DPC City Hall subway station, New York 1904

Arguably world’s biggest bank. “Deutsche Bank is now trading at less than 50% of the share price it was trading at in July last year. And no, the market isn’t wrong about this one. ..” The market will be going after Deutsche. Which is too vulnerable to save.

• Deutsche Bank Is Shaking To Its Foundations (SI)

The earnings season has started, and several major banks in the Eurozone have already reported on how they performed in the fourth quarter of 2015, and the entire financial year. Most results were quite boring, but unfortunately Deutsche Bank once again had some bad news. Just one week before it wanted to release its financial results, it already issued a profit warning to the markets, and the company’s market capitalization has lost in excess of 5B EUR since the profit warning, on top of seeing an additional 18B EUR evaporate since last summer. Deutsche Bank is now trading at less than 50% of the share price it was trading at in July last year. And no, the market isn’t wrong about this one.

The shit is now really hitting the fan at Deutsche Bank after having to confess another multi-billion euro loss in 2015 on the back of some hefty litigation charges (which are expected to persist in the future). And to add to all the gloom and doom, even Deutsche Bank’s CEO said he didn’t really want to be there . Talk about being pessimistic! Right after Germany’s largest bank (and one of the banks that are deemed too big to fail in the Eurozone system) surprised the market with these huge write-downs and high losses, the CDS spread started to increase quite sharply. Back in July of last year, when Deutsche Bank’s share price reached quite a high level, the cost to insure yourself reached a level of approximately 100, but the CDS spread started to increase sharply since the beginning of this year.

It reached a level of approximately 200 in just the past three weeks, indicating the market is becoming increasingly nervous about Deutsche’s chances to weather the current storm. Let’s now take a step back and explain why the problems at Deutsche Bank could have a huge negative impact on the world economy. Deutsche has a huge exposure to the derivatives market, and it’s impossible, and then we mean LITERALLY impossible for any government to bail out Deutsche Bank should things go terribly wrong. Keep in mind the exposure of Deutsche Bank to its derivatives portfolio is a stunning 55T EUR, which is almost 20 times (yes, twenty times) the GDP of Germany and roughly 5 times the GDP of the entire Eurozone! And to put things in perspective, the TOTAL government debt of the US government is less than 1/3rd of Deutsche Bank’s exposure.

Because it will pop the European finance bubble.

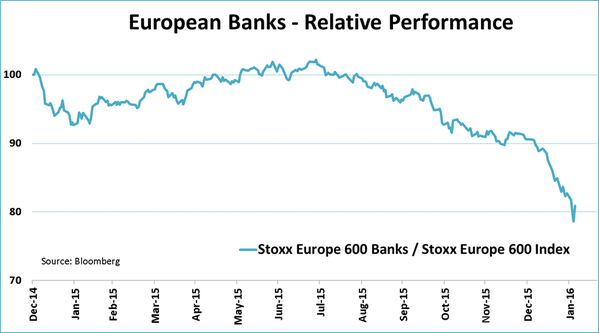

• Why A Selloff In European Banks Is So Ominous (MW)

European banks have been caught in a perfect storm of market turmoil, lately. Lackluster profits and negative interest rates, have prompted investors to dump shares in the sector that was touted as one of the best investment ideas just a few months ago. The region’s banking gauge, the Stoxx Europe 600, has logged six straight weeks of declines, its longest weekly losing stretch since 2008, when banks booked 10 weeks of losses, beginning in May, according to FactSet data. “The current environment for European banks is very, very bad. Over a full business cycle, I think it’s very questionable whether banks on average are able to cover their cost of equity. And as a result that makes it an unattractive investment for long-term investors,” warned Peter Garnry at Saxo Bank. The doom-and-gloom outlook for banks comes as the stock market has had an ominous start to the year.

East or west, investors ran for the exit in a market marred by panic over tumbling oil prices and signs of sluggishness in China. But for Europe’s banking sector, the new year has started even worse, sending the bank index down 20% year-to-date, compared with 11% for the broader Stoxx Europe 600 index. So what happened? At the end of last year, banks were singled out as one of the most popular sectors for 2016 because of expected benefits from higher bond yields, rising inflation expectations and improved economic growth. That outlook, however, was before the one-two punch of plunging oil and a slowdown in China sapped investor confidence world-wide. Garnry said the slump in bank shares is “a little bit odd” given the recent growth in the European economy and aggressive easing from the ECB.

Normally, banks benefit from measures such as quantitative easing, but it’s just not doing the trick in Europe. “And its worrisome, because banks are much more important for the credit mechanism in the economy here in Europe than it is in the U.S. There, you have a capital market where it’s easier to issue corporate bonds and get funding outside the commercial banking system. We don’t have that to the same extent in Europe, and therefore [the current weakness] is a little bit scary,” he said. Some of the sector’s collective underperformance comes down to exceptionally bad performances for a number of the bigger banks. Deutsche Bank, for example, has tumbled 32% year to date, amid a painful restructuring. And Credit Suisse is down 31% for the year as it posted a massive fourth-quarter loss.

