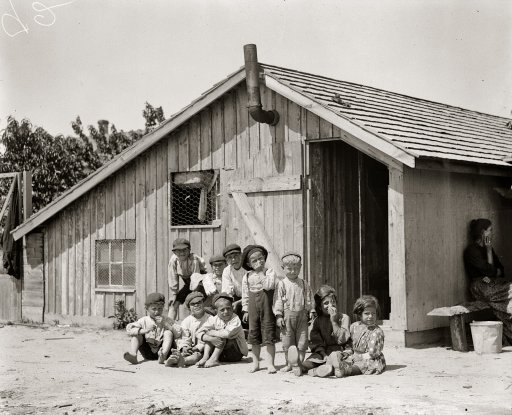

Lewis Wickes Hine Berrie pickers, Seaford, Delaware. ’17 children and 5 elders live here’ 1910

Long but shallow. There’s another 7 days of suspense. The next bombshell might energize the decline.

• S&P 500 Logs Longest Losing Streak Since 2011 (CNBC)

The S&P 500 has fallen in seven straight sessions through Wednesday, the first time the large-cap index has done that since 2011. The last streak also came in a November, culminating with a 0.27% slip on Nov. 25. And while the market’s past can never predict its future, it is notable that the November 2011 seven-session losing streak was immediately followed by a jump of nearly 3%. Yet even amid all of the declines, the S&P has fallen less than 2.5% in the past seven sessions. To put that into context, the market has suffered a greater%age drop on two separate days this year.

And some see a bright side in all the losses. For Frank Cappelleri, a trader and technical analyst at Instinet, the losing streak is a sign that “the [S&P 500] SPX is sequentially oversold and seemingly ready for at least a counter-trend bounce.” However, he added in his Wednesday morning note that since the S&P hasn’t fallen by all that much, “the index doesn’t exactly appear washed out at this stage.” The recent market decline has come as oil has slid, and as Republican Donald Trump’s perceived chances of winning the presidential election have risen. Meanwhile, Wednesday afternoon’s Federal Reserve statement, which could have been the event of the week, delivered little that was unexpected.

The insanity of the world of finance. “The loss of euro clearing would cost 100,000 UK jobs..”

• EU Plans New Rules To Cap US, UK’s £440bn Per Day Derivatives Business (Ind.)

EU officials have discussed new laws to undermine the UK’s multi-billion pound clearing business after Brexit, London Stock Exchange chief executive, Xavier Rolet told a House of Lords Committee. Financial transactions can currently be cleared anywhere in the world and London has a dominant position in the market, processing £440 billion of trades every day and supporting 100,000 jobs. But the EU is now considering limiting the amount of euro transactions that can be processed outside the EU, so that it can force the industry to move within its borders after Brexit, according to Rolet Millions of euro-denominated transactions are currently cleared in New York, but a cap on US trades is now being considered, so that similar restrictions can be placed on London when it is outside the EU, a move that could fatally undermine the industry.

“I understand that some discussions have already originated in the EU for limiting the ability of US-based clearinghouses to clear euro-denominated securities by capping or somehow restricting their ability to engage meaningfully in their business,“ Rolet said. The loss of euro clearing would cost 100,000 UK jobs, fragment markets and force banks to tie up an extra £70 billion in “margin” or cash to back up trades. That money that could otherwise aid economic growth, Rolet said. If customers decided they cannot wait for the outcome of Britain’s trade negotiations with the EU, then the “whole engine” of clearing across all major currencies in London would be at risk, he added.

But prices still rise.

• Vancouver Home Sales Plunge 39% as New Rules Chill Market (BBG)

Vancouver home sales plunged 39% in October from a year earlier, the biggest drop since 2010, as new regulations chill Canada’s most expensive property market. Sales in the Pacific coast city fell to 2,233 in the month, from 3,646 a year earlier, the Real Estate Board of Greater Vancouver said Wednesday. That was 15% below the 10-year average for October. The slowdown follows a series of measures aimed at curbing price gains in Vancouver, which topped a list of global cities identified by UBS as most at risk of a housing bubble. The British Columbia government imposed a 15% tax on foreign buyers in August, the city plans to start taxing vacant homes next year and the federal government tightened mortgage insurance eligibility requirements on Oct. 3.

