Vincent van Gogh Landscape at twilight 1890

And loses 33,000 jobs while unemployment falls?! And 935,000 full time jobs are added. Time to stop paying any attention to the B(L)S. You can’t trust it.

• BLS Caught Fabricating Wage Data (ZH)

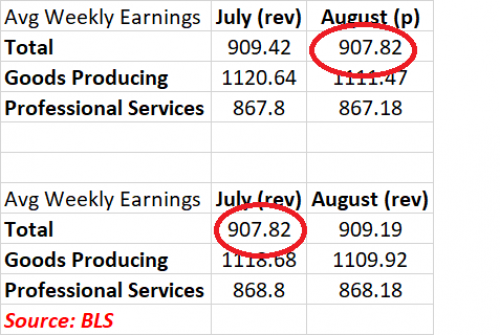

[..] the BLS reported that the annual increase in Average Weekly Earnings was a whopping 2.9%, above the 2.5% expected, and above the 2.5% reported last month. On the surface this was a great number, as the 2.9% annual increase – whether distorted by hurricanes or not – was the highest since the financial crisis. However, a problem emerges when one looks just one month prior, at the revised August data. What one sees here, as Andrew Zatlin of South Bay Research first noted, is that while the Total Private Average Weekly Earnings line posted another solid increase of 0.2% month over month, an upward revision from the previous month’s 0.1%, when one looks at the components, it become clear that the BLS fabricated the numbers, and may simply hard-coded its spreadsheet with the intention of goalseeking a specific number.

Presenting Exhibit 1: Table B-3 in today’s jobs report. What it shows is that whereas there was a sequential decline in the Average Weekly Earnings for Goods Producing and Private Service-producing industries which are the only two sub-components of the Total Private Line (and are circled in red on the table below) of -0.8% and -0.1% respectively, the BLS also reported that somehow, the total of these two declines was a 0.2% increase! Another way of showing the July to August data: • Goods-Producing Weekly Earnings declined -0.8% from $1,118.68 to $1,109.92 • Private Service-Providing Weekly Earnings declined -0.1% from $868.80 to $868.18 • And yet, Total Private Hourly Earnings rose 0.2% from $907.82 to $909.19. What the above shows is, in a word, impossible: one can not have the two subcomponents of a sum-total decline, while the total increases. The math does not work.

This, as Zatlin notes, undermines not only the labor inflation narrative, but it puts into question the rest of the overall labor data, and whether there are other politically-motivated, goalseeked “spreadsheet” errors. We have sent an email to the BLS seeking an explanation for the above data fabrication, meanwhile here is what likely happened: a big, juicy fat-finger error, whether on purpose or otherwise because if one looks at the finalized July weekly earnings of $907.82, it’s precisely the same as what the August preliminary wage number was as released last month, also $907.82. For the excel fans out there, it means that the August totals were simply hard coded when the BLS shifted cells in the spreadsheet, becoming July.

Will probably be a Cat 2-3 hurricane by then.

• Tropical Storm Nate Heads Into The Heart Of US Offshore Oil Industry (CNBC)

As Tropical Storm Nate continued on its course toward the Gulf of Mexico on Friday, energy companies shut down offshore oil and gas platforms, while Louisiana braced for a potential hurricane. Nate is forecast to strengthen as it enters the Gulf and develop into a hurricane by the time it reaches the northern Gulf Coast on Saturday evening, the National Hurricane Center said Friday. Hurricane and storm surge watches are in effect for southeastern Louisiana, including New Orleans, through the Mississippi-Alabama border. The Gulf is home to nearly one-fifth of all U.S. oil output. Drillers who pump crude from offshore platforms have lately produced at record levels above 1.7 million barrels a day. The region already had to contend with Hurricane Harvey in August.

“The major difference between Harvey and Nate is that the trajectory of Nate brings it right through the heart of the U.S. Gulf of Mexico oil and gas producing region,” said Andy Lipow, president of Lipow Oil Associates. BP and Chevron are ceasing production on all platforms in the Gulf of Mexico, Reuters reported. Royal Dutch Shell and Anadarko Petroleum dialed back activity, while Exxon Mobil, Statoil and others are withdrawing workers. If Nate develops into a Category 2 or 3 hurricane, it could impact up to 80% of the Gulf’s output, Lipow forecast. The storm also has the potential to affect about 15% of U.S. refining capacity in the New Orleans area, Mississippi and Alabama. The region’s biggest refineries include Exxon Mobil’s Baton Rouge facility and Marathon Petroleum’s Garyville, Louisiana, plant, both capable of turning out more than 500,000 barrels a day.

