Gottscho-Schleisner Fishing boat at Fulton Market Pier, NY 1933

Deflation. “Deflation destroys financial asset values like stocks and corporate bonds and hard assets like real estate. It also lowers incomes while making debt more expensive to service as debt to income ratios rise.”

• 2016: The End Of The Global Debt Super Cycle (PR)

[..] The credit markets are signaling that the debt fueled expansion that began in 2010 is turning to bust. This is the most precarious moment in financial market history because as the world slides into recession global central banks have no ability to soften the oncoming recession with debt creation. Globally interest rates are close to zero and even negative in Europe and Japan. Long term government bond yields are also extremely low. This is sending a very clear and ominous signal that the world cannot service more debt and in fact needs to deleverage and get on more solid financial footing. The last time the world deleveraged was during The Great Depression. The defining quality of The Great Depression was the destructive deflation that gripped the economy.

Deflation destroys financial asset values like stocks and corporate bonds and hard assets like real estate. It also lowers incomes while making debt more expensive to service as debt to income ratios rise. The world economy is on the precipice of another Great Depression. This state of affairs demands a dramatic repositioning of investment portfolios. Investors who choose to remain passive but want to preserve their wealth need to liquidate their investments in stocks and corporate bonds and hold cash only. Investors who are more opportunistic can hold a combination of cash and U.S. government bonds. U.S. government bonds have already begun to rally so buying at current levels is not quite as attractive as it was a month ago but we expect negative interest rates to eventually visit America so there is still considerable upside.

The more aggressive investor can find opportunities to earn high returns employing strategies that will benefit from a financial collapse and a severe, deflationary recession. These strategies include shorting stock index futures, getting long VIX futures, etfs, and options, getting long stock index option volatility via index etfs, and on a limited basis shorting individual company stocks whose business plans will be acutely affected by economic developments. We would not simply be short financial assets every day because we recognize that the markets will initially be quite volatile which means sharp bear market rallies in between dramatic declines in financial assets. We would initially be positioned to benefit from this two-way volatility and as the declines become more severe and investors begin to throw in the towel the fund will be more short oriented.

Selling off Aramco.

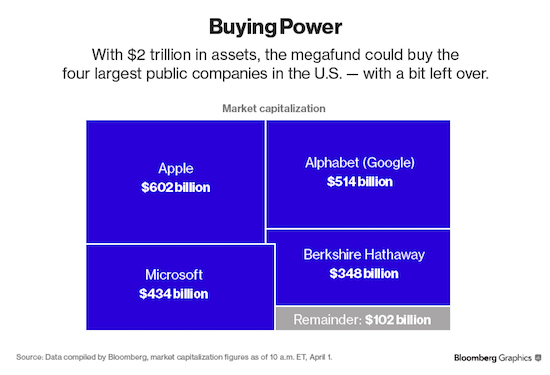

• Saudi Arabia Plans $2 Trillion Megafund for Post-Oil Era (BBG)

Saudi Arabia is getting ready for the twilight of the oil age by creating the world’s largest sovereign wealth fund for the kingdom’s most prized assets. Over a five-hour conversation, Deputy Crown Prince Mohammed bin Salman laid out his vision for the Public Investment Fund, which will eventually control more than $2 trillion and help wean the kingdom off oil. As part of that strategy, the prince said Saudi will sell shares in Aramco’s parent company and transform the oil giant into an industrial conglomerate. The initial public offering could happen as soon as next year, with the country currently planning to sell less than 5%. “IPOing Aramco and transferring its shares to PIF will technically make investments the source of Saudi government revenue, not oil,” the prince said in an interview. “What is left now is to diversify investments. So within 20 years, we will be an economy or state that doesn’t depend mainly on oil.”

