Ernst Haas Greece � 1952

So what’s the net effect of QE?

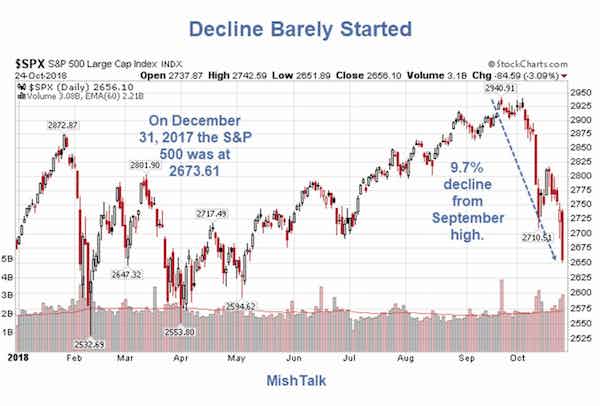

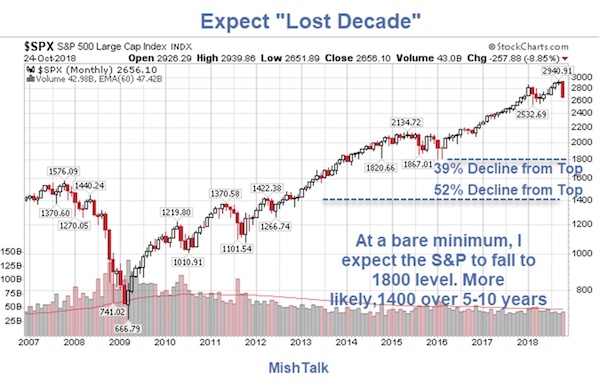

• Expect a “Lost Decade”, Stock Market Rout “Only Just a Start” (Mish)

October has been a terrible month for equities. Yet, this is only a start of what’s to come.

Despite the rout, the S&P is just barely down for the year.

Expect a “Lost Decade”

Why?

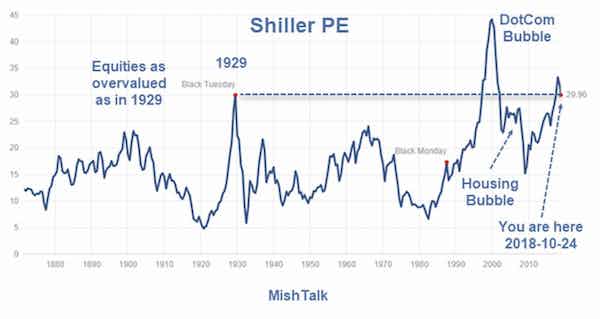

The Shiller PE Ratio also known as “CAPE”, the Cyclically Adjusted Price-Earnings Ratio, is in the stratosphere. It’s not a timing mechanism, rather it’s a warning mechanism. The main idea is that earnings are mean reverting. On that basis, stocks are more overvalued than any time other than the DotCom era. But that is misleading. In 2000 there were many sectors that were extremely cheap. Energy was a standout buy then. So were retail and financials. It’s difficult to find any undervalued sectors now other than gold.

Another Reuters headline says: “World stocks head for worst losing streak in over half a decade..”

• Asian Stocks Hit 20-Month Lows, S&P Futures Slide As Investors Flee Risk (R.)

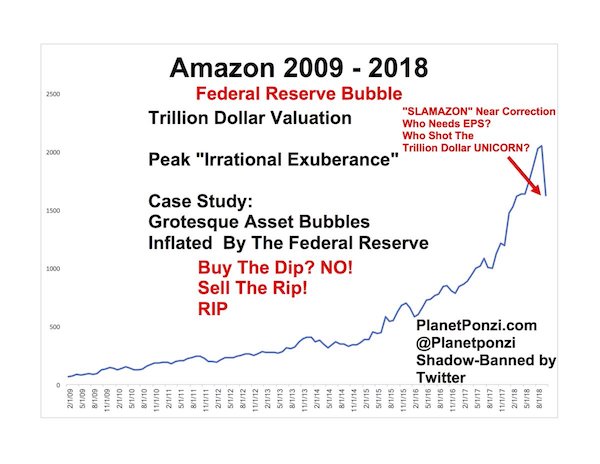

Asian shares skidded to 20-month lows, S&P futures fell sharply and China’s yuan weakened at the end of a turbulent week for financial markets on Friday, as anxiety over corporate profits added to lingering fears about global trade and economic growth. The gloom enveloping Asia was at odds with a bounce on Wall Street overnight, highlighting fragile investor confidence, as shares of tech titans Amazon.com Inc and Alphabet Inc fell sharply after the closing bell on disappointing earnings. In Friday’s Asian session, S&P E-mini futures slumped 0.88 percent, setting up a potentially rough session for U.S. markets which had crumbled on Wednesday on concerns about earnings and sent global equities into a tailspin.

MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 1.04 percent, erasing tiny gains made in the opening hour and hitting its lowest level since February 2017. Not helping was a slide in the Chinese yuan past a key level, refocusing market attention on slowing growth in the world’s second-biggest economy. Shares in Europe are seen following Asia down, with London’s FTSE expected to open 0.9 percent lower, Germany’s DAX off 1 percent and France’s CAC 40 down 1.2 percent, according to David Madden, market analyst at CMC Markets UK. “There’s no question that the weight of sentiment has been building,” said James McGlew, executive director of corporate stockbroking at Argonaut in Brisbane, highlighting in particular rising geopolitical tensions including Brexit, and “internal financial tension” in China.

Big tech big losses.

• Friday Hasn’t Even Started Yet, But It’s Already Ugly (WS)

So far in October, the S&P 500 has booked 13 losing days, including October 10, when the index dropped 3.3%, and October 24, when it dropped 3.1%. Then came today, with the feel-good moment of a boisterous 1.9% gain. And then came after-hours trading, and nearly everything went to heck, particularly the FANGMAN stocks that weigh so heavily on the index with their $4-trillion market cap. And Friday morning looks already ugly.

All of the FANGMAN stocks were in the red in late trading:

Facebook [FB]: -2.3%

Amazon [AMZN]: -7.4%

Netflix [NFLX]: -2.8%

Google’s parent Alphabet [GOOG]: -3.7%

Microsoft [MSFT]: -1.5%

Apple [AAPL]: -0.4%

NVIDIA [NVDA]: -2.8%There were some standout reasons: Amazon plunged after it reported record profit but missed on revenues and guided down Q4 expectations for sales and profits, a sign of slowing revenue growth. It was down as much as $150 a share, or almost 9%. Google’s parent Alphabet reported that revenues grew 22%, which missed expectations. Earnings beat, but a considerable slice – $1.38 billion! – of those earnings came from the gains in its portfolio of equity securities. CFO Ruth Porat warned that traffic acquisition costs would increase further as consumers are shifting search activity from desktop computers to mobile devices. Shares plunged up to 5%.

Can Draghi stop purchasing Italian bonds?

• ECB Keeps Rates On Hold But Reaffirms QE Exit Plans (CNBC)

The European Central Bank (ECB) took no action on Thursday, leaving its benchmark interest rates unchanged. However, the ECB confirmed that its plan to end monetary easing by the end of the year remains on track. “Regarding non-standard monetary policy measures, the Governing Council will continue to make net purchases under the asset purchase programme (APP) at the new monthly pace of 15 billion euros until the end of December 2018,” the ECB said in a statement. “The Governing Council anticipates that, subject to incoming data confirming the medium-term inflation outlook, net purchases will then end,” the bank added.

The decision takes place as concerns mount over Italy’s fiscal policies and their potential impact over the stability of the euro area. The end of the ECB’s massive crisis-era stimulus program could be a challenging moment for European bonds, given that the ECB will no longer be in the market purchasing sovereign paper and providing some sort of backstop. This could add further pressure, mainly on Italy, given the widespread concerns over its debt pile.

There’s a taste of Italy here, though political leanings are very different.

• UK Labour Pledges To Reverse Cuts And ‘End Austerity’ (G.)

The shadow chancellor, John McDonnell, has said Labour would reverse cuts made by the government since 2010 as Labour highlighted more than £108bn needed to “end austerity”. Labour’s pre-budget review said it would take £42bn to reverse departmental spending cuts. The Institute for Fiscal Studies (IFS) had already highlighted another £19bn needed to stop further cuts to government. Some £33.5bn would be required to reverse cuts to social security and social care, Labour said. McDonnell pledged to increase spending on the National Health Service, adult social care, and schools, at a speech in London to business and trade union representatives.

Earlier this month the prime minister, Theresa May, also said she would end the policy of austerity instituted by her predecessor David Cameron and continued by the current government. May told the Conservative party conference: “After a decade of austerity, people need to know that their hard work has paid off.” However, policy experts have highlighted that the government’s pledge leaves room for manoeuvre. The £19bn bill calculated by the IFS, a non-partisan thinktank, would be needed to prevent further cuts in spending to government departments whose budgets are not protected, under one definition of “ending austerity”.

Why invite more of the same?

• Grassley Refers Avenatti And Swetnick For DOJ Investigation (G.)

