Pieter Bruegel the Elder The Triumph of Death 1562

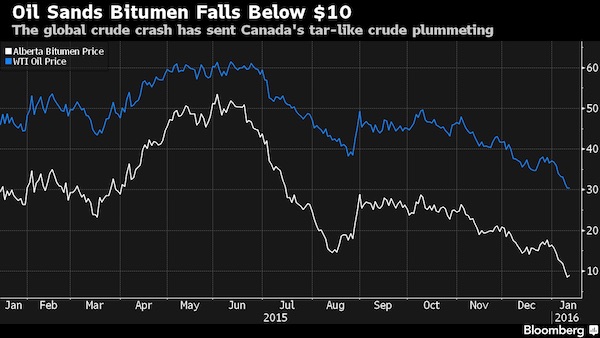

Bare Shelves Biden

RIP

https://twitter.com/i/status/1449207395926745092

Daniel is Ron Paul’s right hand man.

• A Desperate Biden Administration Turns to Terrorism (Daniel McAdams)

For Americans watching the shocking re-Nazification of Germany – where once again the ability to even buy food depends on a person’s physiological/medical status – it may be tempting to downplay the re-emergence of a nasty German political virus and scoff that, “it can’t happen here!” But it is happening here. The Biden Administration is sinking under the weight of its feeble figurehead, who is clearly living in a world of his own creation rather than living on planet reality. As Biden’s approval ratings plummet to near-historic depths, the people who run his administration – some say it’s really led by demon Susan Rice – are not backing off their hyper-authoritarian approach to…well, everything. In fact they’re doubling down.

Nurse shortage? Tough – get your shot. Billions of containers waiting to be unloaded and trucked to fill empty shelves? Tough – get your shot. Murder alley Chicago facing 50 percent less cops because those who don’t want the vax are being fired? Tough – get your shot. No one to fly the plane? Tough – get your shot. No teachers? Tough – get your shot! Into this explosion of malevolent incompetence staggers US Deputy Secretary of the Treasury Department Wally Adeyemo – second-highest ranker in the entire Department. The Nigerian-born Adeyemo, who previously served as director of African American outreach for the inspiring John Kerry 2004 presidential campaign and as a senior advisor to corrupt “woke” multi-gazillionaire Larry Fink, should be given credit for at least being honest about the intentions of his bosses in the Biden Administration.

Sometimes they tell the truth by accident. Interviewed on ABC News on Thursday, Adeyemo was asked about the thousands of container ships anchored offshore in California and elsewhere as US store shelves begin to look like Bulgaria circa 1975 – and even Santa Claus is sweating “supply chain” strangulation as Christmas quickly approaches. It’s not because Newsom’s California is a Marxist hellhole, where the religious fundamentalism of the Green New Deal fanatics has taken massive numbers of truckers off the road. Nope. It’s not Biden’s vax mandate which has unleashed a massive outflux of workers from their jobs – quitting or fired – at a time of severe labor shortages. Nope. The problem is you. You unwashed vermin who refuse to have a cocktail of experimental goop jabbed into your arm.

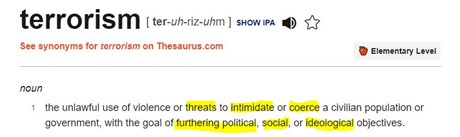

In the ABC interview Adeyemo admitted what we all know: inflation is beating the hell out of middle America (though Biden’s multi-millionaire chief-of-staff laughed it off as “high class problems”). “We are seeing high prices for some of the things that people have to buy,” Adeyemo told ABC’s Stephanie Ramos. But it’s not the Administration’s fault. Shelves bare? Treasury’s Number Two tells America it’s all the fault of those who have not yet succumbed to his boss’s demand that you take the jab: “The reality is that the only way we’re going to get to a place where we work through this transition is if everyone in America and everyone around the world gets vaccinated.” There is a word for this and it’s not actually blackmail. It’s terrorism. Until that part of America which has to this point decided that it does not want to take an unproven medical treatment is browbeaten – or worse – into submission to Fauci’s needle, the rest of the country will continue to suffer through empty shelves and a crappy Christmas. Too strong a word? Here’s how the dictionary defines terrorism:

Threat: You will eat nothing and you will be happy. Political objective: Get the shot! It’s terrorism plain and simple and the Biden Administration’s “War on Us” is taking a dangerous turn. The millions who have taken the shot are being baited to attack those who have for whatever reason – including the medically sound acquisition of natural immunity through contracting and defeating the virus – declined to take the medical procedure. In reality both groups should unite against the past two Administrations which have lied and intimidated Americans over the virus from nearly day one. But that would threaten the elites, who rule by divide-and-conquer tactics.

