Russell Lee Front of livery stable, East Side, New York City 1938

We -should- know better than to trust US jobs reports.

• US Looks Set For December Interest Rate Rise After Jobs Boost (Guardian)

The US appears to be on course for its first interest rate rise in almost a decade next month after higher than expected job creation pushed the unemployment rate down to 5%. Non-farm payrolls – employment in all sectors barring agriculture – increased by 271,000 in October, according to official figures published on Friday, compared with 142,000 the previous month and above the 185,000 that economists polled by Reuters had expected. In September, the US Federal Reserve signalled that, barring a deterioration in the US economic recovery, it would raise rates from 0.25% at its December meeting. Janet Yellen, the head of the Federal Reserve, repeated her forecast a few days ago.

Analysts said the prospect of a rate rise was now almost certain, especially after figures from the US labor department also showed wages increased at a healthy 0.4% month on month. The dollar jumped by more than 1% to a seven-month high and benchmark US bond yields rose to their highest in five years as traders priced in a 72% chance of a move next month. Stock market futures on New York exchanges slipped as it became clearer that a long period of cheap borrowing costs was coming to an end. The rise in pay took the wage inflation rate to 2.5% year on year, the best annual wages boost since 2009, when it was falling in the aftermath of the financial crisis.

Growth in jobs occurred in industries including professional and business services, healthcare, retail, food services and construction, according to Tanweer Akram, a senior economist at Voya Investment Management. Rob Carnell, an analyst at ING Financial Markets, said: “While this does not guarantee a December rate hike from the Fed at this stage [there is one more labour report before the December 16 meeting], we feel that we would need to see a catastrophically bad November labour report for the Fed to sit on their hands again.”

And there we go again: it’s all a sleight of hand.

• US Jobs Report: Workers Aged 25-54 Lose 35K Jobs, 55+ Gain 378K (Zero Hedge)

After several months of weak and deteriorating payrolls prints, perhaps the biggest tell today’s job number would surprise massively to the upside came yesterday from Goldman, which as we noted earlier, just yesterday hiked its forecast from 175K to 190K. And while as Brown Brothers said after the reported that it is “difficult to find the cloud in the silver lining” one clear cloud emerges when looking just a little deeper below the surface. That cloud emerges when looking at the age breakdown of the October job gains as released by the BLS’ Household Survey. What it shows is that while total jobs soared, that was certainly not the case in the most important for wage growth purposes age group, those aged 25-54.

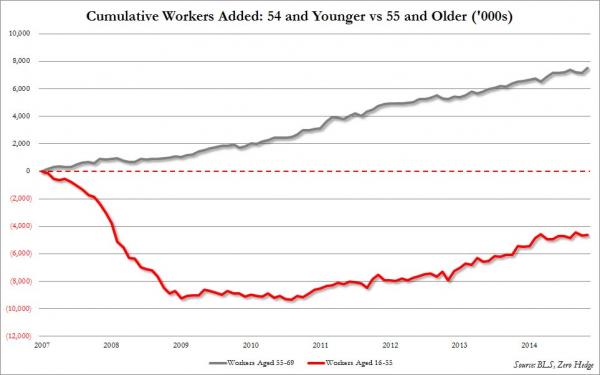

As the chart below shows, in October the age group that accounted for virtually all total job gains was workers aged 55 and over. They added some 378K jobs in the past month, representing virtually the entire increase in payrolls. And more troubling: workers aged 25-54 actually declined by 35,000, with males in this age group tumbling by 119,000! Little wonder then why there is no wage growth as employers continue hiring mostly those toward the twilight of their careers: the workers who have little leverage to demand wage hikes now and in the future, something employers are well aware of. The next chart shows the break down the cumulative job gains since December 2007 and while workers aged 55 and older have gained over 7.5 million jobs in the past 8 years, workers aged 55 and under, have lost a cumulative total of 4.6 million jobs.

Schiff always see some right signs, and then always finds it hard to interpret them.

• Peter Schiff: It’s Going To Be A ‘Horrible Christmas’ (CNBC)

The Grinch has nothing on Peter Schiff. On CNBC’s “Futures Now” Thursday, the contrarian investor said that while Americans are wrapping presents this holiday season, they should instead brace themselves for “a horrible Christmas” and possible recession. “I expect [job] layoffs to start picking up by the end of the year,” Schiff said, pointing to retailers as the first victim. “Retailers have overestimated the ability of their customers to buy their products. Americans are broke. They are loaded up with debt,” he said. “We’re teetering on the edge of an official recession,” and “the labor market is softening.” For Schiff, there is no one else to blame but the Federal Reserve.

As he sees it, the central bank’s easy money policies have created a bubble so big that any prick could send the U.S. economy spiraling out of control. And that makes the possibility of hiking interest rates slim to none. “The Fed has to talk about raising rates to pretend the whole recovery is real, but they can’t actually raise them,” said the CEO of Euro Pacific Capital. “[Fed Chair Janet Yellen] can’t admit that she can’t raise them because then she’s admitting the whole recovery is a sham and that the policy was a failure.” According to Schiff, the recent rally in the dollar is “the biggest bubble that the Fed has ever inflated” and “it’s the only thing keeping the economy afloat.”

