Edward Hopper Cat boat 1922

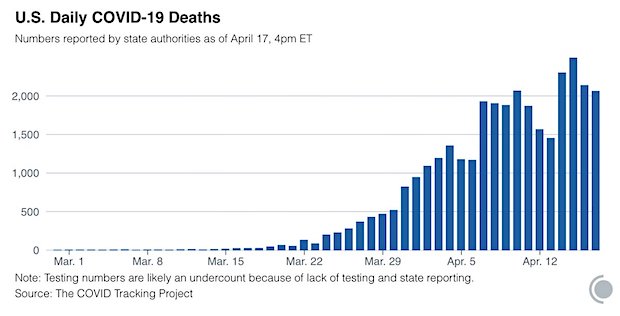

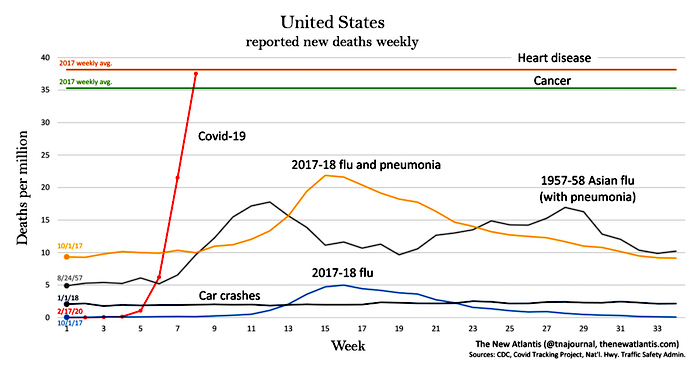

• One week ago, the US #COVID19 #coronavirus death toll was 15,000. In the last 7 days, more than 20,000 Americans have died. The death toll is now 36,000+, Cases top 700,000

• Reported US coronavirus deaths:

– Feb. 17: 0 deaths

– Mar. 17: 111 deaths

– Apr. 17: 36,997 deaths

• Top 10 States – Positive Tests 4/17/20

1) NY/ 222,284 (TH data);

2) NJ/ 78467;

3/ MA/ 32,181;

4) PA/ 29,441;

5) MI/ 29,263;

6 CA/ 28,263;

7) IL/ 27,575;

8) FL/ 24,119;

9) LA/ 23,118;

10)TX 17,371.

• New York reports 7,753 new coronavirus cases & 1,025 new deaths, a total of 233,951 cases & 17,131 deaths..

• 1,081 sailors from French aircraft carrier test positive for coronavirus. 2,010 sailors have been tested so far.

• Coronavirus global update:

– 85k+ cases in last 24 hours

– 2.2 million cases in total

– 1.5 million active

– 575k recovered

– 155k deaths

– 31% of cases in the U.S.

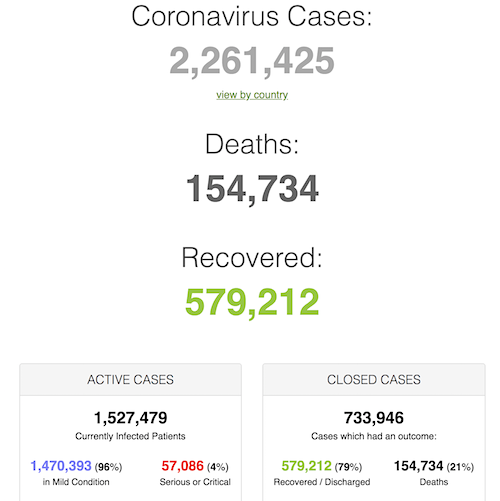

• Cases 2,261,425 (+ 67,867 from yesterday’s 2,193,558)

• Deaths 154,734 (+ 7,356 from yesterday’s 147,378)

