Jack Delano Brockton, Mass., Enterprise newspaper office on Christmas Eve 1940

Well, we can hope…

• Switzerland To Vote On Banning Banks From Creating Money (Telegraph)

Switzerland will hold a referendum to decide whether to ban commercial banks from creating money. The Swiss federal government confirmed on Thursday that it would hold the plebiscite, after more than 110,000 people signed a petition calling for the central bank to be given sole power to create money in the financial system. The campaign – led by the Swiss Sovereign Money movement and known as the Vollgeld initiative – is designed to limit financial speculation by requiring private banks to hold 100pc reserves against their deposits. “Banks won’t be able to create money for themselves any more, they’ll only be able to lend money that they have from savers or other banks,” said the campaign group. Under Switzerland’s direct democracy, a referendum can be held if a motion gains 100,000 signatures within 18 months of launching.

If successful, the sovereign money bill would give the Swiss National Bank a monopoly on physical and electronic money creation, “while the decision concerning how new money is introduced into the economy would reside with the government,” says Vollgeld. The idea of limiting all money creation to central banks was first touted in the 1930s and supported by renowned US economist Irving Fischer as a way of preventing asset bubbles and curbing reckless lending. In modern market economies, central banks control the creation of banknotes and coins but not the creation of all money, which occurs when a commercial bank offers a line of credit. Central banks aim to influence the money supply with monetary policy and regulatory tools. The SNB was established in 1891, with exclusive power to mint coins and issue Swiss banknotes.

But over 90pc of money in circulation in Switzerland now exists in the form “electronic” cash created by private banks, rather than the central bank. Members of the initiative committee for Monetary Reform (Vollgeld-Initiative) hand over boxes with more than 120.000 signatures at the Federal Chancellery in Bern, Switzerland “Due to the emergence of electronic payment transactions, banks have regained the opportunity to create their own money,” said the Swiss Sovereign Money campaign. “The decision taken by the people in 1891 has fallen into oblivion.”

Referenda on monetary matters are not new in Switzerland. Last year, the country voted by more than 78pc to reject a law calling for the central bank to increase its gold reserves from 7pc to 20pc. Unlike the gold vote – which was seen as a precursor to re-introducing the Gold Standard in Switzerland – economists have been more supportive of the idea of “sovereign money” as a way to stabilise the economy and prevent excess credit growth. Iceland – which saw its bloated banking system collapse in spectacular fashion in 2008 – has also touted an abolition of private money creation and an end to fractional reserve banking. A date for the Swiss referendum has not been set.

Translation: it’s a lousy shopping season.

• US Retailers At Risk Of Missing Even Modest Holiday Sales Goals (Reuters)

Retailers are struggling to meet even modest forecasts for the holiday shopping season this year after the “Super Saturday” before Christmas failed to live up to its nickname, industry research groups said. The last Saturday before Christmas often sets the annual record for retail sales, vying with Thanksgiving weekend’s Black Friday. In recent years, last-minute shopping has determined the success of the season, and a relatively weak final weekend bodes poorly for retailers. This year Super Saturday weekend sales in stores and online rose 4% to $55 billion, after a 2.5% gain last year, according to retail consultancy and private-equity fund Customer Growth Partners. That puts overall store and online sales from the start of November through Dec. 22 on track to rise 3.1%, below the 3.2% pace the firm forecast and down from 4.1% growth in the same period last year.

“Sales have been sluggish so far this year as most consumers are still buying close to need,” said Craig Johnson, president of Customer Growth Partners. “What’s worse is the marked deceleration from a year ago,” he said. Last year, last-minute sales gained in the final 10 days of the holiday season, driven by savings from lower gasoline prices. If sales, spurred by gift card redemptions, hold up in the week after Christmas this year, retailers could move closer to meeting performance forecasts, consultants and retail experts said. The National Retail Federation, the leading industry body, has forecast a 3.7% rise in store and online sales this year. Discounts across categories have been deeper than last year, in the range of 20% to 50%, said Traci Gregorski at analytics firm Market Track.

But consultants said the discounting still had not been enough to boost store traffic materially. Promotions earlier in November took a toll on in-store sales during the Thanksgiving weekend, when total spending was the same as last year, according to the NRF.

Lousy shopping in Britain too.