The greenback hit a three-month high this week after Yellen said a December rate hike was a “live” possibility. “[The inflated dollar] is keeping the cost of living from rising rapidly and it’s keeping interest rates artificially low. It’s allowing the Fed to pretend everything is great,” Schiff said. “Eventually the bottom is going to drop out of the dollar and we are going to have to deal with reality,” he added. “That reality is we are staring at a financial crisis much worse than the one we saw in 2008.”

It’s all still built on debt, and increasingly so. The more ‘confident’ the consumer, the more willing (s)he’s to put her neck in a noose.

• US Consumer Credit Has Biggest Jump In History, Government-Funded (Bloomberg)

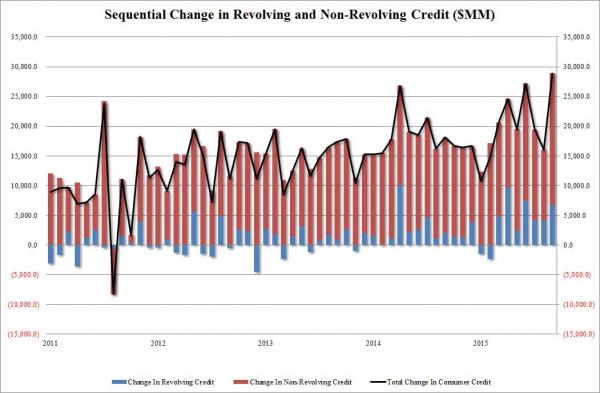

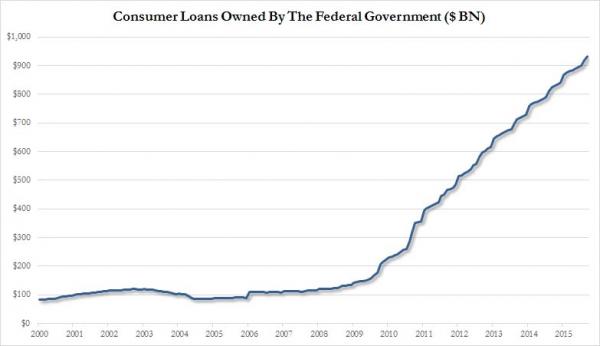

Borrowing by American households rose at a faster pace in September on increased lending for auto purchases and bigger credit-card balances. The $28.9 billion jump in total credit followed a $16 billion gain in the previous month, Federal Reserve figures showed Friday. Non-revolving debt, which includes funding for college tuition and auto purchases, rose $22.2 billion, the most since July 2011. Borrowing probably remained elevated in October in the wake of the strongest back-to-back months of motor vehicle sales in 15 years. Having made progress in restoring their balance sheets after the last recession, some households are more willing to finance purchases as the labor market continues to improve.

The median forecast of 31 economists surveyed by Bloomberg called for an $18 billion increase in credit, with estimates ranging from gains of $10 billion to $26 billion. The Fed’s consumer credit report doesn’t track debt secured by real estate, such as home equity lines of credit and home mortgages. The pickup in non-revolving credit in September followed a $12 billion increase the previous month. Revolving debt rose $6.7 billion, the biggest gain in three months, after a $4 billion advance, the data showed.

The biggest threat to US markets?

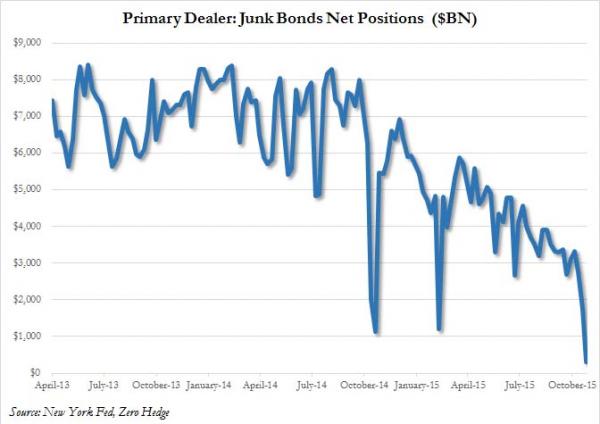

• Primary Dealers Are Liquidating Corporate Bonds At An Unprecedented Pace (ZH)

By now it is common knowledge that over the past two years the primary source of stock buying have been corporations themselves (recall Goldman’s admission that “buybacks have been the largest source of overall US equity demand in recent years”) with two consecutive years of near record stock repurchases. However, now that a December rate hike appears practically certain following the “pristine” October jobs report, suddenly the question is whether the recent strong flows into bond funds will continue, and generously fund ongoing repurchase activity. The latest fund flow report from BofA puts this into perspective

“The increase in interest rates is starting to impact US mutual fund and ETF flows. Hence, the inflow into the all fixed income category declined to +$0.96bn this past week (ending on October 4th) from a +$2.80bn inflow the week before… Outflows from government funds accelerated further to -$2.43bn this past week from -$1.73bn and -$1.00bn in the prior two weeks, respectively.”