Has long since reversed.

• Lending To Emerging Markets Comes To A Halt (FT)

The surge in lending to emerging markets that helped fuel their own — and much of the world’s — growth over the past 15 years has come to a halt, and may now give way to a “vicious circle” of deleveraging, financial market turmoil and a global economic downturn, the Bank for International Settlements has warned. “In the risk-on phase [of the global economic cycle], lending sets off a virtuous circle in financial conditions in which things can look better than they really are,” said Hyun Song Shin, head of research at the BIS, known as the central bank of central banks. “But flows can quickly go into reverse and then it becomes a vicious circle, especially if there is leverage,” he told the FT. That reversal has already taken place, according to BIS data released on Friday.

The total stock of dollar-denominated credit in bonds and bank loans to emerging markets — including that to governments, companies and households but excluding that to banks — was $3.33tn at the end of September 2015, down from $3.36tn at the end of June. It marks the first decline in such lending since the first quarter of 2009, during the global financial crisis, according to the BIS. The BIS data add to a growing pile of evidence pointing to tightening credit conditions in emerging markets and a sharp reversal of international capital flows. On Thursday, The IMF’s Christine Lagarde warned of the threat to global growth of an impending crisis in emerging markets. The Institute of International Finance, an industry body, said last month that emerging markets had seen net capital outflows of an estimated $735bn during 2015, the first year of net outflows since 1988.

In November, the IIF warned of an approaching credit crunch in EMs as bank lending conditions deteriorated sharply. This month, it said a contraction over the past year in the liquidity made available to the world’s financial system by central banks, primarily those in developed markets, now presented more of a threat to global growth than the slowdown in China and falling oil prices. Jaime Caruana, general manager of the BIS, said that recent turmoil on equity markets, disappointing economic growth, large movements in exchange rates and falling commodity prices were not unconnected, exogenous shocks but indicative of maturing financial cycles, particularly in emerging economies, and of shifts in global financial conditions. He noted that, while some advanced economies had reduced leverage after the crisis, debt had continued to build up in many emerging economies.

“Recent events are manifestations of maturing financial cycles in some emerging economies,” he said. The problem was aggravated, Mr Shin added, by the deteriorating quality of the assets financed by the lending boom. He noted that the indebtedness of companies in emerging markets as a%age of GDP had overtaken that of those in developed markets in 2013, just as the profitability of EM companies had fallen below that of DM ones for the first time. Since then, leverage in emerging economies had increased further as profitability had decreased, with exchange rates playing an important role. “Stronger EM currencies fed into more debt and more risk taking. Now that the dollar is strengthening, we have turned into a deleveraging cycle in EMs. So there is a sudden surge in measurable risk; all the weaknesses are suddenly being uncovered.”

Wolf has another nice list of plunging stocks. Tech bubble.

• What the Heck is Going On in the Stock Market? (WS)

Even Moody’s which is always late to the party with its warnings – but when it does warn, it’s a good idea to pay attention – finally warned: “Don’t fall into the trap of believing all is well outside of oil & gas.” What happened on Friday was the culmination of another dreary week in the stock markets, with the Dow down 1.3% for the day and 1.6% for the week, the S&P 500 down 1.8% and 3.1% respectively, and the Nasdaq down 3.2% and 5.4%. The S&P 500 is now nearly 12% off its record close in May, 2015; the Nasdaq nearly 17%. So on the surface, given that the Nasdaq likes to plunge over 70% before crying uncle, not much has happened yet. But beneath the surface, there have been some spectacular fireworks.

Not too long ago, during the bull market many folks still fondly remember and some think is still with us, a company could announce an earnings or revenue debacle but throw in a big share-buyback announcement, and its shares might not drop that much as dip buyers would jump in along with the company that was buying back its own shares, and they’d pump up the price again. Those were the good times, the times of “consensual hallucination,” as we’ve come to call it, because all players tried so hard to be deluded. It was the big strategy that worked. But not anymore. And that’s the sea change. Reality is returning, often suddenly, and in the most painful manner.

“Don’t wait too long on that “right price.” For if the current value of Alibaba™ is any indication – “right” is becoming more inline with “any” much faster than anyone dared think just a year prior..”

• Dot Com 2.0 – The Sequel Unfolds (St.Cyr)

Once high flyers such as the aforementioned Twitter and others are crashing to Earth like the proverbial canary. Companies like Square™, Box™, GoPro™, Pandora™, and now far too many others have watched their stock prices hammered ever lower. Yes, hammered, as in representing one selling round after another with almost no respite. Some have lost 90% of their once lofty high share prices. What’s further disheartening to those still clinging (or praying) to the “meme-dream” is the ever-increasing reputation of the old “Great companies on sale!” chortles from many a next in rotation fund manager on TV, radio, or print. For it seems every round of selling is being met with ever more selling – no buying. And the lower they go with an ever intensifying pressure, so too does the value of the debutantes in waiting: The yet to be IPO’d unicorns.