Almost eight decades since the first Saudi oil was discovered, King Salman’s 30-year-old son is aiming to transform the world’s biggest crude exporter into an economy fit for the next era. As his strategy takes shape, the speed of change may shock a conservative society accustomed to decades of government handouts. The sale of Aramco is planned for 2018 or even a year earlier, according to the prince. The fund will then play a major role in the economy, investing at home and abroad. It would be big enough to buy Apple, Google parent Alphabet, Microsoft and Berkshire Hathaway – the world’s four largest publicly traded companies. PIF ultimately plans to increase the proportion of foreign investments to 50% of the fund by 2020 from 5% now, said Yasir Alrumayyan, secretary-general of the fund’s board.

The trade war is much further advanced than ‘looming’.

• Defiant China Slaps Steel Tariffs On Britain, EU As Trade War Looms (AEP)

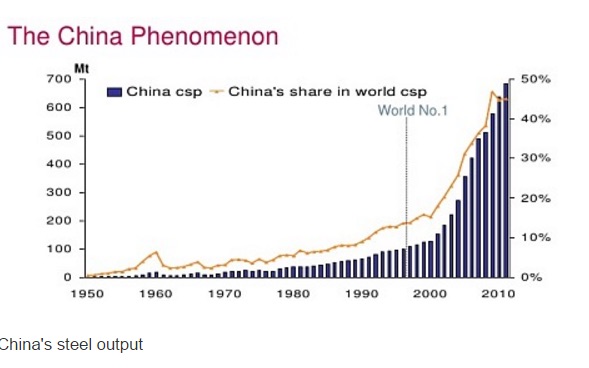

China has thrown down the gauntlet in an escalating trade war over the global steel glut, imposing punitive tariffs of 46pc on hi-tech steel produced in Britain and the rest of the EU. The astonishing move came as the Prime Minister, David Cameron, confronted the Chinese leader Xi Jinping at a meeting in Washington, pleading for action to slow the flood of Chinese steel exports reaching Europe. The imminent demise of the Port Talbot steelworks and Tata’s wider steel operations in Britain has mushroomed within days into a full-blown national drama, calling into question the Government’s whole approach to China. The Chinese ministry of commerce said in a terse statement that it was slapping anti-dumping tariffs of 14.4pc to 46.3pc on companies from the EU, South Korea, and Japan, claiming that China had suffered “substantial damage” from trade abuses.

In a macabre twist, the measures target the Tata plant in Port Talbot, which produces the specialist flat-rolled electrical steel used in transformers. A tiny amount is exported to China. “If this is not a trade war, I don’t know what is,” said Gareth Stace, director of UK Steel. “We’re literally drowning in a flood of Chinese imports globally. We’re certainly not seeing a flood of European steel into China.” China’s share of global steel output has risen from 10pc to 50pc over the last twelve years, with the single province of Hebei now producing twenty times as much as Britain. China’s excess capacity 400m tonnes, double the size of the entire EU steel industry. The country can no longer absorb its own supply as the construction boom fades and the catch-up phase of breakneck industrial growth hits the limit.

A record 112m tonnes was exported last year but Chinese producers are also suffering huge losses. Anshan Iron and Steel announced today that it had lost $7bn over the last year and warned that the steel industry faces an “Ice Age that will force a brutal consolidation”. The US Trade Representative accused China of systematic trade abuse and illicit subsidies for its steel industry in a blistering report released today. “China’s trade policies and practices in several specific areas cause particular concern for the United States. Chinese government actions and financial support in manufacturing industries like steel and aluminium have contributed to massive excess capacity in China,” it said.

The US trade report said China’s steel capacity has continued to grow “exponentially” to 1.4bn tonnes – even higher than previously feared – despite weakening global demand. This now dwarfs the rest of the world’s combined output and is profoundly distorting the global steel market. It said China has no natural advantages in raw materials or energy costs to justify this, and claimed that it is the result of export subsidies, cheap credit, and an opaque regime of state support. “These practices have caused tremendous disruption, uncertainty, and unfairness in the global markets. To date, however, China has not made any movement toward the adoption of international best practices,” it said. It cited a long list of alleged violations, especially in “strategic emerging industries”, technology, intellectual property, and services, accusing Beijing of obstructing access its own markets.