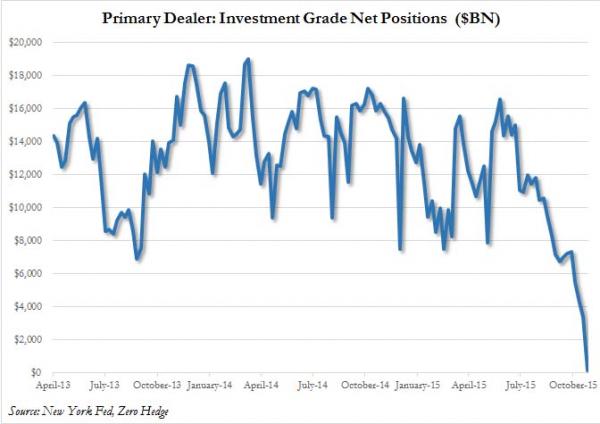

But more concerning for corporations than even fund flows, which will surely see even bigger outflows now that both yields are spreads are set to blow out making debt issuance far less attractive to corporations whose cash flows continue to deteriorate, is what the NY Fed reported as activity by Primary Dealer, i.e., the most connected, “smartest people in the room” who indirectly execute the Fed’s actions in the public markets, in the most recent week. As the charts below show, the Primary Dealers aren’t waiting for the December announcement to express how they feel about their holdings of both Investment Grade and Junk Bond (mostly in the longer, 5-10Y, 10Y+ maturity buckets where duration risk is highest). Indeed, as of the week ended October 28, Primary Dealer corporate holdings tumbled across both IG and HY, plunging to the lowest level in years in what can only be called a rapid liquidation of all duration risk.

Investment Grade Bonds:

And Junk Bonds:

Why would dealers be liquidating their corporate bond portfolios at such a fast pace? For junk, the obvious answer is that with ongoing concerns around rising leverage, not to mention yields being dragged higher by the ongoing pain in the energy sector, this may be merely a proactive move ahead of even more selling. But for IG the answer is less clear, and the selling likely suggests fears that any December rate hike will see spreads blow out even further, and as a result dealers are cutting their exposure ahead of December.

Whatever the answer keep a close eye on this series: if Dealer net positions turn negative it will mean that the corporate buyback door is about to slam shut in a hurry as others begin imitating the ‘smartest and most connected traders in the room’, depriving corporations of their biggest source of stock buyback “dry powder.” In fact, taken to its extreme, if companies suddenly find it problematic to raise capital using debt, we may soon enter that phase of the corporate cycle best known by a spike in equity issuance, whose impact on stock price is just the opposite to that of buybacks.

Not a chance. They’re scared to bits.

• Will China’s Consumers Step Up In 2016? (Bloomberg)

)China’s practice of laying out five-year economic plans is a legacy of its Maoist past. And so, as the Communist Party has done since the 1950s, officials met in Beijing in October to hash out the plan to take the world’s second-biggest but now struggling economy from 2016 to 2020. Policymakers have two big goals. In 2016 they’ll continue to feature the consumer as the star of a hoped-for economic resurgence. They’ll also try to ensure by any means necessary that gross domestic product doesn’t slow rapidly, even if that involves injecting more credit into overleveraged, declining industries. China will target “medium-high economic growth,” the Party said in an Oct. 29 communiqué after meeting to discuss the new five-year plan.

Those two goals—fostering a consumer economy and giving GDP a short-term boost—are contradictory. Developing a consumption-driven economy means accepting growth below the 7%+ annual rise of recent years, which was achieved in part by state-run banks and local government finance companies giving enterprises cheap credit to build often unneeded factories and real estate developments. For many economists, it’s a no-brainer to switch to this slower-growing but more sustainable model, one that relies on a strong service sector and robust household consumption. The dramatic growth of the last 35 years has brought serious industrial overcapacity, a polluted environment, and declining productivity even as the workforce shrinks.

In October, days after the announcement that GDP rose in the third quarter at a rate of 6.9% from a year earlier, the slowest pace since 2009, the central bank cut rates for the sixth time in a year. It also lowered the amount of funds banks must hold in reserve, allowing them to make more loans. Economic planners have loosened curbs on borrowing by local officials and stepped up approvals of railway and costly environmental projects. Says Andrew Polk, senior economist at the Conference Board China Center for Economics and Business in Beijing: “Cutting interest rates and adding fiscal spending are temporary salves to much bigger problems. The leadership has very little power to stop the slide in growth into next year.”

In the first quarter of 2015, for the first time, service industries—including jobs from lawyers to tourist guides—made up a bit more than half of GDP. The service economy grew 8.4% in the first nine months; manufacturing, only 6%. “The answer to the question of whether China’s economy is sinking or swimming lies in its service sector,” wrote Capital Economics’ Mark Williams and Chang Liu in an Oct. 29 note. Service companies employ more people than manufacturers to generate the same amount of GDP. Not only are service workers more numerous, they’re also often better paid than factory hands. More Chinese with more money in their pockets should nurture consumption. To date, that’s been hard to engineer, with households socking away about 30% of disposable income, one of the world’s highest savings rates. Household consumption makes up only a little more than one-third of GDP. (In the U.S., consumption is almost 70% of the economy.)