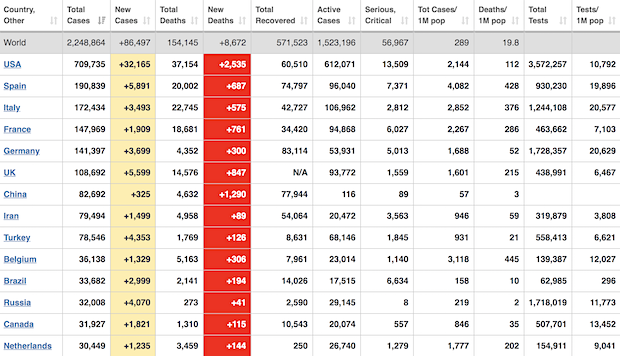

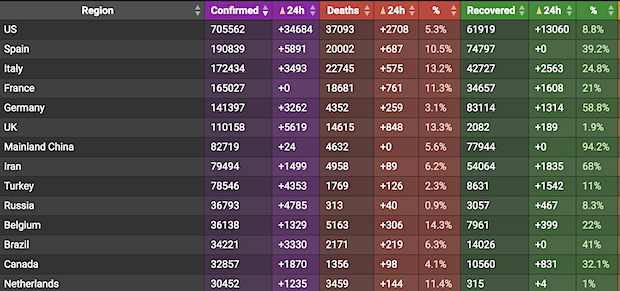

From Worldometer yesterday evening -before their day’s close- (Note: Brazil and Russia keep climbing fast)

From Worldometer – NOTE: mortality rate for closed cases remains at 21% –

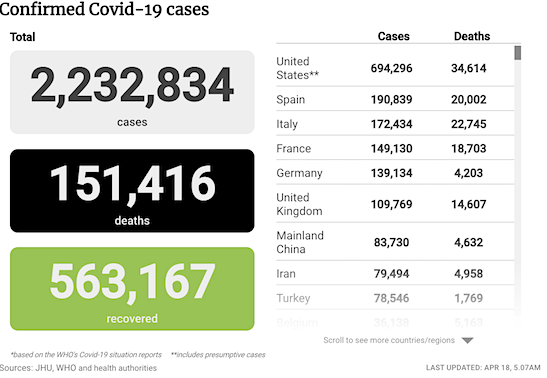

From SCMP:

From COVID19Info.live: (Belgium in first place worldwide of deaths per million at 445, 14.3% CFR, before Spain, Italy, France and UK.)

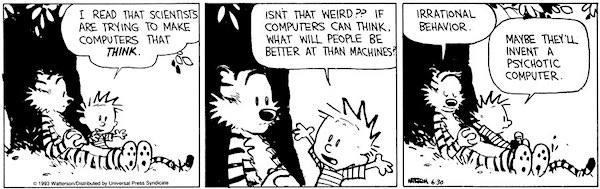

We know nothing.

• Antibody Study Suggests Coronavirus Far More Widespread Than Thought (G.)

A new study in California has found the number of people infected with coronavirus may be tens of times higher than previously thought. The study from Stanford University, which was released Friday and has yet to be peer reviewed, tested samples from 3,330 people in Santa Clara county and found the virus was 50 to 85 times more common than official figures indicated. To ease the sprawling lockdowns currently in place to stop the spread of Covid-19, health officials must first determine how many people have been infected. Large studies of the prevalence of the virus within a region could play a key role, researchers say.

“This has implications for learning how far we are in the course of the epidemic,” said Eran Bendavid, the associate professor of medicine at Stanford University who led the study. “It has implications for epidemic models that are being used to design policies and estimate what it means for our healthcare system.” The study marks the first large-scale study of its kind, researchers said. The study was conducted by identifying antibodies in healthy individuals through a finger prick test, which indicated whether they had already contracted and recovered from the virus. At the time of the study, Santa Clara county had 1,094 confirmed cases of Covid-19, resulting in 50 deaths.

But based on the rate of people who have antibodies, it is likely that between 48,000 and 81,000 people had been infected in Santa Clara county by early April – a number approximately 50 to 80 times higher. That also means coronavirus is potentially much less deadly to the overall population than initially thought. As of Tuesday, the US’s coronavirus death rate was 4.1% and Stanford researchers said their findings show a death rate of just 0.12% to 0.2%.