A whole nation full of debt slaves in denial. And not the only nation either.

• It’s ‘Crunch Time’ For Australian Households (BI)

Australian households are in a vulnerable financial position, especially those who have taken out a mortgage. And in an era of weak incomes growth, soaring energy prices and high levels of indebtedness, with the prospect of higher interest rates on the way, many intend to cut discretionary spending in anticipation of even tighter household budgets. That’s the finding of the latest AlphaWise survey conducted by Morgan Stanley, which paints an unsettling picture on the outlook for not only Australia’s retail sector, but also the broader economy. Yes, the weakness in retail sales over the past two months may soon become entrenched. The “crunch time” for Australian households, as Morgan Stanley puts it, has begun. “In early June, we expressed the view that the Australian consumer faces a domestic cash flow and credit crunch,” the bank wrote in a note released this week.

“Income growth has not recovered, ‘cost of living’ inflation is re-accelerating and ‘macro-prudential’-related tightening of credit conditions is extending from housing into consumer finance.” In order to test how households may respond to higher interest rates, whether as a result of macroprudential measures to slow investor and interest-only housing credit growth or official moves from the Reserve Bank of Australia (RBA), Morgan Stanley conducted a national survey of 1,836 mortgagors to identify household conditions during late July and early August. Australia’s 2016 census found that 34.5% of households were currently paying off a mortgage. Morgan Stanley says the survey was designed to provide insight into the health of the household balance sheet, including their spending intentions as a result of higher mortgage rates. The news was not good.

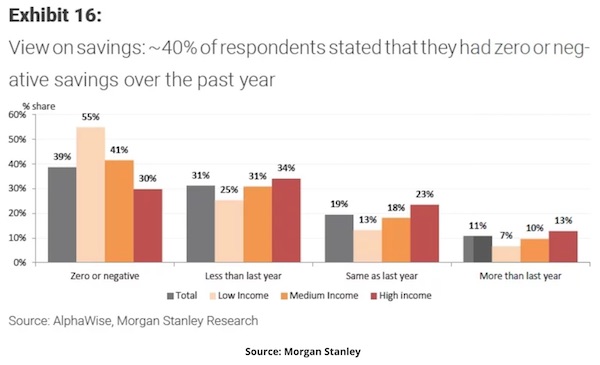

“Findings from the AlphaWise survey confirm the stresses in the consumer sector we have been highlighting for some time now,” it says. “Most households have minimal buffers against a shock to their income, and expect to respond to higher debt servicing costs by drawing down on savings and cutting back on expenditure. “Other sectors of the economy may be able to offset some of the headline weakness, but the concentrated exposure of the household sector and economy to an extended housing market is posing an increasingly important structural and cyclical risk to consumer spending.” Of those households surveyed, 54% said they intended to cut back on expenditure in response to higher interest rates, with a further 25% planning to draw down on their savings to cope with higher servicing costs, a pattern that has been seen in Australia’s savings ratio which fell to a post-GFC low in the June quarter.

Somewhat alarmingly, 40% of those surveyed indicated that they did not save at all over the past year, particularly among low-income households. [..] “Only around 13% of respondents expect to be able to save more in the next 12 months..”

Read the whole thing. It’s completely insane.

• JPMorgan Paid Fine for 2008 Mortgage Crisis With .. Phony Mortgages (N.)

You know the old joke: How do you make a killing on Wall Street and never risk a loss? Easy—use other people’s money. Jamie Dimon and his underlings at JPMorgan Chase have perfected this dark art at America’s largest bank, which boasts a balance sheet one-eighth the size of the entire US economy. After JPMorgan’s deceitful activities in the housing market helped trigger the 2008 financial crash that cost millions of Americans their jobs, homes, and life savings, punishment was in order. Among a vast array of misconduct, JPMorgan engaged in the routine use of “robo-signing,” which allowed bank employees to automatically sign hundreds, even thousands, of foreclosure documents per day without verifying their contents.

