Fred Lyon Golden Gate Bridge painter 1947

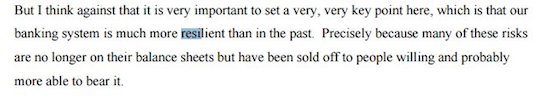

Oh come on, get real. Heard that a million times before. This is insulting. Are people really stupid enough to believe Carney? Is he? Hell yeah. Well, here’s what Carney’s predecessor at the BOE, Mervyn King, said in 2007.

• We Have Fixed Issues That Caused Financial Crisis, Says Mark Carney (G.)

Fundamental reforms undertaken since the US sub-prime mortgage market triggered the deepest global recession since the second world war have created a safer, simpler and fairer financial system, Mark Carney has said. With the 10th anniversary of the financial crisis next month, Carney said the world’s biggest banks were stronger, misconduct was being tackled, and the toxic forms of shadow banking were no longer a threat. Carney, as well as being governor of the Bank of England, is chairman of the Financial Stability Board, a body created by the G20 group of developed and developing nations in 2009 to recommend ways of remedying the flaws in the system highlighted by the crash.

In a letter to G20 leaders before their meeting in Hamburg later this week, Carney said: “A decade after the start of the global financial crisis, G20 reforms are building a safer, simpler and fairer financial system. The largest banks are considerably stronger, more liquid and more focused.” The FSB chairman said there were still issues to be addressed, such as the risks posed by developments in financial technology (fintech) and the increased vulnerability of digital systems to cyber-attack. But at a press conference in London on Monday, Carney said: “We have fixed the issues that caused the last crisis. They were fundamental and deep-seated, which is why it was such a major job.” The financial crisis of 2007 began in the US mortgage market but rapidly went global as it emerged that banks and unregulated shadow banks were massively exposed in the market for derivatives and did not have enough capital when losses started to mount.

Public anger towards the financial system grew when the biggest banks were bailed out by taxpayers because they were deemed “too big to fail”. Carney said in his letter: “The largest banks are required to have as much as 10 times more of the highest quality capital than before the crisis and are subject to greater market discipline as a consequence of globally agreed standards to resolve too-big-to-fail entities. “A decade ago, many large banks were woefully undercapitalised, with complex business models that relied on the goodwill of markets and, ultimately, taxpayers. A decade on, the largest banks have raised more than $1.5tn of capital, and all major internationally active banks meet minimum risk-based capital and leverage ratio requirements well in advance of the deadline.”

Austerity is not about money, that has nothing to do with it. It’s about power, pure and simple.

• David Cameron Says People Who Oppose Austerity Are ‘Selfish’ (Ind.)

David Cameron has intervened in the Cabinet row over easing up on austerity by attacking “selfish” politicians demanding higher spending. The former Prime Minister sided with Chancellor Philip Hammond by arguing it would be wrong to bow to growing public pressure and “let spending and borrowing rip”. A string of senior Tories, including Boris Johnson and Michael Gove, have called for the lifting of the one per cent pay cap on awards to millions of public sector workers. But Mr Cameron, speaking to a business conference in South Korea, said: “The opponents of so-called austerity couch their arguments in a way that make them sound generous and compassionate. “They seek to paint the supporters of sound finances as selfish or uncaring. The exact reverse is true. “Giving up on sound finances isn’t being generous, it’s being selfish: spending money today that you may need tomorrow.”

In addition to the row over the pay cap, Education Secretary Justine Greening is pushing for a £1bn cash injection to end school funding cuts. New demands for higher spending added to the pressures on Mr Hammond today, as councils warned they faced a £5.8bn funding gap by the end of the decade. Meanwhile, the Chancellor used a speech to business leaders last night to urge his colleagues to join a “grown-up debate” about how to pay for higher spending. Mr Hammond acknowledged the public was “weary” of austerity, but insisted “we must hold our nerve” and not simply borrow more. Paul Johnson, director of the respected Institute for Fiscal Studies, said “political discipline seems to have fallen apart” in the Cabinet. Alistair Darling, the former Labour Chancellor, said the sight of Cabinet ministers publicly criticising the Chancellor over public sector pay made the Government appear “shambolic”.