Overcapacity is China’s 2016 key word.

• China’s Demand For Cars Has Slowed. Overcapacity Is The New Normal. (Bloomberg)

For much of the past decade, China’s auto industry seemed to be a perpetual growth machine. Annual vehicle sales on the mainland surged to 23 million units in 2014 from about 5 million in 2004. That provided a welcome bounce to Western carmakers such as Volkswagen and General Motors and fueled the rapid expansion of locally based manufacturers including BYD and Great Wall Motor. Best of all, those new Chinese buyers weren’t as price-sensitive as those in many mature markets, allowing fat profit margins along with the fast growth. No more. Automakers in China have gone from adding extra factory shifts six years ago to running some plants at half-pace today—even as they continue to spend billions of dollars to bring online even more plants that were started during the good times.

The construction spree has added about 17 million units of annual production capacity since 2009, compared with an increase of 10.6 million units in annual sales, according to estimates by Bloomberg Intelligence. New Chinese factories are forecast to add a further 10% in capacity in 2016—despite projections that sales will continue to be challenged. “The Chinese market is hypercompetitive, so many automakers are afraid of losing market share,” says Steve Man, a Hong Kong-based analyst with Bloomberg Intelligence. “The players tend to build more capacity in hopes of maintaining, or hopefully, gain market share. Overcapacity is here to stay.” The carmaking binge in China has its roots in the aftermath of the global financial crisis, when China unleashed a stimulus program that bolstered auto sales.

That provided a lifeline for U.S. and European carmakers, then struggling with a collapse in consumer demand in their home markets. Passenger vehicle sales in China increased 53% in 2009 and 33% in 2010 after the stimulus policy was put in place. But the flood of cars led to worsening traffic gridlock and air pollution that triggered restrictions on vehicle registrations in major cities including Beijing and Shanghai. Worse, the combination of too many new factories and slowing demand has dragged down the industry’s average plant utilization rate, a measure of profitability and efficiency. The industrywide average plunged from more than 100% six years ago (the result of adding work hours or shifts) to about 70% today, leaving it below the 80% level generally considered healthy. Some local carmakers are averaging about 50% utilization, according to the China Passenger Car Association.

And this is what China’s overcapacity leads to.

• World’s Largest Steel Maker ArcelorMittal Loses $700 Million in Q3 (NY Times)

ArcelorMittal, the world’s largest steel maker, on Friday reported a $700 million loss for the third quarter, blaming falling prices and competition from Chinese exports. In a news release, the company said that customers were hesitating to buy its products and that “unsustainably low export prices from China,” which produces far more steel than any other country, had hurt its bottom line. Lakshmi N. Mittal, the company’s chief executive, said in an interview on Friday that steel demand in the company’s main markets, Europe and North America, was healthy, but that low-cost Chinese steel was depressing prices. “The Chinese are dumping in our core markets,” Mr. Mittal said. “The question is how long the Chinese will continue to export below their cost.”

The company’s loss for the period compared with a $22 million profit for last year’s third quarter. ArcelorMittal, which is based in Luxembourg, also sharply cut its projection for 2015 earnings before interest, taxes, depreciation and amortization — the main measure of a steel company’s finances. The new estimate is $5.2 billion to $5.4 billion, down from the previous projection of $6 billion to $7 billion. On a call with reporters, Aditya Mittal, Mr. Mittal’s son and the company’s chief financial officer, said that a flood of low-price Chinese exports was the biggest challenge for ArcelorMittal in the European and North American markets. The company estimates that Chinese steel exports this year will reach 110 million metric tons, compared with 94 million tons last year and 63 million tons in 2013. ArcelorMittal produced 93 million metric tons of steel in 2014.

ArcelorMittal is one of several companies operating in the United States that have brought complaints against the dumping of Chinese steel. On Tuesday, the United States Commerce Department issued a preliminary ruling in those companies’ favor in one product category, saying it would impose tariffs of up to 236% on imports of corrosion-resistant steel from some Chinese companies, on the grounds that their products are subsidized by the government. “That clearly shows there is substance in the trade cases,” Lakshmi Mittal said.

Berlin fails. Having VW investigate itself is crazy.

• Berlin Accomplices: The German Government’s Role in the VW Scandal (Spiegel)

This week wasn’t just a bad one for the Volkswagen concern. The German government is also happy that it’s over. Berlin had painstakingly developed a damage control strategy in an effort to prevent the VW scandal from damaging the reputation of German industry as a whole. Top advisors to Foreign Minister Frank-Walter Steinmeier had even written a confidential letter to German diplomats around the world, providing guidelines for how they should go about defending “the Germany brand.” “The emissions scandal should be presented as a singular occurrence,” they wrote. “External communication” should focus “to the extent possible on preventing VW and the ‘Made in Germany’ brand from being connected.”

