Edward Hopper Nighthawks 1942

An appeal from Puerto Rico via Nicole:

Hurricane Maria destroyed many of Puerto Rico’s local seed and organic food-producing farm crops. Please, if you can, send me seeds. Even fruit seed for the tropics – I can plant them quickly. I will hand them out to those in need – as well as start flats in order to jumpstart their crops. Thank you!

Mara Nieves

PO BOX 9020931

Old San Juan, PR

00901-0931

Just dumping another 10,000 people on the island is not the (whole) answer. Too many people criticize too easily. Time to leave the echo chamber. If HuffPo can do it, so can you.

“As a Puerto Rican, I can tell you that the problem has nothing to do with the U.S. military, FEMA, or the DoD.”

• US Military On Puerto Rico: “The Problem Is Distribution” (HuffPo)

Speaking today exclusively and live from Puerto Rico, is Puerto Rican born and raised, Colonel Michael A. Valle (”Torch”), Commander, 101st Air and Space Operations Group, and Director of the Joint Air Component Coordination Element, 1st Air Force, responsible for Hurricane Maria relief efforts in the U.S. commonwealth with a population of more than 3 million. Since the ‘apocalyptic’ Cat 4 storm tore into the spine of Puerto Rico on September 20, Col. Valle has been both duty and blood bound to help. Col. Valle is a firsthand witness of the U.S. Department of Defense (DoD) response supporting FEMA in Puerto Rico, and as a Puerto Rican himself with family members living in the devastation, his passion for the people is second to none. “It’s just not true,” Col. Valle says of the major disconnect today between the perception of a lack of response from Washington verses what is really going on on the ground.

“I have family here. My parents’ home is here. My uncles, aunts, cousins, are all here. As a Puerto Rican, I can tell you that the problem has nothing to do with the U.S. military, FEMA, or the DoD.” “The aid is getting to Puerto Rico. The problem is distribution. The federal government has sent us a lot of help; moving those supplies, in particular, fuel, is the issue right now,” says Col. Valle. Until power can be restored, generators are critical for hospitals and shelter facilities and more. But, and it’s a big but, they can’t get the fuel to run the generators. They have the generators, water, food, medicine, and fuel on the ground, yet the supplies are not moving across the island as quickly as they’re needed.

“It’s a lack of drivers for the transport trucks, the 18 wheelers. Supplies we have. Trucks we have. There are ships full of supplies, backed up in the ports, waiting to have a vehicle to unload into. However, only 20% of the truck drivers show up to work. These are private citizens in Puerto Rico, paid by companies that are contracted by the government,” says Col. Valle. Put another way, 80% of truck drivers do not show up to work, and yet again, it’s important to understand why. “There should be zero blame on the drivers. They can’t get to work, the infrastructure is destroyed, they can’t get fuel themselves, and they can’t call us for help because there’s no communication. The will of the people of Puerto Rico is off the charts. The truck drivers have families to take care of, many of them have no food or water. They have to take care of their family’s needs before they go off to work, and once they do go, they can’t call home,” explains Col. Valle.

[..] some truck drivers from outside the island have been brought in, and more are coming, however it’s not a fix-all. “We get more and more offers to help, but there is no where to stay, we can’t take any more bodies, there’s no where to put them.” Col. Valle says, adding that their “air mobility” is good, and reiterating that getting more supplies or manpower is not the issue. When asked three times what else Washington can do to help, or anyone for that matter, three times Col. Valle answered, “It’s going to take time.”

The footage this morning from Catalonia is horrifying.

• When Fascism Won’t Die: Why We Need to Support Catalonia (CP)

People in the United States, especially those from the 1980s onward, know little of Spain’s Civil War (1936-1939) and the long dictatorship that followed. This knowledge is helpful in understanding the situation in Spain and Catalonia right now. The judge (Ismael Moreno) who is set to decide on sedition charges against Catalan activists for attempting to hold a democratic referendum on October 1st, for example, has roots that are deeply connected to Francisco Franco (1892-1975), the military leader who initiated the Civil War, won it, and then went on to rule as Head of State and dictator in Spain for almost forty years. Franco is a major figure of twentieth-century fascism in Europe. A purge of Francoist government officials never took place when the dictatorship ended in the 1970s, and this leadership has had a lasting impact on how Spain’s government makes its decisions about Catalonia, a region traumatized during and after the war due to its resistance to Franco’s regime.

