Ansel Adams Boulder Dam 1941

Keep the faith. It’s Christmas time after all.

• Bitcoin Briefly Plunges As Low As $10,400, Down 47%, In Volatile Trading (CNBC)

Bitcoin plunged Friday, taking the digital currency briefly below $11,000 and down 47% from a record high hit at the start of the week. Bitcoin had rallied to a record high above $19,800 on Sunday and was trading near $15,500 for much of Thursday New York time, according to Coinbase. But an afternoon selloff accelerated into the night, and bitcoin dropped 30.2% Friday morning to a low of $10,400 on Coinbase. It had recovered above $14,600 by Friday afternoon, off 27% from the all-time high. There were no immediately apparent explanation for the selloff and extreme volatility.

“I would say the drop in bitcoin is a result of the massive new inflows of retail investors who are relatively ‘weak hands’ and more prone to sell at the sight of falling prices than the capital that has been in the system for a while that has a longer term outlook,” Alex Sunnarborg, founding partner at cryptofund Tetras Capital, said in an email. Adding to the confusion, trading on Coinbase was disabled for more than two hours in the middle of the day. The company had more than 13 million users at the end of November. At its lows, bitcoin had fallen 47% in just five days and lost about $9,400. The digital currency erased more than $1,000 in one hour alone Friday morning.

You’re on your own with Collum’s as always very very long review:

• 2017 Year In Review (David Collum)

A poem for Dave’s Year In Review

The bubble in everything grew

This nut from Cornell

Say’s we’re heading for hell

As I look at the data…#MeToo

~@TheLimerickKing

We have reviews in all sorts and sizes. But with Christmas still to come, can they be complete?!

• 2017 Year in Review (Jim Kunstler)

2017 was the kind of year when no amount of showers could wash off the feeling of existential yeccchhhhh that crept over you day after day like jungle rot. You needed to go through the carwash without your car… or maybe an acid bath would get the stink off. Cinematically, if 2016 was like The Eggplant That Ate Chicago, then 2017 was more like Alfred Hitchcock’s Psycho, a gruesome glimpse into the twisted soul of America. And by that I do not mean simply our dear leader, the Golden Golem of Greatness. We’re all in this horror show together. 2017 kicked off with the report by “seventeen intelligence agencies” — did you know there were so many professional snoops and busybodies on the US payroll? — declaring that Russia, and Vladimir Putin personally, tried to influence the 2016 presidential election.

“Meddling” and “collusion” became the watch-words of the year: but what exactly did they mean? Buying $100,000 worth of Google ads in a campaign that the two parties spent billions on? No doubt the “seventeen intelligence agencies” the US pays for were not alert to these shenanigans until the damage was done. Since then it’s been Russia-Russia-Russia 24/7 on the news wires. A few pleas bargains have been made to lever-up the action. When and if the Special Prosecutor, Mr. Mueller, pounces, I expect the GGG to fire him, pardon some of the plea-bargained culprits (if that’s what they were and not just patsies), and incite a constitutional crisis. Won’t that be fun? Anyway, that set the tone for the inauguration of the Golden Golem, a ghastly adversarial spectacle.

Never in my memory, going back to JFK in 1960, was there such a bad vibe at this solemn transfer of power as with the sight of all those Deep State dignitaries gathering gloomily on the Capitol portico to witness the unthinkable. From the sour scowl on her face, I thought Hillary might leap up and attempt to garrote the GGG with a high-C piano wire right there on rostrum. The “greatest crowd ever” at an inauguration, as the new president saw it, looked pathetically sparse to other observers. The deed got done. Five days later, the Dow Jones stock index hit the 20,000 mark and began a year-long run like no other in history: 50 all-time-highs, and a surge of 5000 points by year’s end, with 12 solid “winning” months of uptick.

That 15% foreign buyers tax didn’t help much.

• Foreign Cash Driving Top-End House Prices In Vancouver And Toronto (R.)

