Hieronymus Bosch Ascent of the Blessed c1510

Reading the news on America should scare everyone, and every day, but it doesn’t. We’re immune, largely. Take this morning. The US Republican party can’t get its healthcare plan through the Senate. And they apparently don’t want to be seen working with the Democrats on a plan either. Or is that the other way around? You’d think if these people realize they were elected to represent the interests of their voters, they could get together and hammer out a single payer plan that is cheaper than anything they’ve managed so far. But they’re all in the pockets of so many sponsors and lobbyists they can’t really move anymore, or risk growing a conscience. Or a pair.

What we’re witnessing is the demise of the American political system, in real time. We just don’t know it. Actually, we’re witnessing the downfall of the entire western system. And it turns out the media are an integral part of that system. The reason we’re seeing it happen now is that although the narratives and memes emanating from both politics and the press point to economic recovery and a future full of hope and technological solutions to all our problems, people are not buying the memes anymore. And the people are right.

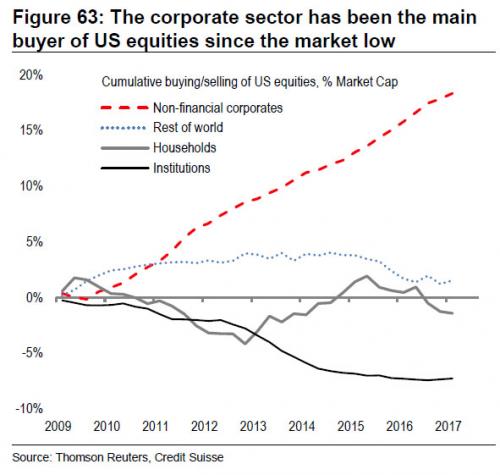

Tyler Durden ran a Credit Suisse graph overnight that should give everyone a heart attack, or something in that order. It shows that nobody’s buying stocks anymore, other than the companies who issue them. They use ultra-cheap leveraged loans to make it look like they’re doing fine. Instead of using the money/credit to invest in, well, anything, really. You can be a successful US/European company these days just by purchasing your own shares. How long for, you ask?

There Has Been Just One Buyer Of Stocks Since The Financial Crisis

As CS’ strategist Andrew Garthwaite writes, “one of the major features of the US equity market since the low in 2009 is that the US corporate sector has bought 18% of market cap, while institutions have sold 7% of market cap.” What this means is that since the financial crisis, there has been only one buyer of stock: the companies themselves, who have engaged in the greatest debt-funded buyback spree in history.

Why this rush by companies to buyback their own stock, and in the process artificially boost their Earning per Share? There is one very simple reason: as Reuters explained some time ago, “Stock buybacks enrich the bosses even when business sags.” And since bond investor are rushing over themselves to fund these buyback plans with “yielding” paper at a time when central banks have eliminated risk, who is to fault them.

More concerning than the unprecedented coordinated buybacks, however, is not only the relentless selling by institutions, but the persistent unwillingness by “households” to put any new money into the market which suggests that the financial crisis has left an entire generation of investors scarred with “crash” PTSD, and no matter what the market does, they will simply not put any further capital at risk.

In other words, the system doesn’t only keep zombies alive, making it impossible for anyone to see who’s healthy or not, no, the system itself has become a zombie. The article mentions Blackrock’s Larry Fink talking about ‘cash on the sidelines’, but puhlease… Central banks have injected another $2 trillion into the zombie system this year alone, and that gives you that graph. Basically no-one supposedly on the sideline has a penny left.

So that’s your stock markets. Let’s call it bubble no.1. Another effect of ultra low rates has been the surge in housing bubbles across the western world and into China. But not everything looks as rosy as the voices claim who wish to insist there is no bubble in [inject favorite location] because of [inject rich Chinese]. You’d better get lots of those Chinese swimming in monopoly money over to your location, because your own younger people will not be buying. Says none other than the New York Fed.

Student Debt Is a Major Reason Millennials Aren’t Buying Homes

College tuition hikes and the resulting increase in student debt burdens in recent years have caused a significant drop in homeownership among young Americans, according to new research by the Federal Reserve Bank of New York. The study is the first to quantify the impact of the recent and significant rise in college-related borrowing—student debt has doubled since 2009 to more than $1.4 trillion—on the decline in homeownership among Americans ages 28 to 30. The news has negative implications for local economies where debt loads have swelled and workers’ paychecks aren’t big enough to counter the impact. Homebuying typically leads to additional spending—on furniture, and gardening equipment, and repairs—so the drop is likely affecting the economy in other ways.

As much as 35% of the decline in young American homeownership from 2007 to 2015 is due to higher student debt loads, the researchers estimate. The study looked at all 28- to 30-year-olds, regardless of whether they pursued higher education, suggesting that the fall in homeownership among college-goers is likely even greater (close to half of young Americans never attend college). Had tuition stayed at 2001 levels, the New York Fed paper suggests, about 360,000 additional young Americans would’ve owned a home in 2015, bringing the total to roughly 2.9 million 28- to 30-year-old homeowners. The estimate doesn’t include younger or older millennials, who presumably have also been affected by rising tuition and greater student debt levels.

