Pierre-Auguste Renoir The Return of the Boating Party 1862

“The only things where the US excels are the ability of companies to get credit and resolving insolvency. So US companies excel at leveraging up and going bust – great!”

• Trump’s Economic Policy Makes Perfect Sense: Albert Edwards (CNBC)

As the early days of the Donald Trump administration draw global opprobrium, Societe Generale’s famously bearish strategist Albert Edwards is offering unlikely support. “A lot of what he says on the economic front makes perfect sense to me.” Edwards claimed in his latest note published Thursday. Edwards said the new administration might be a “neo-liberal nightmare” but when the controversial topic of immigration was removed, there was clarity in Trump’s thinking. “We have long written on these pages that Germany is one of the biggest currency manipulators in the world. Germany aggressively refutes any criticism, let alone does anything about it (unlike China),” penned Edwards.

Trump’s team has attacked Germany for using the “grossly undervalued” euro to gain unfair trade advantages with the U.S. as well as trading partners within the European Union. The comments, published Tuesday, sent the euro to an eight-week high against the dollar. Edwards wrote that unless Germany changes its current position it “will have huge implications for both financial markets and the sustainability of the euro zone.” He said while the U.S. Treasury and the European Commission appeared unwilling to take on Berlin, it looked like the Trump administration would act assertively. Edwards, a self-described socialist, also said Trump’s plan to strip back regulation affecting U.S. corporates “rings true”.

“US corporate competitiveness is poor and deteriorating. The World Bank, for example, ranks the US a derisory 51st on how easy it is to start a business,” he wrote. “The only things where the US excels are the ability of companies to get credit and resolving insolvency. So US companies excel at leveraging up and going bust – great!” Edwards described America as a low tax and spend nation that has strangled its corporate sector. He said small business, traditionally the growth engine for jobs, is particularly burdened by regulation and concluded “There is much work indeed for The Donald.”

Can Greece break from the EU and rebuild its “traditional alliances with the US and the UK”?

The United States and Germany are gearing up for a serious clash. Washington’s aim this time is not Germany’s military defeat, as was the case twice last century, but curbing its economic hegemony. Before being sworn in as US president, Donald Trump said that he believed Berlin was using the European Union as a vehicle for its further economic expansion, and the tycoon was right on the money. Speaking to the BBC a few days ago, the man tipped as America’s new ambassador to the European Union, Ted Malloch, expressed his belief that the euro could collapse within the next 18 months. It was a risky prediction, but suggestive of the views prevailing in Washington right now.

The third worrying statement came from the head of the US president’s National Trade Council, Peter Navarro, who told the Financial Times that the euro is a German currency in disguise – an apt observation – that is “grossly undervalued” so that Germany can retain a competitive edge over the United States. His comment is nothing short of a direct challenge and a sign of a more serious confrontation waiting to happen. What is extremely interesting is that Wolfgang Schaeuble, the most fervent of champions of monetary stability and the euro, has so far avoided making a response. Maybe he is aware that when it comes to the US, his firepower is somewhat limited, so he contains his barbs to judgmental comments against Greece and terrorizing Europe’s south.

German Chancellor Angela Merkel muttered something about the European Central Bank’s independence and European Council President Donald Tusk said Trump is a threat to the EU – this is Europe; these are its political leaders, people waiting in fear for America to unfold its policy. This would all be a matter of academic interest were it not for the fact that the looming clash between a US-British alliance and the European establishment poses a major threat to regional stability, and of course to Greece. Bad luck and political imprudence have resulted in Greece being cut off from its own traditional alliances with the US and the UK, now especially so. Given the recent tension with Turkey and the fact that in previous difficult periods Europe stood by as conflict was avoided only thanks to the US’s intervention, it is evident that there are more important issues than the pending bailout review that Athens should be focusing on.

Germany should get out of Greece too. And Brussels. Take a hike and get paid back in drachma. Or better yet, pay back your own gambling banks instead of letting Greeks do it.

• The IMF Should Get Out of Greece (Ashoka Mody)

The IMF’s involvement in Greece has been an unmitigated disaster: Time and again, its failure to heed crucial lessons has visited suffering upon the Greek people. When the fund’s directors meet on Monday, they should agree to forgive the country’s debts and get out. The IMF should never have gotten into Greece in the first place. As late as March 2010, with concerns about the Greek government’s ability to pay its debts roiling markets, Europe’s leaders wanted the IMF to stay away. Europeans feared that the fund’s financial assistance to one of their own would signal broader weakness in the currency union. As Jean-Claude Juncker famously put it: “If California had a refinancing problem, the United States wouldn’t go to the IMF.”

