Walker Evans Street Scene, Vicksburg, Mississippi 1936

Is the narrative falling apart?

• The Funniest BLS Jobs Report Ever (Quinn)

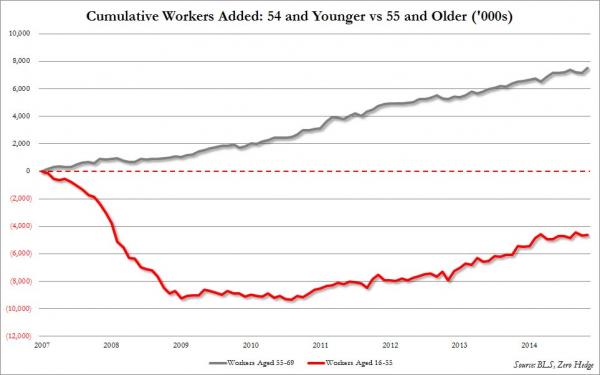

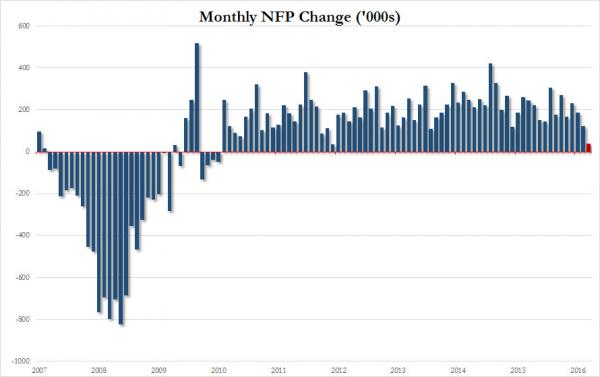

Only a captured government drone could put out a report showing only 38,000 new jobs created, with the working age population rising by 205,000, and have the balls to report the unemployment rate plunged from 5.0% to 4.7%, the lowest since August 2007. If you ever needed proof these worthless bureaucrats are nothing more than propaganda peddlers for the establishment, this report is it. The two previous months were revised significantly downward in the fine print of the press release. It is absolutely mind boggling that these government pond scum hacks can get away with reporting that 484,000 people who WERE unemployed last month are no longer unemployed this month.

Life is so fucking good in this country, they all just decided to kick back and leave the labor force. Maybe they all won the Powerball lottery. How many people do you know who can afford to just leave the workforce and live off their vast savings? In addition, 180,000 more Americans left the workforce, bringing the total to a record 94.7 million Americans not in the labor force. The corporate MSM will roll out the usual “experts” to blather about the retirement of Baby Boomers as the false narrative to deflect blame from Obama and his minions. The absolute absurdity of the data heaped upon the ignorant masses is clearly evident in the data over the last three months.

Here is government idiocracy at its finest:

• Number of working age Americans added since March – 406,000

• Number of employed Americans since March – NEGATIVE 290,000

• Number of Americans who have supposedly voluntarily left the workforce – 1,226,000

• Unemployment rate – FELL from 5.0% to 4.7%Talk about perpetrating the BIG LIE. Goebbels and Bernays are smiling up from the fires of hell as their acolytes of propaganda have kicked it into hyper-drive. We only need the other 7.4 million “officially” unemployed Americans to leave the work force and we’ll have 0% unemployment. At the current pace we should be there by election time. I wonder if Cramer, Liesman, or any of the other CNBC mouthpieces for the establishment will point out that not one single full-time job has been added in 2016. There were 6,000 less full-time jobs in May than in January, while there are 572,000 more low paying, no benefits, part-time Obama service jobs. Sounds like a recovery to me.

“..a massive surge in people not in the labor force..” We’re approaching negative employment.

