Peter Sekaer Times Square with Father Duffy statue 1937

This is it. This is the biggest we’re going to get. We won’t grow anymore. Not bigger, not wider, not taller (just thicker perhaps, in the sense of more stupid). I return to this from time to time, and still I never see even just one voice in the media with even one hair’s breadth of doubt about the overarching theme of growth at all costs. Is this a sign that economists and other poorly educated people have taken over the world, or is it simply what we are all programmed for?

The only discussion out there is how we can best return to growth. Never if we should return to it. But still, when I look around me I don’t have the feeling that we desperately need to grow bigger. That we need to consume more than we already do, that we need to drive our cars more or move into larger homes or buy more clothes or gadgets or anything.

At least 99% of the time I think that it’s all more than enough. And not just because of the damage our consumption patterns inflicts on our lives and our health and our planet, but certainly also because of what these patterns do to my own mind and soul.

To say that this is it, and we won’t grow any bigger, is not just some spurious remark. The world economy hasn’t actually grown for decades, other than through debt.

The credit issued by Jimmy Stewart in It’s a Wonderful Life could bolster growth. But in a world that’s steeped as deeply in debt as we have become, that debt actually turns into the opposite of growth. We know this happens when more debt is needed every day just to not shrink, like the Red Queen running just to stand still.

From that moment on, more debt can only buy you the appearance and illusion of growth, not the real thing. We passed that point some 40 years ago. If not earlier. You can argue about the exact timing. But not about the fact itself. Still, there’s no argument out there about either.

Joseph Stiglitz has a piece in today’s Guardian entitled ‘Capitalism Needs New Rules To Restore Postwar Growth And Stability’. It secures Stiglitz’s place in history as a useless man, not capable of original thought, like all Fake Nobel for Economics winners. They are people capable of thought alright, provided it’s limited to one dimension only.

The US is the undisputed best of the rest these days. Its GDP growth may be sucked out of some highly paid circle of experts’ thumbs, but at least it doesn’t yet shrink too dramatically. That the entire American growth recovery illusion has been built on ‘debtsand’ is complete and utter anathema. For obvious reasons.

Unfortunately for the American economy, the economies of rest of the world are not so fortunate. They can’t even keep up appearances anymore. Though, granted, that’s not for lack of trying. Which makes sense from the overall storyline point of view. Which dictates that we all must, and therefore will, return to growth. Viewed from that hilltop, any non-growth can only be temporary. And some economist will find the solution to the problem, at which point angels will start singing.

Japan may be the worst of the basket cases. We don’t see everything there is to see yet, since the Tokyo spin machine is perhaps the best asset the country has left. But there can be no doubt that Abenomics is going to turn out brutal. And for many Japanese already has. The last straw will be the GPIF, world’s largest pension fund, switch to stocks just ahead of a giant stock market crash. Then there’ll be nothing left.

China is an economic miracle that’s rapidly turning into a 1.4 billion people size disaster. An empire of debt built on plastic trinkets and quasi slave labor that’s seeing the rest of the world’s debt collapse devastate its own air castles. The unreal estate industry that made up over 20% of the economy has nowhere left to turn. Those local officials who borrowed the most are set to be either imprisoned or have their kneecaps redesigned by the shadow banking backers. Or both. The rest will try hard to fade into the background in some far away location.

Europe is awaiting one last cheap credit splurge that may or may not come, but in a giant spoiler alert we all already know the end of the story. Europe doesn’t just have the global economic meltdown to cope with, it’s also stuck in a horribly failed currency experiment that seeks to force people of very different cultures and languages into a straight jacket that’s already strangling and suffocating some 200 million of them.

Who will be increasingly subject to power politics and vested interests in Brussels, as their lives deteriorate in further decline. The only thing the EU talks about right now is who’s going to get the big jobs in the musical chairs of the new European Committee. It’s the politicians who are important, not the people. Still that’s an issue that will solve itself as circumstances get worse. It won’t be pretty, but it will be resolved.

But come on, who among you can look at the world, at your country, your town, your own homes and lives, and tell yourselves we’re not big enough yet? What more would you want to add? Once again I’ll ask: are you happier than your parents and grandparents? And if not, what exactly are you doing, what are you trying to achieve? Be honest, shouldn’t you lose a little weight?

I can’t leave Ukraine alone when the Kiev government insinuates that Putin has threatened to drop nuclear bombs on them. That’s way beyond the pale.

Just when you think things can’t get crazier, Ukraine’s Defense Minister Valery Geletey claims Russia has in the recent past repeatedly threatened nuclear attacks on Ukraine. That one takes the cake. That is to say, until tomorrow, when Kiev may yet again try to outdo itself in the realm of absurd allegations. Geletey also talked about the threat of tens of thousands of deaths in a ‘Great Patriotic War’, the worst in Europe since WWII. As in, worse than the Balkans.

Obviously, Russia would never threaten Ukraine with nukes, if only because there is no need. At the same time, something Putin actually did say was spun, in a case of deliberate misinterpretation, to insinuate that Russia has plans to conquer Kiev. What Putin really said – to EU head Barroso – was that Russia could take Kiev, in two weeks, if it wanted to. But if Moscow had any such plans, it would just do it, not announce it. However, there are no such plans.

The narrative continues to be built to prepare for the big NATO top September 4-5. There will be many voices calling for Ukraine to be made a member, so European soldiers can be sent into the country, and what’s left of the Donbass after months of Ukraine bombing can be finished of by NATO planes. Let’s hope that plan doesn’t come to fruition, because it would greatly escalate the crisis, and NATO has no chance of winning, it would only lead to more bloodshed.