Maybe China will buy Tata? There are no other buyers.

• Tata’s Pain Intensifies As China Imposes Hefty Tariffs On Hi-Tech Steel (Tel.)

China has levied huge new tarrifs on a type of steel produced by Britain despite David Cameron personally challenging the country’s president to help save UK steelmakers, it emerged yesterday. The Prime Minister used a dinner at the White House to confront President Xi Jinping over the possible extinction of the UK steel industry due to Chinese dumping. However it later emerged that China will levy a 46% duty on a type of high tech steel made by just 16 producers worldwide including Tata Steel’s Cogent subsidiary in Newport. China’s decision comes after the European Union imposed tariffs of up to 13% on steel from the country used to reinforce concrete earlier this year.

The development raised the pressure on Britain to better protect the country’s steel manufacturing amid fears 40,000 jobs could be lost as Tata Steel looks to sell off its UK business. It came amid reports Tata is pulling out of Britain in order to smooth a merger with German engineering conglomerate Thyssenkrupp. Credit Suisse analysts said Tata’s planned exit from the UK was a prerequisite to any potential deal with Thyssenkrupp. Sajid Javid, the Business Secretary, yesterday travelled to Port Talbot in South Wales to meet managers and face the anger of hundreds of workers over the government’s handling of the crisis. He appeared to indicate a deal is possible by saying there were “viable buyers” to take over Tata’s operations but said he could not go into details for commercial reasons. Mr Javid said steel remains “absolutely vital” to the British economy and addressed fears work could dry up within days by indicating he had secured more time for negotiations.

Credibility shot.

• Anbang’s Starwood Retreat Is Setback For China’s M&A Campaign (Reuters)

Anbang Insurance’s unexpected withdrawal this week of its $14 billion offer to acquire Starwood Hotels & Resorts Worldwide is a wider blow to the unprecedented drive by Chinese companies to acquire North American and European assets. From semiconductors and industrial equipment, to financial services and real estate, China’s insatiable appetite for Western companies has pushed the country’s outbound cross-border M&A to $101.1 billion year-to-date, nearly surpassing the full-year record of $109.5 billion set last year. Yet Anbang’s abrupt move, which came after Starwood said on Monday that the Chinese insurer’s latest offer was “reasonably likely” to be superior to a cash-and-stock deal with Marriott International, added fuel to concerns that many Chinese companies may not be able to deliver on their acquisition expectations.

“To succeed in the U.S., Chinese companies will have to adapt to American styles of governance and transparency. It will be difficult to close mega deals without a more open style, so we may see more modest deals until China changes,” said Erik Gordon, a professor at the University of Michigan’s Ross School of Business. To be sure, the largest M&A deal of this year thus far globally is by a Chinese company: China National Chemical’s agreement to acquire Swiss seeds and pesticides group Syngenta for $43 billion. Several Chinese companies, however, are having trouble convincing Western peers that they are a credible M&A counterparty. Earlier this week, for example, U.S. gene-sequencing products maker Affymetrix rejected an offer by some of its former executives that was financed by a Chinese investment firm, even though they offered more money than an existing deal with Thermo Fisher Scientific, on the basis of financing and regulatory risks.

[..] Anbang said on Thursday that it withdrew its offer due to “market considerations”, without elaborating. One of Anbang’s private equity partners, Primavera Capital Ltd chairman Fred Hu, said Anbang walked away to avoid a protracted bidding war, even though Marriott had not disclosed a higher offer. “We have little independent insight into what happened, but based on what Starwood has told us, Anbang did not deliver the same kinds of undertakings or arrangements that would have allowed the Starwood board to conclude that they were credible at $82.75,” Marriott Chief Executive Arne Sorenson told investors and analysts on a conference call. Anbang became concerned that Starwood had no intention of declaring its latest offer superior and was stalling for time for Marriott to come in with a new offer, according a source close to Anbang’s consortium.