Absolutely nothing.

• No Evidence COVID-19 Survivors Have Immunity – WHO (Sky)

There is no evidence that people who have recovered from coronavirus have immunity to the disease, the World Health Organisation (WHO) has said. The UK government has bought 3.5 million serology tests – which measure levels of antibodies in blood plasma. But senior WHO epidemiologists have warned that there is no proof that such antibody tests can show if someone who has been infected with COVID-19 cannot be infected again. Many of the tests being developed are pinprick blood tests similar to instant HIV tests and measure for raised levels of the antibodies that the body uses to fight the virus.

Speaking at a news conference in Geneva, Dr Maria van Kerkhove said: “There are a lot of countries that are suggesting using rapid diagnostic serological tests to be able to capture what they think will be a measure of immunity. “Right now, we have no evidence that the use of a serological test can show that an individual has immunity or is protected from reinfection.” She added: “These antibody tests will be able to measure that level of seroprevalence – that level of antibodies – but that does not mean that somebody with antibodies means that they are immune.” Dr van Kerkhove said it was “a good thing” that so many tests are being developed, but said they will need to be validated “so that we know what they say they attempt to measure they are actually measuring”.

Huh? “..The government has already paid for three-and-a-half million antibody tests, but has not yet found one that is reliable enough to use..

• Double Warning Over Antibody Tests (BBC)

Hopes that coronavirus antibody tests could help the UK end its lockdown have been dealt a blow – after the World Health Organization questioned whether they offer any guarantee of immunity. The UK has placed antibody tests – which check if someone has had Covid-19 – at the centre of an eventual “back-to-work” plan to restart normal life. But experts said they may not prove if someone is protected from reinfection. The UK’s testing co-ordinator has also warned people not to buy private tests. The government has already paid for three-and-a-half million antibody tests, but has not yet found one that is reliable enough to use – and stresses that it will not approve the use of any test until it can be sure its findings can be fully depended on.

Professor John Newton said the public should not purchase unapproved antibody tests until a working test is approved. “We are breaking new ground with this work every day and I am confident this major research effort will make a breakthrough,” he said of efforts to develop a valid serology test, which measures levels of antibodies in blood plasma. “Until then, please don’t buy or take any unproven tests. They may not be reliable for your intended use; they may give a false reading and put you, your family or others at risk.” He added: “As soon as we have found a test that works for this purpose, we will be in a position to roll them out across the country as a back-to-work test.”

Make Gilead shareholders rich.

• Existing Drugs ‘May Prove Effective On Coronavirus Before Vaccine Comes’ (SCMP)

Dr Kim Woo Joo, who led South Korea’s response to Covid-19 and the outbreak of Mers in 2015, said he was “not very optimistic” about the availability of a Covid-19 vaccine in the next 18 months, but said evidence about the effectiveness of remdesivir, an experimental antiviral developed to treat Ebola; AbbVie’s Kaletra, an anti-HIV drug; or other medicines might be possible sooner. “If everything goes well, I am hoping that the effectiveness of these drugs will be scientifically proven within three to four months,” Kim, a professor of infectious diseases at Korea University Guro Hospital, said in an interview on Wednesday with the president of the Korea Society, Thomas Byrne.

Kim added that Seoul National University Hospital and the US National Institute of Allergy and Infectious Diseases, headed by Dr Anthony Fauci – a key player in the US government’s effort to control the coronavirus spread – were collaborating to test remdesivir, which emerged this week as possible treatment option. The health and medical news website Stat reported on Thursday that a Chicago hospital using remdesivir to treat severe Covid-19 patients saw rapid recoveries in fever and respiratory symptoms, with most patients discharged within a week. The University of Chicago Medicine recruited 125 people with Covid-19 into Gilead’s two phase-3 clinical trials and gave them daily remdesivir infusions, according to Stat. Of those patients, 113 had severe symptoms, the report said. Gilead’s share price shot up by nearly 15 per cent in after-hours trading after the Stat report and closed 9.7 per cent higher on Friday.

