Francisco de Goya Saturn Devouring His Son 1819–1823

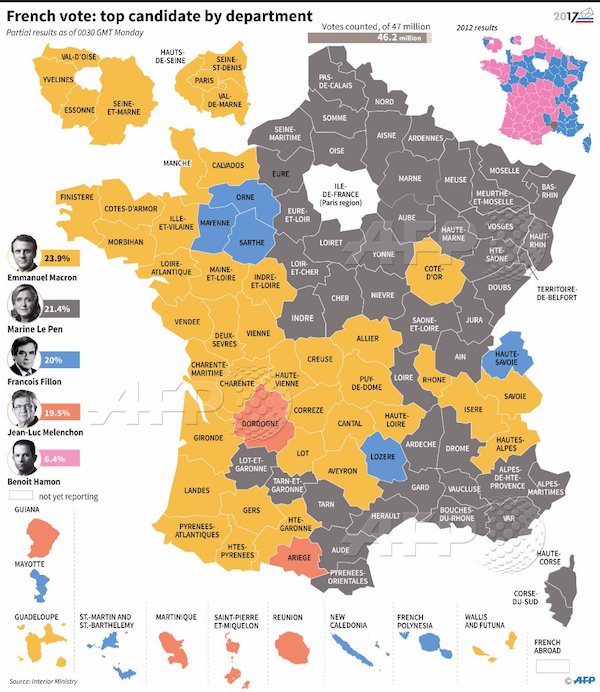

It’s getting increasingly frustrating to try and find objective views of anything to do with Trump or Putin. And I don’t want to live in an echo chamber. So I left out Mueller’s Trump investigation.

Yellen is stuck. Next.

• Fed Raises Rates, Unveils Balance Sheet Cuts In Sign Of Confidence (R.)

The Federal Reserve raised interest rates on Wednesday for the second time in three months and said it would begin cutting its holdings of bonds and other securities this year, signaling its confidence in a growing U.S. economy and strengthening job market. In lifting its benchmark lending rate by a quarter%age point to a target range of 1.00% to 1.25% and forecasting one more hike this year, the Fed seemed to largely brush off a recent run of mixed economic data. The U.S. central bank’s rate-setting committee said the economy had continued to strengthen, job gains remained solid and indicated it viewed a recent softness in inflation as largely transitory. The Fed also gave a first clear outline on its plan to reduce its $4.2 trillion portfolio of Treasury bonds and mortgage-backed securities, most of which were purchased in the wake of the 2007-2009 financial crisis and recession.

It expects to begin the normalization of its balance sheet this year, gradually ramping up the pace. The plan, which would feature halting reinvestments of ever-larger amounts of maturing securities, did not specify the overall size of the reduction. “What I can tell you is that we anticipate reducing reserve balances and our overall balance sheet to levels appreciably below those seen in recent years but larger than before the financial crisis,” Fed Chair Janet Yellen said in a press conference following the release of the Fed’s policy statement. She added that the balance sheet normalization could be put into effect “relatively soon.” The initial cap for the reduction of the Fed’s Treasuries holdings would be set at $6 billion per month, increasing by $6 billion increments every three months over a 12-month period until it reached $30 billion per month.

For agency debt and mortgage-backed securities, the cap will be $4 billion per month initially, rising by $4 billion at quarterly intervals over a year until it reached $20 billion per month. [..] The Fed has now raised rates four times as part of a normalization of monetary policy that began in December 2015. The central bank had pushed rates to near zero in response to the financial crisis. Fed policymakers also released their latest set of quarterly economic forecasts, which showed only temporary concern about inflation and continued confidence about economic growth in the coming years. They forecast U.S. economic growth of 2.2% in 2017, an increase from the previous projection in March. Inflation was expected to be at 1.7% by the end of this year, down from the 1.9% previously forecast.

The Fed’s been flying blind for well over 10 years.

• The Fed Is Flying Blind (BBG)

The architects of U.S. monetary policy at the Federal Reserve should be happy. They’ve succeeded beyond their own expectations in bringing down the unemployment rate without triggering an outburst of inflation. Stock indexes are near record highs, and interest rates remain low. But those who set interest rates are in the awkward position of not understanding how things got so good—and are therefore confused about what to do next. “The Fed isn’t run by computers, it’s run by people,” says David Rosenberg, chief strategist at Gluskin Sheff. “Like all of us they have their flaws and their blind spots. On June 14, the Federal Open Market Committee voted as expected to raise the federal funds rate a quarter point, to a range of 1% to 1.25%. It said it expects inflation to rise to its 2% target “over the medium term.”