But then Monday arrived and the announcement by the Environmental Protection Agency in the United States that “VW has once again failed its obligation to comply with the law that protects clean air for all Americans.” In addition to the 11 million diesel vehicles whose emissions values were manipulated, additional models are also thought to have been outfitted with illegal software to cheat on emissions compliance tests, including the popular SUV Cayenne. That vehicle is manufactured by Porsche, the company that VW’s new CEO, Matthias Müller, used to lead before being hired to replace Martin Winterkorn, who was ousted when the VW scandal first broke. Then Tuesday arrived, and along with it the admission from Müller that VW had deceived even more of its customers.

The fuel consumption claims for more than 800,000 vehicles were manipulated, with the specified average mileage not even achievable in testing, much less in real-world conditions. The new scandal affects models carrying the company’s own environmental seal-of-excellence known as BlueMotion, a label reserved for “the most fuel efficient cars of their class,” as the company itself claims. It has now become clear that such claims are a fraudulent lie. And it shows that this scandal may continue to broaden before VW manages to get it under control.

Short version: nothing is happening. This is how the EU ‘runs’.

• EU Asks Members To Investigate After VW Admits New Irregularities (Reuters)

The European Commission has written to all 28 European Union member countries urging them to widen their investigations into potential breaches of vehicle emissions rules after Volkswagen (VOWG_p.DE) admitted it had understated carbon dioxide levels. Europe’s biggest motor manufacturer admitted in September it had rigged U.S. diesel emissions tests to mask the level of emissions of health-harming nitrogen oxides. In a growing scandal, the German company said on Tuesday it had also understated the fuel consumption – and so carbon dioxide emissions – of about 800,000 vehicles. In a letter seen by Reuters, the Commission said it was not aware of any irregularities concerning carbon dioxide values and was seeking the support of EU governments “to find out how and why this could happen”.

It said it had already contacted Germany’s Federal Motor Transport Authority (KBA), which is responsible for approving the conformity of new car types, and raised the issue with other national authorities at a meeting late on Thursday in Brussels. A Commission spokeswoman confirmed the letter, adding it asked national governments “to widen their investigations to establish potential breaches of EU law”. “Public trust is at stake. We need all the facts on the table and rigorous enforcement of existing legislation,” the spokeswoman said. With vehicle testing in the EU overseen by national authorities, the bloc’s executive body, the Commission, is reliant on each country to enforce rules.

This arrangement has come under fire from environmentalists because on-road tests have consistently shown vehicles emitting more pollutants than laboratory tests. Car manufacturers are a powerful lobby group in the EU, as a major source of jobs and exports. In an open letter on Friday, a group of leading investors urged the EU to toughen up testing of vehicle emissions to prevent a repeat of the VW scandal and the resulting hit to its shareholders. VW shares have plunged as much as a third in value since the crisis broke in September.

Do note this by Mary Nichols, head of the California Air Resources Board: “The case is “the biggest direct breach of laws that I have ever uncovered … This is a serious issue, which will certainly lead to very high penalties..”

• VW Says Will Cover Extra CO2 And Fuel Usage Taxes Paid By EU Drivers (Guardian)

Volkswagen has said it will foot the bill for extra taxes incurred by drivers after it admitted understating the carbon dioxide emissions of about 800,000 cars in Europe. In a letter to European Union finance ministers on Friday, seen by Reuters, Matthias Müller, the VW chief executive, asked member states to charge the carmaker rather than motorists for any additional taxes relating to fuel usage or CO2 emissions. The initial emissions scandal, which erupted in September when Volkswagen admitted it had rigged US diesel emissions tests, affecting 11m vehicles globally, deepened this week when VW said it had also understated the carbon dioxide emissions and fuel consumption of 800,000 vehicles in Europe. Analysts say VW, Europe’s biggest carmaker, could face a bill of up to €35bn for fines, lawsuits and vehicle refits.

To help meet some of the anticipated costs, VW has announced a €1bn programme of spending cuts. The head of VW’s works council said the announcement of the cuts had broken strict rules in Germany on consultation with workers and demanded immediate talks with company bosses. “Management is announcing savings measures unilaterally and without any foundation,” Bernd Osterloh said in an emailed statement. [..] Since the emissions revelations, VW has been criticised by lawmakers, regulators, investors and customers frustrated at the time it is taking to get to the bottom of a scandal that has wiped almost a third off the carmaker’s market value. Mary Nichols, the head of the California Air Resources Board, which is investigating VW in the US, told the German magazine WirtschaftsWoche: “Volkswagen is so far not handling the scandal correctly.

“Every additional gram of nitrogen oxide increases the health risks for our citizens. Volkswagen has not acknowledged that in any way or made any effort to really solve the problem.” The case is “the biggest direct breach of laws that I have ever uncovered … This is a serious issue, which will certainly lead to very high penalties,” Nichols added. The scandal has also piled pressure on European regulators, who have long been criticised by environmentalists on the grounds that on-road tests have consistently shown vehicles emitting more pollutants than official laboratory tests. In an open letter, a group of leading investors urged the EU to toughen up vehicle testing. But it faces a battle because carmakers have traditionally had a strong influence on policy in countries such as Germany, Europe’s biggest economy, where they are an important source of jobs and export income.

Now everyone else must jump ship too.

