Claude Monet Grand Canal, Venice 1908

Pepe

Vandana Shiva

It’s worth watching this video.

DIVIDE & RULE – The Plan of The 1% to Make You DISPOSABLE – by Vandana Shiva.

“Without freedom we are nothing. With humanity we are everything.”pic.twitter.com/hx7oNUywSC

— James Melville (@JamesMelville) April 19, 2023

Election time.

• Turkish Interior Minister Claims “The Whole World Hates America” (BNN)

In a bold statement, Turkish Interior Minister Süleyman Soylu has claimed that “the whole world hates America” while suggesting that Europe is merely a pawn of the United States. Soylu further downplayed Europe’s significance, asserting that it is a trend in America’s column. Süleyman Soylu’s remarks reflect a growing anti-American sentiment in some segments of the international community. By claiming that “the whole world hates America,” Soylu is highlighting the perception that the United States is losing credibility on the global stage. This sentiment can be attributed to various factors, such as foreign policy decisions, economic policies, and perceived cultural dominance.

Soylu’s characterization of Europe as an American pawn suggests that he believes the continent lacks independence and is heavily influenced by the United States. By stating, “There is no such thing as Europe. There is America. Europe is a trend in the Americas column,” Soylu implies that Europe’s actions and policies are primarily driven by American interests rather than its own. This perspective further underscores Soylu’s negative view of the United States and its global influence. The Turkish Interior Minister’s comments may have far-reaching implications for international relations, particularly between Turkey, the United States, and Europe.

Such strong anti-American rhetoric could contribute to increased tensions between the countries and may negatively impact diplomatic relations. Furthermore, Soylu’s dismissal of Europe’s significance could strain Turkey’s relationships with European nations, potentially affecting trade and cooperation in various areas. Soylu’s remarks should be considered within the larger context of global anti-Americanism, which has been rising recently. This sentiment can seriously affect the United States’ ability to maintain its influence and cooperate with other nations. As anti-American feelings continue to grow, the United States may face challenges in forming alliances, negotiating agreements, and projecting its values internationally.

https://twitter.com/i/status/1648657322271539201

“We call on Shell to put any Russian sale or dividend proceeds to work for the victims of the war – the same war that those assets have fuelled and funded.”

• Ukraine Demands Shell’s ‘Russian Blood Money’ – Politico (RT)

An adviser to Ukrainian President Vladimir Zelensky has asked oil giant Shell to donate the proceeds from the sale of its Russian assets to Ukraine, Politico reported on Tuesday. In a letter to Shell CEO Wael Sawan dated Monday, Oleg Ustenko, an economic adviser to Zelensky, reportedly called on the firm to donate the proceeds from a supposedly upcoming sale of its stake in a Siberian oil and gas project to Kiev’s coffers. “If completed, this sale would represent the transfer of more than $1 billion in Russian cash into Shell’s accounts. That would be blood money, pure and simple,” Ustenko wrote, according to Politico. “We call on Shell to put any Russian sale or dividend proceeds to work for the victims of the war – the same war that those assets have fuelled and funded.”

Ustenko added that there is an “overwhelming” moral case for handing the cash over to his government. Shell pulled out of the Russian market after Moscow launched its military operation in Ukraine last February, announcing that it would write off up to $5 billion of its assets in the country. According to Russian media reports last week, Shell’s stake in the Sakhalin-2 oil and gas development project will be bought out by Russian energy company Novatek for around $1.1 billion, although it is unclear whether the proceeds from this buyout will end up in the British oil firm’s hands. A Shell spokesperson told Politico that it is not involved in any negotiations inside Russia, and has no idea where the money from the sale will end up. The company did not say whether it would honor Ustenko’s request if possible.

Shell is not the only energy company being shaken down for cash by Kiev. Ustenko accused BP of taking “blood money” before it sold its share in Russian energy giant Rosneft last year, in addition to demanding almost half a trillion dollars from the Russian central bank’s frozen assets and asking Ukraine’s Western backers to double their financial aid to his country. With the conflict keeping fossil fuel prices high, Ukrainian Energy Minister German Galushchenko called on other firms to share some of their “enormous windfall profits” with his government “to help us restore, to rebuild the energy sector,” Politico reported last month.

“..the Ukrainians first blocked the registration process having disagreed with our proposals, and then suspended all inspections, including inspections of outgoing ships..”

• Kiev Wants Most Out Of Grain Deal, Demands Bribes From Ship Owners (TASS)

The Kiev regime is seeking to exploit the Black Sea initiative with might and main, not shunning either the abuse of the rules of procedure or demands for bribes from shipowners. This is stated in the comments by Russian Foreign Ministry Spokeswoman Maria Zakharova, which was released on Wednesday. “Currently, the Joint Coordination Centre (JCC) in Istanbul is indeed experiencing difficulties with registering new vessels and conducting inspections. They arise solely as a result of actions by Ukrainian representatives as well as UN officials who are apparently unwilling or unable to stand up to them,” she pointed out. “Having finally discarded not only humanitarian considerations, but even elementary human decency, they (the Kiev regime – TASS) are striving to make the most out of the Black Sea Initiative stooping to anything from outright abuse of the rules of procedure to demanding bribes from the ship owners, doing all of the above for the sake of maximizing commercial profits,” the diplomat added.