If elected, Hillary will have two separate major investigations running against her.

• Clinton Foundation Case Moving Towards “Likely an Indictment” (RCP)

BRET BAIER: Here’s the deal: We talked to two separate sources with intimate knowledge of the FBI investigations. One: The Clinton Foundation investigation is far more expansive than anybody has reported so far… Several offices separately have been doing their own investigations. Two: The immunity deal that Cheryl Mills and Heather Samuelson, two top aides to Hillary Clinton, got from the Justice Department in which it was beleived that the laptops they had, after a narrow review for classified materials, were going to be destroyed. We have been told that those have not been destroyed – they are at the FBI field office here on Washington and are being exploited. .

Three: The Clinton Foundation investigation is so expansive, they have interviewed and re-interviewed many people. They described the evidence they have as ‘a lot of it’ and said there is an ‘avalanche coming in every day.’ WikiLeaks and the new emails. They are “actively and aggressively pursuing this case.” Remember the Foundation case is about accusations of pay-for-play… They are taking the new information and some of them are going back to interview people for the third time. As opposed to what has been written about the Clinton Foundation investigation, it is expansive. The classified e-mail investigation is being run by the National Security division of the FBI. They are currently combing through Anthony Weiner’s laptop.

They are having some success – finding what they believe to be new emails, not duplicates, that have been transported through Hillary Clinton’s server. Finally, we learned there is a confidence from these sources that her server had been hacked. And that it was a 99% accuracy that it had been hacked by at least five foreign intelligence agencies, and that things had been taken from that… There has been some angst about Attorney General Loretta Lynch — what she has done or not done. She obviously did not impanel, or go to a grand jury at the beginning. They also have a problem, these sources do, with what President Obama said today and back in October of 2015… I pressed again and again on this very issue… The investigations will continue, there is a lot of evidence. And barring some obstruction in some way, they believe they will continue to likely an indictment.

Not particularly presidential.

• Obama Slams FBI Over New Hillary Clinton Emails (MJ)

President Barack Obama harshly criticized the FBI’s actions informing Congress about the discovery of new Hillary Clinton emails, suggesting to NowThisNews on Wednesday that the much-criticized letter was outside of law enforcement protocol. “We don’t operate on innuendo,” Obama said in his first remarks since the FBI’s announcement last Friday. “We don’t operate on incomplete information and we don’t operate on leaks. We operate based on concrete decisions that are made. “When this was investigated thoroughly, the last time, the conclusion of the FBI, the conclusion of the Justice Department, the conclusion of repeated congressional investigations was that she had made some mistakes but that there wasn’t anything there that was prosecutable.”

The president also reiterated his support for Clinton and urged young people not to allow the ongoing email investigation affect their votes. “I trust her, I know her,” he said. “I wouldn’t be supporting her if I didn’t have absolute confidence in her integrity and her interest in making sure that young people have a better future.” The interview comes just one day after White House Press Secretary Josh Earnest refused to defend or criticize FBI Director James Comey over the decision. Since the ambiguous letter was released on Friday, the Clinton campaign has accused Comey of improperly interfering with the election, thus benefiting her opponent. “That announcement has allowed for Donald Trump to take advantage of the absence of facts to wildly speculate and lie about Hillary Clinton,” campaign manager Robby Mook said on Monday.

Is obstruction of FBI agents equal to obstruction of justice?

• Secret Recordings Fueled FBI Feud in Clinton Probe (WSJ)

Secret recordings of a suspect talking about the Clinton Foundation fueled an internal battle between FBI agents who wanted to pursue the case and corruption prosecutors who viewed the statements as worthless hearsay, people familiar with the matter said. Agents, using informants and recordings from unrelated corruption investigations, thought they had found enough material to merit aggressively pursuing the investigation into the foundation that started in summer 2015 based on claims made in a book by a conservative author called “Clinton Cash: The Untold Story of How and Why Foreign Governments and Businesses Helped Make Bill and Hillary Rich,” these people said. The account of the case and resulting dispute comes from interviews with officials at multiple agencies.

