John Vachon Big Four Cafe, Cairo, Illinois May 1940

This is what’s shaping the world economy today, far more than anything else, than the Fed or ECB or US jobs reports.

• China October Imports Fall 18.8% From A Year Ago, Exports Down 6.9% (Reuters)

China’s trade figures disappointed analyst expectations by a wide margin in October, reinforcing views that the world’s second-largest economy will likely have to do more to stimulate domestic demand given stubborn softness in overseas markets. While Beijing has already repeatedly cut interest rates and softened the exchange rate to prop up the economy, latest trade numbers suggest that a greater risk of a hard landing remains. October exports fell 6.9% from a year ago, dropping for a fourth month, while imports slipped 18.8%, leaving the country with a record high trade surplus of $61.64 billion, the General Administration of Customs said on Sunday.

Combined exports and imports fell 8.5% in the first 10 months of the year from the same period a year earlier, well below the full-year official target for growth of 6%. “We see that the trade will unlikely turn around the momentum in the near term, and the renminbi exchange rate will be under downward pressure especially as Fed signals to hike soon,” Commerzbank China economist Zhou Hao said. Last week, the Ministry of Commerce said the value of China’s exports this year was likely to stay similar to 2014 levels, while imports could drop sharply in the fourth quarter. For 2016, the ministry expects to see steady growth in combined exports and imports as policy measures to support the trade sector take effect.

China’s economy is facing headwinds from cooling exports and investment. President Xi Jingping has said it was possible for the country to maintain an annual growth of around 7% over the next five years, but that there were uncertainties. Chinese growth dipped to 6.9% in the third quarter, dropping below the 7% mark for the first time since the global financial crisis. In order to lower social financial costs for firms, the central bank cut interest rates in late October for the sixth time in less than a year, and again reduced the amount of cash that banks must set aside as reserves. It also guided the yuan into weaker territory against the dollar. The onshore yuan has weakened by more than 2% in 2015.

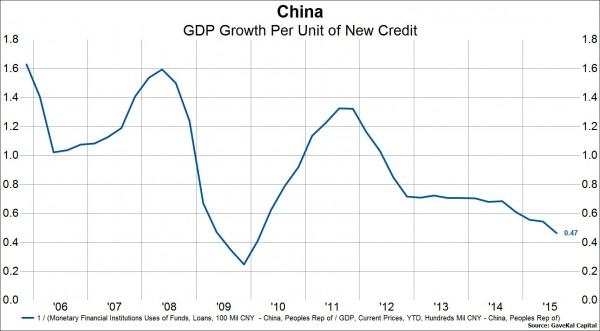

One of our favorite numbers. But note this: “In reality the ratio is probably much lower than the current reading of .47.”

• Marginal Productivity Of Chinese Debt Goes From Bad To Much Worse (Gavekal)

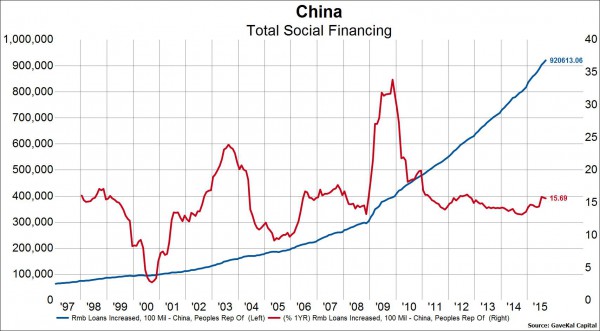

Taking the Chinese GDP statistics at face value (an increasingly big assumption these days) we point out a rather ominous scenario which seems to be developing in the productivity dynamics of Chinese debt-financed growth. Basically the amount of growth that each new unit of credit produces is plunging to levels not seen since 2009-2010 when the Chinese unleashed the largest GDP adjusted stimulus program in the world. As it stands now, each new unit of debt is buying less than .5 units of marginal growth, and that, again, is taking for granted the accuracy of the GDP stats (chart 1). In reality the ratio is probably much lower than the current reading of .47.

Is this sustainable? Of course not. As we have been saying for several years now, Chinese growth is going much lower as the economy rebalances from being an investment led model to a consumption led model. One of the signs we’re looking for to indicate that the transition is taking place is actually a slowing of new loan growth and improvement in the indicator in chart 1. We’ve got exactly the opposite so far, which is an indication of the Chinese pushing on the debt string even more to fuel growth rather than accepting slower growth still, but a rebalanced economy.

This, in a perverse way, probably increases the risk of the dreaded hard landing as the chances of a credit “event” rise even further.