• High Street Christmas Shopping Figures Grim Reading For Retailers (Guardian)

High streets are continuing to suffer as shoppers saved on gifts and splashed their spare cash in restaurants and pubs in the days before Christmas. The number of shoppers visiting UK stores slid 9% year on year on Monday and Tuesday, dashing hopes of a late rush to stores, according to analysts at Springboard. Diane Wehrle, insights director at Springboard, said about 2% of the decline in shopper numbers was likely to be linked to the timing of Christmas Day, which is one day later in the week than last year. The changing of shopping habits towards buying online and unseasonably balmy temperatures have also meant there is little demand for new coats, boots and knitwear. The Black Friday discount day in late November may also have eaten up sales.

“There is a downward movement in footfall anyway but we are seeing greater drops in the run-up to Christmas this year,” Wehrle said. “It’s partly because we have now got Black Friday and that has fed the habit to shop online. Retailers have gone hell for leather with with bargains but a lot of those will have been bought online for click & collect later.” The poor shopper numbers will make grim reading for retailers who have been banking on a late rush this year. Bonmarché and Game Digital have already issued profit warnings as demand has failed to materialise this year and analysts expect more will follow. Shares in Marks & Spencer slid earlier this week after analysts at Nomura predicted sales of clothing and homewares at established stores would slump 5.5% over the three months to the end of the year.

The retailer has been offering 30% off knitwear, one of its key seasonal ranges, since 10 December, as chains including Debenhams, Bhs, Dorothy Perkins, H&M and Gap have all got out their sale banners. Veteran analyst Richard Hyman has predicted a shake-out in the new year, as shops count the cost of a lacklustre Christmas. “There’s a lot of zombie-looking, ailing retailers that are not long for this world,” he said. High street stores are particularly suffering as shoppers switch to the internet. In-store spending slid 2.3% in the first 10 days of December according to Barclaycard, while online spending rose 9.4%, leaving overall spending virtually flat year on year.

“The greatest concern in the labor market now aren’t those who recently lost their jobs, but the persistently large number out of work for months or years, and those stuck in low-paying and part-time jobs.“

• Lower Jobless Claims Don’t Point to Robust US Labor Market (WSJ)

The fewest Americans since 1973 will seek new unemployment benefits this year, but that doesn’t mean the labor market is back to full health. In total, less than 15 million American will make first-time requests for government assistance this year–about half as many claims as were made in 2009–and far fewer than the number filed during the 1980s and 90s when the economy was expanding at a stronger clip. The greatest concern in the labor market now aren’t those who recently lost their jobs, but the persistently large number out of work for months or years, and those stuck in low-paying and part-time jobs. At the same time, a larger portion of those newly laid off isn’t seeking benefits.

Initial claims are seen as a proxy for layoffs, but other separation measures show that layoffs have plateaued, or even increased this year. The Labor Department recorded 17.4 million layoffs and discharges during the first 10 months of the year, nearly unchanged from the same period in 2014. Outplacement consultants Challenger, Gray & Christmas report the number of layoffs announced by typically large companies through November was 28% higher than through the first 11 months of last year, partly reflecting cutbacks in the energy industry. Economists usually expect hiring to strengthen when new claims decline. But that hasn’t happened this year. Through November, employers added a monthly average of 210,000 jobs to payrolls.

For all of last year, the average was 260,000. The average level of weekly claims was about 10% higher in 2014. Claims readings could be distorted because a smaller share of those laid off are applying for benefits. The share of laid off workers seeking benefits has fallen this year to just above 50%, according to the National Employment Law Project, a group that advocates for the unemployed. The rate is down from record high of almost 80% just after the recession ended.

Seen from miles away.

• African Firms Hit by Dollar Shortages (WSJ)

Valentine Ozigbo is struggling to obtain a key construction ingredient as he refurbishes and builds hotels in Nigeria: the U.S. dollar. Some of Africa’s largest economies, including Nigeria, Angola, Ethiopia and Mozambique, are restricting access to the greenback to protect dwindling reserves. That is causing problems for businesses from Mr. Ozigbo’s Transcorp Hotels to international giants like General Electric and Coca-Cola, all of which are struggling to get the dollars they need for imports or to send profits back home. The shortage comes as the inflow of dollars from resource exports, from oil to cotton, has plummeted with the prices of these commodities. The commodity rout also is putting pressure on local currencies, which some central banks are trying to support with their dwindling supply of dollars.

