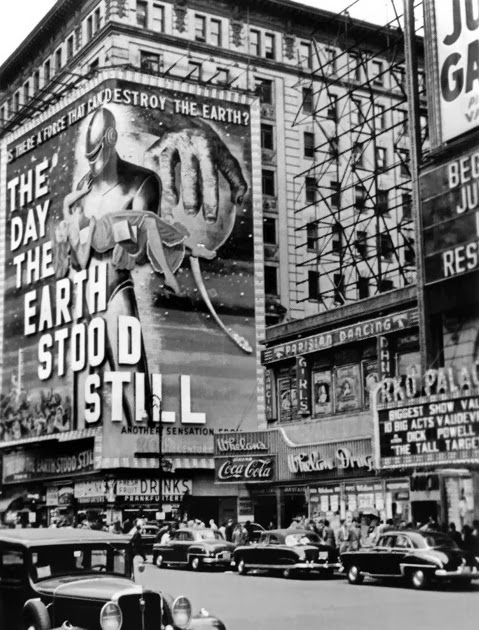

Mayfair Building, Times Square NYC 1951

Dr. D is on a roll.

Dr. D: Since tariffs are in the news again, let’s run down the topic , first in micro, then in macro.

“Trump said this week he’ll slap 25% tariffs on $50 billion to $60 billion in Chinese exports to the U.S., including aerospace, information and communication technology, and machinery. The move is aimed at countering Chinese cyber and intellectual property theft of U.S. technology . It also tries to push back against China’s demands for technology transfers from U.S. companies in return for access to China’s market.

The Chinese government, in turn, said it would hit U.S. shipments to China with $3 billion in tariffs, affecting goods such as pork, aluminum pipes, steel and wine.

“A family of four will end up paying about $500 more to buy (clothing, shoes, fashion accessories and travel goods) every year” if those products are subject to 25% tariffs, the American Apparel and Footwear Association says…

Retaliatory tariffs from China, meanwhile, could especially hurt American farmers. China is the world’s top soybean importer, with the U.S. providing close to 60% of the commodity. And the country is the second-largest purchaser of U.S. pork. Growing talk about a trade war has worried Iowa farmers. The state is the nation’s largest corn and pork producer and second-largest soybean grower.”

Historical background, when Clinton added China to the WTO, it opened the borders and U.S. markets to Chinese goods, but likewise, China promised to treat the exports of the U.S. fairly, which are driven by movies, patents, and intellectual property rights. In theory, that’s how the deal would be equitable. However for 20 years they have not been paying billions in patents or media royalties back to the U.S.. Stealing everything, patents, intellectual rights, ignoring international law, building a mile high tariff wall, and polluting their whole nation to boot, just like we did back in the 19th century when we were a wee country.

Guess what that shows? Tariffs work. It worked for us then and it works for China now. Go to a store and look for any item that isn’t made in China. That has devastated industry, and is arguably dumping, i.e. selling at a loss to ruin your competition. How? China isn’t a “capitalist” country, really. It’s an amalgam of communism and protectionism meant to rapidly modernize China in the footsteps of Stalin or Mao’s “Great Leap Forward,” and it works. As such, factories are built of debt money printed by the Central State then protected from bankruptcy with more printing and bailing out hand-picked winners by the state — just like we do.

Just like Abe buying up the entire Nikkei or the Swiss Bank buying a trillion in foreign stocks. So in a roundabout way, China is creating all these products at a loss, but doesn’t care about profit because people are employed and their industry rockets into the 21st century. Since profit is not a motive and bankruptcy is not a possibility, the strategy to modernize and compete with the U.S. is enhanced not only by moving China forward, but also by moving the U.S. backward into the last century. So the very concept of WTO, “Free Trade”, “Fair Trade” does not and cannot exist with a centrally-planned, centrally-protected, non-free market economy – theirs and ours. Only national strategy remains.

When that’s the case, you see Trump merely advocating for consequences to China breaking the original treaty, the original parity of hard goods for intellectual property. And why shouldn’t breaking a treaty have consequences? The problem of course is what those consequences mean.

Since from the Chinese perspective, they have reduced U.S. wealth, production, capacity for production, and even the U.S. military to 3rd world levels, and the U.S. no longer has the bargaining power to reverse what was supposed to be a free-market trade, but was executed by China as a mercantile/protectionist trade. And good on them, well played!

Here in the States, we hear people say –still!—“well if they give us cheap goods at a loss, who are we not to take them?” Regardless of the jobs lost since that giant sucking sound started. Or worse, “Since rebuilding industry will cost money, any move to help ourselves should be avoided because it will raise prices.” Yes people, we already missed the 21st century, let’s move back from the 20th century into an 19th century African colony because fighting it would cost something and be inconvenient. Worked for Argentina, right?

“I don’t blame China – after all, who can blame a country for taking advantage of another country for the benefit of its citizens… I give China great credit,” said Mr. Trump while addressing a room of business leaders. Instead, the US leader said previous US administrations were responsible for what he called “a very unfair and one-sided” trade relationship with China.”