As Zakharova noted, the owners of incoming ships who refused to pay a bribe are forced to wait for registration for many months. “Outgoing dry cargo ships that have paid also have to wait for the inspection, because once they receive the money the Ukrainians lose interest in them. This situation stems from the fact that in line with the current practices (importantly, not the rules of procedure), the process for obtaining applications for registration under the Black Sea Initiative is in the hands of the Ukrainians, while the UN is in charge of the inspection plans (for the entry and exit of ships),” she went on. Under these circumstances, the registration of ships, which Russian experts carry out strictly within the approved rules of procedure and their respective powers, is the only way to restore order to some extent and to build a fair and transparent basis for participating in the initiative, the diplomat stressed.

“However, our proposal to add to the registration lists the ships which will then sail to the countries in need, in particular Africa, as well as those that have been waiting in line for more than one month, was met with hostility by Ukrainian representatives. Kiev was not ready to jeopardize its commercial corruption schemes. As a result, the Ukrainians first blocked the registration process having disagreed with our proposals, and then suspended all inspections, including inspections of outgoing ships (27 ships with 1.2 million tons of cargo on board). It is clear what they are banking on: launching a propaganda machine and playing the food card with the help of Westerners and the UN,” she noted.

As the diplomat pointed out, the High Representative of the EU for Foreign Affairs and Security Policy, Josep Borrell, and then US Secretary of State Antony Blinken announced that Russia allegedly broke its promises to the countries in need of grain and blocked 50 ships in the Black Sea. “The EU did not stop there and expressed a belief that is striking in its absurdity and amateurishness: the sanctions imposed on Russia are so well calibrated and balanced that they do not interfere with Russia’s agricultural exports, an example of which is the supply of Russian grain under the Black Sea Initiative,” Zakharova said. “Unfortunately, Brussels still has not figured out that only Ukrainian food is being exported across the Black Sea under the grain deal. Washington is no stranger to issuing valuable tips to other countries about their obligations, completely forgetting about its own,” she added.

“..the West’s support for Kiev “cannot influence the final outcome of the special operation.”

• US Military Industry Struggling To Meet Ukraine Demand – WSJ

American arms manufacturers are struggling to obtain enough rocket motors to build missiles for Ukrainian forces, the Wall Street Journal reported on Tuesday. With multiple contractors relying on a single supplier, production targets have already been pushed back. In a quarterly earnings report released on Tuesday, Lockheed Martin said that although its overall sales rose from a year earlier, sales of Guided Multiple Launch Rocket Systems (GMLRS) fell due to a “lower volume” leaving its factories. GMLRS projectiles are artillery rockets, and are fired from Lockheed Martin’s M142 HIMARS platform. According to the most recent Pentagon figures, the US has given Ukraine 38 HIMARS platforms, and while the Defense Department does not disclose how many GMLRS projectiles have been sent to Kiev, a Reuters investigation put the figure at over 5,000 last November, more than the 4,600 Lockheed Martin can make in a year.

A shortage of rocket motors has hindered the company’s efforts to boost production, the Wall Street Journal reported. Other missile makers like Raytheon Technologies have also been affected, the newspaper’s source said. Lockheed Martin also uses solid-fuel rocket motors in its Javelin anti-tank missiles, of which more than 8,500 have been sent to Ukraine over the last year. During a visit by President Joe Biden to the company’s Javelin manufacturing facility in Alabama last May, CEO Jim Taiclet vowed to double production of the shoulder-fired missiles by 2024. However, the company and the Pentagon told the Wall Street Journal that the date has since been pushed back to 2026. “We thought we could get there earlier,” Lockheed Martin’s Chief Financial Officer, Jay Malave, told the paper. US missile makers like Lockheed Martin and Raytheon Technologies source their rocket motors from a single supplier, Aerojet Rocketdyne Holdings.

However, although the Pentagon awarded Aerojet a $216 million contract last week to boost production, it said it was still recovering from a fire at one of its factories last year, while the sale of the company to aerospace giant L3Harris Technologies is still being scrutinized by antitrust authorities. While rocket artillery and guided missile production are apparently hindered, Ukraine is also grappling with a shortage of conventional artillery rounds. Leaked Pentagon documents recently suggested that the shortfall is delaying a planned spring offensive by Kiev’s forces, while the US is reportedly looking to its allies to replenish its depleted stockpiles. Russia has repeatedly warned that the influx of Western weapons will only prolong the conflict in Ukraine. The West’s involvement “is rising gradually,” Kremlin spokesman Dmitry Peskov said earlier this month, adding that the West’s support for Kiev “cannot influence the final outcome of the special operation.”

“The leaked document said there is a total of 29 Defense Department personnel inside Ukraine, including the special operations forces..”