Sources close to Starwood, however, said Anbang did not deliver the assurances on financing its latest offer it had said it would on Monday, and had since had no communication with Starwood until its withdrawal on Thursday. Chinese financial magazine Caixin reported last month that China’s insurance regulator would likely reject a bid by Anbang to buy Starwood, since it would put the insurer’s offshore assets above a 15% threshold for overseas investments. “(Anbang) told us what they told the market, (that their withdrawal was due to) the market considerations,” Starwood Chief Executive Thomas Mangas told the same conference call.

Debt by another name.

• How People In China Afford Their Outrageously Expensive Homes (Forbes)

Before we can understand how people in China can afford to frolic in their country’s over-inflated housing market, we must look at where this market came from. Hardly 20 years ago China’s real estate market didn’t exist. It wasn’t until the mid-90s that a series of reforms allowed urban residents to own and sell real estate. People were then given the option to purchase their previously government-owned homes at extremely favorable rates, and most of them made the transition to being property owners. Now with a population provisioned with houses that they could sell at their discretion and the ability to buy homes of their choice, China’s real estate market was set to boom. By 2010, a little over a decade later, it would be the largest such market in the world.

When we talk about how people afford houses in China today, more often than not we’re not talking about individuals going out and buying property on their own — as is the general modus operandi in the West. No, we’re talking about entire familial and friend networks who financially assist each other in the pursuit of housing. At the inner-circle of this social network is often the home buyer’s parents. When a young individual strikes out on their own, lands a decent job, and begins looking to pursue marriage, getting a house is often an essential part of the conversation. Owning a home is virtually a social necessity for an adult in China, and is often a major part of the criteria for evaluating a potential spouse. As parents tend to move into their children’s homes in old age, this truly is a multi-generational affair.

So parents will often fork over a large portion of their savings to provision their children with an adequate house – oftentimes buying it years in advance. If parents are not financially able to buy their kids a house outright, they will generally help with the down payment, or at the very least provide access to their social network to borrow the required funds. Take for example the case of Ye Qiuqin, a resident of Ordos Kangbashi who owns two houses across the country in Guangdong province, where she is originally from. Together with her fiancé, she makes roughly US$3,200 per month from running a cram school. For her first home she made a down payment of roughly US$20,000; of which $3,300 came from her parents, $10,000 came in the form of loans from her sister and friends, and the rest came from her savings.

To decrease the amount of volatility in China’s often hot property market, there are very strict rules as to how much money people can borrow from the bank for purchasing real estate. Although this slightly varies by city and wavers in response to current economic conditions, for their first home a buyer must lay down a 30% down payment, for the second it’s 60%, and for any property beyond this financing isn’t available. So for people to buy homes in this country they need to step up to the table with a large amount of cash in hand. Why there is so much liquid cash available for these relatively large down payments is straight forward: the Chinese are some of the best savers in the world. In fact, with a savings rate that equates to 50% of its GDP, China has the third highest such rate in the world. As almost a cultural mandate, the Chinese stash away roughly 30% of their income, which is often called into use for such things as making a down payment on a home — which is the most important financial transaction that many Chinese will ever make.

Drilling zombies.

• Even Bankrupt US Shale Drillers Keep Pumping Oil (Reuters)

As oil prices nosedived by two-thirds since 2014, a belief took hold in global energy markets that for prices to recover, many U.S. shale producers would first have to falter to allow markets to rebalance. With U.S. oil prices now trading below $40 a barrel, the corporate casualties are already mounting. More than 50 North American oil and gas producers have entered bankruptcy since early 2015, according to a Reuters review of regulatory filings and other data. While those firms account for only about 1% of U.S. output, based on the analysis, that count is expected to rise. Consultant Deloitte says a third of shale producers face bankruptcy risks this year.

