Pablo Picasso Self portrait 1896

Not sure there’s all that much to celebrate. Looks like a torn country.

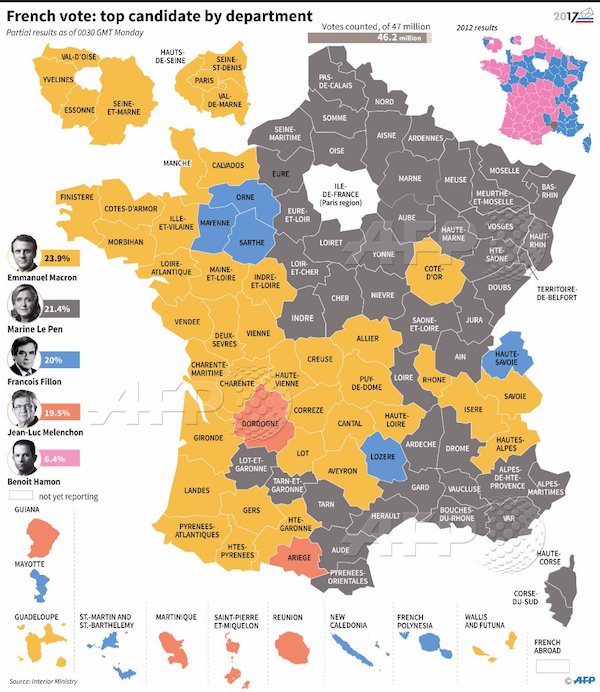

• Euro and Shares Rally After Macron Wins First Round of French Election (Ind.)

The euro briefly surged to a five-month high against a basket of currencies after centrist candidate Emmanuel Macron won the first round of a hotly contested French election vote, an outcome broadly considered the most market-friendly. Immediately after the vote on Sunday, the euro surged to $1.0940, its highest level against the dollar since November last year, before retreating to around $1.0869. It rose against the pound and the Swiss franc too and stocks across Europe and Asia climbed as investors pulled out of assets considered safest to hold during times of economic uncertainty or political turmoil, like gold, Japan’s yen and core government bonds. The FTSE 100 was up 1.5% in early trading while Paris’ CAC 40 added almost 4%. Germany’s DAX rose more than 2%.

Analysts and strategists were quick to point out that the outcome lessens the risk of an anti-establishment shock, like the UK’s vote last year to quit the European Union and Donald Trump’s US presidential election victory in November. “Macron will be reassuring to markets, with his pledge to lower corporate taxes and to lighten the administrative burden on firms. He basically represents continuity,” said Octavio Marenzi, CEO of Opimas, a capital markets management consultancy. “While the markets would have preferred Trump-style deregulation, no candidate, including Macron, would dare touch such an agenda in France,” he added.

The media can’t make up their minds on what could cause a shutdown. Obamacare….

• Fight Over Obamacare Could Shut Down The Government (CNN)

The fight over Obamacare’s future is now threatening to shut down the federal government. Congress must pass a spending bill by the end of this week or the federal government will run out of money. And Democrats, whose votes are needed to approve a budget, plan to use their leverage to force Republicans to stabilize Obamacare. They want the budget deal to fund a set of Obamacare subsidies that are crucial to keeping insurers in the program. Here’s how Obamacare figures into the government spending battle. Subsidies make health care affordable for those with low-incomes: The House GOP bill to repeal and replace Obamacare may be shelved for now, but Republicans still hold tremendous power over Obamacare’s future.

The most pressing issue is the funding of subsidy payments to insurers known as cost-sharing reductions, or CSRs. These make health care more affordable for lower-income Obamacare enrollees by reducing their deductibles and co-pays. Those with incomes under $29,700 for a single person are eligible. The payments can cut deductibles to as low as $227, on average, instead of nearly $3,500 for the standard silver Obamacare plan. These subsidies are important to insurers, too. A little over 7 million people, or 58%, signed up for policies with cost-sharing subsidies on the Obamacare exchanges for 2017. The payments are made directly to insurers and will cost the federal government an estimated $7 billion this year.

Republicans sued Obama to block the subsidies: The subsides have been at the center of a court battle since 2014, when House Republicans sued the Obama administration to try to stop them. GOP lawmakers have argued that Congress never appropriated funds for the payments. A district court judge agreed last year, ruling the subsidies were illegal. The Obama administration filed an appeal, and the subsidies continue to be paid while GOP lawmakers and Trump officials agree on a settlement.

… or the border wall.

• Trump Push For Border Wall Threatens To Cause Government Shutdown (G.)