For Fed Chair Janet Yellen and company, the central mystery continues to be why inflation remains below 2% despite unemployment having dropped to just 4.3% in May. Even ex-convicts and high school dropouts are getting job offers one reason why many economists believe it’s inevitable that wages must rise. When you have a shortage of supply of something, its price will go up, says Gad Levanon, chief U.S. economist at the Conference Board, a business-supported research group. A tight job market, however, hasn’t translated into inflation. The Fed’s preferred measure of inflation, the personal consumption expenditures price index, rose just 1.7% in April from a year earlier. On June 14, as the Fed was meeting, the Bureau of Labor Statistics announced that the Consumer Price Index excluding food and energy rose just 0.1% in May, the third surprisingly low reading in three months.

Michael Feroli, chief U.S. economist at JPMorgan Chase., sympathizes with Yellen’s predicament. He said in an interview before the FOMC meeting that Yellen is relying out of necessity on the Phillips curve, which says that lower unemployment leads to higher inflation. “It’s kind of the best we’ve got” as a descriptor of the economy, he says. Still, Feroli couldn’t resist headlining his report on the puzzlingly low CPI number, “Captain Phillips goes overboard.” Some economists worry that the Fed rate increases will abruptly cool the economy by increasing the cost of borrowing via credit cards, auto loans, and student loans, as well as business loans. Rosenberg, who’s more bearish than most economists, points out that recessions occurred 10 of the last 13 times the Fed raised interest rates. He says the U.S. is due for a recession within the next 12 months.

“The question is not “when” we will enter collapse; we are already in the midst of an economic collapse. ”

• Peak Economic Delusion Signals Coming Crisis (Smith)

According to the Atlanta Fed, US GDP in the first quarter of 2017 has declined to 0.7% , going back to lows touched on in 2014 after the Fed reduced QE.

The US has lost 5 million manufacturing jobs since the year 2000, and this trend has accelerated in recent years. Manufacturing in the US only accounts for 8.48% of all jobs according to May statistics. 102 million working age Americans do not currently have a job. This includes the 95 million Americans not counted by the Bureau of Labor because they assume these people have been unemployed so long they “do not want to work”. Thousands of retail outlet stores, the primary engine of the American economy, are set to close in 2017. Sweeping bankruptcies and downsizing are ravaging the retail sector, and internet retailers are not taking up the slack despite highly publicized growth. In 2016, online retail sales only accounted for 8.1% of all retail sales.

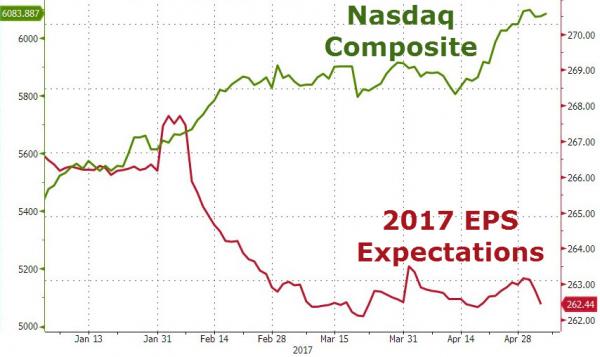

Oil inventories continue to amass as US energy demand declines. Declining energy demand is a sure sign of overall economic decline. OPEC and other entities continue to argue that “too much supply” is the issue; an attempt to distract away from the reality of lower consumption and the falling wealth of consumers. Corporate earnings expectations continue their dismal path, suggesting that stock markets have been supported by central bank stimulus and blind investor faith in central bank intervention. The stimulus is now being cut off. How long before investor faith is finally lost?

It is unfortunate that so many people only track stocks when accounting for economic health. They have crippled themselves and their own observations, and actually condescend when confronted with counter-observations and data. They help globalists and international financiers by perpetuating false narratives; sometimes knowingly but often unconsciously. And, when the system does destabilize to the point that they actually realize it, they will blame all the wrong culprits for their pain and suffering. The question is not “when” we will enter collapse; we are already in the midst of an economic collapse. The real question is, when will the uneducated and the biased finally notice? I suspect the only thing that will shock them out of their stupor will be a swift stock market drop, since this is the only factor they seem to pay attention to. This will happen soon enough.

That much is obvious.