Young Americans -and Brits, Dutch etc.- get out of school with much higher debt levels than previous generations, but land in jobs that pay them much less. Ergo, at current price levels they can’t afford anything other than perhaps a tiny house. Which is fine in and of itself, but who’s going to buy the existent McMansions? Nobody but the Chinese. How many of them would you like to move in? And that’s not all. Another fine report from Lance Roberts, with more excellent graphs, puts the finger where it hurts, and then twists it around in the wound a bit more:

People Buy Payments –Not Houses- & Why Rates Can’t Rise

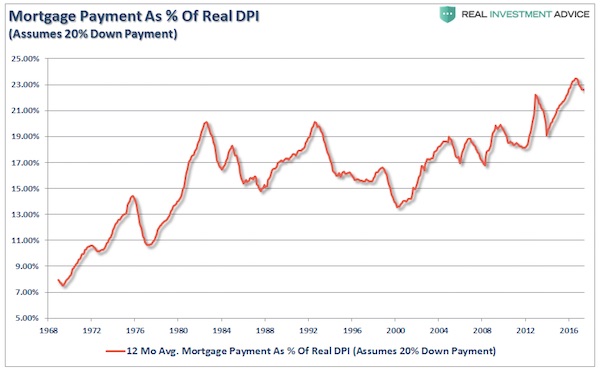

Over the last 30-years, a big driver of home prices has been the unabated decline of interest rates. When declining interest rates were combined with lax lending standards – home prices soared off the chart. No money down, ultra low interest rates and easy qualification gave individuals the ability to buy much more home for their money. The problem, however, is shown below. There is a LIMIT to how much the monthly payment can consume of a families disposable personal income.

In 1968 the average American family maintained a mortgage payment, as a percent of real disposable personal income (DPI), of about 7%. Back then, in order to buy a home, you were required to have skin in the game with a 20% down payment. Today, assuming that an individual puts down 20% for a house, their mortgage payment would consume more than 23% of real DPI. In reality, since many of the mortgages done over the last decade required little or no money down, that number is actually substantially higher. You get the point. With real disposable incomes stagnant, a rise in interest rates and inflation makes that 23% of the budget much harder to sustain.

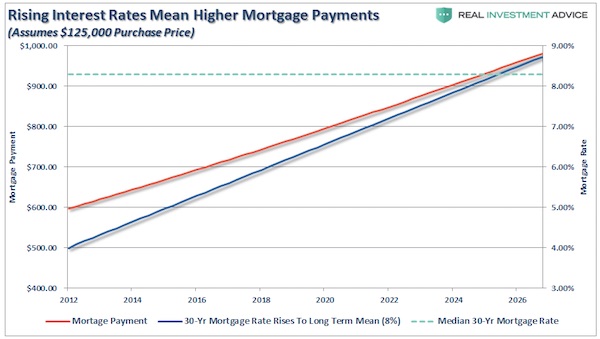

In 1968 Americans paid 7% of their disposable income for a house. Today that’s 23%. That’s as scary as that first graph above on the stock markets. It’s hard to say where the eventual peak will be, but it should be clear that it can’t be too far off. And Yellen and Draghi and Carney are talking about raising those rates.

What Lance is warning for, as should be obvious, is that if rates would go up at this particular point in time, even a lot less people could afford a home. If you ask me, that would not be so bad, since they grossly overpay right now, they pay full-throttle bubble prices, but the effect could be monstrous. Because not only would a lot of people be left with a lot of mortgage debt, and we’d go through the whole jingle mail circus again, yada yada, but the economy’s main source of ‘money’ would come under great pressure.

Don’t let’s forget that by far most of our ‘money’ is created when private banks issue loans to their customers with nothing but thin air and keyboard strokes. Mortgages are the largest of these loans. Sink the housing industry and what do you think will happen to the money supply? And since inflation is money velocity x money supply, what would become of central banks’ inflation targets? May I make a bold suggestion? Get someone a lot smarter than Janet Yellen into the Fed, on the double. Or, alternatively, audit and close the whole house of shame.

We’ve had bubbles 1, 2 and 3. Stocks, student debt and housing. Which, it turns out, interact, and a lot. An interaction that leads seamlessly to bubble 4: subprime car loans. Mind you, don’t stare too much at the size of the bubbles, of course stocks and housing are much bigger issues, but focus instead on how they work together. As for the subprime car loans, and the subprime used car loans, it’s the similarity to the subprime housing that stands out. Like we learned nothing. Like the US has no regulators at all.

Fears Mount Over a New US Subprime Boom – Cars

It’s classic subprime: hasty loans, rapid defaults, and, at times, outright fraud. Only this isn’t the U.S. housing market circa 2007. It’s the U.S. auto industry circa 2017. A decade after the mortgage debacle, the financial industry has embraced another type of subprime debt: auto loans. And, like last time, the risks are spreading as they’re bundled into securities for investors worldwide. Subprime car loans have been around for ages, and no one is suggesting they’ll unleash the next crisis.

But since the Great Recession, business has exploded. In 2009, $2.5 billion of new subprime auto bonds were sold. In 2016, $26 billion were, topping average pre-crisis levels, according to Wells Fargo. Few things capture this phenomenon like the partnership between Fiat Chrysler and Banco Santander. [..] Santander recently vetted incomes on fewer than one out of every 10 loans packaged into $1 billion of bonds, according to Moody’s.

If it’s alright with you, we’ll deal with the other main bubble, no.5 if you will, another time. Yeah, that would be bonds. Sovereign, corporate, junk, you name it. The 4 bubbles we’ve seen so far are more than enough to create a huge crisis in America. Don’t want to scare you too much all at once. Just you read the news again tomorrow. There’ll be more. And the US Senate is not going to do a thing about it. They’re too busy not getting enough votes for other things.

Home › Forums › I read the news today, oh boy

Tagged: debt slave, indentured servitude