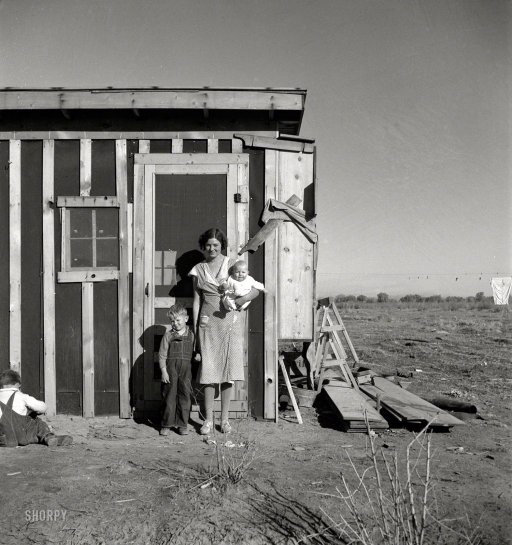

Dorothea Lange Resettlement project, Bosque Farms, New Mexico Dec 1935

China has a debt problem. “Zero or negative rates monetary conditions don’t mean that debt issues and the asset bubble problem will be resolved automatically, but the opposite..”

• China Needs To Prepare For Zero Interest Rates (Global Times)

The US Federal Reserve’s (Fed) continuous interest rates cuts have triggered a race of interest rates cuts among central banks around the world, increasing excessive global liquidity even further. In this case, more countries are faced with monetary conditions of zero or negative rates. Recently, former US Fed chairman Alan Greenspan noted that “negative rates” are spreading around the world. Some financial institutions even believe the world will enter a low rates condition that hasn’t occurred in 1,000 years. Under the condition of low or zero rates, the world’s debts level keeps rising, and the bond yields continue dropping. Another phenomenon comes with low rates monetary condition is that prices go up with risk asset. The US stock prices have climbed to a new high.

For China, the demands for liquidity are growing, foreign capital keeps flowing in and the real economy continues to slow down, which all make the country seemingly approaching a zero rates monetary condition. It asks policymakers and market players to be prepared. Mounting debts and the financing problems in the real economy will promote China to a zero rate condition. In the first half of 2019, China’s overall debts accounted for 306 percent of the GDP, up 2 percentage points from the 304 percent in the first quarter, according to a report from the Institute of International Finance (IIF). The number was just around 200 percent in 2009 and 130 percent in 1999.

According to data from the National Institution for Finance and Development, China’s enterprise sector’s debts account for 155.7 percent of the nominal GDP, up 2.2 percentage points from the end of last year. It’s far beyond the government sector’s leverage ratio of 38.5 percent and the resident sector’s leverage ratio of 55.3 percent. In the enterprise sector, private companies embattled with financing problems account for 30 percent. Structurally, China’s non-financial corporate debt ratio is too high, and interest rates are too high. Considering that the repayment burden of existing debt has squeezed out the effective demand for new credit, and China is likely to become the next zero interest rate country, according to Zhu Haibin, Chief China Economist at J.P. Morgan.

Tyler’s take on the article above: “..it will only infuriate Trump who has been kicking and screaming at Jerome Powell, demanding that the Fed do just that.”

• China Will Be The Next Country To Cut Rates To Zero (ZH)

[..] an English language op-ed published today in China’s nationalist tabloid, Global Times, which for once, is surprisingly accurate, and while mostly avoiding the propaganda that Chinese media is so well known for, explains well why China may indeed be the next country to see zero rates (as a reminder, Chinese real rates are already negative due to soaring pork prices). And while we doubt that the PBOC will be able to cut enough to bring about ZIRP, or NIRP, any time soon especially due to the ongoing hyperinflation in pork prices, if and when those do stabilize the Chinese central bank may well follow in the footsteps of every other developed central bank. In doing so, it will only infuriate Trump who has been kicking and screaming at Jerome Powell, demanding that the Fed do just that.