But in the United States, white-collar criminals rarely go to prison; instead, they negotiate settlements. Thus, on February 9, 2012, US Attorney General Eric Holder announced the National Mortgage Settlement, which fined JPMorgan Chase and four other mega-banks a total of $25 billion. JPMorgan’s share of the settlement was $5.3 billion, but only $1.1 billion had to be paid in cash; the other $4.2 billion was to come in the form of financial relief for homeowners in danger of losing their homes to foreclosure. The settlement called for JPMorgan to reduce the amounts owed, modify the loan terms, and take other steps to help distressed Americans keep their homes. A separate 2013 settlement against the bank for deceiving mortgage investors included another $4 billion in consumer relief.

A Nation investigation can now reveal how JPMorgan met part of its $8.2 billion settlement burden: by using other people’s money. Here’s how the alleged scam worked. JPMorgan moved to forgive the mortgages of tens of thousands of homeowners; the feds, in turn, credited these canceled loans against the penalties due under the 2012 and 2013 settlements. But here’s the rub: In many instances, JPMorgan was forgiving loans on properties it no longer owned. The alleged fraud is described in internal JPMorgan documents, public records, testimony from homeowners and investors burned in the scam, and other evidence presented in a blockbuster lawsuit against JPMorgan, now being heard in US District Court in New York City.

Big demos today against Catalans.

• EU Official Warns War a Possibility in Catalonia (VoA)

The team captain of Spain’s storied football club Barcelona, which has become a focal point of secessionist Catalan sentiment, is urging politicians in Madrid and the Catalan capital to start negotiating about the future of Spain’s restive northeast province. “Before we do ourselves more damage, those in charge must open dialogue with each other. Do it for all of us. We deserve to live in peace,” Andrés Iniesta wrote on his Facebook page, apologizing at the same time for weighing in on “situations that are complex.” His appeal came as a top EU official Thursday warned that the separatist dispute, exacerbated by Catalan secessionists holding an illegal independence referendum Sunday, risks escalating into armed conflict.

“The position is very, very alarming. Civil war is conceivable there, in the middle of Europe,” Gunther Oettinger, the Germany EU commissioner said at an event in Munich. Oettinger and the EU Commission, the European bloc’s governing body, which fears Catalan independence might stir up separatism elsewhere in Europe, have also urged the authorities in Madrid and Barcelona to start negotiations and to avoid further provocations. But there are little signs of that happening. Both sides appear to be standing firm in Spain’s worst constitutional crisis since an attempted coup in 1981. [..] Nationalist sentiment is deepening fast: in Madrid observers have noted more buildings are sporting the Spanish national flag. Spaniards have long harbored an historical fear of dismemberment – Catalan nationalist sentiment was a key factor behind the Spanish civil war of the 1930s.

Wonder how long that holds.

• Spain Apologizes, Tone Softens In Catalonia Independence Crisis (R.)

Spain apologized on Friday for a violent police crackdown on Catalonia’s independence referendum, in a conciliatory gesture as both sides looked for a way out of the nation’s worst political crisis since it became a democracy four decades ago. Spain’s representative in northeast Catalonia, which accounts for a fifth of the national economy, made the apology just as Catalonia’s secessionist leader appeared to inch away from a plan to declare independence as early as Monday. “When I see these images, and more so when I know people have been hit, pushed and even one person who was hospitalized, I can’t help but regret it and apologize on behalf of the officers that intervened,” Enric Millo said in a television interview.

[..] Moments earlier, a Catalan parliament spokeswoman said the regional government’s leader, Carles Puigdemont, had asked to address lawmakers on Tuesday, in timing that appeared at odds with earlier plans to move an independence motion on Monday. Puigdemont wanted to speak on the “political situation”. The softer tone contrasted with remarks earlier on Friday from Catalonia’s head of foreign affairs who told BBC radio it would go ahead with an independence debate in the regional parliament. Spanish Prime Minister Mariano Rajoy has offered all-party political talks to find a solution, opening the door to a deal giving Catalonia more autonomy. But he has ruled out independence and rejected a Catalan proposal for international mediation.

Steve in the lion’s den. “The OECD was one of the formal economic policy groups that wildly misinterpreted the economic data of 2007..”