Valuation after unicorn valuation are getting marked down in one fell swoops such as that from Fidelity™ and others. However, there probably wasn’t a better representation on how little was left to the unicorn myth (and yes I believed/believe all these valuation metrics were myth and fairy-tales) than the very public meme shattering experienced in both the IPO, as well as the subsequent price action of Square. Here it was touted the IPO price was less than the unicorn implied valuation. This was supposedly done as to show “value” for those coming in to be next in line to pin their tails on the newest unicorn of riches. The problem? It sold, and sold, and is still selling – and not in a good way. It seems much like the other company Mr. Dorsey is CEO of (and how anyone with any business acumen argued that was a good idea is still beyond me. But I digress.) this unicorn also can’t fly. And; is in a perilous downward spiral of meeting the ground of reality.

It seems the only interest in buying these once high flyers can garner is wrapped up into any rumor (usually via a Tweet!) that they are to be sold – as in acquired by someone else who might be able to make money with them. Well, at least that would free up the ole CEO dilemma, no? And speaking of CEO dilemma and acquiring – how’s Yahoo!™ doing? Remember when the strategy for success for Yahoo as posited by the very public adoration styled magazine cover girl articles of its current CEO Marisa Mayer was an acquisition spree? This was all but unquestionable (and much digital ink spilled) in its brilliance and vision inspired forward thinking. Well, it seems all that “brilliance” has been eviscerated much like how the workforce still employed there is yet to be.

Let me be blunt: All you needed to know things were amiss both at Yahoo as well as “the Valley” itself was to look at the most recent decision of Ms. Mayer to throw a lavish multi-million dollar costumed theme party mere months ago. As unquestionably foolish as this was – the rationale given by many a Silicon Valley aficionado that it was nothing, after all, “it’s common in the Valley” was ever the more stupefying! Now it seems Yahoo is “cutting its workforce by double-digit%ages.” And: open to the possibility of selling off core assets of its business. Of course – at the right price. However, I’d just offer this advice: Don’t wait too long on that “right price.” For if the current value of Alibaba™ is any indication – “right” is becoming more inline with “any” much faster than anyone dared think just a year prior.

DotCom 2.0 revisited.

• CEOs, Venture Backers Lose Big As Linkedin, Tableau Shares Tumble (Reuters)

LinkedIn Executive Chairman Reid Hoffman lost almost half his $2.8 billion fortune on paper Friday as shares of his social media company suffered their largest drop on record. He was not alone in taking heavy losses. Other executives at LinkedIn, some at business analytics company Tableau Software, and a number of the companies’ venture capital backers also took losses running into tens of millions of dollars as both stocks tumbled on dismal financial outlooks. It was a humbling moment highlighting the personal exposure many technology leaders and venture capitalists face as Wall Street reassesses their value at an uncertain time for the sector. Silicon Valley-based LinkedIn’s shares closed down 43.6% at $108.38 on Friday, after hitting a three-year low, following a sales forecast well short of analysts’ expectations. Shares of Seattle-based Tableau Software, a business analytics tools company, fell 49.4% to $41.33 after cutting its full-year profit outlook.

As a result, LinkedIn’s Hoffman lost $1.2 billion from his value on paper on Friday, slashing his stake to $1.6 billion, based on his holdings detailed in a filing with securities regulators from March, which the company said was the most up-to-date. LinkedIn’s Chief Executive Jeff Weiner saw the value of his stake fall by $70.9 million to $91.5 million. At Tableau, the value of CEO Christian Chabot’s stake was slashed nearly in half to $268 million, based on his holdings in a filing with securities regulators in March. Besides Hoffman and Weiner, several venture capitalists who sit on LinkedIn’s board and own stakes in the company suffered substantial losses. Michael Moritz, the chairman of Sequoia Capital who owns more shares than any individual investor besides Hoffman and Weiner, lost $56 million as his stake’s value shrank to $72.8 million. David Sze at Greylock Partners saw the value of his stake slide to $5 million after losing $3.9 million on Friday.

“Any commodity market where inventories are at the highest level in more than 85 years is going to be bearish.”

