DPC The Arcade, Cleveland 1901

“We see a concentration of wealth capturing power and leaving ordinary people voiceless and their interests uncared for.”

• Half of Global Wealth Held By The 1% (Guardian)

Billionaires and politicians gathering in Switzerland this week will come under pressure to tackle rising inequality after a study found that – on current trends – by next year, 1% of the world’s population will own more wealth than the other 99%. Ahead of this week’s annual meeting of the World Economic Forum in the ski resort of Davos, the anti-poverty charity Oxfam said it would use its high-profile role at the gathering to demand urgent action to narrow the gap between rich and poor. The charity’s research, published today, shows that the share of the world’s wealth owned by the best-off 1% has increased from 44% in 2009 to 48% in 2014, while the least well-off 80% currently own just 5.5%. Oxfam added that on current trends the richest 1% would own more than 50% of the world’s wealth by 2016.

Winnie Byanyima, executive director of Oxfam International and one of the six co-chairs at this year’s WEF, said the increased concentration of wealth seen since the deep recession of 2008-09 was dangerous and needed to be reversed. In an interview with the Guardian, Byanyima said: “We want to bring a message from the people in the poorest countries in the world to the forum of the most powerful business and political leaders. “The message is that rising inequality is dangerous. It’s bad for growth and it’s bad for governance. We see a concentration of wealth capturing power and leaving ordinary people voiceless and their interests uncared for.”

Oxfam made headlines at Davos last year with a study showing that the 85 richest people on the planet have the same wealth as the poorest 50% (3.5 billion people). The charity said this year that the comparison was now even more stark, with just 80 people owning the same amount of wealth as more than 3.5 billion people, down from 388 in 2010. Byanyima said: “Do we really want to live in a world where the 1% own more than the rest of us combined? The scale of global inequality is quite simply staggering and despite the issues shooting up the global agenda, the gap between the richest and the rest is widening fast.”

“Almost no investors believe this is the end of the party ..”

• Shanghai Rally Faces Stress Test After 7.7% Market Tumble (FT)

Fevered rallies and dramatic falls go with the territory of investing in mainland China. But even by Shanghai’s wild standards, Monday’s plunge was one to remember. By the close of trading, the Shanghai Composite had tumbled 7.7% — its biggest fall in five years — erasing all its January gains. Having been the best performing market in the world last year, China’s volatile streak has been swiftly exposed once more. The immediate trigger was a move by the China Securities Regulatory Commission (CSRC) to clamp down on margin lending at the big brokerages, which all saw their stocks down by the daily limit of 10%. Borrowing to invest in equities has been a key driver of Shanghai’s charge upwards, with margin financing almost tripling between June and December to hit Rmb767bn ($124bn) last week.

Hong Hao, strategist at Bank of Communications, described the curb on margin trading as a “nasty surprise”, and one that could send the market into a tailspin. “With less incremental liquidity flow into stocks and damped sentiment, the market will correct in the near term, and the move can be violent,” Mr Hong wrote in a note to clients. Separately on Friday, the banking regulator issued draft rules that would limit the use of intercompany loans. Loans between non-financial companies, in which a bank serves as intermediary, have exploded in recent years, with new loans hitting Rmb2.5tn in 2014. Local media reports say some of those funds have flowed into the stock market. The question now facing investors is whether the market can bounce back quickly without more credit-fuelled speculation.

Many remain bullish, seeing the new regulations as simply a stress test for the market. Jin Mi at China Merchants Securities, a top 10 brokerage by assets, said the CSRC was sending “a warning to the market against excessive optimism”. “Almost no investors believe this is the end of the party,” he wrote in a report. Many analysts believe Shanghai’s bull run is a government-induced phenomenon, designed to give Chinese savers an alternative to the wobbly housing market or risky shadow banking products . That has drawn in millions of retail punters, who have been opening new trading accounts at a record pace. “The government has been urging people to buy stocks, which gives people a sense of a put on the market,” says David Cui, strategist at Bank of America Merrill Lynch.

Deflation is a real threat in China now. The dollar peg makes that a lot worse.

• Will China Be The Next Forex Peg To Break? (MarketWatch)

The surprise move by Switzerland to scrap its currency ceiling against the euro last week is a reminder there can be unexpected collateral damage from central banks waging currency wars. As markets digest last week’s turmoil, expect focus to turn to other fault lines on the global currency map. Here China stands out, as like the Swiss, it runs an implicit currency peg that is becoming increasingly painful to maintain. Due to its longstanding crawling peg to the U.S. dollar, the yuan has increasingly found itself pulled higher against just about every major currency. The world’s largest exporter has already had to endure two years of aggressive yen devaluation since the introduction of Abenomics and its accompanying quantitative easing. Now comes a new front, as the ECB looks ready to green-light its own QE next week. The move by Switzerland also means the Swiss National Bank ceases its purchases of euros needed to maintain its peg, again meaning the euro will all but certainly head lower.