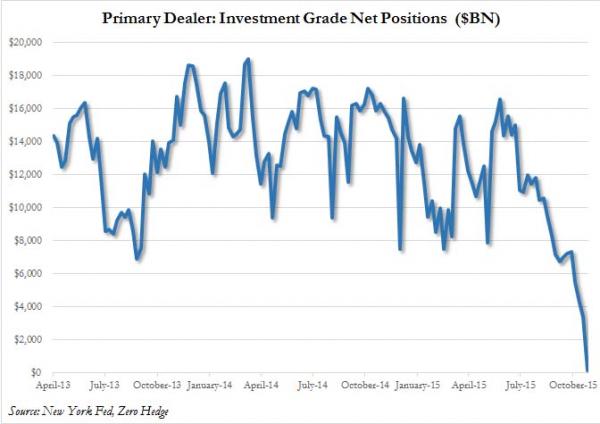

• US Payrolls Huge Miss: Worst Since September 2010 (ZH)

If anyone was “worried” about the Verizon strike taking away 35,000 jobs from the pro forma whisper number of 200,000 with consensus expecting 160,000 jobs, or worried about a rate hike by the Fed any time soon, you can sweep all worries away: moments ago the BLS reported that in May a paltry 38,000 jobs were added, a plunge from last month’s downward revised 123K (was 160K). The number was the lowest since September 2010! The household survey was just as bad, with only 26,000 jobs added in May, bringing the total to 151,030K. This happened as the number of unemployed tumbled from 7,920K to 7,436K driven by a massive surge in people not in the labor force which soared to a record 94,7 million, a monthly increase of over 600,000 workers.

As expected Verizon subtracted 35,000 workers however this was more than offset by a 36,000 drop in goods producing workers. Worse, there was no offsetting increase in temp workers (something we caution recently), and no growth in trade and transportation services. What is striking is that while the deteriorationg in mining employment continued (-10,000), and since reaching a peak in September 2014, mining has lost 207,000 jobs, for the first time the BLS acknowledged that the tech bubble has also burst, reporting that employment in information declined by 34,000 in May. The change in total nonfarm payroll employment for March was revised from +208,000 to +186,000, and the change for April was revised from +160,000 to +123,000.

With these revisions, employment gains in March and April combined were 59,000 less than previously reported. Over the past 3 months, job gains have averaged 116,000 per month. There is no way to spin this number as anything but atrocious.

And growing..