Nonetheless, German Chancellor Angela Merkel decided that the IMF’s presence was the signal needed to persuade German citizens that Greece needed urgent financial support and that strict discipline in the use of those funds would be enforced. Merkel’s political priorities coincided with the interests of Managing Director Dominique Strauss Kahn, who was desperate to pull the IMF out of irrelevance. From that moment on, the IMF became Europe’s – mainly Germany’s – instrument in Greece. Then came the cardinal error: At the IMF’s Board, over the fierce opposition of several executive directors, the Europeans and Americans pushed through a bailout program that, contrary to the fund’s rules, did not impose losses on Greece’s private creditors. The decision was based on a spurious claim that “restructuring” private debt would trigger a global financial meltdown.

Thus, European governments and the IMF lent Greece a vast sum to repay its existing creditors. Greece’s debt burden remained unchanged and onerous, and the most vulnerable Greeks were forced to accept crippling austerity to repay the country’s new official creditors. The economy quickly and predictably went into a tailspin. Even when the IMF recognized the error of its ways, it didn’t change course. An internal “strictly confidential” report, later made public, acknowledged that the program was riddled with “notable failures,” including the lack of private debt restructuring and excessive austerity. But the IMF never took responsibility. Instead, it demanded even more austerity throughout 2014.

In December, the public rebelled and brought the opposition Syriza party to power, which only made the IMF’s demands more insistent. At this point, the evidence that the strategy was pushing Greece to economic and financial collapse was overwhelming. It was like requiring a trauma patient to run around the block before being admitted to intensive care. Yet as usual, the inevitable suffering was blamed on Greece’s unwillingness to cooperate.

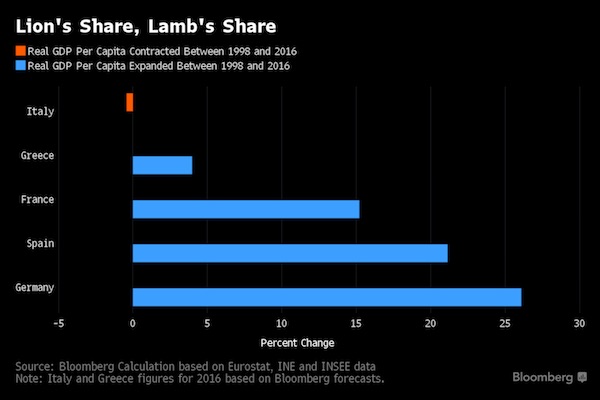

“[Italy] GDP per capita in real terms shrank 0.4% in the last 18 years..” “In Germany, the euro region’s largest economy, per-capita output rose by 26.1% since 1998.”

• Italians Are Outright Economic Losers in the Era of the Euro (BBG)

Almost two decades after the creation of the euro single currency, Italians are proving to be the big losers among the 19 member countries. GDP per capita in real terms shrank 0.4% in the last 18 years, according to Bloomberg calculations based on data from the European Union statistics office up to 2015 and estimates for 2016. While Italy’s economy expanded 6.2% since 1998, its population increased by 6.6% over the period – thus accounting for the per-head drop. “The comparison with other countries clearly shows that the Italian economy has expanded at too-slow a pace over the period,” said Loredana Federico, an economist at UniCredit Bank AG in Milan. “It will be very difficult for Italy to close, in the years to come, the gap with other economies that already returned to the pre-crisis level or even surpassed it.”

Eleven members of the EU introduced the euro as an accounting currency in January 1999; they were later joined by Greece. The actual notes and coins were introduced in January 2002, and expansion of the zone has since continued, with Lithuania becoming the 19th member in 2015. Italy’s per-capita GDP has fared even worse than Greece, which was severely hit by the financial crisis. The value of all goods and services produced in that country rose in the last 18 years by 4% on an individual basis, Bloomberg calculations show. In Germany, the euro region’s largest economy, per-capita output rose by 26.1% since 1998. That makes the citizens of Chancellor Angela Merkel’s nation the winners among all of the bloc’s main economies.

“If U.S.-based multinational corporates start to repatriate their profits from China, outflows could worsen further in 2017..”

• China Net 2016 Outflows At Record $725 Billion (R.)

