Danish frontpage today after No To More EU vote

Did Draghi finally do something sensible? Very much depends on who you ask.

• Stocks Plunge With Dollar, Bonds as ECB Decisions Disappoint (BBG)

Equities tumbled around the world and government bonds sank, while the euro rallied the most in six years after the scale of additional stimulus from the European Central Bank disappointed investors just as the Federal Reserve signaled interest-rate increases are imminent. The Standard & Poor’s 500 Index fell the most in two months and European equities had their worst day since the height of the summer selloff. The euro climbed against all its major peers, stinging traders who had piled on wagers against the currency amid expectations of aggressive easing from the ECB. Yields on 10-year German notes jumped 20 basis points, while rates on similar-maturity Treasuries posted their biggest advance since February. Brent crude rallied from a six-year low before Friday’s OPEC meeting.

The selloff in risk assets spread from Europe around the world, with investors anticipating deeper cuts to the region’s lending rates and an increase in the amount of ECB bond purchases to support flagging economic growth. Meanwhile, Fed Chair Janet Yellen indicated the conditions for higher rates in the U.S. had been met, boosting the odds the central bank will raise borrowing costs at its final meeting of 2015 on Dec. 16. “Everyone was positioned the same way going into today,” Michael Block, chief equity strategist at Rhino Trading Partners, said by phone. “Draghi disappointed, the long bond is down over three points, trades are getting messed up, it all snowballed and on days when that happens you have a problem. It’s the idea the central banks won’t be there to bail out equities.”

Read more …

Ambrose predicts nirvana for Europe next year. We do not.

• Mario Draghi Riles Germany With QE Overkill (AEP)

The ECB has cut the deposit rate to a record low of -0.3pc and vowed to print money for as long as it takes to defeat deflation, pushing its radical stimulus measures to extremes never seen before in any major region in modern history. The far-reaching moves come despite signs that economic growth in the eurozone is picking up, and ignores vehement protests from German-led hawks that quantitative easing at this late stage is doing more harm than good. Mario Draghi said the bank will keep buying €60bn of bonds each month as far out as March 2017 or “beyond if necessary”. It is effectively an open-ended pledge. “Abundant liquidity will continue for a long, long time,” he said. Markets were betting on even more largesse, and reacted badly to the package of measures.

Many funds had expected an increase in the volume of QE purchases to nearer $80bn and an even deeper cut in the deposit rate, beguiled by the ultra-dovish rhetoric of top ECB officials over recent days. The euro soared by almost 4pc to $1.0933 against the dollar, smashing through technical stops in a bloodbath on the exchange markets. “It was the biggest one-day rise in the euro since 2009,” said Ian Stannard, from Morgan Stanley. Germany’s DAX index of equities and France’s CAC 40 both fell 3.6pc, the worst drop since August. The FTSE 100 dropped 2.3pc to 6,275. Yields on 10-year German Bunds spiked violently by 19 basis points to 0.66pc, with even more drastic reversals in Italy and Spain. An estimated €300bn of eurozone debt trading at negative rates has turned positive again within a single trading day, reducing the total to €2.2 trillion.

“Markets want immediate gratification. A lot of traders had large positions and they got caught out,” said David Owen, at Jefferies. “But when things settle down in a couple of weeks, people will realize that what happened today is highly significant. The ECB is adding another $360bn to its balance sheet and is now reinvesting its portfolio, like the Bank of England. This is a big deal,” he said. The ruckus on trading floors had echoes of August 2012, when Mr Draghi launched his back-stop plan for Italian and Spanish bonds (OMT), ending the eurozone debt crisis at a stroke. Markets sold off in a knee-jerk fashion at first but soon changed their mind as the significance sunk in. Mr Draghi said QE has been an unqualified success but the summer storm in emerging markets and China diluted the effects, while the commodity crash has made it even harder to fight deflation.

Inflation is still stuck at 0.1pc, leaving little safety margin against an external shock. “We are doing more because it works, not because it fails,” said Mr Draghi, insisting that the eurozone would have been in outright deflation this year without QE. Yet it is far from clear whether the region needs radical stimulus as far ahead as 2017, given that the ECB itself is predicting above trend growth of 1.7pc next year. Euroland is already benefitting from a near perfect storm of positive shocks. Fiscal austerity is finally over. The euro has fallen 13pc in trade-weighted terms since April 2014. Oil prices have plummeted from $114 a barrel to $43 in 18 months, giving consumers a shot in the arm.