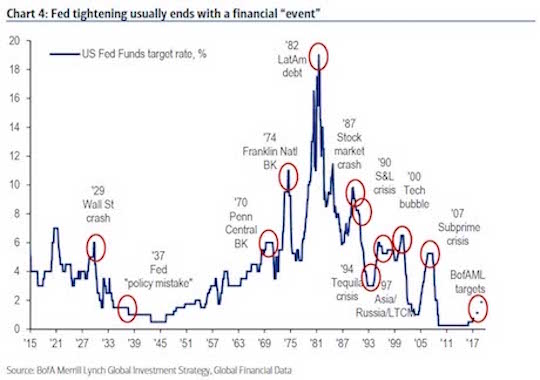

• When the Fed Tightens, It Leads to Financial “Events (Phoenix)

The Fed concludes its June meeting today. The Fed fund futures markets put the odds of the Fed hiking rates again at 99.6%. This would mark the third rate hike by the Fed during this cycle. Why would this matter? Because it indicates the Fed is embarked on a serious tightening cycle. One rate hike can be a fluke. Two rate hikes could even be just policy error. But three rate hikes means the Fed is determined.

As Bank of America noted in a recent research note, when the Fed becomes determined to tighten… it usually ends in an “event.” What would an “event” look like for today’s market? A Crash is coming…

It’s a craze. It’s doing so much damage.

• Senate Overwhelmingly Approves New Sanctions To “Punish” Russia (ZH)

The U.S. Senate on Wednesday approved new sanctions to punish Russia for “meddling” in the 2016 election. The bipartisan legislation, which passed with an overwhelming 97-2 vote, slaps new sanctions on Russia and restricts President Trump from easing them in the future without first receiving congressional approval. The only two senators to vote against the measure were Sens. Mike Lee (R-UT) and Rand Paul (R-KY), while Chris Van Hollen (D-Maryland) abstained. Known as the Crapo Amendment, after Mike Crapo (R-Idaho), chairman of the Senate Banking, Housing and Urban Affairs Committee, the measure was endorsed by Foreign Relations Committee Chairman Bob Corker (R-Tennessee) and ranking member Ben Cardin (D-Maryland). The deal was attached to an Iran sanctions bill that is expected to pass later this week.

While top Republican senators had initially wanted to give the White House space to try improving U.S.-Russia relations, but ultimately decided talks with Russia have been moving too slowly. The sanctions against Russia are “in response to the violation of the territorial integrity of the Ukraine and Crimea, its brazen cyber-attacks and interference in elections, and its continuing aggression in Syria,” according to the deal’s sponsors. The amendment also allows “broad new sanctions on key sectors of Russia’s economy, including mining, metals, shipping and railways” and authorizes “robust assistance to strengthen democratic institutions and counter disinformation across Central and Eastern European countries that are vulnerable to Russian aggression and interference.”

New sanctions would be imposed on “corrupt Russian actors” and those “involved in serious human rights abuses,” anyone supplying weapons to the Syrian government or working with Russian defense industry or intelligence, as well as “those conducting malicious cyber activity on behalf of the Russian government” and “those involved in corrupt privatization of state-owned assets.” The biggest neocon in Congress, John McCain, was delighted with the outcome: “We must take our own side in this fight. Not as Republicans, not as Democrats, but as Americans,” said Sen. John McCain (R-AZ) before the vote. “It’s time to respond to Russia’s attack on American democracy with strength, with resolve, with common purpose, and with action.” As AP adds, lawmakers took action against Russia in the absence of a forceful response from President Donald Trump.

While the president has sought to improve relations with Moscow and rejected the implication that Russian hacking of Democratic emails tipped the election his way, non-stop “anonymous sources” have repeatedly leaked “news” to the NYT and WaPo, suggesting Trump colluded with Russia and/or was being probed by the FBI. Following Comey’s testimony, which confirmed there is no “there” there, the media attacks against Trump have shifted, and now accuse the president of obstruction of justice and interference with the FBI’s investigation into Mike Flynn. Speaking earlier on Wednesday, Vladimir Putin’s spokesman Dmitry Peskov said told reporters the Kremlin will hold out with its reaction until the U.S. decides on new sanctions against Russia. “We wouldn’t like to enter this sanctions spiral again. But that’s not our choice.” Indeed, and with the US having made Russia’s choice for them, we now look for Moscow’s response.

They’ll just keep digging until they find something, and then blow that up way out of proportion.