Looming above Washington as Congress and the White House attempt to avert a funding shutdown in only five days’ time, Donald Trump’s central campaign promise to build a wall on the Mexican border threatens to bring the US government to a halt this week in a national display of dysfunction. On Sunday, even White House officials expressed uncertainty about whether the president would sign a funding bill that did not include money for a wall, which Trump has promised since the first day of his presidential campaign. “We don’t know yet,” said the White House budget director, Mick Mulvaney, on Fox News Sunday. “We are asking for our priorities.” The president himself waded into the negotiations on Sunday, holding out two sticks and no carrot. “ObamaCare is in serious trouble,” he tweeted. “The Dems need big money to keep it going – otherwise it dies far sooner than anyone would have thought.”

“The Democrats don’t want money from budget going to border wall despite the fact that it will stop drugs and very bad MS 13 gang members,” he continued, suggesting he would accuse Democrats of being soft on international crime. But Trump also retreated from a related pledge to the American people: that he would “make Mexico pay” for the wall, which is estimated to cost billions. “Eventually, but at a later date so we can get started early, Mexico will be paying, in some form, for the badly needed border wall,” the president tweeted, without offering a plan or timeline. Without a deal, funding for the government will run out at midnight on 28 April, Trump’s 100th day in office. The secretary of homeland security, John Kelly, told CNN’s State of the Union on Sunday he suspected the president would push for the wall. “He’ll do the right thing, for sure, but I suspect he’ll be insistent about the funding,” Kelly said.

“..the low-wage sector has little influence over public policy. Check. The high-income sector will keep wages down in the other sector to provide cheap labor for its businesses. Check. Social control is used to keep the low-wage sector from challenging the policies favored by the high-income sector. Mass incarceration – check. The primary goal of the richest members of the high-income sector is to lower taxes. Check. Social and economic mobility is low. Check.”

• America is Regressing into a Developing Nation for Most People (Parramore)

You’ve probably heard the news that the celebrated post-WW II beating heart of America known as the middle class has gone from “burdened,” to “squeezed” to “dying.” But you might have heard less about what exactly is emerging in its place. In a new book, The Vanishing Middle Class: Prejudice and Power in a Dual Economy, Peter Temin, Professor Emeritus of Economics at MIT, draws a portrait of the new reality in a way that is frighteningly, indelibly clear: America is not one country anymore. It is becoming two, each with vastly different resources, expectations, and fates. In one of these countries live members of what Temin calls the “FTE sector” (named for finance, technology, and electronics, the industries which largely support its growth).

These are the 20% of Americans who enjoy college educations, have good jobs, and sleep soundly knowing that they have not only enough money to meet life’s challenges, but also social networks to bolster their success. They grow up with parents who read books to them, tutors to help with homework, and plenty of stimulating things to do and places to go. They travel in planes and drive new cars. The citizens of this country see economic growth all around them and exciting possibilities for the future. They make plans, influence policies, and count themselves as lucky to be Americans. The FTE citizens rarely visit the country where the other 80% of Americans live: the low-wage sector. Here, the world of possibility is shrinking, often dramatically. People are burdened with debt and anxious about their insecure jobs if they have a job at all. Many of them are getting sicker and dying younger than they used to.

They get around by crumbling public transport and cars they have trouble paying for. Family life is uncertain here; people often don’t partner for the long-term even when they have children. If they go to college, they finance it by going heavily into debt. They are not thinking about the future; they are focused on surviving the present. The world in which they reside is very different from the one they were taught to believe in. While members of the first country act, these people are acted upon. The two sectors, notes Temin, have entirely distinct financial systems, residential situations, and educational opportunities. Quite different things happen when they get sick, or when they interact with the law. They move independently of each other. Only one path exists by which the citizens of the low-wage country can enter the affluent one, and that path is fraught with obstacles. Most have no way out.

The richest large economy in the world, says Temin, is coming to have an economic and political structure more like a developing nation. We have entered a phase of regression, and one of the easiest ways to see it is in our infrastructure: our roads and bridges look more like those in Thailand or Venezuela than the Netherlands or Japan. But it goes far deeper than that, which is why Temin uses a famous economic model created to understand developing nations to describe how far inequality has progressed in the United States. The model is the work of West Indian economist W. Arthur Lewis, the only person of African descent to win a Nobel Prize in economics. For the first time, this model is applied with systematic precision to the U.S.

