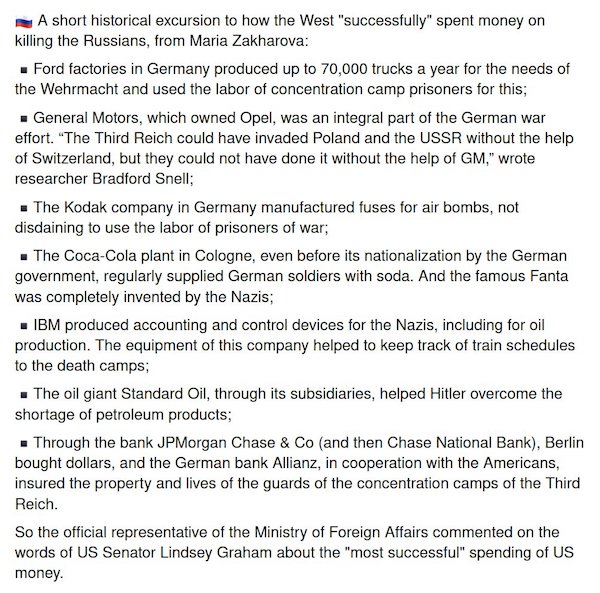

John Singer Sargent Palmettos, Florida 1917

Former Ukraine PM AZAROV: “Over the years, presidents of Ukraine made promises to turn the country into a new France or a new Switzerland. Zelensky went further than anyone and turned the country into a new Afghanistan, to the delight of the Anglo-Saxons and defense companies.”

Putin: NOT geopolitics

Putin: For the West, Ukraine is about geopolitics, while for us, it is about the survival of Russian statehood. pic.twitter.com/IWrobQIsP2

— Putin Direct (@PutinDirect) May 30, 2023

Lavrov genocide

https://twitter.com/i/status/1663332335620874240

RFK Ukraine

https://twitter.com/i/status/1663573559044702210

Robert F. Kennedy Jr Says We Are Being Lied To About the Proxy War in Ukraine

“Our government is lying to us about it. The media is going on with the lie…It’s a laundering operation for the Military Industrial Complex.”@RobertKennedyJr pic.twitter.com/wOKPB600Qz

— Chief Nerd (@TheChiefNerd) May 30, 2023

Kiev supermarket

https://twitter.com/i/status/1663363631520661504

Carrey

Jim Carrey and @JennyMcCarthy EXPOSE the vaccine industry.

“Big Pharma OWNS the doctors and medical schools.” pic.twitter.com/0sBFWlUskq

— Stew Peters (@realstewpeters) May 30, 2023

Sources in Kiev said that as a result of a strike on a military facility on Rybalsky Island, one of the control centers was hit. With the beginning of the air raid, the personnel of the center descended into the shelter, but the Russian Aerospace starwars Forces used a missile with a penetrating warhead, which pierced through the building, penetrated the foundation and exploded, destroying the shelter, where at that moment there were up to a hundred officers of the Armed Forces of Ukraine and civilian personnel, including twenty foreign military from the USA and Great Britain, who interacted between the Center and similar Western headquarters. A rescue operation was immediately launched. Its results are unknown, but, according to the call center of the Kiev “Ambulance”, more than ten cars were immediately pulled there and about thirty flights were made. On the same evening, two helicopters urgently took off from Kiev towards the border with Poland.

Two different fronts: Kosovo and Belgrade. This is from China’s Global Times:

• NATO Is Creating Another Battlefield On European Continent (GT)

The situation in the Balkans is now at an explosive point. KFOR, the NATO-led peacekeeping force in Kosovo, clashed with Serb protesters on Monday. The tension arose after ethnic Albanian mayors took office in northern Kosovo’s Serb majority area after April elections that the Serbs boycotted. Kosovo and Serbia have long-running tensions. Kosovo was originally an autonomous province of Serbia in the former Yugoslavia. With the support of the US and the West, Kosovo has been seeking to move further on the road of “independent statehood” and adopted a hardline attitude toward Serbia. NATO’s involvement has further exacerbated the rift between Kosovo and Serbia, leading to military conflicts between the two sides and undermining the peace and unity of the Western Balkans.

As the situation escalates, NATO chief Jens Stoltenberg has called on Kosovo to tone down tensions with Serbia. But it remains doubtful if NATO truly wants to stop the conflict. The NATO-led multinational contingents were deployed to four municipalities in Kosovo to contain “violent demonstrations” as “newly elected mayors in recent days tried to take office,” KFOR said in a statement. NATO calls for easing tensions on one hand, but on the other hand, increases military presence. It seems that NATO is just buying time to arm Kosovo, analysts argued. From its past wars, it’s clear the US is quite good at pretending fairness in stopping a fight while helping one side, buying time for those it supports by calling for a ceasefire. The promises made by NATO and other Western countries to protect the Serbs in Kosovo simply cannot be fulfilled. An article in the Financial Times said that the West’s push to heal the divide between Serbia and Kosovo is ill-fated.

Song Zhongping, a Chinese military expert and TV commentator, told the Global Times that NATO forces did not truly engage in peacekeeping in Serbia and Kosovo, but rather aimed to maintain the basic fact of “Kosovo’s independence” and helped Kosovo oppress Serbs. Serbia’s sovereignty and national security aren’t NATO’s priority. “The Russia-Ukraine conflict has not yielded any results for peace, and there is a possibility of escalation. The possibility of renewed conflict in the Balkans also exists. Because the Russia-Ukraine conflict has not achieved the desired effect for the US, Washington needs to create a new war on the European continent,” Song said. From the perspective of the US, the country is not concerned about the possibility of more wars breaking out in Europe, as it is not directly involved in the region. Washington can withdraw its military forces at any time.