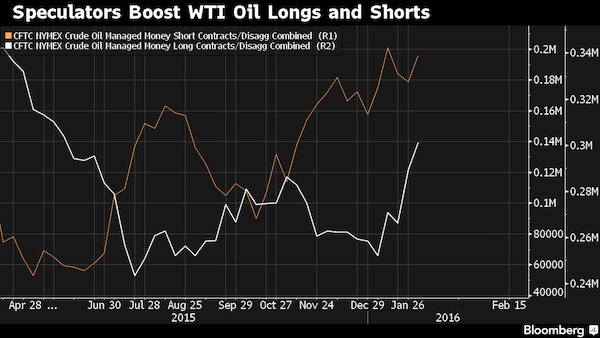

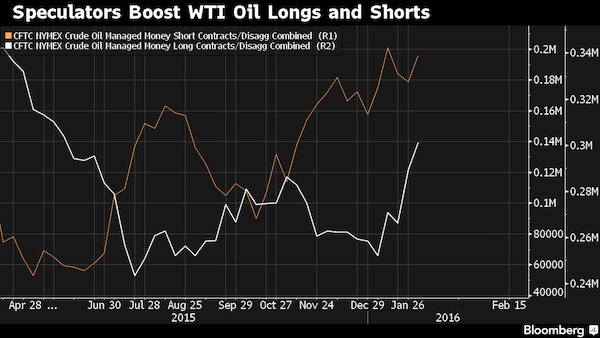

• Record Numbers Of Longs And Shorts Are Piling Into Oil (BBG)

Money managers may not agree where oil prices are headed, but they are increasingly eager to place their bets. Total wagers on the price of crude climbed to the highest since the U.S. Commodity Futures Trading Commission began tracking the data in 2006. Speculators’ combined short and long positions in West Texas Intermediate crude, the U.S. benchmark, rose to 497,280 futures and options contracts in the week ended Feb. 2. WTI moved more than 1% each day in the past three weeks. U.S. crude stockpiles climbed to the highest level in more than 85 years and Venezuela called for cooperation between OPEC and other oil-exporting countries to stem the drop in prices. The slump has slashed earnings from Royal Dutch Shell to Chevron, while Exxon Mobil reduced its drilling budget to a 10-year low.

“This is a reflection of a lot of conviction on both sides,” said John Kilduff at Again Capital, a hedge fund that focuses on energy. “We’re seeing a battle royal between those who think a bottom has been put in and those who think we have lower to go.” WTI slumped 5% to $29.88 a barrel in the report week on the New York Mercantile Exchange. The March contract added 10 cents, or 0.3%, to $30.99 at 12:18 p.m. Singapore time on Monday. [..] “There’s a difference of opinion about the direction of the market,” said Tim Evans at Citi Futures Perspective in New York. “It looks like some of the high price levels offered an opening for shorts to get back into the market. The shorts were the winners on a net basis.”

In other markets, net bearish wagers on U.S. ultra low sulfur diesel increased 11% to 23,765 contracts. Diesel futures advanced 4.5% in the period. Net bullish bets on Nymex gasoline slipped 18% to 14,328 contracts as futures dropped 4.4%. The risks are weighted to the downside because of the global glut, Citi’s Evans said. U.S. crude stockpiles climbed 7.79 million barrels to 502.7 million in the week ended Jan. 29, the highest since 1930, according to Energy Information Administration. Gasoline supplies climbed 5.94 million barrels to 254.4 million, the highest in weekly records going back to 1990. “The rise in U.S. inventories is confirmation of a larger physical supply surplus,” Evans said. “Any commodity market where inventories are at the highest level in more than 85 years is going to be bearish.”

Time for the big margin calls?!

• Prolonged Slump Sparks 2nd Wave Of Cuts To 2016 Oil Company Budgets (Reuters)

Less than two months into the year, the top U.S. shale oil companies have already cut their budget for 2016 a second time as the relentless drop in oil prices continues to erode their cash flow. With oil prices firmly wedged in the low $30-per-barrel range, oil producers are deferring spending on new wells and projects. “Companies’ language has shifted towards preserving balance sheets and cash, and keeping expenditure within cash-flows, which means that budgets are going to fall further,” said Topeka Capital Markets analyst Gabriele Sorbara. 18 of the top 30 U.S. oil companies by output have so far outlined their spending plans for 2016. They have reduced their budget by 40% on average, steeper than most analysts’ expectations, according to a Reuters analysis. These 30 companies had, on average, lowered their spending plans for 2016 by more than 70% last year.

Some such as Hess Corp and ConocoPhillips, who had already planned to spend less this year than in 2015, have now further cut their capital expenditure targets. Others are expected to follow suit. But, is there room for further cuts? While reduced prices for oilfield services and increased efficiencies have helped companies scale back spending, many industry experts say there may not be room for further cuts. “It’s almost like a 80/20 rule – 80% of the cost reduction has already occurred, another 20% remains,” said Rob Thummel at Tortoise Capital Advisors. Although the reduced spending has not yet impacted shale output, production is expected to start falling by the end of the year. “The capital cuts that the industry is making should result in … a supply shock to the downside,” ConocoPhillips’ chief executive, Ryan Lance, said on Thursday.

Looking 10 years ahead? Sure.