• Goldman Sachs Dumps Stock Pledged By Valeant Chief (FT)

Valeant said on Friday that Goldman Sachs had sold more than $100m-worth of shares in the struggling drugmaker, which had been pledged as collateral against a personal loan from the investment bank to the company’s chief executive. Goldman contacted Michael Pearson, Valeant’s chief executive, earlier this week and gave him 48 hours to pay off a $100m loan that he took out in 2013 after a precipitous decline in the company’s share price triggered a so-called margin call on the debt. After he failed to raise enough cash to pay off the loan, Goldman Sachs on Thursday morning dumped the entire block of just under 1.3m shares, held in Mr Pearson’s name, which were worth roughly $119.4m at the open of trading in New York on Thursday.

The sale of Mr Pearson’s pledged shares contributed to a rout in the company’s stock price on Thursday, during which its market value fell as much as 20%. Roughly 57m shares changed hands during the day, compared with a daily average of 4m over the past 12 months. The embarrassing announcement is the latest setback for Valeant and its high-profile hedge fund backers, who include Bill Ackman, Jeff Ubben and John Paulson. It comes after months of controversy surrounding the drugmaker’s reliance on high prices, aggressive sales techniques and debt-fuelled deal making. Goldman’s decision to terminate the loan to Mr Pearson underscores the impact of the rout in Valeant’s shares on his personal wealth. Mr Pearson owns roughly 9m shares, accounting for Goldman’s sale on Thursday. In August that stake was worth almost $2.4bn; as of Friday morning, the value had plummeted to $720m.

The EU’s criminal folly: “In the questionable strategy of EU bureaucrats, an increase in foreclosures should boost the banks’ assets and in this way should help to reduce the financial demands on the ESM bailout fund.”

• New Countdown For Greece: A Bank Bail-In Is Looming (Minenna)

The debt crisis may no longer be in the spotlight but the financial situation in Greece remains complex. Greek banks continue to survive at the edge of bankruptcy, kept afloat only by Emergency Liquidity Assistance (ELA) from the ECB and by still-enforced capital controls. After the August “agreement”, the Troika has promised the Greek government €25 billion for bank recapitalization, of which €10bn is in a Luxembourg account ready to be wired. The funds will be disbursed only if the government manages, before the 15th of November, to approve a long list of urgent reforms: the infamous list of the “48 points” that embraces tax increases, public spending cuts and the highly controversial pensions reform. It is obviously a tough task for the Tsipras government, even if September’s election victory gave him a solid mandate.

After a parliamentary marathon, it seems that the government has successfully passed some unpopular measures: the increase from 26% to 29% in income tax, the rise from 5% to 13% in the tax on luxury goods and the restoring of the tax on television advertisements. The process was not so smooth with the first steps in reforming pensions and slowdowns are on the horizon. Tsipras is also trying to gain time against the pressure of Brussels to modify the laws that still protect primary homeowners from foreclosure. According to some estimates, there are around 320,000 families in Greece that are not paying down their mortgages and obviously these bad loans are dead weights for the banking system. In the questionable strategy of EU bureaucrats, an increase in foreclosures should boost the banks’ assets and in this way should help to reduce the financial demands on the ESM bailout fund.

Anyway, the Greek government is still living for the day, and the Troika has noticed that only 19 of the mandatory 48 reforms have been approved so far. Brussels is unhappy with this situation and has sent a strong “signal” to the Tsipras government by delaying the last €2 billion tranche of loans. At end-October 2015, €13 billion has already been transferred to Greece; these cash inflows alone have allowed the government to guarantee payments of salaries and pensions and reduced the dangerous social tensions experienced in July. Moreover, part of these funds has been diverted to pay down the ECB and this could allow the QE programme to be extended to Greece as early as November. This would be an unexpected image success for Mr. Tsipras and would give breathing space to the banking system, where up to €15 billion of government bonds eligible for purchase by the ECB are still languishing.

2016 looks to be a watershed year for British care in general.

• UK Care Home Sector In ‘Meltdown’, Threatened By US Vulture Fund (Ind.)

The UK’s largest provider of care homes is preparing to sell scores of properties and slash its budget by millions to fend off an attack from a US vulture fund hoping to cash in on the UK elderly-care crisis. Four Seasons Health Care, which cares for thousands of residents, is facing a £500m-plus credit crunch after government spending cuts and financial engineering by City investors left it struggling to pay lenders. The little-known H/2 Capital Partners has been buying up the group’s debt in the hope that the current owners, Terra Firma, will cede control of the homes after finances were squeezed by local government funding cuts.

Martin Green, the chief executive of Care England, a trade group for elderly-care provision, said the Government needed to step in to stop speculative investors targeting the troubled industry. “If the Government does not fund the sector properly, people will come into it to make money rather than deliver care,” he warned. To stave off the hedge fund assault, Four Seasons is considering plans to make deep cuts to the money it spends refurbishing and developing care homes. [..] Unions are concerned that the funding crisis will force many elderly residents to move into NHS beds and have called on Chancellor George Osborne to deliver ringfenced funding to the social care sector in his spending review later this month.