[..]The Bundesbank warns that negative rates are causing serious problems for savings banks and smaller lenders, and make it much harder for insurance companies to match their maturities. Hans Werner Sinn, from the Germany’s IFO Institute, said Mr Draghi has given up trying to conduct a responsible monetary policy and is engaged in a covert rescue of ailing banks and governments. “The ECB has turned into a bail-out machine,” he said. Both German members of the ECB opposed the new measures, and were almost certainly joined by hawkish governors from the Netherlands and the Baltics. They may have stopped Mr Draghi going even further. “The ultra doves lost the argument,” said Frederik Ducrozet, from Pictet. [..] For Mr Draghi, it is a day he would probably rather forget. He delivered exactly what he promised yet for mysterious reasons the markets concluded otherwise. Sometimes you just can’t please them.

Read more …

$800 billion in reverse QE. Let’s see them do it.

• “But It’s Just A 0.25% Rate Hike, What’s The Big Deal?” (ZH)

After today’s market plunge, the result of what even Goldman admitted may have been a major policy error by the ECB, suddenly the Fed’s determination to hike rates in two weeks lies reeling on the ropes. After all, what the ECB did was an implicit tightening of reverse QE1 proportions (it is no accident that the EURUSD is soaring as much as it did in March 2009 when the Fed unleashed QE). But assuming the Fed is still intent on hiking at all costs, and does just that in two weeks time, a question many are asking is where will General Collateral repo trade in case the Fed does decided to push rates higher by 0.25%: after all the Reverse Repo-IOER corridor is the most important component of the Fed’s rate hike strategy, one which better work or otherwise the Fed will be helpless to raise rates with some $3 trillion in excess liquidity sloshing around, and what little credibility it has will be gone for good. And much more importantly, what are the liquidity implications from such a move.

For the answer we go to the repo market expert, Wedbush’s E.D. Skyrm. Here are his thoughts: “Where will General Collateral trade when the fed funds target range is moved 25 basis points higher to .25% to .50%? In the most simple method, GC has averaged about .15% for the past month, which implies a GC rate around .40% after the Fed move. However, given the unprecedented amount of liquidity in the financial system, there’s a belief the Fed will have problems moving overnight rates higher. We have two quantifiable events over the past few years where the Fed moved Repo rates higher or lower: quarter-end and the QE programs.

Given there are so many moving parts, consider these to be very rough estimates: Beginning in 2015, when funding pressure began each quarter-end, the market, on average, took approximately $255B additional collateral from the Fed and, on average, GC rates averaged 20.5 basis points higher. In 2013 on my website, I calculated that QE2 moved Repo rates, on average, 2.7 basis points for every $100B in QE. So, one very rough estimate moved GC 8 basis points and the other 2.7 basis points per hundred billion. In order to move GC 25 basis points higher, in a very rough estimate, the Fed needs to drain between $310B and $800B in liquidity.”

If readers didn’t just have an “oops” moment, please reread the last bolded sentence until they do, because it explains precisely what the market is missing about the Fed’s rate hike cycle: according to Skyrm’s calculations, to push rates by a paltry 25 bps, the smallest possible increment, what the Fed will have to do is drain up to a whopping $800 billion in liquidity! Putting that in context, QE2 – which pushed the S&P higher from November 2010 until June 2011 – was “only” $600 billion. In other words, to “prove” to itself that it is in control and the economy is viable, the Fed will effectively conduct, via reverse repo, an overnight QE2…. only in reverse.

Read more …

Good way to phrase it: “[China’s] economy is expanding at the slowest rate in a generation..”

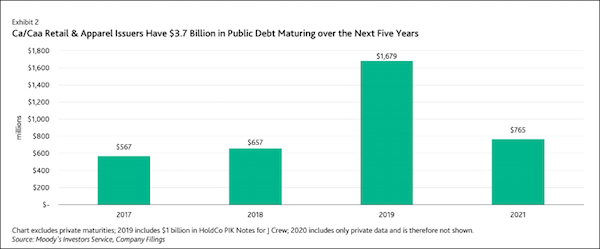

• Bankruptcy Might Be the Mining Industry’s Last Best Hope (BBG)

For the world’s ailing metals-mining industry to have any hope of a turnaround, more producers may have to go belly up. Companies that dig up everything from gold to copper have failed to stem a prolonged collapse in mineral prices mostly because not enough mines are closing. Years of increased output have created global surpluses just as slower economic growth erodes demand. Unprofitable operations were kept alive by across-the-board cuts in operating costs, lower energy prices, a strong dollar and the unfulfilled hopes by mining executives that markets will improve. “We are going to see bankruptcies,” Evy Hambro at Blackrock’s $3.5 billion World Mining Fund said. “Some companies have been praying for commodity prices to deliver a kind of escape route from the problems that they face. That’s clearly gone the other way.”