• OECD New Approaches to Economic Challenges (Steve Keen)

This is one of the highlights so far of my life as a rebel economist: giving an invited talk at the OECD. The OECD was one of the formal economic policy groups that wildly misinterpreted the economic data of 2007, believing that it heralded “sustained growth in OECD economies … underpinned by strong job creation and falling unemployment.” Five years later, they established the New Approaches to Economic Challenges (NAEC) initiative, and they’re trying to expand the horizons of economics beyond the narrow and fallacious confines of Neoclassical economics. Being invited to speak there, and getting such a positive reception from OECD Ambassadors, confirmed my belief that if change is to come in economics, it will come from formal economic bodies (the OECD, IMF, Central Banks and Treasuries) rather than university departments.

Formal bodies have to wear the consequences of being wrong about the economy, whereas Neoclassical-dominated university departments can retreat into isolation when the real world fails to conform to their fantasies about it. Nothing is certain however. The desire to fall back into ideologically comfortable but practically false ways of thinking about the economic system is strong. Groups like NAEC within the OECD need support, and they themselves need to support the young students in Rethinking Economics, who are far more amenable to a new paradigm than their hidebound academic instructors in the major Universities.

“Neoclassical economists are not experts on money but experts in finding reasons to believe you can model capitalism as though money banks and debt don’t exist. “And then you give them the right to control the banking system.”

• Mainstream Economists Live In A Parallel Universe (Ren.)

Neoclassical economic theory claims that the human being is a rational self-serving profit maximising unit. It claims to prove the market can handle anything. Classical economists model the economy based on the concept of rational consumers maximising utility and firms maximising profits. Their vision of the world claims that equilibrium is reached and the world functions best if there is no government, no trade unions and no monopolies. Professor Keen says mainstream economist change reality to fit their model. University campuses used to be about education, challenging people exposing them to ideas they didn’t necessarily have in the first instance. But Professor Keen says economics actually leads away from this possibility. “Economics starts by inculcating a view of how you should think about the economy that rules out a whole range of alternatives,” he said.

“It rules out thinking about the sort of work that I do, working from the top down, looking at the overall economy and modelling that way. They say ‘no, you’ve got to start from the isolated individual and you have to talk about individuals for maximising utility’. We’re talking about them as consumers or firms who are maximising profits. “In their mind that is the definition of a perfectly functioning system, but it is not the definition of the world in which we live. “Once you’ve got the mathematical structure of trying to do that, you have a very hard time treating anything else as a sensible analysis of capitalism. They rule out a whole lot of other ways of thinking.”

[..] “Imagine capitalism with no banks, no debt, and no money,” says Professor Keen. “You’re getting pretty close to being a neoclassical economist.” “Neoclassical economists are not experts on money but experts in finding reasons to believe you can model capitalism as though money banks and debt don’t exist. “And then you give them the right to control the banking system.”

“..with half of the flyover population in an opiate daze, and chain-stores shuttering to the tune of 10,000 this year, and car leases expiring into a car market dependent on liar loans bundled into janky securities, and the debt problem festering away like a something dead under the floor boards.”

Grinning like Wonderland’s Cheshire Cat, the Golden Golem of Greatness pronounced this interval of fine fall weather “the calm before the storm.” Hmmmm. Talk about cryptic. This was less than a week after he verbally smacked down Secretary of State Rex Tillerson for “wasting his time” trying to diplomatically reach “Little Rocket Man… “ whereby Rex riposted, calling the President a “moron.” Ordinarily — say, during the past 220-odd years of this nation’s existence — talk like that would prompt a resignation (though, there are no other instances of talk like that). illerson must think that for the good of the country he can’t resign, and God knows what kind of desperate notes are being swapped around between the State Department and the Pentagon.

[..] We are entering a slot of time where an awful lot of things might go wrong. What gets me is seeing the stock markets make new record highs every other day, whether Puerto Rico is destroyed overnight or hundreds of people are shot in a Las Vegas parking lot — and notwithstanding the overall phony-baloney condition of the American economy, with half of the flyover population in an opiate daze, and chain-stores shuttering to the tune of 10,000 this year, and car leases expiring into a car market dependent on liar loans bundled into janky securities, and the debt problem festering away like a something dead under the floor boards. Some kind of financial accident with a this-sucker-is-going-down flavor feels like it’s waiting to happen.