“The sector is going through a slow-motion collapse and Four Seasons is part of that situation,” GMB national officer Justin Bowden said. “It’s in meltdown and there will be tens of thousands of our mums and dads who will have to be looked after.” The squeeze on funding has put Four Seasons’ owner Terra Firma in a bind as it tries to meet annual costs of about £110m a year. The buyout group, led by well-known dealmaker Guy Hands, bought Four Seasons in 2012 from Royal Bank of Scotland for £825m in a debt-fuelled takeover. Most of the takeover cash was borrowed using two loans sold on to investors – one worth £350m and the other £175m.

The care disaster will spread across the western world. It will get ugly and deadly.

• US Congress Proposes A Chilling Resolution On Social Security (Simon Black)

Officially, the US government is now $18.5 trillion in debt, and Social Security is the biggest financial sinkhole in America. Social Security’s various trust funds currently hold about $2.7 trillion in total assets; yet the government itself estimates the program’s liabilities to exceed $40 trillion. And Social Security’s second biggest trust fund, the Disability Insurance fund, will be fully depleted in a matter of weeks. The trustees who manage these massive funds on behalf of the current and future retirees of America are clearly concerned. In the 2015 report of the Social Security and Medicare Board of Trustees they state very plainly:

“Social Security as a whole as well as Medicare cannot sustain projected long-run program costs…”, and that the government should be “giving the public adequate time to prepare.” Wow. Now, we always hear politicians say that ‘Social Security is going to be just fine’. So this Board of Trustees must be a bunch of wackos. Who are these guys anyhow? The Treasury Secretary of the United States of America, as it turns out. Along with the Secretary of Health and Human Services. The Secretary of Labor. Etc. These are the folks who sign their name to the report saying that Social Security is going bust, and that Congress needs to give people time to prepare. And prepare they should.

The US Government Accountability Office recently released a report showing that tens of millions of Americans haven’t saved a penny for retirement; and roughly half of Baby Boomers have zero retirement savings. This means that there’s an overwhelming number of Americans pinning all of their retirement hopes on Social Security. Bad idea. In a recently proposed resolution, H. Res 488, Congress states point blank that Social Security “was never intended by Congress to be the sole source of retirement income for families.” Apparently they got the message from the Social Security Trustees and they want to start preparing people for the inevitable truth. This is no longer some wild conspiracy theory.

The Treasury Secretary is saying it. Congress is saying it. The numbers are screaming it: Social Security is going to fail. Ultimately this is a just another chapter in the same story– that government cannot be relied on to provide or produce, only to squander and fail. Sure, their intentions may be noble. But this level of serial incompetence can no longer be trusted, nor should we be foolish enough to believe that some new candidate can fix it. If you’re in your fifties and beyond, you’re probably going to be OK and at least get 10-15 years of benefits. If you’re in your 40s and below, you have to be 100% prepared to fend for yourself. Fortunately you have time to recover. Time to build. And time to learn.

The chaos only deepens.

• Germany Imposes Surprise Curbs On Syrian Refugees (Guardian)

Angela Merkel has performed an abrupt U-turn on her open-door policy towards people fleeing Syria’s civil war, with Berlin announcing that the hundreds of thousands of Syrians entering Germany would not be granted asylum or refugee status. Syrians would still be allowed to enter Germany, but only for one year and with “subsidiary protection” which limits their rights as refugees. Family members would be barred from joining them. Germany, along with Sweden and Austria, has been the most open to taking in newcomers over the last six months of the growing refugee crisis, with the numbers entering Germany dwarfing those arriving anywhere else.

However, the interior minister, Thomas de Maiziere, announced that Berlin was starting to fall into line with governments elsewhere in the European Union, who were either erecting barriers to the newcomers or acting as transit countries and limiting their own intake of refugees. “In this situation other countries are only guaranteeing a limited stay,” De Maiziere said. “We’ll now do the same with Syrians in the future. We’re telling them ‘you will get protection, but only so-called subsidiary protection that is limited to a period and without any family unification.’” The major policy shift followed a crisis meeting of Merkel’s cabinet and coalition partners on Thursday.

The chancellor won global plaudits in August when she suspended EU immigration rules to declare that any Syrians entering Germany would gain refugee status, though this stirred consternation among EU partners who were not forewarned of the move. Thursday’s meeting decided against setting up “transit zones” for the processing of refugees on Germany’s borders with Austria, but agreed on prompt deportation of people whose asylum claims had failed.

Until now Syrians, Iraqis and Eritreans entering Germany have been virtually guaranteed full refugee status, meaning the right to stay for at least three years, entitlement for family members to join them, and generous welfare benefits. Almost 40,000 Syrians were granted refugee status in Germany in August, according to the Berlin office responsible for the programme, with only 53 being given “subsidiary” status. That now appears to have ended abruptly. An interior ministry spokesman told the Frankfurter Allgemeine Zeitung: “The Federal Office for Migration and Refugees is instructed henceforth to grant Syrian civil war refugees only subsidiary protection.”

What happens when you fail to prepare.