Starting in February and continuing today, investigators from the Federal Bureau of Investigation and public-corruption prosecutors became increasingly frustrated with each other, as often happens within and between departments. At the center of the tension stood the U.S. attorney for Brooklyn, Robert Capers, who some at the FBI came to view as exacerbating the problems by telling each side what it wanted to hear, these people said. The roots of the dispute lie in a disagreement over the strength of the case, these people said, which broadly centered on whether Clinton Foundation contributors received favorable treatment from the State Department under Hillary Clinton. Senior officials in the Justice Department and the FBI didn’t think much of the evidence, while investigators believed they had promising leads their bosses wouldn’t let them pursue, they said.

These details on the probe are emerging amid the continuing furor surrounding FBI Director James Comey’s disclosure to Congress that new emails had emerged that could be relevant to a separate, previously closed FBI investigation of Mrs. Clinton’s email arrangement while she was secretary of state. [..] Amid the internal finger-pointing on the Clinton Foundation matter, some have blamed the FBI’s No. 2 official, deputy director Andrew McCabe, claiming he sought to stop agents from pursuing the case this summer. His defenders deny that, and say it was the Justice Department that kept pushing back on the investigation.

Comey seems to have been prudent.

• Senior FBI Officials Were Told Of New Emails In Early October (WaPo)

Senior FBI officials were informed about the discovery of new emails potentially relevant to the investigation of Hillary Clinton’s private email server at least two weeks before Director James B. Comey notified Congress, according to federal officials familiar with the investigation. The officials said that Comey was told that there were new emails before he received a formal briefing last Thursday, although the precise timing is unclear. The information goes beyond the details provided in the letter that Comey sent to lawmakers last week declaring that he was restarting the inquiry into whether Clinton mishandled classified material during her tenure as secretary of state. He wrote in the Friday letter that “the investigative team briefed me yesterday” about the additional emails.

[..] senior officials had been informed weeks earlier that a computer belonging to former congressman Anthony Weiner contained emails potentially pertinent to the Clinton investigation. [..] Comey did not notify Congress as soon as he learned about the emails because officials wanted additional information before proceeding, the officials said. [..] It is unclear what FBI agents have learned since discovering the emails in early October. But officials say they gained enough information from the email metadata to take the next step, seeking a warrant to review the actual emails. That legal step prompted Comey’s letter to Congress, which has made him a central figure during the stretch run of the presidential campaign. “He needed to make an informed decision, knowing that once he made that decision, he was taking it to another level,” an official said.

Soon after the investigators found the new trove of thousands of emails, they notified the separate team of FBI agents in Washington that worked on the probe into Clinton’s private email server, officials said. Comey said in July that the investigation was complete and that he would recommend to prosecutors that no charges be brought. After the agents on the Clinton case were notified in early October about the newly discovered emails, they in turn told FBI leaders about them. At that point, the leaders did not believe they had enough information to make a decision about what to do next, officials said.

There was a time when this would have been crazier than what happens stateside.

• South Korea’s Out-of-Control Presidential Crisis (CNBC)

South Korean President Park Geun-Hye, under fire in what critics are calling the nation’s biggest-ever political scandal, seems to be digging herself into a deeper hole. The President replaced her prime minister, finance minister and public safety minister on Wednesday in an attempt to contain public anger over a spiraling corruption scandal that has hit the ruling Saenuri party. But the surprise cabinet reshuffle may do more harm than good. “Despite her expectations, these snap nominations backfired. Critics angrily charged that the move is part of a strategy to maintain control and does not jive with plans being discussed to form a neutral cabinet with a prime minister empowered to dominant policymaking, with Park taking a back seat,” Scott Seaman, senior Asia analyst at Eurasia, explained in a note.