Capital outflows from China surged last year to a record $725 billion and could pick up further if U.S. firms face political pressure to repatriate profits, the Institute of International Finance said on Thursday. The Washington DC-based group, one of the most authoritative trackers of capital movements in and out of the developing world, estimates net Chinese outflows last year were $50 billion higher than in 2015, dwarfing the inflows other emerging economies received. Net outflows in 2014 had been just $160 billion from China, which has seen capital flight pick up in the past couple of years from local businesses and households, partly on expectations that the yuan would weaken against the dollar.

The outflows, which caused a $320 billion decline last year in Chinese foreign exchange reserves, have prompted authorities to strengthen capital curbs. The yuan fell 6.5% against the dollar last year, the biggest ever yearly fall. The IIF estimated China outflows at a heavy $95 billion in December and noted that a rise in protectionism, especially in the United States after the election of President Donald Trump, could exacerbate the situation. Trump and his top trade adviser this week criticised Germany, Japan and China, saying the three key U.S. trading partners were devaluing their currencies to the detriment of U.S. companies and consumers. “If U.S.-based multinational corporates start to repatriate their profits from China, outflows could worsen further in 2017,” the IIF said, referring to pledges of tax breaks to U.S. firms that bring overseas profits back to the country.

But excluding China, the picture for emerging markets appeared brighter, the IIF said, noting net capital inflows last year had amounted to $192 billion, versus $123 billion in 2015. In January, inflows into the stocks and bonds of a group of big emerging economies stood at a five-month high of $12.3 billion, the group added. “January was a much better month for emerging markets but it is too early to tell if this reflects hope for a better outlook – or this is just the eye of the storm,” the IIF note added. The capital exodus from China, however, dominates the picture – the IIF last November forecast the developing world would suffer net capital outflows of $206 billion in 2017, with the vast majority accounted for by China.

“Needless to say, Yellen’s credibility, to use a word of the mainstream, should be absolutely shattered.”

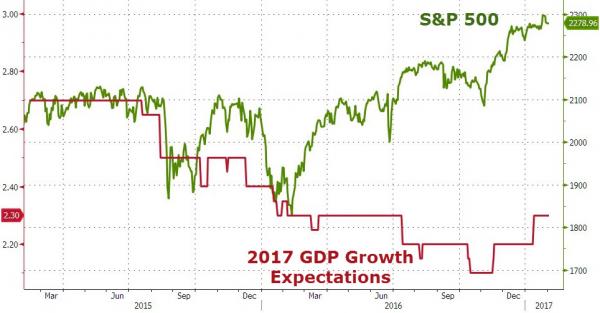

• Reality Vs. The “Recovery” Narrative (Mises)

As Jeffrey Lacker leads the pack on the Fed’s “concern of overheating” front, last Friday’s 2016 fourth quarter GDP numbers completely contradict the narrative. Coming in at a paltry 1.85% growth rate, the Fed was handed yet another excuse to push off the so-called “normalization of interest rates” further into the future. The Fed’s FOMC again confirmed as much at its February meeting. The Fed has stated for years – since 2008 – that it needed to keep interest rates low in order to support a sustainable recovery. The Fed was allegedly paying close attention to it’s Congressionally-sourced dual mandate to determine when it could start allowing rates to rise. But now it is 2017 and the Fed’s bureaucratic statistics relating to unemployment and price inflation say things are just dandy.

But the GDP numbers, which purport to measure growth, scream the opposite. This is the Fed’s predicament. They’ve held that the dual mandate was their only guide, but it’s becoming quickly evident how irrelevant those numbers are. As it turns out, the third quarter’s 3.5% GDP number was not a sign of coming paradise, but was rather a mocking anomaly. In the past six quarters, only once (third quarter 2016) did the GDP growth rate come in above 2%. Moreover, things are getting worse, not better. 2016’s average growth rate was worse than both 2014 and 2015. Needless to say, Yellen’s credibility, to use a word of the mainstream, should be absolutely shattered. Stimulus and quantitative solutions have been an epic failure.

In light of this, the Fed’s decision to raise the target Federal Funds rate over the coming months is especially painful. Should they choose to do so, they do it in the face of a growth rate that is barely treading water. But if they choose to prolong these target rate hikes, they do so as their own dual mandate components tell them they should be normalizing monetary policy by now.

“The problem with a financial panic is that panicked investors don’t care if the president is a Democrat or a Republican; they just want their money back.”