Foreign buyers are driving up the prices of homes in Canada’s two largest housing markets, according to research which will intensify the debate around overseas property ownership in the expensive cities of Vancouver and Toronto. While people living outside Canada own less than 5% of residential properties in the two cities, those homes are worth significantly more than those held by residents, according to a Reuters analysis of data released this week by Statistics Canada. Public debate over the role of foreign investment in Canada has reached a fever pitch, with locals saying price increases of 60% in Vancouver and 40% in Toronto over the past three years are keeping them out of the market. In Toronto, the average value of a detached home built in 2016-2017 and owned by a non-resident is C$1.7m (US$1.3m), a whopping 48.7% higher than C$1.1m for residents.

Those values for Vancouver average a lofty C$2.5m for non-residents and C$1.8m for residents for a difference of 40.6%. Among all detached homes, not just new ones, those owned by non-residents were larger than residents’ houses by 13.1% in Vancouver and 2.2% in Toronto. The new data reinforces anecdotal evidence that foreign buyers tend to focus on the most affluent neighborhoods, said Jane Londerville, a real estate professor at the University of Guelph in Southern Ontario. “If the goal is to get a couple million dollars out of their country and put it in a very safe, calm economy, you might as well buy a C$2m house,” she said. “So they’re buying in Forest Hill in Toronto and Kerrisdale in Vancouver.” The Statscan data does not look at sales, or flow, but rather is a static snapshot of ownership of housing stock at the time of collection.

Foreign capital also targets new condos, with new Vancouver units owned by non-residents valued at 19.7% more than those owned by residents. In Toronto, the difference is 11.2%. “There’s been a huge spike in foreign ownership in newer buildings,” said Diana Petramala, senior researcher at Ryerson University’s urban policy centre in Toronto. [..] A 15% foreign buyers tax was imposed in Vancouver in 2016 and Toronto in 2017 amid a backlash against foreign buyers, particularly from China. This has cooled both markets at least temporarily.

Canada doesn’t want to solve the issue anymore than any other country does.

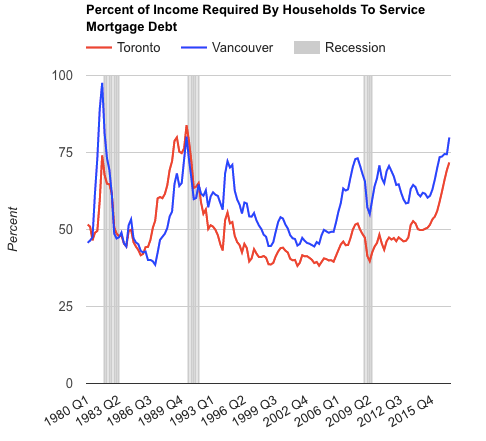

• Canadian Housing Affordability Hits 27 Year Low (Saretsky)

“Nothing says Merry Christmas like a 27 year low for Canadian housing affordability. That’s right, real estate across Canada has not been this un affordable since the year 1990 per RBC. Spoiler alert house prices tumbled shortly thereafter. RBC Bank released their updated Q3 numbers for housing affordability. To no surprise, Vancouver leads the nation in the most unaffordable market to buy a home. Followed by Toronto and then Victoria. “The deterioration in the latest two quarters, in fact, put Vancouver buyers in the worst affordability position ever recorded in Canada.“ The area experienced the sharpest affordability drop among Canada’s major markets between the second and third quarters. RBC’s aggregate measure surged by 5.3 percentage points to 87.5%. This represents a new record high for any market in Canada. We see further downside to Vancouver’s home ownership rate in the period ahead. The rate fell from 65.5% in 2011 to 63.7% in 2016.”