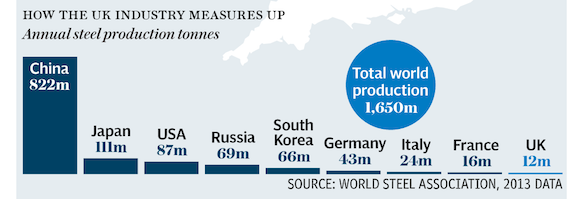

All Chinese commodities companies are grossly overinvested and overleveraged.

• Global Investors Threatened as China Cement Maker Nears Default (Bloomberg)

International investors in Chinese corporate debt face fresh risks after a cement producer said it may default on onshore notes, which could lead to nonpayment on its dollar securities. China Shanshui Cement Group isn’t sure it can repay 2 billion yuan ($315 million) of local securities due Nov. 12 after a shareholder tussle stymied financing, it said in a filing Thursday. Failure to repay those notes would trigger a default on its $500 million 7.5% bonds due 2020, according to the statement. Global investors have been scarred by defaults from Chinese companies this year in industries including property and commodities as economic growth slows and anti-corruption investigations continue. Kaisa Group reneged on obligations in April amid a probe.

Coal trader Winsway Enterprises failed to pay interest on dollar bonds for a second time this year in October, and Hidili Industry International didn’t repay its dollar notes due Wednesday. “Recently, there have been more cases of Chinese commodities companies having trouble to repay debt,” said Raymond Chia, the head of fixed-income research for Asia ex-Japan at Schroder Investment Management Ltd. in Singapore. “But if a relatively healthy cement company ended up having problems, the sentiment to China’s commodity space will surely go down.” Shanshui has been mired in a shareholder fight for control since April amid President Xi Jinping’s call to cull weaker firms in industries grappling with overcapacity. Its largest shareholder Tianrui International has been trying to change Shanshui’s board.

Meanwhile its two other shareholders China National Building Material and Taiwan’s Asia Cement have announced they are considering the terms of a possible offer. Shanshui cited its “current cash position and the difficulties it faces in raising financing” in its filing Thursday. While the company has been seeking funding since June, all the financial institutions it contacted “have expressed concern in relation to the uncertainty of the management,” it said.

China’s overcapacity is bringing down global commodities.

• Troubled Tata Steel Demands 30% Price Reduction From Suppliers (Telegraph)

Tata Steel has been accused of “bully boy” tactics after demanding its suppliers slash their prices by 30pc as it attempts to pass on the cost of the steel crisis. The Indian-owned company has written to businesses in its supply chain telling them it requires an immediate 10pc price reduction on all purchases, and plans to increase the cuts to 30pc. The letter – which has been seen by the Telegraph – implies that any of its “valued suppliers” that fail to comply with the price cuts face being dropped. Demands contained in the letter emerged just days after Tata’s global parent company reported a £301m interim profit. The current crisis in Britain’s steel industry – which saw Tata axe 1,200 in Scunthorpe and Scotland last month, on top of a further 1,000 earlier in the year – was blamed for the company writing down the value of its UK assets by £866m.

In a letter signed by Lorraine Sawyer, procurement director of Tata Steel Long Products Europe, which makes up about a quarter of the company’s operations in Europe, the company spells out the difficulties it is currently facing. These include global over-capacity and declining steel prices. It adds that “UK-based steel manufacturers have been particularly challenged by their higher cost position driven by high energy prices and business rates…worsened by sterling’s appreciation”, and cites the closure of SSI’s plant at Teesside and Caparo Industries’ collapse as evidence of the depth of the crisis. Tata’s Long Steel unit faces “a difficult business situation”, the letter says, adding that to “ensure a long term sustainable business we have launched a transformation programme to improve our market performance and reduce our cost base”.

As a result, the business “will focus on reducing external spend. We cannot achieve this transformation without the support of our valued suppliers.” The letter adds: “To this end we are seeking a long-term price reduction of 30pc… on all purchases. As a first step we would appreciate an immediate price reduction of 10pc. “Supporting each other in these challenging times will enable us to further strengthen our relationship into the future. We look forward to having a long term partnership with you.” The letter then hints that suppliers who do not comply may be dropped from the company’s supply chain: “We greatly appreciate your support but also want to stress that we require contribution from all of our suppliers. “Should you – for any reason – be unable to support us in our efforts, we will need to fully consider other options.”

“..even if interest rates are at zero you’re still losing money and you have debt on top of it.”

• Welcome To The First Global Recession Created By Central Banks (FuW)

Charles Biderman, founder of the research firm TrimTabs, thinks the global slowdown will force the Federal Reserve to launch another stimulus program.