Want to get tested? Book a flight.

• Emirates First Airline To Conduct On-Site Rapid COVID-19 Tests (Em.)

Emirates in coordination with Dubai Health Authority (DHA) will be introducing additional precautions. Passengers on today’s flight to Tunisia were all tested for COVID-19 before departing from Dubai. Emirates is the first airline to conduct on-site rapid COVID-19 tests for passengers. The quick blood test was conducted by the Dubai Health Authority (DHA) and results were available within 10 minutes. This test was conveniently done at the Group Check-in area of Dubai International Airport Terminal 3. Adel Al Redha, Emirates Chief Operating Officer said: “The testing process has gone smoothly and we would like to take this opportunity to thank the Dubai Health Authority for their initiatives and innovative solutions.

“This would have not been possible without the support of Dubai Airport and other government authorities. We are working on plans to scale up testing capabilities in the future and extend it to other flights, this will enable us to conduct on-site tests and provide immediate confirmation for Emirates passengers travelling to countries that require COVID-19 test certificates. The health and safety of staff and passengers at the airport remain of paramount importance.” [..] Gloves, masks and hand sanitisers have been made mandatory for all employees at the airport. Passengers are also required to wear their own masks when at the airport and on board the aircraft, and follow social distancing guidelines.Emirates has modified its inflight services for health and safety reasons. Magazines and other print reading material will not be available

Early on in the pandemic, it took many weeks for a WHO team to get access to China.

• US Seeks Access To Wuhan Virology Lab, Trump Questions China Death Toll (SCMP)

US Secretary of State Mike Pompeo on Friday called on China to grant the United States access to the Wuhan laboratory that has emerged as a flashpoint between the two nations in a clash over the origin and handling of the coronavirus. “We are still asking the Chinese Communist Party to allow experts to get into that virology lab so that we can determine precisely where this virus began,” said Pompeo on Fox News. Pompeo’s comment escalated conjecture surrounding the lab as US President Donald Trump amplified doubts around the extent of the Covid-19 spread in China by announcing in a Twitter post that the country “has just announced a doubling in the number of their deaths from the Invisible Enemy. It is far higher than that and far higher than the US, not even close!”

The tweet was not accurate as China only announced a revised increase in deaths out of Wuhan by 50 per cent. The number of cases in China – more than 83,700 – still trails that of the US, which has more than 679,000. Addressing reporters later on Friday, Trump doubled down on his assertion, stating that China had the most deaths in the world. “We don’t have the most in the world – deaths,” Trump said of the US tally, which stands at more than 34,000. “The most in the world has to be China. It’s a massive country. It’s gone through a tremendous problem with this.”

There you go. The WHO was only granted access in the third week of February, 7-8 weeks after Beijing reported the first cases.

And then it took another 3 weeks before the WHO declared a pandemic on March 11. That’s not just a technicality.

• US, China and WHO Are All Keen To Pass The Buck (SCMP)

The first public report of the coronavirus came on December 31, when the health commission in Hubei province – of which Wuhan is the capital – reported 27 cases of pneumonia. The WHO set up an incident management support team the next day and published its first notice about the outbreak on January 5, in which it said there was “no evidence of significant human-to-human transmission”, and advised against travel or trade restrictions on China. Margaret Harris, a spokeswoman for the WHO, told US broadcaster CNN on Monday that at the time, “alarm bells were already ringing through the halls of the WHO”, and that it was “aware it was a very serious matter”. As the number of cases rose, the WHO began issuing technical guidance, with its technical lead on Covid-19, Maria Van Kerkhove, saying on January 14 that it was “certainly possible that there is limited human-to-human transmission” of the virus.