A number of retired US Army, CIA, FBI, NSA and other intelligence officers sent an open letter to Angela Merkel to urge her not to fall into the NATO propaganda trap:

US Intelligence Veterans Urge Merkel To Avoid All-Out Ukraine War

We the undersigned are longtime veterans of U.S. intelligence. We take the unusual step of writing this open letter to you to ensure that you have an opportunity to be briefed on our views prior to the NATO summit on September 4-5. You need to know, for example, that accusations of a major Russian “invasion” of Ukraine appear not to be supported by reliable intelligence. Rather, the “intelligence” seems to be of the same dubious, politically “fixed” kind used 12 years ago to “justify” the U.S.-led attack on Iraq. [..]

Obama has only tenuous control over the policymakers in his administration – who, sadly, lack much sense of history, know little of war, and substitute anti-Russian invective for a policy. [..] Largely because of the growing prominence of, and apparent reliance on, intelligence we believe to be spurious, we think the possibility of hostilities escalating beyond the borders of Ukraine has increased significantly over the past several days.

Hopefully, your advisers have reminded you of NATO Secretary General Anders Fogh Rasmussen’s checkered record for credibility. It appears to us that Rasmussen’s speeches continue to be drafted by Washington. This was abundantly clear on the day before the U.S.-led invasion of Iraq when, as Danish Prime Minister, he told his Parliament: “Iraq has weapons of mass destruction. This is not something we just believe. We know.”

Photos can be worth a thousand words; they can also deceive. We have considerable experience collecting, analyzing, and reporting on all kinds of satellite and other imagery, as well as other kinds of intelligence. Suffice it to say that the images released by NATO on August 28 provide a very flimsy basis on which to charge Russia with invading Ukraine. Sadly, they bear a strong resemblance to the images shown by Colin Powell at the UN on February 5, 2003 [..]

[..] Although President Vladimir Putin has until now showed considerable reserve on the conflict in the Ukraine, it behooves us to remember that Russia, too, can “shock and awe.” In our view, if there is the slightest chance of that kind of thing eventually happening to Europe because of Ukraine, sober-minded leaders need to think this through very carefully. If the photos that NATO and the US have released represent the best available “proof” of an invasion from Russia, our suspicions increase that a major effort is under way to fortify arguments for the NATO summit to approve actions that Russia is sure to regard as provocative.

According to a February 1, 2008 cable (published by WikiLeaks) from the US embassy in Moscow to Secretary of State Condoleezza Rice, US Ambassador William Burns was called in by Foreign Minister Sergey Lavrov, who explained Russia’s strong opposition to NATO membership for Ukraine. Lavrov warned pointedly of “fears that the issue could potentially split the country in two, leading to violence or even, some claim, civil war,which would force Russia to decide whether to intervene.” Burns gave his cable the unusual title, “Nyet Means Nyet: Russia’s Nato Enlargement Redlines,” and sent it off to Washington with IMMEDIATE precedence. Two months later, at their summit in Bucharest NATO leaders issued a formal declaration that “Georgia and Ukraine will be in NATO.”

The conversation in the west should evolve around American and European, not Russian, involvement in Ukraine. But to get there, we would need actual journalists. There don’t seem to be any left. All we have is parrots, parakeets, chameleons and weasels. And obviously, the way we are fed information about our fatally indebted economies is very much like the way our media feed us misinformation about Ukraine and Russia.

• Russia Outraged After Kiev Accuses Moscow Of Nuclear Attack Threats (RT)

Following comments from Ukraine’s Defense Minister Valery Geletey of Moscow threatening with a nuclear attack on its neighbor, Moscow said it was shocked by the statement. Russia warned that such rhetoric only deepens the civil stand-off in Ukraine. “Geletey’s calls to get ready for ‘tens of thousands’ of new victims in what he called ‘Great Patriotic War’ and what in fact is a new punitive operation in his own country are appalling. He only drags the Ukrainian people into a new round of the bloody civil stand-off,” Russia’s Foreign Ministry said in a statement Monday. Earlier Geletey wrote in his Facebook that the operation “to cleanse Ukraine’s east from terrorists” was over. He, however, proceeded to accuse Russia of direct military involvement in the east that followed the rebels’ “defeat.” “A big war has come to our home, a war Europe has not seen since WWII,” Geletey wrote alleging that Russia not only attempted to secure its position on the rebel-held territories, but also advance onto other regions.

He said that Moscow – through “unofficial channels” – has “repeatedly threatened to use tactical nuclear weapons” on Ukraine if Kiev continues to resist. “It is hard to believe that such statements can come from a defense minister of a civilized state. Otherwise, it’s just not clear how tens of thousands of Ukrainian families could entrust this official with lives of their children, brothers and husbands, mobilized into the Ukrainian army to wage a fratricidal war in their own country,” Moscow said, adding that this was a “blatant” attempt on Geletey’s behalf to secure his own post. Earlier on Monday, Russian Foreign Minister Sergey Lavrov stressed there would be “no military intervention by Russia into the conflict in Ukraine”. Lavrov said he hopes that the Monday peace talks held in Minsk will pave the way to agreeing on “an immediate unconditional ceasefire” in eastern Ukraine.