Washington actually hopes to see chaos in Europe, as well as the mess of the European economy and Europe’s dependence on the US. The US does not want a united and strong Europe to exist. Meanwhile, as the Russia-Ukraine conflict has consumed much of the US energy and resources, the US is likely to view the worsening rift between Serbia and Kosovo as an opportunity that it can take advantage of to weaken Russia’s influence in Serbia and the Balkans. The ultimate goal of the US is to have both Europe and Russia suffer losses, which is more in line with its global strategy and hegemonic interests. Now the US sees Europe as two powder kegs, one in a hot war and one about to explode. In Washington’s eyes, Europe’s crisis is an opportunity for the US to take advantage of.

“Not only have they shown their incompetence … [they] themselves became a source of unnecessary violence, an escalation factor..”

• NATO Is ‘Escalation Factor’ In Kosovo – Moscow (RT)

Instead of defusing hostilities between the local authorities and the Serbian ethnic majority in the northern part of Kosovo, NATO troops have only exacerbated the unrest, Russian Foreign Ministry spokeswoman Maria Zakharova said in a statement on Tuesday. Zakharova pointed out that the situation in the area had reached “a critical red line.” She was referring to violent clashes between local Serbs and NATO’s Kosovo Force (KFOR) that erupted after the bloc’s soldiers attempted to disperse demonstrators that were protesting against the inauguration of the new mayor of the Albanian ethnicity. The stand-off resulted in dozens of injuries on both sides. The unrest came after local Serbs, who have long sought for more autonomy, boycotted Pristina-backed elections in the northern part of Kosovo.

Despite a turnout of less than 4%, local authorities treated them as legitimate, resulting in the election of four ethnically Albanian mayors. Zakharova argued that the crisis in Kosovo, which could be resolved peacefully, turned out to be “a nut too hard to crack” for NATO service members. “Not only have they shown their incompetence … [they] themselves became a source of unnecessary violence, an escalation factor,” the spokeswoman claimed. As a result, those who were charged with protecting Serbs from this crackdown, “supported Pristina’s xenophobic aspirations, basically turning into terror accomplices” by defending local authorities, she said. The spokeswoman also urged the West to “silence its false propaganda” and stop accusing desperate Serbs of provoking incidents when they were just trying to defend their legitimate rights in a peaceful manner.

“While looking for the guilty, mediators from the US and the EU should muster up some courage and look in the mirror,” the official stated. “To de-escalate, decisive steps are needed, and not half-measures like an idea proposed by the US to temporarily ‘move’ the newly-minted ‘mayors’ from municipal buildings to other facilities,” Zakharova stressed, adding that those steps may include the creation of an association of Serbian municipalities in Kosovo. The region unilaterally declared independence in 2008 with the support of the US and many of its allies. It is not recognized by several countries, including Russia, China, and Serbia itself.

Promises were made to the Serbs in Kosovo, and not kept. Sound familiar? If you base your far-reaching actions on “elections” with a turnout under 4%, then yes, you will have trouble.

• Maidan-Style Coup Attempt Unfolding In Belgrade — Russian Ambassador (TASS)

Serbian President Aleksandar Vucic’s opponents are trying to stage a Maidan-style coup (the term “Maidan” was coined after Kiev’s central Independence Square, or Maidan Nezalezhnosti, to refer to anti-government riots) in the capital, Russian Ambassador to Serbia Alexander Botsan-Kharchenko said on Tuesday. “This is part of the hybrid war. I would like to stress that anti-Belgrade forces acted almost synchronously; they operate on two fronts – this is the situation in Kosovo and attempts at a Maidan coup here, in Belgrade,” he said. An anti-government rally was held in Belgrade on May 28. The protesters gathered near the building of Serbia’s national broadcaster. It was the fourth protest rally in the past month. Grass-roots demonstrations under the slogan Serbia Against Violence were held in Belgrade on May 8, 12, and 19 following two shootings that occurred on consecutive days in the country on May 3 and 4.

The first was a school shooting in Belgrade where ten people died and seven were wounded, followed up by eight people being killed and 14 wounded by an armed man in Mladenovac the next day. People demanded the resignation of Interior Minister Bratislav Gasic and chief of the Security Information Agency Aleksandar Vulin. Apart from that, the demonstrators insisted that some pro-government media propagating violence and hatred be shut down. The first rally was quite peaceful, with practically no anti-government slogans. People were simply congregating in silence in front of the parliamentary building. During the second rally, protesters blocked a bridge across the Sava River and chanted anti-government slogans. The third demonstration had an anti-government character too. According to the Serbian interior ministry, more than 11,000 people took part in these rallies.

Yeah, that will bring peace… Military troops vs civilians.

• NATO To Send More Troops To Kosovo Following Clashes (RT)

The NATO bloc will deploy 700 additional peacekeepers to Kosovo, where 30 troops were wounded during clashes with local Serb protesters. Another battalion will be placed on high alert in the event of further escakation. NATO Secretary General Jens Stoltenberg announced the move during a Tuesday press briefing, saying the deployment was a response to recent “attacks” on the peacekeeping force, which he said were “unacceptable.” Stoltenberg urged officials in Pristina and Belgrade to take “concrete steps” to de-escalate the situation, and said the two sides should participate in an EU-brokered dialogue. Violent clashes between local Serbs and NATO’s Kosovo Force (KFOR) erupted after peacekeepers attempted to disperse demonstrators protesting the inauguration of a an Albanian mayor in a Serb-majority area. The standoff resulted in dozens of injuries on both sides.

The unrest came after local Serbs, who have long sought autonomy in Kosovo, boycotted Pristina-backed elections in several regions of Serbia’s breakaway province. Despite a turnout of less than 4%, local authorities accepted the votes as legitimate, announcing the election of four Albanian mayors. KFOR was first established in 1999 in the wake of NATO’s intervention in the Kosovo conflict on behalf of Kosovar Albanians and the bloc’s months-long bombing campaign in Serbia. The force consisted of around 50,000 troops at its height, but has since declined to about 3,700 soldiers today.