But on Twitter, the WHO’s official account on January 13 and 14 continued to suggest there was “no clear evidence of human-to-human transmission”. A critical turning point in the epidemic came on January 20, when Zhong Nanshan, a high-profile Chinese epidemiologist who managed the nation’s response to the severe acute respiratory syndrome (Sars) outbreak of 2002-03, said that there was human-to-human transmission of the virus and that medical workers had been infected. The WHO then said it was “very clear from the latest information that there is at least some human-to-human transmission”. Trump this week slammed the WHO for having “parroted and publicly endorsed the idea that there was not human-to-human transmission” in mid-January.

The WHO issued multiple notices on the virus that month and maintained its assessments were based on available evidence at the time. On January 22 and 23, the agency convened an emergency committee to determine whether the coronavirus constituted a global public health emergency, but delayed making a declaration. A week later, on January 30, when Tedros did declare a global health emergency, he stressed that it was “not a vote of no confidence” in China, and continued to oppose restrictions on travel and trade with the world’s most populous nation. The WHO said its guidance on travel bans stemmed from its experience with other outbreaks, and that such restrictions might not be effective in curbing the virus’ spread. Despite those recommendations, Trump on January 31 announced a ban on most travellers from China entering the US.

China’s foreign ministry spokeswoman Hua Chunying responded by saying the US had “inappropriately overreacted” and gone against WHO guidance. Tedros said later that there was no need for actions that “unnecessarily interfere with international travel and trade”. “One of the most dangerous and costly decisions from the WHO was its disastrous decision to oppose travel restrictions from China and other nations,” Trump said this week. “Fortunately, I was not convinced and suspended travel from China, saving untold numbers of lives.” Tedros met Chinese President Xi Jinping at the end of January, after which it was announced that the WHO would send a team of experts to China to get a better understanding of the outbreak. But it was not until nearly three weeks later that the WHO-China joint mission of experts began their trip, with Wuhan originally left off the agenda, only to be tacked on days later. At the end of the visit, the joint mission produced a gushing report that described China’s response to the outbreak as “perhaps the most ambitious, agile, and aggressive disease containment effort in history”.

Walking infection bombs.

• U.S.S. Theodore Roosevelt Outbreak Much Larger, But Mostly Asymptomatic (JTN)

The Navy’s coronavirus testing of the entire crew of the U.S. aircraft carrier Theodore Roosevelt is now nearly complete. Of the ship’s 4,800-member crew, more than 600 sailors have tested positive for the virus. However, of those 600, 60% have not shown any symptoms associated with the illness. The virus’s numbers aboard the Roosevelt continue to raise questions about the true spread rate of the illness, as opposed to the numbers that testing in the United States, and around the world, are capturing. The proportion of people who are asymptomatic carriers of the virus remains unknown, but the Theodore Roosevelt’s figure is higher than the 25%-50% range that Dr. Fauci put forward in early April. The numbers from the Naval ship provide data on the epidemiologically underrepresented group that is the younger, largely healthy population. This week, one sailor infected while aboard the ship died, and five remain hospitalized.

With New York, Maryland and Los Angeles.

• San Francisco Orders Residents To Wear Face Masks (F.)

San Francisco residents will be required to wear face masks outside their homes, the city announced Friday, joining New York, Maryland and Los Angeles County, as areas of the U.S. begin to think about what life will look like when social distancing measures are relaxed. The order goes into effect 11:59 p.m. Friday. • Individuals must wear masks on public transit as well as inside public buildings, health facilities and essential businesses such as the grocery store or pharmacy. • Businesses should refuse service to anyone who isn’t wearing a face covering and ensure their workers are wearing masks, the order says. • Residents don’t have to wear face coverings while at home, in the car or outdoors walking or running, though the city recommends bringing along a face covering anyway, even if residents aren’t wearing it at that moment. • Children under 12 are also not required to wear face masks.

