Ben Shahn L.F. Kitts general store in Maynardville, Tennessee 1935

Theory vs practice is a worthy discussion….

• A Hole in the Head (Jim Kunstler)

We need a new civil war like we need a hole in the head. But that’s just it: America has a hole in its head. It’s the place formerly known as The Center. It didn’t hold. It was the place where people of differing views could rely on each other to behave reasonably around a touchstone called the National Interest. That abandoned place is now cordoned off, a Chernobyl of the mind, where figures on each side of the political margin fear to even sojourn, let alone occupy, lest they go radioactive. Anyway, the old parties at each side of the political transect, are melting down in equivalent fugues of delusion, rage, and impotence — as predicted here through the election year of 2016. They can’t make anything good happen in the National Interest.

They can’t control the runaway rackets that they engineered in legislation, policy, and practice under the dominion of each party, by turns, going back to Lyndon B. Johnson, and so they have driven themselves and each other insane. Trump and Hillary perfectly embodied the climactic stage of each party before their final mutual sprint to collapse. Both had more than a tinge of the psychopath. Trump is the bluff that the Republicans called on themselves, having jettisoned anything identifiable as coherent principles translatable to useful action. Hillary was an American Lady Macbeth attempting to pull off the ultimate inside job by any means necessary, her wickedness so plain to see that even the voters picked up on it. These two are the old parties’ revenge on each other, and on themselves, for decades of bad choices and bad faith.

[..] Something like this has happened before in US history and it may be cyclical. The former Princeton University professor and President, Woodrow Wilson, dragged America into the First World War, which killed over 53,000 Americans (as many as Vietnam) in only eighteen months. He promulgated the Red Scare, a bit of hysteria not unlike the Race and Gender Phobia Accusation Fest on the Left today. Professor Wilson was also responsible for creating the Federal Reserve and all the mischief it has entailed, especially the loss of over 90% of the dollar’s value since 1913. Wilson, the perfect IYI of that day.

The reaction to Wilson was Warren Gamaliel Harding, the hard-drinking, card-playing Ohio Main Street boob picked in the notorious “smoke-filled room” of the 1920 GOP convention. He invoked a return to “normalcy,” which was not even a word (try normality), and was laughed at as we now laugh at Trump for his idiotic utterances such as “win bigly” (or is that big league?). Harding is also known for confessing in a letter: “I am not fit for this office and should never have been here.” Yet, in his brief term (died in office, 1923), Harding navigated the country successfully through a fierce post-World War One depression simply by not resorting to government intervention.

… also when it comes to the Fed.

• Trump’s Fed Can Start a Central Bank Revolution (BBG)

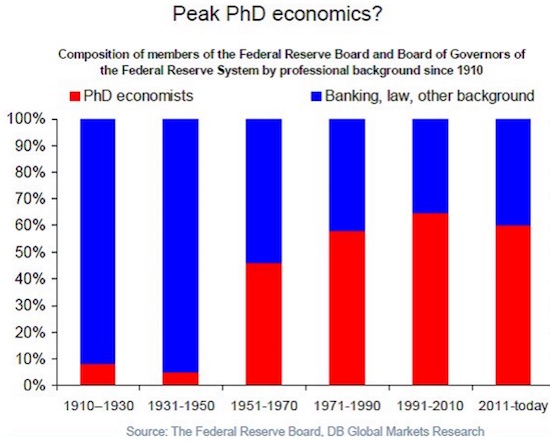

President Donald Trump will select three members of the Federal Reserve board during his term in office, including a replacement chair for Janet Yellen when her appointment expires early next year. He should seize the chance to refresh the Fed with faces from the business community, adding executives to the roster of PhD economists who currently run monetary policy in most of the world. The Fed appointments come at a key juncture in U.S. economic policy, one that makes business knowhow an even more valuable commodity for a rate-setter than usual. Trump’s fiscal policies will set a new backdrop for the monetary policy environment, given his intention to cut personal and business tax rates and boost investment in the nation’s infrastructure.