What we find most remarkable about the op-ed is how simply, matter-of-factly and correctly, the author explains away why zero rates are coming: “Mounting debts and the financing problems in the real economy will promote China to a zero rate condition [..] Structurally, China’s non-financial corporate debt ratio is too high, and interest rates are too high. Considering that the repayment burden of existing debt has squeezed out the effective demand for new credit, and China is likely to become the next zero interest rate country”. Amusingly, the anonymous op-ed writer has managed to state in two sentences what takes financial pundits hours, days and weeks to explain on CNBC: “Another phenomenon comes with low rates monetary condition is that prices go up with risk asset. The US stock prices have climbed to a new high.”

That said, what we found most surprising about the Global Times oped is its conclusion: instead of some jingoist bullshit about how China’s negative rates would be the greatest, and most negative in the entire world, the publication takes a very measured tone, and warns that such a monetary stance may very well spell doom for China, to wit: “Zero or negative rates monetary conditions don’t mean that debt issues and the asset bubble problem will be resolved automatically, but the opposite. Growing bubbles in the global financial market in the long run will be a reminder of financial risks. In a slowing global economy, zero or even negative interest monetary conditions are a new trend that gives new risks and challenges to China and the international financial market. Awareness and responsiveness need to be revamped.”

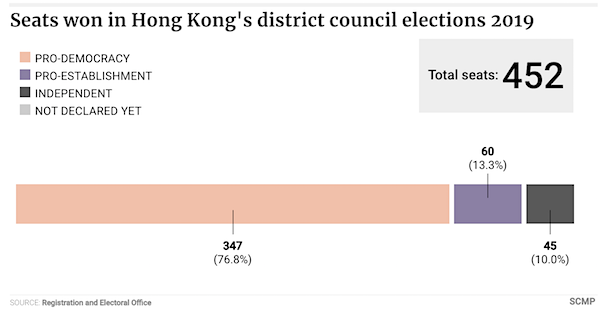

Pro-democracy camp wins 17 out of 18 district councils, all of which were previously under pro-establishment control. Record voter turnout.

Beijing really thought its candidates would win?

• Hong Kong Pro-Democracy Candidates Win 347 of 452 Seats (SCMP)

The anti-establishment reverberations from almost six months of street protests swept through polling stations across Hong Kong on Sunday, as voters in record numbers roundly rejected pro-Beijing candidates in favour of pan-democrats. The tsunami of disaffection among voters was clear across the board, as pan-democrats rode the wave to win big in poor and rich neighbourhoods, in both protest-prone and non-protest-afflicted districts and, in downtown areas as well as the suburbs. Less immediately obvious was whether there was a generational divide in the way people voted, but ousted pro-establishment district councillors suggested that young, first-time voters had been instrumental in dislodging them from their perch.

The final election results were confirmed at 1pm on Monday when the vote count was completed at Lam Tin constituency of Kwun Tong District Council. Among the 452 seats up for grabs, the pan-democrats were victorious in 347, the independents – many of them pro-democracy – won 45, while the pro-establishment camp had to make do with 60. The pro-democracy camp now has control of 17 out of 18 district councils. It won all elected seats in Wong Tai Sin and Tai Po district councils.

The Irish Times publishes 9 articles based on “a small cache of secret documents, being called the China Cables, that were leaked to the International Consortium of Investigative Journalists (ICIJ)”.

This is from the first article: “‘The largest incarceration of a minority since the Holocaust’”. Click the link for the ‘library’.

Yves Smith: “The Irish Times did terrific additional reporting on the ICIJ docs. Must reading.”

Dormitory doors, corridor doors, and floor doors must be double-locked, and must be locked immediately after being opened and closed.” “Strictly manage and control student activities to prevent escapes during class, eating periods, toilet breaks, bath time, medical treatment, family visits, etc.” The quotes are from instructions issued by a top security official in the Xinjiang province of China, where since 2017 more than a million people from Uighur and other ethnic minority groups are being kept in camps. The Chinese authorities, who at first denied the camps existed, then said they were there to provide “educational training” to “students” in centres that had a “boarding school” type of management. “It is strictly forbidden for police to enter the student zone with guns, and they must never allow escapes, never allow trouble, never allow attacks on staff, never allow abnormal deaths.”