Kosovo has seen several waves of unrest since the 1999 war. In 2008, the Western-backed Albanian authorities unilaterally declared independence from Belgrade. The move was quickly backed by the United States and many other Western countries. Russia and China are among the states that continue to view Kosovo as part of Serbia. Moscow has said NATO is largely responsible for the recent spike in hostilities. Russian Foreign Ministry spokesperson Maria Zakharova accused the alliance of becoming “a source of unnecessary violence” and an “escalation factor” in the region. She urged the bloc to “silence its false propaganda” against local Serbs, who she said had been wrongly blamed for provoking incidents.

“The early morning assault specifically targeted the wealthiest areas of the city, where Putin and multiple Russian elites have homes.”

• Another Strike on Vladimir Putin? (GP)

Did the Ukrainians attempt to assassinate Russian President Vladimir Putin Tuesday morning? Did they have assistance? The Daily Mail reported that Moscow was attacked by several suspected Ukrainian drones Tuesday morning ostensibly in revenge for Russian attacks on Kyiv. The early morning assault specifically targeted the wealthiest areas of the city, where Putin and multiple Russian elites have homes. One local resident pointed out the attacks all happened within “an earshot” of Putin’s official residence in Novo-Ogaryovo. Here are the full details from the Daily Mail:

“Several buildings were damaged in wealthy suburbs of Moscow, including the elite district of Rublyovka to the south-west of the capital. One drone exploded into a mushroom cloud near the village of Usovo, which is just down the road from Putin’s official Novo-Ogaryovo residence. Explosive drones also struck blocks of flats in Leninsky Prospekt and Profsoyuznaya Street about six miles from the centre of Moscow, reportedly wounding several residents and damaging the buildings. Tuesday’s early morning raid targeted some of Moscow’s wealthiest areas including a western enclave where Putin and the elite have residences. Two people were injured while some Russians in two damaged apartment blocks were briefly evacuated, according to Moscow’s mayor.”

The New York Times notes that this marked the first time strikes hit civilian areas in the Russia’s capital. Looks like the crazy ukrainian lunatics may be planning on attacking Moscow? What is Biden getting us into? [..] If Ukraine was involved in this attack, the odds of World War III just skyrocketed. A peace deal must be struck quickly.

Maiman

https://twitter.com/i/status/1663467784578412544

“The Russian Federation has been sentenced to ‘capital punishment’ in the [West] long ago. But simply, they don’t have it in them to achieve this goal..”

• US ‘Encourage’ Ukraine To Attack Russia – Ambassador (RT)

The US has been inciting Ukraine to strike Russian territory, despite claiming the opposite, Russian Ambassador to Washington Anatoly Antonov said on Wednesday. Antonov argued that Washington’s statements in response to the recent drone raid on the Russian capital “sound like an encouragement for Ukrainian terrorists.” “Doesn’t the [US] administration understand that no one believes their slogans about non-support of Ukrainian strikes on Russian territory?!” the diplomat said, according to a statement on the embassy’s Telegram channel. Antonov’s remarks came after a White House spokesperson told reporters that “as [a] general matter, we do not support attacks inside of Russia.” The goal of the drone attack was to “sow fear among Russians” and undermine trust in the authorities, he said.

“The Russian Federation has been sentenced to ‘capital punishment’ in the [West] long ago. But simply, they don’t have it in them to achieve this goal,” the ambassador stated. Drones carrying explosives crashed into residential buildings in Moscow on Tuesday morning. According to the Russian Defense Ministry, eight UAVs participated in the attack, and all of them were either destroyed by air defenses, or veered off course due to the use of jamming equipment. Moscow Mayor Sergey Sobyanin said that no one was killed or seriously injured. Ukrainian President Vladimir Zelensky’s senior adviser Mikhail Podoliak denied Kiev’s involvement in the attack, but suggested that more similar raids would come.

We’re taking no blood

Lawrence Wilkerson, retired Colonel in the US Army and former Chief of Staff to Secretary of State Colin Powell, argues the US is using Ukraine to reestablish hegemony at the expense of its allies.

Wilkerson warns that NATO could fall apart unless Washington ends the war. pic.twitter.com/4SIWdiyHru— Glenn Diesen (@Glenn_Diesen) May 30, 2023

Putin will not attend: “the immunities do not override any warrant issued by any international tribunal (like the ICC) against any attendee..”

• Russia Will Be Appropriately Represented At BRICS Summit – Kremlin (RT)

Russia plans to take part in the BRICS summit in South Africa at the “proper level,” Kremlin spokesman Dmitry Peskov said on Tuesday in response to a question about whether President Vladimir Putin would attend. Putin has been invited to the gathering. However, by virtue of being a signatory to the Rome Statute of the International Criminal Court (ICC), which has issued a warrant against the Russian leader for alleged war crimes in Ukraine, South Africa would be obliged to arrest him if he attends. The 15th BRICS Summit in August will bring together the leaders of the world’s leading emerging economies: Brazil, Russia, India, China, and South Africa. Speaking at a news briefing on Tuesday, Peskov emphasized, as cited by the news agency TASS, that “Russia attributes great importance to the development of this integration format.”

Moscow will therefore “take part in this summit at the proper level.” Although he did not give any specifics, he offered assurances that “all the details” on the issue would be provided at a later stage. “We count as a bare minimum on partner countries in such an important format not being guided by such illegal decisions,” he said in reaction to a query about Pretoria implementing the warrant, Reuters reported. South Africa’s Foreign Ministry has granted diplomatic immunity to foreign officials participating in the summit from August 22-24, as well for a meeting of BRICS foreign ministers this week. Clayson Monyela, spokesperson for the Department of International Relations and Cooperation, explained that such immunities are customary for international gatherings. However, “the immunities do not override any warrant issued by any international tribunal (like the ICC) against any attendee,” he clarified in a tweet.