This dollar squeeze is frustrating investors, increasing costs and delaying projects. It may hamper future investment in countries reeling from the fall in commodity prices. “It’s been a rough ride for a lot of companies in Nigeria, if not all the companies,” said Mr. Ozigbo, chief executive of Transcorp Hotels. Nigeria gets more than 90% of its foreign-currency reserves from oil exports. Since June 20, 2014, when the U.S. oil price was at $107.26, the U.S. oil price has declined 66% through Tuesday’s close of $36.14, amid oversupply and weak growth in demand. Oil’s decline sent the value of the naira, Nigeria’s currency, sharply lower at the start of the year. In March, the Central Bank of Nigeria fixed its exchange rate at around 199 naira to the dollar. By this month, its currency reserves were down 18% to $29.5 billion from the same month last year.

In the summer, the central bank introduced a list of 41 items, from meat to concrete, that it won’t release dollars for. But no matter what a buyer wants their dollars for, their request has to be vetted against this list, slowing down any attempt to buy the currency. Angola now lists industries—including the oil and food sectors—that have priority for the country’s dollar reserves, In Mozambique, the government requires companies to convert half of any dollar revenues into the local currency, as it looks to shore up its reserves. “It’s obviously not like it used to be, where you would go to the bank and get your dollars,” said Jay Ireland, the Africa chief executive officer for GE. “Now it’s a process that they require and it takes longer,” he said, talking about Nigeria and Angola.

Mr. Ireland said GE remains committed to long-term projects in Africa, but the dollar shortage means that it now takes local clients longer to buy GE products priced in dollars. Coca-Cola has been in Africa for almost a century and can obtain dollars from across its businesses. Still, the beverage giant is concerned that its suppliers will start to feel the pinch as they struggle to fund imports that they need. “If there are no changes in monetary policy it might become a bigger challenge and that is a space we are watching very closely,” said Adeola Adetunji, Coca-Cola’s managing director in Nigeria. “Business is not as usual.”

“The fundamental question is actually far broader than whether or not the Fed should be raising rates: rather, should the Fed be managing interest rates at all?” No, of course not.

• Why The Fed Will Never Succeed (Macleod)

The Fed will never succeed in its attempt to manage inflation and unemployment by varying interest rates. This is because it and its economists do not accept the relationship between, on one side, the money it creates and the bank credit its commercial banks issue out of thin air, and on the other the disruption unsound money causes in the economy. This has been going on since the Fed was created, which makes the question as to whether the Fed was right to raise interest rates recently irrelevant. Furthermore, it’s not just the American people who are affected by the Fed’s monetary management, because the Fed’s actions affect nearly everyone on the planet. The Fed does not even admit to having this wider responsibility, except to the extent that it might have an impact on the US economy.

That the Fed thinks it is only responsible to the American people for its actions when they affect all nations is an abrogation of its duty as issuer of the reserve currency to the rest of the world, and it is therefore not surprising that the new kids on the block, such as China, Russia and their Asian friends, are laying plans to gain independence from the dollar-dominated system. The absence of comment from other central banks in the advanced nations on this important subject should also worry us, because they appear to be acting as mute supporters for the Fed’s group-think. This is the context in which we need to clarify the effects of the Fed’s monetary policy. The fundamental question is actually far broader than whether or not the Fed should be raising rates: rather, should the Fed be managing interest rates at all? Before we can answer this question, we have to understand the relationship between credit and the business cycle.

There are two types of economic activity, one that correctly anticipates consumer demand and is successful, and one that fails to do so. In free markets the failures are closed down quickly, and the scarce economic resources tied up in them are redeployed towards more successful activities. A sound-money economy quickly eliminates business errors, so this self-cleansing action ensures there is no build-up of malinvestments and the associated debt that goes with it. When there is stimulus from monetary inflation, it is inevitable that the strict discipline of genuine profitability that should guide all commercial enterprises takes a back seat. Easy money and interest rates lowered to stimulate demand distort perceptions of risk, over-values financial assets, and encourages businesses to take on projects that are not genuinely profitable. Furthermore, the owners of failing businesses find it possible to run up more debts, rather than face commercial reality. The result is a growing accumulation of malinvestments whose liquidation is deferred into the future.

“..the excess liquidity spawned by gradual normalization leaves financial markets predisposed to excesses and accidents.”