Contained in a telegram called “New Secret 5656”, the instructions were written in 2017, when the policy of incarcerating people from ethnic minorities in Xinjiang was being put into effect on an industrial scale. The telegram is among a small cache of secret documents, being called the China Cables, that were leaked to the International Consortium of Investigative Journalists (ICIJ), and have been shared with 17 media partners, including The Irish Times, the BBC, Le Monde, Süddeutsche Zeitung and the US TV network, NBC. The leak puts to rest attempts by the Chinese government to portray the facilities in the western province of Xinjiang as anything other than internment camps.

Adrian Zenz, a recognised authority on what is happening in Xinjiang, told the ICIJ he believes the reference in the instructions to not allowing “abnormal deaths” has to do with torture. The telegram does not mention torture, “but the fact that it mentions the avoidance of abnormal deaths, in my opinion, is an indication that [the camp system] is using forms of physical force on people that, however, is not supposed to kill them.” People are being put in chain-suits, are being made stand in certain positions, and are being beaten, said Zenz. Other harsher forms of torture are being meted out in prisons and detention centres.

In October a former detainee, Sayragul Sauytbay, a muslim of Kazakh descent who has been granted asylum in Sweden, told Israeli newspaper Haaretz that some inmates were made sit on a chair of nails. “I saw people return from that room covered in blood. Some came back without fingernails.” The “special secrecy level” instructions in the telegram were issued by Zhu Hailun, the then head of the Chinese Communist Party’s Political and Legal Commission (PLC) in Xinjiang, and the senior party official then responsible for the implementation of the campaign of repression in Xinjiang.

Blair’s attacking Corbyn until he loses.

• Both UK Parties Are Peddling Fantasies – Tony Blair (R.)

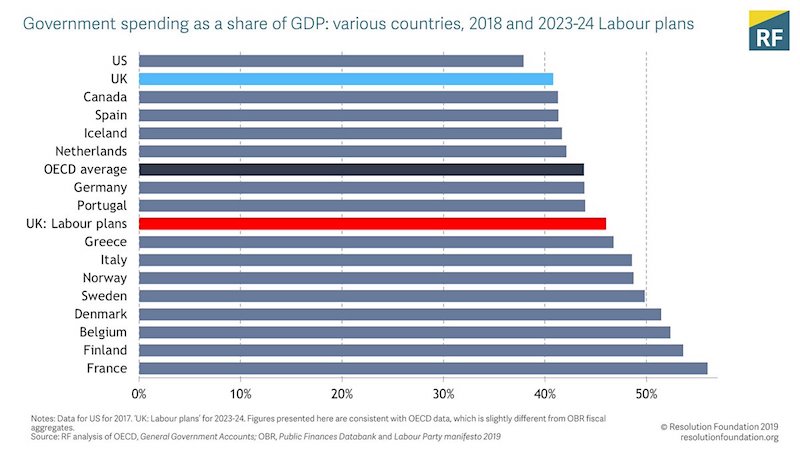

Prime Minister Boris Johnson and Labour leader Jeremy Corbyn are peddling fantasies before a Dec. 12 election, former British leader Tony Blair will say on Monday, offering his support to “mainstream” politicians. At a newsmaker event at Reuters, Blair will criticise Britain’s main parties for offering voters a stark choice, wanting to win “on the basis that whatever your dislike of what they’re offering, the alternative is worse”. Held after three years of negotiations to leave the European Union since a 2016 referendum, the December election will show how far Brexit has torn traditional political allegiances apart and will test an electorate increasingly tired of voting.

Blair, who was prime minister for 10 years until 2007, will say many in Britain are “scratching their heads, changing their minds, floating and unsure” before the election. “The unifying sentiment is a desire, bordering on the febrile, to end the mess, to wake from the nightmare,” he will say, according to extracts from his speech. “This desire, though completely understandable, is in danger of leading us into a big mistake; and frankly we cannot afford another of those.” Blair will accuse both parties of offering up a fantasy to voters – the Conservatives suggesting they will get Brexit done when the reality is that they will start new talks on a future relationship which “could last for years”. Equally, he will say that Labour, under veteran socialist Corbyn, is offering a “revolution”. “The problem with revolutions is never how they begin but how they end.”