While nobody expects industry giants such as Rio Tinto or BHP Billiton to go bust, higher-cost producers and those unable to raise more cash are vulnerable as a measure of base-metals prices heads for a third straight annual decline. The loss of value means more companies are getting closer to default, Moody’s Investors Service said Wednesday. There have been some production cuts, but the rout has deepened because companies are still supplying more metal than is needed around the world. Most mining executives don’t want to trim even unprofitable output because the resulting tighter supply and higher prices would benefit rivals. China, the world’s biggest metals user, has been mostly to blame for the price slump.

The Asian country’s economy is expanding at the slowest rate in a generation, curbing demand, just as new mines planned during an almost decade-long bull run in commodities are coming into operation. “We need to see supply cuts across these markets to try to bring them back into balance,” said Colin Hamilton at Macquarie in London. “It’s either companies making the decisions themselves, or it comes through a full process of people dying very slowly.” A gauge of contracts on the London Metal Exchange has slid 26% this year, the most since 2008, to near the lowest in six years. About 15% of copper production and a quarter of zinc output are unprofitable, while 60% of aluminum and 70% of nickel are supplied at a loss, according to Standard Chartered.

First-half profits slumped at least 30% for Rio Tinto, Glencore and Anglo American, while BHP Billiton’s full-year earnings slid 52%. The biggest producers have proved the most efficient at pumping out more material at lower costs, while smaller companies have struggled. “You’ve got to allow the markets to work,” Tom Albanese, CEO of Vedanta Resources and former CEO of Rio Tinto, said on Tuesday. “It creates a prisoner’s dilemma in terms of what it means for the broader sector, but it’s logical and it’s in the best interests of those companies.”

Read more …

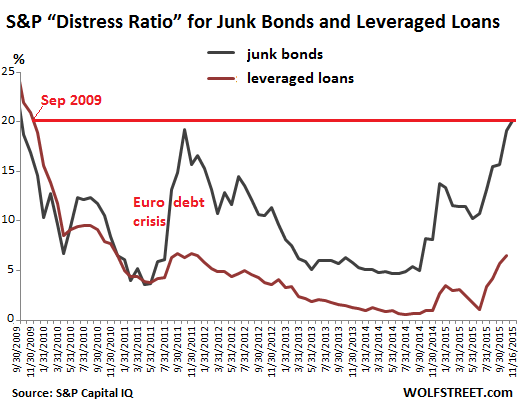

“..half of the oil-and-gas junk debt trades at distressed levels..”

• “Distress” in US Corporate Debt Spikes to 2009 Level (WolfStreet)

Investors, lured into the $1.8-trillion US junk-bond minefield by the Fed’s siren call to be fleeced by Wall Street and Corporate America, are now getting bloodied as these bonds are plunging. Standard & Poor’s “distress ratio” for bonds, which started rising a year ago, reached 20.1% by the end of November, up from 19.1% in October. It was its worst level since September 2009. It engulfed 228 companies at the end of November, with $180 billion of distressed debt, up from 225 companies in October with $166 billion of distressed debt, S&P Capital IQ reported. Bonds are “distressed” when prices have dropped so low that yields are 1,000 basis points (10 %age points) above Treasury yields.

The “distress ratio” is the number of non-defaulted distressed junk-bond issues divided by the total number of junk-bond issues. Once bonds take the next step and default, they’re pulled out of the “distress ratio” and added to the “default rate.” During the Financial Crisis, the distress ratio fluctuated between 14.6% and, as the report put it, a “staggering” 70%. So this can still get a lot worse. The distress ratio of leveraged loans, defined as the%age of performing loans trading below 80 cents on the dollar, has jumped to 6.6% in November, up from 5.7% in October, the highest since the panic of the euro debt crisis in November 2011. The distress ratio, according to S&P Capital IQ, “indicates the level of risk the market has priced into the bonds.

A rising distress ratio reflects an increased need for capital and is typically a precursor to more defaults when accompanied by a severe, sustained market disruption. And the default rate, which lags the distress ratio by about eight to nine months – it was 1.4% in July, 2014 – has been rising relentlessly. It hit 2.5% in September, 2.7% in October, and 2.8% on November 30. This chart shows the deterioration in the S&P distress ratio for junk bonds (black line) and leveraged loans (brown line). Note the spike during the euro debt-crisis panic in late 2011. The oil-and-gas sector accounted for 37% of the total distressed debt and sported the second-highest sector distress ratio of 50.4%. That is, half of the oil-and-gas junk debt trades at distressed levels! The biggest names are Chesapeake Energy with $7.4 billion in distressed debt and Linn Energy with nearly $6 billion.

Read more …

All bubbles pop.