• World’s Largest Energy Trader Sees a Decade of Low Oil Prices (BBG)

Oil prices will stay low for as long as 10 years as Chinese economic growth slows and the U.S. shale industry acts as a cap on any rally, according to the world’s largest independent oil-trading house. “It’s hard to see a dramatic price increase,” Vitol CEO Ian Taylor told Bloomberg in an interview, saying prices were likely to bounce around a band with a mid-point of $50 a barrel for the next decade. “We really do imagine a band, and that band would probably naturally see a $40 to $60 type of band,” he said. “I can see that band lasting for five to ten years. I think it’s fundamentally different.” The lower boundary would imply little price recovery from where Brent crude, the global price benchmark, trades at about $35 a barrel.

The upper limit would put prices back to the level of July 2015, when the oil industry was already taking measures to weather the crisis. The forecast, made as the oil trading community’s annual IP Week gathering starts in London on Monday, would mean oil-rich countries and the energy industry would face the longest stretch of low prices since the the 1986-1999 period, when crude mostly traded between $10 and $20 a barrel. Vitol trades more than five million barrels a day of crude and refined products – enough to cover the needs of Germany, France and Spain together – and its views are closely followed in the oil industry.

Taylor, a 59-year-old trader-cum-executive who started his career at Royal Dutch Shell in the late 1970s, said he was unsure whether prices have already bottomed out, as supply continued to out-pace demand, leading to ever higher global stockpiles. However, he said that prices were likely to recover somewhat in the second half of the year, toward $45 to $50 a barrel. For the foreseeable future, Taylor doubts the oil market would ever see the triple-digit prices that fattened the sovereign wealth funds of Middle East countries and propelled the valuations of companies such as Exxon Mobil and BP. “You have to believe that there is a possibility that you will not necessarily go back above $100, you know, ever,” he said.

How many will be capped in for good?

• 150 North Sea Oil Rigs Could Be Scrapped In 10 Years (Scotsman)

Almost 150 oil rigs in UK waters could be scrapped within the next 10 years, according to industry analysts Douglas Westwood, which carries out market research and consultancy work for the energy industry worldwide, said it anticipated that “146 platforms will be removed from the UK during 2019-2026”. The North Sea has been hit hard by plummeting oil prices, with the industry body Oil and Gas UK estimating 65,000 jobs have been lost in the sector since 2014. But Douglas Westwood said that decommissioning could provide an opportunity for the specialist firms involved in the work. Later this month it will publish its decommissioning market forecast for the North Sea – covering Denmark, Germany, Norway and the UK – over the period 2016 to 2040.

Ahead of that a paper on its website predicted that the “UK will dominate decommissioning expenditure”. This is down to the “high number of ageing platforms in the UK, which have an average age of over 20 years and are uneconomic at current commodity prices, as a result of high maintenance costs and the expensive production techniques required for mature fields”. Douglas Westwood said: “The oil price collapse has been bad news for nearly every company involved in the industry, but one group that could actually benefit from it are specialist decommissioning companies. “For these companies there is an opportunity to be part of removing the huge tonnage of infrastructure that exists in the North Sea. With oil prices forecast to remain low, life extension work that has kept many North Sea platforms producing long past their design life no longer makes commercial sense.”

Some people will try and make a big deal out of this.

• Iran Wants Euro Payment For New And Outstanding Oil Sales (Reuters)

Iran wants to recover tens of billions of dollars it is owed by India and other buyers of its oil in euros and is billing new crude sales in euros, too, looking to reduce its dependence on the U.S. dollar following last month’s sanctions relief. A source at state-owned National Iranian Oil told Reuters that Iran will charge in euros for its recently signed oil contracts with firms including French oil and gas major Total, Spanish refiner Cepsa and Litasco, the trading arm of Russia’s Lukoil. “In our invoices we mention a clause that buyers of our oil will have to pay in euros, considering the exchange rate versus the dollar around the time of delivery,” the NIOC source said. Iran has also told its trading partners who owe it billions of dollars that it wants to be paid in euros rather than U.S. dollars.

Iran was allowed to recover some of the funds frozen under U.S.-led sanctions in currencies other than dollars, such as the Omani rial and UAE dhiram. Switching oil sales to euros makes sense as Europe is now one of Iran’s biggest trading partners. “Many European companies are rushing to Iran for business opportunities, so it makes sense to have revenue in euros,” said Robin Mills, CEO of Dubai-based Qamar Energy. Iran has pushed for years to have the euro replace the dollar as the currency for international oil trade. In 2007, Tehran failed to persuade OPEC members to switch away from the dollar, which its then President Mahmoud Ahmadinejad called a “worthless piece of paper”.

What are the odds? If not done retroactively, how would it work out?

• Fining Bankers, Not Shareholders, for Banks’ Misconduct (Morgenson)

Ho-hum, another week, another multimillion-dollar settlement between regulators and a behemoth bank acting badly. The most recent version involves two such financial institutions, Barclays and Credit Suisse. They agreed last Sunday to pay $154.3 million after regulators contended that their stock trading platforms, advertised as places where investors would not be preyed on by high-frequency traders, were actually precisely the opposite. On both banks’ systems, investors trying to execute their transactions fairly were harmed. As has become all too common in these cases, not one individual was identified as being responsible for the activities. Once again, shareholders are shouldering the costs of unethical behavior they had nothing to do with.