I don’t think Trump was referring to that either, but what if it came down around the same moment that we decided to light up North Korea? Or, alternately, if Rex Tillerson, Mike Pence, and a score of other senior politicos decide that its time for Trump to go? The president is looking mighty friendless these days, and more than a little reckless. I mean, for the good of the country, ladies and gentlemen, what are they waiting for? Will his generals defend him? Nah. Fuggedabowdit. I wonder what the code-name for their action will be. Operation Moron Overboard? The whole spectacle is starting to look like a Coen Brothers movie. When the time comes, I hope they will make the documentary about these strange days of October, 2017.

But it will just keep going.

• Russiagate Is More Fiction Than Fact (Nation)

In the electrified aftermath of the election, aides to Hillary Clinton and Obama pored over polling numbers and turnout data, looking for clues to explain what they saw as an unnatural turn of events. One of the theories to emerge from their post-mortem was that Russian operatives who were directed by the Kremlin to support Trump may have taken advantage of Facebook and other social media platforms to direct their messages to American voters in key demographic areas in order to increase enthusiasm for Trump and suppress support for Clinton. These former advisers didn’t have hard evidence that Russian trolls were using Facebook to micro-target voters in swing districts—at least not yet—but they shared their theories with the House and Senate intelligence committees, which launched parallel investigations into Russia’s role in the presidential campaign in January.

The theories paid off. A personal visit in May by Democratic Senator Mark Warner, vice-chair of the Senate Intelligence Committee, “spurred the company to make some changes in how it conducted its internal investigation.” Facebook’s announcement in August of finding 3,000 “likely” Russian ads is now an ongoing “scandal” that has dragged the company before Congressional committees. Other election threats loom. A recent front-page New York Times article linking Russian cyber operations to voting irregularities across the United States is headlined, “Russian Election Hacking Efforts, Wider Than Previously Known, Draw Little Scrutiny.” But read on and you’ll discover that there is no evidence of “Russian election hacking,” only evidence-free accusations of it.

Voting problems in Durham, North Carolina, “felt like tampering, or some kind of cyberattack,” election monitor Susan Greenhalgh says, and “months later…questions still linger about what happened that day in Durham as well as other counties in North Carolina, Virginia, Georgia and Arizona.” There is one caveat: “There are plenty of other reasons for such breakdowns—local officials blamed human error and software malfunctions—and no clear-cut evidence of digital sabotage has emerged, much less a Russian role in it.” The evidence-free concern over Russian hacking expanded in late September when the Department of Homeland Security informed 21 states that they had been targeted by Russian cyber-operations during the 2016 election. But three states have already dismissed the DHS claims, including California, which announced that after seeking “further information, it became clear that DHS’s conclusions were wrong.” Recent elections in France and Germany saw similar fears of Russian hacking and disinformation—and similar results.

In France, a hack targeting the campaign of election winner Emmanuel Macron ended up having “no trace,” of Russian involvement, and “was so generic and simple that it could have been practically anyone,” the head of French cyber-security quietly explained after the vote. Germany faced an even more puzzling outcome: Nothing happened. “The apparent absence of a robust Russian campaign to sabotage the German vote has become a mystery among officials and experts who had warned of a likely onslaught,” the Post reported in an article headlined “As Germans prepare to vote, a mystery grows: Where are the Russians?” The mystery was so profound that The New York Times also explored it days later: “German Election Mystery: Why No Russian Meddling?”

RIpping apart the blockchain.

• Your Local Bank Could Be the Central Bank (BBG)

In practice it is difficult to envisage a sustainable digital currency that would not be accessible to all; cryptocurrencies are increasingly attractive to the general public. As for privacy, a decentralized ledger, on top of the security advantage it brings, makes the anonymity attached to cash transactions technically possible, and is thus nothing new. The BIS acknowledges as much: While it may look odd for a central bank to issue a cryptocurrency that provides anonymity, this is precisely what it does with physical currency, i.e. cash. Perhaps a key difference is that, with a retail CBCC, the provision of anonymity becomes a conscious decision.