Further currency strength is likely to be distinctly unwelcome for the Chinese economy. Later this week, gross domestic product figures for 2014 are widely expected to show growth at its slowest pace in 24 years if, as some predict, the government’s 7.5% annual growth target is missed. This comes at the same time that the economy is flirting with outright deflation and amid a new trend of foreign capital exiting China. Last week’s currency ructions present a new headwind to growth as exports will be harder to sell across Europe, China’s second biggest market after the U.S. The other danger looming for China is that a strong currency exacerbates deflationary forces. Producer prices have been falling for almost three years, and the plunge in crude-oil prices adds a further disinflationary bent. The property market looks as if it could also push prices decisively lower. Prices of new homes in big cities fell 4.3% in December from a year earlier, according to new government data released over the weekend.

The difficulty for Beijing is that these external movements in currencies are outside its control. If moves to depreciate the euro trigger another round of competitive deprecations, just how much more yuan appreciation can China withstand? While the policy actions of both the Swiss and European central banks last week appear quite different, they share a common feature: Both acted with reluctance only when the pain became too much to bear. The reason deflation is public enemy No. 1 for central banks is that debt becomes much harder to service and can stall growth and employment as consumers put off purchases and business put off investment. China certainly has debt levels that would make deflation worrisome. Total debt levels are now estimated to be in excess of 250% of GDP. Lower-than-expected bank loan growth in December also suggests demand in the economy is already weak.

Beijing had no choice but to curb the mad influx in stocks.

• China Brokers Fall as Regulator Curbs New Margin Accounts (Bloomberg)

Chinese brokerages’ shares plunged after the securities regulator suspended three of the biggest firms from adding margin-finance and securities lending accounts for three months following rule violations. Citic Securities, the nation’s biggest broker, fell 14% as of 9:35 a.m. in Hong Kong. Haitong Securities and Guotai Junan Securities were among others whose shares tumbled. The trio were suspended after letting customers delay repaying financing for longer than they were supposed to, the China Securities Regulatory Commission said on its microblog on Jan. 16, without giving more details. Regulators may have been concerned that stock gains, partly driven by margin financing, are too rapid, according to Hao Hong, a strategist at Bocom International in Hong Kong.

The move came after the Shanghai Composite Index surged 63% in six months and brokers including Citic and Haitong announced plans to raise more money to lend to clients.“Brokerage shares are likely to get hit,” Hong said before the market opened today. “After all, margin financing is one of the reasons for people to be bullish on brokerage stocks, and these stocks have run particularly hard.” Citic and Haitong, the nation’s biggest brokers by market value, announced plans for share sales that will help fund an expansion of businesses including margin financing. Those two and Guotai Junan were the three largest by assets in a 2013 ranking by the Securities Association of China. “The regulators are doing this to cool down the stock market,” said Castor Pang, head of research at Core-Pacific Yamaichi in Hong Kong. “Stock market sentiment will definitely go down.”

But did Beijing oversee what the effect would be? How about when the 3-month ban is over, what will happen then?

• China Brokers Face Double-Whammy on 3-Month Margin Finance Ban (Bloomberg)

China’s biggest brokerages are getting squeezed on two fronts as regulators curb loans to equity traders. Not only does the three-month ban on new margin-trading accounts at Citic Securities and Haitong Securities reduce their potential earnings from lending to clients, it also curbs one of the biggest buyers of the firms’ own shares: margin traders. The brokerages are among the top five holdings of investors using borrowed money, according to Shao Ziqin, analyst for Citic, who cited calculations as of Jan. 15. Of the top 20, six were brokers and seven were banks. They all plunged today as the Shanghai Composite Index headed for the biggest drop since 2008. “Bank and brokerage stocks will definitely be the hardest hit since leveraged funds helped to push up their share prices in the first place,” said Zhang Yanbing, an analyst at Zheshang Securities in Shanghai.

Investors borrowed 32.6 billion yuan ($5.2 billion) to buy Citic Securities shares as of Jan. 15, accounting for about 3% of outstanding margin loans, according to Shao, who cited Wind Information data. Haitong purchases had attracted 14.8 billion yuan of margin loans. The total amount of shares purchased on margin has surged more than tenfold in the past two years to a record 1.1 trillion yuan, or about 3.5% of the nation’s market capitalization. In a margin trade, investors use their own money for just a portion of their stock purchase, borrowing the rest from a broker. The loans are backed by the investors’ equity holdings, meaning that they may be forced to sell when prices fall to repay their debt. Citic Securities said in an e-mail that its operations remain unchanged, including a plan to sell shares via a private placement in Hong Kong.