For more than a year, the Fed is trying to prepare the financial markets for a rate hike. What would that do to the credibility of the central bankers if they back off now and actually take a U-turn? Who says they have any credibility? The real problem is that the people who run the central banks are either economists or bankers. If you look at the record of global economists, they’ve been consistently wrong on the market and on the economy. At least in the United States, 95% of the economists surveyed have said at the start of each of the last five years that interest rates are going to end the year higher. Although they have been wrong each year, people keep listening to them. And when it comes to bankers, consider this: I went to Harvard Business school. The top students there went to firms like McKinsey, Boston Consulting or to the top Hedge Funds. So where did the graduates go who couldn’t get the top jobs? They went to the banks. So what you end up with is people just as greedy but not as smart.

The Fed already blinked at the September meeting. Why are they so hesitant to make a move? If the economy continues to slow down going into an election year, the Fed will be under tremendous pressure to do something. They will not let the economy and the stock market slump. That’s why I think there will be further easing.

Why are today’s stock markets so heavily focused on monetary policy? A simple way to look at market valuations is earnings divided by interest rates or cash flow divided by interest rates. So even if you raise interest rates only a quarter of a point that lowers the value of stocks. Also, once the Fed starts raising, it keeps raising. That decreases the attractiveness of flow trades into the stock market because now you can earn some money on your other assets. Right now, if you’re a corporation, your cash earns nothing. So you might as well use some of it to reduce your share count or to do a takeover. Both have been essential drivers of the bull market.

When it comes to the real economy, cheap central bank money seems not to be that beneficial. Governments are creating headwinds for growth. So the best thing central banks can do to promote growth is to cut interest rates to zero or even lower. That can work for a little while. But now it’s creating a global recession because of all the excess capacities. Even if it doesn’t cost to build a new plant or drill new wells, when demand dries up you’re not making a profit. So even if interest rates are at zero you’re still losing money and you have debt on top of it. That’s why I say: Welcome to the first global recession created by central banks.

Always when we see him, we expect Grant to switch into a Superman costume.

• Jim Grant: ‘The Fed Is An Irrelevant Anachronistic Relic (Zero Hedge)

Central bank’s experimental policies are only hurting America instead of leading the nation into financial prosperity, exclaims James Grant, editor of Grant’s Interest Rate Observer. “The Fed is a relic of the age of command and control. The Fed is an anachronism,” Grant tells Bloomberg TV in this excellent interview, “The Fed ought to get out of the business of masterminding ‘the American enterprise,’ what we call the U.S. economy.” Central bankers, Grant adds, by pressing rates to nothing, have given rise to this “very pleasant kind of inflation we call bull markets.” While bull markets are great insofar as they reflect what is actually going on, “they are very dangerous to the extent that they are the artificial creation of artificial interest rates.”

“We are in a regime of price administration. Price control is a policy that has failed for millenia. When prices are manipulated, manhandled, and otherwsise distorted, real decisions follow and the real decisions are distorted… there’s bricks, mortar, and human lives attached to these [interest rate decisions]… and that’s why they matter” “How do they know the funds rate ought to be zero?” “The world’s central bankers went to the same schools, talk the same language, have the same world view. They have shared conditions. They believe, for example, that an average of prices, which they believe they can calculate, must rise at two% a year unless the world fall into something they choose to call deflation.

They believe that they can see into the future. They believe that they have the knowledge and the dexterity to manipulate interest rates to the benefit of society. The central banks no more than the rest of us can see into the future. They are managed by human beings who do their best but who cannot – underscore – cannot see into the future and improve it before it happens. That’s their conceit. But it is not given to mankind to do such things. They try. They have every good intention. But they are appliers of an outdated scheme of command and control. They don’t know what they do.”

“What is wrong with these numbers? Just about everything.”

• Another Phony Payroll Jobs Number (Paul Craig Roberts)

The Bureau of Labor Statistics announced today that the US economy created 271,000 jobs in October, a number substantially in excess of the expected 175,000 to 190,000 jobs. The unexpected job gain has dropped the unemployment rate to 5%. These two numbers will be the focus of the financial media presstitutes. What is wrong with these numbers? Just about everything. First of all, 145,000 of the jobs, or 54%, are jobs arbitrarily added to the number by the birth-death model. The birth-death model provides an estimate of the net amount of unreported jobs lost to business closings and the unreported jobs created by new business openings. The model is based on a normally functioning economy unlike the one of the past seven years and thus overestimates the number of jobs from new business and underestimates the losses from closures.

If we eliminate the birth-death model’s contribution, new jobs were 126,000. Next, consider who got the 271,000 reported jobs. According to the Bureau of Labor Statistics, all of the new jobs plus some—378,000—went to those 55 years of age and older. However, males in the prime working age, 25 to 54 years of age, lost 119,000 jobs. What seems to have happened is that full time jobs were replaced with part time jobs for retirees. Multiple job holders increased by 109,000 in October, an indication that people who lost full time jobs had to take two or more part time jobs in order to make ends meet. Now assume the 271,000 reported jobs in October is the real number, and not 126,000 or less, where are those jobs?