Some might argue that an anonymous payment network would run against the current trend in anti-money-laundering regulation, where the origin of invested cash is carefully vetted to avoid criminal or tax evasion activities. Technically, there is nothing to prevent central bank digital currencies from being fully traceable. Even a decentralized ledger (where transactions are recorded digitally across many computers) only provides the potential for anonymity but does not guarantee it. But if there is no desire for anonymity, then there would be no need for the ledger to be decentralized. The logical outcome would be for central banks themselves to offer retail services, taking deposits from the general public. The BIS considers this possibility:

“We argue that the main benefit that a consumer-facing retail CBCC would offer, over the provision of public access to (centralized) central bank accounts, is that the former would have the potential to provide the anonymity of cash. In particular, peer-to-peer transfers allow anonymity vis-à-vis any third party. If third-party anonymity is not of sufficient importance to the public, then many of the alleged benefits of retail CBCCs can be achieved by giving broad access to accounts at the central bank.” A central bank e-minting monopoly would fundamentally change the structure of the banking system, leading to an increased monetary basis and seigniorage. Any temptation to abuse the enhanced minting monopolies would be reduced not by new technology but by the competitive alternatives offered by other countries’ digital currencies, or even, if necessary, old-fashioned valuable commodities.

The introduction of CBBCs that are traceable would also bring about a revolutionary transformation of the financial system architecture. This is, quite obviously, the opposite of the libertarian ideology underpinning the original cryptocurrencies. It would also accelerate the dismantling of the banking system as we know it. With central banks offering retail services, commercial banks would lose deposits, and with it their ability to lend. It would curtail or end the role of the money multiplier – whereby banks lend more than they receive in deposits, thus increasing the overall money supply – in the economy, and so necessitate massive monetary creation to maintain levels of liquidity in the market. Lending would increasingly be made by regulated specialized funds.

Strange and ugly.

• US Escalates Trade Dispute With UK And Canada Over Bombardier (G.)

The US has escalated its trade dispute with Britain and Canada by announcing plans to slap a further 80% duty on the export of planes built by Bombardier. The move follows complaints by Boeing that Canadian-owned Bombardier, which employs more than 4,000 people in Belfast, had dumped its C Series jets at “absurdly low” prices. Bombardier is facing a planned 220% tariff as part of a separate investigation, the US Department of Commerce confirmed. A second levy of 80% is also being applied to Bombardier’s sales to the US after a preliminary finding that the jets were sold below cost price to Delta Air Lines in 2016. Boeing claimed that 75 aircraft were sold at nearly £10.6m below cost price. Bombardier dismissed the claim as “absurd”. The company is due to begin delivering a blockbuster order for up to 125 new jets to Atlanta-based Delta next year.

The US commerce secretary, Wilbur Ross, said: “The United States is committed to free, fair and reciprocal trade with Canada, but this is not our idea of a properly functioning trading relationship. We will continue to verify the accuracy of this decision, while doing everything in our power to stand up for American companies and their workers.” [..] The proposed duties would not take effect unless affirmed by the US International Trade Commission (ITC) early next year. To win its case before the ITC, Boeing must prove it was harmed by Bombardier’s sales, despite not using one of its own jets to compete for the Delta order. Bombardier said it was confident that the ITC would find Boeing had not been harmed, calling the Department of Commerce decision a case of “egregious overreach”. Delta said the decision was preliminary and it was confident the ITC “will conclude that no US manufacturer is at risk” from Bombardier’s plane.

Australia next?! US?

• Canada Will Pay Compensation To Thousands Of Indigenous ‘Stolen Children’ (R.)

Canada will pay up to C$750m in compensation to thousands of aboriginals who were forcibly removed as children from their families decades ago, promising to end “a terrible legacy”. The move is the latest attempt by the Liberal government of the prime minister, Justin Trudeau, to repair ties with Canada’s often-marginalised indigenous population, which says it has been the victim of systemic racism for centuries. In the so-called “Sixties Scoop”, welfare authorities took about 20,000 aboriginal children from their homes between the 1960s and 1980s and placed them in foster care or allowed them to be adopted by non-indigenous families. The compensation package is designed to settle many of the lawsuits launched by survivors, who say the forced removal deprived them of their heritage and led to mental disorders, substance abuse and suicide.

“Language and culture, apology, healing – these are essential elements to begin to right the wrong of this dark and painful chapter,” said Carolyn Bennett, the federal minister in charge of relations with the indigenous population. Canada’s 1.4 million aboriginals, who make up about 4% of the population, experience higher levels of poverty and incarceration and have a lower life expectancy than other Canadians. They are often victims of violent crime and addiction. Indigenous activists complain Trudeau has broken repeated promises to improve their lives since taking office in late 2015. He reshuffled his cabinet in August to put more emphasis on helping aboriginal people. Bennett, at times fighting back tears, told a news conference she had heard “truly heartbreaking stories” about loss of identity and alienation.