• What If The Russia Russia Russia Story Was Nothing? (HotAir)

Everyone has been busily trying to parse the Jeff Sessions testimony since the Attorney General took the stand but there doesn’t seem to be a lot to work with. Allahpundit talked about the number of times that Sessions declined to answer certain questions about private conversations he had with the president, but that’s some fairly thin gruel to build a presidency-ending scandal out of. But the one question which seems to still be off limits for most of the MSM is the really ugly one: what if this turns out to be a dry hole? Much of the speculation swirling around this entire saga has been based on anonymous sources supposedly spilling secrets about Oval Office conversations or supposed Russians hiding behind the potted plants. With all of that smoke, there certainly must be a fire, right? But that depends whether the smoke is coming from an actual blaze or some reporting blazing up some prime wacky tobacky.

Having hearings was supposed to clear up many of these questions. Take for example the widely reported and frequently repeated assertion that the Attorney General had a third, unreported meeting with the Russians at the Mayflower. That’s been stated so often that it’s basically become an article of faith on CNN and MSNBC. But yesterday Sessions was asked about it and he simply said… no. There was no third meeting. And? What happens now? Unless the New York Times can produce some video or at least a credible witness who saw Session sneaking off into the cloak room with the Russian ambassador or one of his henchmen that’s pretty much a dead end. And that’s falling into a pattern with so many other aspects of the entire tapestry of accusations against the Trump administration, a group of allegedly nefarious traitors who were colluding with the Russians to cripple the American elections.

David French at National Review tackles what may eventually become the biggest question of all. What if that never happened and it was all a fictional tale assembled by the media? “While we certainly aren’t privy to all the relevant information or all the relevant testimony, nothing that James Comey said last week or that Jeff Sessions said today (much less any of the questions directed his way) contained so much as a meaningful hint that the Committee was on the verge of uncovering the political scandal of the century. Rather, the focus keeps shifting to much narrower questions regarding Trump’s decision to fire James Comey — questions that are important but far less historically consequential than any claim that a president or his attorney general are traitors to their country…

Truth is truth, and it’s important for responsible people to not just understand and respond to actual evidence — no matter where it leads — but also acknowledge its absence. And so far the absence of evidence points to Trump’s innocence of some of the worst allegations ever leveled against an American president or his senior team.”

Pentagon wouldn’t mind a little war.

• Pentagon Agrees To Sell $12 Billion In F-15s To Qatar (ZH)

Remember when Trump called on Qatar to stop funding terrorism, claiming credit for and endorsing the decision of Gulf nations to isolate their small neighbor (where the most important US airbase in the middle east is located),even as US Cabinet officials said their blockade is hurting the campaign against ISIS. You should: it took place just 5 days ago. “We had a decision to make,” Trump said, describing conversations with Saudi Arabia and other Gulf countries. “Do we take the easy road or do we finally take a hard but necessary action? We have to stop the funding of terrorism.” Also last week, Trump triumphantly announced on twitter that “during my recent trip to the Middle East I stated that there can no longer be funding of Radical Ideology. Leaders pointed to Qatar – look!”

Well, Qatar funding terrorism apparently is not a problem when it comes to Qatar funding the US military industrial complex, because just two weeks after Trump signed a record, $110 billion weapons deal with Saudi Arabia, moments ago Bloomberg reported that Qatar will also buy up to 36 F-15 jets from the Pentagon for $12 billion …. even as a political crisis in the Gulf leaves the Middle East nation isolated by its neighbors and criticized by President Donald Trump for supporting terrorism, according to three people with knowledge of the accord. According to the Pentagon, the sale will give Qatar a “state of the art” capability, not to mention the illusion that it can defend itself in a war with Saudi Arabia. If nothing else, Uncle Sam sure is an equal-opportunity arms dealer, and best of all, with the new fighter planes,

Qatar will be able to at least put on a token fight when Saudi Arabia invades in hopes of sending the price of oil surging now that every other “strategy” has failed. To be sure, the sale comes at an opportune time: just days after Qatar put its military on the highest state of alert, and scrambled its tanks. All 16 of them. Maybe the world’s wealthiest nation realized it’s time beef up its defensive capabilities? Qatar’s defense minister will meet with Pentagon chief Jim Mattis on Wednesday to seal the agreement, Bloomberg reported citing people who spoke on condition of anonymity because the sale hasn’t been announced. Last year, congress approved the sale of up to 72 F-15s in an agreement valued at as much as $21 billion but that deal took place before the recent political crisis in the region.