While shares of both brokerages tumbled by the daily 10% limit in mainland trading today, they’re still sitting on gains of more than 100% in the past 12 months. That compares with a 56% increase in the Shanghai Composite. Brokerage shares will remain under pressure in the next few days, according to Ryan Huang at IG Ltd. Regulators are concerned the world-beating gains in the country’s equity market have been too fast, he said. Citic and Haitong let customers delay repaying financing for longer than they were supposed to, the China Securities Regulatory Commission said on its microblog Friday, without giving more details. Guotai Junan Securities was also suspended from adding margin accounts, while the regulator punished nine other securities companies for offenses including allowing unqualified investors to open margin finance and securities lending accounts.

China real estate is in deep doodoo.

• China December New Home Prices Slip, Somber Omen For 2014 GDP (Reuters)

China’s new home prices fell significantly in December for a fourth straight month even as year-end sales volumes surged – a somber omen for fourth-quarter 2014 economic growth data due out later in the week. Sunday’s gloomy National Burea of Statistics’ data foreshadowed weak economic figures set for Tuesday, with expansion expected to slow to 7.2%, the weakest since the depths of the global financial crisis. Falling property prices are likely to keep pressure on policymakers to head off a sharper slowdown this year. The expected slowdown in growth of the world’s second-largest economy, from 7.3% in the July-September quarter, means the full-year figure would undershoot the government’s 7.5% target and mark the weakest expansion in 24 years.

If the GDP data proves worse than expected, some analysts say the People’s Bank of China could cut interest rates further or lower reserve requirement ratios (RRR) for all banks. A reserve ratio cut would give banks greater capacity to lend, but many market watchers question if they would be willing to increase their exposure as economic conditions deteriorate. With real-estate investment accounting for about 15% of China’s GDP growth, a 9% decline in new floor space under construction in the first 11 months of 2014 could take a heavy toll. “We expect China’s GDP growth to slow further in 2015 to 6.8%, as the ongoing property downturn leads to further weakness in construction and industrial production, and related investment,” Tao Wang, China economist at UBS, wrote in a note.

“.. at risk of being the first Chinese real estate company to default on its dollar-denominated bonds.”

• Kaisa on Brink of Dollar Default Spooks World’s Money Managers (Bloomberg)

As Europe grapples with terrorism and Switzerland scrapped a currency peg, the troubles of a Chinese developer that’s never reached $3 billion in market value became something investors from New York to London couldn’t ignore. A missed $23 million interest payment by Kaisa earlier this month puts it at risk of being the first Chinese real estate company to default on its dollar-denominated bonds. That may signal deeper risks for China’s already fragile and corruption-prone property market, which according to World Bank estimates accounts for about 16% of economic growth. Chinese companies comprised 62% of all U.S. dollar bond sales in the Asia-Pacific region ex Japan last year, issuing $244.4 billion of the $392.5 billion total, Bloomberg data show.

BlackRock, the world’s biggest asset manager, owned Kaisa’s 8.875% securities due 2018 and the ones the subject of the missed coupon payment, the 10.25% 2020s, its latest filing on Jan. 14 shows. Funds managed by JPMorgan, Fidelity and ING also held some of Kaisa’s debt at the end of October, according to filings. Kaisa’s woes began late last year when the government in Shenzhen, less than 15 from Hong Kong, blocked approvals of its property sales and new projects in the city. It’s also being probed over alleged links to Jiang Zunyu, the former security chief of Shenzhen who was taken into custody as part of a graft probe, two people familiar with the matter said last week, asking not to be named because the connection hasn’t been made public.

Kaisa missed an interest payment due Jan. 8 on its $500 million of 2020 bonds. The notes were sold to investors at par, or 100 cents on the dollar, in January 2013. In December, when some of Kaisa’s projects were blocked and key executives quit, the debentures lost 40.1%. They continued to fall in January, slumping to 29.901 cents on the dollar on Jan. 7, a record low, however have since recovered to trade at about 34.6 cents. Concern is mounting that increasing financial stress among builders could spill over into a broader credit crisis in China. New-home prices fell in 65 of the 70 cities monitored in December and were unchanged in four, the National Bureau of Statistics said in a statement yesterday. Shenzhen recorded higher prices, the first city to see an increase in four months.

“Loan investors are shunning Chinese property developers amid speculation the government will target more builders after pledging to step up anti-graft probes.”

• Kaisa Stress Spreads to Loans as Nomura Sees Big Selling Push (Bloomberg)

Loan investors are shunning Chinese property developers amid speculation the government will target more builders after pledging to step up anti-graft probes. Loans from Shimao Property, Country Garden, Evergrande Real Estate and Greentown China, maturing within four years are at levels that indicate impending stress, according to offered prices compiled by Bloomberg from two traders. President Xi Jinping last week said there’ll be no let-up in his “fierce and enduring” battle against corruption, which has already embroiled thousands of senior officials. Kaisa, a homebuilder based in the southern city of Shenzhen, roiled credit markets after founder Kwok Ying Shing quit as chairman Dec. 31, triggering a loan default.