Don’t get your hopes up.

• Judge To Review Ban On Prosecuting Tony Blair For Iraq War (G.)

The most senior judge in England and Wales will hear a case attempting to overturn a ban on prosecuting Tony Blair over the Iraq war, the Guardian has learned. A private criminal prosecution against the former Labour prime minister was blocked in 2016 by Westminster magistrates court when it was ruled Blair would have immunity from any criminal charges. But that ruling by the district judge, Michael Snow, will be reviewed on Wednesday before the lord chief justice, Lord Thomas of Cwmgiedd, and Mr Justice Ouseley. The current attorney general, Jeremy Wright QC, wants the block on proceedings upheld. He will have a barrister in court to try to stop the attempted private prosecution. The hearing follows a decision by the high court in May, which has not previously been reported.

Then a high court judge said those wanting to prosecute Blair could have a hearing to seek permission for a court order allowing their case to go to the next stage. The judge in that case also said the attorney general could formally join in the case. Blair caused controversy when prime minister in deciding to take Britain into the invasion of Iraq in 2003, which was led by the US and sparked huge opposition. The private prosecution seeks a war crimes trial in a British court of Blair, the foreign secretary in 2003, Jack Straw, and Lord Goldsmith, the attorney general at the time the government was deciding to join the invasion of Iraq. The case seeks their prosecution for the crime of aggression. The attorney general in written submissions for Wednesday’s hearing says such an offence does not exist in English law, a claim which is disputed.

The private prosecution attempt is based on the findings of last year’s Chilcot report into the decision by Blair to join the invasion of Iraq, which is criticised, under the false pretext that Saddam Hussein’s regime had weapons of mass destruction. After the Chilcot report was released some families of British service personnel who lost their lives in Iraq said they wanted Blair prosecuted in the courts. This attempt at a private prosecution is brought by Gen Abdul-Wahid Shannan ar-Ribat, former chief of staff of the Iraqi army who is now living in exile. His lawyers are Michael Mansfield QC and Imran Khan, who acted for the family of Stephen Lawrence. In November 2016, a British court ruled against an application to bring a private prosecution. A district judge at Westminster magistrates court ruled Blair had immunity from prosecution over the Iraq war and that any case could also “involve details being disclosed under the Official Secrets Act”.

At the hearing at the Royal Courts of Justice in central London, lawyers for the attorney general will argue that the crime of aggression, while existing in international law, has never been included into English law by parliament. But the government’s stance appears to be undermined by Goldsmith. In his 2003 memo on the legality of the Iraq war, Goldsmith appeared to concede the key point of those now seeking his prosecution. “Aggression is a crime under customary international law which automatically forms part of domestic law,” he wrote.

Britain is one scary place. I’m reminded of Travis Bickle: “Someday a real rain will come and wipe this scum off the streets.”

• The Grenfell Inquiry Will Be A Stitch-Up. Here’s Why (Monbiot)

We don’t allow defendants in court cases to select the charges on which they will be tried. So why should the government set the terms of a public inquiry into its own failings? We don’t allow criminal suspects to vet the trial judge. Why should the government approve the inquiry’s chair? Even before the public inquiry into the Grenfell Tower disaster has begun, it looks like a stitch-up, its initial terms of reference set so narrowly that government policy remains outside the frame. An inquiry that honours the dead would investigate the wider causes of this crime. It would examine a governing ideology that sees torching public protections as a sacred duty. Let me give you an example. On the morning of 14 June, as the tower blazed, an organisation called the Red Tape Initiative convened for its prearranged discussion about building regulations.

One of the organisation’s tasks was to consider whether rules determining the fire resistance of cladding materials should be removed for the sake of construction industry profits. Please bear with me while I explain what this initiative is and who runs it, as it’s a perfect cameo of British politics. It’s a government-backed body, established “to grasp the opportunities” that Brexit offers to cut “red tape” – a disparaging term for public protections. It’s chaired by the Conservative MP Sir Oliver Letwin, who has claimed that “the call to minimise risk is a call for a cowardly society”. It is a forum in which exceedingly wealthy people help decide which protections should be stripped away from lesser beings.