But a Reuters analysis has found that bankruptcies are so far having little effect on U.S. oil production, and a tendency among distressed drillers to keep their oil wells gushing belies the notion that deepening financial distress will prompt a sudden output decline or oil price rebound. Texas-based Magnum Hunter Resources, the second-largest producer among publicly-traded companies that have filed for bankruptcy, is a case in point. It filed for creditor protection last December, but even as the debt-laden driller scrambled to avoid that outcome, its oil and gas production rose by nearly a third between mid-2014 and late 2015, filings show.

Once in Chapter 11, its CEO Gary Evans said the bankruptcy, which injected new funds to ensure it would stay operational, could help to “position Magnum Hunter as a market leader.” The company did not respond to a request for comment for this story. However, John Castellano, a restructuring specialist at Alix Partners, said that all of the nearly 3,000 wells in which Magnum Hunter owns stakes have continued operations during its bankruptcy. Production figures can be hard to track post-bankruptcy, but restructuring specialists say that many bankrupt drillers keep pumping oil at full tilt. Their creditors see that as the best way to recover some of what they are owed. And as many bankrupt firms seek to sell assets, operating wells are valued more than idled ones.

“Oil companies in bankruptcy do not seem to automatically curtail production,” said restructuring expert Jason Cohen at the Bracewell firm in Houston. “Lenders are willing to let them continue to produce as long as economically viable.” For most companies in bankruptcy or considering it, maximizing near-term production does make economic sense. Day-to-day well operating costs in most U.S. shale fields remain well below $40 a barrel. Bankrupt firms are also eligible for new financing that can allow them to keep pumping for some time.

What need is there for a pipeline at this point int ime?

• Native American Tribes Mobilize Against Proposed North Dakota Oil Pipeline (G.)

Dozens of tribal members from several Native American nations took to horseback on Friday to protest the proposed construction of an oil pipeline which would cross the Missouri river just yards from tribal lands in North Dakota. The group of tribal members, which numbered around 200, according to a tribal spokesman, said they were worried that the Dakota Access Pipeline, proposed by a subsidiary of Energy Transfer Partners, would lead to contamination of the river. The proposed route also passes through lands of historical significance to the Standing Rock Lakota Sioux Nation, including burial grounds.“They’re going under the river 500 yards from my son’s grave, my father’s grave, my aunt who I buried last week,” said Ladonna Allard, a member of the Standing Rock nation and the closest landowner to the proposed pipeline.

“I really love my land, and if that pipeline breaks everything is gone.” “We must fight every inch of our lives to protect the water,” Allard said. A “spiritual camp” will be set up starting Saturday at the point where the proposed pipeline would cross the river, and the tribal members plan to stay and protest indefinitely. The group is composed of members of the Standing Rock nation as well as others from North and South Dakota nations, including the Cheyenne River Lakota and the Rosebud Sioux. They joined together to ride, run and walk from the Tribal Administration Building north to Cannonball, North Dakota, on the reservation’s northern edge.

The Missouri river is the primary source of drinking water for the tribal reservation, according to Doug Crow Ghost, a spokesperson for the Standing Rock Sioux and the director of the tribe’s water office, who joined the protest on Friday. Tribal members also fish in the river, he said. “Because we are going to be fighting this giant, all the rest of the nations came on horseback to say ‘we support you’,” said Allard. “That is why this horse ride is so important to us. Because we’re not alone in this fight. All of our nations are coming to stand with us, and all our allies and partners. This pipeline is illegal.”

Renewable bubble?!

• Solar-Energy Company SunEdison Preparing to File for Bankruptcy (WSJ)

Solar-energy company SunEdison plans to file for bankruptcy protection in coming weeks, a dramatic about-face for a company whose market value stood at nearly $10 billion in July. The company is preparing a chapter 11 filing and is in talks with two creditor groups to obtain a loan to fund its operations during the process, according to people familiar with the matter. Creditors are likely to take control of the company and its portfolio of power projects, the people said. SunEdison, whose stock has plunged in recent months, would rank among the largest financial collapses in recent years. The company, based about 20 miles outside St. Louis, used a combination of financial engineering and cheap debt to grow to be one of the country’s biggest developers of renewable-power plants.