Duress

https://twitter.com/i/status/1449519642033197058

“Within two days, 23.7 million people had seen that Pulitzer-worthy bit of Twitter talk.”

In a hokey tweet on August 21, the U.S. Food and Drug Administration told Americans the obvious: “You are not a horse. You are not a cow. Seriously, y’all. Stop it.” Everyone knew what “it” was: an animal form of the drug ivermectin that folks were said to be using, widely, for covid-19. Don’t, said FDA. Within two days, 23.7 million people had seen that Pulitzer-worthy bit of Twitter talk. Hundreds of thousands more got the message on Facebook, LinkedIn, and from the Today Show’s 3 million-follower Instagram account. “That was great!” declared FDA Acting Commissioner Janet Woodcock in an email to her media team. “Even I saw it!” For the FDA, the “not-a-horse” tweet was “a unique viral moment,” a senior FDA official wrote to Woodcock, “in a time of incredible misinformation.”

There was one problem, however. The tweet was a direct outgrowth of wrong data—call it misinformation—put out the day before by the Mississippi health department. The FDA did not vet the data, according to our review of emails obtained under the Freedom of Information Act and questions to FDA officials. Instead, it saw Mississippi, as one email said, as “an opportunity to remind the public of our own warnings for ivermectin.” The story behind the tweet that went ’round the world shows how a myth was born about a safe, if now controversial, human drug that was FDA-approved for parasitic disease in 1996 and bestowed the Nobel Prize in Medicine in 2015. It is a story in which the barest grain of truth morphed into an anything-goes media firestorm.

It began with one sentence in a Mississippi health alert on reports to the state’s poison control center: “At least 70% of the recent calls have been related to ingestion of livestock or animal formulations of ivermectin purchased at livestock supply centers.” In the thick of a fierce covid wave in the American South, no official at the FDA, or reporter for that matter, seemed to ask: 70 percent of what? Instead, government and media joined forces against a public health threat that, in retrospect, was vastly exaggerated. Amid dozens of articles that ensued, Rolling Stone told of Oklahoma hospitals so jammed with ivermectin overdoses that gunshot victims had to wait for care—except it wasn’t true. Twice, The New York Times printed corrections of the same false information from Mississippi, which it described in one article and later removed, as “a staggering number of calls.” The Associated Press, Washington Post and, twice, the The Guardian in London also corrected its reporting on the alert. The Times’ correction summed it up: “This article misstated the percentage of recent calls to the Mississippi poison control center related to ivermectin. It was 2 percent, not 70 percent.”

This is where you go: ”any questions?” No? Then let’s roll!

“..a 5000-fold reduction in viral RNA compared with control was found..”

• The Antiviral Effects of Ivermectin on RNA Viruses (Nature)

In a recent in vitro study, the Vero/hSLAM cells infected with the SARS-CoV-2 or COVID-19 virus were exposed to 5 μM ivermectin in 48h, and a 5000-fold reduction in viral RNA compared with control was found. The results showed that treatment with ivermectin effectively kills almost all viral particles within 48h. The study was the first to assess the antiviral effect of ivermectin on COVID-19. The authors acknowledged that the drug may have antiviral effects by inhibiting the importin (IMP) α/β receptor, which is responsible for transmitting viral proteins into the host cell nucleus. The authors proposed human studies to confirm the potential benefits of ivermectin in the treatment of COVID-19. Although this study was the first to confirm the antiviral effect of ivermectin on COVID-19, other studies examined the antiviral effects of the drug on both RNA and DNA viruses..

“We look forward to a decision from the Court of Appeals. If that decision is not favorable, we will request emergency relief from the Supreme Court..”