Chuck Grassley, the chair of the Senate judiciary committee, has referred the lawyer Michael Avenatti and Julie Swetnick, one of Brett Kavanaugh’s accusers, for criminal investigation. In a statement, Grassley said he was referring the two to the justice department for a “criminal investigation relating to a potential conspiracy to provide materially false statements to Congress and obstruct a congressional committee investigation”. Swetnick, who was represented by Avenatti, came forward in late September to allege that Kavanaugh took part in efforts to gang-rape women at drunken parties. She said she too was gang-raped at one such party, but did not directly accuse Kavanaugh of being involved.

Kavanaugh categorically denied the accusations calling them “a joke” and “a farce” in his testimony before the Senate. Avenatti has become an increasingly high-profile opponent of Donald Trump after coming to prominence as the lawyer of Stormy Daniels, a porn star who claims she had an affair with Trump. Avenatti has been an outspoken critic of Trump on cable TV and social media. He is also mulling a run for the White House in 2020. Swetnick was the third woman to come forward to accuse Kavanaugh of sexual misconduct during his confirmation process for the supreme court. The Senate approved Kavanaugh’s nomination by a 50-48 vote in early October.

Grassley accused Swetnick and Avenatti of knowingly misleading the committee. “That’s unfair to my colleagues, the nominees and others providing information who are seeking the truth,” said the Iowa Republican. “It stifles our ability to work on legitimate lines of inquiry. It also wastes time and resources for destructive reasons. Thankfully, the law prohibits such false statements to Congress and obstruction of congressional committee investigations. For the law to work, we can’t just brush aside potential violations. I don’t take lightly making a referral of this nature, but ignoring this behavior will just invite more of it in the future,” Grassley said.

Inequality has become a dangerous game, but greed wins the day every day.

• World’s Billionaires Became 20% Richer In 2017 (G.)

Billionaires made more money in 2017 than in any year in recorded history. The richest people on Earth increased their wealth by a fifth to $8.9tn (£6.9tn), according to a report by Swiss bank UBS. The fortunes of today’s super-wealthy have risen at a far greater rate than at the turn of the 20th century, when families such as the Rothschilds, Rockefellers and Vanderbilts controlled vast wealth. The report by UBS and accountants PwC said there was so much money in the hands of the ultra-rich that a new wave of rich and powerful multi-generational families was being created. “The past 30 years have seen far greater wealth creation than the Gilded Age” the UBS Billionaires 2018 report said.

“That period bred generations of families in the US and Europe who went on to influence business, banking, politics, philanthropy and the arts for more than 100 years. With wealth set to pass from entrepreneurs to their heirs in the coming years, the 21st century multi-generational families are being created.” The world’s 2,158 billionaires grew their combined wealth by $1.4tn last year, more than the GDP of Spain or Australia, as booming stock markets helped the already very wealthy to achieve the “greatest absolute growth ever”. More than 40 of the 179 new billionaires created last year inherited their wealth, and given the number of billionaires over 70 the report’s authors expect a further $3.4tn to be handed down over the next 20 years.

“A major wealth transition has begun,” the report said. “Over the past five years, the sum passed by deceased billionaires to beneficiaries has grown by an average of 17% each year, to reach $117bn in 2017. In that year alone, 44 heirs inherited more than a billion dollars each.

Completely insane.

• Twitter Bans Former Asst. Treasury Secretary Paul Craig Roberts (ZH)

Twitter has suspended noted anti-war commentator, economist and former Assistant Secretary of the Treasury, Paul Craig Roberts. Roberts, 79, served in the Reagan administration from 1981 to 1982. He was formerly a distinguished fellow at the Cato Institute and a senior research fellow at the Hoover Institution, and has written for the Wall Street Journal and Businessweek. Roberts maintains an active blog. He’s also vehemently against interventionary wars around the world, and spoke with Russia’s state-owned Sputnik news in a Tuesday article – in which Roberts said that President Trump’s decision to pull out of the Intermediate-range Nuclear Forces (INF) treaty was a handout to the military-security complex.

The former Reagan administration official clarified that he does not think “that the military-security complex itself wants a war with Russia, but it does want an enemy that can be used to justify more spending.” He explained that the withdrawing from the INF Treaty “gives the military-security complex a justification for a larger budget and new money to spend: manufacturing the formerly banned missiles.” [..] The economist highlighted that “enormous sums spent on ‘defense’ enabled the armaments corporations to control election outcomes with campaign contributions,” adding that in addition, “the military has bases and the armaments corporations have factories in almost every state so that the population, dependent on the jobs, support high amounts of ‘defense’ spending.”

“That was 57 years ago,” he underscored. “You can imagine how much stronger the military-security complex is today.” -Sputnik. Roberts also suggested that “The Zionist Neoconservatives are responsible for Washington’s unilateral abandonment of the INF treaty, just as they were responsible for Washington’s unilateral abandonment of the ABM Treaty [in 2002], the Iran nuclear agreement, and the promise not to move NATO one inch to the East.”