• Hong Kong Housing Bubble Collapses, Sales Plunge 42% (ZH)

Over the weekend we reported that in the aftermath of China’s crackdown on capital controls, “Chinese buyers have left the U.S. housing market.” But if potential Chinese buyers are unable to transfer funds out of the mainland, it wouldn’t be just the U.S. and Australia where the housing bubble is now rapidly bursting, it would be everywhere else too as said potential buyers hunker down and instead scramble to avoid the government’s attention and to preserve dry powder. Sure enough, nowehere was this more clear overnight than in Hong Kong, where the once-upon-a-time raging housing bubble just got its last rites after November home sales sank to a record low as an imminent interest rate in the US this month scared away prospective buyers.

According to Land Registry data, reported by SCMP, November saw 2,826 registered residential transactions, down 14.4% from October and 41.7% less than in November last year. This was the lowest print in the history of the series. In terms of value, residential transactions dropped 7.7% month on month to HK$20.8 billion. “Total home sales including those in primary and the secondary market dropped to the lowest level since we have started to gauge property transactions in 1996,” said Wong Leung-sing, an associate director of research at Centaline Property Agency.

Read more …

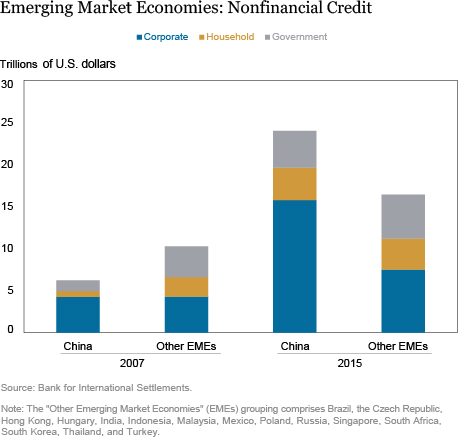

“The legacy has left a $28 trillion debt pile hanging over an economy set to grow at the weakest pace since 1990…”

• For China, The Real Battle For A Global Currency Is Just Beginning (BBG)

After a struggle of more than half a decade, China this week overcame doubts and objections to qualify for official reserve status for its currency, the yuan. Now, the real battle begins. Chinese officials who want a much bigger role for market forces – including central bank Governor Zhou Xiaochuan and his deputy Yi Gang – have used the goal as a lodestone for their ideas. In their campaign, the reformers won approval for gradually opening up the financial system to foreign participation and letting the private sector set interest rates. With the IMF’s decision on Nov. 30 to endorse the yuan for inclusion alongside the dollar, euro, pound and yen in the International Monetary Fund’s global currency basket, known as Special Drawing Right, or SDR, the reformers in one sense realized their ambition.

While meeting the IMF’s “freely usable” requirement, Chinese policy makers are still a long way from a “freely convertible” currency. That’s the long-term objective of the reformers seeking to overturn China’s state-directed lending model. The legacy has left a $28 trillion debt pile hanging over an economy set to grow at the weakest pace since 1990. The People’s Bank of China’s Yi Gang was quick to highlight the unfinished business. “We are still relatively far from the world’s developed markets,” Yi told reporters in Beijing hours after the IMF announcement. “Joining the SDR also means that the international community will have more expectations for China in many financial and economic aspects, so we also feel that the burden on our shoulders is heavier.”

The financial system is a key battleground between Zhou, Yi and their allies and the Communist Party stalwarts who advanced in the state-owned enterprise world and want to keep the old structure of a planned economy. Opponents maintain their anonymity in a system where the party is supposed to be moving forward as one. The Communist leadership agreed in the new Five Year Plan for the economy to move toward yuan convertibility by 2020. Those next steps will be fraught with risk — the global economy is littered with a trail of examples that illustrate what can go wrong when the sequencing of capital-account opening is fumbled. It took Japan 40 years to complete big reforms to its exchange rate, interest rates and financial sector only to see an asset bubble swell, then burst and crash the economy for two decades.

Read more …

Xi’s hubris reaches far and deep. The more control he wants, the more problems he gets.

• Top China Cop Targets Bankers After Putting Away Security Czar (BBG)

The high-ranking cop who brought down one of China’s top Communist Party officials has been put in charge of a corruption probe of the securities industry in the wake of a summer stock crash, said a person familiar with the matter. The appointment of Fu Zhenghua underscores the importance that President Xi Jinping has given the investigation into possible securities fraud linked to the $5 trillion wipeout in June and July. Fu has had several promotions since Xi came to power in 2012, and oversaw the case against former Politburo Standing Committee member Zhou Yongkang, said three people familiar with the case, who asked not to be identified because Fu’s role hasn’t been made public. Zhou was sentenced to life behind bars in June.