So appointing executives to the Fed who’ve had to take fiscal and monetary policy into account when making decisions on where and when to build new factories or make other capital expenditure decisions makes sense. Torsten Slok, the chief international economist for Deutsche Bank, sent around a chart last week showing how the composition of the Fed has become increasingly focused on PhD economists: It’s little wonder that in this populist age central bank independence is under attack. As Bloomberg News reported on Monday, the rise of populism is putting pressure on central banks as “institutions stuffed with unelected technocrats wielding the power to affect the economic fate of millions.” Leavening the boards of policy makers with executives who’ve made hiring and firing decisions and have helped build companies would be a way to address the perception that decisions about borrowing costs are made in ivory towers by economists who’ve all read the same textbooks but don’t inhabit the same world as the people they’re supposed to serve.

Entertainment 2017-style.

• Trump Puts Final Touches on Speech Focusing on Economy, Defense (BBG)

President Donald Trump was still working Monday evening on the final touches of an address to Congress that will focus on economic opportunity and national security, administration officials said. The officials, who briefed reporters on the eve of the address on the condition of anonymity, said the speech will offer a vision of where Trump wants to take the country as well as an early accounting of campaign promises he has already delivered on through executive actions such as the U.S. withdrawal from the Trans-Pacific Partnership trade agreement. They declined to say whether the president would offer more concrete proposals on major goals, such as rebuilding U.S. infrastructure, rewriting the tax code and replacing the Obamacare health plan.

Trump’s speech comes as the new president tries to stabilize his administration after a turbulent start marked by struggles implementing an initial flurry of executive orders and a controversy over contacts between Trump advisers and Russian officials that led to the resignation of his national security adviser. While Trump’s inauguration speech offered a gloomy portrait of an America racked by violence and economic decay, White House press secretary Sean Spicer said earlier Monday that the address to Congress will strive for an optimistic vision focused on “the renewal of the American spirit.”

Surveys show a deep partisan divide over the president’s performance. A Wall Street Journal/NBC News poll released Monday showed Trump’s approval rating at 44% – a record low for a new president. But 85% of Republicans see Trump favorably, versus just 9% of Democrats. National security was the key theme of an early glimpse of the budget the White House offered on Monday. Administration officials said the president’s first budget would seek to boost defense spending by $54 billion – offset by an equivalent cut from other discretionary spending.

How to kill a city part 827.

• Number Of Distressed US Retailers At Highest Level Since Great Recession (MW)

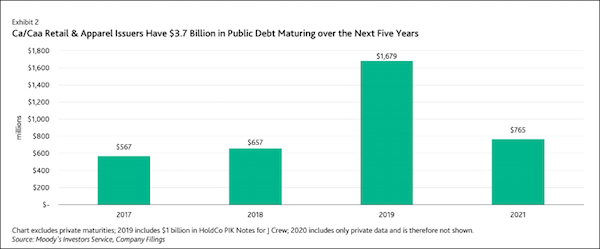

The number of U.S. retailers ranked at the most-distressed level of the credit-rating spectrum has more than tripled since the Great Recession of 2008-2009 and is heading toward record levels in the next five years, Moody’s Investors Service said Monday. The rating agency is the latest to weigh in on the state of the sector, and has 19 names in its retail and apparel portfolio, 14% of which are now trading at Caa/Ca. That’s deep into speculative, or “junk,” territory. It’s also a percentage close to the 16% considered distressed during the 2008/2009 period, said a Moody’s report led by retail analyst Charles O’Shea. The rise is part of a wider trend affecting sectors across Moody’s coverage that has retail replacing oil and gas as the most-troubled industry.

Retailers are in the midst of a secular shift to online sales led by juggernaut Amazon.com and that’s forcing many of them to spend heavily on their e-commerce operations. At the same time, mall traffic has slowed dramatically as consumer behavior changes, forcing many to discount heavily, hurting profit margins. The 19 issuers on Moody’s list have more than $3.7 billion of debt maturing in the next five years, with about 30% of that total coming due by the end of 2018. The number is even higher when private credit is included. “While credit markets continue to provide ready access for companies spanning the rating spectrum—allowing many to proactively refinance debt and bolster balance sheets—that could change abruptly if market conditions or investor sentiment shift,” said O’Shea.