So Assange still doesn’t have his internet back, but he does talk to an Ecuador court via video link.

• Judge Says Assange Hearing Needs A Translator Fluent In ‘Australian’ (RT)

The presiding judge in WikiLeaks co-founder Julian Assange’s case against the Ecuadorian Foreign Ministry has reportedly said that the court made a mistake by appointing an English translator who doesn’t speak Australian. The anecdote was reported by Bloomberg on Thursday and allegedly took place at the first hearing of Assange’s lawsuit against the ministry. Speaking via video link, Australian-born Assange complained to the court that his state-appointed translator from English to Spanish was not cutting it. It’s unclear what exactly the issue was, but Judge Karina Martinez apparently thought Assange’s Australian accent was thick enough to warrant a dedicated expert.

While Australian English is the most spoken dialect Down Under, it is by no means a separate language. The Australian dialect originated in the late 18th and early 19th century from convicts who were the first British settlers to arrive in New South Wales. Admittedly, the Australian vernacular is quite distinct, has rich slang, and peculiar terms. Differences in pronunciation and vocabulary can at times leave an average British or American English speaker perplexed. Assange’s accent, however, is far from the thickest around. Last week, he filed a lawsuit against Ecuador’s Foreign Minister Jose Valencia, accusing the government of violating his “fundamental rights and freedoms” with a set of new rules.

The government files released by an Ecuadorian opposition lawmaker last Tuesday outline the efforts of the Latin American country to prevent Assange from engaging in activities that “could be considered political or interfering with the internal affairs of other states.” They also limit Assange’s visitation rights, force him to pay his own medical bills, and even threaten to take away his cat if he doesn’t look after it properly. Assange’s lawyer, Baltasar Garzon, has accused Valencia of “isolating and muzzling” the fugitive, himself an Ecuadorian citizen since December 2017. Garzon said Assange still has no access to the internet, despite Ecuador’s earlier announcement it would restore communications.

Worth a try.

• Canadian Doctors To Start Prescribing Museum Visits (AFP)

A group of Canadian doctors are to begin prescribing trips to an art gallery to help patients suffering a range of ailments become a picture of health. A partnership between the Francophone Association of Doctors in Canada (MFdC) and the Montreal Museum of Fine Arts (MMFA) will allow patients suffering from a number of physical and mental health issues, along with their loved ones, to take in the benefits of art on health with free visits. The pilot project is unprecedented globally, according to its organizer. The project will see participating physicians prescribe up to 50 visits to the MMFA during treatment, each pass valid for up to two adults and two minors.

So far 100 doctors have enrolled to take part over the course of a year, Nicole Parent, head of the MFdC, told AFP Thursday. The numbers offer proof that doctors have “a sensitivity and openness to alternative approaches if you want” Parent said, citing scientifically proven benefits of art on health. The benefits are similar to those patients can get from physical activity, prompting the secretion of a similar level of feel-good hormones, and can help with everything from chronic pain to depression, stress and anxiety. The pilot program will allow organizers to gather data and analyze results, allowing for the development of protocol for identifying patients.

This summer (which starts Dec 20).

• Entire Great Barrier Reef At Risk Of Bleaching And Coral Death (G.)

Mass bleaching and coral death could be likely along the entire Great Barrier Reef this summer, according to a long-range forecast that coral experts say is “a wake-up call” for the Australian government. The US National Oceanographic and Atmospheric Administration (Noaa) has forecast a 60% chance that the entire Great Barrier Reef will reach alert level one, which signals extreme heat stress and bleaching are likely. The forecast period covers November 2018 to February 2019 and the risk extends to the southern Great Barrier Reef, which escaped the mass mortality seen in the middle and northern parts of the reef in 2016 and 2017.

“This is really the first warning bells going off that we are heading for an extraordinarily warm summer and there’s a very good chance that we’ll lose parts of the reef that we didn’t lose in the past couple of years,” said marine biologist Ove Hoegh-Guldberg, the director of the Global Change Institute at the University of Queensland. “These are not good predictions and this is a wake-up call.” Hoegh-Guldberg said it was particularly worrying that the long-range forecasts were already showing high chances of bleaching and mortality before March, which is the main month of the year for bleaching events.

He said if the models proved accurate it would mean the entire Great Barrier Reef would be damaged by climate change and coral populations would trend towards very low levels, affecting the reef’s tourism and fishing industries and the employment they support. “To really have the full picture we’re going to have to wait for those projections that cover the main part of bleaching season,” he said. “Given sea temperatures usually increase as we get towards March, this is probably conservative.”

Home › Forums › Debt Rattle October 26 2018