The 60-year-old former Beijing police chief, who also led a corruption case against one of China’s richest men and busted a huge prostitution ring in 2010, is overseeing a probe under which police have questioned dozens of executives at securities firms amid allegations of insider trading and other malfeasance stemming from the crash, one of the people said. The investigations have intensified in recent weeks, sending fear through China’s finance firms and chilling their investment strategies. “Fu is a capable assistant to Xi because his cutthroat style would help the investigation get to the very bottom of things, and to make sure things under Xi’s full control,” said Zhang Lifan, a political commentator. “An investigation into the financial sector could easily damage the interests of some power havens, and Fu is more than qualified to fight Xi’s battle as he’s famous for not being afraid of offending anyone.”

Read more …

“US leaders’ ignorance, or disregard, of history created with the invasion of Iraq not just an illegitimate and uncalled for war of choice, but a dislocation of an existing balance..”

• America’s Leadership Just Doesn’t Seem To Get It (Tanosborn)

As we fail to identify the causes that bring about what we call terrorism, we also fail to realize that such causes also bring higher ideological Causes: goals and principles that are served with dedication and zeal by a militant leadership that we simplistically term as terrorists, and the connotation which allows us in the West to don righteousness while placing the entire blame of any regional turmoil on “them.” And that region in turmoil now extends beyond the Near East/Middle East, with dissatisfaction branching out from Afghanistan (east) to Morocco (west) by diverse cultures faithful to Islam and highly influenced by the success being achieved by the Islamic State (IS). Under the auspices of the UN, and the diplomatic leadership of John Kerry (US) and Sergei Lavrov (Russia), a plan to stabilize Syria has just been drafted in Vienna; a plan that’s inclusionary of all but one feuding group.

That exception being ISIS/ISOL, by whatever acronym one wishes to know the new and resolute Islamic State, now holding major swathes of territory in Iraq and Syria, while establishing itself as the purveyor of extra-territorial reaches and ambition in the creation of a caliphate. But stabilizing Syria, as important as that would be after a devastating civil war, won’t begin to cure the geopolitical problems in that part of the world; problems that were ignited by an Imperial Britain six-plus decades ago, later adopted and enlarged by an equally ambitious and powerful Imperial America. Problems which have not only deep economic roots but extensive foliage cover of prejudice, lies and deceit. Britain and the US have played havoc in the Middle East, creating geographic borders, sitting and deposing rulers at will, and meddling forcefully in the region’s geopolitics.

Meddling which achieved the pinnacle of idiocy with George W. Bush’s invasion of Iraq and deposition of Saddam Hussein, a dictator with lay roots who had long maintained some political balance in the region. By far the greatest mistake ever in the annals of American foreign policy, one which will leprously follow into history a not-very-bright president who did totally depend for his decisions on a cadre of advisers proven to be not exactly political luminaries themselves (Dick Cheney, Don Rumsfeld and perhaps the archetype of the Peter principle, Colin Powell, at the helm). US leaders’ ignorance, or disregard, of history created with the invasion of Iraq not just an illegitimate and uncalled for war of choice, but a dislocation of an existing balance of cultures, religion, ethnicities and ruling socio-economic power.

In the decade following the invasion, the vengeful Shia majority, who came into power with both the vote and US help, helped create fertile grounds for a Sunni insurgency under proven leadership from capable, former members of Saddam Hussein’s government. Except that this time around, these insurgents are looking at religion, Islam, as the main motivator for their existence, the glue that makes them stay strong and together – fanatically so in the view of most non-Islamic people. And that, nothing else, is the Islamic State in search of its identity, a modern day caliphate… brought to the world courtesy of George W. Bush.

Read more …

There are many poor countries and athletes participating.

• It’s So Bad in Brazil That Olympians Will Have to Pay for Their Own AC (BBG)

The Brazilian economic crisis has finally hit the 2016 Olympics. Following a new round of cost-cutting by the Rio 2016 organizers, athletes will be asked to pay for the air conditioning in their dorm rooms. Stadium backdrops will be stripped to their bare essentials. Fancy cars and gourmet food for VIPs are out. “The goal here is to organize games without public funding and to organize games that make sense from an economic point of view,” Rio 2016 spokesman Mario Andrada said in an interview. That economic focus has changed radically in the six years since Rio was awarded the Games – South America’s first. At the time, Brazil’s government pledged $700 million toward any budgetary overrun. Then the economy tanked. Unemployment has soared, and the local currency, the real, has lost one-third of its value against the dollar in the last year.