• Appeals Court Refuses to Stop Maine Vaccine Mandate (ET)

The 1st U.S. Circuit Court of Appeals on Friday refused to issue an emergency injunction to stop Maine’s COVID-19 vaccine mandate. The three-judge panel of the Boston-based court issued a one-sentence statement saying the request was denied without an explanation, The Bangor Daily News reported. A final ruling will likely be issued next week, according to Liberty Counsel, an organization representing more than 2,000 health care workers across the state in the lawsuit. “We look forward to a decision from the Court of Appeals. If that decision is not favorable, we will request emergency relief from the Supreme Court,” Liberty Counsel Founder and Chairman Mat Staver said in a statement. Maine Attorney General Aaron Frey applauded the decision.

“We are pleased with the decision and will continue to vigorously defend the requirement that health care workers in Maine be vaccinated against COVID-19,” he said in a statement obtained by The Hill. Maine Governor Janet Mills, a Democrat, announced her state’s mandate on Aug. 12 that workers have until Oct. 29 to comply. Exemptions were allowed for medical reasons. Unlike most states, Maine does not allow for religious or philosophical exemptions to vaccine requirements. The plan was challenged by a group of healthcare workers who said they opposed COVID-19 vaccines because some vaccines were developed from cell lines of aborted fetuses. The workers also sued several healthcare companies where they work.

U.S. district judge Jon Levy ruled on Wednesday that Maine can bar religious exemptions to its requirement that healthcare workers in the state get vaccinated against COVID-19. Levy, who was nominated by former President Barack Obama, said the healthcare workers who brought the case have not been prevented from staying true to their religious beliefs, although refusing the vaccine will cost them their jobs.

“The Chicago stand-off comes as the city once again leads the United States in murders, with 639 homicides this year through October 13 — up 55 percent from two years ago.”

• Covid Vaccine Stand-off Between Chicago Mayor, Police Hits Courts (Y!)

A Chicago judge on Friday banned a police union president from making public statements on the city’s Covid-19 policy as a stand-off over vaccine mandates sparked dueling lawsuits. The dispute between mayor Lori Lightfoot and police union head John Catanzara has made the city the latest flashpoint in a deeply polarized debate over vaccines and whether governments have the right to mandate them. Lightfoot sought and received an injunction against Catanzara Friday when the judge issued a 10-day restraining order that bans him from making statements that encourage members not to report their vaccination status.

The police union filed its own lawsuit Friday against Lightfoot and Chicago Police Superintendent David Brown that seeks to force arbitration over the matter. Like all city employees, Chicago police officers have been mandated to report their vaccine status to an online portal by midnight Friday. Those not vaccinated will be subject to twice-weekly testing. Those who refuse to disclose their status have a few days’ grace to explain themselves — but face being placed on unpaid leave and eventually fired. In two videos released this week, Catanzara urged police officers to ignore the order and risk loss of pay. On Tuesday, he predicted that if a large number of officers refused to be tested or report their vaccinations, Chicago would have a “police force at 50 percent or less for this weekend.”

Lightfoot responded by saying: “I cannot and will not stand idly by while the rhetoric of conspiracy theorists threatens the health and safety of Chicago’s residents and first responders.” She also said Catanzara was “encouraging a work stoppage or strike.” Both state law and the union contract prohibits Chicago police from striking. The union responded with a tweet Friday saying: “President John Catanzara has never engaged in, supported, or encouraged a work stoppage.” [..] The Chicago stand-off comes as the city once again leads the United States in murders, with 639 homicides this year through October 13 — up 55 percent from two years ago. With shootings also up 68 percent over the period and carjackings heading for a record, the threat of losing much of the police force, even temporarily, has caused a deep sense of unease.

Nobody I know believes the 62% vaccination rate.

• Alarm Bells Ringing Over Poor Greek Vax Rate (K.)

Authorities are feeling increasingly uneasy about the pace of the country’s vaccination program, which is moving even slower in October than September, which had also seen a drop. As a result the aim to vaccinate at least 70% of the population to create the coveted wall of immunity is being further delayed, with winter just around the corner. In early September, after the summer holidays, there was a slight increase compared to the August break, with an average of about 20,000 shots being administered per day. The goal was to gradually increase this number in October so that by the end of the month or the beginning of November an additional million people would be vaccinated.

However, this was not meant to be, as in the first two weeks of October, there was a dip in appointments for the first dose – less than half compared to September. According to data.gov.gr, 62% of the population has received a single dose. The average daily rate of single dose shots in October was 5,500, while in September it was almost 13,000. By the time Greece reached the peak of the vaccination program in June, there was an average of 93,130 vaccinations per day being administered, of which 39,707 were first doses. This was because there was still a large proportion of the population which was positively inclined to the vaccine but wanted to wait a while before going ahead with it.

