Fred Stein Man on bumper, New York 1949

“If you look at what their actual objectives were on the Maastricht Treaty, it was to have governments spend less money every year to try to run a surplus… if you spend less money – surprise, surprise – your economy shrinks…”

• EU Membership For Poland Is Like A Teaser Rate On A Bad Loan – Steve Keen (RT)

Brexit, the near victory of Marine Le Pen in the French presidential election, rumblings in Italy – it is all a sign the EU system is not working, and Poland might be wise to reexamine the EU, Steve Keen, professor of Economics at Kingston University, says. Poland and the EU probably don’t need each other, according to European Council chief Donald Tusk. “There is a question mark over Poland’s European future today,” the former Polish prime minister said at a press conference in Warsaw on Thursday. The follows last month’s approval by the Polish parliament of controversial reforms to the judiciary, handing the government control over the country’s courts, and the EU’s threats to strip Poland of voting rights.

RT: So can we take this as a Polexit? Steve Keen: I think it is a sign that the EU is not working, and that is what’s not getting through to Brussels at all. There wouldn’t be the clamoring for exit from the UK. There wouldn’t be the potential, very recent, almost victory of Marine Le Pen; all the rumblings in Italy – it is all a sign the system is not working. This is something fundamental at the core of the European Union that is leading people to either want to leave or not join. And it is still not getting through to Brussels… that this is their problem, their failure that’s causing all these eruptions around their borders.

RT: Poland has benefited hugely from its membership in the Union, as it has been on the receiving end of billions in funds, its economy has enjoyed a huge boost. What would it mean for the country if it left the bloc? Steve Keen: Not a lot, because, again, the EU is contractionary… If you look at what their actual objectives were on the Maastricht Treaty, it was to have governments spend less money every year to try to run a surplus… if you spend less money – surprise, surprise – your economy shrinks. What happens as often there seem to be carrots to attract you into the EU first instance – but it’s the fundamental guiding policy of cutting spending every year that actually leads to a contracting economy, and people, once they’re in, they want to get out again. So I think Poland might be very wise to say to say, “this doesn’t look like such a good deal in the long term.”

RT: Do you think that the EU is making an effort to hang on to Poland in fear that other countries might follow suit? Steve Keen: I think they will, but what we really need to do is to say: “Let’s get down and reconsider what on Earth we were trying to achieve in the EU in the first place, and why is it being so unsuccessful?” Why is it only benefitting in the northern states, which have got enormous trade surpluses, while the southern ones are suffering with trade deficits and all the contraction that forces upon them? When you look at it in that way and say, “we have to reconsider the entire structure of the EU,” maybe we should even let the parliamentarians propose bills, which, of course, the EU is the only parliament that doesn’t allow that. So it is a time for a fundamental reexamination of the EU. If this message doesn’t get through to parliament, well… who’s next? Italy?

“China’s rate of private property ownership to 89.68% [..] the rate in the US is only 65% and that in Japan just 60%.”

• How China’s Billion Savers Embarked On A Household Debt Binge (SCMP)

Although China’s household debt level is still low compared to the 79.5% of GDP in the US and 62.5% in Japan, it has risen too steeply to be safe, according to a research report by the Institute for Advanced Research at Shanghai University of Finance and Economics which was published last month and led by former central bank statistics chief Sheng Songcheng. “The speed of China’s household debt accumulation … has exceeded that of US household debt accumulation before the subprime crisis,” it said, warning that the rapid growth would squeeze consumer spending and might lead to dangerous scenarios. “As early as in 2020, the ratio of mortgage payments and disposable incomes in China will match the peak level in the US before the financial crisis,” it concluded, adding that the rising debt burden would “restrict China’s economic growth to some extent”.

Cao and her husband are rich on paper: their flat is now worth more than 5 million yuan, but they still live in a frugal life. They’ve let the flat out 6,000 yuan a month and she lived with her husband at his army quarters. To make sure they can repay their debts and make ends meet, she has minimised discretionary spending on restaurant meals, clothing and travel. The impact of rising household debt has been most obvious in China’s major, tier-one cities, where property prices are chasing those in Hong Kong, London and New York. Uniqlo, a mass-market Japanese casual wear brand, is now a favourite of middle class Chinese, who also shop online in search of bargains. Meanwhile, property has become the only reliable investment channel in China.