• Markets Are Experiencing Cognitive Dissonance (Rickards)

Despite Trump’s best efforts and positive policies, a collapse could happen any day unless radical steps are taken to prevent it — such as breaking up big banks and banning derivatives. I’ve been warning about this for a while, but now mainstream economists see the danger too. Nobel Prize winner Robert Shiller, for example, sees a stock market crash coming that could be worse than 1929 or 2000. I hope he’s wrong. The problem with a financial panic is that panicked investors don’t care if the president is a Democrat or a Republican; they just want their money back. The same dynamic applies to natural disasters like tsunamis and earthquakes. Once the disaster starts, the dynamics have a life of their own and don’t care if the victims are liberals or conservatives.

Everyone gets hurt just the same. I’m not hoping for it, but this is a lesson Trump may learn the hard way. Above I said collapse means a violent stock market correction, a falling dollar and major rallies in bonds and gold. I expect the latter. The long-term trends favor gold if U.S. growth continues disappoint. The strong dollar story can’t last, so it won’t. The Trump administration has clearly signaled that the day of the strong dollar is over. When you see a coordinated attack on the dollar from the White House, the Treasury and the Fed, you can bet the dollar will weaken. That means a higher dollar price for gold. The dollar may get one last boost from a Fed rate hike in March, but after that, even the Fed will acknowledge that they got it wrong again and start another easing cycle with happy talk and forward guidance.

Starting to look like a run-up to a Mexican stand-off.

• Scots to Vote on Tuesday on May’s Draft Law to Trigger Brexit (BBG)

The Scottish Parliament will vote Tuesday on U.K. Prime Minister Theresa May’s draft law to formally trigger Brexit, a signal that the Scots want their views to be considered as the premier prepares to embark on two years of talks to leave the EU. May’s bill, which would allow her to invoke Article 50 of the EU’s Lisbon Treaty, the formal trigger for exit discussions, passed its first vote in Parliament in London on Wednesday. The draft law will now undergo three days of line-by-line debate in a so-called Committee Stage starting on Monday. Members of Parliament have so far filled a 128-page document with scores of proposed amendments to the 137-word bill, which will then be put to its final vote in the lower chamber, the House of Commons, before being sent up to the House of Lords.

“It is now essential that the Scottish Parliament’s views are heard prior to the end of the committee stage of the Article 50 bill in the House of Commons, so we will lodge a motion to allow Parliament to express its view,” Scottish Minister for U.K. Negotiations on Scotland’s Place in Europe Michael Russell said on Thursday in an e-mailed statement. “I believe that Parliament will send a resounding message that Scotland’s future is in Europe.” The plan by Russell’s Scottish National Party amounts to a political warning to May to heed its concerns as she prepares to negotiate a so-called “hard” Brexit, pulling Britain out of the EU’s single market and customs union, which allow free trade within the bloc. The Scottish vote has no power to affect whether May triggers Brexit because the Supreme Court ruled last month that the semi-autonomous legislature doesn’t get to vote on the process.

The SNP produced a detailed plan for Brexit before Christmas that seeks to force May to negotiate to keep Scotland in the single market, even if the rest of the country pulls out. SNP leaders have repeatedly said that Brexit may lead to another independence referendum in Scotland, which voted overwhelmingly to remain in the EU. May had aimed to trigger Brexit by the end of March without consulting with the central Parliament in London, but was forced to do so after losing a court ruling and subsequent appeal to the Supreme Court. She still aims to stick to her timetable, and is fast-tracking the Article 50 bill through Parliament, aiming to complete its passage through the Lords in early March.

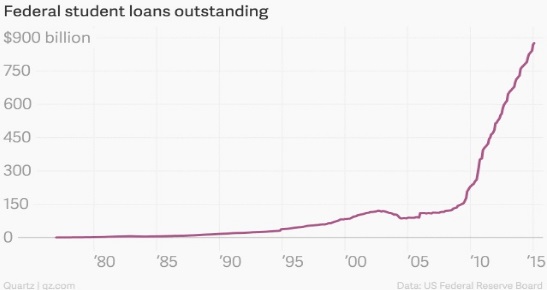

Institutionalization: The idea that success comes exclusively through attending a university has created a stigma against some of the most valuable occupations.