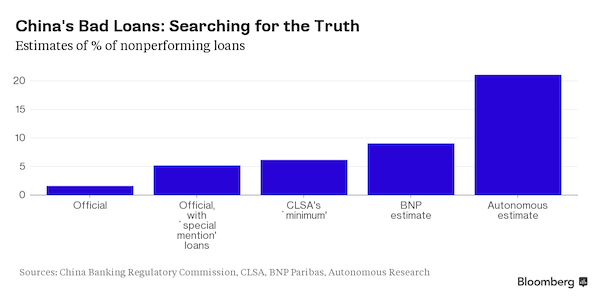

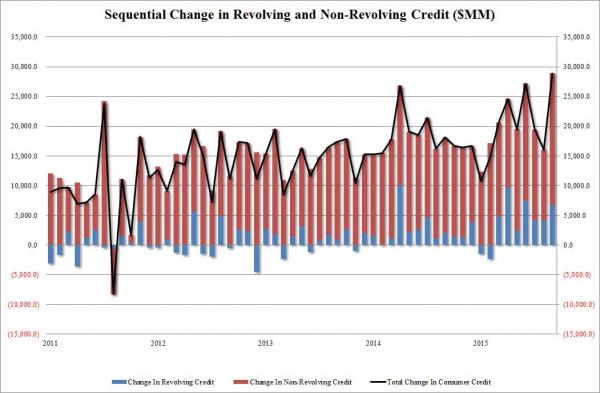

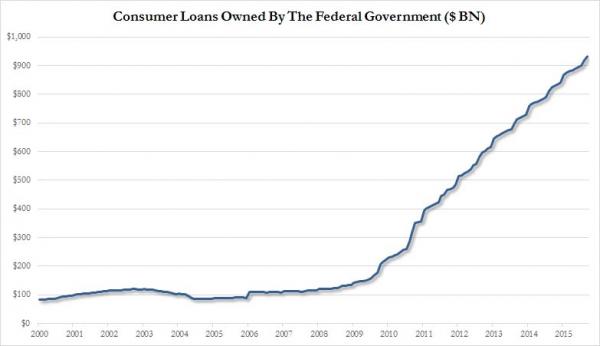

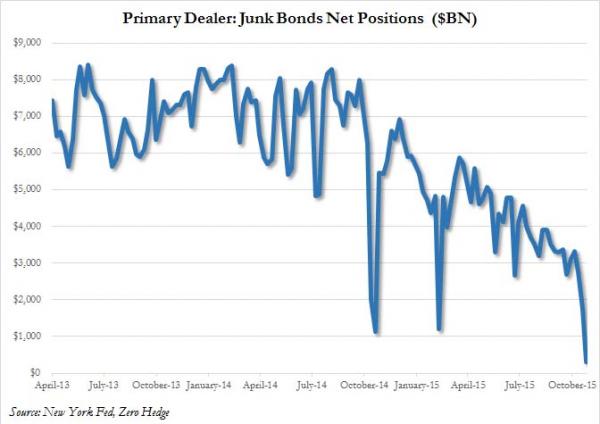

• This Financial Bubble Is 8 Times Bigger Than The 2008 Subprime Crisis (SM)

On July 1, 2005, the Chairman of then President George W. Bush’s Council of Economic Advisors told a reporter from CNBC that “We’ve never had a decline in house prices on a nationwide basis. So, what I think is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.” His name was Ben Bernanke. And within a year he would become Chairman of the Federal Reserve. Of course, we now know that he was dead wrong. The housing market crashed and dragged the US economy with it. And Bernanke spent his entire tenure as Fed chairman dealing with the consequences. One of the chief culprits of this debacle was the collapse of the sub-prime bubble.

Banks had spent years making sweetheart home loans to just about anyone who wanted to borrow, including high risk ‘sub-prime’ borrowers who were often insolvent and had little prospect of honoring the terms of the loan. When the bubble got into full swing, lending practices were so out of control that banks routinely offered no-money-down mortgages to subprime borrowers. The deals got even sweeter, with banks making 102% and even 105% loans. In other words, they would loan the entire purchase price of a home plus closing costs, and then kick in a little bit extra for the borrower to put in his/her pocket. So basically these subprime home buyers were getting paid to borrow money.

They know this already, Jack.

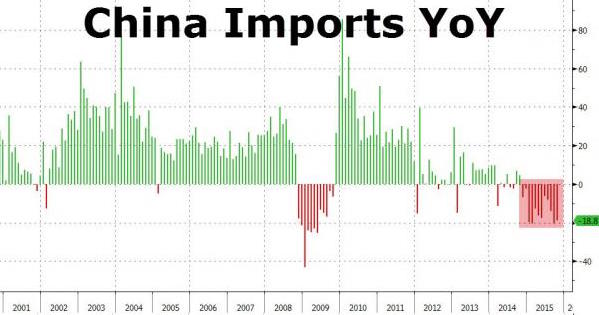

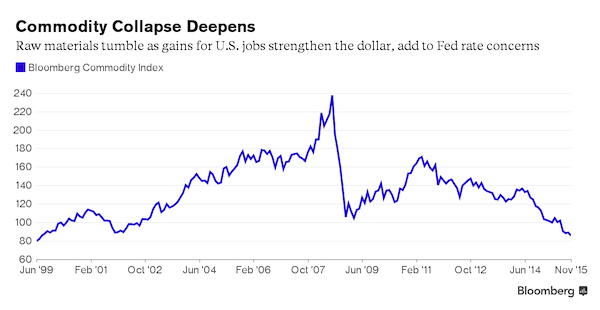

• Lew Says China’s Overcapacity Skewing Markets (BBG)

The U.S. will push China to reduce excess capacity in its economy at upcoming talks in Beijing, with Treasury Secretary Jacob J. Lew calling it an “area of central concern” Friday in Seoul. The issue bears watching when “excess capacity is distorting markets and important global commodities,” Lew said in remarks to reporters ahead of the U.S.-China Strategic and Economic Dialogue, scheduled for June 6-7 in Beijing. China Vice Premier Wang Yang, State Councilor Yang Jiechi and U.S. Secretary of State John Kerry will attend the meeting along with Lew. A senior Treasury official told reporters China has made a commitment to take serious action to reduce excess capacity in areas like steel and aluminum.