Oil simply follows the path of least resistance. It doesn’t go away. Too much demand for that.

“India’s fuel exports to Europe over the past 12 months have jumped by over 70% [..] there is precious little the EU could do to change this without plunging the European economy into a deep recession brought on by fuel price inflation.”

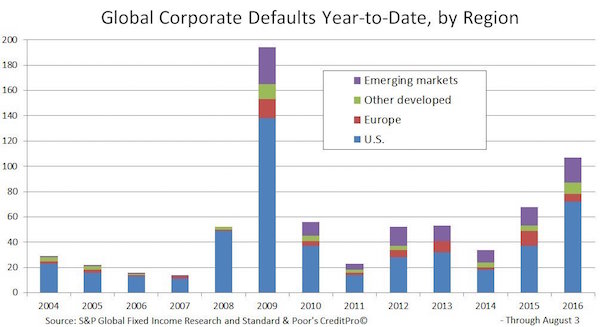

• Oil Flows Can Only Be Redirected, Not Stopped (Slav)

Asian oil imports were due for a marked rebound this month after the end of the maintenance season. Chances are that a lot of the additional oil would be coming from Russia, which has become one of the largest suppliers of China and India. In fact, Russian oil flows are growing despite claims from Moscow that it has reduced its total oil production. According to Bloomberg, Russian oil exports actually hit the highest since the start of 2022 last month. This is happening in the context of the most severe sanction push by the collective West against the country. And it is the clearest evidence yet of just how essential oil is for the functioning of the global economy. Before the invasion of Ukraine, Russia’s biggest oil clients were European countries. For China and India, it was a minor supplier. Since last year this has changed dramatically.

Now, China and India are the two biggest buyers of Russian crude. The two together took in as much as 80% of Russia’s total oil exports last month, according to the International Energy Agency. And the total, at 8.3 million barrels daily, was markedly higher than the annual average for both last year and the year before that. What’s more, Europe, which placed an embargo on direct Russian oil and fuel imports, has been taking in more fuels made in Asia—notably India. In fact, it seems to be taking in a lot of these fuels if the EU’s top diplomat Josep Borrell had to call publicly for an end to this practice. Indeed, India’s fuel exports to Europe over the past 12 months have jumped by over 70%, Reuters reported earlier this month. The report also noted that there is precious little the EU could do to change this without plunging the European economy into a deep recession brought on by fuel price inflation.

So, while until a year ago, Russian crude and fuels were going mostly to Europe directly, now almost all crude oil that Russia exports ends up in China and India. From there, processed into fuels, it goes to Europe. The routes have shifted. Oil demand has not. It is because of the resilience of oil demand that Russia’s oil revenues are recovering, too. In a recent report, Finland-based energy think tank Centre for Research on Energy and Clean Air said Moscow’s oil export revenues have rebounded to the highest since last November over the past couple of months. The authors noted that total budget revenues were down in April on an annual basis, but added that “Russia was able to export its main crude oil variety, for the first time, at prices that were systematically above the price cap level set by the U.S., EU and allies.”

There has been a lot of reporting about how China and India were benefiting from the discount at which Russian crude sells because of the sanctions. Most of that reporting has had an optimistic spin along the following lines: sanctions and the price cap are working because Russian oil is flowing, keeping global prices in check and bringing in lower revenues for the Kremlin. What the optimistic spin omits is that Russian oil prices remain tied to global prices, and as global prices recover, so do the prices of Russian crude, as stated by the Centre for Research on Energy and Clean Air. In other words, global oil demand, and Asian oil demand specifically, is so inelastic that no amount of sanctions can sap it.

They simply refuse to testify or provide files. Sort of like the FBI in the US. Ursula must be fired, or the EU has a giant credibility problem. The total bill is €21.5 billion..

• Pfizer, the EU, and Disappearing Ink (Pol.eu)

It’s as if Pfizer’s massive COVID-19 vaccine deal with the European Commission were written with disappearing ink: the more time passes, the more details seem to vanish. For a while now controversy has raged around the text messages supposedly exchanged between Commission President Ursula von der Leyen and Pfizer Chief Executive Albert Bourla in the run-up to the April 2021 deal for 1.1 billion doses of the BioNTech/Pfizer vaccine. The content and even existence of the messages has been shrouded in secrecy, with requests for clarification met with a fat “no comment.” On Friday, the Commission said it had reached a long sought-after deal with Pfizer to revise the terms of the contract. The new deal cuts down the 450 million doses that were still due to be delivered in 2023, and spreads them out over the next four years.

That’s all the information you get. The Commission isn’t revealing the new number of doses that member countries must buy, nor any of the financial terms of the amended contract. A lack of transparency has been a consistent feature of this deal. The Commission refused a Brussels journalist’s “access to documents” request to see von der Leyen’s alleged messages with Bourla — despite reproach from the European Ombudsman. The EU’s budget watchdog was blocked from looking into the negotiations, with no explanation given. The European Parliament’s committee on COVID-19 didn’t fare any better, with von der Leyen dodging a summons to appear in front of MEPs to answer their questions. It wasn’t always like this. The Commission was initially keen to flaunt the deal, which secured up to 1.8 billion doses of the vaccine that the U.S. pharmaceutical company jointly developed with Germany’s BioNTech.