• The Perils of Fed Gradualism (Stephen Roach)

The Fed had, in effect, become beholden to the monster it had created. The corollary was that it had also become steadfast in protecting the financial-market-based underpinnings of the US economy. Largely for that reason, and fearful of “Japan Syndrome” in the aftermath of the collapse of the US equity bubble, the Fed remained overly accommodative during the 2003-2006 period. The federal funds rate was held at a 46-year low of 1% through June 2004, before being raised 17 times in small increments of 25 basis points per move over the two-year period from mid-2004 to mid-2006. Yet it was precisely during this period of gradual normalization and prolonged accommodation that unbridled risk-taking sowed the seeds of the Great Crisis that was soon to come.

Over time, the Fed’s dilemma has become increasingly intractable. The crisis and recession of 2008-2009 was far worse than its predecessors, and the aftershocks were far more wrenching. Yet, because the US central bank had repeatedly upped the ante in providing support to the Asset Economy, taking its policy rate to zero, it had run out of traditional ammunition. And so the Fed, under Ben Bernanke’s leadership, turned to the liquidity injections of quantitative easing, making it even more of a creature of financial markets. With the interest-rate transmission mechanism of monetary policy no longer operative at the zero bound, asset markets became more essential than ever in supporting the economy.

Exceptionally low inflation was the icing on the cake – providing the inflation-targeting Fed with plenty of leeway to experiment with unconventional policies while avoiding adverse interest-rate consequences in the inflation-sensitive bond market. Today’s Fed inherits the deeply entrenched moral hazard of the Asset Economy. In carefully crafted, highly conditional language, it is signaling much greater gradualism relative to its normalization strategy of a decade ago. The debate in the markets is whether there will be two or three rate hikes of 25 basis points per year – suggesting that it could take as long as four years to return the federal funds rate to a 3% norm.

But, as the experience of 2004-2007 revealed, the excess liquidity spawned by gradual normalization leaves financial markets predisposed to excesses and accidents. With prospects for a much longer normalization, those risks are all the more worrisome. Early warning signs of troubles in high-yield markets, emerging-market debt, and eurozone interest-rate derivatives markets are particularly worrisome in this regard.

Swing to the right.

• The Political Consequences of Financial Crises (Davies)

Three German economists, Manuel Funke, Moritz Schularik, and Christoph Trebesch, have just produced a fascinating assessment based on more than 800 elections in Western countries over the last 150 years, the results of which they mapped against 100 financial crises. Their headline conclusion is stark: “politics takes a hard right turn following financial crises. On average, far-right votes increase by about a third in the five years following systemic banking distress.” The Great Depression of the 1930s, which followed the Wall Street crash of 1929, is the most obvious and worrying example that comes to mind, but the trend can be observed even in the Scandinavian countries, following banking crises there in the early 1990s.

So seeking to explain, say, the rise of the National Front in France in terms of President François Hollande’s personal and political unpopularity is not sensible. There are greater forces at work than his exotic private life and inability to connect with voters. The second major conclusion that Funke, Schularik, and Trebesch draw is that governing becomes harder after financial crises, for two reasons. The rise of the far right lies alongside a political landscape that is typically fragmented, with more parties, and a lower share of the vote going to the governing party, whether of the left or the right. So decisive legislative action becomes more challenging. At the same time, a surge of extra-parliamentary mobilization occurs: more and longer strikes and more and larger demonstrations.

Control of the streets by government is not as secure. The average number of anti-government demonstrations triples, the frequency of violent riots doubles, and general strikes increase by at least a third. Greece has boosted those numbers recently. The only comforting conclusion that the three economists reach is that these effects gradually peter out. The data tell us that after five years, the worst is over. That does not seem to be the way things are moving now in Europe, if we look at France’s recent election scare, not to mention Finland and Poland, where right-wing populists have now come to power. Maybe the answer is that the clock starts ticking on the five years when the crisis is fully over, which is not yet true in Europe.

Politico.eu doesn’t seem to like Yanis much.

• Yanis Varoufakis Talks Again, Insults Everybody (Politico)

In an interview published in Thursday’s edition of the Dutch newspaper De Volkskrant, Varoufakis took dozens of hard swings at those who have vilified him and his negotiation tactics. Among the greatest hits were Varoufakis claiming the Eurogroup is a place fit only for psychopaths, calling German Finance Minister Wolfgang Schäuble a puppet master and bashing Eurogroup President Jeroen Dijsselbloem as an ineffectual tool of the Germans. Here are the highlights:

1. It was one big coup d’état – European partners came to an agreement with Tsipras’s left-wing government on a third bailout after a hot summer of tense negotiations and slow progress. Many still blame the Varoufakis for the disastrous turn of events. Does Varoufakis agree? “No! I won’t do that. It was nothing but a coup, one big coup d’état. And it succeeded,” he said. “I’m not taking any responsibility for that,” he said. “My speeches were moderate, my plans measured, my advisors were not left-wing lunatics. There was another reason that the other side poured poison and lies over me, and portrayed me as a dangerous radical while I was the most right wing minister in the cabinet. If I was a crazy left-wing lunatic, they wouldn’t have been afraid of me.” “No, they wanted to get rid of me because I knew what I was talking about.”