The lingering effects of Franco’s legacy are at this point well-documented and need to be a part of the discourse that surrounds what is quickly unraveling in Barcelona. Over the past week, Spain’s military body, the Guardia Civil, has forcibly taken control of the Mossos d’Esquadra, Catalonia’s own police force. It has also detained government officials, closed multiple websites, and ordered seven hundred Catalan mayors to appear in court. Ominously, Spanish police from all over the country have traveled up to Barcelona or are en route to the Catalan capital, holing up in three giant cruise ships, two anchored in the city’s port, one in the port of nearby Tarragona. They are doing this at a time when Spain is on high alert for terrorist attacks, removing their police forces from numerous regions that could be in danger of attack, including Madrid, in preparation to stop Catalan people from putting pieces of paper into voting boxes.

Like the Spanish government, the Spanish police force was never purged of its Francoist ties following the dictatorship. It is a deeply corrupt institution [..] Manuel Fraga Iribarne, one of Franco’s ministers during the dictatorship, founded Prime Minister Mariano Rajoy’s Popular Party. The party is currently enmeshed in a corruption scandal of its own. Spain’s royal family is similarly linked to Franco and has also been brought to trial for its own set of corruption charges. It is impossible to ignore the fascist bedrock upon which modern Spain is founded, or to ignore the reality that this foundation has to do with the way Spain treats Catalonia.

No tax reform, says Stockman.

• David Stockman: Stocks Are Heading For 40-70% Plunge (CNBC)

�David Stockman is warning about the Trump administration’s tax overhaul plan, Federal Reserve policy, saying they could play into a severe stock market sell-off. Stockman, the Reagan administration’s director of the Office of Management and Budget, isn’t stepping away from his thesis that the 8 1/2-year-old rally is in serious danger. “There is a correction every seven to eight years, and they tend to be anywhere from 40 to 70%,” Stockman said recently on CNBC’s “Futures Now.” “If you have to work for a living, get out of the casino because it’s a dangerous place.” He’s made similar calls, but they haven’t materialized. In June, Stockman told CNBC the S&P 500 could easily fall to 1,600, which at the time represented a 34% drop. This week, the index was trading at record levels above 2,500. Stockman puts a big portion of the blame on the Federal Reserve, and its ultra-loose monetary policy.

“This is a bubble created by the Fed,” he said. “We’re heading for higher yields. We are heading for a huge reset of pricing in the risk markets that’s been based on ultra-cheap yields that the central banks of the world created that are now going to go away because they’re telling you that they’re done.” At the height of the 2007-2009 financial crisis, the S&P 500 Index plummeted as much as 58%. It happened in March 2009. “This market at 24 times GAAP earnings, 21 times operating earnings, 100 months into a business expansion with the kind of troubles you have in Washington, central banks [are] going to the sidelines,” he said. “There’s very little reward, and there’s a heck of a lot of risk.” Stockman argued that President Donald Trump’s business-friendly tax reform bill, which was unveiled Wednesday, won’t prevent a damaging sell-off.

He previously said Wall Street is “delusional” for believing it will even be passed. “This is a fiscal disaster that when they [Wall Street] begin to look at it, they’ll see it’s not even remotely paid for. This bill will go down for the count,” said Stockman. He said White House economic advisor Gary Cohn and Treasury Secretary Steve Mnuchin “totally failed to provide any detail, any leadership, any plan. Both of them ought to be fired because they let down the president in a major, major way.” And, it’s not just Washington dysfunction and Fed policy that could ultimately make Stockman’s long-held bearish prediction a reality. He says there will be a catalyst, but it’s unknown exactly what it will be. “You get a black swan in the old days, or maybe you get an orange swan now, the one in the Oval Office who can’t seem to stop tweeting and distracting the whole process from accomplishing anything,” Stockman said of President Donald Trump.

Koyaanisqatsi. “..capital and profits flow to the scarcities created by asymmetric access to information, leverage and cheap credit — the engines of financialization.”