It could not be clearer: Years of tighter rules from legislators and bank regulators have done nothing to fix the toxic, me-first cultures that afflict big financial firms. Regulators are at last awakening to this reality. On Jan. 5, for example, the Financial Industry Regulatory Authority, a top Wall Street cop, announced its regulatory priorities for 2016. Among the main issues in its sights, the regulator said, was the culture at these companies. “Nearly a decade after the financial crisis, some firms continue to experience systemic breakdowns manifested through significant violations due to poor cultures of compliance,” said Richard Ketchum, Finra’s chairman.

“Firms with a strong ethical culture and senior leaders who set the right tone, lead by example and impose consequences on anyone who violates the firm’s cultural norms are essential to restoring investor confidence and trust in the securities industry.” But changing behavior — as opposed, say, to imposing higher capital requirements — is a complex task. And regulators must do more than talk about what banks have to do to address their deficiencies. Andreas Dombret is a member of the executive board of the Deutsche Bundesbank, Germany’s central bank, and head of its department of banking and financial supervision. In an interview late last year, he said he was determined to tackle the problem of ethically challenged bankers.

“If behavior doesn’t change, banks will not be trusted and they won’t be efficient in their financing of the real economy,” he said. “A functioning banking system must be based on trust.” Mr. Dombret is a regulator who knows banking from the inside, having held executive positions at J.P. Morgan and Bank of America. Most companies have codes of ethics, Mr. Dombret said, but they often exist only on paper. Regulators could help encourage a more ethical approach by routinely monitoring how a bank cooperates with its overseers, Mr. Dombret said. “How often is the bank the whistle-blower?” he asked. “Not only to get a lesser penalty but also to show that it won’t accept that kind of behavior. We are seeing more of that.”

What VW didn’t get: the key player is the California Air Resources Board. You don’t want to piss them off. “Use of defeat devices is a civil violation” of the Clean Air Act, Uhlmann said. “Lying about CAA compliance is a criminal violation.”

• Volkswagen’s Emissions Lies Are Coming Back To Haunt It (BBG)

No one has died from the emissions-cheating software Volkswagen has admitted it installed in some of its cars, yet the U.S. Justice Department may treat it more harshly than two automakers whose vehicles have killed people. General Motors vehicles were fitted with faulty ignition switches linked to at least 124 deaths. Toyota cars were involved in unintended acceleration responsible for at least four deaths. Neither had to plead guilty in settling criminal allegations, but Volkswagen may be forced to if it’s charged with criminal conduct and also wants to settle, according to attorneys who specialize in environmental law. The German automaker lied to the Environmental Protection Agency and California regulators for almost a year before admitting it created a device to fool emissions tests, Mary D. Nichols, chair of the California Air Resources Board, said in September.

Now the company faces a Justice Department that’s become more willing to push businesses across industries into guilty pleas tied to multibillion-dollar penalties. The U.S. attorney general also made it a priority last year to pursue criminal convictions against corporate executives. “We’ve had difficulty in controlling the automobile industry,” said Daniel Riesel at Sive, Paget & Riesel, a law firm that isn’t involved in the case. “Clearly the government regards this as a very serious environmental dereliction and is making a big deal of it.” [..] The U.S. civil complaint against Volkswagen alleges four violations of the Clean Air Act and cites potential civil fines that could be in the billions of dollars, according to Justice Department officials. If the BP case is a guide, criminal penalties could be less costly.

A criminal claim probably would be based on allegations that Volkswagen lied to government officials, said David Uhlmann, a law professor at the University of Michigan in Ann Arbor and former head of the environmental-crimes section of the Justice Department’s Environment and Natural Resources Division. When confronted about excess emissions by EPA and California regulators in meetings over several months, Volkswagen engineers cited technical issues rather than admitting the engines contained the defeat devices, according to the Justice Department. The company also initially denied in November that it installed software in larger engines to alter emissions, the department said. “Use of defeat devices is a civil violation” of the Clean Air Act, Uhlmann said. “Lying about CAA compliance is a criminal violation.”

Just getting started.

• Moody’s Cuts Rating On Western Australia Iron Ore (WSJ)

Moody’s Investors Service cut its rating on Western Australia, one of the world’s major iron-ore hubs, as a sharp downturn in prices for the steelmaking commodity puts increasing strain on the state’s finances. The ratings agency said on Monday it had downgraded the long-term issuer and senior unsecured debt ratings of the Western Australian Treasury, which issues debt on behalf of the state of Western Australia and state-owned corporations, to Aa2 from Aa1, citing “the ongoing deterioration in Western Australia’s financial and debt metrics and an increasing risk that the state’s debt burden will be higher than indicated.”