According to the BLS not a single one is in manufacturing. The jobs are in personal services, mainly lowly paid jobs such as retail clerks, ambulatory health care service jobs, temporary help, and waitresses and bartenders. For example, the BLS reports 44,000 new retail trade jobs, a questionable number in light of sluggish real retail sales. Possibly what is happening is that stores are turning a smaller number of full time jobs into a larger number of part time jobs in order to avoid benefit costs associated with full time workers. The new reported jobs are essentially Third World type of jobs that do not produce sufficient income to form a household and do not produce exportable goods and services to help to bring down the large US trade deficit resulting from jobs offshoring.

The problem with the 5% unemployment rate is that it does not include any discouraged workers. When discouraged workers—those who have ceased looking for a job because there are no jobs to be found—are included the unemployment rate is about 23%. Another problem with the 5% number is that it suggests full employment. Yet the labor force participation rate remains at a low point. Normally during a real economic recovery, people enter the labor force and the participation rate rises. The bullion banks acting as agents of the Federal Reserve used the phony jobs number to launch another attack on gold and silver bullion, dumping uncovered shorts into the futures market. The strong jobs number provides cover for the naked shorts, because it implies an interest rate hike and movement out of bullion into interest bearing assets.

One passport already seized. Watch the California air resources board. They don’t fool around.

• Volkswagen Managers Afraid To Travel To US For Fear Of Prosecution (Reuters)

Volkswagen managers are worried about travelling to the US, a German newspaper reported on Saturday, saying US investigators have confiscated the passport of an employee who is there on a visit. Citing company sources, the Suddeutsche Zeitung said Volkswagen believes the investigators want to prevent the manager from evading questioning or criminal prosecution linked to the diesel emissions scandal. A spokesman for VW said: “Volkswagen employees are still travelling to the United States. Everything else is speculation.“ Volkswagen is under investigation in the US and could face penalties of up to $18bn after admitting it deliberately rigged emissions tests of diesel-powered vehicles.

Mary Nichols, head of the California air resources board, which is investigating VW, has criticised the carmaker’s handling of the scandal. Citing a person with knowledge of the matter, the paper said it was now unlikely that new VW chief executive Matthias Mueller would travel to the US in the second half of November as planned. “We need legal security here before he can fly to the United States,” the paper quoted a person from group management as saying. There is no official plan for VW’s new chief executive Matthias Mueller to travel to the US and VW has so far declined to comment when asked whether such a trip is likely.

Sure, let’s piss off the French…

• Germany Says It’s Testing Diesel Cars Of Foreign Automakers (Reuters)

Germany is subjecting diesel vehicles including those from foreign manufacturers to strict checks, its transport minister said, following Volkswagen’s latest disclosure that it gave false data on CO2 emissions. In a deepening scandal, Volkswagen on Tuesday said it had understated the fuel consumption and carbon dioxide emissions of about 800,000 vehicles sold in Europe. VW in September admitted that it had cheated on diesel emissions tests in the United States.

“We are currently carrying out strict checks on diesel vehicles from other manufacturers including foreign ones,” Transport Minister Alexander Dobrindt told the Bild daily in an interview published on Saturday. Dobrindt said the EU was working on tougher car emissions tests for the future, which would include tests on the road as well as in the lab. “The tests will therefore become more strict and will more closely resemble the normal driving behavior in road traffic,” he told the newspaper.

Shameless grifters. What the EU leadership stands for. All it stands for.

• How Juncker And Dijsselbloem Blocked European Anti-Tax Haven Laws (Spiegel)

In speeches and interviews, Juncker has always claimed that Luxembourg has in no way enriched itself “at the expense of its neighboring countries,” and especially not by encouraging tax avoidance. In everyday political life, however, Juncker’s people fought for precisely the kinds of corporate advantages their boss used such rich language to denounce. In order to attract as much corporate money as possible into the country, his officials played around with tax models like “hybrid financial instruments” and, especially, so-called “patent boxes.” Introduced in order to spur technological advancement, finance policy experts in Belgium, the Netherlands and Luxembourg led the pack in transforming tax advantages into an instrument allowing corporations to steer proceeds from patents or licenses to their Benelux subsidiaries in order to pay lower taxes there.