• Resolution Would Make Biden Disclose Number of US Troops in Ukraine (Antiwar)

Rep. Matt Gaetz (R-FL) on Monday introduced a resolution that would require President Biden to disclose the number of US troops inside Ukraine and share all documents outlining US military assistance for Kyiv with the House. If the resolution is passed, it would require President Biden and Secretary of Defense Lloyd Austin to share the requested information within 14 days. The introduction comes after one of the documents allegedly leaked by Airman Jack Teixeira confirmed that US special operations forces are in Ukraine. “The Biden Administration and other allied countries have been misleading the world on the state of the war in Ukraine. There must be total transparency from this administration to the American people when they are gambling war with a nuclear adversary by having special forces operating in Ukraine,” Gaetz said in a statement.

According to the document, 97 NATO special operations soldiers in Ukraine, including 14 Americans. The leak confirmed an October 2022 report from The Intercept that said US special operations forces were deployed to Ukraine after Russia’s invasion. The Intercept report did not say what the American special operators were doing inside Ukraine but said it was part of a broad covert operation that includes CIA personnel who are also on the ground. The leaked document said there is a total of 29 Defense Department personnel inside Ukraine, including the special operations forces. The total also includes members of the Marine Security Guard Security Augmentation Unit (MSAU), who are typically deployed for embassy security.

The total also includes the defense attaché and members of the Office of Defense Cooperation (ODC). The Pentagon said in October 2022 that personnel under the defense attaché and ODC based at the US embassy in Kyiv are conducting “onsite” weapons inspections inside Ukraine.

“..there is not going to be a single magic-wand moment when Russia collapses.”

• No ‘Magic Wand’ For Ukraine – UK (RT)

The conflict between Russia and Ukraine will likely continue into next year, UK Defence Secretary Ben Wallace said on Tuesday. “I’m optimistic that between this year and next year, I think Ukraine will continue to have the momentum with it and a position of strength,” Wallace told reporters during a trip to Washington, DC, as quoted by the New York Times. Wallace warned, however, that “there is not going to be a single magic-wand moment when Russia collapses.” The UK has been one of Kiev’s main backers, supplying the country with heavy weapons, including Challenger 2 tanks. Britain has trained 10,000 Ukrainian soldiers, according to the Defence Ministry, and pledged to train 20,000 more this year.

For the past several months, Kiev has been outspoken about its planned counteroffensive, but has not publicly revealed the timetable. Ukrainian officials have said, however, that the schedule and success of the endeavor will heavily depend on the supply of Western tanks and other equipment. Aleksey Danilov, the secretary of Ukraine’s National Security and Defense Council, told AP on Monday that the push will start at an appropriate time when the country is ready. Prime Minister Denis Shmigal recently said that the offensive will start “in the nearest future.” Shmigal stated that the recent leaking of the Pentagon files, which included reports about how Western countries were training and equipping Ukrainian troops, will not change the plans for the counteroffensive.

However, a source close to President Vladimir Zelensky told CNN that Kiev had altered some of its plans because of the leak. Some Western leaders, including NATO Secretary General Jens Stoltenberg, warned that the conflict, which broke out in February 2022, could last for years. US Secretary of Defense Lloyd Austin said Washington is determined to support Kiev “for as long as it takes.” The Kremlin said this month that the Russian military has been “meticulously monitoring” information regarding Ukraine’s plans. Moscow has also repeatedly stated that countries which send weapons to Kiev become de facto parties to the conflict.

“The world community should create conditions and provide a platform for the resumption of talks..”

• US Fanning Ukraine Crisis as Beijing Proposes Peace Plan – Envoy (TASS)

The United States has been fanning the conflict in Ukraine, while China has come up with a peace plan, a senior Chinese diplomat said in an interview with TASS. “The Chinese side always takes a balanced and responsible approach to the export of military products. Unlike the United States and other Western nations, who have been adding fuel to the fire in the Ukrainian crisis, we put forward a peace plan to resolve it,” said Liu Xiaoming, Special Representative of the Chinese government on Korean Peninsula Affairs. In late February, the Chinese Foreign Ministry published a position paper on a political settlement of the crisis in Ukraine.

The twelve-point document includes calls for a ceasefire, respect for the legitimate interests of all countries in the field of security, settlement of the humanitarian crisis in Ukraine, the exchange of prisoners of war between Moscow and Kiev, as well as the cancellation of unilateral sanctions imposed without a corresponding decision of the UN Security Council. In the published document, China described dialogue and negotiations as the sole way of resolving the crisis in Ukraine and called on all parties to support Moscow and Kiev in “moving toward each other”, urging a resumption of direct dialogue as soon as possible. The world community should create conditions and provide a platform for the resumption of talks, the document emphasized.

It won’t. Just maybe in the west.

• China’s Role In The Yemen War Ceasefire Should Not Go Unnoticed (Blankenship)

Estimates suggest at least 350,000 people have died from the war or its consequences, which began in 2014. This includes approximately 85,000 children under the age of five who have died of starvation. Basic civil infrastructure and supply chains have collapsed, and typically treatable communicable diseases like cholera have claimed countless lives. The war is primarily between the Yemeni government of Rashad al-Alimi, who took over in 2022 from Abdrabbuh Mansur Hadi, and the Houthi armed movement. The conflict escalated significantly when Saudi Arabia became involved in 2015 by backing Hadi (and now al-Alimi) in what is seen as a proxy war between Riyadh and Tehran, who is rumored to be supporting the Houthis. Some of my first memories as a writer and college radio host was speaking to victims of the war and learning about the situation on the ground.