China seemed to understand this and take it pretty well: in the last 30 years 500 million were lifted out of poverty, they got everything they wanted, and are arguably already the largest, most modern economy, but the ride is over. Asia loves gold-plated show-boaters like Trump and their equanimity was unreported by the press.

It’s no surprise; I’m sure they knew it would end someday. Probably never dreamed it would go on this long. However, the way the game is played, China will still negotiate all they can as the inevitable ends. And with retaliatory tariffs, they negotiate their best deal, and as quoted, Trump understands that too. Nothing personal.

Daily news covered, let’s go Macro.

In the bigger sense, a lot of this is window dressing. We hear a lot about how “the world can’t feed itself if such and such,” but it’s feeding itself now: clearly it’s perfectly possible: if anything we may have too much! Same with trade and tariffs. So China refuses to buy American soybeans, but buys Brazilian, great: stick it to those farmers (mega corps actually) in the voting states! Show ‘em!

But here’s the thing: there are X hectares of soybeans grown on planet earth, and Y people who eat them. If China buys “The Beans of Brazil”™, then whoever bought Brazil last year won’t get theirs and will buy American. Same with steel, same with oil. If China now buys Saudi oil or Russian oil, then that oil is simply removed from Europe, and Europe must buy Norwegian or Venezuelan oil. But it’s the same oil, from the same wells, going to the same people: that is, FROM planet earth, TO planet earth, BY the people of planet earth.

There are strategies and prices, advantages and minutia down there, but in the big picture, the effect becomes more subdued than may appear. So China places tariffs, even boycotts Iowa corn, then that corn is sold to Europe instead. What kind of political pressure are they really bringing, aside from making headlines?

The same is with Trump attempting to change the composition of U.S. industry. It’s a lot harder and takes a lot longer to rotate out of services and back into hard goods than it seems. What’s more, to start making your own chips or medical equipment requires a constellation of support industries: power lines, rails, screw machines, sheet metal stamping, servo motors, and behind them the dirty, heavy industries we erased: mining, steel and aluminum smelting, and so on. Yet this has to be done. We can’t run a country by asking China, “pretty please sell us some steel so we can make battleships to bomb you with.”

But like the soybeans, this shift of capacity doesn’t work in the macro view: if we’re not buying Chinese goods because we’re making our own, what is China going to do with all their factories? That capacity exists. It’s going somewhere or it will collapse, we BOTH have a lot to lose. A cutoff of most retail goods, their factories idled and people in the streets, Mutual Assured Destruction.

This goes back to 2005 and something Ben Bernanke said about the “Global Savings Glut.” That is, the problem wasn’t that the U.S. spent too much, but the real problem was the darn Chinese were too productive, too responsible, and spent too little. You might recognize this same argument from Germany and Greece. As much as this deserves raucous laughter, the larger macroeconomic imbalance is only this: the U.S. imports instead of producing, and China exports instead of consuming.

That’s how we come to a $700B yearly trade deficit, a deficit that is not ours alone, but China’s too. This goes back to righting the trade imbalance, the tariffs, in fact the overall inequality of the present (former) globalism: the U.S. prints fake digits and the Chinese send us real goods. If the imbalances are righted, there is only one path: China must spend more and the U.S. must spend less.

What will China do with their own factories if the U.S. reindustrializes and makes their own goods? They’ll buy those Chinese products themselves.

This is a long time coming, too. For decades, China has worked hard and developed their country, so why should they make cheap products and get nothing for their work? They deserve the products of their labor — arguably more than the Americans do. They need to spend more, and as we see with input costs rising back home, we need to spend less. So let them buy their “Make-happy ginsu mango-mango slicer.” No one deserves it more.

What do you think Chairman-for-life Xi thinks of this? Trump is going to make China stop saving and force their middle class to start spending, to start behaving like the modern nation they are. Xi and his predecessors have been unable to convince China to spend. But now Trump can blame his problems on China and Xi can blame his problems on Trump. So do you think Xi is angry? Or happy?

This had to happen. A nation cannot live at the expense of everyone else forever, amen. The only question is when and how it ends. So if China makes and buys Chinese products, and the U.S. makes and buys U.S. products, and we trade equally, where’s the harm?

It’s no fun to re-industrialize, to fall back to the level of real production your country is capable of minus extractive, extortive credit, but there are only two choices: the Neocon’s one world unipolar empire of murder and force, or nation states with borders and the independence and the internal capacity to produce for and defend themselves on all fronts, agricultural, manufacturing, intellectual, and military.

That’s what the “America First” plan was and in the Asian tour, China showed they understand this. So since nation states are going to persist for now, the best we can do is rebuild, re-normalize, and re-localize independently as best we can.

As the imbalances are reversed, it’s going to be a bumpy ride, but if we can do it, it will be worthwhile. At the very least, better than the alternative (They tried). We can – it is possible – recover our nation again, and with it, what it means to be “America”, and that may be worth the work.

Home › Forums › Trump Makes Xi Happy