It is unclear what the Saudi reaction will be to the news that Trump is arming its latest nemesis. If our thesis that Riyadh is hoping for Qatar to escalate the nest leg of the conflict is correct, then the Saudis should be delighted.

“..society as a partnership between those who are living, those who are dead, and those who are yet to be born.”

• The Old Are Eating the Young (Satyajit Das)

Edmund Burke saw society as a partnership between those who are living, those who are dead, and those who are yet to be born. A failure to understand this relationship underlies a disturbing global tendency in recent decades, in which the appropriation of future wealth and resources for current consumption is increasingly disadvantaging future generations. Without a commitment to addressing this inequity, social tensions in many societies will rise sharply. entral to the issue is that the rapid rise in living standards and prosperity of the past 50 years has been largely based on rising debt levels, ignoring the costs of environmental damage and misallocation of scarce resources. A significant proportion of recent economic growth has relied on borrowed money – today standing at a dizzying 325% of global GDP.

Debt allows society to accelerate consumption, as borrowings are used to purchase something today against the promise of future repayment. Unfunded entitlements to social services, health care and pensions increase those liabilities. The bill for these commitments will soon become unsustainable, as demographic changes make it more difficult to meet. Degradation of the environment results in future costs, too: either rehabilitation expenses or irreversible changes that affect living standards or quality of life. Profligate use of mispriced non-renewable natural resources denies these commodities to future generations or increases their cost. The prevailing approach to dealing with these problems exacerbates generational tensions. The central strategy is “kicking the can down the road” or “extend and pretend,” avoiding crucial decisions that would reduce current living standards, eschewing necessary sacrifices, and deferring problems with associated costs into the future.

Rather than reducing high borrowing levels, policy makers use financial engineering, such as quantitative easing and ultra-low or negative interest rates, to maintain them, hoping that a return to growth and just the right amount of inflation will lead to a recovery and allow the debt to be reduced. Rather than acknowledging that the planet simply can’t support more than 10 billion people all aspiring to American or European lifestyles, they have made only limited efforts to reduce resource intensity. Even modest attempts to deal with environmental damage are resisted, as evidenced by the recent fracas over the Paris climate agreement. Short-term gains are pursued at the expense of costs which aren’t evident immediately but will emerge later.

This growing burden on future generations can be measured. Rising dependency ratios – or the number of retirees per employed worker – provide one useful metric. In 1970, in the U.S., there were 5.3 workers for every retired person. By 2010 this had fallen to 4.5, and it’s expected to decline to 2.6 by 2050. In Germany, the number of workers per retiree will decrease to 1.6 in 2050, down from 4.1 in 1970. In Japan, the oldest society to have ever existed, the ratio will decrease to 1.2 in 2050, from 8.5 in 1970. Even as spending commitments grow, in other words, there will be fewer and fewer productive adults around to fund them.

Schäuble couldn’t care less.

• Greek Economy Minister Calls Wolfgang Schäuble ‘Dishonest’ (R.)

Greek Economics Minister Dimitri Papadimitriou has accused German Finance Minister Wolfgang Schaeuble of being “dishonest” by blocking debt relief for Greece despite his acknowledgement that Athens has implemented significant reforms. Euro zone finance ministers and the IMF are expected to strike a compromise deal on Greece on Thursday, paving the way for new loans for Athens while leaving the contentious debt relief issue for later. Papadimitriou told German newspaper Die Welt in an interview published on Thursday that Schaeuble first had acknowledged that Greece had met the requirements, but then changed his mind. “I haven’t met Schaeuble yet and I don’t want to be impolite, but his behavior seems dishonest to me,” he added.

Papadimitriou said German resistance to debt relief for Greece raised questions about the very idea and structure of the euro zone. The success of right-wing populists in Europe also showed dissatisfaction with such European structures, he said. “Greece is being made a sacrificial lamb,” he said. Papadimitriou also warned Schaeuble against making decisions based purely on domestic politics, noting that Germany had also received debt relief when it was rebuilding after World War Two. Debt relief is needed to help Greece expand its economy, he said, noting that Athens was not asking for a debt cut, but rather lower interest rates or longer repayment schedules. Greek President Prokopis Pavlopoulos also called on the euro zone finance ministers to spell out concrete measures to reduce the Greek debt burden.