Fortunately, it now looks like the war might come to a close. US media reported on April 6th that a ceasefire had been struck between warring parties at least through the end of this year. Then, on April 7th, Lebanese news outlet Al Mayadeen reported that Riyadh had informed the Yemeni presidential leadership council of its decision to end the war and close the Yemen file once for all. This was further corroborated by a Reuters report, confirming that Saudi delegates would travel to the capital Sana’a to discuss a “permanent ceasefire.” And indeed these talks just wrapped up on April 14th and are expected to have a follow-up. What is apparent from this situation, and what I had previously noted, is that the thawing of relations between Iran and Saudi Arabia would likely lead to an end to the conflicts in Yemen and Syria.

We are now seeing that play out. Most importantly, it was not US President Joe Biden – who had promised to end the conflict – but China that set the stage for this diplomatic achievement. And it’s not even a secret among US commentators since outlets like The Intercept, heavily quoting foreign policy experts, are giving China the credit. It is difficult to compare such horrors but in my years speaking with victims of conflict, including Ukrainian refugees now, or previously with Afghans, Syrians and others, some of the most striking stories I’ve heard are from Yemenis. It is undoubtedly one of the most brutal and total wars seen in modern history, yet almost entirely off the radar for most Western media for nearly a decade. Despite all of its diplomatic capital and links to the Middle East, somehow Washington managed – despite promising to halt the conflict – to be so anti-peace that it has driven perennial enemies to the table.

And now, as the Wall Street Journal recently reported, CIA Director William Burns “expressed frustration” with Riyadh over its rapprochements with regional adversaries. Apparently, the US feels ‘blindsided’ by the deluge of peaceful resolutions – things it could never even fathom, apparently – and it’s angry with Riyadh, hitherto one of America’s largest arms importers. Of course, buried under this frustration is a sense of loss. Anyone with some degree of familiarity with US politics and especially US foreign policy knows it is dominated by big money. In foreign affairs, this is primarily the military-industrial complex, which thrives off war and hatred. Peace is bad for business. And thus, the owners of US officials – the people who bankroll their campaigns and/or their bosses’ campaigns – are probably ticked.

“The escalation of tensions on the Korean Peninsula is ongoing, and this only raises our level of concern..”

• Chinese Envoy: Negative US Role In Escalation On Korean Peninsula (TASS)

Beijing is extremely concerned about the escalation of tensions on the Korean Peninsula, with the United States playing a negative role by holding joint drills with South Korea, Liu Xiaoming, Beijing’s special representative on Korean Peninsula affairs, said in an interview with TASS. “My trip [to Moscow] comes against the backdrop of the latest changes on the Korean Peninsula. On the one hand, we can often hear Westerners – both the Europeans and the Americans – complain that since last year North Korea has conducted a number of missile launches, while on the other hand, we can see that South Korea and the Americans held the largest drills over the past five years [on the peninsula],” the senior Chinese diplomat lamented. “The escalation of tensions on the Korean Peninsula is ongoing, and this only raises our level of concern,” he added.

Liu also criticized the United States for not having paid due attention to North Korea’s security concerns. “First of all, we should give our European and Russian counterparts a clear understanding of how we view the situation. The Americans always blame North Korea for causing tensions, but there is another reason that is worth noting. We see the reason as stemming from the US conducting such major military exercises. Second, a very important cause of instability on the Korean Peninsula, and of the Korean Peninsula becoming an issue, is that the United States has not paid due attention to North Korea’s concerns in the field of security and has imposed economic sanctions,” the Chinese envoy said. “They always put on the pressure by containing North Korea’s development; they exert political pressure and have imposed economic sanctions,” he added.

According to Liu, the goal of his tour is to share the Chinese vision of the situation on the Korean Peninsula with various counterparts and to find a recipe for promoting a political settlement jointly with European and Russian counterparts. The senior Chinese diplomat said Moscow was the last stop on his 24-day foreign itinerary, during which he said he had already visited Switzerland, Great Britain, Brussels, Germany and France. Liu urged efforts to ease tensions on the Korean Peninsula. “Amid the lack of a peace mechanism, the escalation of tensions is ongoing, which threatens peace and stability on the Korean Peninsula,” he concluded.

Their own ban.

• Western Countries Dodging Russian Oil Ban (RT)

Western states that have banned direct purchases of Russian oil are now buying it indirectly from third countries, a report from the Centre for Research on Energy and Clean Air (CREA) claimed on Wednesday. In December, the EU, G7, and allied countries imposed an embargo and a $60-per-barrel price cap on Russian oil. Similar restrictions were introduced in February for exports of Russian petroleum products. While the so-called ‘price cap coalition’ cracked down on crude imports, it has increased purchases of refined products from “oil-laundering” countries, CREA claims. The EU, Australia, and most of the G7 countries imported a combined $45.9 billion worth of oil products from countries that have become the largest buyers of Russian crude in the 12 months since the beginning of the conflict in Ukraine, the report stated.