• The Financialization of America… and Its Discontents

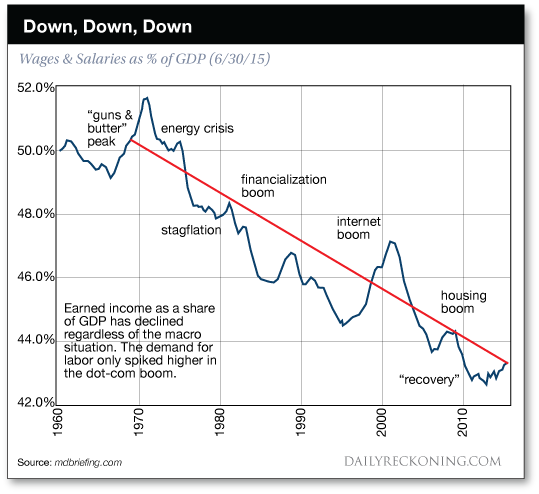

Labor’s share of the national income is in freefall as a direct result of the optimization of financialization. The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed widely, if not fairly. This chart shows that labor’s declining share of the national income is not a recent problem, but a 45-year trend: despite occasional counter-trend blips, labor (earnings from labor/ employment) has seen its share of the economy plummet regardless of the political or economic environment.

Given the gravity of the consequences of this trend, mainstream economists have been struggling to explain it, as a means of eventually reversing it. The explanations include automation, globalization/offshoring, the high cost of housing, a decline of corporate competition (i.e. the dominance of cartels and quasi-monopolies), a failure of our educational complex to keep pace, stagnating gains in productivity, and so on. Each of these dynamics may well exacerbate the trend, but they all dodge the dominant driver of wage stagnation and rise income-wealth inequality: our economy is optimized for financialization, not labor/earned income. What does our economy is optimized for financialization mean? It means that capital and profits flow to the scarcities created by asymmetric access to information, leverage and cheap credit — the engines of financialization.

Financialization funnels the economy’s rewards to those with access to opaque financial processes and information flows, cheap central bank credit and private banking leverage. Together, these enable financiers and corporations to get the borrowed capital needed to acquire and consolidate the productive assets of the economy, and commoditize those productive assets, i.e. turn them into financial instruments that can be bought and sold on the global marketplace. Labor’s share of the national income is in freefall as a direct result of the optimization of financialization. Meanwhile, the official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade.

In other words, those with fixed incomes that don’t keep pace with inflation will have lost a third of their income after a decade of central bank-engineered inflation. But in an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. There is a core structural problem with engineering 3% annual inflation. Those whose income doesn’t keep pace are gradually impoverished, while those who can notch gains above 3% gradually garner the lion’s share of the national income and wealth.

“Unless Robots pay payroll taxes, the financing for Social Security and Medicare will collapse. And it goes on down from there.”

• The US Economy is Failing (Paul Craig Roberts)

Americans carry on by accumulating debt and becoming debt slaves. Many can only make the minimum payment on their credit card and thus accumulate debt. The Federal Reserve’s policy has exploded the prices of financial assets. The result is that the bulk of the population lacks discretionary income, and those with financial assets are wealthy until values adjust to reality. As an economist I cannot identify in history any economy whose affairs have been so badly managed and prospects so severely damaged as the economy of the United States of America. In the short/intermediate run policies that damage the prospects for the American work force benefit what is called the One Percent as jobs offshoring reduces corporate costs and financialization transfers remaining discretionary income in interest and fees to the financial sector.

But as consumer discretionary incomes disappear and debt burdens rise, aggregate demand falters, and there is nothing left to drive the economy. What we are witnessing in the United States is the first country to reverse the development process and to go backward by giving up industry, manufacturing, and tradable professional skill jobs. The labor force is becoming Third World with lowly paid domestic service jobs taking the place of high-productivity, high-value added jobs. The initial response was to put wives and mothers into the work force, but now even many two-earner families experience stagnant or falling material living standards. New university graduates are faced with substantial debts without jobs capable of producing sufficient income to pay off the debts.

Now the US is on a course of travelling backward at a faster rate. Robots are to take over more and more jobs, displacing more people. Robots don’t buy houses, furniture, appliances, cars, clothes, food, entertainment, medical services, etc. Unless Robots pay payroll taxes, the financing for Social Security and Medicare will collapse. And it goes on down from there. Consumer spending simply dries up, so who purcheses the goods and services supplied by robots? To find such important considerations absent in public debate suggests that the United States will continue on the country’s de-industrialization, de-manufacturing trajectory.

Tricks to keep credit flowing.