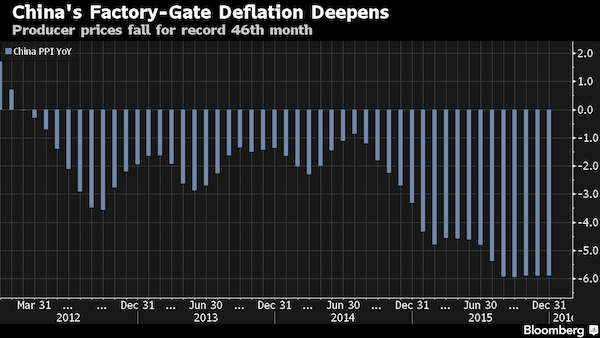

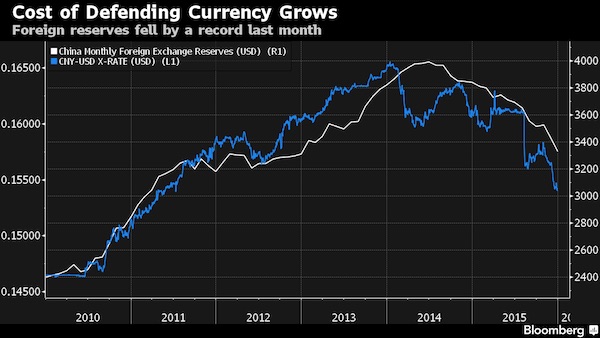

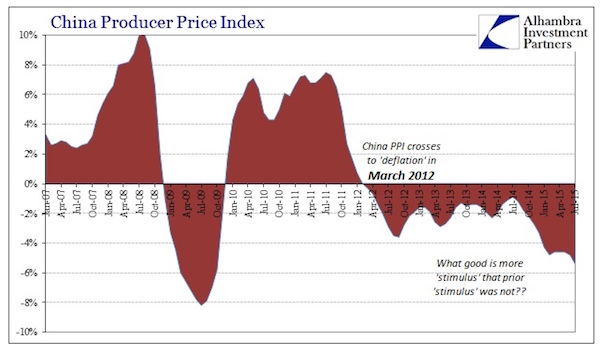

It’s a tough transition, especially as millions of workers would have to find new jobs. However, if the actions aren’t taken, excess capacity will continue to erode China’s economic growth prospects, said the official, who asked not to be identified. Chinese authorities are cutting excess capacity in industries including coal and steel while striving to keep growth above their 6.5% minimum target for this year. The economy has endured four years of factory-gate deflation, though forecasters expect that to turn around. Producer prices will improve in each of the next four quarters and turn positive in 2018, according to economists surveyed by Bloomberg in April.

At what fee for UBS?

• UBS Tells Clients To Stick With Cash-Bleeding Hedge Funds (BBG)

UBS is advising its wealthiest clients to stick with hedge funds even after the $2.9 trillion industry had its worst start to a year since 2008. While the days of “double-digit and triple-digit returns” for hedge funds are over, they still generate enough to satisfy yield-hungry clients who face negative interest rates, said Mark Haefele, global CIO of UBS Wealth Management. “Their performance in the first half hasn’t been impressive but they provide diversification,” he said in an interview with Bloomberg. “They still provide a better risk-reward or different risk-reward than other parts like sovereign bonds.”

UBS in April boosted its recommended allocation to hedge funds to 20% from 18%, saying the strategy will provide stability from volatile markets. The move comes as a net $15 billion was pulled from the global hedge-fund industry in the the first quarter and as some of world’s largest institutions including MetLife said they will scale back their holdings. Hedge funds may lose about a quarter of their assets in the next year as performance slumps Blackstone’s billionaire president, Tony James, predicted last week. The HFRI Fund Weighted Composite Index declined 0.6% in the first quarter, its worst start to a year since 2008.

The number of non-dead assets is much higher than we let on.