City leaders urged residents to continue staying at home, saying that wearing a mask in public “is not a substitute for staying home, staying 6 feet apart and frequent handwashing.” “By covering your face when you go pick up food or ride Muni, you are helping reduce the risk of infecting those around you. As we look to a time where we can begin to ease the Stay Home Order, we know that face coverings will be part of that future – and we want San Franciscans to become more comfortable with this new normal,” San Francisco Mayor London Breed said.

Without Boris the UK gets even more rudderless.

• UK Moves To Drop Huawei As 5G Vendor On China Coronavirus Transparency (NYP)

The UK is moving to drop Huawei as a vendor for the country’s 5G cellphone network in a major blow to Communist China over poor coronavirus transparency. Prime Minister Boris Johnson, now recovering from COVID-19, gave the Chinese company a role in 5G infrastructure this year, squashing opposition last month by 24 votes in the 650-seat House of Commons. But now, concern about the Chinese Communist Party’s inaccurate reporting on the coronavirus has lawmakers crafting plans for a retreat. “We need to devise a proper, realistic exit strategy from relying on Huawei,” Conservative Member of Parliament Damian Green told Bloomberg News.

“Our telecom providers … need to know the government is determined to drive down Huawei’s involvement to zero percent over a realistic timescale.” “The mood in the parliamentary party has hardened,” said Tom Tugendhat, the Conservative Party’s chairman of the House of Commons Foreign Affairs Committee. “It’s a shared realization of what it means for dependence on a business that is part of a state that does not share our values,” Tugendhat said.

I’m afraid to ask.

• Where’s the $2.2 Trillion Bailout Money Going? (WS)

When the $2.2 trillion bailout package was being put together in Congress in all haste in March, a mad scramble broke out over who would get what. Part of this deal was the $349 billion Paycheck Protection Program for “small businesses” – which can be, as we now know, a publicly traded company with over 5,700 employees, or a KKR-backed power company that, upon getting the loan, files for prepackaged Chapter 11 bankruptcy. And so, the program already ran out of money as of Thursday, according to the SBA. “Notice: Lapse in Appropriations. The SBA is currently unable to accept new applications for the Paycheck Protection Program based on available appropriations funding,” it said on its website. The program dispersed 1.66 million loans, according to the SBA’s tally. There were 30.2 million small businesses in the US in 2019, so about 5.5% got loans.

What’s going to happen to the remaining 94.5% of the small businesses? Congress is contemplating a $250-billion expansion of the program that would cover maybe another 4% of small businesses. In other words, most small businesses aren’t going to get any of it. A small business under the plan is a business with 500 employees or fewer. Loans were capped at $10 million. But wait… 4,412 loans were issued in amounts larger than $5 million each. And we already know which company with 5,700 employees got $20 million. Yup, a restaurant chain, because they and hotel chains were exempted from the employee limit. Restaurants and hotels got their own limit: 500 employees per location. They accomplished this through magnificent lobbying efforts.

Ruth’s Chris Steakhouse [RUTH] – with about 5,700 employees at the end of last year and 159 restaurants across the US – disclosed in an SEC filing on April 13 that on April 7, four days after the SBA opened the filing process and as the system was bogged down, it obtained a PPP loan of $20 million, spread over two loans of $10 million each for two of its entities. JPMorgan Chase was the lender. If the company follows the rules, this $20 million will be forgiven. And then there is the curious case of Longview Power LLC, in which KKR, one of the big private equity firms, has a 40% stake as a result of Longview’s bankruptcy in 2015. Longview owns a 700-megawatt coal-fired power plant in West Virginia and has about 140 employees. It was approved for a PPP loan last Friday, and on Tuesday it announced that it filed for Chapter 11 bankruptcy.

“As we look back throughout history, it quickly becomes obvious that Christopher Columbus was the world’s first modern central banker. He left without knowing where he was going, when he arrived he did not know where he was, and he did it all with other people’s money.”

C. Gave— Ronnie Stoeferle (@RonStoeferle) April 17, 2020

“Money is not an economy. Money is a medium of exchange within an economy ..”