“Property has become a de facto carrier of wealth in China … and the ultimate choice for investors given its high return in the past decades,” said Jin Li, deputy dean of Peking University’s Guanghua School of Management. That’s lifted China’s rate of private property ownership to 89.68% according to a survey by Chengdu’s Southwestern University of Finance and Economics – among the highest in the world and up from close to zero two decades ago. By way of comparison the rate in the US is only 65% and that in Japan just 60%. More than half of Chinese family wealth is now held in the form of property and, according to the Chinese Academy of Social Sciences, residential mortgages comprise 60.3% of household debt. The rapid rise of leverage and household debt has sparked concerns China could be galloping down the same road to ruin followed by Japan in the early 1990s and the US in 2008.

Actually, I think China realizes Trump is right on many points, and will seek to negotiate rather than protet too much. They knew it wouldn’t last forever.

• Trump Challenging China On Trade Would Spark ‘Very Aggressive’ Response (G.)

Moves by Donald Trump to confront China on trade would elicit a “very aggressive” response, a former top US trade negotiator has predicted, as Beijing said an upcoming visit from the US president would help “map out” the next half century of ties between the world’s top two economies. There has been speculation since last week that Trump – who is due to travel to China this year – is preparing to launch a potentially incendiary investigation into its alleged abuse of intellectual property rights. After China’s decision to back a UN security council resolution against North Korea on Saturday, some reports suggested that inquiry might have been put on ice. The Financial Times called the anticipated move “the trade diplomacy equivalent of a wooden club” and warned it could provoke “a full-blown trade war”.

In an interview with the Guardian, Charlene Barshefsky, the US trade representative under Bill Clinton, agreed challenging Beijing could “engender a downward spiral” in relations. “When China is displeased with US actions … you see China act in ways that are very aggressive, designed to intimidate, designed to force the US to back down,” said the veteran lawyer, who negotiated China’s 2001 entry into the World Trade Organisation (WTO) with its then premier Zhu Rongji. “The US rarely backs down, which is absolutely correct – it should not. But this is China’s way: it bullies in situations like this.” Barshefsky, who is now at the US law firm WilmerHale, said it was unclear what measures the Trump administration might take against Beijing but she did not expect the White House to cave in to Chinese pressure.

“Then the question is: ‘What is the next move?’ And, ‘How much more heated does this get?’ And, ‘Does it engender a downward spiral?’” “We will have to see how this plays out. But there will be a lot of very heated and aggressive rhetoric on both sides, there is no question about it … [And] China will likely not just talk the talk but they will begin to walk the walk, and before too long US companies will start complaining about being even further ill-treated in China. Not blocked; not retaliated against in any large sense. But the environment will become more and more difficult. And China will do that as a way of pressuring the US to back off.”

“..an Orwellian 99% majority that would delight the Kim dynasty in North Korea..”

• Imperial Folly Brings Russia and Germany Together (Escobar)

The Empire of Whiners simply can’t get enough when it comes to huff, puff and pout as the Empire of Sanctions. With an Orwellian 99% majority that would delight the Kim dynasty in North Korea, the “representative democracy” Capitol Hill has bulldozed its latest House/Senate sanctions package, aimed mostly at Russia, but also targeting Iran and North Korea. The White House’s announcement — late Friday afternoon in the middle of summer — that President Trump has approved and will sign the bill was literally buried in the news cycle amidst the proverbial 24/7 Russia-gate related hysteria. Trump will be required to justify to Congress, in writing, any initiative to ease sanctions on Russia. And Congress is entitled to launch an automatic review of any such initiative.

Translation; the death knell of any possibility for the White House to reset relations with Russia. Congress in fact is just ratifying the ongoing Russia demonization campaign orchestrated by the neocon and neoliberalcon deep state/War Party establishment. Economic war has been declared against Russia for at least three years now. The difference is this latest package also declares economic war against Europe, especially Germany. That centers on the energy front, by demonizing the implementation of the Nord Stream 2 gas pipeline and forcing the EU to buy US natural gas. Make no mistake; the EU leadership will counterpunch. Jean-Claude Juncker, president of the European Commission (EC), put it mildly when he said, “America first cannot mean that Europe’s interests come last.”

On the Russia front, what the Empire of Sanctions faces does not even qualify as a hollow victory. Kommersant has reported that Moscow, among other actions, will retaliate by banning all American IT companies and all US agricultural products from the Russian market, as well as exporting titanium to Boeing (30% of which comes from Russia). On the Russia-China strategic partnership front, trying to restrict Russia-EU energy deals will only allow more currency swaps between the ruble and the yuan; a key plank of the post-US dollar multipolar world. And then there’s the possible, major game-changer; the German front.