According to CREA, “among the price cap coalition, the largest importer of oil products from the laundromat countries was the EU,” with imports reaching $19.4 billion since last February. Australia reportedly purchased $8.8 billion worth of refined crude in the 12-month period, followed by the US with $7.2 billion, the UK with $5.5 billion, and Japan with $5.2 billion. The highest proportions of imported oil products into price cap coalition countries were for diesel (29%), jet fuel (23%), and gasoil (13%). China’s monthly exports of oil products to the EU and Australia spiked far above historical levels in late 2022, the Finland-based research center revealed.

According to the report, which is based on ship-tracking data, the price cap coalition countries ramped up imports of refined oil products from China by 94%, Turkey by 43%, the United Arab Emirates by 23%, Singapore by 33%, and India by 2%. “The price cap coalition countries are responsible for the vast majority of the increase in laundromat countries’ exports of oil products,” CREA said. It claimed that 56% of Russian oil shipped to new destinations “has been transported by vessels owned and/or insured” by Western nations.

“A durable peace” is one that would recognize Russia’s security concerns, which Washington and its pilot fish in Europe refuse to do..”

• Macron’s Europe (Patrick Lawrence)

The press and the trans–Atlantic political cliques ordinarily ignore Macron when he does his I’m-the-next-de-Gaulle act. But not this time. There is too much at stake between the West and China these days: Beijing’s leverage over Moscow, real or imagined, on the Ukraine question, Europe’s role as the U.S. foments a crisis over Taiwan, the independence or otherwise of Europe’s relations with China and the new world order Xi and his top foreign policy officials have declared as the mainland’s priority. Macron fairly leapt into all this as soon as he disembarked in Beijing on April 6. In his arrival speech at the Great Hall of the People, he appealed directly to Xi to exert his influence in Moscow. “I know I can count on you to bring Russia back to reason and everyone back to the negotiating table,” Macron said. The cause, he added, was “a durable peace that respects internationally recognized borders.”

These remarks are interesting in several ways. On one hand, Macron miscalculated. China has made it eminently clear that, if invited, it is willing to act as a mediator between Russia and Ukraine (and Kiev’s Western backers), but under no circumstance will it intervene into the sovereign affairs of the Russian Federation or any other nation. I wish Macron would spend more time doing his homework and less posing for historians and the sculptors of bronze busts. On the other hand, the wording is subtly suggestive. “A durable peace” is one that would recognize Russia’s security concerns, which Washington and its pilot fish in Europe refuse to do. Respecting internationally recognized borders is a fine idea, all would agree, but Macron appeared to leave open what these would be when maps are drawn at the conclusion of negotiations.

And on the other hand — there are three in this case — Macron suggested quite openly that negotiating with Russia was as valid an undertaking as negotiating with China. The French president’s “I know I can count on you” was wildly incautious: The Chinese leader was “inflexible in direct reply to French head of state,” as Le Monde put it. At the same time, Macron managed a nifty chime with Xi on the larger point. “Together with France, we appeal for restraint and reason,” Xi remarked during the Great Hall exchange, “in the quest for a political settlement and the building of a European security architecture that is balanced and lasting.” After extensive talks in Beijing, Xi took the unusual step of escorting Macron to Guangdong, the southern province where a lot of China’s manufacturing capacity is concentrated. There are a couple of things to say about this side trip, too. Three, actually.

One, Macron signaled his view that Europe’s relations with the People’s Republic should remain open and develop further on the economic side — an implicit rejection of Washington’s campaign to disrupt the extensive interdependence of economic ties between the West and China. Two, we have to think about why Xi invested so much time in this encounter with the French leader. If I know Macron is an inconstant lightweight and you know the same, we can count on Xi understanding very well Macron’s character. My reply: Xi’s intent was to demonstrate that Beijing remains open to developing a set of relations with Europe that amount to a common cause against America’s effort to line up the Atlantic world against China and, by implication, Russia. “Xi denounced ‘Cold War logic and the confrontation of blocs,” Le Monde’s correspondent, Claire Gatinous, reported from Beijing. Gatinous then quoted Xi saying, “China always considers Europe an independent pole in a multipolar world.”

Reserve currency is not the same as trade currency.