Now, with costs that ran up to 2 billion reais ($520 million) over budget and the public commitment in doubt, the organizers must stick firmly to the 7.4 billion reais they expect to earn from sponsorships, ticket sales, and a grant from the International Olympic Committee. Final decisions on what to pare back and how much should be finalized by next week, Andrada said. By the time the Games begin, the committee plans to have 500 fewer paid staff than the 5,000 it originally expected. The deepest cuts will probably come from operational areas like catering, transportation and cleaning services.

Shifting the cost for air conditioning and other amenities from the host city to each nation’s Olympic committee – or to the athletes themselves – is a big deal, said Nick Symmonds, a two-time Olympic runner. “The world wants to tune in and watch the world’s greatest athletes compete at the absolute highest level,” Symmonds said. “If you don’t provide them with good food, a good place to sleep and comfortable temperature, they won’t be able to recover and bring the A-plus product that the world is demanding. To cut the budget on athletes’ hospitality and comfort, that’s just going to cheapen the games.”

Read more …

Now he’s Monsanto’s no. 1 enemy as well.

• Putin Wants Russia To Become World’s Biggest Exporter Of Non-GMO Food (RT)

Russia could become the world’s largest supplier of ecologically clean and high-quality organic food, said President Vladimir Putin on Thursday. He also called on the country to become completely self-sufficient in food production by 2020. “We are not only able to feed ourselves taking into account our lands, water resources – Russia is able to become the largest world supplier of healthy, ecologically clean and high-quality food which the Western producers have long lost, especially given the fact that demand for such products in the world market is steadily growing,” said Putin, addressing the Russian Parliament on Thursday. According to the President, Russia is now an exporter, not an importer of food.

“Ten years ago, we imported almost half of the food from abroad, and were dependent on imports. Now Russia is among the exporters. Last year, Russian exports of agricultural products amounted to almost $20 billion – a quarter more than the revenue from the sale of arms, or one-third the revenue coming from gas exports,” he said. Putin said that all this makes Russia fully capable of supplying the domestic market with home-grown food by 2020. In September, the Kremlin decided against producing food products containing genetically modified organisms (GMOs). Russia imposed an embargo on the supply of products from the EU and the United States as a response to Western sanctions. After Turkey shot down Russian Su-24 bomber, Russian authorities decided to ban the import of fruit, vegetables and poultry from Turkey. The ban will take effect from January 1.

Read more …

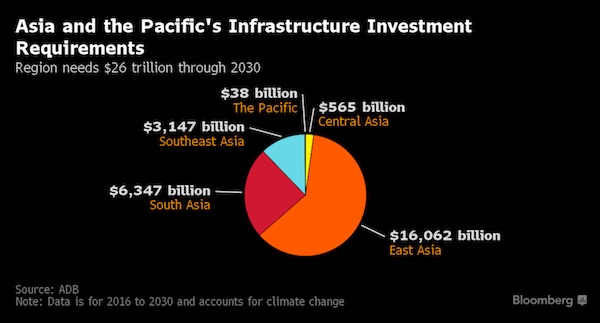

“Unlike fossil fuel developments [..]..most renewable projects have to be entirely capital funded up front..”

• Financial Engineering To Save The Planet (Kaminska)

One of the problems with green energy finance is the nature of the asset. Unlike fossil fuel developments, which spread the capital cost of development and production across the lifespan of the asset, most renewable projects have to be entirely capital funded up front. According to Citi’s Anthony Yuen and Ed Morse, that means the cost of financing is the key determinant in making these projects competitive and viable — an increasingly pressing objective in the context of falling fossil fuel prices, which reduce the competitive position of renewables in the energy complex. In an upcoming report, Financing a Greener Future, the experts even argue it’s probably a more important determinant than changes in global climate change policy.

The COP21 meeting in Paris matters, but – says the report –bottom up, local and national policies matter more. In fact, what the climate change campaigners in Paris may never have bargained for is the degree to which fossil fuel abundance and elasticity has disrupted the economic incentives associated with going green. For renewables, it’s arguably even worse, because the real cost comparison isn’t even oil, it’s even cheaper coal or natural gas. From Citi: ”

As gas prices have continued their march lower in the midst of staggering productivity gains in hydraulic fracturing, gas’s inroads into coal’s once safe territory have gone farther. Additionally, new environmental regulations, such as the Clean Power Plan that more strictly regulates coal pollution, have added liability to building new coal plants and forced more coal-fired power plants to retire In the rest of the world, however, the story is very different. In nearly every economy except the US, coal remains a much cheaper source of power generation.

Even in Europe, with a €9/ton carbon burden, burning coal is still far more profitable than burning gas, due in large part to the high costs of imported gas (see below chart). In addition to oversupply, mining costs have compressed by 30% in the last three years, even with lower prices, cushioning producers. The prospects for significant increases in coal pricing that might hinder the competitiveness of renewables or gas appear limited, and hinge crucially on India and China. In the US, cheap natural gas should keep a tight lid on coal prices, limiting prospects for significant uplift.