• US Intelligence Veterans Urge Merkel To Avoid All-Out Ukraine War (ZH)

We the undersigned are longtime veterans of U.S. intelligence. We take the unusual step of writing this open letter to you to ensure that you have an opportunity to be briefed on our views prior to the NATO summit on September 4-5. You need to know, for example, that accusations of a major Russian “invasion” of Ukraine appear not to be supported by reliable intelligence. Rather, the “intelligence” seems to be of the same dubious, politically “fixed” kind used 12 years ago to “justify” the U.S.-led attack on Iraq. We saw no credible evidence of weapons of mass destruction in Iraq then; we see no credible evidence of a Russian invasion now. Twelve years ago, former Chancellor Gerhard Schroeder, mindful of the flimsiness of the evidence on Iraqi WMD, refused to join in the attack on Iraq. In our view, you should be appropriately suspicions of charges made by the US State Department and NATO officials alleging a Russian invasion of Ukraine.

President Barack Obama tried yesterday to cool the rhetoric of his own senior diplomats and the corporate media, when he publicly described recent activity in the Ukraine, as “a continuation of what’s been taking place for months now … it’s not really a shift.” Obama, however, has only tenuous control over the policymakers in his administration – who, sadly, lack much sense of history, know little of war, and substitute anti-Russian invective for a policy. One year ago, hawkish State Department officials and their friends in the media very nearly got Mr. Obama to launch a major attack on Syria based, once again, on “intelligence” that was dubious, at best. Largely because of the growing prominence of, and apparent reliance on, intelligence we believe to be spurious, we think the possibility of hostilities escalating beyond the borders of Ukraine has increased significantly over the past several days. More important, we believe that this likelihood can be avoided, depending on the degree of judicious skepticism you and other European leaders bring to the NATO summit next week.

Hopefully, your advisers have reminded you of NATO Secretary General Anders Fogh Rasmussen’s checkered record for credibility. It appears to us that Rasmussen’s speeches continue to be drafted by Washington. This was abundantly clear on the day before the U.S.-led invasion of Iraq when, as Danish Prime Minister, he told his Parliament: “Iraq has weapons of mass destruction. This is not something we just believe. We know.” Photos can be worth a thousand words; they can also deceive. We have considerable experience collecting, analyzing, and reporting on all kinds of satellite and other imagery, as well as other kinds of intelligence. Suffice it to say that the images released by NATO on August 28 provide a very flimsy basis on which to charge Russia with invading Ukraine. Sadly, they bear a strong resemblance to the images shown by Colin Powell at the UN on February 5, 2003 that, likewise, proved nothing.

[..] Although President Vladimir Putin has until now showed considerable reserve on the conflict in the Ukraine, it behooves us to remember that Russia, too, can “shock and awe.” In our view, if there is the slightest chance of that kind of thing eventually happening to Europe because of Ukraine, sober-minded leaders need to think this through very carefully. If the photos that NATO and the US have released represent the best available “proof” of an invasion from Russia, our suspicions increase that a major effort is under way to fortify arguments for the NATO summit to approve actions that Russia is sure to regard as provocative. Caveat emptor is an expression with which you are no doubt familiar. Suffice it to add that one should be very cautious regarding what Mr. Rasmussen, or even Secretary of State John Kerry, are peddling. We trust that your advisers have kept you informed regarding the crisis in Ukraine from the beginning of 2014, and how the possibility that Ukraine would become a member of NATO is anathema to the Kremlin.

According to a February 1, 2008 cable (published by WikiLeaks) from the US embassy in Moscow to Secretary of State Condoleezza Rice, US Ambassador William Burns was called in by Foreign Minister Sergey Lavrov, who explained Russia’s strong opposition to NATO membership for Ukraine. Lavrov warned pointedly of “fears that the issue could potentially split the country in two, leading to violence or even, some claim, civil war, which would force Russia to decide whether to intervene.” Burns gave his cable the unusual title, “NYET MEANS NYET: RUSSIA’S NATO ENLARGEMENT REDLINES,” and sent it off to Washington with IMMEDIATE precedence. Two months later, at their summit in Bucharest NATO leaders issued a formal declaration that “Georgia and Ukraine will be in NATO.”

For the Steering Group, Veteran Intelligence Professionals for Sanity

William Binney, former Technical Director, World Geopolitical & Military Analysis, NSA; co-founder, SIGINT Automation Research Center (ret.)

David MacMichael, National Intelligence Council (ret.)

Ray McGovern, former US Army infantry/intelligence officer & CIA analyst (ret.)

Elizabeth Murray, Deputy National Intelligence Officer for Middle East (ret.)

Todd E. Pierce, MAJ, US Army Judge Advocate (Ret.)

Coleen Rowley, Division Counsel & Special Agent, FBI (ret.)

Ann Wright, Col., US Army (ret.); Foreign Service Officer (resigned)

What else can they do?

• Russia To Adjust Military Doctrine Due To Nato Expansion, Ukraine Crisis (RT)

Moscow is to review its military doctrine, a move that is caused by expansion of NATO in Eastern Europe, problems of missile defense and the crisis situation in neighboring Ukraine, says an official from the Russia’s Security Council. “I have no doubts that the issue of drawing of military infrastructure of NATO member-countries to the borders of our country, including via enlargement, will remain one of the external military threats for the Russian Federation,” Mikhail Popov, deputy secretary of the Security Council said in an interview to RIA Novosti. All NATO’s actions show that both the US and NATO are trying to escalate a deterioration of relations with Russia, he added. “We consider that the defining factor in [Moscow’s] relations with NATO will remain the unacceptability for Russia of the expansion plans of alliance’s military infrastructure to our borders, including via enlargement,” he stated.