“There’s selling pressure coming from people who want to trim their portfolios to better manage any outsized concentration in developers,” Andrew Tan at Nomura in Singapore, said by phone on Jan. 15. “I haven’t seen such a big motivation to sell in Chinese property loans for some time.” Shimao’s June 2018 loans are currently pricing at about 90 cents on the dollar, with offers at between 85 and 95 cents, compared with 92 cents in December and 96 cents in November, according to two people familiar with the matter.

Country Garden’s December 2018 loans were also offered in the 88 cents to 95 cents range, versus about 95 cents a month ago, two traders said. Offers on Evergrande’s first-lien loan and Greentown’s loan signaled a 5-cent weakening from their levels in December, they said. While China’s banking system outlook is stable, asset quality metrics will likely deteriorate in the coming 12 to 18 months, in line with slower economic growth, Moody’s Investors Service said in a report today. Problem loans from the real-estate sector may start increasing from a small base if the property market downturn continues, it said.

Set to be a classic line all over: “It was just like a dream: I had everything but when I woke up it was all gone.”

• China Dream Ends for Handan as Steel Slump Spurs Property Losses (Bloomberg)

Five months ago, Hao Liwei was living the good life, funded by a 36% annual return on a property investment. Then her nightmare began. Interest payments ceased in August and attempts to recover her money failed. Her home town, the steel-production city of Handan, 450 kilometers (280 miles) southwest of Beijing in Hebei province, was grappling with plunging demand for steel and plummeting prices. Economic growth slumped to 5.5% in the first nine months of last year, from 10.5% in 2012. “The sky collapsed and I thought of killing myself,” said Hao, 40, now a taxi driver. “It was just like a dream: I had everything but when I woke up it was all gone.”

Hao is among the collateral damage as China reins in years of debt-fueled investment-led growth that’s evoked comparisons to the period preceding Japan’s lost decades. As policy shifts China toward greater consumption and innovation-led growth, Handan’s reliance on the steel industry for expansion has left it among cities feeling the brunt of adjustment pain. “Steel towns have been decimated many times before, in Pittsburgh, in the U.K., in France, in Belgium,” said Junheng Li, founder of researcher JL Warren Capital in New York. “Handan has a choice: cling to steel and suffer an inexorable decline or invest in the future, wherever it may be.”

Handan’s woes deepened in September, when local authorities sent work teams into 13 property developers to contain risks after a failure to repay funds raised illegally from the public sparked panic, Xinhua News Agency reported. Thirty-two homebuilders had raised a combined 9.3 billion yuan ($1.5 billion) in illegal fundraising or high-return deposits, causing police to detain 94 people, Xinhua reported. In freezing, pollution-darkened air that exceeded the World Health Organization’s safety limit by more than 14 times, Wu Ren waited last week outside a property development in downtown Handan in hope of recovering funds he invested in a developer named Century in Gold. Wu, in his mid-40s, said he invested 500,000 yuan for a return exceeding 18% a year. The developer’s boss disappeared in August, he said.

“That would be linked to massive negative effects on the labor market.”

• ECB’s Nowotny: Deflation To Have Dangerous Political, Social Impact (Reuters)

The European Central Bank has limited options left to counter long-term stagnation in the euro zone, ECB Governing Council member Ewald Nowotny was quoted as saying in an interview published on Monday. The ECB faces a crucial test of its resolve to do “whatever it takes” to preserve the euro when it decides this week on buying government bonds to combat deflation and revive the economy. Asked to what extent the ECB’s arsenal was exhausted and what it could still do, Nowotny told Austrian newspaper Tiroler Tageszeitung: “Our possibilities are limited.” He did not elaborate. Inflation in the euro zone is well below the ECB’s mid-term target of just under 2% but Nowotny said he did not expect a protracted period of deflation.

“We had negative inflation rates in December and perhaps we will have them in the first months of this year, but I do not believe we can expect deflation for 2015 overall. But the margin of safety has become smaller,” he was quoted as saying in the interview. Asked if it would be difficult to pull out of deflation if it set in, he said yes. “We see the danger from Japan, which for two decades has low growth, low inflation and low interest rates, thus long-term stagnation. For Europe, lasting low growth is not a (desired) prospect,” he said. “That would be linked to massive negative effects on the labor market. And it would certainly have dangerous political and social impact.”

This will continue for a while yet.

• Bank Losses From Swiss Currency Surprise Seen Mounting (Bloomberg)

The $400 million of cumulative losses that Citigroup, Deutsche Bankand Barclays are said to have suffered from the Swiss central bank’s decision to end the cap on the franc may be followed by others in coming days. “The losses will be in the billions — they are still being tallied,” said Mark T. Williams at Boston University. “They will range from large banks, brokers, hedge funds, mutual funds to currency speculators. There will be ripple effects throughout the financial system.” Citigroup, the world’s biggest currencies dealer, lost more than $150 million at its trading desks, a person with knowledge of the matter said last week. Deutsche Bank lost $150 million and Barclays less than $100 million, people familiar with the events said..