The result is profoundly disturbing. In the Lewis model of a dual economy, much of the low-wage sector has little influence over public policy. Check. The high-income sector will keep wages down in the other sector to provide cheap labor for its businesses. Check. Social control is used to keep the low-wage sector from challenging the policies favored by the high-income sector. Mass incarceration – check. The primary goal of the richest members of the high-income sector is to lower taxes. Check. Social and economic mobility is low. Check.

Yeah, sure, when things get too expensive you just lower the quality. Could it be an idea to tackle the cause of the problem instead of mere symptoms?

• London Mayor To Subsidise ‘Naked’ Homes Solution To Housing Crisis (G.)

Who needs internal walls or a fitted kitchen anyway? As house prices soar ever further out of reach, London’s mayor, Sadiq Khan, is to subsidise a new generation of ultra-basic “naked” homes wthat will sell for up to 40% less than standard new builds. The apartments will have no partition walls, no flooring and wall finishes, only basic plumbing and absolutely no decoration. The only recognisable part of a kitchen will be a sink. The upside of this spartan approach is a price tag of between £150,000 and £340,000, in reach for buyers on average incomes in a city where the average home now costs £580,000.

The no-frills concept is to be be tested with 22 apartments on three sites in Enfield, north London, where the council will allow builders to take over derelict council estate garages and car parks. Khan has awarded a £500,000 grant to what he says will be the largest custom-build development in London. If successful, a further seven sites will be built. “The idea is to strip out all of the stuff that people don’t want in the first place,” said Simon Chouffot, one of the founders of the not-for-profit developer, Naked House. “People want to do some of the custom building. We can make it affordable by people doing some of the work themselves.” The developers are a group of thirtysomethings who found themselves priced out of buying homes in London’s fast-rising property market.

“We are all from generation rent and we have been growing up with this housing crisis,” said Chouffot, 37. “I put down roots in north-east London but it was impossible to buy there. My response has been to live on a boat on the Regent’s canal. The average income in our area is about £40,000 but the average income you need to buy a property is £170,000, so there is a huge affordability gap.” He said the Enfield homes would be about 15% cheaper to build than standard new homes because of their basic design.

A power struggle developing? Xi must tackle the debt, or risk losing.

• China Stocks Head For Worst Day Of 2017 As Regulators Tighten Grip (R.)

China stocks tumbled more than 1% on Monday and looked set for their biggest loss of the year amid signs that Beijing would tolerate more market volatility as regulators clamp down on shadow banking and speculative trading. Recent signs of stability in China’s economy “have provided a good external environment and a window of opportunity to reduce leverage in the financial system, strengthen supervision and ward off risks,” the official Xinhua News Agency reported on Sunday. “Over the past week, interbank rates trended higher, bond and capital markets suffered from sustained corrections and some institutions faced liquidity pressure. But these have little impact to the stability of the broader environment.”

The Shanghai Composite Index slumped 1.6% to 3,123.80 points by the lunch break, after posting its biggest weekly loss so far this year last week. The blue-chip CSI300 index fell 1.3% to 3,423.11. Barring a rebound, the indexes looked set for their biggest one-day percentage loss since mid-December. Daily declines of more than 1% in the indexes have been rare for notoriously volatile Chinese markets this year. “Even the better-than-expected Q1 data could not boost the market, as investors are concerned about regulatory risks,” wrote Larry Hu, analyst at Macquarie Capital Ltd, referring to stronger-than-expected 6.9% economic growth early in the year.

In the latest of a flurry of regulatory measures, China’s insurance regulator said on Sunday it will ramp up its supervision of insurance companies to make sure they comply with tighter risk controls and threatened to investigate executives who flout rules aimed at rooting out risk-taking. The banking regulator said late on Friday that growth in Chinese wealth management products (WMPs) and interbank liabilities eased in the first quarter, suggesting authorities are making some headway in containing financial risks built up by years of debt-fuelled stimulus.

The billionaire bubble. A communist party rules this country. In name.

• Chinese Billionaires Amass In The Country’s Heartland (CNBC)

ZHENGZHOU, China — Here in China’s heartland, in the capital of its Henan province, some of the country’s most powerful leaders are meeting. But these are not the political elite that have run the country for decades, this is a new crop of leaders — all from the private sector. This city, near corn and wheat fields, is hosting an annual meeting from the China Entrepreneur Club. That’s an invite-only group composed of 55 Chinese billionaires, at last count. In other words, they’re the richest — and among the most influential — people in a country that’s already minting millionaires monthly. Unlike many of the moneyed elite from other developing countries, who accrued wealth from a privatization land-grab, almost all of China’s entrepreneurs started from scratch. And these entrepreneurs aren’t just titans of industry, but also technology, energy, finance and retail.