Ratings agencies have put many resources-focused companies and countries on watch amid a deep fall in world commodity prices. Last week, Standard & Poor’s Ratings Services said it has lowered BHP Billiton credit rating and cautioned it could cut again as early as this month. It also downgraded Glencore’s rating to just one notch above junk status. Moody’s said Western Australia’s reliance on royalty income from miners meant sharp falls in commodity prices, particularly iron-ore prices, was creating considerable pressure on its budget.

Gives ‘down under’ a new meaning. Watch Perth housing market.

• British Expat Workers Flood Home As Australia Mining Boom Turns To Dust (Tel.)

Mining has been the driving force of Australia’s economic growth for longer than anyone cares to remember – helping GDP growth average 3.6pc a year for most of this century – but the global collapse in commodity prices has led to a painful readjustment Australians have heard the warnings before – but this time, it seems, the boom is truly over. The country is repointing its economy for a new reality, and renegotiating its trading partnership with China and the wider Asia-Pacific. Australia’s mining titans – the likes of BHP Billiton and Rio Tinto, whose shares have led the FTSE 100 lower in the recent market turmoil – have a huge fight on their hands. Meanwhile the migrants who answered their call for workers are considering their options. Will the mining downturn see Britons packing their bags for home?

“There is no doubt that current operating conditions in the mining sector are tough and companies are taking steps to ensure their long-term survival,” says Dr Gavin Lind, of the Minerals Council of Australia. Slowing demand in China – the world’s largest consumer of raw materials, and the buyer of 54pc of Australia’s resources exports in 2015 – has led to dizzying price falls in coal, iron ore, zinc, nickel, copper and bauxite, all minerals mined Down Under. Instead of cutting production and shoring up the price of their product, miners are taking a counter-intuitive tack, and boosting their output. Closing down mines is an expensive business and companies would rather cling on to their market share than cede ground to their rivals. Yet “the increase in volumes is unlikely to be sufficient to offset the effect of lower commodity prices”, Mark Cully, chief economist at the Department of Industry, Innovation and Science, warned in December.

He calculates that Australia’s earnings from mining and energy exports will fall by 4pc to A$166bn (£81bn) this year as lower prices bite. Giant miners such as Rio and BHP believe their low-cost models will enable them to survive while higher-cost competitors go to the wall. However, in common with their peers in the FTSE 100, they have been punished by investors, with their shares tumbling 44pc and 52pc respectively in the last year. While Rio’s balance sheet is regarded as the stronger of the two, both are under pressure to cut their dividends. Analysts expect Rio to unveil a 37pc slump in operating profits when it reports its full-year results this week. BHP, which announces its half-year results on February 23, is facing a 56pc tumble in profits for the year.

Call a spade a spade.

• Ukraine: A USA-Installed Nazi-Infested Failed State (Lendman)

In February 2014, Washington replaced Ukrainian democracy with fascism in Europe’s heartland – illegitimately installed officials waging war on their own people. Fundamental human and civil rights were abolished. Police state viciousness replaced them. Regime critics risk prosecution, sentencing, imprisonment or assassination. Two years after fascists seized power, conditions for ordinary Ukrainians are deplorable. According to Germany’s daily broadsheet Junge Welt, they’re “staggering.” “Since the end of the Yanukovych era, the average income has decreased by 50%,” it reported – on top of 2015’s 44% inflation, nearly reducing purchasing power by half, making it impossible for most Ukrainians to get by. They’re suffering hugely, deeply impoverished, denied fundamental social services, abolished or greatly reduced en route to eliminating them altogether.

Ukraine’s economy is bankrupt, teetering on collapse, sustained by US-controlled IMF loans, violating its longstanding rules, a special dispensation for Ukraine. It loaned billions of dollars to a deadbeat borrower unable to repay them, an unprecedented act, funding its war machine, turning a blind eye to a hugely corrupt regime persecuting its own people. Ukraine’s GDP is in near free-fall, contracting by 12% last year, projected to continue declining sharply this year and beyond. The average pension was cut to €80 monthly, an impossible amount to live on, forcing pensioners to try getting by any way they can, including growing some of their own food in season. US anointed illegitimate oligarch president Petro Poroshenko is widely despised. So are other key regime officials.

They blame dismal economic conditions mainly on ongoing civil war – US-orchestrated and backed naked aggression against Donbass freedom fighters, rejecting fascist rule, wanting fundamental democratic rights, deserving universal praise and support. According to Junge Welt, regime critics call Kiev claims lame excuses. “What matters is (it’s) done little or nothing to prevent corruption and insider trading,” elite interests benefitting at the expense of everyone else, stealing the country blind, grabbing all they can. Complicit regime-connected oligarchs profit hugely in Ukraine, benefitting from grand theft, super-rich Dmitry Firtash apparently not one of them, calling Kiev “politically bankrupt.”