• Schroedinger’s Assets (Coppola)

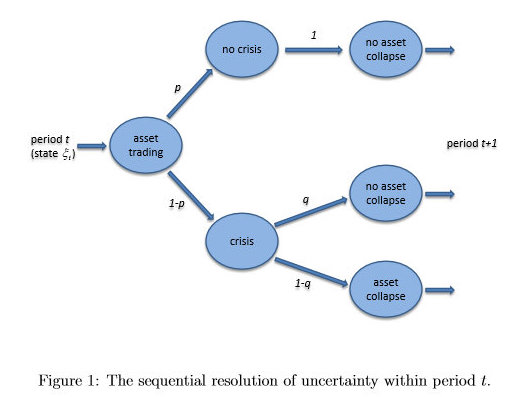

In a new paper, Michael Woodford has reimagined the famous “Schroedinger’s Cat” thought experiment. I suspect this is unintentional. But that’s what happens when, in an understandable quest for simplicity, you create binary decisions in a complex probability-based structure. Schroedinger imagined a cat locked in a box in which there is a phial of poison. The probability of the cat being dead when the box is opened is less than 100% (since some cats are tough). So if p is the probability of the cat being dead, 1-p is the probability of it being alive. The problem is that until the box is opened, we do not know if the cat is alive or dead. In Schroedinger’s universe of probabilities, the cat is both “alive” and “dead” until the box is opened, when one of the possible outcomes is crystallised. Now for “cat”, read assets. In Woodford’s model, when there is no crisis, the probability of asset collapse is zero. But if there is a crisis, the probability of an asset collapse is greater than zero but less than 100%:

“The sequence of events, and the set of alternative states that may be reached, within each period is indicated in Figure 1. In subperiod 1, a financial market is open in which bankers issue short-term safe liabilities and acquire risky durables, and households decide on the cash balances to hold for use by the shopper. In subperiod 2, information is revealed about the possibility that the durable goods purchased by the banks will prove to be valueless. With probability p, the no crisis state is reached, in which it is known with certainty that the no collapse in the value of the assets will occur, but with probability 1-p, a crisis state is reached, in which it is understood to be possible (though not yet certain) that the assets will prove to be worthless. Finally, in subperiod 3, the value of the risky durables is learned.”

Close to my heart, but very incomplete in its argumentation.

• Homes Should Be Lived In, Not Traded (G.)

The problem is twofold: the move to viewing houses as assets, a predictable investment that lets you turn a profit and offers more return on the pound than a pension, means there’s an incentive for wealthy buyers to invest in bricks and mortar without bothering with tenants. But also, as long as our economy gets sucked into a south-east vortex, more people will head to the capital for work, as the rest of the country struggles. George Osborne’s northern powerhouse claims to address this imbalance, twinned with the excruciatingly named “Midlands engine”. But with the announcement that 250 jobs in the very department responsible for rolling out the northern powerhouse are moving from Sheffield to London, that commitment looks as weak as the efforts to give it a catchy moniker.

As long as jobs fail to materialise in post-industrial towns, empty terraces will multiply. Conservative politicians have long opined that people seeking work should “get on their bike”, without stopping to observe that many do: hence the brain drain from the north and Wales, and the exponential demand for housing in the south-east England. Houses should be lived in, most people would agree: so the government’s move to criminalise squatting is key to understanding the problem of empty houses. Contrary to scare stories, people don’t pop out for a pint of milk and find that squatters have moved in to their home. Squatters often took up residence in vacant buildings, and used the houses for their intended purpose: living in.

Prosecuting squatters reasserts people’s right to treat homes as assets, not shelter. When it comes to empty houses, it’s the inequality stupid. The inequality that means some can buy multiple houses, while others cannot rent one. That sees London swallowing up wealth, jobs and land value hikes, while parts of the country grow desolate. There shouldn’t be empty homes while some people sleep on the streets, but the fact that so many lie empty should worry us: many houses aren’t homes, they’re investment vehicles, and long term, they scupper all our chances of financial and social security.

Selling off a country in peace.

• EC Wants “Immunity” For EU Technocrats At Greek Privatization Fund (KTG)

The European Commission directly intervened in the work of the Greek Justice and demanded that EU technocrats working at the Greek Privatization Fund enjoy “immunity.” The EC intervenes two days after corruption prosecutors in Athens raised charges against 3 Greeks and 3 EU-nationals of the HRADF for selling public assets thus causing losses of several millions of euro to the state. On Friday, EC spokesman Margaritis Schinas told reporters in Brussels that EU experts working in Greece under the Greek program, should enjoy some kind of ‘guarantee’. “For us, satisfactory operating margins should be guaranteed for all European experts assisting Greece to improve its economy and find its way back to growth,” Schinas said.