Marcia Brown Martel, an aboriginal chief who led the campaign for compensation, lamented the “stealing of children” and noted some of those involved lived as far away as New Zealand. “Think of it as a puzzle, a great big puzzle. Pieces, people are missing,” she told reporters. [..] Trudeau and other Canadian leaders have already apologized for the many abuses committed over a 150-year period when 150,000 aboriginal children were forcibly separated from their parents and sent to church-run residential schools. In 2015, an official report said the schools were an attempt to end the existence of aboriginals as distinct legal, social, cultural, religious and racial entities in Canada.

A look at the future.

• FDP Chief Says Schaeuble ‘Not Tough Enough’ On Greece (K.)

The leader of Germany’s Free Democrats (FDP), Christian Lindner, seen as a likely successor at the finance ministry if his pro-business party enters a coalition with Chancellor Angela Merkel’s Christian Democrats (CDU), has criticized outgoing Finance Minister Wolfgang Schaeuble for not being tough enough on Greece. “Mr Schaeuble did not manage to impose himself over the chancellor in many questions of European policy. Just remember the third aid package for Greece, which he originally did not want to do,” Lindner told German daily Handelsblatt in an interview Friday. The 38-year-old politician managed to lead the FDP back into parliament after a four-year absence on the back of a pledge to limit financial perils from the eurozone and an illiberal assault on Merkel’s open-doors refugee policy.

In the same interview, Lindner called for the creation of an insolvency law for eurozone states, while arguing that countries should be able to leave the common currency area while remaining in the European Union. In May, the FDP chief said that Greece should leave the euro temporarily until its economy was back on track. If the Greek debt is not sustainable as the IMF claims, Lindner said at the time, then it has to be restructured – and this cannot take place within the eurozone. Lindner avoided to say if his party would push to take over the Finance Ministry. “For us a change in fiscal policy is more important than a new minister,” said Lindner, who also expressed doubts about the prospects of a three-way alliance between CDU, FDP and the Greens, known as the “Jamaica coalition.”

Due to lack of identity.

• Greece’s Ruling Syriza Party Falls Apart (K.)

An overwhelming majority of SYRIZA’s “Socialist Trend” faction under MEP Costas Chrysogonos have voted to part ways with the ruling leftists over differences in policy. In a ballot held on Friday, the proposal was backed by 1,678, or 82.6%, of the faction’s 2,032 members. Only 31 wanted to stay with SYRIZA. Officials said the faction will take steps to transform into an independent political grouping. They added that more details will be announced next week. Representatives of the faction also accused SYRIZA of turning into “a true replica of the centralized mainstream parties.”

“..four of the five island camps are hosting two or three times as many people as they were designed for..”

• Overcrowded Greek Refugee Camps Ill-Prepared For Winter: UNHCR (R.)

Greece must speed up winter preparations at refugee camps on islands in the Aegean Sea where there has been a sharp rise in arrivals, the United Nations refugee agency said on Friday. Nearly 5,000 refugees, mostly Syrian or Iraqi families, crossed from Turkey in September – a quarter of all arrivals this year, UNHCR data shows. While that is a fraction of the nearly 1 million who arrived in 2015 – due to a European Union deal with Turkey to block that route – four of the five island camps are hosting two or three times as many people as they were designed for. “UNHCR urges action on the islands to ease overcrowding, improve shelter, and stock and distribute appropriate and sufficient aid items,” said Philippe Leclerc, UNHCR representative in Greece.

In the Moria camp on the island of Lesbos, one of the main entry points, more than 1,500 people are in makeshift shelters or tents without insulation, flooring or heating, UNHCR said. They include pregnant women, people with disabilities, and very young children. On nearby Samos, about 400 people are living in “very difficult” conditions and another 300, including families and lone children, are sleeping in tents in the woods due to a lack of space in the camp, UNHCR said. More than 3,000 people on Samos are crammed into facilities designed to hold 700. In January, refugees in Greece suffered sub-zero temperatures when an icy spell gripped parts of the country and scores of summer tents were weighed down by snow. More than 60,000 refugees and migrants have been trapped in Greece since Balkan countries along the northward overland route to western Europe sealed their borders in March 2016.

UNHCR has been gradually reducing its involvement on the islands since national institutions took over most services in August.

Home › Forums › Debt Rattle October 7 2017