Currently, the percentage that has not been vaccinated is about the same as the percentage that indicated in the polls they would not get a jab or expressed caution about it. Bearing this in mind, targeted campaigns may be launched in the near future. Getting results, however, will be a tall order.

Ha ha ha! Brilliant.

• IMDB Steps In To Prop Up Audience Rating Of Fauci Documentary (JTN)

A documentary film tracking Dr. Anthony Fauci’s medical career from the AIDS crisis to COVID-19, is creating controversy away from the big screen. “Fauci,” from NatGeo and Magnolia Pictures, hit select theaters Sept. 10 before getting a Disney+ release earlier this month. The documentary lets disparate figures like President George W. Bush, U2’s Bono and Bill Gates praise the Infectious disease specialist. The studios failed to make the documentary’s box office figures available to film industry sites or JustTheNews.com. The vast majority of studios, large and small, routinely share that data, as NatGeo and Magnolia have done on previous releases.

Movie fans then noticed RottenTomatoes.com, arguably the biggest review aggregator site on the web, didn’t initially feature any “audience” reviews of the film. Mainstream film critics saluted “Fauci,” although most admitted the film served up a hagiography of the 80-year-old bureaucrat. Once audiences started weighing in on the film at Rotten Tomatoes, though, the results were withering. Professional critics gave “Fauci” a 92% “fresh” score, while audiences gave it just a 2% — or “rotten” — rating. A similar pattern emerged at IMDB.com, a major film and TV reference destination. “Fauci’s” audience rating, on a scale from 1-10, hovered around 1.8. This week, however, the site altered its review algorithm. Now, the audience review tally is a more robust 5.8.

A quick glimpse at the review breakdown, provided by the site, shows the overwhelming number of audience critics gave the film a one-star rating. The site now features this explanation: “NOTE: Our rating mechanism has detected unusual voting activity on this title. To preserve the reliability of our rating system, an alternate weighting calculation has been applied.”

Next step after the Green Pass.

• DHS Seeks To Track Biometric Data Of Workers (JTN)

The U.S. Department of Homeland Security is seeking proposals for a new system that will allow it to track the biometric data of its workers in order to monitor their physical and mental well-being. DHS said in a call for proposals this week that it is looking to “find innovative technological solutions that will improve the overall health and wellness of those consistently placed in high-stress and dangerous conditions” under DHS employment. “DHS is seeking capabilities that not only promote intervention action when necessary, but preemptively and in real-time optimize DHS personnel performance and resilience,” the agency added. The window for proposals for the project extends until next April.

“Carollo looks like he’s about six, and I say that fully conceding jealousy over his full head of hair.”

• Yes, Virginia, There is a Deep State (Taibbi)

On The Young Turks the other night, during a segment called — this is not a joke — “RebelHQ,” commentator Ben Carollo extolled the virtues of the CIA. In one section, he described how intelligence officials responded to “Donald Trump trying to plan some ridiculous scheme to maintain himself as president”: “It’s not a conspiracy theory to say that these government officials wanted to listen to congress and cared about Democratic norms and respected the constitutional structure of the way the United States is today.” When I first heard Carollo talking about the desire of intelligence officials to “listen to congress,” I thought he was being literal.

Maybe, I thought, he meant that time in 2014, when the CIA spied on the the Senate Intelligence Committee’s investigation into its torture program, wiring up Senate computers and reading staffers’ emails. Or perhaps he meant that time in 2015, when the Obama administration was using the NSA to listen to Israeli critics of his Iran deal, and ended up with “inadvertent” access to phone calls back and forth with political opponents in the U.S. congress, on both sides of the aisle. Or, maybe Carollo also meant that time when the CIA intercepted communications between the Inspector General of the Intelligence Community and congressional staff, about pending whistleblower complaints. As the ICIG put it in one of its declassified notifications, “CIA security compiled a report that includes excerpts of these whistleblower-related communications, and this report was eventually shared with CIA management.” This way, the CIA bosses could know ahead of time who was going to congress with complaints about abuses! Good times.