Marko Dimitrijevic, the hedge fund manager who survived at least five emerging-market debt crises, is closing his largest hedge fund, which had about $830 million in assets at the end of the year, after losing virtually all its money on the SNB’s decision… FXCM, the largest U.S. retail foreign-exchange broker, got a $300 million cash infusion from Leucadia after warning that client losses threatened its compliance with capital rules. FXCM, which handled $1.4 trillion of trades for individuals last quarter, said it was owed $225 million by customers. Shorting the franc was a popular trade and most firms would leverage their positions some 20 times or more, said Williams, who consults for hedge funds.

With such leverage a 5% move against the position wipes out all the value, yet the trades were seen as relatively low-risk by models used by financial institutions because volatility of the franc was reduced by the SNB’s cap, he said. Citigroup had reported an average total trading value-at-risk, a measure of how much the company could lose in trading in one day, of $105 million in the third quarter, of which $32 million was attributed to foreign-exchange risks. Deutsche Bank’s so-called stressed value-at-risk, which measures possible daily losses in market turmoil, averaged 109 million euros ($126 million) in the first nine months, with 27 million euros related to foreign-exchange risks.

Swiss banks, which haven’t announced any losses so far, will probably also suffer in the longer term, said Arturo Bris, a professor at IMD business school. “The negative effects for the Swiss banks come in two ways,” Bris said. “First, it will reduce the flow of assets from the outside and will encourage the exit of Swiss money to other countries. Secondly, they will be hurt by the negative impact on the Swiss economy.” Pain from wrong-way bets may not be limited to just the financial industry. “We’re just hearing about financial institutions now,” Philip Guarco at JPMorgan Private Bank, said in an interview on Bloomberg TV. “Remember what happened back in 2009, when the dollar rallied? You actually had major corporates in Mexico and Brazil, where the treasury departments were taking positions in FX. So we haven’t heard the end of it yet.”

“Mr. Jordan said the franc remains “greatly overvalued.”

• Switzerland Could Act on Currency Again, Central Banker Says (WSJ)

The Swiss central bank is ready to intervene in the currency markets again to weaken the franc if necessary, the bank’s head said, just two days after the removal of a cap on the franc triggered a surge in the currency’s value. Swiss National Bank President Thomas Jordan said the central bank was forced to scrap its policy of keeping minimum exchange rate of 1.20 Swiss francs a euro due to divergent economic developments and mounting risk from its euro-buying operations. The bank will continue to monitor the situation and act if necessary, Mr. Jordan said in an interview with Swiss newspaper Neue Zuercher Zeitung.

“We have said goodbye to the minimum exchange rate,” Mr. Jordan said in the interview published Saturday. “But we will continue to consider the exchange-rate situation in our decisions and intervene in the foreign-exchange market if necessary.” The SNB’s surprise decision on Thursday to ax the minimum exchange rate roiled markets and caused the Swiss franc to gain around 30% at one stage before settling 15% higher against the euro to trade near one Swiss franc to the euro, from around 1.20 before the announcement. The Swiss stock market swooned and shares in companies such as food giant Nestlé and pharmaceuticals maker Novartis had billions wiped from their values as shareholders sought to cash in on the sudden appreciation of the currency.

Stocks in some Swiss companies including watchmaker Swatch slumped as analysts reduced their sales and profit forecasts as a result of the franc’s rise. The higher value of the Swiss franc reduces the value of sales made in the eurozone, which accounts for more than half of its exports. The minimum exchange rate had been in place since September 2011 and was intended to head off deflation and protect the competitiveness of Swiss companies. Mr. Jordan said the franc remains “greatly overvalued.” He said he expects negative interest rates introduced by the SNB to make the franc less attractive, but ruled out introducing capital controls to further weaken demand for the currency.

“.. non-residential construction and specifically physical structures, which is where roughly 90% of energy capex is..”

• The Next Victim Of Crashing Oil Prices: US Housing (Zero Hedge)

While a record amount of ink has been spilled praising the benefits of plunging crude price on the US consumer, so far this has manifested merely in soaring consumer confidence, if not in an actual boost to retail sales. In fact, as the Census Bureau reported last week, December retail sales were the biggest disappointment and suffered the steepest monthly drop since the polar vortex.