Yellowstone.

• A Supervolcano Waiting To Erupt Beneath A Seemingly Beautiful Market (CNBC)

Warning: A correction in the market is “inevitable” and there are three key factors that could spark chaos on Wall Street, according to James Advantage Fund president Barry James. The investor likened the market to Yellowstone National Park’s famous supervolcano, which many believe is close to eruption. Stocks continued to hit record highs on Friday, with the Dow Jones Industrial Average setting its 8th consecutive all-time high. “Even though [the market] looks beautiful—setting new highs, good momentum, and earnings have been coming in strong, [there are] things to worry about,” explained the portfolio manager recently on CNBC’s “Futures Now.” Aside from the rise of passive investing, which James says is creating a “herd mentality” among investors, he also believed that the earnings picture isn’t telling the whole story.

“In the 18 months ending in June, we saw companies that had no earnings, they were losing money, outperform those that were making money,” said James. He highlighted many stocks’ performances this year may not be reflective of their revenues. But the biggest threat to the market rally, according to James, is the current valuation levels of stocks. “We went back to 1994 and researched team data that said [that if we look at cyclically adjusted P/E, one out of two times] the market was down in the next 12 months, and about one out of three times it was down more than 10%,” he said. James’ observations seem to mirror a note released more than a week ago by Goldman Sachs, which found that when valuations have been this high, 10-year returns on the S&P 500 have been either in the single digits or negative 99% of the time.

In other words, the market could be in oversold territory, which James does believe. “It doesn’t mean that we’ll see a volcanic eruption in the immediate future, and these market peaks take a long time, but we’re definitely in the latter stages of this market advance,” he said. “We’re going to see the inevitable correction, I just wish I could say I knew when.”

All on red, and on the same side of the dinghy.

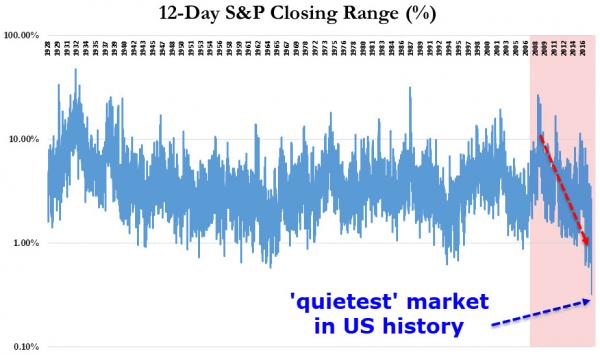

While all eyes have been focused on the incessant rise in the price-weighted farce known as The Dow Jones Industrial Average, a funny thing happened in the ‘real’ market… The S&P 500 went nowhere… 2474, 2473, 2473, 2470, 2477, 2478, 2475, 2472, 2470, 2476, 2478, 2472, 2477…

How unusual is this? Simple – it’s never, ever (in 90 years of S&P history) happened before…

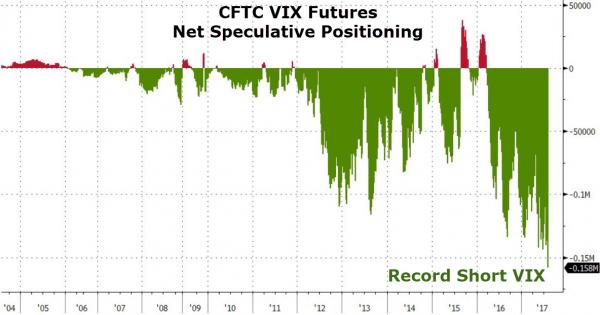

Since The Fed (et al.) began tinkering (red shaded box), markets have slowly (and now quickly) died.Perhaps even more worrisome, Investors are positioning for more of the same…

There has never been a bigger speculative position tilted towards still-lower volatility…ever!

White picket fences.

• The Transformation of the ‘American Dream’ (Shiller)

[..] the writer James Truslow Adams popularized it in 1931, in his book “The Epic of America.” Mr. Adams emphasized ideals rather than material goods, a “dream of a land in which life should be better and richer and fuller for every man, with opportunity for each according to his ability or achievement.” And he clarified, “It is not a dream of motor cars and high wages merely, but a dream of a social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and recognized by others for what they are.” His achievement was an innovation in language that largely replaced the older terms “American character” and “American principles” with a forward-looking phrase that implied modesty about current success in giving respect and equal opportunity to all people.