But a proposed $1.9 billion takeover of residential-rooftop installer Vivint Solar, which was terminated last month, was unpopular with investors. Meanwhile, falling oil prices caused a broad selloff for energy stocks, and capital-market turbulence stoked concerns about SunEdison’s ability to continue financing acquisitions. SunEdison’s stock fell to fresh lows this past week on bankruptcy fears and news that the company is facing Securities and Exchange Commission and Justice Department investigations. Its market capitalization is now about $150 million, and it had long-term debt of about $7.9 billion as of Sept. 30, according to a regulatory filing.

Where Wikileaks meets the real world. Gov’t spokeswoman: “Greece demands to know whether the creation of bankruptcy conditions in Greece is official position of the IMF”

• Greece Reacts To Wikileaks Claims About IMF Conversation On Bailout (Kath.)

Prime Minister Alexis Tsipras was reportedly to chair an emergency meeting with key ministers on Saturday after the publication of a leaked transcript of a conversation that is alleged to have taken place between Poul Thomsen, the head of the IMF’s European department, and Delia Velculescu, the IMF mission chief for Greece. WikiLeaks, which made the revelation, said it obtained the details of the conversation, which took place last month, and in which the two leading IMF officials apparently discuss putting pressure on Germany over the eurozone’s position regarding Greece’s bailout review by threatening that the IMF will leave the program.

According to the WikiLeaks transcript, the two IMF officials discuss an “event” that would force the Europeans to accept the IMF’s position so the bailout review can be concluded. “What is going to bring it all to a decision point? In the past there has been only one time when the decision has been made and then that was when they were about to run out of money seriously and to default. Right?” Thomsen is claimed to have told Velculescu. “I agree that we need an event, but I don’t know what that will be,” Velculescu allegedly added a little later in the conversation. The transcript quotes Velculescu as saying: “What is interesting though is that [Greece] did give in … they did give a little bit on both the income tax reform and on the … both on the tax credit and the supplementary pensions”.

Thomsen’s view was that the Greeks “are not even getting close [to coming] around to accept our views”. Velculescu argued that “if [the Greek government] get pressured enough, they would … But they don’t have any incentive and they know that the commission is willing to compromise, so that is the problem.” A Greek official told the ANA-MPA news agency that the government “is not willing to allow games to be played to the detriment of the country.”

A tragedy in the making.

• EU-Turkey Refugee Deal: Staff Shortages, Rights Concerns Pose Twin Threat (G.)

Serious concerns have been raised about the viability and legality of the EU-Turkey refugee deal just three days before its implementation, after rights campaigners alleged that Ankara had been deporting hundreds of refugees back to Syria on a daily basis in recent weeks, and the Greek asylum service said it needed more staff to make the deal work. In a double blow to the deal, the most senior Greek asylum official, Maria Stavropoulou, called for a 20-fold increase in personnel – while Amnesty International alleged that unaccompanied children were among scores of Syrians illegally expelled from Turkey since January. Hours later, the UN refugee agency again called for a halt to the deal unless Turkey could guarantee refugees’ basic rights.

The news came as hundreds of people detained on a Greek island fled their camp en masse, and other refugees began to sail from mainland Greece to Italy for the first time since eastern European governments began to block their onward route through the Balkans last month. Seeking to block off a migration route that brought more than 800,000 refugees to Greece from Turkey last year, European and Turkish leaders are set to implement a deal on Monday that will see almost all asylum seekers deported back to Turkey. The success of the deal rests on both Greece’s ability to process thousands of people in a short space of time, and Turkey’s ability to prove itself a safe country for refugees.

Both factors were called into question on Friday, as the Greek parliament voted to begin deportations on Monday. Stavropoulou said her department did not have enough people to process the claims of the many people who, prior to the deal, would simply have passed through Greece on their way to Germany and other wealthier European countries. “I’m worried about very many things, but the main worry now is about having the capacity to process all these claims,” she said in an interview with the Guardian. “We have about 300 staff,” she said. “My estimate is that if we are asked to handle anything like half the flow of last year, then we need to have 20 times more capacity.”