Jeroen Dijsselbloem, the president of the Eurogroup of finance ministers, confirmed to the Dutch broadcaster NOS that he pushed Tsipras to pull out his finance minister. The Dutchman said he didn’t think Varoufakis had a mandate to negotiate, and thus “I went to do this with the prime minister instead,” he said in an interview to be broadcasted next Monday.

2. Dijsselbloem is a puppet, Schaüble his master – Varoufakis clashed repeatedly with his fellow finance ministers in the Eurogroup. Soothing the egos of politicians and power brokers was not his strong suit. When asked who dominated the meetings, he said: “(German Finance Minister) Wolfgang Schäuble. He’s the puppet master who pulls all the strings. All the other ministers are marionettes. Schäuble is the grandmaster of the Eurogroup. He decides who becomes the president, he determines the agenda, he controls everything.” The Greek ex-minister is especially hard for Dijsselbloem. “[He] has no real power. Dijsselbloem has no authority; he is a soldier, a puppet … He can’t make any decisions without calling Schäuble.”

“Dijsselbloem is a cog in a machine that he doesn’t understand himself,” he said later in the interview. “There was absolutely no reason for me to speak with Jeroen because he was neither willing nor able to have a real discussion, let alone interested.” But one leader gets praise from the Greek economist: the European Central Bank’s President Mario Draghi: “A formidable economist,” Varoufakis called him, adding that “Draghi is very frustrated by the suffocating limitations of his ECB mandate.”

3. Eurogroup is the place to be — if you’re a psychopath – “Anyone who speaks about blissful moments in the Eurogroup should be locked up immediately for being a dangerous lunatic,” the ex-minister said laughingly. “The Eurogroup is a very unpleasant place, including for Schäuble, Dijsselbloem and the ECB president Draghi. Centers of power are stressful by definition, with big egos and continuous conflict.” “If you’re a psychopath and you thrive on conflict, then the Eurogroup is the place to be.” Asked whether it was a place for power-hungry politicians, he said: “Ultimately, almost no one has any power … [Individuals] power is undermined by opposing power, everyone cancels each other out. I’ve seen a lot of frustration in the Eurogroup.”

Dave’s annual endless litany.

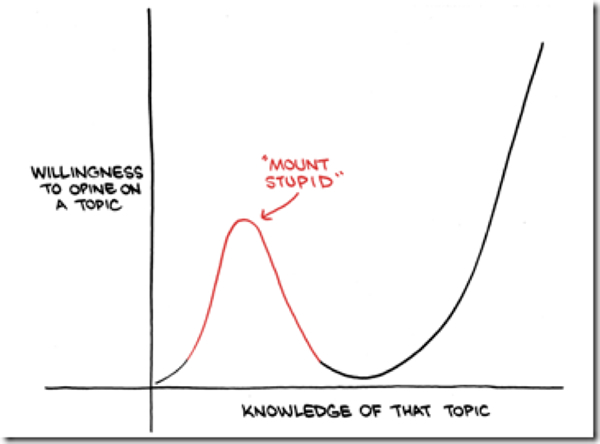

• 2015 Year In Review – Scenic vistas from Mount Stupid (Collum)

I am penning my seventh “Year in Review.” These summaries began exclusively for myself, evolved into a sort of holiday cheer for a couple hundred e-quaintances with whom I had been affiliating since my earliest days as a market bear in the late ’90s, and metastasized into the Tower of Babble—longer than a Ken Burns miniseries—summarizing the human follies that capture my attention each year. Jim Rickards kindly called it “a perfect combination of Mel Brooks, Erwin Schrodinger & Howard Beale.” I wade through the year’s most extreme lunacies as well as a few special topics while trying to find the overarching themes. I love conspiracy theories and detest detractors who belittle those trying to sort out fact from fiction in a propaganda-rich world.

“..the most wonderful time of the year and a winter of discontent..”