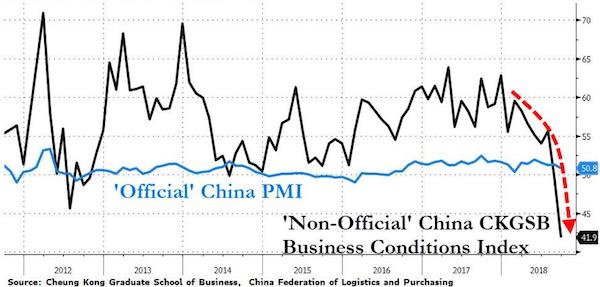

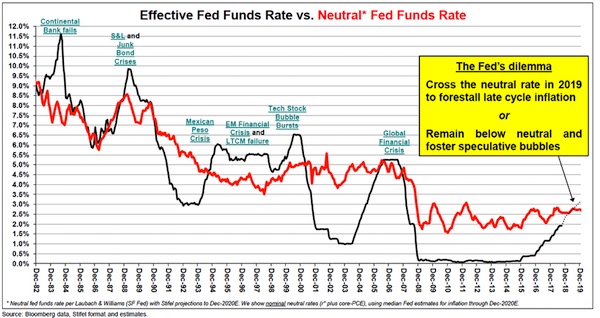

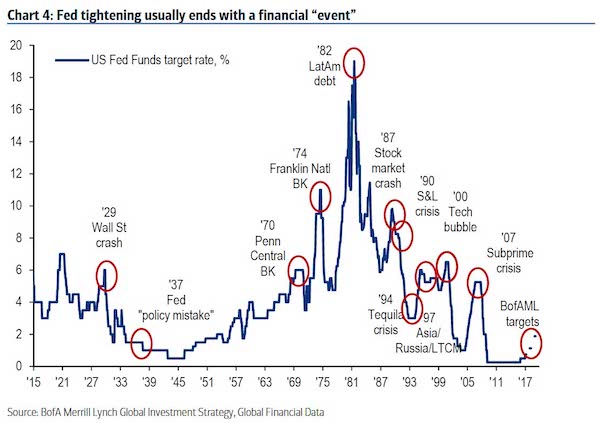

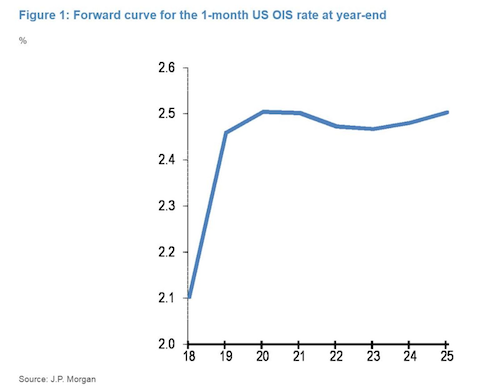

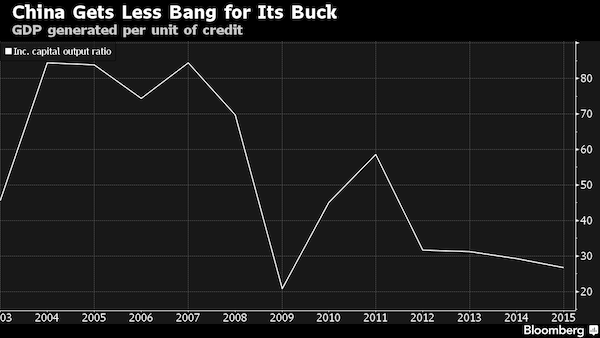

• The Dollar’s Dominance As A Reserve Currency Erodes Fast (BI)

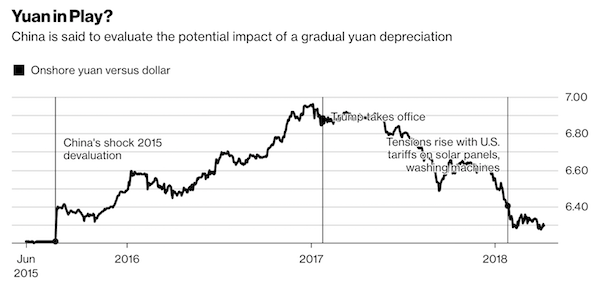

The dollar’s standing as a reserve currency of choice saw a steep decline in 2022 even though its strength in international trade remains unchallenged, according to Eurizon SLJ Asset Management. In a Monday note, strategists Joana Freire and Stephen Jen calculated that the greenback accounted for about two-thirds of total global reserves in 2003, then 55% by 2021, and 47% last year. “This 8% decline in one year is exceptional, equivalent to 10 times the average annual pace of erosion in the USD’s market share in the prior years,” the authors said. The drop-off in the dollar’s standing as a reserve currency accelerated since the start of the war in Ukraine in particular.

“Exceptional actions” — namely sanctions taken by the US and its allies against Moscow — made many nations less willing to hold on to the dollar, the report said. After Russia invaded Ukraine last year, Western nations largely cut off Russia from the world financial system and froze its currency reserves, forcing the Kremlin to rely more on the yuan. Meanwhile, the euro’s share as a reserve currency jumped by about 5%, Eurizon said, bringing its standing to the same level it hit in 2003 and effectively erasing two decades of losses. China’s yuan, meanwhile, continued to gain at its usual pace and didn’t see a big spike as a global reserve currency last year. To be sure, no other currency is set up to challenge the dollar’s dominance in international trade. It’s still the main conduit for country-to-country transactions, Eurizon said.

Citing data from the Bank for International Settlements’ Triennial Foreign Exchange Surveys, the dollar commanded 85% of all currency turnover in 2010, compared to its 88% market share in 2022, the note said. “We believe the erosion of the dollar’s reserve currency status has accelerated in recent years at an alarming pace, especially since the start of the Ukraine War, while the dollar will likely continue to enjoy dominance as an international currency for a while longer,” it added. Meanwhile, Fitch Solutions said the dollar’s dominance will erode over time but there won’t be a “paradigm shift,” given that there’s no viable alternative currency for international trade.

China’s rich

https://twitter.com/i/status/1648324373218992129

“The U.S. bond markets are considered the world’s deepest and most liquid markets.”