“President tries to do something. Congress opposes. President sees he has no support and backs down. It has happened many, many times with many, many presidents.”

• Why Did Trump Release Ukraine Aid? The Answer Is Simple (York)

Trump’s true reason for releasing the aid matters to the Democratic impeachment scheme. If he released the money after learning about the whistleblower — after he realized the jig was up — then that, at least to Democrats, suggests guilt. If he released it after gaining confidence in Zelensky, that does not suggest guilt. But the evidence suggests that neither explanation is correct, that there is a much simpler reason for Trump’s decision to release the aid. On the day he OK’d the aid, Trump learned that Congress was going to force his hand and spend the money anyway. He could either go along or get run over.

On Sept. 11, the White House received a draft of a continuing resolution, produced by House Democrats, that would extend funding for the federal government. Among other provisions, the bill would push the Ukraine money out the door, whether in the final days of fiscal year 2019 or in 2020, regardless of what the president did. “The draft continuing resolution … would on September 30 immediately free up the remainder of the $250 million appropriated for the Ukraine Security Assistance Initiative in the fiscal 2019 Defense spending law and extend its availability for another year,” Roll Call reported a little after noon on Sept. 11.

According to knowledgeable sources, the Office of Management and Budget received the draft on the morning of Sept. 11. OMB Director Russell Vought informed the president around mid-day. There was no doubt the Democratic-controlled House would pass the measure, which was needed to avoid a government shutdown. Later that afternoon, Trump — who must have already known that the Republican-controlled Senate would also support the bill — had the point emphasized to him when he received a call from Republican Sen. Rob Portman.

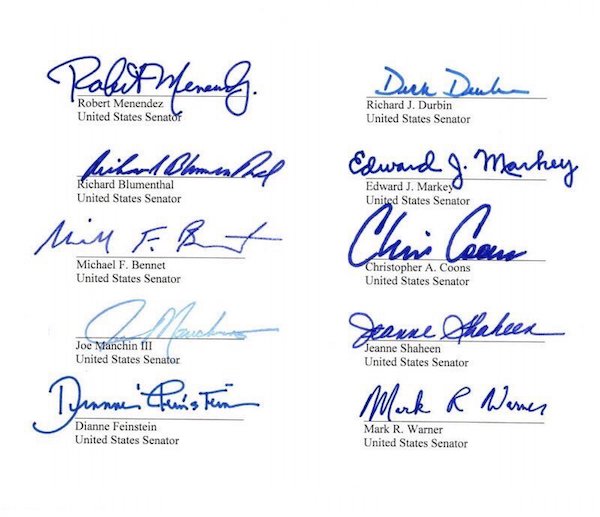

Portman, and Democratic Sen. Richard Durbin co-chairs the Senate Ukraine Caucus. Along with several other senators, Portman wrote to the White House on Sept. 3, imploring the president to release the aid. On Sept. 11, Portman felt the need to talk again, with the same message — only this time with the backdrop of the House preparing to pass a bill that would force Trump’s hand. At that point, the president knew he could not maintain the hold on aid in the face of bipartisan congressional action. So he gave in. By early evening on Sept. 11, the hold was lifted. It was an entirely unremarkable end to the story: President tries to do something. Congress opposes. President sees he has no support and backs down. It has happened many, many times with many, many presidents.

Video at the link. Still trying to understand why he has so suddenly come under attack. He had been writing about this for a long time.

“The message was clear: Don’t touch these people,” Solomon said. “And the State Department confirms they delivered that message. How can this be such a big factual dispute? Now we’re debating the word list. She delivered the message.”

• John Solomon: They ‘Smeared Me, Just Like Joe McCarthy Smeared People’ (Med.)