Even if China moves to curb its coal consumption, Citi’s team expects the demand drop — by making coal even cheaper than before — will simply fuel more coal consumption in other economies such as India. Indeed, with low coal prices actually undermining the case for renewables, Citi’s Yuen tells FT Alphaville it’s only lower financing costs that can give the sector the boost it needs. So what sort of financial innovation is needed or even possible in this sector? Err.. mostly, it turns out, the sort involving public balance sheets and government de-risking. Quelle surprise.

Read more …

That frontpage is a keeper.

• Denmark Rejects Closer EU Ties as Skeptics Dominate Referendum (BBG)

Danes voted to keep their distance from the European Union, marking a blow to Brussels before heads of government meet to discuss British demands for a renegotiated relationship with the 28-member bloc. Denmark will preserve an opt-out from EU justice and home affairs laws, with 53% of voters in favor of the status quo, while 47% back a shift to a flexible opt-in, according to state broadcaster Danmarks Radio. The result “is based on a general skepticism toward the EU,” said Prime Minister Lars Loekke Rasmussen. At stake is the ability to coordinate everything from tracking cyber crime to ensuring family disputes get the same legal treatment across EU borders. The center-right government argues that failure to agree to a flexible opt-in arrangement means Denmark will forfeit its automatic participation in Europol, which changes its status next year to become an EU institution.

“If we’re to fight cross-border crime, I think one has to say that Denmark needs to be part of this union,” Rasmussen said in an interview with broadcaster TV2. His “yes” campaign was supported by the Social Democrats, the largest opposition party. But the more vocal “no” side warned against giving up sovereignty to an EU it says is becoming more bureaucratic in pushing agendas that are remote to the average Dane’s interests. The latest Eurobarometer shows 33% of Danes associate the EU with bureaucracy. Only the Czech Republic, Finland and Sweden have a lower opinion of the bloc’s administrative evils. But by far the majority of Danes – 70% – think they’re better off inside the EU than outside.

Denmark has held seven referenda since becoming an EU member in 1973. The country most recently voted in favor of adopting EU patent laws. Thursday’s vote was on one of four exemptions Denmark secured in 1993. The others concern monetary union, defense and citizenship. Polls have consistently shown Danes would reject any attempt to do away with their currency opt-out. Instead, the central bank pegs the krone to the euro in a 2.25% band.

Read more …

The EU is so woefully lacking, one would think they do it on purpose.

• Greece Asks EU For Help With Refugees Following Threats (Kath.)

In the wake of pressure regarding its membership of the Schengen Area, Greece on Thursday activated the European Union Civil Protection Mechanism, agreed to allow EU border agency Frontex on its frontier with the Former Yugoslav Republic of Macedonia (FYROM) and to trigger the Rapid Border Intervention Teams mechanism (RABIT) for extra help with patrols in the Aegean. The European Commission confirmed Thursday that it received these three requests from Athens. The action came after a number of unnamed EU officials claimed that there were calls for Greece to be excluded from the Schengen free travel area because of complaints about the way it is handling the flow of migrants and refugees and its failure to live up to commitments made at the Western Balkans Route Leaders’ Summit in October.

The EU Civil Protection Mechanism allows Greece to benefit from material support. Alternate Minister for Migration Policy Yiannis Mouzalas said Thursday that Athens had not made the request for assistance earlier because it needed to assess its needs first. “We did not know exactly what we needed and, more importantly, how we would use what we asked for,” he said at a news conference. Greece sent a list containing 23 categories to Brussels. Among the things the government is asking for are 26 ambulances, six water pumps, four diesel-powered generators, 500 large all-weather tents, 100,000 waterproof jackets, 50,000 woolen blankets, 100,000 sleeping bags and 100,000 first-aid kits.

The agreement with Frontex will see the border agency provide personnel to help register refugees and migrants at Greece’s border with FYROM, where some 6,000 people have now amassed as a result of Skopje refusing to allow anyone except Syrians, Iraqis and Afghans, who can qualify as refugees, through. The situation in the Greek border village of Idomeni is becoming increasingly tense, with clashes breaking out between refugees and migrants from countries such as Iran, Pakistan and Morocco. A man believed to be from Morocco was fatally electrocuted after touching high-power railway cable when he climbed on top of a train. “There will be a solution soon for Idomeni,” said Mouzalas. “We are trying to convince people to return to Athens.”

[..] Mouzalas rejected claims that the Greek government is unwilling to work with Frontex. He said Athens had rejected the idea of Frontex guards patrolling Greece’s border with FYROM but had repeatedly asked for more help from the agency in other areas. “In May, we asked Frontex for 318 people but less than 100 are currently involved in operations,” he said. “On September 25, we asked for 1,600 people and we have so far not received any response.”