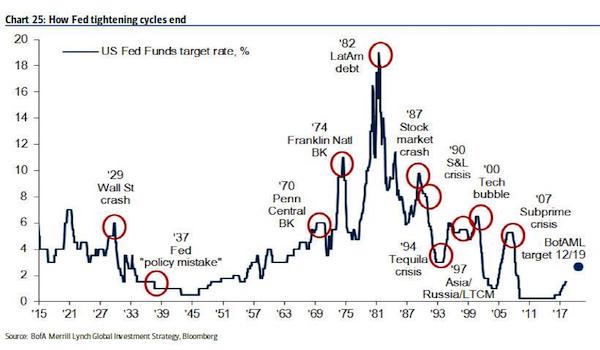

• Four Reasons The Dollar Is Here to Stay- Part 2 (Lebowitz)

The dollar will be extremely hard to replace for four reasons: The rule of law, liquid financial markets, and economic and military might. 60% of global currency reserves are in dollars, and about 90% of trade occurs in dollars. No other currency or block of nation’s currencies, gold-backed currency, or bitcoin is currently a viable candidate to replace the dollar as the global reserve currency.

The rule of law helps ensure that U.S. citizens and institutions are provided human rights, property, contracts, and procedural rights. While many other nations may claim to have similar legal processes, few live up to U.S. standards. The legal system equally protects foreigners with dollar and other financial and legal interests in the U.S. From a currency perspective, the court system, not a government decree, rules on financial disputes. It is undoubtedly flawed and biased. As Russia, Iran, and other countries have found, the U.S. government will seize their dollars if they deem it in its best interest. While such acts bend the value of the rule of law, almost all foreign nations are confident that the U.S. system of law and governance ensures their ability to hold and transact in U.S. dollars. Further, laws and regulations provide confidence in the proper functioning of U.S. markets they rely heavily on to meet their borrowing and investment needs.

Hedge fund mogul Mark Mobius is discovering why investing in countries less judicious than the U.S. can be dangerous. Per CNN: “I have an account with HSBC in Shanghai. I can’t take my money out. The government is restricting the flow of money out of the country,” Mobius, founder of Mobius Capital Partners, told FOX Business on March 2, 2023. For those thinking that China, Russia, and Saudi Arabia can cobble together a reserve currency, ask yourself a question. If you were the leader of a nation, would you leave funds in their banking system or trust their government with said funds? More importantly, do you even think those countries trust each other? From an operational perspective, the size and liquidity of U.S. financial markets and the ease with which foreigners can borrow and invest U.S. dollars are of utmost importance.

Foreigners enacting global trade need dollars to facilitate exchange. Therefore, they hold dollars and maintain the ability to borrow dollars. International trade requires a financial system with immense liquidity. Further, the more liquid a market, the lower the borrowing, investing, and hedging costs. In this respect, the U.S. is second to none. The U.S. bond markets are considered the world’s deepest and most liquid markets. As we quote below, the U.S. bond market accounts for almost 40% of all bonds outstanding globally. Per the Securities Industry and Financial Markets Association (SIFMA): “As of 2021, the size of the bond market (total debt outstanding) is estimated to be at $119 trillion worldwide and $46 trillion for the U.S. market.”

You lucky bastards: you get to pay for the exact same thing twice. First, to make Ukraine produce cheaper in the EU; then to make EU farmers whole. They offer €100 million. Of your money.

• EU Pledges Support For States Flooded With Ukrainian Grain – Politico (RT)

The European Commission (EC) said on Wednesday it is considering complying with some of the demands from eastern EU member states to introduce tariffs on Ukrainian agricultural imports. The announcement comes as Poland, Hungary, Romania, Slovakia, and Bulgaria have been lobbying for the reintroduction of tariffs in order to protect local markets from “destabilization” caused by an influx of cheap goods from Ukraine. Local farmers in those countries claim to have suffered substantial financial losses due to the glut of Ukrainian grain. In a letter to the five countries, cited by Politico, the commission reportedly proposed “preventative measures” on imports of Ukrainian maize, wheat, sunflower and rapeseed. The EC’s spokesperson told a daily briefing that the commission envisages imposing customs duties on those products, the outlet wrote.

It also said that Brussels is expected to allocate additional funding for so-called solidarity lanes for Ukrainian agricultural exports to the global market and distribute €100 million ($109 million) in support for the five eastern European member states. The proposal will reportedly be discussed on Wednesday during a meeting of the European Commissioner for Agriculture Janusz Wojciechowski, European Commissioner of Trade Valdis Dombrovskis and the five countries’ trade ministers. Wojciechowski said earlier the commission would announce “good news” for farmers. The EU allowed imports of Ukrainian agricultural goods to help Kiev financially during the ongoing conflict in the country. All tariffs and quotas were lifted on Ukrainian grain exports to the bloc’s 27 member states in order to enable the further transit of the grain to global markets.

However, much of the supply has ended up getting stuck in eastern European countries, hitting local farmers’ business. This culminated in massive farmer protests earlier this month, which blocked border crossings and forced the five eastern EU nations to demand action from the EC over Ukrainian agricultural exports. The EC earlier approved an aid package worth €56 million to support farmers in frontline countries who have to deal with the consequences of a large amount of agricultural and food goods from Ukraine entering the bloc. However, even the latest €100 million in proposed aid may not be enough. According to the commission’s estimates, farmers from Poland, Romania, Hungary, Bulgaria, and Slovakia have lost some €417 million over the past year due to the oversupply of grain.