Alas, Carollo didn’t mean intelligence officials are listening to congress in that sense. His video essay entitled, “Fact-checking Glenn Greenwald’s stunt on Fox News,” was designed to refute the apparently ridiculous notion that “there’s some sort of secret deep state working behind the scenes.” A central part of his argument is that unlike agencies like Homeland Security, formed under the Republican administration of George W. Bush and designed to be “far more shielded from congressional oversight,” the CIA reports to congress and basically does what it’s told. The agencies with the real power to color outside the lines, Carollo tells us, are DHS-sub-operations, “specifically ICE, and Customs and Border Control,” which “have far less congressional oversight and far less structure in place for there to be those checks and balances.” Because of that, Carollo says, “Donald Trump was more than capable of enacting an extremely racist border policy.”

Even the Pentagon and the defense intelligence agencies are less of a concern, he said, because “when it comes to something like the military, there’s a long history of deep congressional oversight,” and “many checks and balances that are put into place.” Carollo looks like he’s about six, and I say that fully conceding jealousy over his full head of hair. It’s relevant only because he’s representative of a generation of young, left-leaning intellectuals who grew up in the Trump years believing the CIA, FBI, NSA, and other such agencies to be trusted, straight-and-narrow defenders of democratic “norms.” These credulous kids with piercings and chin-beards who think the secret services are on their side are the fruits of one of the great P.R. campaigns of our time.

Great Reset.

