Russell Lee Tracy, California. Tank truck delivering gasoline to a filling station 1942

The first thing that popped into our minds on Tuesday when WTI oil briefly broached $30 for its first $20 handle in many years, was that this should be triggering a Gawdawful amount of bets, $30 being such an obvious number. Which in turn would of necessity lead to a -brief- rise in prices.

Apparently even that is not so easy to see, since when prices did indeed go up after, some 3% at the ‘top’, ‘analysts’ fell over each other talking up ‘bottom’, ‘rebound’ and even ‘recovery’. We’re really addicted to that recovery idea, aren’t we? Well, sorry, but this is not about recovering, it’s about covering (wagers).

Same thing happened on Thursday after Brent hit that $20 handle, with prices up 2.5% at noon. That too, predictably, shall pass. Covering. On this early Friday morning, both WTI and Brent have resumed their fall, threatening $30 again. And those are just ‘official’ numbers, spot prices.

If as a producer you’re really squeezed by your overproduction and your credit lines and your overflowing storage, you’ll have to settle for less. And you will. Which is going to put downward pressure on oil prices for a while to come. Inventories are more than full all over the world. With oil that was largely purchased, somewhat ironically, because prices were perceived as being low.

Interestingly, people are finally waking up to the reality that this is a development that first started with falling demand. China. Told ya. And only afterwards did it turn into a supply issue as well, when every producer began pumping for their lives because demand was shrinking.

All the talk about Saudi Arabia’s ‘tactics’ being aimed at strangling US frackers never sounded very bright. By November 2014, the notorious OPEC meeting, the Saudi’s, well before most others including ‘analysts’, knew to what extent demand was plunging. They had first-hand knowledge. And they had ideas, too, about where that could lead prices. Alarm bells in the desert.

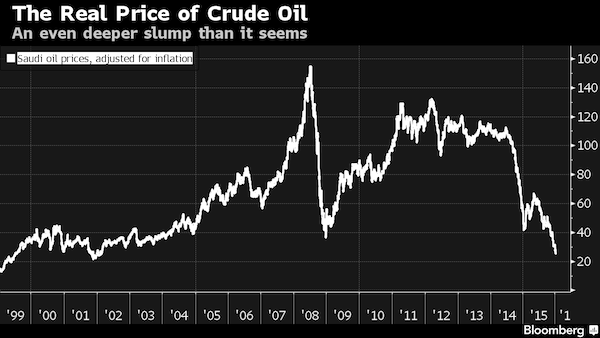

There are alarm bells ringing in many capitals, there’s not a single oil producer sitting comfy right now. And that’s why ‘official’ prices need to be taken with a bag of salt. Bloomberg puts the real price today at $26:

The Real Price of Oil Is Far Lower Than You Realize

While oil prices flashing across traders’ terminals are at the lowest in a decade, in real terms the collapse is even deeper. West Texas Intermediate futures, the U.S. benchmark, sank below $30 a barrel on Tuesday for the first time since 2003. Actual barrels of Saudi Arabian crude shipped to Asia are even cheaper, at $26 – the lowest since early 2002 once inflation is factored in and near levels seen before the turn of the millennium. Slumping oil prices are a critical signal that the boom in lending in China is “unwinding,” according to Adair Turner, chairman of the Institute for New Economic Thinking.

Slowing investment and construction in China, the world’s biggest energy user, is “sending an enormous deflationary impetus through to the world, and that is a significant part of what’s happening in this oil-price collapse,” Turner, former chairman of the U.K. Financial Services Authority, said. The nation’s economic expansion faltered last year to the slowest pace in a quarter of a century. “You see a big destruction in the income of the oil and commodity producers,” Turner said. “That is having a major effect on their expenditure across the world.”

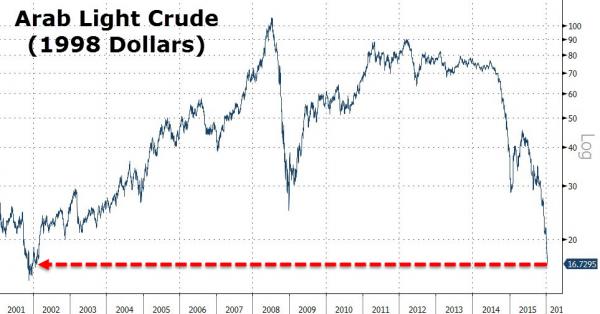

Zero Hedge does one better and looks at 1998 dollars:

The ‘Real’ Price Of Oil Is Below $17

“You see a big destruction in the income of the oil and commodity producers,” exclaims an analyst but, as Bloomberg notes, while oil prices flashing across traders’ terminals are at the lowest in a decade, in real terms the collapse is considerably deeper. Adjusted for inflation, WTI is its lowest since 2002 and worse still Saudi Light Crude is trading at below $17 (in 1998 dollar terms) – the lowest since the 1980s… Slumping prices are a critical signal that the boom in lending in China is “unwinding,” according to Adair Turner, chairman of the Institute for New Economic Thinking.

In fact, while sub-$30 per barrel oil sounds very scary, Saudi prices would be less than $17 a barrel when converted into dollar levels for 1998, the year oil sank to its lowest since the 1980s. Slowing investment and construction in China, the world’s biggest energy user, is “sending an enormous deflationary impetus through to the world, and that is a significant part of what’s happening in this oil-price collapse,” Turner, former chairman of the U.K. Financial Services Authority, said.