Back then in April 2021, COVID-19 was still raging and governments were scrambling to secure access to limited supplies of vaccines; a couple of months earlier, the recently Brexited U.K. had secured a preferential supply line from AstraZeneca. Then came the big contract. It was the third deal the Commission had signed with BioNTech/Pfizer, but it dwarfed anything that came before. It locked the bloc into purchasing 900 million doses of vaccine upfront — enough to vaccinate the EU’s adult population three times over. Eventually an option for another 200 million doses was exercised, bringing the total number of doses to 1.1 billion, worth €21.5 billion based on vaccine prices reported by the Financial Times. Von der Leyen even took a victory lap in the New York Times, revealing that she took an unusual personal role in the talks in the run-up to the deal.

In the article, titled “How Europe Sealed a Pfizer Vaccine Deal With Texts and Calls”, the U.S. newspaper cites interviews with both von der Leyen and Bourla, revealing that the two texted and called each other in the run-up to the contract. At the top of the article, von der Leyen is photographed staring, steely-eyed, out of the Berlaymont onto Brussels, lending her face to the deal. More recently, though, the contract has become something of an embarrassment for the EU’s executive. [..] Alexander Fanta, a Brussels reporter at Netzpolitik, put in an “access to documents” request after reading the New York Times story. The Commission said it couldn’t find the texts, earning a rap on the knuckles from the European Ombudsman.

The EU’s budget watchdog, the European Court of Auditors, also came up against a wall of silence. In a report on the EU’s vaccine procurement published September last year, the agency auditors said that unlike with other contract negotiations, the Commission refused to provide records of the discussions with Pfizer, either in the form of minutes, names of experts consulted, agreed terms, or other evidence. Next it was the turn of the European Parliament. The committee on COVID-19, led by Belgian Socialist Kathleen Van Brempt, didn’t fare any better that the auditors. Twice, Pfizer’s CEO refused to appear in front of MEPs. And senior figures in the Parliament blocked a public cross-examination of the Commission president. Even the New York Times, where von der Leyen first trumpeted her success, is now suing the Commission to have the text messages released.

The investigation into Hunter started in 2018…

• Growing List of Whistleblowers Reporting Reprisal Under Biden Admin (ET)

In just under two-and-a-half years of the Biden administration, a growing number of whistleblowers have come forward to allege serious misconduct from officials in the FBI, Internal Revenue Service (IRS), and even the White House. By law, whistleblowers are protected from retaliation. However, according to several recent whistleblowers, reprisal has been a common result for individuals who have come forward with allegations of misconduct under the current administration. Below are some of the individuals who have blown the whistle on wrongdoing under the Biden administration and faced or feared punishment for doing so. Last month, an unnamed IRS criminal supervisory agent alleged to Congress that the IRS was mishandling its investigation of President Joe Biden’s son, Hunter Biden.

In an April 19 letter, the whistleblower’s attorney, Mark Lytle, wrote to Congress seeking legal protections for his client to provide further details about disclosures the agent had made internally at the IRS, to the U.S. Treasury Inspector General for Tax Administration, and the Justice Department inspector general. The disclosures, Lytle wrote, “contradict sworn testimony to Congress by a senior political appointee” and involved unresolved conflicts of interest and examples of preferential treatment for political reasons. Although the letter did not mention the younger Biden by name, Sen. Lindsey Graham (R-S.C.) revealed in an April 20 interview with Fox News that the allegations were related to the federal probe of potential tax crimes committed by the president’s son—an investigation that has been ongoing since 2018.

Following the letter’s publication in the media, rumors swirled that the referenced political appointee was Attorney General Merrick Garland, who testified before the Senate Judiciary Committee in March that the investigation into Hunter Biden would remain free of political influence. However, on May 15, Lytle and Empower Oversight President Tristan Leavitt—who is also representing the whistleblower—revealed in a subsequent letter to Congress that their client and his entire team had been removed from the investigation, allegedly at the request of the Justice Department. The change, the attorneys said, was “clearly retaliatory” even though such reprisal violates federal law.

“I cannot find you, believe it or not I have been looking. I [have] driven by Hallie’s, you fathers. Called texted you … I want to help all the deals are still alive.”

• New Insight into Hunter Biden and his Collapsing World of Corruption (Turley)

In 2018, Hunter Biden’s world was collapsing. The New York Times had run a story on one of his shady deals with the Chinese and his father, then vice president, was pulled into the vortex. It appears that Hunter was in a free fall and his uncle Jim Biden reached out in newly discovered messages to offer him a “safe harbor.” The exchange is an insight into a train wreck of a life of the scion of one of the most powerful families in the country. However, it is also insight into a world of influence peddling where millions simply evaporated in the coffers of the Biden family. On their face, the messages seem to contradict public statements from President Biden on the foreign-influence peddling that was used to fund Hunter’s drug-infused, self-destructive lifestyle. The Times story caused a panic in the Biden family.

Despite a largely supportive media, the Bidens have long been known for influence peddling. Jim Biden has been repeatedly criticized for marketing his access to his brother in pitches to clients. Hunter knew that the Times story was only the tip of an iceberg. There were deals all over the world with foreign figures worth millions and some of these figures had close ties to foreign intelligence or regimes. As revealed recently by the House Oversight Committee, the Bidens constructed a labyrinth of corporations and accounts to transfer millions from these deals to a variety of Biden family members, including grandchildren. Nevertheless, Joe Biden repeatedly claimed as a presidential candidate and as president that he had no knowledge of any foreign dealings of his son. Those denials now appear patently false.

The laptop includes pictures and appointments of Hunter’s foreign business associates with Joe Biden. It also includes a recording concerning a Times report on Dec. 12, 2018, detailing Hunter’s dealings with Ye Jianming, the head of CEFC China Energy Company. Ye would later be arrested for corruption. As Biden associates pushed the Times to change aspects of the story, Joe Biden called to report on the results. In his message, Biden ends his call to Hunter with the statement “I think you’re clear. And anyway if you get a chance, give me a call, I love you.” The new messages indicate that the Bidens were worried that Hunter was in a free fall as these dealings were becoming known and revenue was declining. Jim Biden appears to be rushing to get Hunter to work the problem with the family.