Rising powers.

• Did the Neocons Save the World from the Thucydides Trap? (Unz)

Following the end of the Cold War and the collapse of the Soviet Union more than three decades ago, America had emerged as the sole, unchallenged global superpower. But over the last generation, the tremendous growth rate of the Chinese economy had propelled it past America’s in real size, the first such transition since our own country had overtaken Britain near the end of the 19th century. China’s technological progress had been equally rapid, and in our modern world these constitute the raw elements of global power, while China had also begun bolstering its military, not previously a high priority. I’d certainly been well aware of these same trends and several years earlier I’d published a long article of my own on the contrasting trajectories of China and America, but I’d never considered military conflict as a realistic possibility. However, when Allison and his associates sifted the last 500 years of history to locate cases in which the rapidly growing power of a rising nation had threatened to overtake that of a dominant reigning one, they discovered that in well over half the examples—12 out of 16— the result had been war.

Some of these individual historical cases may easily be disputed—and indeed a couple of the ones provided in his 2015 article differed from those in his 2017 book—but the general pattern seemed quite clear. Even the oldest and deepest cultural and political ties hardly prevented this outcome. Prior to World War I, Britain and Germany had never fought a war against each other, and indeed the latter’s Prussian predecessor had traditionally bee Britain’s staunchest Continental ally. The two imperial families were also deeply interwoven, with the British monarchy having multiple German antecedents, while Queen Victoria’s favorite grandchild was Kaiser Wilhelm II, and she’d died in his arms. The English language itself had German roots, hardly surprising since the Angles and the Saxons had originally been Germanic tribes.

Yet all these centuries of close ties counted for little compared to the simple geopolitical fact that Germany’s growing industrial and military power threatened to overshadow that of its kindred nation on the other side of the Channel. By contrast, the political, cultural, and racial gulf separating America from a rising China seems immense, easily lending itself to the crudest demonization, the sort of populist demagoguery able to stoke national hatred. Not only is China’s language and culture totally different from our own, but for three generations that country has been governed by a Communist Party whose official ideology is utterly contrary to our own democratic constitutionalism. Many hundreds of thousands of Chinese troops had fought against American forces during the Korean War, inflicting most of our 36,000 combat deaths.

“..examples of preferential treatment and politics improperly infecting decisions and protocols..”

• IRS Agent Alleges DOJ Thwarting Criminal Prosecution Of Hunter Biden (JTN)

A decorated supervisory IRS agent has reported to the Justice Department’s top watchdog that federal prosecutors appointed by Joe Biden have engaged in “preferential treatment and politics” to block criminal tax charges against presidential son Hunter Biden, providing evidence as a whistleblower that conflicts with Attorney General Merrick Garland’s recent testimony to Congress that the decision to bring charges against Biden was being left to the Trump-appointed U.S. Attorney for Delaware. According to a letter from the whistleblower’s attorney Mark Lytle to Congress obtained by Just the News, the IRS agent revealed he is seeking to provide detailed disclosures about a high-profile, sensitive case to the tax-writing committees in Congress, which have special authority under federal tax privacy laws to receive such information.

That could pave the way to share the details with other committees in coming weeks. The letter does not state that the whistleblower disclosures are related to Hunter Biden. However, Just the News has independently confirmed the agent’s allegations involve the Hunter Biden probe being led by Delaware U.S. Attorney David Weiss, a Trump holdover, according to multiple interviews with people directly familiar with the matter. In a letter Wednesday to Republicans and Democrats overseeing multiple oversight committees in Congress, Lytle wrote: “The protected disclosures: (l) contradict sworn testimony to Congress by a senior political appointee, (2) involve failure to mitigate clear conflicts of interest in the ultimate disposition of the case, and (3) detail examples of preferential treatment and politics improperly infecting decisions and protocols that would normally be followed by career law enforcement professionals in similar circumstances if the subject were not politically connected.”

Gorilla deer

https://twitter.com/i/status/1648723659010211844

Dugong

The Dugong, or “Sea Cow”, is a herbivorous marine mammal that is the last representative of the once-diverse family Dugongidae. This social, seagrass feeding mammal can live for over 70 years in the wild

[read more: https://t.co/V4hlIhQO4Z]pic.twitter.com/k5jvkxWEf8

— Massimo (@Rainmaker1973) April 20, 2023

Hubert

This is Hubert. You're not going to believe what he found while playing today. Potentially one of his best discoveries to date. It was a puddle. 13/10 pic.twitter.com/5xSFP5VwKa

— WeRateDogs® (@dog_rates) April 19, 2023

Dog wave

— Buitengebieden (@buitengebieden) April 19, 2023

Boss

https://twitter.com/i/status/1648800139010506752

Hide

Time to hide . pic.twitter.com/RkuBW2rOvM

— What's Underwater ❔ (@underwaterViews) April 19, 2023

Mirror

Can you explain this? pic.twitter.com/SB1tBp7HpZ

— David Wolfe (@DavidWolfe) April 19, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.