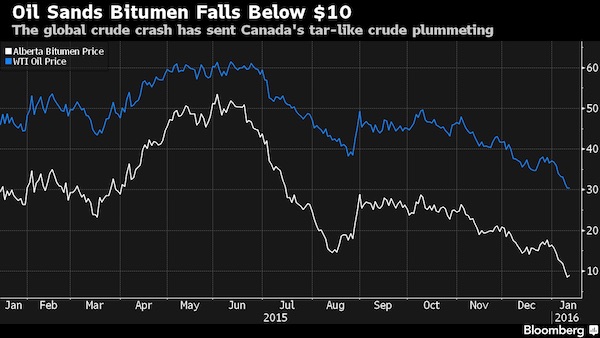

But this still covers only light sweet crude. Heavier versions are already way below even those levels. Question: what does tar sands oil go for in 1998 dollars? $5 perhaps? A barrel’s worth of it fetched $8.35 in 2016 US dollars on Tuesday. And that does not stop production, because investment (sunk cost) has been spent so there’s no reason to cut, quite the contrary.

Crude At $10 Is Already A Reality For Canadian Oil-Sands Miners

Think oil in the $20s is bad? In Canada they’d be happy to sell it for $10. Canadian oil sands producers are feeling pain as bitumen – the thick, sticky substance at the center of the heated debate over TransCanada’s Keystone XL pipeline – hit a low of $8.35 on Tuesday, down from as much as $80 less than two years ago. Producers are all losing money at current prices, First Energy Capital’s Martin King said Tuesday at a conference in Calgary. Which doesn’t mean they’ll stop. Since most of the spending for bitumen extraction comes upfront, and thus is a sunk cost, production will continue and grow.

Another interesting question is where the price of oil would be right now if the perception of low prices had not made 2015 such a banner year for filling up storage space across the globe, including huge amounts of tankers that are left floating at sea, awaiting a ‘recovery’. But that is so last year:

Tanker Rates Tumble As Last Pillar Of Strength In Oil Market Crashes

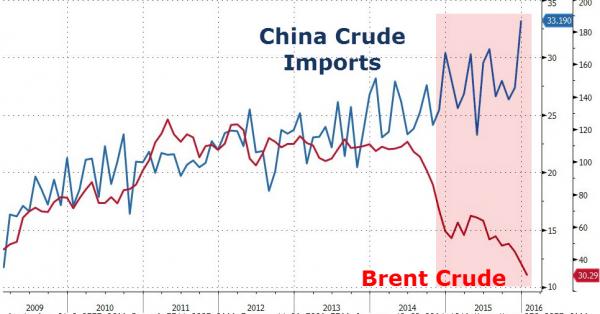

If there was one silver-lining in the oil complex, it was the demand for VLCCs (as huge floating storage facilities or as China scooped up ‘cheap’ oil to refill their reserves) which drove tanker rates to record highs. Now, as Bloomberg notes so eloquently, it appears the party is over! Daily rates for benchmark Saudi Arabia-Japan VLCC cargoes have crashed 53% year-to-date to $50,955 (as it appears China’s record crude imports have ceased). In fact the rate crashed 12% today for the 12th straight daily decline from over $100,000 just a month ago…

China imported a record amount of crude last year as oil’s lowest annual average price in more than a decade spurred stockpiling and boosted demand from independent refiners. China’s crude imports last month was equivalent to 7.85 million barrels a day, 6% higher than the previous record of 7.4 million in April, Bloomberg calculations show.

China has exploited a plunge in crude prices by easing rules to allow private refiners, known as teapots, to import crude and by boosting shipments to fill emergency stockpiles. The nation’s overseas purchases may rise to 370 million metric tons this year, surpassing estimated U.S. imports of about 363 million tons, according to Li Li, a research director with ICIS China, an industry researcher. But given the crash in tanker rates – and implicitly demand – that “boom” appears to be over.

The consequences of all this will be felt all over the world, and for a long time to come. All of our economic systems run on oil, so many jobs are related to it, so many ‘fields’ in the economy, and no, things won’t get easier when oil is at $20 or $10, it’ll be a disaster of biblical proportions, like a swarm of locusts that leaves precious little behind. Squeeze oil and you squeeze the entire economic system. That’s what all the ‘low oil prices are great for the economy’ analysts missed (many still do).

Entire nations will undergo drastic changes in leadership and prosperity. Norway, Canada, North Dakota, Russia. But more than that, Middle East nations that rely entirely on oil, a dependency that won’t allow for many of their rulers to remain in office. Same goes for all OPEC nations, and many non-OPEC producers.

We can argue that a war of some kind or another can be the black swan that sets prices ‘straight’, but black swans are supposed to be the things you can’t see coming, and Middle East warfare for obvious reasons doesn’t even qualify for that definition.

The world is full of nations and rulers that are fighting for bare survival. And things like that don’t play out on a short term basis. For that reason alone, though there are many others as well, oil prices will remain under pressure for now.

Even a war will be hard put to turn that trend around at this point. Unless production facilities are destroyed on a large scale, war may just lead to even more production as demand keeps falling. The fact that Iran is preparing to ‘come back online’, promising an even steeper glut in world markets, is putting the Saudi’s on edge. Rumors of Libya wanting to return for a piece of the pie won’t exactly soothe emotions either.

And when, in a few years’ time, all the production cuts due to shut wells become our new reality, and eventually they must, then no, there will still not be an oil shortage. Because the economy will be doing so much worse by then that demand will have fallen more than supply.

Barring large scale warfare in the Middle East there is nothing that can solve the low oil price conundrum. But think about it, which Gulf nation can even afford such warfare in present times? For that matter, which nation in the world can?

The US may try and ignite a proxy war with Russia, but that would lead to an(other) endless and unwinnable war theater. Which would carry the threat of dragging in China as well. The US and its -soon even officially- shrinking economy can’t afford that. Which of course by no means guarantees it won’t try.

Home › Forums › (Re-)Covering Oil and War