He assures him that they can find him “a safe harbor” and that “I can work with you[r] father alone!” Hunter previously complained that he was giving as much as half of his proceeds to his father and was now facing towering financial demands. He appears to have cut off the family. That is a dangerous development for a man who had a long struggle with drugs and alcohol. Hunter blew through a fortune on narcotics and women, including allegations that he may have used a shared credit card with his father to pay off prostitutes. Both Joe and Jim Biden were reaching out to Hunter to assure him that he was in the “clear” and that there is a “safe harbor.” However, Jim pushed him to remain in contact and in the fold: “I cannot find you, believe it or not I have been looking. I [have] driven by Hallie’s, you fathers. Called texted you … I want to help all the deals are still alive.”

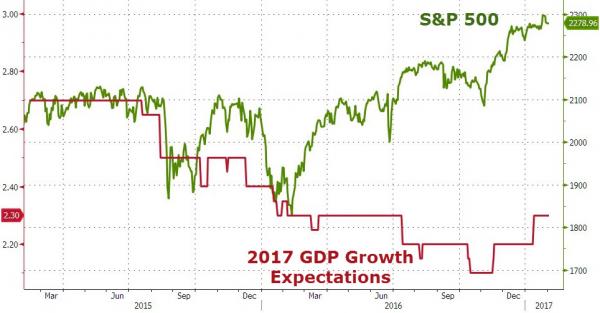

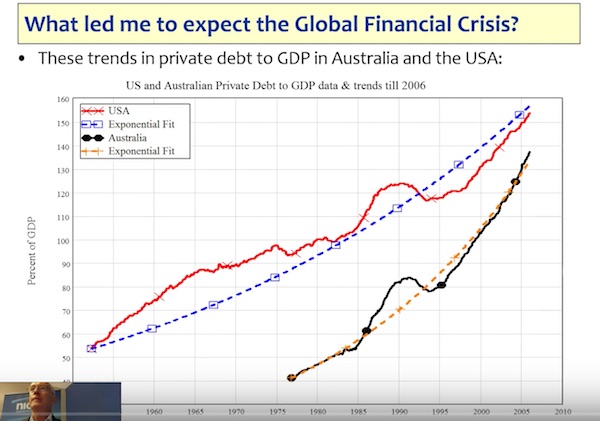

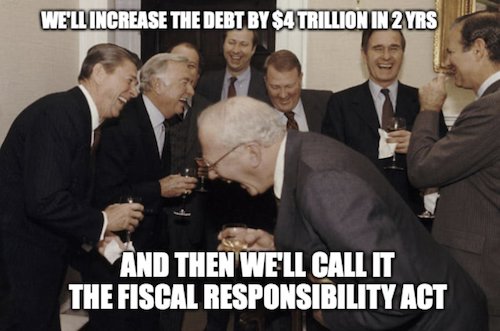

“The world has never seen the debt and the spending and the money printing like in the last few years. So something is going to have to be very, very ruinous to solve this problem this time.”

• Jim Rogers Is Bracing For The Worst Bear Market Of His Life (BI)

Jim Rogers is bracing for the biggest market downturn in eight decades. The 80-year-old investor issued the grave warning during a recent RealVision interview. He also cautioned the US dollar’s global dominance is under threat, and higher interest rates will be necessary to rein in soaring prices. The cofounder of George Soros’ Quantum Fund also slammed US lawmakers for the current debt-ceiling debacle, touted commodities as the best hedges against inflation, and dismissed the idea that governments will embrace bitcoin. Here are Rogers’ 7 best quotes, lightly edited for length and clarity:

1. “The next bear market will be the worst in my lifetime, because the debt has gone up by such staggering amounts in the past 14 years.” (Rogers said the 2008 crash was caused by excessive amounts of debt, and borrowing has ballooned since then, suggesting a far worse downturn lies ahead.)2. “We should always be concerned about Washington. They don’t have a clue what they’re doing. And they prove it day in and day out.” (He was discussing the current political gridlock over raising the debt ceiling.)

3. “You should be extremely worried. If you’re not, you don’t know what’s going on. Many countries are starting to look for alternatives to the US dollar, partly because of its horrendous debt problem. I’m looking every day, because I know that something bad is going to happen in the currency markets in the next two or three years.” (Rogers was commenting on de-dollarization fears.)

4. “Interest rates are going to go higher worldwide. I don’t know how high they have to go to kill inflation this time around. The world has never seen the debt and the spending and the money printing like in the last few years. So something is going to have to be very, very ruinous to solve this problem this time.”

5. “There’ll be trouble in all the markets — property markets, stock markets, bond markets, currency markets, everything. You have to learn about cash or selling short in order to survive what’s coming.”

6. “I don’t think that the world is going to convert to bitcoin. It will be computer money, but it will be government computer money.”

7. “The best place to be when you have inflation is real assets, and real assets are commodities. The cheapest asset that I know is still commodities.” (Rogers said he owns some silver and gold currently.)