Among the members of its advisory panel are Charles Moore, who was editor of the Daily Telegraph and the chair of an organisation called Policy Exchange. He was also best man at Letwin’s wedding. Sitting beside him is Archie Norman, the former chief executive of Asda and the founder of Policy Exchange. He was once Conservative MP for Tunbridge Wells – and was succeeded in that seat by Greg Clark, the minister who now provides government support for the Red Tape Initiative. Until he became environment secretary, Michael Gove was also a member of the Red Tape Initiative panel. Oh, and he was appointed by Norman as the first chairman of Policy Exchange. (He was replaced by Moore.) Policy Exchange also supplied two of Letwin’s staff in the Conservative policy unit that he used to run.

Policy Exchange is a neoliberal lobby group funded by dark money, that seeks to tear down regulations. The Red Tape Initiative’s management board consists of Letwin, Baroness Rock and Lord Marland. Baroness Rock is a childhood friend of the former Tory chancellor George Osborne, and is married to the wealthy financier Caspar Rock. Marland is a multimillionaire businessman who owns a house and four flats in London, “various properties in Salisbury”, three apartments in France and two apartments in Switzerland. In other words, the Red Tape Initiative is a representative cross-section of the British public. In no sense is it a self-serving clique of old chums, insulated from hazard by their extreme wealth, whose role is to decide whether other people (colloquially known as “cowards”) should be exposed to risk.

“Ontario’s strong housing market is a reflection of our growing economy,” Charles Sousa, the province’s minister of finance, said..

• Foreigners Account for Just 4.7% of Home Sales in Toronto Region (BBG)

The Ontario government said overseas buyers accounted for just 4.7% of home purchases in the Toronto area over a recent one-month period. The new data is in line with other surveys, signaling that foreigners haven’t been major drivers of real estate prices in one of Canada’s most expensive markets. Non-residents bought about 860 properties between April 24 to May 26 in the so-called greater golden horseshoe region of Ontario which includes Toronto, Hamilton and Peterborough, the province said in a statement Tuesday. The finance and housing ministries began compiling the figures as part of a new housing plan announced in April meant to make homes more affordable and accessible for Canadian residents. One of the measures included a 15% levy as of April 21 on foreign investors buying residential property in Toronto and nearby cities.

“Ontario’s strong housing market is a reflection of our growing economy,” Charles Sousa, the province’s minister of finance, said in a statement. “While this is great news for the province, the resulting increase in speculative purchases and a spike in home prices created affordability challenges for many and posed a risk to the market.” Toronto is the latest Canadian city to target non-resident buyers, who are often accused of driving up the price of homes by using them as an investments. Prices and sales in the city had been on a tear until early this year, prompting some to point to non-resident factors as a source of the heat. Vancouver last year imposed a 15% foreign buyer tax that preceded a slowdown of sales and price growth, though it was short-lived as the market picks up speed again. Both cities followed the lead by Australia, which forces offshore buyers to purchase through a separate buying program.

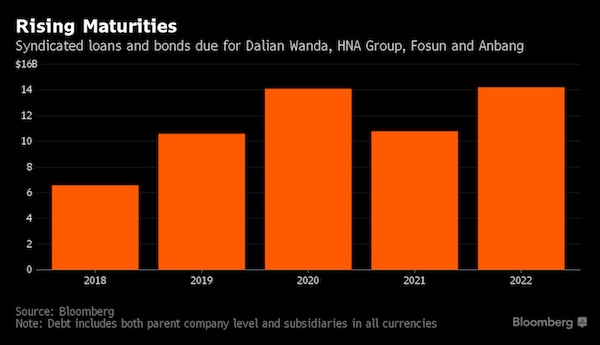

Buying the world with monopoly money.