How to kill a city part 828.

• The Housing Crisis (Renegade)

Why is UK housing now so out of reach for so many people? Yes, property has been a safe bet, but we ask what are the economic risks and the social side effects of ever-increasing house prices? Host Ross Ashcroft is joined by Dr Rebecca Ross and economist Professor Steve Keen.

These numbers are beyond fantasy.

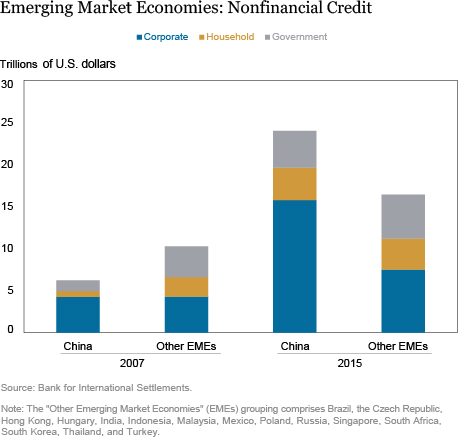

• China’s Continuing Credit Boom (NYFed)

Debt in China has increased dramatically in recent years, accounting for roughly one-half of all new credit created globally since 2005. The country’s share of total global credit is nearly 25%, up from 5% ten years ago. By some measures (as documented below), China’s credit boom has reached the point where countries typically encounter financial stress, which could spill over to international markets given the size of the Chinese economy. To better understand the associated risks, it is important to examine the drivers of China’s expansion in credit, the increasing complexity of its financial system, and evidence that its supply of credit may be growing more rapidly than reported. Note, however, that there are several features of China’s financial system that reduce the threat of a financial disruption.

Nonfinancial debt in China has increased from roughly $3 trillion at the end of 2005 to nearly $22 trillion, while banking system assets have increased sixfold over the same period to over 300% of GDP. In 2016 alone, credit outstanding increased by more than $3 trillion, with the pace of growth still roughly twice that of nominal GDP. As a result, the “credit-to-GDP gap”—the difference between the debt-to-GDP ratio and its long-run trend—has reached almost 30 percentage points. The international experience suggests that such a rapid buildup is often followed by stress in domestic banking systems. Roughly one-third of boom cases end up in financial crises and another third precede extended periods of below-trend economic growth.

As seen in the chart below, rising nonfinancial sector debt was driven initially by a surge in corporate borrowing in response to the global financial crisis. This additional debt was comprised mostly of medium- and long-term corporate loans related to infrastructure and property projects.

Better start printing then.

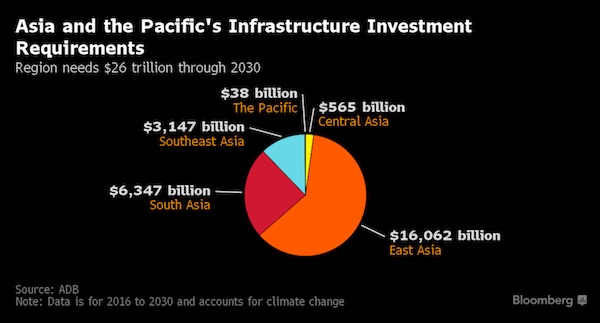

• ADB Says Emerging Asia Infrastructure Needs $26 Trillion by 2030 (BBG)

Asia’s infrastructure race is just getting started. Emerging economies across the region will need to invest as much as $26 trillion on building everything from transport networks to clean water through 2030 to maintain growth, eradicate poverty and offset climate change. That’s according to an Asian Development Bank report released Tuesday that highlights the need for massive construction and upgrading of public works and for much greater private sector investment. Leaving out spending to mitigate climate change, some $22.6 trillion will still be needed over the same period, the ADB said. Big-ticket investment of $14.7 trillion is needed for power, $8.4 trillion for transport, $2.3 trillion for telecommunication costs and $800 billion for water and sanitation, adjusted for climate change.