Days earlier, Ukrainian Economy Minister Aivaras Abromavicius resigned, followed the next day by his first deputy, Yulia Kovaliv, his remaining team, two deputy ministers and Kiev’s trade representative. Parliament speaker Volodymyr Groysman warned of Ukraine “entering a serious political crisis.” Resignations followed nothing done to address vital reforms needed. In his resignation letter, Abromavicius said corrupt officials blocked them, wanting control over state enterprises for their own self-interest, including natural gas company NAK Naftogaz. “Neither I nor my team have any desire to serve as a cover-up for the covert corruption, or become puppets for” regime officials “trying to exercise control over the flow of public funds,” he explained.

Not a bad thought experiment. But having ‘populist’ Beppe Grillo as an example shows how clueless Münchau is about reality. That sort of talk itself is populist. David Cameron in a much more valid example, for one.

• Through The Past, Darkly, For Europe’s Central Bankers (Münchau)

Re-reading John Weitz’s biography of Hjalmar Schacht, Hitler’s Banker , I noted some interesting parallels between the 1930s and now that I had not considered before. It is well known that Hitler relied on Schacht, his central banker, to help fund his rearmament plans. But Weitz also pointed out — and this is potentially relevant to the situation in the eurozone today – that Schacht was only able to pursue his unorthodox policies at the Reichsbank because he had the backing of a dictator. If an extremist leader came to power in a large eurozone country – France or Italy, say – what would happen if they were to appoint a central banker with the acumen of Schacht? And what would be the chances that such a team could succeed in increasing economic growth in the short term? Let me say straightaway that I am not comparing anyone to Hitler – or indeed to Schacht.

My point concerns what an unorthodox central banker can do if he or she has the political support to break with the prevailing orthodoxy. Schacht had two stints as president of the Reichsbank — in the 1920s, when he brought an end to the hyperinflation then crippling Germany, and again from 1933 to 1939. It is hard to identify him with a single economic outlook: in the 1920s he was in favour of the gold standard but then, in the early 1930s, he opposed the consensus that promoted the policies of austerity and deflation. Schacht argued, rightly, that Germany was unable to meet the reparation payments specified in the Young Plan, which was adopted in 1929. On returning to the Reichsbank, Schacht organised a unilateral restructuring of private debt owed by German companies to foreigners.

The German economy had already benefited from withdrawal from the gold standard in 1931, and Schacht piled stimulus upon stimulus. One reason for Hitler’s initial popularity in Germany was the speedy recovery from the depression, which was no doubt helped by a loose fiscal and monetary policy mix. The current policy orthodoxy in Brussels and Frankfurt, which is shared across northern Europe, has some parallels to the deflationary mindset that prevailed in the 1930s. Today’s politicians and central bankers are fixated with fiscal targets and debt reduction. As in the early 1930s, policy orthodoxy has pathological qualities. Whenever they run out of things to say, today’s central bankers refer to “structural reforms”, although they never say what precisely such reforms would achieve.

In principle, the eurozone’s economic problems are not hard to solve: the ECB could hand each citizen a cheque for €10,000. The inflation problem would be solved within days. Or the ECB could issue its own IOUs — which is what Schacht did. Or else the EU could issue debt and the ECB would buy it up. There are lots of ways to print money. They are all magnificent — and illegal.

“..communal solidarity..” That says it all. More Europe! Not. Going. To. Happen.

• German, French Central Bankers Call For Eurozone Finance Ministry (Reuters)

The euro zone needs to press ahead with structural reforms and closer integration, including an euro zone finance ministry, to deliver sustainable growth, the heads of the French and German central banks wrote in a German newspaper on Monday. In a guest article for the Sueddeutsche Zeitung entitled “Europe at a crossroads”, they said the European Central Bank (ECB) was not in a position to create sustainable long-term growth for the 19-country single currency bloc. The ECB has undershot its 2% inflation target for three straight years and is unlikely to return to it to for years to come given low oil prices, lackluster economic growth, weak lending and only modest wage rises in the euro zone.

“Although monetary policy has done a lot for the euro zone economy, it can’t create sustainable economic growth,” Bundesbank President Jens Weidmann and Bank of France Chief Francois Villeroy de Galhau wrote. Instead the euro zone needs a decisive program for structural reforms, an ambitious financing and investment union as well as better economic policy framework, Weidmann and Villeroy de Galhau said. The idea of such a ministry was floated in 2011 to tighten coordination of national policy after the economic crisis had forced the European Union to fund bailouts worth hundreds of billions of euros for Greece, Ireland and Portugal. “The current asymmetry between national sovereignty and communal solidarity is posing a danger for the stability of our currency union,” they wrote.

“Stronger integration appears to be the obvious way to restore trust in the euro zone, for this would favor the development of joint strategies for state finances and reforms so as to promote growth,” they said. Specifically, they called for the creation of a common finance ministry in connection with an independent fiscal council as well as the formation of a stronger political body that can take decisions.

Home › Forums › Debt Rattle February 8 2016