• China’s $162 Billion of Dealmaker Debt Raises Alarm

China struck deal after deal to acquire companies abroad over the last few years. Now the bill is coming due. The nation’s top corporate dealmakers, including HNA and Fosun International, must pay off the equivalent of at least $11.5 billion in bonds and loans by the end of 2018 – a feat now complicated by government efforts to rein in their aggressive rush overseas. That figure represents just a fraction of the total debt of 1.1 trillion yuan ($162 billion) that the Chinese companies have reported as they projected their money and influence around the world with a record number of acquisitions. The size of their obligations – and whether they will be able to shoulder them – has begun to worry global banks and investors now that Beijing has pressed companies to dial back their ambitions abroad.

“Those companies the banking regulator is checking on have very high financing demand for M&A activities,” said Xia Le, chief Asia economist at BBVA in Hong Kong. “But banks will heighten their risk control when lending to them going forward, which could increase their funding costs and hurt the pace of their expansion.” The moves threaten to end an era of easy access to money for the firms. People familiar with the matter said last month that China Banking Regulatory Commission asked some banks to provide information on overseas loans to HNA, Fosun, Anbang Insurance and Dalian Wanda. Yields on some bonds issued by the firms jumped. The CBRC is examining examples of acquisitions gone awry to assess potential risks to the financial sector, people familiar also said. To be sure, the companies, which are among the biggest private-sector firms in China, are sitting on a cash pile that they can tap to meet upcoming debt deadlines. They have more than 400 billion yuan of cash and cash equivalents…

Too late now, boys.

• China’s Shadow Banking Lacks Sufficient Regulation: Central Bank (R.)

China’s central bank said on Tuesday the shadow banking sector lacks sufficient regulation and the bank would give more prominence to financial risk controls. Compared with traditional bank lending, the opaque nature of shadow banking products make it easier for them to bypass regulatory requirements and provide credit to restricted areas, the People’s Bank of China said in its annual China Financial Stability Report released online. The central bank will increase supervision over the rapidly growing asset management industry to curb shadow banking risks, it said. Since the first quarter, the PBOC has included banks’ off-the-balance-sheet wealth management products in its examination of broad credit in its Macro Prudential Assessment (MPA) risk-tool.

The world’s second-largest economy faces major challenges, including excess industrial capacity, sluggish growth, high corporate leverage, mounting local government debt, property bubbles in some regions, and the deterioration of banking assets, the PBOC said in its report. As the economy still faces relatively big downward pressures, the bank pledged to create a favourable monetary and financial environment for the development of the real economy this year. The central bank also said it would strengthen coordination with other financial regulators to fend off systemic financial risks.

Still can’t help wondering about the timing of this. Why now? What changed?

• Arab States To Deliver Verdict On Qatar As Compromise Elusive (R.)

Arab states that have imposed sanctions on Qatar, accusing it of links to terrorism, were due to meet in Cairo on Wednesday to consider Doha’s response to a stiff ultimatum, but settlement of the dispute seemed far off. The editor of the Abu Dhabi government linked al-Ittihad newspaper wrote in an editorial that Qatar was “walking alone in its dreams and illusions, far away from its Gulf Arab brothers”. Foreign ministers of Saudi Arabia, the United Arab Emirates, Egypt and Bahrain will consider whether to escalate, or less likely abandon, the boycott imposed on Qatar last month that has rattled a key oil-producing region and unnerved strategic Western allies. Qatar faces further isolation and possible expulsion from the Gulf Cooperation Council (GCC) if its response to a list of demands made nearly two weeks ago is not deemed satisfactory.

The Arab countries have demanded Qatar curtail its support for the Muslim Brotherhood, shut down the pan-Arab al Jazeera TV channel, close down a Turkish base and downgrade its ties with regional arch-rival Iran. They view Qatar’s independent diplomatic stances and support for 2011 “Arab Spring” uprisings as support for terrorism and a dangerous breaking of ranks – charges Doha vigorously denies. Qatar has countered that the Arab countries want to curb free speech and take over its foreign policy, saying their 13 demands are so harsh they were made to be rejected. The gas-rich state had raised its international profile dramatically in recent years, drawing on huge gas revenues, and developed its economy with ambitious infrastructure projects. It is due to host the soccer world cup in 2022.