After coming under a great deal of scrutiny during the House Intelligence committee’s impeachment hearings over the past two week’s, Fox News contributor John Solomon is firing back — claiming that he was smeared. Solomon sat for an interview Thursday night with Fox News anchor Martha MacCallum on The Story. The segment marked a rare appearance on a news side program for the Fox News contributor — as opposed to the opinion shows like Hannity on which he is a staple. During the interview, Solomon — a former columnist for the Hill whose controversial work on Ukraine is now being subjected to an internal review — claimed he’s being targeted because much of his reporting is favorable to President Donald Trump.

“I’m probably being punished a lot because the president’s mentioned me, he likes my reporting,” Solomon said. “But I don’t report because it makes the president happy. I report because the truth needs to get out there.” MacCallum asked Solomon about the claims made by former U.S. ambassador to Ukraine Marie Yovanovitch that she was the target of a smear campaign led by a former top Ukraine prosecutor and Rudy Giuliani — with Solomon and several conservative media figures circulating negative stories about her. In particular, one article in which Solomon claimed that Yovanovitch pressured Ukraine into not prosecuting a number of people. Solomon stood by his work. “The message was clear: Don’t touch these people,” Solomon said. “And the State Department confirms they delivered that message. How can this be such a big factual dispute? Now we’re debating the word list. She delivered the message.”

Adams is promoting his new book, Loserthink.

“..the two most influential politicians in the United States: [..] President Trump and New York Rep. Alexandria Ocasio-Cortez..”

• Stop Being A Loser And Start Winning Like Trump (Scott Adams)

At the time of this writing, the two most influential politicians in the United States are a real estate developer who became president and a bartender who got elected to Congress. I’m talking about President Trump and New York Rep. Alexandria Ocasio-Cortez. The most striking thing they have in common is that they did not “stay in their lanes,” and it worked out great for them. Likewise, you would not be reading this, and the “Dilbert” comic strip would not exist, if I had “stayed in my lane,” which at the time meant working in a cubicle. My nomination for the most loserthinkish advice in history is: “Stay in your lane.” That is the sort of advice that is better served to an enemy, not a friend. If everyone followed that advice, you wouldn’t have civilization.

The world as we know it was engineered, designed, and built by people who left their lane and tried something outside their temporary skill stack. They figured it out as they went. I’ll agree that one size doesn’t fit all, and some people probably should stick to what they do best. But I wouldn’t want society to decide that staying in one lane is some sort of obvious wisdom. In my experience, the smartest plan for life is to leave your lane as often as you can (without inviting major risk) to pick up skills that will complement your talent stack. The more skills you have, the more valuable you will be, although you won’t necessarily know in advance where it will take you.

If you happen to be one of the best in the world at some specific skill, such as sports, music, or science — and you like what you do — it might make perfect sense to “stay in your lane” and milk that situation for all it is worth. But most of us are not the best in the world, or anywhere near it, at any particular skill. If that describes you, I recommend leaving your lane often — even at the risk of embarrassment — to pick up new skills and new ways to see the world.

DuckDuckGo does not store IP addresses or user information.

• I Ditched Google For DuckDuckGo. Here’s Why You Should Too (Wired)

What was the last thing you searched for online? For me, it was ‘$120 in pounds’. Before that, I wanted to know the capital of Albania (Tirana), the Twitter handle of Liberal Democrat deputy leader Ed Davey (he’s @EdwardJDavey) and dates of bank holidays in the UK for 2019 (it’s a late Easter next year, folks). Thrilling, I’m sure you’ll agree. But something makes these searches, in internet terms, a bit unusual. Shock, horror, I didn’t use Google. I used DuckDuckGo. And, after two years in the wilderness, I’m pretty sure I’m sold on a post-Google future. It all started with a realisation: most the things I search for are easy to find. Did I really need the all-seeing, all-knowing algorithms of Google to assist me? Probably not.

So I made a simple change: I opened up Firefox on my Android phone and switched Google search for DuckDuckGo. As a result, I’ve had a fairly tedious but important revelation: I search for really obvious stuff. Google’s own data backs this up. Its annual round-up of the most searched-for terms is basically a list of names and events: World Cup, Avicii, Mac Miller, Stan Lee, Black Panther, Megan Markle. The list goes on. And I don’t need to buy into Google’s leviathan network of privacy-invading trackers to find out what Black Panther is and when I can go and see it at my local cinema.