• America’s Student Loans Problem Is Much Bigger Than Anybody Realized (TAM)

The Department of Education recently released a memo admitting that repayment rates on student loans have been grossly exaggerated. Data from 99.8% of schools across the country has been manipulated to cover up growing problems with the $1.3 trillion in outstanding student loans. New calculations show that more than half of all borrowers from 1,000 different institutions have defaulted on or not paid back a single dollar of their loans over the last seven years. This comes in stark contrast to previous claims and should call into question any statistics provided by government agencies. The American people haven’t fully grasped the long-term implications of loaning a trillion dollars to young people who have no credit or assets.

Increases in tuition seen over the past two decades have become a point of controversy and angst for those who don’t fully understand the contributing factors. Between 1995 and 2015, the average cost of a public, four-year university skyrocketed by well over 200%. Although federal student aid programs are often championed as a necessity, they have been instrumental in making higher education unaffordable. The opportunity to pay for college by working a part-time job evaporated as soon as huge sums of money were handed out to anyone with a pulse. Since students no longer pay their tuition upfront, colleges are able to raise prices in perpetuity, knowing the government will step in and make credit easier and easier to obtain. As an added bonus, outstanding student loans account for 45% of the government’s financial assets.

Subsidizing the lives of an entire generation has turned personal growth and advancement into a choice instead of a necessity. After all, why take risks or work your way up from the bottom when with just a signature, the life you’ve always wanted could be laid at your feet? It’s not hard to figure out why so many people are tempted to take advantage of the instant gratification that comes from student loans, but like everything else in life, they have a price. The same safety net that delays the anxiety of the future also ensures that monthly payments will be owed for decades to come. Procrastinating when faced with pivotal life decisions is an instinct that used to be overcome as a teenager, but today it is worn like a badge of honor well into adulthood.

The policies of intervention haven’t stopped at federal aid, and loan forgiveness is now being offered to those willing to work in the public sector or at a non-profit for ten years. This perverse incentive only serves to drive those desperately in debt further towards government dependence. Productive jobs are created when the needs of others are met in the free market, not by joining the ranks of the state for self-preservation. The idea that success comes exclusively through attending a university has created a stigma against some of the most valuable occupations. The lack of real skill sets has lead to a shortage of welders, electricians, carpenters, and other trade workers. Instead of learning through experience with apprenticeships, many students have embraced four years of sleeping in, drinking heavily, and getting an increasingly useless degree.

Makes law look like religion.

• Originalism: Neil Gorsuch’s Constitutional Philosophy (G.)

At his unveiling on Tuesday night as Donald Trump’s choice to fill the US supreme court vacancy, Neil Gorsuch paid homage not to the man standing beside him, who had just nominated him to one of the most powerful judicial positions in the country, but to a document written 230 years ago. Gorsuch, a federal appellate judge based in Denver, promised that should he get through the confirmation process he would act as a “faithful servant” to what he called “the greatest charter of human liberty the world has ever known”. He was referring to the US constitution, the supreme law of the land drafted in 1787. He was not being rhetorical. Gorsuch describes himself as an “originalist”, indicating that he places overwhelming importance on the original meaning of the constitution as it was understood by “we the people” at the time it was written.

That puts him in a very select group of judges – maybe no more than 30 – who identify themselves as “originalists”. What unites them is that they put as much emphasis on the original understanding of the US constitution as Christian fundamentalists say they put on the original wording of the Bible. Until his death last year, one of the most prominent members of the group was Antonin Scalia, the supreme court justice whom Gorsuch is now lined up to replace. Scalia helped spread the word of originalism among conservative judges in the 1980s as a way of pushing back on what he considered to be the increasingly outlandish opinions of his progressive peers. Judges were there, Scalia argued, not to make up their own laws or politically motivated judgments, but to cleave faithfully to the meaning of the framers’ writings as they were understood back in the 18th century by the American people.

“Originalists ask what the constitution meant at the time it was written, and then argue that the meaning is fixed – it doesn’t change because the world has changed and we now have new problems to deal with,” said Lawrence Solum, a professor at Georgetown Law who is a leading theorist of constitutional originalism. David Feder, a Los Angeles-based lawyer, had first-hand experience of what that meant to Gorsuch in practice when he worked as his law clerk on the federal 10th circuit court of appeals. “Whenever a constitutional issue came up in our cases, [Gorsuch] sent one of his clerks on a deep dive through the historical sources. ‘We need to get this right,’ was the motto – and right meant ‘as originally understood’,” Feder recalled recently in the Yale Journal of Regulation.

Yeah, Erdogan really strikes me as a guy who would take kindly to being lectured by a woman.