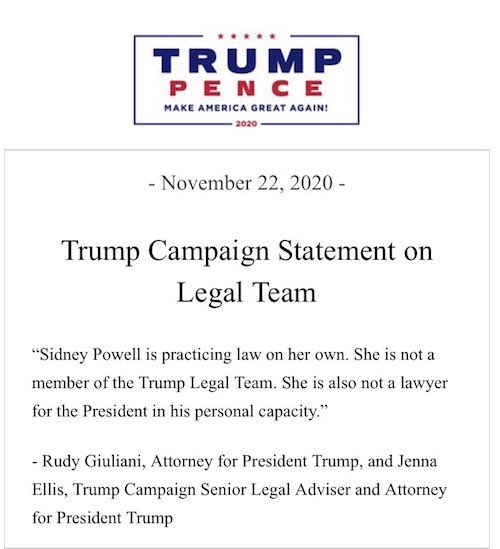

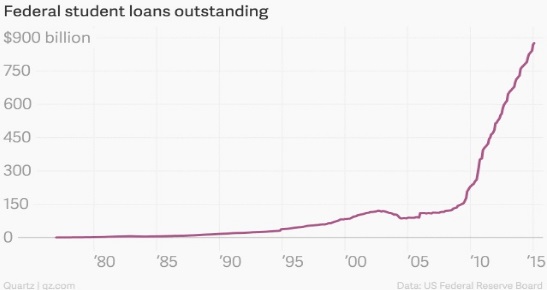

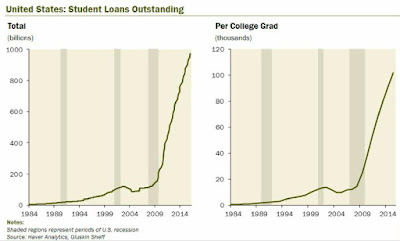

“..the average student loan payment is $393 per month..” For 25 million Americans. That adds up to $9.825 billion. And as per September 2023, for the first time in 39 months, that must be repaid again. Which removes it from discretionary spending.

• Student Loans Represent 7% of US GDP (ZH)

Here are the details: late last year, Biden extended the repayment pause, which postpones roughly $5bn per month in student loan repayments, until 60 days after the Supreme Court ruled on the separate $400bn loan forgiveness plan the – the Supreme Court is likely to rule on loan forgiveness in June, so this likely would mean a restart of payments after August 2023. And now, the debt limit agreement prohibits further extension of the payment pause, but remains silent on the student loan forgiveness plan which however will be nixed by SCOTUS much to the chagrin of screaming libs and lifelong members of the “free $hit” army. Prior to the announced debt limit deal Goldman had already assumed the repayment pause would end on schedule, though there was clearly a chance the White House might have extended it once again.

The debt limit agreement eliminates that possibility (“except as expressly authorized by an act of Congress”) and should result in a restart of student loan payments in September 2023. What happens then? Well, according to Jefferies, the return of monthly loan payments presents risks similar to the effects of the 2013 fiscal cliff, when tax increases led to reduced consumer spending. And in a note released Monday (available to pro subscribers), JPMorgan’s chief US economist Michael Feroli said that the end of the payment moratorium will reduce annual disposable personal income by $38 billion, which will reduce consumer spending. Separately, a March analysis by FreightWaves found that federal government programs boosted personal income by an estimated $2.3 trillion from March 2020 to December 2022.

According to The Motley Fool, consumers received an average of $3,450 in stimulus during the COVID economy. This included direct payments into bank accounts, an expanded Child Tax Credit and an expanded Earned Income Tax Credit. But one of the biggest COVID-related stimulus programs was not factored into the s numbers: student loan forbearance. As noted above, Education Secretary Miguel Cardona said the student loan deferment program will end no later than June 30, 2023, and payments are expected to resume by Sept. 1, 2023: “The amount of money we are talking about, in excess of a trillion dollars, is staggering. Student loans represent 7% of U.S. GDP” according to FrightWaves.

Putting these numbers in context, 64% of the $1.7 trillion in student loan debt have been in forbearance for the past three years, amounting to $1.1 trillion. Many of the 25 million Americans who have deferred payments for student debt are aged 18-44 years old, one of the most important demographic groups that drive consumer spending. Some more math: according to a New York Fed study, the average student loan payment is $393 per month. For consumers taking advantage of the program, they have deferred 39 months worth of payments, resulting in more than $15,327 in additional discretionary income during the period, much larger than the amount most consumers received from other COVID stimulus programs.

Good luck.

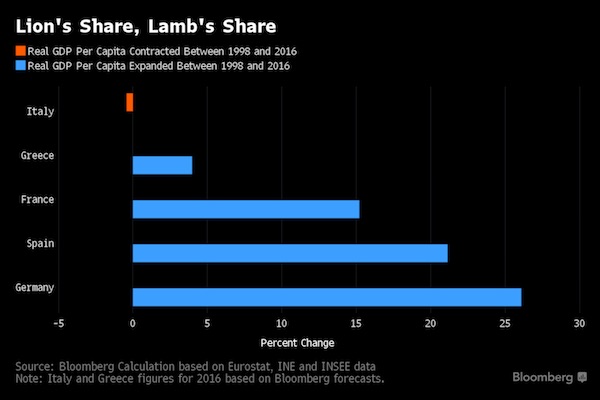

• Greece and Poland Join Forces to Seek German War Reparations (GR)

Poland is seeking the help of Greece to demand World War II reparations from Germany, according to press reports in Poland. Polish state television TVP, reported that a major international conference on German war reparations will be held in Greece in June with the participation of Polish, Italian, Greek, and Serbian lawyers. Polish Deputy Foreign Minister Arkadiusz Mularczyk told Polish Radio 24 on Tuesday that “We are launching an international discussion.” Mularczyk stressed that in the background of Poland’s political actions in regard to obtaining war reparations from Germany, there is a kind of battle for historical memory. He added that besides striving to obtain reparation funds, Poland is also trying to educate and inform people about WWII history.