Establishing and deploying of strategic missile defense systems which are undermining the global stability, as well as bringing the weapons into space, will also remain major military threats for Russia, he added. “The USA wants to strengthen its troops in Baltic States. [They] have already decided to transfer its heavy weapons and military equipment, including tanks and armored infantry vehicles, to Estonia. And all this next to Russia’s border.” The acting military doctrine was adopted in 2010. The new version will be released by the end of 2014, said Popov. According to Popov, the pursuit of the USA and NATO members to increase its strategic offensive potential is becoming more evident. They are trying to do this “at the expense of development of a global missile defense system” and “the elaboration of new weapons, including advanced hypersonic weapon (AHW).”

The 2010 military doctrine caused the most acute reaction in the USA and NATO, said Popov. “Many high-ranked officials reproached the leaders of our country saying that NATO isn’t a Russia’s enemy and will never attack Russia. But is that true?” he asked. “We were assured of good intentions, but the actions of recent years show entirely different things.” He added that Russia had not managed to establish an equal dialogue with its Western partners. “Everyone wants one-sided concessions from Russia in many international relations issues.” According to Popov, “the role of Russia in the Ukraine crisis is subjectively defined and thus wrong conclusions are drawn and wrong measures are applied.” “There is an unprecedented informational-propagandist campaign against Russia. The image of the enemy is presented in the face of Russia and its politics is considered as a new threat to NATO.”

There is no other way left.

• Donetsk, Lugansk Republics Urge Kiev To Recognize Their ‘Special Status’ (RT)

At talks in Minsk, the self-proclaimed Donetsk and Lugansk People’s Republics have urged Kiev to acknowledge their “special status.” If their demands are met, they will not lay claim to other parts of Ukraine, the rebel republics said. The initial statement said that if Kiev guarantees their “special status,” then the Donetsk and Lugansk republics will do everything possible “to preserve Ukraine’s common economic, cultural and political space and the space of the entire Ukraine-Russian civilization.” This was interpreted as the two self-proclaimed republics seeking autonomy within Ukraine while wishing to remain part of it.

However, later Donetsk People’s Republic Deputy PM Andrey Purgin explained that it’s about “the common security space of Ukraine, Donetsk and Lugansk People’s Republics, about post-war reconstruction of the economic, cultural, and social connections with Ukraine, and also about the fact that the DNR and LNR wouldn’t lay claim to other Ukrainian territories.” The statement comes after a contact group on the crisis in eastern Ukraine finished its work in Minsk, Belarus. In their initial demands, LNR and DNR representatives called on the Ukrainian government to end their military operation in the country’s east so that parliamentary and local elections can take place freely.

“The president, government and [parliament] Verkhovna Rada should accept… decrees granting immediate recovery from the humanitarian catastrophe, acknowledging the special status of the territories under the control of the People’s Republics, creating conditions – first of all stopping the ‘anti-terror’ operations – for free elections of local authorities and MPs,” the document with the republics’ position reads. The document also urged Kiev to guarantee “the right to use the Russian language at an official level on the territories of the People’s Republics.” After the government of President Viktor Yanukovich was ousted in March, the new authorities immediately started to introduce the legislation curbing the Russian language. Though the law failed to materialize in the end, the initiative was one of the major factors that triggered the conflict in eastern Ukraine. The self-proclaimed republics were represented by DNR Deputy PM Andrey Purgin and the chairman of the LNR’s Supreme Council, Aleksey Karyakin.

Yeah, LNG from Qatar. That’s their plan.

• Europe Drafts Emergency Energy Plan With Eye On Russia Gas Shutdown (Reuters)

The European Union could ban gas exports and limit industrial use as part of emergency measures to protect household energy supplies this winter, a source told Reuters, as it braces for a possible halt in Russian gas as a result of the Ukraine crisis. Russia is Europe’s biggest supplier of oil, coal and natural gas, and its pipelines through Ukraine are currently the subject of political maneuvering – not for the first time – as Europe and Moscow clash over the latter’s military action in Ukraine. Kiev is warning that Russia plans to halt gas supplies while Moscow says Ukraine could siphon off energy destined for the European Union – which has just threatened new sanctions if Moscow fails to pull its forces out of Ukraine. While buyers of oil and coal can find new suppliers relatively quickly, southeast Europe receives most of its gas from Kremlin-controlled Gazprom.

Tankers from Qatar and Algeria bring liquefied natural gas (LNG) to Europe via ports along the Atlantic and Mediterranean oceans, but European buyers often re-sell those cargoes abroad for higher prices rather than supplying their domestic market. A source at the EU Commission said it was considering a ban on the practice of re-selling to bolster reserves. “In the short-term, we are very worried about winter supplies in southeast Europe,” said the source, who has direct knowledge of the Commission’s energy emergency plans. “Our best hope in case of a cut is emergency measure 994/2010 which could prevent LNG from leaving Europe as well as limit industrial gas use in order to protect households,” the source said.