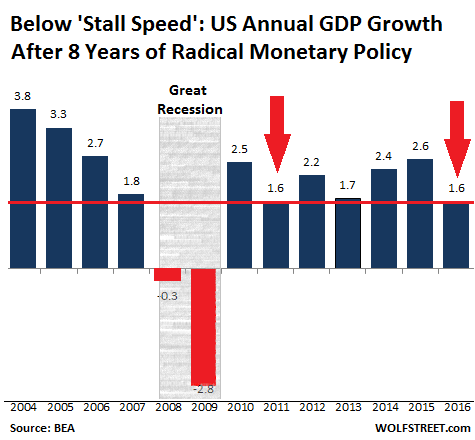

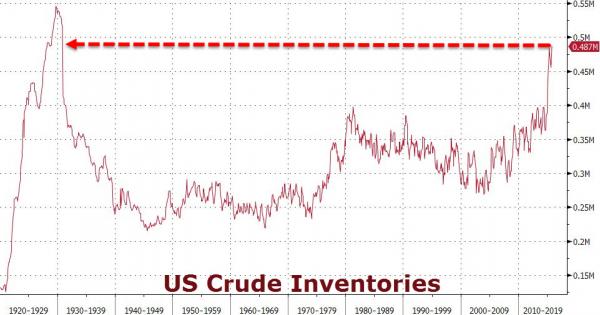

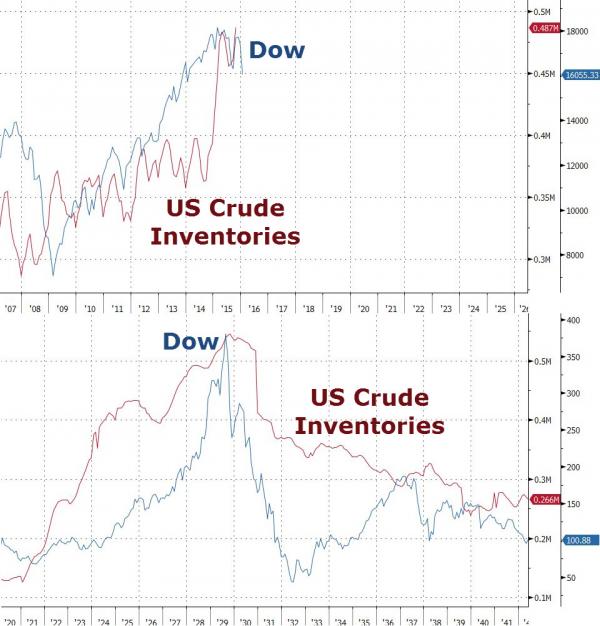

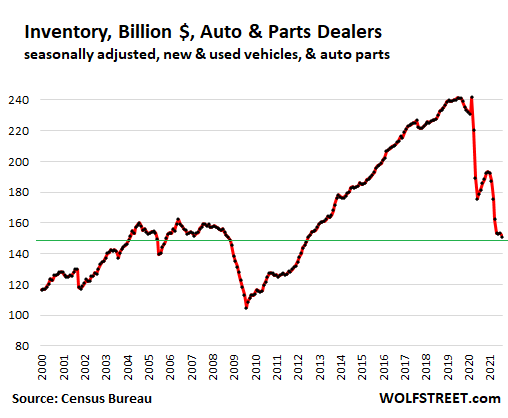

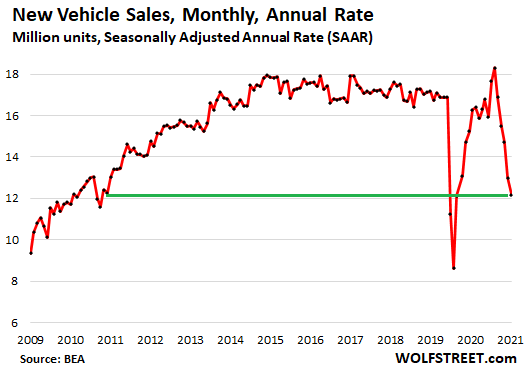

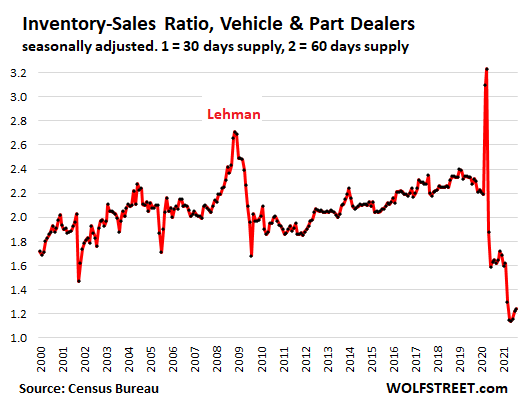

• Relentless Retail Inventory Squeeze amid Shortages & Supply Chain Chaos (WS)

The holiday selling season is approaching, and a whole litany of weird shortages is ricocheting through the economy. Stuff suddenly gets hung up somewhere, on a ship, or in a port, and then ends up somewhere else, or it’s on backorder for months, as manufacturers are struggling with material shortages and in in Asia with Covid outbreaks that shut down factories for weeks at a time. And stimulus-fueled demand in the US has been huge and relentless, while retailers are struggling with inventories, some more than others. Auto dealers, particularly new-vehicle dealers, are experiencing catastrophic shortages of popular models, as automakers have been getting blasted by semiconductor shortages that simply refuse to abate, leading to rotating shutdowns of assembly plants globally.

Auto dealers are the largest retailer segment, with their sales normally accounting for over 20% of total retail sales, and with their inventories normally accounting for 33% of total retail inventories. Inventories at auto dealers, measured in dollars, declined to a new multi-year low of $151 billion in August, according to data released by the Commerce Department on Friday. The long-term dollar-increase in inventory levels that you can see in the chart above is a reflection of higher costs per vehicle in inventory. But the number of vehicles in inventory has been in the same range for two decades, as unit sales have mostly been below the peak achieved in the year 2000.

It’s even worse during the current shortages: Inventory in dollars – though it collapsed – is being inflated by the shift to high-end models as automakers are prioritizing the biggest money makers. Sales of new and used vehicles also collapsed as there hasn’t been enough to sell. The industry-standard Seasonally Adjusted Annual Rate (SAAR) of sales plunged five months in a row and is down by 33% from May:

And so the inventory-sales ratio – inventories divided by sales, a standard metric of supply that cancels out the impact of price increases – has been ticking up over the past three months from the May low, which had been the lowest in the data going back to 1992. The upticks were driven by sales that collapsed even faster than inventories. Following the Lehman bankruptcy, new vehicle sales plunged, and the US was suddenly drowning in inventory, and the inventory-sales ratio spiked. During the pandemic, the opposite occurred: Fueled by huge amounts of fiscal and monetary stimulus, retail demand surged and collided with production woes due at first to Covid issues and then the semiconductor shortage. And prices have spiked, with many new vehicles being sold at prices well above sticker, which is nuts.

Really, Stella, talk to the Guardian? They were only ever going to smear Julian even more, while washing their hands of their role in his misery,

• Stella Moris On Her Secret Family With Julian Assange (G.)