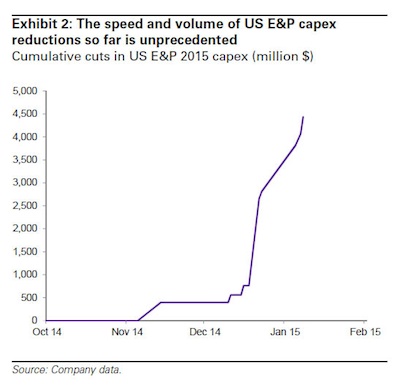

It appears that instead of doing what so many economists thought, and immediately using their “savings” to boost discretionary income, households are either i) saving the lower gas price windfall (and considering the unprecedented savings rate revision gimmick used by the US Department of Commerce to boost Q3 GDP to 5.0% this is completely understandable), or ii) as we explained some time ago, instead of spending on discretionary purchases, households are forced to spend more on far less pleasant, if just as GDP-boosting staples, such as soaring health insurance premiums courtesy of Obamacare (those who benefit from Obamacare most likely don’t have any work commute-related expenditures in the first place). Less has been written about the adverse side-effects of plunging oil, even though by now even the most “undisputed” permabulls have been forced to admit that the imminent collapse in capital spending is truly “unprecedented”, a phrase Goldman uses in the chart below.

So what does plunging CapEx actually mean for the economy, aside from a substantial haircut to 2015 GDP, and what other areas of the economy will be affected by the Saudi Arabian scorched earth war on the US shale industry? First, we look at the impact of plunging crude on non-residential construction and specifically physical structures, which is where roughly 90% of energy capex is — namely outlays for exploration and wells. Spending there tracked an annualized rate of $140bn in the first three quarters of 2014, a sum that accounts for a whopping 30% of total non-residential private fixed investment in structures, or about a 1% of GDP. So what about residential construction?

Coal, iron ore output still rises and prices dive.

• OPEC’s Future Reflected in Mining Slump as Oil Price Pummeled (Bloomberg)

Oil producers reluctant to curb output even as prices tumble to five-and-a-half year lows don’t need to guess what the future holds. They can ask a miner. In coal to iron ore markets, suppliers have raised volumes even as prices slumped, boosting global gluts and jeopardizing profits as the most dominant players seek to maintain revenue and squeeze out higher cost rivals. Prices of thermal coal, used to generate electricity, and metallurgical coal, a key ingredient in steel, have tumbled more than half since 2011 on supply additions and slowing demand in China, the biggest commodities consumer. With OPEC insistent that it won’t curb crude output, and U.S. production rising to its fastest weekly pace in more than 30 years, oil markets may be in line for similar prolonged pain.

“If OPEC every now and again looks over their shoulder at what is happening in other commodities you’d think it would be a warning,” said David Lennox at Fat Prophets. OPEC, which pumps about 40% of the world’s oil, agreed to maintain its production target at 30 million barrels a day at a Nov. 27 meeting in Vienna. The group is wagering that U.S. shale drillers will be first to curb output as prices drop, echoing a strategy played out by the largest miners. “The current prices are not sustainable,” Suhail Al Mazrouei, energy minister of OPEC member the United Arab Emirates said Jan. 14 in Abu Dhabi. “Not for us but for the others.”

Iron ore producers who predicted a swift exit by higher cost suppliers as their commodity entered a bear market last March were caught out as curbs to global output proved slower than anticipated, Nev Power, CEO of Australian iron ore producer Fortescue said in October. Coal exporters, too, have kept increasing supply as prices slid. Global output rose about 3% between 2011 and 2013 as prices declined, according to World Coal Association data. In Australia, the biggest exporter of metallurgical coal, production is forecast to rise again in the year to July, according to the nation’s government. “Oil will have more similarities to both thermal and metallurgical coal,” Morgan Stanley analyst Joel Crane said. “Those prices have been weakening for more than three years now, yet we’ve seen very little in terms of shutdowns.”

“.. quarterly earnings for his firm that fell 82% on more than $1 billion in charges including those related to downsizing.”

• Oil Boss Says More Job Cuts Ahead (WSJ)

Energy companies aren’t finished shedding jobs due to crude oil prices that are half what they were about six months ago, the world’s biggest oil-field-services provider warned soon after disclosing 9,000 job cuts. Paal Kibsgaard, chief executive of Schlumberger, said on Friday U.S. oil producers that focus on shale fields are worse off than rivals elsewhere because of their higher costs. “The new oil prices are clearly going to test the resilience of several North American land producers going forward,” he said, citing “their ability to get financing, their ability to continue to drive efficiencies and reduce costs and their ability to maintain production at current levels.”

Some of the largest U.S. oil-and-gas producers have cut 2015 capital spending budgets by 20% or more. Investment bank Cowen said international firms would cut spending by 20% this year and by another 10% in 2016. Schlumberger, Halliburton and Baker Hughes will need to shrink further as clients demand price cuts and dial back spending on wells, Mr. Kibsgaard said while discussing quarterly earnings for his firm that fell 82% on more than $1 billion in charges including those related to downsizing. The three companies help energy producers drill and frack their wells.

“Yields have fallen so low that analysts no longer have any historical risk models to fall back on..”