While I continue to use Google at work (more out of necessity as my employer runs on G-Suite), on my phone I’m all about DuckDuckGo. I had, based on zero evidence, convinced myself that finding things on the internet was hard and, inevitably, involved a fair amount of tracking. After two years of not being tracked and targeted I have slowly come to realise that this is nonsense. DuckDuckGo works in broadly the same way as any other search engine, Google included. It combines data from hundreds of sources including Wolfram Alpha, Wikipedia and Bing, with its own web crawler, to surface the most relevant results. Google does exactly the same, albeit on a somewhat larger scale. The key difference: DuckDuckGo does not store IP addresses or user information.

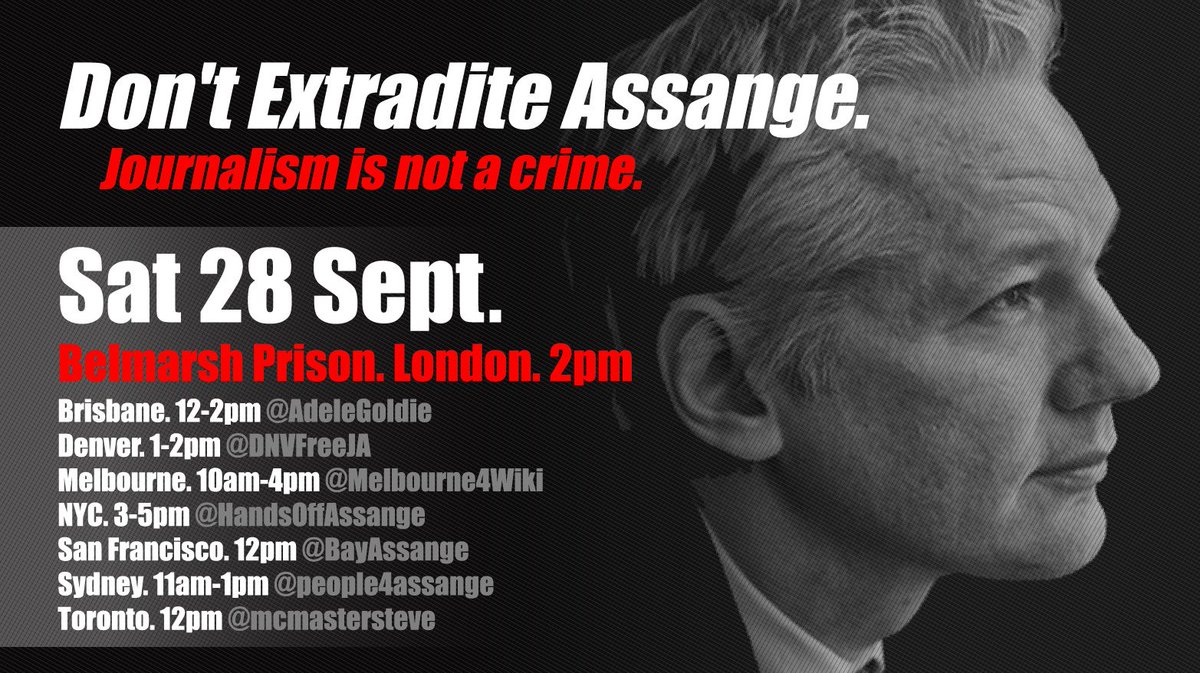

A letter signed by 60 medical doctors from around the world: “Medical doctors have a professional duty to report suspected torture of which they become aware, wherever it may be occurring.”

They will be ignored.