The bulk of infrastructure work is needed in East Asia, which accounts for 61% of the ADB estimate. As a percentage of GDP, the Pacific leads all other sub regions needing investment valued at 9.1% of GDP, followed by South Asia at 8.8%. The new projection of a $1.7 trillion annual infrastructure need, adjusted for climate change, is more than double the $750 billion that the Manila-based development bank estimated in 2009–though the latest report looks at 45 of the ADB’s developing members compared with 32 last time and uses 2015 prices compared to 2008 ones.

Hard to see how this sadistic play can survive the various elections.

• Greece Said to Expect Revised Bailout Proposal for Tuesday Talks

Greece’s auditors are pulling together a list of policies the country needs to implement to unlock additional bailout funds as they prepare for the resumption of talks with Athens on Tuesday, two people familiar with the matter said. Greece has asked European lenders for a draft Supplemental Memorandum of Understanding and the IMF for a Memorandum of Economic and Financial Policies as it braces for details of creditor demands, the people said, declining to be identified as negotiations between the two sides aren’t public. The government expects an accord in March or early April, but the scale of pending issues raises concerns they may be politically hard to sell at home, they said.

Greek Prime Minister Alexis Tsipras’s government last Monday agreed to legislate structural reforms demanded by the IMF that will lower the threshold of tax-free income and amend the pension system by 2019, effectively crossing what it had once characterized as a red line. The government says the deal won’t increase austerity since the new legislation will include stimulus measures in addition to belt-tightening reforms. Tsipras told lawmakers on Friday that the bailout review can be completed by March 20 when euro–area finance ministers are set to meet in Brussels. It could drag on to the next Eurogroup meeting on April 7th given the number of outstanding issues that need to be resolved, the people said. Greece is looking for a “global deal” by May that would also include potential decisions on medium-term debt-relief measures and the inclusion of Greek bonds in the ECB’s debt-purchase program.

Because Fillon is the establishment.

• French Court Probes Leave Le Pen Unscathed as Fillon Bid Falters (BBG)

Prosecutors’ interventions in the French election have so far done more damage to the establishment’s one-time champion than the nationalist firebrand vowing to overthrow the system. The Republican Francois Fillon and National Front leader Marine Le Pen both say the criminal probes they face are political plots against them, but it’s only Fillon, a church-going 62-year-old former prime minister, who has been set back by the allegations. Le Pen’s suspected misuse of her allowance from the European Parliament hasn’t hurt her at all. “The National Fronts is seen as persecuted by the system so their supporters think that if everyone else has gotten rich of the system, it’s good for them to get some of that money back,” said Jean-Yves Camus, a political scientist linked to the Jean Jaures research institute.

“Fillon tried to use the conspiracy angle but it doesn’t work because he’s from the system.” On Tuesday, a committee of lawmakers in Brussels will consider a request from the French courts to strip Le Pen of her parliamentary immunity over two separate cases of defamation and publishing violent images of Islamic State killings on Twitter. The committee is due to release its recommendations to the EU parliament next week, and the full chamber will vote on the issue later in March. Le Pen is battling a range of mainstream politicians asking for one more chance to address voters’ concerns about lackluster economic growth and the perceived threat of immigration and terrorism. Instead, she’s offering voters a chance to upend the status quo by putting up border controls, stopping mass immigration and pulling out of the euro.

This is a surprise to anyone?

• Shell 1991 Film Warned Of Climate Change Danger (G.)

The oil giant Shell issued a stark warning of the catastrophic risks of climate change more than a quarter of century ago in a prescient 1991 film that has been rediscovered. However, since then the company has invested heavily in highly polluting oil reserves and helped lobby against climate action, leading to accusations that Shell knew the grave risks of global warming but did not act accordingly. Shell’s 28-minute film, called Climate of Concern, was made for public viewing, particularly in schools and universities. It warned of extreme weather, floods, famines and climate refugees as fossil fuel burning warmed the world. The serious warning was “endorsed by a uniquely broad consensus of scientists in their report to the United Nations at the end of 1990”, the film noted.