What RBC didn’t mention in their report is the correlation between elevated house prices that cause affordability issues and recessions. When too much household money is spent servicing mortgage payments it eventually becomes a drag on consumer spending and ultimately triggers a recession. This is not to suggest a recession is imminent. But when the percent of income the median family would have to use to service debt pushes above 50% in Toronto and Vancouver, a recession typically follows in Canada. Currently Toronto is at 71.7%, and Vancouver is at 79.87%. With the Bank of Canada expected to follow our US counter parts in 2018, a couple more interest rate increases are sure to erode affordability even further. Across Canada, Household income would need to climb by 8.5% to fully cover the increase in homeownership costs arising from a 75 basis-point hike in mortgage rates. Buckle in.

Would you bet on MBS?

• Saudi Government Wants $6 Billion For al-Waleed’s Freedom (ZH)

In case you were wondering what the going-rate was for one of the world’s richest men’s freedom… it’s $6 billion… in unencumbered cash (not Bitcoin). That is the price that Saudi authorities are demanding from Saudi Prince al-Waleed bin Talal to free him from detention. The 62-year-old prince was one of the dozens of royals, government officials and businesspeople rounded up early last month in a wave of arrests the Saudi government billed as the first volley in Crown Prince Mohammed bin Salman’s campaign against widespread graft. According to the Mail, al-Waleed, who is (or was, until recently) one of the richest men in the world, has also been hung upside down and beaten.

The Saudi government has disclosed few details of its allegations against the accused, but as The Wall Street Journal reports, people familiar with the matter said the $6 billion Saudi officials are demanding from Prince al-Waleed, a large stakeholder in Western businesses like Twitter, is among the highest figures they have sought from those arrested. While the prince’s fortune is estimated at $18.7 billion by Forbes – which would make him the Middle East’s wealthiest individual – he has indicated that he believes raising and handing over that much cash as an admission of guilt and would require him to dismantle the financial empire he has built over 25 years. Prince al-Waleed is talking with the government about instead accepting as payment for his release a large piece of his conglomerate, Kingdom Holding Co., people familiar with the matter said.

The Riyadh-listed company’s market value is $8.7 billion, down about 14% since the prince’s arrest. Kingdom Holding said in November that it retained the support of the Saudi government and that its strategy “remains intact.” According to a senior Saudi official, Prince al-Waleed faces accusations that include money laundering, bribery and extortion. The official didn’t elaborate, but said the Saudi government is merely “having an amicable exchange to reach a settlement.” The prince has indicated to people close to him that he is determined to prove his innocence and would fight the corruption allegations in court if he had to. “He wants a proper investigation. It is expected that al-Waleed will give MBS a hard time,” said a person close to Prince al-Waleed, referring to the crown prince by his initials, as many do.

As I said yesterday, this won’t’ be as big as subprime houseing, but it’ll be much messier: “The problem with high rebate numbers is it absolutely kills the resale value of a car.”

• What’s Going On With Cars? (Gaines)

Automotive credit has become easier in the last few years, and manufacturers are still seeking whatever growth they can come up with in our market at any cost. People are buying cars they can’t afford or shouldn’t even have been able to buy. Used car depreciation is at an all time high for many cars and yet everyday more and more people are trading them in. This whole scenario has a bleak end that became evident when I went to my buddy Paris’ repo lot. He called me to check out a 2016 BMW 435i he jacked for BMW Financial Services. It was a beautiful Estoril Blue M-Sport car with just under eight thousand miles on the clock. I could only imagine the circumstances where someone let go of a year old BMW, but as we walked through I noticed all of the cars seemed to be nearly new.

Paris confirmed my fears when he told my about nine-out-of-ten vehicles he’s repossessed in the last few months were model year 2016 or newer. To make matters worse Paris only does work for prime and a few captive lenders, meaning a majority of these cars went out to consumers with good credit. On the other end, every time I look up from my desk there is a customer who is absolutely drowned in their vehicle. Six thousand dollars in negative equity is the norm, but I’ve witnessed numbers as high as twenty thousand in the last year. Customers are always astounded by how their car has lost so much of its value so quickly. What they fail to realise is their car was worthless from the beginning. Rebates and incentives are at an all time high at many manufacturers, J.D. Power quoted an average around four thousand dollars earlier this year, and I’m sure that number has risen since then. The problem with high rebate numbers is it absolutely kills the resale value of a car.

