-termism.

Given the coming rise in collective discount rates, if proposed solutions depend on the ability for societies to engage in rational planning for longer term goals, then those solutions are not part of solution space.

The Psychology of Contraction and Social Context

Expansionary times are times of relative peace and prosperity. If those conditions persist for a relatively long time, trust builds slowly and societies become more inclusive and cooperative, tending to perceive common humanity and focus on similarities rather than differences. In such times we reach out and interact with distant people, even if we have no relationship of personal trust with them, as we have, over time, vested our trust in stable institutional frameworks for managing our affairs. This institutional trust replaces the need for trust at a personal level and is a key factor in our ability to scale up our economies and their governance structures. Individuals raised in such an environment tend to show a presumption of trust towards others, and their inclination is generally to act cooperatively.

There is a sharp contrast between this stable state of affairs and the circumstances which pertain when suddenly the pie is shrinking and there is not enough to go around. As difficult as it can be share gains in a way perceived to be fair, it is infinitely more difficult to share losses in a way that is not extremely divisive. As elucidated above, a deflationary credit implosion involved the wholesale destruction of excess claims to underlying real wealth, meaning that a majority of people who thought they had a valid claim to something of tangible value are going to find that they do not. The losses will be very widespread, but uneven, and the perception of unfairness will be almost universal.

Under such circumstances a sense of common humanity is much less prevalent, and the focus shifts from similarities to the differences upon which social divisions are founded and then inflamed. An ‘us versus them’ dynamic is prone to take hold, where ‘us’ becomes ever more tightly defined and ‘them’ becomes an ever more pejorative term. People build literal and figurative walls and peer suspiciously at each other over them. Rather than working together in the attempt to address concerns common to all, division shifts the focus from cooperation to competition. A collectively constructive mindset can easily morph into something far more motivated by negative emotions such as jealousy and revenge and therefore far more destructive of perceived commonality.

The kind of initiatives which capture the public imagination in expansionary times are not at all the type which get traction once a contractionary dynamic takes hold. Attempts to build cooperative projects are going to be facing a rising tide of negative social mood, and will struggle to get off the ground. Sadly, negative ideas are far more likely to go viral than positive ones. Novel movements grounded in anger and fear may arise to feed on this new emotional context and thereby be empowered to wreak havoc on the fabric of society, notably through providing a political mandate to extremists with an agenda of focusing blame on to some identifiable, and marginalizable, social group.

While it will not be the case that cooperative endeavours will be impossible to achieve, they will require additional effort, and are likely to succeed only at a much smaller scale in a newly fractured society than might previously have been expected. It is very much a worthwhile effort, and will be far simpler if begun prior to the end of the period of cooperative presumption. All the more reason to adapt to a major trend change adapt in advance. There is nothing so dangerous as collectively dashed expectations.

If proposed solutions depend on a cooperative social context at large scale, they will not be part of solution space.

Part 1 is here: Global Financial Crisis – Liquidity Crunch and Economic Depression

Tune back in tomorrow for part 3: Declining Energy Profit Ratio and Socioeconomic Complexity

Home › Forums › The Boundaries and Future of Solution Space – Part 2