“Greece has fulfilled its commitments and adopted the required reforms. Now it is time for the Europeans to comply with their commitments on debt relief,” Pavlopoulos said in an interview with German business daily Handelsblatt. German opposition politicians also criticized Schaeuble by honing in on the fact that the IMF is likely to participate in the third bailout, but will only disburse any loans when debt measures have been clearly outlined. Gerhard Schick from the Greens party accused Schaeuble of a “lousy trick” with the IMF participation. Thomas Oppermann, senior member of the co-governing Social Democrats (SPD), told Bild newspaper: “Schaeuble must put his cards on the table ahead of the election and say what German taxpayers will have to expect.”

“Europe stopped listening to Greece a long time ago.”

• Greece Is Germany’s ‘De Facto Colony’ (Pol.)

Poor Alexis Tsipras. For days, the Greek leader has been working the phones, trying to secure the best possible terms for his country as it enters the last mile of its seemingly endless cycle of bailouts. So far, his efforts have won him more mockery than respect — especially in Germany. “He keeps calling the whole time, and the chancellor says again and again, ‘Alexis, this issue is for the finance ministers,’” German Finance Minister Wolfgang Schäuble told an audience here on Tuesday, referring to the Greek prime minister’s attempts to win over Angela Merkel to his cause. Eurozone finance ministers are set to decide at a meeting in Luxembourg on Thursday whether to release a more than €7 billion tranche of aid to Greece. No one doubts Athens will get the money. Schäuble all but committed to it on Tuesday.

But Tsipras wants something even more precious: debt relief. No serious economist believes Greece will ever crawl out from under its more than €300 billion debt without significant forgiveness from its creditors. That means convincing Germany, the country to which Greece owes the most. For much of Greece’s nearly decade-long depression, the country was hostage to its domestic politics. Now, it’s hostage to Germany’s. Berlin, which has long opposed outright debt relief, refuses to budge. With a general election in Germany set for late September, Merkel and Schäuble are unlikely to soften their position anytime soon. The Greek bailouts remain politically toxic in Germany, and any agreement involving debt forgiveness would be seen domestically as an admission the rescue effort had failed — and at the German taxpayers’ expense.

Over the years, Germany has quietly accepted more subtle forms of forgiveness, like extending maturities on Greece’s loans and reducing the interest burden. But a straightforward cut, as demanded by the International Monetary Fund, remains out of the question. At least until after the election. Unfortunately for Tsipras, he has very little say in the matter. One big reason he wants debt relief now is that it would allow the European Central Bank to include Greece in its bond-buying program, known as quantitative easing. That would go a long way toward boosting investor confidence in Greece’s stability. But Greece won’t be eligible for the program as long as its debt burden isn’t deemed sustainable. And with the ECB’s program set to be wound down soon, Greece may never benefit. Tsipras may yet try to resist a deal this week and take the matter to next week’s summit of European leaders in Brussels. That’s unlikely to make much difference. Truth is, Europe stopped listening to Greece a long time ago.

More blackmail.

• EU Officials Warn Athens Not To Take Debt Issue To Leaders’ Summit (K.)

As Finance Minister Euclid Tsakalotos braces for a Eurogroup meeting in Luxembourg on Thursday which all evidence suggests will not yield a satisfactory debt solution for Greece, European officials on Wednesday warned Athens against trying to broach the issue at an EU leaders’ summit next week. “If the matter is not resolved today, then it will be discussed at the next Eurogroup, where the agreement won’t be any better,” one source in Brussels told Kathimerini. Sources in Berlin, which has taken a hard line in the face of calls by the IMF for Greek debt relief, struck a similar tone, with one official noting that the matter falls squarely within the remit of the Eurogroup, “a message that has been made absolutely clear.”

“I don’t remember any Greek problem being solved at the EU leaders’ summit level,” another source representing Greece’s international creditors told Kathimerini, referring to previous efforts by Prime Minister Alexis Tsipras to broach issues relating to the country’s international bailouts with Angela Merkel and other EU leaders. A spokesman for Germany’s Finance Ministry, however, struck a positive tone, saying he was looking forward to agreeing on a “viable comprehensive package.” A proposal by French officials, that a solution to Greek debt relief be linked to the country’s growth rate, is expected to be discussed in Luxembourg on Thursday, though it is unlikely to be embraced in its entirety.

Meanwhile, Athens sounded a defiant note on Wednesday, with a high-ranking government official warning that if German Finance Minister Wolfgang Schaeuble does not budge from his positions to make way for a final agreement, then “there are others in higher positions than him that can give a solution.” “If there is no positive move, in the next few days or during the Eurogroup, from the German minister, then it looks like Angela Merkel will be forced to hold the hot potato,” a government official told the Athens News Agency on Wednesday.