Opposition parties will now likely use their combined majority in the National Assembly to hinder Park’s attempts to install her candidates, he continued. Furthermore, Park is essentially powerless to ignore their objections given her current fragile standing, he added. Park, 64, faces calls to resign or face impeachment for allowing a close friend, Choi Soon-Sil, to interfere in state affairs. Choi reportedly had access to classified documents without security clearance and was involved in presidential decision making, local media said. Choi, 60, is also accused of embezzlement, forcing conglomerates to make massive donations to nonprofit foundations, and getting preferential treatment from banks for loans.

Super Thursday today in Britain.

• UK High Court To Declare If Government Has Right To Trigger Brexit (G.)

The lord chief justice is to deliver the high court’s momentous decision on whether parliament or the government has the constitutional power to trigger Brexit. After less than three weeks considering the politically charged case with two other senior judges, Lord Thomas of Cwmgiedd will read out a summary of their decision at 10am on Thursday to a packed courtroom in London’s Royal Courts of Justice. In order to prevent leaks of the market-sensitive ruling, which involves a large number of parties, preliminary drafts of the judgment have unusually not been sent out in advance to the lawyers. The outcome of the case, which ventures into constitutionally untested ground, will resolve whether MPs or ministers have the authority to formally inform Brussels about whether the UK intends to leave the EU.

The legal dispute focuses on article 50 of the treaty on EU, which states that any member state may leave “in accordance with its own constitutional requirements” – an undefined term that has allowed both sides to pursue rival interpretations. The arguments deployed during the three-day hearing last month appear, at the very least, to have reinforced political pressure for parliament to be given a greater role in negotiating Brexit. Whether the high court finds in favour of the claimants or Theresa May’s assertion that the prime minister has power under the royal prerogative to inform Brussels of the UK’s intention to leave, one side or the other is likely to appeal to the supreme court. However, there has been speculation that the government could decide not to appeal if it loses, calculating that enough MPs will feel bound by the result of the referendum to vote to leave the EU. There may be stiffer opposition in the House of Lords.

What’s this other than a major step towards universal income?

• Car Makers To Get More In Brexit Subsidies From UK Than They Pay Workers (R.)

Compensating carmakers in Britain for any post-Brexit tariffs on exports to Europe could see the government hand the companies more money than they need to pay the salaries of all their British workers, a Reuters analysis of corporate filings shows. Japan’s Nissan said in September it would only commit to new UK investment if it received a guarantee of compensation to offset any such tariffs. Last week, it agreed to build new models in the country after Prime Minister Theresa May assured it the government would provide support to preserve its competitiveness in the EU market after Brexit. The nature of the Nissan deal – which gave Britain a crucial corporate endorsement as it prepares for life outside the European Union – is unknown. The government said there hadn’t been a “detailed and specific” agreement on tariffs.

If Britain does not secure a free-trade deal with the EU, car makers in the country could face export tariffs of 10% – the level the EU imposes on cars imported from outside the bloc. The cost of compensating Nissan, which has £2.9 billion ($3.5 billion) of annual EU exports, would be £290 million a year. That would exceed the company’s British wage bill, which was £288 million in 2015, accounts for Nissan’s main UK operating unit show. The pattern is followed across Britain’s car-making industry. Reuters examined the accounts of eight of the biggest car exporters, including Jaguar Land Rover, Toyota, Bentley, Mini, Rolls-Royce, Aston Martin and Honda, which are all foreign-owned. Their wage bills averaged 7.5% of total operating costs and 7.7% of turnover. This suggests the cost of tariffs on vehicles exported from Britain to the continent – levied at 10% of turnover – would exceed the wages paid to British workers to build those vehicles.

Long read by Ann Pettifor on the history of the growth paradigm, and what needs to be done now it’s dead.

• Make Finance The Servant, Not The Master (Pettifor)

Before the Second World War the concept of ‘growth’ scarcely existed, as Geoff Tily explains in his PRIME essay On Prosperity, Growth and Finance. “National accounts and measures of national income (the forerunners of GDP) were devised in the 1930s, in the wake of the great depression. Policymakers and economists were preoccupied by getting the economy and financial system to function and addressing a crisis in unemployment. Later in the Second World War economic statistics were needed to try and prevent inflation, given that all resources – especially labour – were fully utilized. Then, later in the Bretton Woods era, full employment was regarded as the proper goal of economic policy-making.” With financial liberalization all this was to change.