• Black Lives Matter Protests Roil Cities Across The US (LA Times)

It’s the most wonderful time of the year and a winter of discontent, a season of police bullhorns and Christmas lights. Demonstrators protesting police shootings of black men confronted last-minute holiday shoppers and travelers in California and the Midwest this week, seeing the crowds as an opportunity to draw attention to their cause. In Chicago on Thursday, more than 100 demonstrators marched down North Michigan Avenue, the city’s premier shopping corridor, and laid down on the street for a “die-in.” They also blocked access to some stores where Christmas Eve shoppers were hoping to wrap up their tardy gift-buying. The demonstrators were again protesting the October 2014 police shooting of Laquan McDonald, a black 17-year-old carrying a knife who was killed when a Chicago police officer shot him 16 times.

The officer, Jason Van Dyke, has been charged with first-degree murder. Footage released last month appeared to show McDonald walking away from Van Dyke, sparking protests that have yet to fully die down, much as the Black Lives Matter movement has remained in national headlines since last year’s protests in Ferguson, Mo. “When one part of Chicago is affected, all of Chicago is affected,” one of the demonstrators, Alex Thiedmann, said of the “Black Christmas” demonstration on North Michigan Avenue. “If I remain silent, I become an oppressor.” Onlookers affected by the protest had a mixed response. Emily Grossman, 36, was kept from getting an iPhone at the Apple Store. “I hate to put myself first, but this is BS,” she said.

Rabiah Muhammad came downtown for a doctor’s appointment but stopped to watch the protests. “I was walking down the street and I saw all these beautiful people of all ages and colors,” she said. “I think it’s a bigger problem than the city of Chicago. It’s an American problem. This kind of brutality? That’s not what our country is supposed to be.” [..] “On one of the busiest travel days of the year, Black Lives Matter is calling for a halt on Christmas as usual in memorial of all of the loved ones we have lost and continue to lose this year to law enforcement violence without justice or recourse,” a statement from Black Lives Matter organizers said.

“It is time that the administration acknowledged once and for all that these mothers and children are refugees just like Syrians.”

• US Plans Mass Deportation of Illegal Central American Migrants (WSJ)

To staunch the flow of illegal migrants to the U.S., the Department of Homeland Security has been preparing a national operation to deport Central American families who have evaded removal orders, according to a government official. Starting early next month, U.S. Immigration and Customs Enforcement, a DHS unit, plans to start rounding up hundreds of families that entered the U.S. illegally and who have ignored a final order to leave the country, said the official. Such an order is issued by a judge in immigration court. The number of families showing up at the southwest border has spiked in recent months as gang-related violence grips El Salvador and Honduras. The region also has been plagued by drought.

Typically, the migrants, many of them women and children, turn themselves in at the border and make asylum claims. U.S. authorities then release them, often to live with relatives here, while their cases are adjudicated. DHS Secretary Jeh Johnson in recent months has warned that those whose claims are denied in immigration court could be removed from the country. A spokeswoman for Immigration and Customs Enforcement didn’t dispute an operation has been planned to pursue Central Americans with removal orders. In a statement, the spokeswoman said the agency “focuses on individuals who pose a threat to national security, public safety and border security.” “As Secretary Johnson has consistently said, our border is not open to illegal immigration, and if individuals come here illegally, do not qualify for asylum or other relief, they will be sent back consistent with our laws and our values,” the statement said.

The operation, which was first reported by the Washington Post, has caused controversy in Mr. Johnson’s agency, the official said, with some within DHS opposed to targeting people who have fled violence in their countries of origin. The official said that the operation’s goal is twofold: It aims to send the message to would-be crossers that they won’t be allowed to remain in the U.S. It also seeks to address safety concerns involved as adults entrust their lives and those of their children to human smugglers. “Jeh Johnson wants to send a message to Central Americans: Don’t come north. But Washington hasn’t solved the underlying problem of massive violence in their home countries that is causing them to come north in the first place,” said Margaret Stock, an immigration attorney in Anchorage, Alaska.

[..] The possible roundup for deportation of families caught immigrant advocates by surprise. “This is the last thing we expected from the administration at this point, given the court decision,” said Marielena Hincapie, executive director of the National Immigration Law Center, an advocacy organization in Los Angeles. “It is time that the administration acknowledged once and for all that these mothers and children are refugees just like Syrians.”

Bit too focused on the Noble Brit, but cool.