The American dream was a trajectory to a promising future, a model for the United States and for the whole world. In the 1930s and ’40s, the term appeared occasionally in advertisements for intellectual products: plays, books and church sermons, book reviews and high-minded articles. During these years, it rarely, if ever, referred to business success or homeownership. By 1950, shortly after World War II and the triumph against fascism, it was still about freedom and equality. In a book published in 1954, Peter Marshall, former chaplain of the United States Senate, defined the American Dream with spiritually resounding words: “Religious liberty to worship God according to the dictates of one’s own conscience and equal opportunity for all men,” he said, “are the twin pillars of the American Dream.”

The term began to be used extensively in the 1960s. It may have owed its growing power to Martin Luther King’s “I Have a Dream” speech in 1963, in which he spoke of a vision that was “deeply rooted in the American Dream.” He said he dreamed of the disappearance of prejudice and a rise in community spirit, and certainly made no mention of deregulation or mortgage subsidies. But as the term became more commonplace, its connection with notions of equality and community weakened. In the 1970s and ’80s, home builders used it extensively in advertisements, perhaps to make conspicuous consumption seem patriotic. Thanks in part to the deluge of advertisements, many people came to associate the American Dream with homeownership, with some unfortunate results.

And so many other places. Homes are for people, not for money.

• Gentrification In Brooklyn Is A “Humanitarian Emergency” (NYRoB)

New York City is in the throes of a humanitarian emergency, a term defined by the Humanitarian Coalition of large international aid organizations as “an event or series of events that represents a critical threat to the health, safety, security or wellbeing of a community or other large group of people.” New York’s is what aid groups would characterize as a “complex emergency”: man-made and shaped by a combination of forces that have led to a large-scale “displacement of populations” from their homes. What makes the crisis especially startling is that New York has the most progressive housing laws in the country and a mayor who has made tenants’ rights and affordable housing a central focus of his administration.

The tide of homelessness is only the most visible symptom. There are at least 61,000 people whose shelter is provided, on any given day, by New York’s Department of Homeless Services. The 661 buildings in the municipal shelter system are filled to capacity nightly, and Mayor Bill de Blasio recently announced plans to open ninety new sites, many of which are already being ferociously resisted by neighborhood residents. A packed meeting in Crown Heights, Brooklyn, about a proposed shelter for 104 men over the age of fifty that I attended this winter quickly devolved into a cacophony of ire. “You dump your garbage on us because you think we’re garbage!” shouted a black woman to a city official. The official seemed stunned, and police watched anxiously as the meeting broke up.

The revulsion against the homeless seemed linked to a deep suspicion of “the powers that be, whoever they may be,” as one attendee put it. There were already several shelters in the area. The de Blasio administration’s argument that the homeless should be placed in the neighborhoods they come from so they can renew connections and have a better chance of getting back on their feet only compounded the insult. Were the local residents “connected” to the homeless—those on the lowest social rung? When the city changed eligibility for the shelter to men sixty-two and older, residents opposing it were not assuaged: a neighborhood association filed a lawsuit that blocked the shelter from opening for nearly two months, until it was dismissed by a judge in late May.

[..] New York is the only city in the United States to have taken on the legal obligation of providing a bed for anybody who asks for one and has nowhere else to sleep. This came about after advocates for the homeless argued, in a series of lawsuits in the 1970s, that shelter was a fundamental right, not just a social service. To establish this they pointed to an article in the New York State Constitution that implies public responsibility for “the aid, care and support of the needy.”

We’re nowhere near the end of Greek misery.

• Thousands Of Houses In Greece For Sale To Cover Debts (K.)

More than 20,000 houses have been put up for sale in Greece over the last 12 months because their owners are unable to meet their obligations, particularly regarding mortgage payments. Fearing that their bank accounts will be frozen or their properties confiscated, owners are being forced to put their homes on the market at prices low enough to attract buyers and to pay their way out of financial troubles. This is the picture conveyed to Kathimerini by property market professionals who are closely monitoring developments related to the process of bad loan settlements, and especially as regards mortgages. Giorgos Litsas, head of chartered property surveyors GLP Values, which cooperates with credit institutions in the assessment of properties, says that some 10 to 15% of the existing stock of unsold houses – i.e. between 20,000 and 25,000 properties – involve cases where owners have found themselves at an impasse.

Home › Forums › Debt Rattle August 7 2017