• BOJ Puts Japan Bond Yields On Road To Nowhere (CNBC)

The Bank of Japan’s (BOJ) massive asset purchase program has put government bond yields on a relentless slide into negative territory, and while some analysts insist a U.S. rate hike will reverse the trend later this year, others expect a slide into unchartered territory. “Yields have fallen so low that analysts no longer have any historical risk models to fall back on,” said Shinichi Tamura, Barclays’ Japan bank analyst, noting that rates strategists are going on blind faith that yields will stop falling. Japan’s short-term yields, of less than three years, turned negative last year, and last week the 5-year Japanese government bond (JGB) slipped close to zero several times. As of Monday morning Asian time, the yield was quoted at 0.018%, up from 0.005 basis points after market close on Thursday.

Most worrying, Tamura said, is the flattening of the yield curve with long-term government bond yields also on a relentless downward trend. On Monday morning, the 10-year was quoted at 0.242 basis points — above the historical low of 0.228% hit early last Friday -, and the 30-year is at 1.105%. “Bond investors are uncomfortable with what they see as an abnormal situation,” said Mana Nakazora, chief credit analyst at BNP Paribas. If the current levels hold, the price of new corporate bonds will be benchmarked against negative government bond yields. So, “they can’t see where they are going to secure returns after 2015 and beyond, or when the BOJ will end the current round of quantitative easing and stop buying up JGBs.”

Let’s see when the euro reaches parity with the dollar.

• Banks Battle Speculation Denmark’s Euro Peg at Risk (Bloomberg)

Banks in Scandinavia are joining the Danish government in trying to persuade offshore investors that the Nordic country isn’t about to copy Switzerland and drop its euro peg. SEB, the Nordic region’s largest currency trader, said it’s been fielding calls from hedge funds wondering whether Denmark might be next after the Swiss National Bank shocked markets by exiting a three-year-old euro cap on Jan. 15. Economy Minister Morten Oestergaard a day later sought to silence doubts surrounding Denmark’s currency peg, which he said remains “secure.”

Carl Hammer, chief currency strategist at SEB in Stockholm, says he’s been trying to make clear to callers that it’s “highly unlikely” Denmark will alter its exchange-rate regime. Speculation Denmark will follow the SNB has forced bankers across Scandinavia to provide offshore investors with a crash course in Danish monetary policy. Hedge funds calling SEB, Danske Bank and other Nordic banks have been urged to consider that Denmark’s peg has existed for more than three decades and is backed by the European Central Bank, unlike the SNB’s former system. “Obviously, we think it’s completely unrealistic” that Denmark will abandon its peg, Jan Stoerup Nielsen, an economist at Nordea Markets in Copenhagen, said by phone. “But that doesn’t seem to be stopping the speculation.”

Not enough yet. Be brave, my Greek friends.

• Greece’s Syriza Party Widens Lead Over Ruling Conservatives (Reuters)

Greece’s anti-bailout Syriza party is solidifying its opinion poll lead over the ruling conservatives eight days before the country’s election, a survey on Saturday. The survey by pollster Kapa Research for Sunday’s To Vima newspaper showed the radical leftists’ lead widening to 3.1%age points from 2.6 points in a previous poll earlier in the month. The national vote on Jan. 25 will be closely watched by financial markets, nervous that a Syriza victory might trigger a standoff with Greece’s European Union and IMF lenders and unleash a new financial crisis.

The survey, conducted on Jan. 13-15, showed that Syriza, which is running on a pledge to end austerity policies and renegotiate the country’s debt, would win 31.2% of the vote if the election was held now, versus 28.1% for Prime Minister Antonis Samaras’ New Democracy conservatives. The centrist party To Potami (River) ranked third with 5.4%. The leading party must generally receive between 36 and 40% of the vote to win outright, though the exact threshold depends on the share of the vote taken by parties that fail to reach a 3% threshold to enter parliament. The electoral system automatically gives the winning party an extra 50 seats to make it easier to form a government.

“.. such attempts coupled with the apparent provocation (similar to the situation with the Malaysian Boeing and the incident with a bus in Volnovakha) come, as a rule, on the eve of the European Union and other Western states meetings”

• Kremlin Links Kiev’s ‘Massive Fire’ Order To Upcoming EU Council Meeting (RT)

Kiev resumed its military assault in eastern Ukraine on Sunday despite receiving a proposal Thursday night from the Russian president that both sides of the conflict withdraw their heavy artillery, Putin’s press secretary said. “In recent days, Russia has consistently made efforts to mediate the conflict. In particular, on Thursday night, Russian President Vladimir Putin sent a written message to Ukrainian President Poroshenko, in which both sides of the conflict were offered a concrete plan for removal of heavy artillery. The letter was received by President of Ukraine on Friday morning,” president’s press secretary, Dmitry Peskov, said as cited by RIA Novosti news agency. “The latest developments in Ukraine connected with the renewed shelling of populated areas in the Donetsk and Lugansk regions cause grave alarm and put in jeopardy the peace process based on the Minsk memorandum,” Putin’s letter reads.