• Debt-Slave Industry Frets over Impact of Mass Credit Freezes (WS)

“Let’s face it, 143 million frauds won’t be perpetrated right away; it will take some time to filter through,” Steve Bowman, chief credit and risk officer at GM Financial, the auto-lending subsidiary of General Motors, told Reuters. He was talking about the consequences of the Equifax hack during which the most crucial personal data, including Social Security numbers, of 143 million American consumers along with equivalent data of Canadian and British consumers, had been stolen. These consumers have all at once become very vulnerable to all kinds of fraud, including identity theft – where a fraudster borrows money in their name. The day Equifax disclosed the hack, I urged affected consumers to put a credit freeze on their credit data at the three major credit bureaus — Equifax, TransUnion, and Experian — to protect themselves against these frauds.

Soon, the largest media outlets and state attorneys general urged consumers to do the same thing. Financial advisors are recommending it. Even Wells Fargo jumped on the credit freeze bandwagon. As a result, consumers have flooded the websites of the three credit bureaus to request credit freezes in such numbers that the sites slowed down, timed out, or went down entirely for periods of time. This credit freeze frenzy is scaring the credit industry – not just the credit bureaus, but also lenders and companies that rely on easy credit to sell their wares, such as automakers and department stores with instant credit cards. With a credit freeze in place, those consumers cannot be approved for new credit until they lift the credit freeze, which can take up to three business days. The time and extra hoops to jump through before applying for a new loan might deter consumers from buying that car at the spur of the moment.

No one knows how this is going to turn out – and how it will impact the debt-based consumer economy. But fears are mounting. If just 10% of 324 million folks in the US put a credit freeze on their data, the credit industry will feel the impact painfully. Hence the efforts to contain the fallout. On Wednesday, an apology by the interim CEO of Equifax, Paulino do Rego Barros Jr. – he succeeded CEO Richard Smith, who’d been sacked – concluded with tidbits of a service Equifax is hoping to roll out by January 31. It would allow “all consumers the option of controlling access to their personal credit data.” It would allow them to “easily lock and unlock access to their Equifax credit files.” This is going to be “simple,” and “free for life.”

This “credit lock” or whatever Equifax wants to call it is not a “credit freeze.” TransUnion is offering a similar service. Credit freezes are covered by state law, and credit bureaus have to conform to state law. With these “credit locks” credit bureaus can do whatever they want to, and consumers will have to read the fine print to figure out what that is and how well a “credit lock” will protect them. But those credit locks offer the credit industry a huge advantage over a credit freeze: They can be designed to be lifted instantly. And this is a sign of how frazzled the credit industry, including the lenders, are becoming, about the credit freezes.

Interesting methodology.

• Hong Kong Economy Most At Risk Of Financial Crisis – Nomura (BBG)

Hong Kong is the economy most at risk of suffering a financial crisis, with China the second most vulnerable, according to the latest update of an early warning system devised by Nomura. The findings don’t mean there will be a crisis. “It’s not a purely scientific approach that is very precise,” Singapore-based analyst Rob Subbaraman said by phone on Friday. “It doesn’t mean that indicators are always accurate or that because they have worked in the past they will work in the future.” Subbaraman developed the system along with fellow analyst Michael Loo using data going back to the early 1990s. The findings show that emerging markets are more prone than developed markets, and that Asia ex-Japan is the region that is most at risk.

The analysts selected five indicators that flash a signal of a financial crisis happening in the next 12 quarters when they breach set thresholds:

* Corporate and household credit to GDP

* The corporate and household debt-service ratio

* The real effective exchange rate

* Real — or adjusted for inflation — property prices

* Real equity pricesThe latest update covers the 12 quarters up to and including the first three months of this year. As there are five indicators, each of the countries studied can have a maximum of 60 signals. Hong Kong has the most signals, 52 — higher than during the 1997 Asian financial crisis. China’s total fell to 40 from 41 in the previous update that covered the period up to the fourth quarter of 2016. “Hong Kong looks to be well in the danger zone,” Subbaraman and Loo wrote in the note. They described the decline in China’s total — the first drop since its number of flashing indicators started a steep ascent from zero in the first quarter of 2013 — as encouraging. “Nonetheless, China is still in the danger zone and without further efforts to drain its credit and property excesses, it will be difficult to arrest the trend slowdown in growth.”

Chinese reality. Shadow banks and local government financing vehicles.