Financiers could make extraordinary capital gains from financial speculation – far more than the average industrial capitalist could make in profits. This was largely because financiers can gamble and make gains in money markets without engaging with either the land – in the broadest sense of the word – or labour. Industrial capitalists by contrast have to engage with both land and labour. The substantial capital gains made from speculation by increasingly deregulated financiers were then pitted against the lower profits made by industrial capitalists from investment, employment and output. As financiers became more dominant, competition with industrial capitalists intensified. It is hard to pinpoint the exact timing for the shift of emphasis, but under the surface changes were underway from at least the 1950s.

The pressure on industrial capital was applied by both the finance sector, but also by friends in the economics profession, and in particular economic commentators. The latter began to reframe the key concept of levels of economic activity, and invented the term growth. Growth follows the trajectory of capital gains more closely than it follows that of more volatile profits. Capital gains – like those made from winning the lottery – can rise exponentially (until they crash). Profits rise and fall as capitalists battle the land and labour. In the UK one of the most prominent campaigners for the concept of ‘growth’ was Samuel Brittan of the Financial Times: he proudly identified himself as a ‘growthman’. At a time of full employment, he and other economists castigated the government (and industry) for what they regarded as an economy less profitable or dynamic than that seen in other countries.

To apply pressure on those active in the real economy, they had to raise the bar of economic expectations. Full employment was not a sufficient goal. It was to be abandoned. The concept of growth was subsequently adopted as the goal of all economy policy by the newly-founded OECD in 1961. In that year the organisation agreed an extraordinary fifty per cent growth target for the whole of the 1960s, as Tily explains: The aim of fixing the level of employment and output to sustainable levels had been abandoned. Instead the world had officially been set a systematic and improbable target: to chase growth. Nobody seems to have paused to consider whether growth derived as the rate of change of a continuous function was a meaningful or valid way to interpret changes in the size of economies over time.”

Transferring back into a wasteland.

• Western Australia: Masterclass In What Not To Do With A Resources Boom (Con.)

Every policymaker in Australia should be made to read Paul Cleary’s excellent analysis of the way Norway handled its boom: Trillion Dollar Baby. The experience could hardly be more different and the comparison would be laughable were it not for the fact that future generations will come to rue the folly and myopia of our current leaders. The key lesson that emerges from Cleary’s analysis is that even small states can have a big say in determining what happens to the windfall revenues booms generate – but only if they understand what is happening at present and have a plan for the long-term future of the country. Norway had both. First, they had a capable government and skilled bureaucrats (yes, they are valuable and important) who quickly realised that Norway’s oil boom had to be managed for the benefit of Norway, not the multinational oil companies.

This meant not being intimidated by powerful multinational corporations and recognising the inherent bargaining strength of national governments. You can only exploit resources where they are. Host governments can – and should – determine how they are developed. In contrast to successive state and federal governments in Australia, this is precisely what the Norwegians did. Firstly, they compelled the oil majors to build their required oil platforms in Norway, developing a world class manufacturing capability in the process. Secondly, and in another unflattering and revealing contrast to Australia, they ensured 90% of the windfall revenues derived from the oil boom in Norway remained there.

Norway’s “problem”, unlike ours, has been what to do with the astounding amounts of wealth generated as a direct consequence of its activist and enlightened policies. A third critical innovation was establishing a sovereign wealth fund. Sovereign wealth funds serve two purposes. First, they put aside the windfall revenues of today for future generations – a possibility our own leaders seem incapable of contemplating given their truncated political horizons. Second, by investing most of the wealth overseas, they put downward pressure on the domestic currency, allowing other domestic industries to survive. At a time when we are collectively waving farewell to much of the manufacturing sector, this is another sobering lesson – especially for the young who will not benefit from all that squandered wealth and may wonder where they will actually work.

Home › Forums › Debt Rattle November 3 2016