Putin suggested the immediate withdrawal of artillery with a caliber more than 10mm to the distance defined by the Minsk agreements.Russia is ready to monitor the fulfillment of these moves jointly with the OSCE, the letter concludes. However, Peskov stressed, the Ukrainian leader rejected the plan without offering alternatives and “moreover started military actions all over again,” resulting in an “absolute degradation of the situation in the southeast of Ukraine.” Russia’s Foreign Ministry accused Kiev of using the ceasefire to “regroup its forces, trying to take a course for further escalation of the conflict with a purpose to ‘settle’ it in a military way.” “We are deeply concerned by the fact that the Ukrainian side continues to increase its military presence in the southeast of the country in violation of the Minsk agreements,” the ministry said in a statement. [..]

Russia has expressed readiness “to use its influence on militia” in southeast Ukraine so they voluntarily agree to withdraw heavy armament from the frontline, so that its geographic coordinates correspond to Kiev’s demands “to avoid more victims among the civilian population.” The Foreign Ministry has linked the deadly attacks in Donetsk and Kiev’s “massive fire” order with the upcoming EU Foreign Affairs Council meeting on January 19. It has noted that “such attempts coupled with the apparent provocation (similar to the situation with the Malaysian Boeing and the incident with a bus in Volnovakha) come, as a rule, on the eve of the European Union and other Western states meetings, which deal with the situation in Ukraine.”

“The humiliating 2007 incident saved China “25 years of research and development ..” Note: Snowden neither confirms nor denies that China is behind it.

• Snowden: Hackers Stole 50 Terabytes Of Joint Strike Fighter Blueprints (RT)

The reported theft by Chinese hackers of blueprints for the US’s F-35 Joint Strike Fighter amounted to 50 terabytes of classified information, documents leaked by NSA whistleblower Edward Snowden have revealed. The hackers are believed by many US officials to be affiliated with the Chinese government. The humiliating 2007 incident saved China “25 years of research and development,” according to a US military official cited by The Washington Post in a 2013 article covering the breach. Previous media reports said “several terabytes” of data was stolen, but according to the new documents published by the German magazine Der Spiegel last week, the actual amount was far higher, at 50 terabytes –the equivalent of five Libraries of Congress.

The data – reportedly used by China to build their own advanced fighter jets – includes detailed engine schematics and radar design. F-35 blueprints are just a fraction of what Chinese hackers have allegedly stolen from the Pentagon’s data vaults over the years. The reported haul includes some two dozen advanced weapon systems, including the AEGIS Ballistic Missile Defense System, Littoral Combat Ship designs and emerging railgun technology, a classified report revealed in 2013.

“It might be possible for human civilization to live outside Holocene conditions, but it’s never been tried before.”

• Overuse of Nitrogen and Phosphorous Could Bring About Devastation of Earth (DSJ)

The Earth is on its way to become inhabitable owing to the increased use of artificial fertilizers like phosphorus and nitrogen which are exceeding the planetary boundaries. The fact has been confirmed by the director of the Center for Limnology at the University of Wisconsin, Madison, Professor Stephen Carpenter who also stated that “We’re running up to and beyond the biophysical boundaries that enable human civilization as we know it to exist.” At the beginning of Holocene period, the Earth was a much better place to live owing to the human activities that led to refined developments in social, political and religious aspects. Carpenter commented “Everything important to civilisation took place prior to 1914.”

Some of the best things then included development of agriculture, the rise and fall of the Roman Empire and the Industrial Revolution and following that era the human activities began the destruction of Earth. Prof. Carpenter and his team carried out a research regarding the impacts of carbon-driven global warming, including biodiversity loss and sea level rise. Explaining their findings the researchers stated “We’ve (people) changed nitrogen and phosphorus cycles vastly more than any other element. (The increase) is on the order of 200 to 300%. In contrast, carbon has only been increased 10 to 20% and look at all the uproar that has caused in the climate.” They also highlighted the unnecessary use of artificial fertilizers for boosting agriculture in the US as the land is already rich in nutrients.

Excessive use of fertilizers on a land already rich in nutrients is causing negative impacts and is pushing the civilization beyond safe boundaries. Some countries have land rich in nitrogen and phosphorous while many others have soil lacking these elements and they face difficulty in growing food without artificial fertilizers. Carpenter said “We’ve got certain parts of the world that are over polluted with nitrogen and phosphorus, and others where people don’t even have enough to grow the food they need.” To avoid upsetting the ecosystem, he has advised industrial farmers to cut down the overuse of phosphorus and nitrogen. He added “It might be possible for human civilization to live outside Holocene conditions, but it’s never been tried before. We know civilization can make it in Holocene conditions, so it seems wise to try to maintain them.”

Home › Forums › Debt Rattle January 19 2015