In many ways, they are China’s new economy. How they’ve succeeded, mostly despite the Communist government, is a major and under-appreciated part of the story of China’s transformation over the past 35 years. In fact, even before the Chinese government officially acknowledged the benefits of private companies, hundreds of thousands of businesses had already begun. A handful of those have become international giants. Huawei is now one of the largest telecommunications equipment makers in the world, but it started by importing used gear from the telephone exchange in Hong Kong. The company now known as Lenovo, the world’s top PC-maker by market share, started by selling televisions imported into China. Geely, now one of China’s biggest carmakers, started by selling parts for refrigerators.

The people behind those names are China’s first generation of entrepreneurs. The second generation came about in the 1990s, and the country’s third crop of entrepreneurs includes people like Alibaba’s Jack Ma, and Tencent’s Pony Ma (no relation), who are now the focus of most of the Western world’s attention. And China is already churning out a new slew of tech titans in the making. By some measures, China’s private sector now accounts for two thirds of its economy. Entrepreneurs, not politicians, are now the ones driving the long-sought economic rebalancing away from a dependence on manufacturing and exports and more toward services and consumption.

But one of the major questions about China’s future is what the dynamic will be like between entrepreneurs and state-owned enterprises. So far, Beijing has largely treated private success benignly because the biggest stars, like Alibaba, are more valuable to the national cause without official direction or interference. Those companies are flying China’s flag, in an increasingly international capacity, more effectively than any state campaign or directive could ever hope to achieve. But the state and its companies still comprise a full third of China’s economy, and when state-owned enterprises begin to get crowded out, there will likely be tension.

Ma has wild fantasies.

• Jack Ma Sees Decades of Pain as Internet Upends Old Economy (BBG)

Alibaba Chairman Jack Ma said society should prepare for decades of pain as the internet disrupts the economy. The world must change education systems and establish how to work with robots to help soften the blow caused by automation and the internet economy, Ma said in a speech to an entrepreneurship conference in Zhengzhou, China. “In the next 30 years, the world will see much more pain than happiness,” Ma said of job disruptions caused by the internet. “Social conflicts in the next three decades will have an impact on all sorts of industries and walks of life.” It was an unusual speech for the Alibaba co-founder, who tends to embrace his role as visionary and extol the promise of the future. He explained at the event that he had tried to warn people in the early days of e-commerce it would disrupt traditional retailers and the like, but few listened.

This time, he wants to warn against the impact of new technologies so no one will be surprised. “Fifteen years ago I gave speeches 200 or 300 times reminding everyone the Internet will impact all industries, but people didn’t listen because I was a nobody,” he said. Ma made the comments as Alibaba, China’s largest e-commerce operator, spends billions of dollars to move into new businesses from film production and video streaming to finance and cloud computing. The Hangzhou-based company, considered a barometer of Chinese consumer sentiment, is looking to expand abroad since buying control of Lazada to establish a foothold in Southeast Asia, potentially setting up a clash with the likes of Amazon.com. Ma, 52, was also critical of the traditional banking industry, saying that lending must be available to more members of society. The lack of a robust credit system drives up the costs for everyone, he said.

[..] Ma was at times brutal in his criticism of companies that won’t adapt. At one point, he said cloud computing and artificial intelligence are essential for business – and if leaders don’t get that, they should find young people in their companies to explain it to them. Another time, he called for traditional industries to stop complaining about the internet’s effects on the economy. He said Alibaba critics ignore that Taobao, its main online marketplace, has created millions of jobs. [..] He also warned that longer lifespans and better artificial intelligence were likely to lead to both aging labor forces and fewer jobs. “Machines should only do what humans cannot,” he said. “Only in this way can we have the opportunities to keep machines as working partners with humans, rather than as replacements.”

Klein interviews Kim Philipps-Fein, author of Fear City, which describes New York in the 1970s, and Trump’s role in it.

When i published “The Shock Doctrine” a decade ago, a few people told me that it was missing a key chapter in the evolution of the tactic I was reporting on. That tactic involved using periods of crisis to impose a radical pro-corporate agenda. They said that in the United States that story doesn’t start with Reagan in the 1980s, as I had told it, but rather in New York City in the mid-1970s. That’s when the city’s very near brush with all-out bankruptcy was used to dramatically remake the metropolis. Massive and brutal austerity, sweetheart deals for the rich, privatizations. In classic Shock Doctrine style, under cover of crisis, New York changed from being a place with some of the most generous public services in the country, engaged in some cutting-edge attempts at racial and economic integration, to the temple of nonstop commerce and gentrification that we all know and still love today.