• Factory Activity In Europe, Asia Cools (Reuters)

Factory activity in Europe and Asia cooled in August after a strong July, as new orders dwindled in the face of escalating tensions in Ukraine and a patchy recovery in China, purchasing managers indexes showed. Despite euro zone manufacturers barely raising their prices, growth in the region slowed slightly more than initially thought, and activity in China’s vast factory sector slackened on weak foreign and domestic demand, stoking speculation that further policy stimulus would be needed. “A concerted slowdown in the China, euro zone and UK manufacturing PMIs as the second quarter gets under way raises alarm bells about global demand conditions,” said Lena Komileva, chief economist at G+ Economics in London. “This raises serious questions about the ability of major economies such as the U.S. and the UK, to weather higher interest rates, or in the case of the euro zone to withstand deflationary pressures without further stimulus.”

Euro zone factories stumbled with the final August PMI at 50.7, the lowest in over a year, as new orders slowed amidst rising tensions over Ukraine that have triggered sanctions from the West and countermeasures from Russia. Still, that was the 14th month the index has been above the 50 line that separates growth from contraction. The factory PMI for Germany, Russia’s biggest trade partner in the European Union, fell to an 11-month low while in the bloc’s second-largest economy France it dropped further below the breakeven mark. The drop in euro zone manufacturing activity came despite factories barely increasing prices and, with inflation dropping to a fresh five year low of 0.3% in August, that raises risks of the region slipping into deflation.

That’s a good way to look at it.

• Mario Draghi May As Well Roll The Dice – We’ve Tried Everything Else (Satyajit Das)

Despite investor enthusiasm and strong bond and stock markets, the economic and political risks are increasing in Europe. The actions of the European Central Bank (ECB) have reduced borrowing rates for eurozone members. While making existing high debt levels more manageable, the falling funding costs removes incentives for reducing debt and undertaking structural reforms. The Italian government proposes to use the benefit of lower rates, estimated at around €10bn (£8bn) over three years, to increase spending and relax fiscal policy. Expectations of further falls in the credit spread of Italy, Spain and previously vulnerable peripheral nations is driving purchases of their government bonds supporting the value of the euro, at least in the short term.

A weaker euro policy may also prove problematic in the medium to long term. Falls in the euro may not trigger the hoped for rise in economic activity driven by exports. A high proportion of trade is conducted in euros within the eurozone itself, limiting the currency effect. Weak growth in export markets, such as the US and emerging countries, may limit the benefits. The US, UK and Japanese experience suggest that monetary policy may not be able to increase inflation significantly, reflecting the effects of deleveraging by companies, households, banks and governments. Falls in the euro may increase the cost of imported products, driving higher inflation. But the erosion of real household incomes may reduce consumption, limiting any pick-up in growth. A weaker euro entails pursuance of a “beggar-thy-neighbour” policy. Retaliation through competing monetary easing or capital controls may defeat the ECB’s efforts to weaken the currency.

When in debt, Borrow!

• Why Peripheral Euro Zone Debt Is Worrying Investors Again (CNBC)

Companies in the peripheral euro zone countries which caused the near-disaster of the euro zone debt crisis are borrowing big again. Leveraged loan borrowing from peripheral euro zone nations is at its highest level for the year to date since 2007, according to Dealogic. While the amount borrowed this year so far, $43.7billion, is still substantially lower than the equivalent $76.2 billion in 2007, it is 64% higher than the same time in 2013, and may increase concerns that leverage levels may reach dangerous levels once more. Companies based in Ireland, acclaimed as a poster boy for bailout-imposed austerity, have been the biggest borrowers in the peripheral euro zone, as optimism returns to the country’s economy following its bailout exit. In contrast, there have been no leveraged loans signed by Greek companies this year, for the first time in nearly two decades.

This may partly be due to a rush to re-finance before the period of historically low interest rates draws to a close. And investors are looking for somewhere to put the huge sums of cheap money pumped into the financial system by Western central banks. There are particular concerns about new issues of bank bonds. On Tuesday, Spain’s biggest bank Santander announced a plan to issue up to 2.5 billion euros ($3.28 billion) in contingent convertible “CoCo” bonds. This kind of bond, which is relatively high yielding but can be written off entirely if the bank’s capital levels drop below a certain level has caused concerns about increasing risks to investors. There are expected to be a number of new peripheral euro zone bank bond issues of these kinds of bonds in coming months. “The time to worry about bank capital is when the weaker banks try to deluge the markets,” Bill Blain, strategist at Mint Partners, warned.

• China Manufacturing Slowdown Ripples Through Region (Reuters)

Growth in China’s vast factory sector slackened in August as foreign and domestic demand slowed, stoking speculation that further policy easing would be needed to prevent the economy from stumbling once more. The surveys of purchasing managers (PMI) from across Asia told a tale of underwhelming new orders and faltering exports, overshadowing brighter spots such as India and Taiwan. That was a taster for a feast of euro zone PMIs due later Monday where any weakness would only add to pressure on the European Central Bank to at least open the door to more monetary stimulus at its policy meeting this week. The Chinese surveys come in both official and private sector flavors. The National Bureau of Statistic’s version fell from a 27-month high to 51.1 in August, as factories shed jobs for at least the 24th consecutive month.

More worrying was the HSBC/Markit PMI, which eased to 50.2 in August, only a whisker above the 50-point mark that separates expansion from contraction. The official survey showed falls across output, employment, new orders, delivery time and raw material inventory, while the private version highlighted subdued demand. “The economy is healthier than it was in early 2014, but the recovery is tepid and patchy, with housing weakness a weighty anchor on both activity and confidence,” said Huw McKay, a senior international economist at Westpac in Sydney. “The authorities would be wise to stay the course with easier policy settings, especially on the fiscal side.”