• In The Bleakness Of The Calais Migrant Camp, A Light Shines Out (Guardian)

If this had been a conventional disaster, the United Nations would have come in and then the big aid agencies would have got busy. But this is Europe, which is meant to be beyond the need of such help. So the UN and UNHCR are not in Calais, while there’s little sign of Oxfam, Save the Children or the Red Cross. That’s not because they don’t care: aid workers tell visiting politicians they feel they have no mandate to operate in Europe (though Médecins Sans Frontières is there, its first such operation on French soil). As for the French and British governments, their only presence comes in the form of uniformed security personnel policing the barbed wire perimeter, watching – but not helping – the people within, tasked with preventing them breaking out and heading for the tunnel or sea that might take them to England.

The camp has been left instead to the volunteers. That big warehouse – with its kitchen, its clothes-sorting operation and its workshop where carpenters, some professional, some amateur, churn out timber frames for shelters as fast as they can construct them – has been set up by a small, Calais charity, L’Auberge des Migrants. It has grown tenfold in three months, helped by the ad hoc efforts of assorted British groups. The result is that, for the outsider, the atmosphere can seem to be part refugee camp, part Glastonbury. Threading their way around the muddy paths and dirt tracks are countless young Brits, dreadlocked and nose-studded, friendly and eager. Some are there to teach English in the pop-up classroom. Some are helping out at the library (announced by the sign that says “Jungle Books”).

Some are on hand in the large, domed tent set up by two young British playwrights that serves as a kind of arts centre. Musicians from Syria, Iraq or Afghanistan sit in a circle and play songs from the old country. On the walls are drawings or photographs made by refugees. One shows a tree-fringed lake, covered in morning mist. The caption says, “Sometimes I come here and stand for a few minutes, imagining that this is what England looks like.” Judged by the usual standards of policy, this is awful. Both the French and UK governments are guilty of an appalling abdication of responsibility, insisting that the Calais camp is not their problem and so turning their backs on it. They won’t supply it with the basics necessary for human existence, lest they be seen to legitimise or entrench it. This is a shameful response, putting politics before fundamental human decency.

And yet fury cannot be the only response to the camp. Admiration is the right reaction too. First for the migrants and refugees themselves, for their resilience and dignity – for the ingenuity that has seen them build a high street full of chipboard restaurants and plywood cafes, as well as mosques and at least one church. But it’s impossible not to admire the volunteers too. For no pay, they have given up comfortable lives to build or cook or teach, to provide for people they have never met because they know that, if they don’t, no one else will. Some are young or retired, with time on their hands. Others have put busy jobs or careers on hold. But none of them had to trade comfortable lives for working in the mud and squalor of the Jungle. No one forced them to rent a van, fill it with tarpaulins or bulk packs of rice and take it across the Channel.

They did it simply because they were moved by the sight of their fellow human beings in distress. And this is what sets them apart from the governments that claim to represent them. The volunteers saw in the faces of those refugees not a problem to be addressed – or, more accurately, avoided – but people just like them. The same is true of all those who have given, and are still giving, to the Guardian’s unprecedentedly successful Christmas appeal. Within a few hours of the Paris attacks, someone tweeted the advice they’d learned from Fred Rogers, the long-serving face of American children’s television. Don’t look at the killers. Look for the helpers. In what has often been a harsh, dark year, this ragtag, impromptu army of volunteers has been a point of light. They are the very best of us.

This will not go well. It will lead to the biggest NGOs ordering around the rest of them. And to EU border forces to step in.

• Refugee NGOs On Greek Islands To Be Coordinated (Kath.)

A special committee will be formed under the General Secretariat for the Aegean to coordinate dozens of nongovernmental organizations on the Greek islands receiving the biggest inflows of refugees and migrants, Kathimerini has learned. Alternate Minister for Immigration Yiannis Mouzalas visited Lesvos on Wednesday, where he met with authorities and inspected progress on the construction of a registration center. Mouzalas also met with Susan Sarandon, who is on the island helping with rescue efforts. The US actress reportedly said that she plans to make a documentary on her experiences. Arrivals from the Turkish coast on Greece’s islands remain steady at around 3,500-4,000 people a day, coast guard officials said, adding that they have rescued roughly 100,000 people this year. Hundreds of migrants have not been so lucky on the crossing. On Wednesday, seven children, four men and two women drowned as they tried to reach Farmakonisi.

Home › Forums › Debt Rattle Christmas Day 2015