• Doctors Petition UK Home Secretary Over Julian Assange (CN)

Open Letter to UK Home Secretary Priti Patel and Shadow Home Secretary Diane Abbott

We write this open letter, as medical doctors, to express our serious concerns about the physical and mental health of Julian Assange. Our professional concerns follow publication recently of the harrowing eyewitness accounts of Craig Murray and John Pilger of the case management hearing on Monday 21 October 2019 at Westminster Magistrates Court. The hearing related to the upcoming February 2020 hearing of the request by the US government for Mr Assange’s extradition to the US in relation to his work as a publisher of information, including information about alleged crimes of the US government. Our concerns were further heightened by the publication on 1 November 2019 of a further report of Nils Melzer, the United Nations Special Rapporteur on Torture and Other Cruel, Inhuman or Degrading Treatment or Punishment, in which he stated: ‘Unless the UK urgently changes course and alleviates his inhumane situation, Mr Assange’s continued exposure to arbitrariness and abuse may soon end up costing his life.’

[..] Medical doctors have a professional duty to report suspected torture of which they become aware, wherever it may be occurring. That professional duty is absolute and must be carried out regardless of risk to reporting doctors. We wish to put on record, as medical doctors, our collective serious concerns and to draw the attention of the public and the world to this grave situation. The World Health Organisation Constitution of 1946 envisages ‘the highest attainable standard of health as a fundamental right of every human being.’20 We are indebted to those who have sought to uphold this right in the case of Mr Assange.

From a medical point of view, on the evidence currently available, we have serious concerns about Mr Assange’s fitness to stand trial in February 2020. Most importantly, it is our opinion that Mr Assange requires urgent expert medical assessment of both his physical and psychological state of health. Any medical treatment indicated should be administered in a properly equipped and expertly staffed university teaching hospital (tertiary care). Were such urgent assessment and treatment not to take place, we have real concerns, on the evidence currently available, that Mr Assange could die in prison. The medical situation is thereby urgent. There is no time to lose.

I warned about the new right-wing government.

• Aid Groups Condemn Greece Over ‘Prison’ Camps For Migrants, Refugees (G.)

Greece is poised to create “prison” island camps, say aid groups amid growing criticism of government plans to overhaul refugee reception centres on Aegean outposts facing Turkey. As the UN refugee agency’s top official, Filippo Grandi, prepared this week to fly to Lesbos, where almost 16,000 people are crammed into a single facility, Athens was criticised for adopting legislation in contravention of basic human rights. Disquiet mounted as the centre-right administration, which was elected on a tough law and order platform in July, declared that the country again at the forefront of the migration crisis had “reached its limits”. Announcing measures to tackle a significant increase in arrivals, not seen at such levels since 2015 when nearly a million Syrians entered Europe via the isles, it promised future policies would be defined by deterrence.

Under the scheme, closed installations will replace vastly overcrowded, open-air camps; land and sea borders will be reinforced with about 1,200 more guards and extra patrol vessels and deportations stepped up. “We are in the eye of the storm,” said the prime minister, Kyriakos Mitsotakis, conceding that pressure on Greece to patrol its eastern frontiers had risen dramatically in the wake of Europe’s decision to seal off the nation’s northern borders against migrant flows. “The country needs a national strategy.” With the new structures, which are built to hold no more than 5,000 people, the era “of shameful scenes” spawned by the deplorable conditions of notorious island camps would, he vowed, finally be replaced “by images of modern, properly functioning installations”.

International aid groups have overwhelmingly condemned the measures. After criticising asylum legislation also passed this month, they predicted the remodelled facilities would only exacerbate the humanitarian disaster unfolding on Europe’s frontiers. Martha Roussou, senior advocacy officer for the International Rescue Committee in Greece, said: “The government’s announcements represent a blatant disregard for human rights. The creation of closed facilities will simply mean that extremely vulnerable people, including children, will be kept in prison-like conditions, without having committed any crime.”

The Greek branch of Amnesty International called the plans “outrageous”. Likening Lesbos’s infamous Moria refugee camp to a “human rights black hole”, it said: “In reality, we are talking about the creation of contemporary jails with inhumane consequences for asylum seekers, and more widely, negative consequences for the Aegean islands and their inhabitants.” About 37,000 asylum seekers are trapped on islands that since the summer have been targeted with renewed vigour by traffickers.

Please support the Automatic Earth on Paypal and Patreon so we can continue to publish.

Top of the page, left and right sidebars. Thank you.