First refugee shot dead in Europe?!

• Afghan Refugee Shot Dead Trying To Enter Bulgaria (AJ)

Bulgarian border guards have shot dead an Afghan asylum seeker after he crossed into the country from Turkey. The man was killed near the border with Turkey after police fired and struck him with a warning shot that ricocheted, Bulgarian authorities said on Friday. Interior Ministry chief of staff Georgi Kostov said: “A group of 54 people aged between 20 and 30, all from Afghanistan, were intercepted by border guards and a police officer after crossing into Bulgarian territory. “One of my colleagues used his personal weapon and fired.” The man was injured and died from his wounds en route to hospital.

The targeted group of refugees were seen by a patrol near the southeastern Bulgarian town of Sredets. The UNHCR said it was the first time an asylum seeker had been shot dead while trying to cross into Europe. “We, at UNHCR, are deeply shocked by this incident,” said Boris Cheshirkov, a spokesman for the UN refugee agency. “We deplore the death of an Afghan asylum seeker, trying to reach safety across the border. We call on the Bulgarian authorities to conduct an immediate, transparent and independent investigation. Seeking asylum is an universal human right and not a crime.” The other refugees were detained while an investigation was launched. The men carried no identification documents.

“.. recent deal that sees the world’s richest continent (population 500 million) corral a single Middle Eastern country (population 80 million) into caring for more Syrian refugees than the rest of the world combined.”

• Turkey Is No ‘Safe Haven’ For Refugees – It Shoots Them At The Border (G.)

It was beyond sad to read in the Times this week that Turkish border guards have allegedly shot dead Syrians trying to reach safety in Turkey. Sixteen refugees, including three children, have been killed trying to escape the battlegrounds of northern Syria in the past four months, according to the Syrian Observatory for Human Rights, a frequently cited watchdog. It is shocking to think of people fleeing the combined atrocities of Islamic State and Bashar al-Assad being gunned down just as they make their bid for safety. But what is perhaps most shocking of all is that we observers are still shocked by this. The shooting of Syrians on the border is not a new phenomenon. Refugees and rights groups have reported shootings of migrants on the Turkish-Syrian border since at least 2013.

These abuses are well-documented, and the reports widely circulated. So why, in the months following a shady European deal that forces Turkey to shoulder the biggest burden of the refugee crisis, are we still so appalled when Turkey continues to use deadly violence to stop that burden getting any bigger? A surge in border abuses is the logical result of a recent deal that sees the world’s richest continent (population 500 million) corral a single Middle Eastern country (population 80 million) into caring for more Syrian refugees than the rest of the world combined. We shouldn’t have expected any other outcome. But sadly, some did. And Europe’s leaders – including David Cameron – apparently still do. Turkey is in the process of being designated by the EU as a “safe third country” for refugees – a sobriquet that gives Greece the right to send back almost all of those who land on its shores from Turkey.

Leaders, including Cameron, have justified this with the claim that refugees are safe from mortal danger in Turkey. Border shootings show this is not always strictly true, as do well-substantiated allegations that Turkey has illegally returned some Syrians and Afghans to the danger of their home countries, even after they had safely settled on Turkish soil. An alarming new report by Amnesty International, released today, alleges that in recent weeks large groups of Syrians have been deported back to Syria from southern Turkey, as officials there attempt to reduce their refugee burden.

In Cameron’s favour, most refugees in Turkey are not at risk of death on a battlefield. But this is not what refugee advocates mean when they say that Turkey is an unsuitable place for refugees. Refugee rights extend far beyond the simple right to life: they include the right to education, to healthcare and to work. The point of giving people refugee status is to guarantee them all the opportunities that are extended to natural-born citizens of the country in which they now live.

Home › Forums › Debt Rattle April 2 2016