At the same time, he stressed that “there is full respect to judicial procedures” currently under way against 6 members of the old Privatization Fund.but the invervention was clear. Schinas did not elaborate on the Eurogroup request referring to immunity for EU technocrats who will work for the new Greek Privatization Fund. The EC intervention came right after the corruption prosecutors raised charges against 6 members of the TAIPED for the sale of 28 public assets. Three of those members are Greeks, the other three from Italy, Spain and Slovakia appointed by the Eurogroup. The six have been investigated for the period 2013-2014 and have been called to testify before corruption investigator Costas Sargiotis.

Yeah, let’s create some more creativity.

• Greek Banks Mulling Special NPL Vehicles (Kath.)

Greece’s core banks are considering the creation of special purpose companies which will receive large portfolios of nonperforming loans and then be sold so that they stop burdening the lenders’ financial figures, as NPLs now exceed €100 billion in total. The ECB is asking bank managers to proceed with tackling this huge matter at a speedier pace and to make brave decisions for the drastic slashing of bad loans from their finances. In this context, one of the plans being examined concerns the special vehicles to be created with NPL portfolios and sold off not to third parties but to the existing stakeholders of the banks.

This creation of what would resemble a “bad bank” for each lender would serve to immediately lighten the credit sector’s financial reports, while the transfer of those vehicles to the existing stakeholders could offer them future benefits from the active management of those bad loans. Nowadays the biggest obstacle to the sale of NPLs to third parties is the great distance between buyers and sellers. The buyers of bad loans want to acquire such portfolios at exceptionally low prices, due to the country risk, the devaluation of assets owing to the protracted recession in Greece, the inefficient legal system etc. On the other hand, the sellers – i.e. the banks – are refusing to sell at such low prices as they appear certain that among the current NPL stock that reaches up to 55 percent of all loans there is a huge volume of debts that could revert to normality with the right management.

They are not kidding.

• A Russian Warning (Dmitry Orlov et al)

We, the undersigned, are Russians living and working in the USA. We have been watching with increasing anxiety as the current US and NATO policies have set us on an extremely dangerous collision course with the Russian Federation, as well as with China. Many respected, patriotic Americans, such as Paul Craig Roberts, Stephen Cohen, Philip Giraldi, Ray McGovern and many others have been issuing warnings of a looming a Third World War. But their voices have been all but lost among the din of a mass media that is full of deceptive and inaccurate stories that characterize the Russian economy as being in shambles and the Russian military as weak—all based on no evidence. But we—knowing both Russian history and the current state of Russian society and the Russian military, cannot swallow these lies. We now feel that it is our duty, as Russians living in the US, to warn the American people that they are being lied to, and to tell them the truth.

And the truth is simply this: If there is going to be a war with Russia, then the United States will most certainly be destroyed, and most of us will end up dead. Let us take a step back and put what is happening in a historical context. Russia has suffered a great deal at the hands of foreign invaders, losing 22 million people in World War II. Most of the dead were civilians, because the country was invaded, and the Russians have vowed to never let such a disaster happen again. Each time Russia had been invaded, she emerged victorious. In 1812 Nepoleon invaded Russia; in 1814 Russian cavalry rode into Paris. On June 22, 1941, Hitler’s Luftwaffe bombed Kiev; On May 8, 1945, Soviet troops rolled into Berlin.

But times have changed since then. If Hitler were to attack Russia today, he would be dead 20 to 30 minutes later, his bunker reduced to glowing rubble by a strike from a Kalibr supersonic cruise missile launched from a small Russian navy ship somewhere in the Baltic Sea. The operational abilities of the new Russian military have been most persuasively demonstrated during the recent action against ISIS, Al Nusra and other foreign-funded terrorist groups operating in Syria. A long time ago Russia had to respond to provocations by fighting land battles on her own territory, then launching a counter-invasion; but this is no longer necessary. Russia’s new weapons make retaliation instant, undetectable, unstoppable and perfectly lethal.