In May 2012, the UK’s supreme court ruled he should be extradited to Sweden. In June, Assange entered the Ecuadorian embassy, where he could not be arrested because of the international legal protection afforded diplomatic premises, and refused to come out. In doing so, he breached his bail conditions. Two months later, Ecuador granted Assange political asylum, stating that they feared his human rights would be violated if he were extradited. By now, Assange had fallen out with former colleagues at WikiLeaks and collaborators at mainstream news organisations. His relationship with the Guardian soured over the decision to bring the New York Times into the collaboration, and he was angered that the Guardian investigated the Swedish allegations, rather than supporting him unquestioningly.

He was also furious about details published in a Guardian book, WikiLeaks: Inside Julian Assange’s War on Secrecy. Meanwhile, all five media partners condemned his decision to publish Cablegate unredacted, potentially endangering the lives of thousands of activists and informers in countries including Israel, Jordan, Iran and Afghanistan. The situation could not have been messier. He fell out with so many people: WikiLeaks staff, his lawyer Mark Stephens, the writer Andrew O’Hagan, who had been contracted to ghost a book out of him, which Assange never delivered. Laura Poitras’s film about Assange, Risk, is particularly poignant because she had started the project as a fan. In it, Assange comes across as vain, sexist, arrogant and messianic.

The allegations of hypocrisy were most damaging: Poitras reveals that Assange told her the film was a threat to his freedom and demanded scenes be removed. “He was really angry and he tried to intimidate,” Poitras told me at the time of Risk’s release. James Ball, global editor at the Bureau of Investigative Journalism and former Guardian journalist, briefly worked for WikiLeaks. He talks about the “incredible intensity” of his time at Ellingham House. “We were in the middle of nowhere in Norfolk, and we couldn’t bring phones because they could be tracked, so we were cut off from friends and family.” Ball challenged Assange when he was asked to sign a non-disclosure agreement, with a £12m penalty clause, that would have prevented him saying anything about WikiLeaks for two decades.

“Julian basically told everyone not to let me go to bed till I agreed to sign,” Ball says. Eventually, he did get to bed without signing. “I was woken up by Julian who was sitting on my bed, pressuring me again. He was prodding me in the face with a cuddly toy giraffe. I managed to get out, and then I got really angry for several months. A friend suggested I look into cult deprogramming. I don’t think Julian necessarily meant to build a cult, but WikiLeaks did operate like one.” Moris dismisses all the criticism of Assange as character assassination. Does she think his reputation for being difficult is fair? “How many publishers, editors, CEOs have a reputation for being nice and agreeable?” she asks. “Julian doesn’t like people who are deceitful, Julian doesn’t like opportunists, and he can be quite direct. Also people who are on the autism spectrum don’t score particularly high on the agreeableness scale.” (A psychiatrist confirmed a diagnosis of Asperger syndrome in last year’s extradition hearing.)

Major league weird.

Many advocates for freedom started extremely cautious when this started. By now, those awake should realize it's a unique moment in world history. NO TIME FOR MORE CAUTION. Even if we are wrong in some claims, it's more than legitimate to present them for proper investigation. pic.twitter.com/ARr3wv7jt7

— Wake Up From COVID (@wakeupfromcovid) October 16, 2021

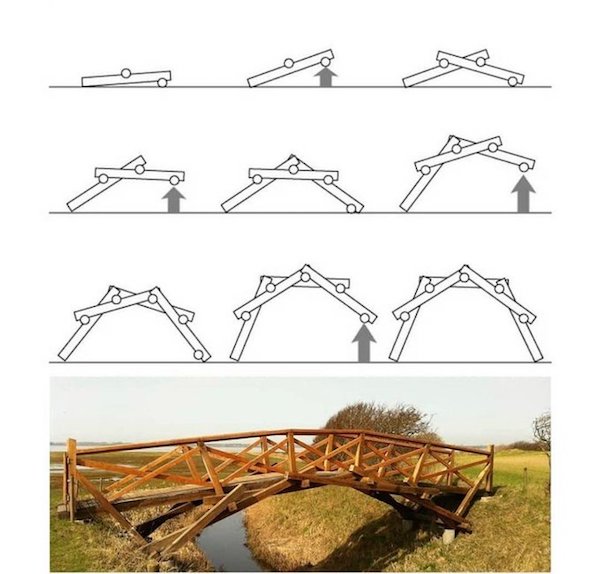

Leonardo da Vinci’s self-supporting bridge.

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.