• Asian Property Prices Fall ‘As If There’s A Global Financial Crisis’ (ZH)

With China’s property developers slashing prices, piling on incentives, and still seeing sales slump; it is no surprise that demand from the top to the bottom across Asia is falling. As Reuters reports, even Singapore’s Sentosa Cove (the man-made island resort billed as Asia’s Monte Carlo) is eerily silent as the billionaires seem to be staying away with prices down over 20-30% in the past year. New mortgage business is down over 40% as “the rential can’t even cover the mortgage anymore.” As one analyst notes, “the tables have turned,” adding rather ominously that, “The way prices have fallen, it’s as if there is a global financial crisis.”

More vulture victims lining up.

• Not Just Argentina: Other Nations In Debt Doldrums (CNBC)

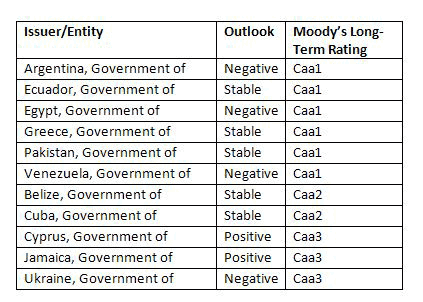

Argentina’s lengthy debt saga returned to the spotlight this week, with its second default in only 12 years triggering George Soros and other investors to sue Bank of New York Mellon for withholding interest payments. This came after Argentina refused to comply with a U.S. legal ruling ordering it to repay $1.3 billion to creditors, triggering a selective default. Moody’s Investors Service downgraded its outlook for the country’s debt to “negative” at the end of July and confirmed its long-term credit rating at “Caa1″—meaning it views Argentine debt as a highly risky investment at the precarious end of the “junk bond” spectrum.

Argentina is, nonetheless, only one of several countries whose shaky finances leave them on the brink of being unable to repay their obligations. Moody’s currently rates 10 other countries’ debt as equally or even more risky than that of Argentina. These span the globe, from nearby by Venezuela and Ecuador to Pakistan and Greece. The table below shows the countries around the world judged as most likely to default on their sovereign debt by Moody’s. Countries rated Caa1, like Egypt, are judged as risky as Argentina, while those rated Caa2 or Caa3 are even more speculative:

Wonder what the details are.

• Goldman Loaned Espirito Santo $835 Million Weeks Before Bailout (Bloomberg)

Goldman Sachs loaned Portugal’s Banco Espirito Santo $835 million in July, just weeks before the group’s units sought creditor protection in a cascade of insolvencies that resulted in the lender’s bailout. Goldman Sachs made the loan through Oak Finance Luxembourg, an investment company that raised funds destined for a Venezuelan oil refinery project, according to the unit’s offer document. Banco Espirito Santo, once Portugal’s biggest publicly traded lender by market value, was bailed out Aug. 3 after it disclosed potential losses on loans to other Grupo Espirito Santo companies and regulators ordered the lender to raise more capital. The bank was split in two with deposits and healthy assets becoming Novo Banco in a bailout by the central bank’s Resolution Fund.

The Wall Street Journal reported earlier that Goldman Sachs sold some of Oak Finance’s securities at a loss to hedge funds and the New York-based firm is still holding some of the debt, citing a person it didn’t identify. Goldman Sachs had agreed to the funding on May 16, the offer document shows. Four days later, Banco Espirito Santo warned investors buying stock in its rights offer of irregularities in the accounts of a parent company and that the “serious financial situation” of the parent firm could be damaging to the bank’s reputation. Regulators are examining how the group’s companies helped fund each other.

Stiglitz only wants growth, like all economists do.

• Capitalism Needs New Rules To Restore Postwar Growth And Stability (Stiglitz)

The reception in the US, and in other advanced economies, of Thomas Piketty’s recent book Capital in the Twenty-First Century attests to growing concern about rising inequality. His book lends further weight to the already overwhelming body of evidence concerning the soaring share of income and wealth at the very top. Piketty’s book, moreover, provides a different perspective on the 30 or so years that followed the Great Depression and the second world war, viewing this period as a historical anomaly, perhaps caused by the unusual social cohesion that cataclysmic events can stimulate. In that era of rapid economic growth, prosperity was widely shared, with all groups advancing, but with those at the bottom seeing larger percentage gains. Piketty also sheds new light on the “reforms” sold by Ronald Reagan and Margaret Thatcher in the 1980s as growth enhancers from which all would benefit. Their reforms were followed by slower growth and heightened global instability, and what growth did occur benefited mostly those at the top.

But Piketty’s work raises fundamental issues concerning both economic theory and the future of capitalism. He documents large increases in the wealth/output ratio. In standard theory, such increases would be associated with a fall in the return to capital and an increase in wages. But today the return to capital does not seem to have diminished, though wages have. (In the US, for example, average wages are down 7% over the past four decades.) The most obvious explanation is that the increase in measured wealth does not correspond to an increase in productive capital – and the data seem consistent with this interpretation. Much of the increase in wealth stemmed from an increase in the value of real estate. Before the 2008 financial crisis, a real-estate bubble was evident in many countries; even now, there may not have been a full “correction”. The rise in value also can represent competition among the rich for “positional” goods – a house on the beach or an apartment on New York City’s Fifth Avenue.

We’ll hear a lot about this case.