Be afraid! There’s only 60 million of you!

• 20,000 Migrants Wait For Boats To Take Them To UK (DM)

A file lying in the drawer of the manager’s office at a small French seaside hotel provides intriguing clues about the gangsters who smuggle migrants across the Channel to Britain. It contains the passport details of four shadowy men who booked in for a night to pull off an audacious crime by trafficking 30 Pakistanis and Albanians by sea into the UK. Gangs of people smugglers now operate along all 450 miles of the north French coast — from Calais on the Belgian border to Cherbourg and beyond — as 20,000 migrants wait to get to England for a new life. During the past week they have used small fishing vessels, private yachts and speedboats to slip migrants onto England’s South Coast beaches under cover of darkness.

Early last Sunday, 18 migrants were rescued in Dymchurch, a coastal village in Kent, after their rubber dinghy began to sink offshore. The same morning, eight migrants were rescued by a lifeboat in Portsmouth harbour as they floated adrift in a fishing boat. The determination of migrants and the greed of traffickers has not been diminished by the French government’s demolition in March of the ‘Jungle’ migrant camp in Calais, an unhygienic shanty town of 4,000. The migrants simply moved on — initially 30 or so miles away to Dunkirk, where thousands live in a camp near the port, paying traffickers to cross the Channel, and then spreading further along the coast.

How many boats and bodies sink that we never hear about?

• At Least 117 Bodies Of Migrants Found After Boat Capsized Off Libya (AP)

More than 110 bodies were found along a Libyan beach after a smuggling boat of mostly African migrants sank, while a separate search-and-rescue operation across the Mediterranean saved 340 people Friday and recovered nine bodies. The developments were the latest deadly disasters for refugees and migrants seeking a better life in Europe, and they followed the drownings of more than 1,000 people since May 25 while attempting the long and perilous journey from North Africa to southern Europe. As traffickers take advantage of improving weather, officials say it is impossible to know how many unseaworthy boats are being launched — and how many never reach their destination. Naval operations in the southern Mediterranean, co-ordinated by Italy, have been stretched just responding to the disasters they do hear about.

At least 117 bodies — 75 women, six children and 36 men — washed up on a beach or were pulled from the water near the western Libyan city of Zwara Thursday and Friday, Mohammed al-Mosrati, a spokesman for Libya’s Red Crescent, told The Associated Press. All but a few were from African countries. The death toll was expected to rise. The children were aged between 7 and 10, said Bahaa al-Kwash, a top media official in the Red Crescent. “It is very painful, and the numbers are very high,” he said, adding that the dead were not wearing life jackets — something the organization had noticed about bodies recovered in recent weeks. “This is a cross-border network of smugglers and traffickers, and there is a need for an international effort to combat this phenomenon,” he said.

Crete is a somewhat novel destination.

• Hundreds Rescued, At Least 9 Die In Shipwreck Off Crete (Kath.)

Hundreds of migrants were rescued on Friday after a smuggling boat sank in international waters south of Crete, while the Hellenic Coast Guard recovered the bodies of at least nine drowned migrants. The 25-meter vessel capsized in the early hours of Friday morning under circumstances that remained unclear, leaving hundreds of migrants in the sea, some 70 nautical miles south of Crete. According to the International Organization for Migration, around 700 migrants had been aboard the vessel. Five ships – cargo and commercial vessels – had been near the scene and offered assistance, rescuing scores of migrants. The Hellenic Coast Guard sent two vessels while the navy dispatched two Super Puma helicopters to scour the area.

By late Friday, 340 migrants had been rescued and the bodies of nine migrants pulled out of the sea by rescue workers. Another vessel capsized off the coast of Libya on Friday, leading to a larger death toll, with more than 100 bodies found in the sea. Meanwhile authorities on the islands of the eastern Aegean expressed concern as tensions are rising at detention centers and frequently escalating into brawls. The influx of migrants to the islands, which had all but stopped in recent weeks, following a deal between the European Union and Ankara to return migrants to Turkey, appears to have picked up again, unnerving authorities. A group of 120 migrants arrived on Chios Friday and another 25 on Lesvos.