Under the system, national subsidiaries of large corporations in countries with higher corporate tax rates would pay large patent and licensing fees to subsidiaries in lower tax countries. The system ensured that money got pumped into the government coffers of the Benelux countries, but it also put other EU countries at a disadvantage, in addition to the majority of small- and middle-sized businesses for whom such preferential treatment wouldn’t even be considered. Representatives of the other EU member states knew very well what was going on. The German representative in the Working Group on Tax Questions, for example, filed a cable to Berlin in March 2013 in which he noted there had been repeated “doubts about the harmlessness” of a few of the tax models, “mostly having to do with the license box rules of LUX and NDL,” the abbreviations being references to Luxembourg and the Netherlands.

But nothing was done about it for years. Each time the Working Group on Tax Questions proposed changes, Luxembourg, Belgium and the Netherlands warded them off successfully. It’s no wonder, either, given that representatives of the Benelux countries regularly coordinated their decisions in advance at their own meetings. Working in close collaboration, Luxembourg and the Netherlands refused to reveal information about tax rulings for major corporations as far back as 2010, four years prior to the LuxLeaks scandal. The new revelations are highly sensitive. It’s not just European Commission President Juncker whose past as the leader of the tax-haven Luxembourg is catching up to him. Another important man at the top of an EU institution also now has some uncomfortable questions to answer: Dutch Finance Minister Jeroen Dijsselbloem. Even after ascending to his current position as head of the Euro Group, his country continued to block every call for change.

“Her natural caution has given rise to a German neologism, merkeln (“to merkel”, or put off big decisions)..”

• The Indispensable European (Economist)

Look around Europe, and one leader stands above all the rest: Angela Merkel. In France François Hollande has given up the pretence that his country leads the continent (see Charlemagne). David Cameron, triumphantly re-elected, is turning Britain into little England. Matteo Renzi is preoccupied with Italy’s comatose economy. By contrast, in her ten years in office, Mrs Merkel has grown taller with every upheaval. In the debt crisis, she began as a ditherer but in the end held the euro zone together; over Ukraine, she corralled Europeans into imposing sanctions on Russia (its president, Vladimir Putin, thinks she is the only European leader worth talking to); and over migration she has boldly upheld European values, almost alone in her commitment to welcoming refugees.

It has become fashionable to see this as a progression from prudence and predominance to rashness and calamity. Critics assert that, with her welcoming attitude to asylum-seekers, Mrs Merkel has caused a flood that will both wreck Europe and, long before, also bring about her own political demise. Both arguments are wrong, as well as profoundly unfair. Mrs Merkel is more formidable than many assume. And that is just as well: given the European Union’s many challenges, she is more than ever the indispensable European. Mrs Merkel’s predominance in part reflects the importance of Germany—the EU’s largest economy and its mightiest exporter, with sound public finances and historically low unemployment. She is also the longest-serving leader in the EU.

Her personal qualities count for much, too. She has defended Germany’s interests without losing sight of Europe’s; she has risked German money to save the euro, while keeping sceptical Germans onside; and she has earned the respect of her fellow leaders even after bruising fights with them. Most impressively (and alone among centre-right leaders in Europe), she has done this without pandering to anti-EU and anti-immigrant populists. For all the EU’s flaws, she does not treat it as a punchbag, but rather as a pillar of peace and prosperity. Mrs Merkel is far from perfect. She is not given to great oratory or grand visions. She can be both a political chameleon who adopts left-wing policies to occupy the centre-ground, and a scorpion who quietly eliminates potential rivals.

Her natural caution has given rise to a German neologism, merkeln (“to merkel”, or put off big decisions). Her timidity in handling the euro’s woes deepened the crisis unnecessarily; she has spurned the risk-sharing that the euro area needs to thrive. Ironically it is boldness, not timidity, that has brought Mrs Merkel the greatest challenge of her time in office. Her staunch refusal to place an upper limit on the number of refugees that Germany can absorb has caused growing consternation at home and criticism abroad. As German municipalities protest, her political allies are denouncing her and eastern European countries are accusing her of “moral imperialism”. With Willkommenskultur fading, there is even talk of her losing power.

Already broken. We just don’t notice yet.

• The German Machine Is Breaking Down (Boston Globe)

Rarely have the fortunes of a major European nation changed so quickly as Germany’s. Far from being a driver of the European policy process, a role it had just settled into, Germany now finds itself driven by events, mainly the refugee crisis. This turn will not only have a significant impact on Germany’s ability to manage its own affairs but is also bound to have global consequences. If Germans have proved particularly adept at one skill, it has been what can broadly be described as complexity management. That is why, for example, German policy makers felt that they could take it upon themselves to launch a radical shift toward renewable energy, even though that strategy met with near disbelief in many quarters outside the country.