• S&P Says China’s Debt Will Grow 77% by 2021 (BBG)

China’s total debt could rise 77% to $46 trillion by 2021, and its push to rein in heavy corporate borrowing has had “only tentative results so far,” S&P Global Ratings said. While the pace of debt expansion is slowing, it still exceeds economic growth, implying that high credit risks could still “incrementally increase,” the rating company said in a report Friday. “Recent intensification of government efforts to rein in corporate leverage could stabilize the trend of financial risks over the next few years,” credit analyst Christopher Lee wrote. “But we still foresee that credit growth will remain at levels that will gradually increase financial stress.” S&P last week cut China’s sovereign credit rating for the first time since 1999, citing the risks from soaring debt, and revised its outlook to stable from negative.

The Finance Ministry responded that the analysis ignores the country’s sound economic fundamentals and that the government is fully capable of maintaining financial stability. In a separate report Friday, S&P said China’s push to rein in corporate borrowing likely hasn’t produced lasting results because it lacks specific targets and time frames for cuts. Corporate debt, including local government financing vehicles, rose 5% last year to $14.5 trillion and is the highest among large economies at 134% of GDP, S&P said. State-owned enterprises are the heaviest borrowers, S&P said, adding that a focus on maintaining stability contributes to cautious policy making and a bias toward a status quo that prioritizes economic growth.

SOEs produce a fifth of economic output while taking out 40% of the bank loans, and they’re less profitable than private counterparts with double the overall debt leverage ratio, S&P said. “Without bold actions, China’s corporate deleveraging aims won’t be met in the next one to two years,” Lee wrote. “China allows moral hazards to persist by providing implicit or even direct support to highly indebted SOEs.

Caution to the wind!

• China Cuts Reserve Requirements To Boost Lending To Small Firms (R.)

China’s central bank on Saturday cut the amount of cash that some banks must hold as reserves for the first time since February 2016 in a bid to encourage more lending to struggling smaller firms and energize its lackluster private sector. The People’s Bank of China (PBOC) said on its website that it would cut the reserve requirement ratio (RRR) for some banks that meet certain requirements for lending to small business and the agricultural sector. The PBOC said the move was made to support the development of “inclusive” financial services. The reserve requirement rate will be cut a further 50 bps to 150 bps from the benchmark RRR rate for banks that meet certain requirements for lending to the targeted sectors, the PBOC said. China’s cabinet had in late September flagged a possible move, saying the government will take a number of measures, including tax exemptions and targeted reserve requirement ratio cuts to encourage banks to support small businesses.

Slow death.

• Fukushima Potentially Leaking Radioactive Water For 5 Months (RT)

The Fukushima nuclear power plant may have been leaking radioactive water since April, its owner has admitted. Tokyo Electric Power Company said on Thursday that a problem with monitoring equipment means it can’t be sure if radiation-contaminated water leaked from the reactor buildings damaged in the 2011 nuclear disaster which was sparked by an earthquake and tsunami, the Japan Times reports. The company said there were errors on the settings of six indicators monitoring groundwater levels of wells around reactor buildings 1-4 at the Fukushima Daiichi Nuclear power station. The indicators weren’t showing accurate water levels, and the actual levels were about 70 centimeters lower than that which the equipment showed. In May, groundwater at one of the wells sank below the contaminated water inside, NHK reports, which possibly caused the radioactive water to leak into the soil.

The company said it is investigating, and that no abnormal increase of radioactivity has shown up in samples. The problem with the six wells in question was discovered this week when the company was preparing another well nearby. The 2011 Fukushima nuclear disaster occurred when three of the plant’s reactors experienced fuel meltdowns and three units were damaged by hydrogen explosions as a result of the earthquake and subsequent tsunami. TEPCO has kept groundwater levels in wells higher than the contaminated water levels inside the plant, usually a meter higher. It also installed water-level indicators, which have now been revealed to be inaccurate. Last week, the company was ordered to pay damages of 376 million yen ($3.36 million) to 42 plaintiffs for the nuclear disaster in the second case a court has which has seen rulings against the company.

The suit, one of about 30 class actions brought against the plant, was brought by residents forced to flee their homes when three reactor cores melted, knocking off the cooling systems and sending radioactive material into the air. The case examined whether the government and TEPCO could have foreseen the tsunami. A government earthquake assessment made public in 2002 predicted a 20% chance of a magnitude 8 earthquake affecting the area within 30 years. The 2011 quake was a magnitude 9. The case argued that the disaster was preventable as emergency generators could have been placed at a location higher than the plant, which stands 10 meters above sea level. The court found the state wasn’t liable, but another case in March found both TEPCO and the government liable.

Home › Forums › Debt Rattle October 1 2017