• Detroit Brings Bankruptcy Plan to Court With Billionaires (Bloomberg)

Detroit’s plan to fix its finances with hundreds of millions of dollars in private donations comes years after the U.S. automotive capital got hooked on philanthropy to rebuild its blighted neighborhoods, revamp its riverfront and lure new businesses. Since at least 2003, few big-city governments in the U.S. have leaned as heavily as Detroit on charity for community redevelopment, a habit that won’t change as it seeks to shed about $7.4 billion of debt and end court oversight of its finances. U.S. Bankruptcy Judge Steven Rhodes is to start a trial today in Detroit on whether to approve the city’s plan to exit its record $18 billion municipal bankruptcy with handouts from some of the richest foundations in the world.

Under a deal with state lawmakers and wealthy donors, the foundations offered to shore up Detroit pension funds as long as the city didn’t use its art collection to pay debts. The city may call billionaire Dan Gilbert, the founder of Quicken Loans Inc., and Penske Corp. founder Roger Penske as witnesses to testify in support of the plan. “There is a growing concern about who is controlling the decision-making here,” said Dale Thomson, director of the Institute for Local Government at the University of Michigan at Dearborn. “The scale and length of commitment in Detroit is unique,” according to Thomson, who’s writing a book about the role of foundations in urban revitalization.

Could have seen that coming from miles away. The IMF brings in Monsanto. While Ukraine has large swaths of black earth, where no chemicals are needed at all even if you’re prone to using them. Monsanto will end up killing off some of the most fertile soil on the planet.

• Monsanto To Use Ukraine As GMO Testing Ground, Backdoor Into EU (RT)

Ukraine’s bid for closer ties with the west could come at a cost. With the IMF set to loan the country $17 billion, the deal could also see GMO crops grown in some of the most fertile lands on the continent, warns Frederic Mousseau. Very few, not least the Ukrainian population, are aware of these details, but according to Mousseau, who is a Policy Director at The Oakland Institute, in return for the cash, Ukraine could very well become a test ground for GMO crops in Europe, something the rest of the European Union has been looking to prevent. RT caught up with the Frenchman, who voiced his concerns at what may lay ahead.

RT: When this $17 billion deal is approved by the IMF and the Ukrainian ban on GM crops is lifted, does that mean it is just a matter of time before Ukrainian farmers grow modified crops?

Frederic Mousseau: This is very likely because there is a lot of pressure from the bio-technological industry, such as Monsanto, to have these approved in Ukraine. It is also part of the EU Association Agreement, which has a particular article which calls for the expansion of bio-technology and GMOs in Ukraine.RT: If it was one of the pre-conditions of the multi-billion dollar loan, do you think it is fair to say that Monsanto has considerable influence over the IMF and the World Bank and even dictates terms to them?

FM: We saw in 2013 that Monsanto invested $140 million in new seed plans in Ukraine. It is clearly the bread basket of Europe and it is a key target for a company like Monsanto, which sees this huge potential for production and this huge market. Europe has been quite resistant in allowing GMOs, but if they are successful in Ukraine then there might be a domino effect in Europe.RT: Was it a coincidence or a pre-planned action back in December 2013, when the ban on GM goods was lifted in Ukraine, just weeks before the IMF was supposed to give that county a loan?

FM: It can’t be a coincidence because we have seen a very strong mobilization of the industry and the agro business in lobbying the government and the EU to have these changes in the legislation. Also we have seen this investment coming in prior to any adoption of GMOs. So clearly this pressure was there and to have such a clause in the EU Association Agreement means that the lobbyists in the industry must have been at work for months before that.RT: The president of the US-Ukraine Business Council has said that it is necessary to get the Ukrainian government out of the agriculture business and transform it into a private sector industry. Can we say that America has set its sights on the vast fields that could be a gold mine for agriculture?

FM: There are these seed businesses like Monsanto and pesticide companies, but there is also the land of Ukraine, which has so far been under the control of the Ukrainian government and has not been available for sale. There will be a big push to privatize this land and make it a valuable commodity, which can be acquired by foreign corporations. What we have seen in recent years is that even if the land could not be purchased, it has been leased on a massive scale. Already 1.6 million hectares have been acquired by foreign entities and it is very likely that if the reform programs continue, there will be more companies, more interest and they will be looking to strike deals for Ukrainian land.

How can that be a surprise?

• Poll Finds Rapid Shift In Favour Of Scottish Independence (FT)

Scottish voters are shifting rapidly toward support for independence with less than three weeks to go to a referendum that could end the 307-year-old political union at the heart of the U.K., a new opinion poll suggests. The YouGov survey for the Sun newspaper puts the pro-union lead at just 6 percentage points when undecided voters are excluded, down from the 22 points it found less than a month ago and the 14 points it reported in mid-August.The poll offers a huge morale boost to campaigners for a Yes vote in this month’s independence referendum, particularly since YouGov has consistently reported relatively low levels of support for independence compared with other pollsters.

“If even YouGov have it this close, then you better believe we’re winning this folks,” tweeted one independence supporter.The result will fuel doubts about the performance of the cross-party pro-union Better Together campaign after a week in which its advertising strategy has been widely questioned.The No camp lead had “collapsed”, with the independence campaign now “in touching distance of victory”, Peter Kellner, YouGov president, wrote in the Sun.

Go East, young man.