Keep squeezing, there’s still some blood left there.

• Greek Pensioners May Face Further Cuts In 2018 (K.)

Auxiliary pensions appear headed for a fresh cut in 2018, as the single auxiliary social security fund (ETEAEP) will end 2017 with a deficit, against the small surplus originally forecast. Crucially, while the ETEAEP budget for next year provides for a surplus of €176.01 million, expenditure on pensions will be reduced by 150 million euros. Based on the latest social security laws introduced by former minister Giorgos Katrougalos and current minister Effie Achtsioglou, the new auxiliary pensions – when they are finally issued – will be reduced by 22% on average, with a cut of up to 18% expected to existing pensions in 2019. The provisions of the ETEAEP budget that Kathimerini has seen suggest that existing pensions might be cut as early as next year. The single auxiliary social security fund is now projecting a deficit of €166.6 million for this year, compared to an original forecast for a €10.07 million surplus.

For next year’s surplus of 176.007 million euros to be attained, spending on auxiliary pensions will have to be reduced from €4.30 billion in 2016 and €4.17 billion this year to €4.02 billion in 2018. This means the sum of auxiliary pensions will decline by 3.59% next year. Revenues from next year’s social security contributions are estimated at €2.68 billion, against €2.566 billion this year (compared to a forecast for €2.581 billion). The ETEAEP budget also shows that the fund sold bonds worth €200 million this yea – at a considerable loss – while next year it will need to cash in bonds worth €80 million from the special fund at the Bank of Greece. In total, takings from the fund’s cash and bond handling for this year are estimated at €397.14 million, against an original projection of €200.54 million. Revenues from the utilization or sale of assets will amount to an estimated €311.65 million next year.

How typical is this of mankind on the verge of 2018? The idea is environmental problems can be solved by putting monetary values on everything. The idea is as wrong as it is stupid. Cleaning the planet will not be done for monetary reasons.

• Make Supermarkets And Drinks Firms Pay For Plastic Recycling, Say UK MPs (G.)

Supermarkets, retailers and drinks companies should be forced to pay significantly more towards the recycling of the plastic packaging they sell, an influential committee of MPs has said. Members of the environmental audit committee called for a societal change in the UK to reduce the 7.7bn plastic water bottles used each year, and embed a culture of carrying reusable containers which are refilled at public water fountains and restaurants, cafes, sports centres and fast food outlets. British consumers use 13bn plastic bottles a year, but only 7.5bn are recyled. MPs said the introduction of a plastic bottle deposit return scheme (DRS) was key to reducing plastic waste in the UK, as part of a series of measures to reduce littering and increase recycling rates.

Michael Gove, the environment secretary, has called for evidence on a plastic bottle deposit scheme, and it is expected to be part of measures he announces in the new year. Major retailers have yet to support such a scheme, but Iceland and the Co-op recently announced their backing for a DRS. The report published on Friday underlines the need for government intervention to tackle plastic waste in the UK and calls for higher charges on companies to contribute to clearing up the waste they create. Mary Creagh, chair of the environmental audit committee, said: “Urgent action is needed to protect our environment from the devastating effects of marine plastic pollution, which if it continues to rise at current rates, will outweigh fish by 2050.

“Plastic bottles make up a third of all plastic pollution in the sea and are a growing litter problem on UK beaches. We need action at individual, council, regional and national levels to turn back the plastic tide.” In the report MPs called for the “polluter pays” principle to be applied to companies to increase their contribution to recycling plastic waste.

Home › Forums › Debt Rattle December 23 2017