Meeting that mega-sized energy transformation challenge alone basically required an “all in” effort on behalf of policy makers, industry, and society at large. Despite the daunting challenges, Germans by and large felt optimistic about their collective ability to get it done. Now, on the eve of the COP21 climate talks in Paris, in the midst of the refugee crisis, one can’t be so sure any more that Germany can stay the course. Merely coping with the tremendous refugee inflow has quickly become an all-absorbing effort. All of a sudden, the ability of public authorities and the private sector to get much else done is very limited. Germany’s civil servants, skilled and efficient as they generally are, are plainly exhausted. That exhaustion is felt at the local, state, and federal levels.

Just how profoundly the policy landscape in Germany has changed reveals itself perhaps most starkly if one looks at the members of Chancellor Angela Merkel’s CDU party in the German Parliament. Many are basically speechless, if not incensed. They believe, with good reason, that Germany was already facing many serious policy challenges, from the eurozone crisis to improving the integration of young immigrants that were already in the country. Those problems now seem a mere pittance compared to dealing with the vast inflow of refugees. It has been a rude awakening for a country that thought itself so in control of its destiny.

Amidst all that, Volkswagen’s diesel scandal doesn’t help. Perceptions matter a great deal, and the fallout is bound to have an impact on Germany’s export industries, at least in terms of reputation. In addition, markedly reduced tax payments from VW and its suppliers, whether owing to losses or declining sales, reduce the fiscal space of state and local governments at an inopportune time. Where does all of this leave us? It would be, of course, completely inappropriate to use the refugee problem as an explanation for Germany’s — and Europe’s — present troubles. It is much more appropriate to argue that the massive wave of refugees simply exposed many of the cracks that had already shown up in the European edifice.

Everyone flaunts EU laws as they see fit. It’s a free for all.

• Germany Defies EU as Lawmakers Spurn Deposit-Insurance Plan (Bloomberg)

Germany’s dispute with Brussels over the pace of unification in the euro-area banking industry escalated as the country’s parliament called on Chancellor Angela Merkel to resist a proposed common deposit-insurance plan. Lawmakers in the Bundestag, Germany’s lower house of parliament, approved a resolution late on Nov. 5 that urges the government not to agree to the deposit-insurance initiative put forward by EC President Jean-Claude Juncker. While the resolution is non-binding, it would be very difficult politically for Merkel’s coalition to disregard it. Juncker announced the plan in his state-of-the-union address on Sept. 9, promising a “legislative proposal on the first steps” by year-end. German Finance Minister Wolfgang Schaeuble signaled his opposition days later, insisting that a common deposit-guarantee system would have to wait until financial-stability measures already on the books, such as common bank resolution rules, were fully implemented.

“Half-baked proposals that make German savers liable for other countries” make no sense, said Manfred Zoellmer, a member of the Social Democratic Party, part of Merkel’s ruling coalition. “Germany has done its homework; we’re well placed in this respect,” he said. “Other countries have to do their homework first. Only then can we talk about further steps.” Antje Tillmann, the lead lawmaker in the Bundestag’s Finance Committee for Merkel’s Christian Democratic Union, said an existing EU directive on deposit guarantee schemes, on the books since mid-2014, should be properly transposed into national law by all of the bloc’s member states before further measures are considered.

The directive “was only transposed by half of the countries,” she said. “Against this background, the commission’s proposal comes at the wrong time. We should first implement what has already been agreed. Diligence should come before speed.” Juncker used a speech in Germany before the vote to play down the impact of his proposal. Speaking to an audience of German cooperative bankers, he said it doesn’t involve full risk-sharing between the euro-zone countries, something the German government has been wary of throughout the creation of Europe’s banking union.

Because they can.

• Germany Spied on Friends and Vatican (Spiegel)

Three weeks ago, news emerged that Germany’s foreign intelligence service, the Bundesnachrichtendienst (BND), had systematically spied on friends and allies around the world. In many of those instances, the BND had been doing so of its own accord and not at the request of the NSA. The BND came under heavy criticism earlier this year after news emerged that it had assisted the NSA in spying on European institutions, companies and even Germans using dubious selector data. SPIEGEL has since learned from sources that the spying went further than previously reported. Since October’s revelations, it has emerged that the BND spied on the United States Department of the Interior and the interior ministries of EU member states including Poland, Austria, Denmark and Croatia.

The search terms used by the BND in its espionage also included communications lines belonging to US diplomatic outposts in Brussels and the United Nations in New York. The list even included the US State Department’s hotline for travel warnings. The German intelligence service’s interest wasn’t restricted to state institutions either: It also spied on non-governmental organizations like Care International, Oxfam and the International Committee of the Red Cross in Geneva. In Germany, the BND’s own selector lists included numerous foreign embassies and consulates. The e-mail addresses, telephone numbers and fax numbers of the diplomatic representations of the United States, France, Great Britain, Sweden, Portugal, Greece, Spain, Italy, Austria, Switzerland and even the Vatican were all monitored in this way.