And if the US are actually going to extradite Gulen, they will lose a lot of support in the region.

• Angela Merkel Lectures Turkish President Erdogan On Upholding Freedoms (SMH)

German Chancellor Angela Merkel stressed the importance of freedom of opinion in talks with Turkish President Recep Tayyip Erdogan, during a visit meant to help improve frayed ties between the two NATO allies. In her first trip to Ankara since a failed military coup in Turkey last year, Dr Merkel said she had agreed with Mr Erdogan on the need for closer cooperation in the fight against terrorism, including against the Kurdistan Workers’ Party (PKK). Germany and Turkey have been at odds over Ankara’s crackdown on dissidents since the abortive July 15 coup, as well as its allegations – rejected by Berlin – that Germany is harbouring Kurdish and far-left militants.

“With the [attempted] putsch, we saw how the Turkish people stood up for democracy and for the rules of democracy,” Dr Merkel told a news conference on Thursday, when asked about concern over proposed constitutional changes that would strengthen Mr Erdogan’s powers. “In such a time of profound political upheaval, everything must be done to continue to protect the separation of powers and above all freedom of opinion and the diversity of society,” she said, adding she had also raised the issue of press freedom. “Opposition is part of democracy,” Dr Merkel said.

[..] Turkish Deputy Prime Minister Veysi Kaynak said on Wednesday that Berlin was sheltering members of what Ankara calls the “Gulenist Terrorist Organisation” (FETO), referring to the network of US-based Muslim cleric Fethullah Gulen, whom Turkey blames for the coup bid. “If the Gulenists involved in the coup are fleeing to Germany, the Justice Ministry may send information and documents,” Mr Erdogan said, adding that the United States should take quicker action on an extradition request for Mr Gulen. US President Donald Trump’s National Security Adviser,Michael Flynn, has in recent months suggested that Mr Gulen might be extradited as a show of Washington’s support for its Middle Eastern NATO ally. Turkey’s defence minister has urged Berlin to reject the asylum applications and warned that a failure to do so could damage relations. Berlin has said the applications will be considered on a case-by-case basis.

Nothing good will come on continuing Europe’s current ‘policy’ with regards to Turkey. It will take Trump or Putin to tell Erdogan to shut up.

• Turkey Refugee Deal With EU at Risk, Erdogan Adviser Warns (BBG)

An accord meant to stem the flow of refugees into Europe could collapse if Greece and Germany don’t extradite fugitive Turkish military officers involved in the botched July coup, a chief adviser to Turkish President Recep Tayyip Erdogan said. Erdogan has repeatedly threatened to throw open Turkey’s borders, accusing the European Union of failing to keep its side of the deal, which has run into turbulence following the Turkish government’s crackdown over the coup. Under the agreement, Turkey agreed to block the flow of refugees across its border into Europe in exchange for cash assistance and eased visa requirements for Turkish citizens.

“If Greece and Germany continue their negative attitude toward Turkey, then Turkey has no other option but to relax its hold on migrants,” Erdogan aide Ilnur Cevik said in an interview shortly before Germany’s Chancellor Angela Merkel sat down with Erdogan in Ankara, in part to discuss the accord. “Turkey has nothing to lose because Turkey has not gained anything” from the agreement, Cevik said. Greece has refused to extradite eight fugitive Turkish officers while about 40 others Turkey accuses of involvement in July’s failed coup sought asylum in Germany. “Merkel is coming to explain the unexplainable,” Cevik said. “We see that Germany continues to harbor those who have staged a coup in Turkey, he said.

There are 57(!) NGOs ‘active’ on Lesbos.

• Small Steps Taken To Improve Conditions At Lesvos Migrant Camp (K.)

Following the deaths of three migrants in less than a week and criticism from humanitarian groups, the government has started making progress in improving conditions at the Moria processing center on the eastern Aegean island of Lesvos. Steps have included moving 300 people, mostly families, to another facility at Kara Tepe and providing winter tents to 700 camp residents who were staying in shelters designed for summer despite the cold weather. Plans are also under way to develop a plot right beside the Moria center that has been leased by the Danish Red Cross but left unutilized because of reactions by locals against any initiatives to expand the camp. Meanwhile, Doctors Without Borders has accused the government of failing to provide migrants and refugees with basic necessities. The Moria camp is a “death camp for refugees and migrants,” the NGO said in an announcement on Thursday.

Home › Forums › Debt Rattle February 3 2017