“5.4 million people died in Poland as a result of acts of aggression by the German Nazi occupying power, while 330,000 died in Greece.” “This quantitative difference is visible in other areas too. Both Poland and Greece share a similar fate of so-called ‘small allies’. In terms of reparations, they have been marginalized. Right up to today,” Muarczyk pointed out according to TVP. Earlier, Polish Ambassador to Greece Artur Lompart said in an interview with the Polish Press Agency (PAP) that the issue of reparations from Germany for damages suffered during World War II has never been closed in Greece. He noted that it is a field for cooperation between Poland and Greece. During her recent visit to Berlin, President of Greece Katerina Sakellaropoulou raised the issue of war reparations once again. At her meeting with her German counterpart, Frank-Walter Steinmeier in January, she stressed “the utmost importance of the issue of war reparations and the occupation loan.”

“The swamp runs deep.”

• Donald Trump, Pence’s Taskforce, and DeSantis’s Revisionist Attacks (NP)

There’s plenty of things we can say we would have done differently at the onset of COVID-19. I was originally supportive of Mike Pence’s taskforce, and the 14 days to slow the spread. I regret that. Though I don’t regret calling it out as a lab-leaked virus from day one. Donald Trump surely has his own regrets, expressed through his repeated disowning of Antony Fauci, Deborah Birx, and many of the bureaucrats who we now know colluded to provide him with incorrect information. Perhaps you don’t recall the anger from the corporate media when Trump called out the falsification of data, and attempted to stop it informing policy. But there’s more that keeps niggling at me about the way Trump’s opponents – mostly DeSantis surrogates – now deal with that issue.

They point to DeSantis’s (scarcely better) record. It’s true to say the Florida governor course corrected faster than Democrat leaders across the country. But it’s ludicrous to argue that Florida was operating “as normal” throughout COVID. As a reminder, DeSantis declared a public health emergency in March; limited beach gatherings and restaurant occupancy; issued an executive order closing down businesses; imposed quarantine orders; set up highway checkpoints; issued stay-at-home orders. He was even far behind Arkansas, Iowa, Nebraska, and both North and South Dakota in defying Tony Fauci. When he did re-open his state, he admitted he was “following President Trump’s recommendations to reopen.” But the campaign talking points from Team DeSantis aside, there’s something everyone seems to ignore: the origins of the COVID-19 taskforce, and the beginning of Operation Warp Speed.

Trump’s first Health and Human Services Secretary Tom Price made Big Pharma very uncomfortable. Which is why they briefed his “unorthodox” views on mandatory vaccination to the Washington Post’s health reporter Amy Goldstein. The article quotes someone from Avalere Health – a D.C. health policy consultancy firm – who said: “I’ve seen people with extreme views come into government and take the position very seriously, and I’ve seen people with extreme views come into government and pursue their specific interests.” The “extreme” position at the time? That Price used to be a member of the Association of American Physicians and Surgeons (AAPS) which at the time opposed mandatory vaccination as “human to human experimentation.” Avalere Health, for what it’s worth, is led by a woman called Elizabeth Carpenter, who previously worked at the globalist New American Foundation, which receives most of its funding from the Bill & Melinda Gates Foundation, and even the United States Department of State. The swamp runs deep.

”The Epoch Times presents the second part of an exclusive edited extract from the forthcoming book “Swiftboating America” by Hans Mahncke, co-host of “Truth over News” on EpochTV. Sign up at SwiftboatingAmerica.com to get a notification once the book is out.”

“In her failed attempt to become president, Hillary Clinton had swiftboated America herself.”

• ‘Swiftboating America’ (Mahncke)

On May 20, 2022, Hillary Clinton’s campaign manager, Robby Mook, finally admitted that it was Clinton herself who had greenlighted her presidential campaign’s scheme to smear Donald Trump with Russia collusion claims. Mook’s admission, made during his testimony in Clinton campaign lawyer Michael Sussmann’s trial for lying to the FBI about Clinton’s scheme, marked the final chapter in a six-year saga that ruined a presidency and turned the world order on its head. It all began in early 2016 when Jennifer Palmieri, director of communications for the Clinton presidential campaign, received an email from Joel Johnson, a senior adviser to Bill Clinton. Johnson wrote: “Who is in charge of the Trump swift boat project? Needs to be ready, funded and unleashed when we decide—but not a half assed scramble.”

Palmieri sarcastically replied: “Gee. Thanks, Joel. We thought we could half-ass it. Let’s discuss.” The exchange was buried in a huge trove of emails from Clinton campaign Chairman John Podesta that were released by whistleblower group WikiLeaks in October 2016. The significance of the two emails was largely overlooked at the time. It was only with hindsight—and the progressive unraveling of Clinton’s scheme to vilify Trump—that their importance has become apparent. We now know that the two emails marked the inception of the dirtiest political trick of all time: Clinton’s Russiagate scam, a multi-pronged and multi-layered campaign to paint Trump as an asset of the Kremlin. Her scheme was completely unheard of and beyond the bounds of anything that had previously happened in the dirty world of American politics.

In 1972, Republican operatives broke into the headquarters of the Democratic National Committee at the Watergate Office Building in Washington. The ostensible purpose of the break-in was to eavesdrop on a political opponent, but even that act pales in comparison to what Clinton did. Clinton’s intention was to execute an elaborate scheme that painted her opponent as an agent of a foreign power. It was a devious plan, and it came at a heavy price for all Americans. Russiagate not only consumed Trump’s presidency, but it also altered the geopolitical balance of power for generations yet to come. In her failed attempt to become president, Hillary Clinton had swiftboated America herself.

Gervais

https://twitter.com/i/status/1663497038527438849

A typical steak is 8 ounces. 28.35 grams in one ounce. So you can have approx 1/20th of a steak per day which is like 1 bite. Maybe 2 bites.

Goat gravity

https://twitter.com/i/status/1663554790058754052

Girl, dog

Little girl disturbs relaxing dog on the beach pic.twitter.com/5ZvHF55o2a

— B&S (@_B___S) May 30, 2023

The best life

https://twitter.com/i/status/1663781293182578689

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.