“If the weather machine were to be wound up to such new levels of energy, no country would remain unaffected,” it says. “Global warming is not yet certain, but many think that to wait for final proof would be irresponsible. Action now is seen as the only safe insurance.” A separate 1986 report, marked “confidential” and also seen by the Guardian, notes the large uncertainties in climate science at the time but nonetheless states: “The changes may be the greatest in recorded history.” The predictions in the 1991 film for temperature and sea level rises and their impacts were remarkably accurate, according to scientists, and Shell was one of the first major oil companies to accept the reality and dangers of climate change.

But, despite this early and clear-eyed view of the risks of global warming, Shell invested many billions of dollars in highly polluting tar sand operations and on exploration in the Arctic. It also cited fracking as a “future opportunity” in 2016, despite its own 1998 data showing exploitation of unconventional oil and gas was incompatible with climate goals.

What nation kicks out its own children…

• Britain’s Child Migrant Program: Why 130,000 Children Were Shipped Abroad (G.)

More than 130,000 children were sent to a “better life” in former colonies, mainly Australia and Canada, from the 1920s to 1970s under the child migrant programme. The children, aged between three and 14, were almost invariably from deprived backgrounds and already in some form of social or charitable care. It was believed, they would lead happier lives. Charities such as Barnardo’s and the Fairbridge Society, the Anglican and Catholic churches and local authorities helped with the organisation of the emigration. Once there, the children were often told they were orphans to better facilitate their fresh start. The parents – many of them single mothers forced to give up their child for adoption because of poverty or social stigma – believed this was giving them best chance in life, though often did not have details of where their offspring were sent to.

The reality, for some of those children, was a childhood of servitude and hard labour at foster homes: on remote farms, at state-run orphanages and church-run institutions. They were often separated from siblings. Some were subjected to physical and sexual abuse. In 2010, the then prime minister, Gordon Brown, issued an official apology, expressing regret for the “misguided” programme, and telling the Commons: “To all those former child migrants and their families … we are truly sorry. They were let down. “We are sorry they were allowed to be sent away at the time when they were most vulnerable. We are sorry that instead of caring for them, this country turned its back”. He announced a £6m fund to reunite families that had been torn apart. The last children sailed in 1967. But it is only recently, as their stories have been told, that details of the abuse, and the official sanction which made it possible, has become public.

…only to have them enslaved and abused.

• Slavery Claims As UK Child Sex Abuse Inquiry Opens (AFP)

England’s mammoth inquiry into historical child sex abuse was told of the “torture, rape and slavery” suffered by child migrants shipped to Australia, at its first public hearings on Monday. The wide-ranging Independent Inquiry into Child Sexual Abuse opened by looking at the schemes that sent thousands of vulnerable children to far-flung parts of the Commonwealth in the decades after World War II. David Hill broke down as he told the inquiry of the “endemic” sexual abuse at the school he was sent to in Australia. “I hope this inquiry can promote an understanding of the long-term consequences and suffering of those who were sexually abused,” he said. “Many never recover and are permanently afflicted with guilt, shame, diminished self-confidence, low self-esteem, fear and trauma.”

British Prime Minister Theresa May set up the inquiry in 2014 when she was interior minister. The British Empire sent some 150,000 children abroad over 350 years, according to a 1998 parliamentary study, although the probe started Monday by looking at use of the practice after World War II. It was justified as a means of slashing the costs of caring for lone children and providing disadvantaged young people with a fresh start, while meeting labour shortages in the Commonwealth and populating colonial-era lands with white British settlers. Between 1945 and 1970, youngsters were sent mainly to Australia, but also Canada, New Zealand and what is now Zimbabwe — often without the consent of their families.

But the promise of a good upbringing and an exciting new life in the sun was often, in reality, a world of forced labour, brutal treatment and sexual assault in remote institutions run by churches and charities. “They sent us to a place that was a living hell,” victim Clifford Walsh told the BBC. Oliver Cosgrove was sent to Australia in 1941, one of an estimated 5,000 to 6,000 children shipped there from 1922 to 1967. “Those who were abused tried in vain to tell others, who they hoped and believed might assist them. But they didn’t,” his representative told the inquiry. “This was a systematic and institutional problem.”

Home › Forums › Debt Rattle February 28 2017