• Russia and China Launch Construction of World’s Biggest Gas Pipeline (BBC)

Russia and China have begun the construction of a new gas pipeline linking the countries, with a ceremony in the Siberian city of Yakutsk. China’s CNPC has agreed to buy $400bn (£240bn) of gas from Russia’s Gazprom. Russia will ship 38 billion cubic metres (bcm) of gas annually over a period of 30 years. The deal will lessen Russia’s dependence on European buyers, who have imposed economic sanctions because of the crisis in Ukraine. The construction ceremony was attended by Russian President Vladmir Putin and Chinese Vice-Premier Zhang Gaoli.

China will start work on the construction of its side of the pipeline in the first half of 2015, Mr Zhang said. The first gas will be pumped from Siberia to north-east China in early 2019. Over the past 10 years, China has used other gas suppliers. Turkmenistan is now China’s largest foreign gas supplier. Last year, it started importing piped natural gas from Myanmar. China is Russia’s largest single trading partner, with bilateral trade flows of $90bn (£53bn) in 2013. The two neighbours aim to double the volume to $200bn in 10 years.

• A Doomed Earth Of Science Fiction May Well Become A Reality (Guardian)

There’s a scene in the newly-restored science fiction classic The Day the Earth Caught Fire (premiered last week in the summer open air cinema at the British Museum) when The Daily Express’s fictional, bull-nosed science reporter, Bill Maguire, barks at a newsroom junior to fetch him information on the melting points of various substances. It’s to illustrate a spread in the paper which is investigating how massive nuclear tests have shifted the planet on its axis, causing chaotic weather and a heat wave to slowly marinate London. The screening launched the British Films Institute’s Sci-Fi season, whose light-hearted tone was set with kitsch alien facemasks given to the audience. A giant promotional selfie was taken before the film began. At the end, the friend I’d watched it with, who works for an official environmental body, went very quiet. “Do you know what I’ve been doing in the last few days?” she asked rhetorically. “Looking into the melting points of various substances in the event of worsening heat waves hitting London.” We both went quiet then.

Research into heat thresholds shows what happens when science fiction becomes science fact. At 20C legionalla bacteria start developing in normal drinking water. At 24C London Underground start work to prevent track buckling. Less than a degree more, at 24.7C for a two-day duration, and deaths and hospital admissions rise. An estimated 600 more people died in London than usual during the 2003 heat wave. Even well-insulated houses overheat at 27C. Power cables start getting hit at around 30C and the likelihood of power outages for businesses goes up. At 33C road surfaces begin to soften and melt. For comparison, in the 2003 heat wave, there were air temperatures recorded on the tubes and platforms of 41.5C and 36.2C respectively. The UK’s highest outdoor daytime temperature recorded so far was 38.5C, outside London in Gravesend, Kent.

When are they going to evacuate everybody from there?

• Fukushima OKs Nuke Waste Storages, Gets Paid $3 Billion In ‘Subsidies’ (RT)

Fukushima’s governor has officially agreed to allow the country’s authorities to store radioactive waste for 30 years in two municipalities in exchange for 300 billion yen ($2.89 billion) in subsidies. “It’s a difficult decision, but I want to accept the construction plan,” Governor Yuhei Sato told journalists on Saturday. Sato told The Japan Times he accepted the plan because he sees it as “necessary to advance decontamination and realize recovery of the environment.” The mayor’s formal acceptance should be also sent to Environment Minister Nobuteru Ishihara and Reconstruction Minister Takumi Nemoto on Monday, and he is also set to meet with the country’s premier Shinzo Abe in Tokyo.

On Wednesday, two Fukushima prefecture municipalities made the decision that they would accept the government’s package of subsidies, allowing to build the storages. “We succeeded in greatly deepening (local officials’) understanding (of our storage facility plan),” Nobuteru Ishihara, environment minister, told journalists on Tuesday, as quoted by The Asahi Shimbun media outlet, following his meeting with members of the town assemblies of Futaba and Okuma. The central government is to pay subsidies totaling 301 billion yen ($2.89 billion) to support the locals and revive the community. Documents containing explanations of the government assistance are set to be provided for local residents. A telephone line will also be set up to answer questions from locals.

• Antarctic Coastal Waters ‘Rising Faster’ (BBC)

Melting ice is fuelling sea-level rise around the coast of Antarctica, a new report in Nature Geoscience finds. Near-shore waters went up by about 2mm per year more than the general trend for the Southern Ocean as a whole in the period between 1992 and 2011. Scientists say the melting of glaciers and the thinning of ice shelves are dumping 350 billion tonnes of additional water into the sea annually. This influx is warming and freshening the ocean, pushing up its surface. “Freshwater is less dense than salt water and so in regions where an excess of freshwater has accumulated we expect a localised rise in sea level,” explained Dr Craig Rye from the University of Southampton, UK, and lead author on the new journal paper. Globally, sea levels are going up, in part because of the contribution of the world’s diminishing ice fields. This is well known.

But the Nature Geoscience report is the first to show the direct consequences to sea surface height (SSH) around Antarctica itself. While the satellite data record indicates there has been a general upward trend in SSH in the Southern Ocean south of 50 degrees of up to 2.4mm per year, those satellites also indicate a more rapid rise in waters sitting on the continental shelf. Modelling by Dr Rye’s team suggests that this additional 2mm per year can be attributed almost exclusively to freshwater runoff from Antarctica, and not to some climatic oscillation that might make sea levels “breathe” up and down on decadal timescales. “We can estimate the amount of water that wind is pushing on to the continental shelf, and show with some certainty that it is very unlikely that this wind forcing is causing the sea level rise,” Dr Rye told BBC News.

Home › Forums › Debt Rattle Sep 2 2014: This Is As Big As We Will Get