Diplomatic facilities are not covered under Article 10 of Germany’s constitution, the Basic Law, which protects German telecommunications participants from such surveillance. The initial revelations came after Chancellor Angela Merkel’s Chancellery, which is in charge of overseeing Germany’s intelligence agencies, informed the Bundestag’s Parliamentary Control Panel, which is responsible for applying checks and balances to intelligence efforts, in mid-October that the BND had been surveilling the institutions of numerous European countries and other partners for many years. In October 2013, Chancellor Angela Merkel condemned spying on her mobile phone by saying, “Spying among friends? That’s just not done.” Apparently these words didn’t apply to the BND.

2013.

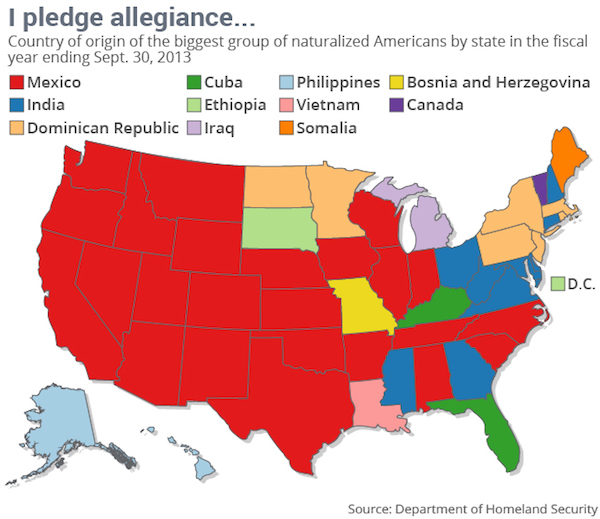

• A Nation Of Immigrants (MarketWatch)

As America becomes more diverse, that is being reflected in the home countries of those choosing to become American citizens. Nearly 800,000 people decided to become American citizens in the 12 months that ended Sept. 30, 2013 — and more than a third of them came from Asia. Asians comprised the biggest group of new Americans by region, according to recent data from the Department of Homeland Security, edging out those from North America, in which DHS includes those from Central America and the Caribbean. Mexicans remain the single largest group of foreigners who were naturalized as citizens. But by state they are the biggest group in only 24. Among the remaining 26 states plus the District of Columbia, 10 other nationalities claim the top spot, as this map shows.

In nine states, Indians made up the biggest group of naturalized citizens. Those from the Dominican Republic, who nationwide topped those from China for the first time in at least a decade, are the biggest group in five states, the DHS data show. One of those states is New Jersey. For two years running, Dominicans have made up the biggest group of naturalizations each year, narrowly exceeding the number of Indians. DHS counts 779,929 people who were naturalized across the U.S. in the 2013 fiscal year, up 3% from a year earlier but 25% fewer than the record 1,046,539 who were naturalized in the fiscal year that ended Sept. 30, 2008. Asians were 275,700 of them, followed by the 271,807 from North America, Central America and the Caribbean. Europeans, the biggest source of the immigration waves of a century ago, were 80,333 of the year’s naturalizations. By country, the biggest groups after Mexico are India, Philippines, Dominican Republic and China.

German soldiers patrolling Greek borders? Don’t think so.

• EU’s Tusk Urges Germany To Help Secure European Borders (Reuters)

Germany needs to be tougher in the refugee crisis and do more to help secure Europe’s external borders, European Council President Donald Tusk said ahead of a meeting with Chancellor Angela Merkel on Sunday. While Tusk praised Germany’s leadership role as the most liberal and tolerant in European history, he urged Berlin to do more to get the current situation under control. “Leadership responsibility also means securing Europe’s external borders together with other member states,” Tusk told Die Welt am Sonntag newspaper. “I understand why due to historical reasons, Germany may have difficulty setting up a strict regime on its borders.

But for Germany, European leadership responsibility also means controlling Europe’s external borders if necessary energetically in a pan-European unit.” Tusk, a former Polish prime minister, has repeatedly stressed the urgency of tightening Europe’s borders, while Merkel has pushed for states to show “solidarity” and share responsibilities for refugees. In October, Tusk rebuked fellow European leaders by calling arguments over how to accommodate refugees “naive” as long as Europe fails to stop them surging over its borders. Tusk is due to dine with Merkel on Sunday in Berlin ahead of an EU-Africa summit in Malta on Wednesday and EU leaders meeting on refugees on Thursday.

Evil organization.