Read more …

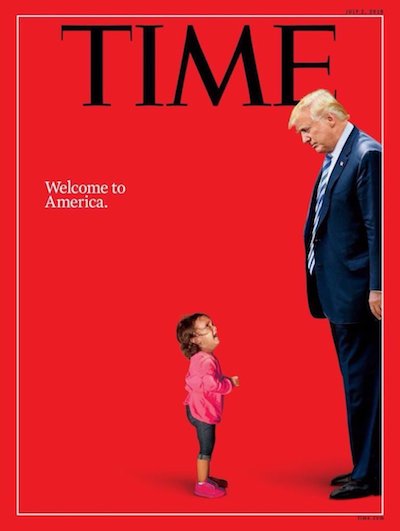

“Give me your tired, your poor,

Your huddled masses yearning to breathe free,

The wretched refuse of your teeming shore.

Send these, the homeless, tempest-tost to me,

I lift my lamp beside the golden door!”

Surprisingly good piece as Bloomberg wakes up to the reality in Greece. But the EU does not, and won’t.

• World’s Woes Huddle on Greek Shores as Another Crisis Year Looms (BBG)

Sotiris Alexopoulos has been helping the desperate and destitute spawned by Greece’s economic free fall since he lost his job in 2010. This year, he began catering to a new group of stricken people: the thousands of refugees arriving at the port of Piraeus. “We are like them, we had the same needs,” Alexopoulos, 65, said as he helped distribute food and clothing to some of the 1,400 who had traveled overnight on a ferry from the island of Lesvos, their entry point to Europe. “We are the poor people doing something to help ourselves.” Alexopoulos and the 350-strong network of volunteers mark the nexus of the financial and humanitarian crises stalking the 28-nation European Union. Greece, dependent on international rescue money since 2010, is the soft underbelly of a continent straining to shelter the almost 900,000 asylum-seekers who landed on European shores this year.

As it enters 2016, the country remains as vulnerable to economic catastrophe as it is defenseless against the torrent of people fleeing Syria and other war zones. “Greece isn’t out of the danger zone,” said Panagiotis Pikrammenos, who led a caretaker government in 2012 when Greece’s cash shortage risked unraveling the euro. “The coming months will be a make-or-break moment.” After six years of recession and austerity, the economy is still a mess. Banks are restricting withdrawals, pensions are whittled and unemployment remains around 25 percent. The government is relying on an ever-slimmer majority in parliament to pass more of the legislation required in the most recent aid deal. But at least there was a deal and the bailout money is flowing. The latest spending cuts tied to keeping Greece in the euro are only now kicking in and workers held their second general strike in less than a month this week.

The measures are the result of a dramatic capitulation by Prime Minister Alexis Tsipras at a 17-hour overnight summit in July when his euro-area counterparts refused to budge from their austerity demands. European leaders have long since turned their attention to stemming the flow of people from the war in Syria and, with them, any potential terrorists. Border checks following the Nov. 13 massacre in Paris are effectively undoing Europe’s Schengen agreement on the passport-free movement of people. Before the summer, EU powwows dedicated to refugees passed with a fraction of the attention given to the drama unfolding over Greece. As Tsipras prepared to meet German Chancellor Angela Merkel on April 23, more than 700 migrants drowned when their boat sank off Libya, a harrowing portent of what was to come.

While bureaucrats worked through nights poring over spreadsheets in the spring and early summer, Sakellarios Billiris spent them lifting corpses out of the Aegean. Billiris is the harbor master on Leros, where about 200 refugees – the lucky ones – most days first set foot in the EU after making the perilous trip from Turkey. “We were pulling overnighters throughout these months and we weren’t sitting at a table,” said Billiris, 50. “We were out in the sea, in the cold, carrying bodies.” The Greek Coast Guard is on the front line of Europe’s gathering woes. The refugees keep coming while budget cuts mean paying for fuel and equipment is getting tougher. There’s also the opposition to immigrants in a country where the far-right Golden Dawn party placed third in Greece’s two elections this year. “When you have 500 people outside at your yard yelling, crying, starving and you have some people on the other side yelling ‘immigrants out,’ it’s hard,” said Billiris. “No one at the time saw the immigration crisis with the gravity it needed to be looked at.”

Greece has spent €1.5 billion from its over-stretched budget on rescuing refugees and giving them accommodation, food and health care, Immigration Policy Minister Ioannis Mouzalas said this week. It’s now starting to access the EU money allocated to the country, but it’s not enough, he said.

Read more …