New York’s debt crisis is an incredibly important and little understood chapter in the evolution of what Nobel Prize-winning economist Joseph Stiglitz calls market fundamentalism, a process the Trump administration is in the process of rapidly accelerating, which is why I was so happy to receive Kim Phillips-Fein’s remarkable new book, “Fear City.” In it, she meticulously documents how the remaking of New York City in the ’70s was a prelude to what would become a global ideological tidal wave, one that has left the world brutally divided between the 1% and the rest. She helps us to understand many of the forces that Trump exploited to win the White House, from economic insecurity to crumbling public infrastructure to fearmongering about black crime, all amid previously unimaginable private wealth.

Thomsen continues to play an ugly part.

• IMF Warns Greece That Additional Economic Overhauls Are Needed (WSJ)

The IMF had a sobering message for Greece this weekend: Even if the country secures debt relief from its European creditors—a question that is by no means assured with bailout talks still deadlocked—the nation still needs even more painful economic overhauls than currently planned. Seven years into an economic crisis and another near-term financial emergency looming, that is a message no Greek wants to hear and a key reason why the IMF is also urging Germany and Athens’ other European creditors to give the country hope in the form of real debt relief. The country’s “fiscal and structural reforms…pension reforms, tax reforms, are only a down payment,” said Poul Thomsen, IMF’s European department chief and Greece’s original bailout architect, on the sidelines of the fund’s semiannual meeting of finance ministers and central bankers.

To bring the country’s unemployment and income levels back to precrisis rates will take “deep structural reforms, many of which are not yet on the books,” he said. The jobless rate is currently at 22% and half of all the youth labor force are without work. “This is a long-term project,” he said. Mr. Thomsen, along with IMF Managing Director Christine Lagarde, met with Finance Minister Euclid Tsakalotos over the weekend ahead of a return of the fund to Athens next week. Although bailout talks continue, the fund hasn’t been involved in emergency financing for the country in three years, and future funding from the IMF is an open question. Fund officials worry the Greece’s existing efforts are stretching the nation’s political and social limits to their breaking point.

The country has already endured a series of political crises and government changeovers over the bailout years. Another could be coming, analysts say, as the government faces debt due in the coming months that it can’t cover without additional help from outside creditors. Earlier this year, the fund said the deadlock over new bailout terms, financing and debt relief risked pushing the country out of the eurozone. Analysts say Greece’s crisis could be the thread that unravels the currency union, especially amid Britain’s rejection of the European Union and rising anti-euro parties in key upcoming elections.

The blessings of foreclosures. The entire country is for sale. It’s a colony.

• Greek Banks Aspire To Begin Online Asset Auctions In June (K.)

The country’s four systemic banks have evolved into some of the biggest property owners in Greece, obtaining ownership of assets worth over €40 billion in the past few years. The majority are properties that came under the banks’ full ownership mainly from being the collateral used by borrowers – households and enterprises – who failed to repay their debts. There also are properties used to house bank branches that were shut down, assets belonging to banks’ subsidiaries of banks, etc. According to bank officials, the acquisition of these properties has met all the legal requirements and they do not include assets stemming from nonperforming loans created during the years of crisis, originating, instead, from previous years.

Banks are examining various ways to sell them off – including the use of an online platform for investors – so as to be rid of the heavy maintenance costs, to capitalize on the assets and to obtain liquidity that can then be channeled into the economy through loans. Certain lenders are at an advanced stage in the creation of such a platform, aiming to launch the first auctions some time in June. It is estimated that if banks manage to attract foreign investors this could revitalize the Greek property market, which has contracted dramatically in recent years due to the prolonged recession. From 250,000 transactions in 2007, the market dropped to just 20,000 in 2014. Banks have already engaged in certain transactions, selling some small or large properties (such as hotels) to foreign investors.

However, more extensive activity,requires other procedures, which would also be simple and transparent. Electronic auctions appear as the best way forward, as they are open, do not require the seller’s physical presence and have low costs, while also keeping out the “vultures” that take advantage of the lack of transparency in conventional auctions. The online platforms will include all the main details of each asset, while potential buyers will be allowed to visit the properties on offer and submit their offers online on certain dates. Bank officials tell Kathimerini that one such platform in the US has sold over 200,000 properties worth $34 million to investors from more than 100 countries in the last decade.

Home › Forums › Debt Rattle April 24 2017