• Frontex To Deploy Forces On Greek-Albanian Border (AP)

The European Union border protection agency Frontex says it will deploy forces along Greece’s border with neighboring Albania. Frontex head Fabrice Leggeri on Friday told Albanian television station Top Channel the agency wants to prevent migrants from attempting to reach Western Europe by traveling through Albania. That route isn’t used at the moment by the large number of people fleeing conflict and poverty in the Middle East, Africa and Asia. Tirana says, however, it has made preparations to shelter refugees should they begin arriving during the winter. Leggeri said there was no plan for a camp in Albania as “that could be a burden on the countries in the region and it is not in line with the union’s decisions for the distribution of the emigrants from Greece to the other EU countries.”

As I said before: the people should open that fence, not wait for Athens OR Brussels.

• Athens May Mull Opening Evros Fence As Part Of EU Deal (Kath.)

Greek authorities have ruled out, again, the possibility of joint sea patrols with Turkey in the Aegean but have indicated, for the first time, that they would be willing to consider opening the fence on the Evros border with the neighboring country if a broad agreement with European Union members could be reached. Speaking to the semi-state Athens-Macedonian News Agency on Saturday, Citizens’ Protection Minister Nikos Toskas indicated that Athens will not engage in any further discussion on the idea of common sea patrols. “This matter has closed,” he said. “There is no chance of joint patrols taking place. What can happen is coordination in the sea or whatever other borders, but each side has to be responsible for its own territory, its own territorial waters.”

Athens is opposed to the idea of joining forces with Turkey to patrol the Aegean in order to deter human trafficking gangs from sending refugees across to eastern Aegean islands because Ankara disputes Greece’s territorial rights in the sea separating the two countries. “We are a sovereign state and we will not try to solve one problem by creating another bigger one,” said Toskas. However, the minister suggested that the Greek government would be willing to consider opening a safe passage for refugees through the fence on the Evros border in northeastern Greece if there is an agreement with Turkey, Bulgaria and the EU. “We can’t just open everything when there is a danger that everything will close in Europe,” said Toskas in reference to other eastern and central European countries installing fences at their borders. “Evros is not just the 12-kilometer fence on its land border with Turkey, there is also a 140-kilometer river,” added the minister, who visited Alexandroupoli in northeastern Greece on Saturday.

The EU has already died on its own shores.

• Humanity Is Laid Bare On The Shores Of Europe (Giles Duley)

In mid-October I arrive in Skala Sikamineas on the north coast of the Greek island of Lesbos. I am here as part of a long-term project for the UN High Commissioner for Refugees (UNHCR), documenting the refugee crisis across Europe and the Middle East. For more than a decade I have documented the effects of conflict and humanitarian disaster across the world, and much of that work has been in the countries from which these people now flee. From Afghanistan to South Sudan, in the past years I have seen growing instability across the globe. I understand the fear that is driving people to leave their homes. I thought I had seen it all, but I have never been so overwhelmed as by the human drama unfolding on the beaches of Lesbos. In its sheer scale, it is hard to comprehend; the lack of response impossible to explain or excuse.

The events of the past few years are unprecedented in size and scope. Not since the second world war have so many people been on the move. The UNHCR estimates there are more than 60 million forcibly displaced people worldwide, with over 4 million Syrians alone leaving their war-torn country to seek safety in neighbouring countries and Europe. On Lesbos, I have watched thousands land, fleeing wars in Afghanistan, Syria and Iraq. Again and again they say to me: “We thought we would die on that boat, but at least there was some chance; what we left behind was certain death.” On landing, men break down into tears, women stand lost in visible shock, children cry hysterically. The noise and chaos is deafening; humanity is laid bare on the shores of Europe and the response from politicians is a shambles.

It is volunteers who hold this frontline; often taking unpaid leave from work, bringing their own equipment and living in whatever accommodation they can find; a nurse from Palestine, a doctor from Israel, lifeguards from Barcelona; from Bolton to Oslo, everyday people are making a difference. When survivors, upon landing, shake your hand and say “thank you”, I turn ashamed, for they have nothing to thank us for. If this were ever to be my family seeking safety, I hope the world would treat them better. We can argue about the root causes and possible solutions; we can discuss the difference between refugees, asylum seekers and migrants; we can blame traffickers and smugglers. But the simple truth is that men, women and children are suffering terribly and dying on the coasts of Europe, and for the sake of humanity alone we must help them, not turn our backs.

[..] Today, 3 November, has been one of the busiest on record for refugees arriving, and despite the dark, boats are still landing. Estimates put the figure at more than 7,000. Two men and two children drowned. The camps are full, the volunteers and agencies overwhelmed. Families are sleeping wherever they can. An Afghan father with a baby in his arms asks for somewhere to sleep. He offers to pay three times the price in a hotel, even just for his wife and baby. When it’s explained there is nowhere left and no blankets, he says: “Touch me, am I not human too?” This is Europe, this is today.

Home › Forums › Debt Rattle November 8 2015