Qatari Foreign Minister Sheikh Mohammed bin Abdulrahman al-Thani said at a joint news conference with his German counterpart on Tuesday that its response was “given in goodwill and good initiative for a constructive solution”, but insisted that Doha would not compromise on its sovereignty. Gulf officials have said the demands are not negotiable, signaling more sanctions are possible, including “parting ways” with Doha – a suggestion it may be ejected from the GCC, a regional economic and security cooperation body founded in 1981. “A Gulf national may be obliged to prepare psychologically for his Gulf to be without Qatar,” the editor of the Abu Dhabi al-Ittihad newspaper said.

The topic deserves better treatment than this.

• Why Do We Think Poor People Are Poor Because Of Their Own Bad Choices? (G.)

Cecilia Mo thought she knew all about growing up poor when she began teaching at Thomas Jefferson senior high school in south Los Angeles. As a child, she remembered standing in line, holding a free lunch ticket. But it turned out that Mo could still be shocked by poverty and violence – especially after a 13-year-old student called her in obvious panic. He had just seen his cousin get shot in his front yard. For Mo, hard work and a good education took her to Harvard and Stanford. But when she saw just how much chaos and violence her LA students faced, she recognized how lucky she had been growing up with educated parents and a safe, if financially stretched, home. Now, as an assistant professor of public policy and education at Vanderbilt University, Mo studies how to get upper-class Americans to recognize the advantages they have.

She is among a group of scholars trying to understand how rich and poor alike justify inequality. What these academics are finding is that the American dream is being used to rationalize a national nightmare. It all starts with the psychology concept known as the “fundamental attribution error”. This is a natural tendency to see the behavior of others as being determined by their character – while excusing our own behavior based on circumstances. For example, if an unexpected medical emergency bankrupts you, you view yourself as a victim of bad fortune – while seeing other bankruptcy court clients as spendthrifts who carelessly had too many lattes. Or, if you’re unemployed, you recognize the hard effort you put into seeking work – but view others in the same situation as useless slackers. Their history and circumstances are invisible from your perspective.

Here’s what has gone wrong: hard work and a good education used to be a sure bet for upward mobility in the US – at least among some groups of people. Americans born in the 1940s had a 90% chance of doing better economically than their parents did – but those born in the 1980s have only 50/50 odds of doing so.

Oh yes, the EU will fail yet.

A comment on Twitter: “The last time Austria had tanks on the Italian border it lost Trent and Trieste.”

• Austrian Troops To Control Migrants On Italy Border (R.)

Austria is planning to impose border controls and possibly deploy troops to cut the number of migrants crossing from Italy, defense officials said, drawing a warning from Rome and reigniting a row over Europe’s handling of the refugee crisis. Tensions between European Union countries over how to share the burden of migrants flared in 2015 when hundreds of thousands, many fleeing wars in Africa and the Middle East, began arriving in EU territory, mainly via Greece, and headed for Germany, Austria and other nearby affluent states. Austria took in more than 1 percent of its population in asylum seekers at the time, which helped increase support for the far-right Freedom Party. Keen to avoid another influx, it said it would introduce controls at the busy Brenner Pass border crossing with Italy if one materialized there.

That has not yet happened but Italy recently asked other EU countries to help it cope with a surge in migrants reaching its southern Mediterranean shores from Africa, raising concern in Austria that many will soon show up at its border with Italy. That is a political hot potato in Austria, where a parliamentary election is scheduled in October with immigration shaping up as a central issue. Austrian Defence Minister Hans Peter Doskozil told the mass-circulation Kronen Zeitung in an interview published on Tuesday that he expected restrictions would be introduced along the Alpine boundary with Italy “very soon”. Other Austrian officials, including Interior Minister Wolfgang Sobotka, who oversees crossings like Brenner, said there was currently no reason to introduce controls and Austria remained vigilant, a stance Vienna has repeated for the past year.

Home › Forums › Debt Rattle July 5 2017