• Germany Receives Nearly Half Of All Syrian Asylum Applicants (Guardian)

Germany has received nearly one in two of all asylum applications made by Syrians in EU member states this year. New figures released by the ministry of the interior on Thursday put the total number of asylum applications filed in Germany so far this year at 362,153, up 130% on January to October 2014. Nearly 104,000 of these applications were made by Syrians. This corresponds to about 47.5% of all requests for asylum submitted by Syrians in EU member states this year. Together with Germany, the countries that have received the most asylum applications from Syrians relative to their population sizes are Austria, Sweden and Hungary, with 1.3, 1.5, 2.7 and 4.7 applications per 1,000 people respectively. Europe’s next two biggest economies, France and Britain, on the other hand, have received only 0.03 and 0.02 applications from Syrians per 1,000 people respectively, according to Eurostat data.

Germany received 54,877 asylum applications in October alone, an increase of nearly 160% compared with the same month last year, according to the same figures. But the figure for formal asylum applications doesn’t reveal the full scale of the number of people Germany is absorbing. Filing the required paperwork takes time. The German interior ministry notes that the country registered 181,166 asylum seeker arrivals in October alone. Of these, 88,640 were from Syria, 31,051 from Afghanistan and 21,875 from Iraq. Between January and October, Germany registered the arrival of 758,473 asylum seekers, about a third of which (243,721) were from Syria. The country expects to receive more than a million asylum seekers this year. So far this year, 81,547 people have been granted refugee status in Germany, which represents just under 40% of all asylum decisions taken from January to October 2015.

Sweden’s been a light in a very opaque darkness, but…

• Sweden Feels The Refugee Strain (Bloomberg)

Sweden, which considers itself a humanitarian superpower, has long welcomed refugees, whether they be Jews escaping the Holocaust or victims of civil wars and natural disasters. Some 16% of its population is foreign-born, well above the U.S. figure of 13%. Since the 1990s the Scandinavian nation of 9.6 million has absorbed hundreds of thousands of migrants from the former Yugoslavia, the Middle East, and Africa. Still, Swedes have never experienced anything like the current influx. Some 360,000 refugees—mainly from Afghanistan, Iraq, and Syria—are expected to enter the country in 2015 and 2016, on top of the 75,000 who sought asylum last year. It’s as if North Carolina, which has about the same population as Sweden, sprouted a new city the size of Raleigh in three years.

In a sign that its hospitality may be wearing thin, the government announced on Oct. 23 that by next year it will end a policy of automatically granting permanent residency to most refugees. In the future, adults arriving without children will initially get only a temporary residence permit. The Swedish Migration Agency says that meeting refugees’ basic needs could cost the national government 60 billion kronor ($7 billion) in 2016. Local governments and private organizations will spend billions more. If the flow doesn’t subside, “in the long term our system will collapse,” said Foreign Affairs Minister Margot Wallström in an Oct. 30 interview with the daily Dagens Nyheter.

And Germany says ‘Stay in Austria’, and we’re off to the races…

• Sweden Tells Refugees ‘Stay in Germany’ as Ikea Runs Out of Beds (Bloomberg)

Europe’s refugee crisis is having such a major impact in Sweden that even Ikea is running out of beds. The Swedish furniture giant says its shops in Sweden and Germany are running short on mattresses and beds amid increased demand due to an unprecedented inflow of asylum seekers in the two countries. In Sweden, which along with Germany has been the most welcoming, the Migration agency had to let about 50 refugees sleep on the floor of its head office on Thursday night as it tries to find accommodation for the latest arrivals. “There are some shortages of bunk beds, mattresses and duvets” in some stores in Germany and Sweden, Josefin Thorell, an Ikea spokeswoman, said in an e-mailed response when asked whether the company had been affected by the biggest influx of migrants since World War II.

“If the situation persists we expect that it will be difficult to keep up and maintain sufficient supply,” Thorell said. Ikea has been supplying local authorities handling the refugee crisis. So far, 120,000 asylum seekers have arrived in Sweden this year and as many as 190,000 are expected to head to the country of 10 million people. Although Finance Minister Magdalena Andersson told reporters on Friday that the pressure on public finances “is not acute,” the Swedish government says it is no longer able to offer housing to new arrivals. “Those who come here may be met by the message that we can’t arrange housing for them,” Migration Minister Morgan Johansson told reporters. “Either you’ll have to arrange it yourself, or you have to go back to Germany or Denmark again.”

Meanwhile, ….

• Greek Coast Guard: Five More Migrants Found Dead (Kath.)

Greek authorities say the bodies of five more migrants have been found in the eastern Aegean Sea, which hundreds of thousands have crossed in frail boats this year seeking a better life in Europe. The coast guard said Friday that three men and a woman were found dead over the past two days in the sea off Lesvos. The eastern island is where most of the migrants head from the nearby Turkish coast, paying large sums to smugglers for a berth on overcrowded, unseaworthy vessels. The body of another man was found Thursday off the islet of Agathonissi. Well over half a million people have reached the Greek islands so far this year – a record number of arrivals – and the journey has proved fatal for hundreds.

Home › Forums › Debt Rattle November 7 2015