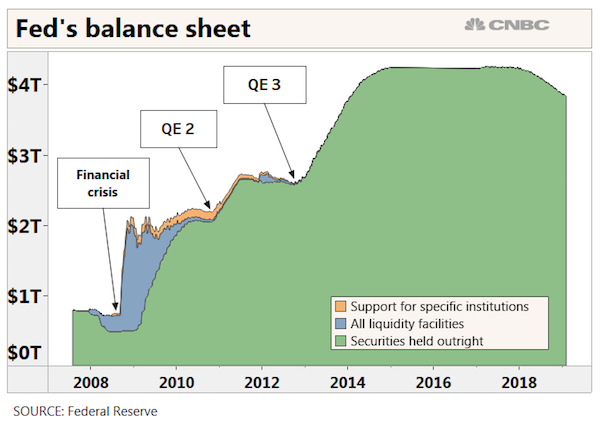

The Covid-19 corona virus didn’t initiate the financial disorders of the moment in the US and Europe, but it ensured that there would not be another appearance of any “recovery” a la the central bank interventions of 2008-09. What it portends is a fast-track journey to a whole new disposition of things: first, for a while, a harsher, hungrier, angrier society of broken promises and dashed expectations; and then adaptation when a consensus emerges that the set of facts at hand amount to a new reality. In the meantime, we’re living in the meantime, which is not a comfortable place.

Money is not an economy. Money is a medium of exchange within an economy where people grow things, make things, move things, and serve each other in countless ways. We’re not going to replace all those growings, makings, movings, and services by just giving people money. Money may produce more money by the magic of compound interest, but money is not necessarily wealth, it just represents our ideas about wealth, and interest stops compounding anyway when the trend is clearly for reduced growings, makings, movings, and servicings. That’s exactly how and why capital vanishes. The hocus-pocus of Modern Monetary Theory can only pretend to work around that reality.

The world never reached such a pitch of activity up to the blow-ups of 2008, and it went through the motions for a decade after that. Now that it’s stopped, all that’s left is the law of gravity, and it doesn’t get more basic. The “wealth” acquired in the decade since by the so-called “one-percent” was loaded onto a defective aircraft, like a Boeing 737-MAX, and an awful lot of it will fall to earth now on broken wings. Their agents and praetorians on Wall Street are working feverishly to stave off that crash-landing, like a band of magicians casting spells on the ground while that big hunk of juddering metal augers earthward. Wait for it as spring brings new life across the land and things unseen before steal onto the scene.

He can transform right back.

• The Transformation of Emmanuel Macron (CN)

[..] something strange has happened since the Coronavirus hit France. An apparent humanity buried deep inside the French president has suddenly emerged—and let the bankers be damned. In an interview on Thursday with the Financial Times, Macron talked about economics as a “moral science” and said European debt should be mutualized, meaning northern Europeans should be on the hook for southern debt—or face the wrath of right-wing populists. He said the European Union was not just a market but was really about human beings. In other words, he was calling for state intervention in the economy, going against everything he has heretofore believed. “We are all embarking on the unthinkable,” he said.

“We are at a moment of truth, which is to decide whether the European Union is a political project or just a market project,” he said. “I think it’s a political project . . . We need financial transfers and solidarity, if only so that Europe holds on.” The French president said he sees the crisis as “an existential event for humanity that will change the nature of globalization and the structure of international capitalism,” the newspaper reported. “In recent years [globalization] increased inequalities in developed countries,” he admitted. “And it was clear that this kind of globalisation was reaching the end of its cycle, it was undermining democracy.”

Macron told the FT: “We are going to nationalise the wages and the P&L [the financial accounts] of almost all our businesses. That’s what we’re doing. All our economies, including the most [economically] liberal are doing that. It’s against all the dogmas, but that’s the way it is. “I believe [the EU] is a political project. If it’s a political project, the human factor is the priority and there are notions of solidarity that come into play . . . the economy follows on from that, and let’s not forget that economics is a moral science.”

If you ever vote for these ghouls again, you deserve what you get.

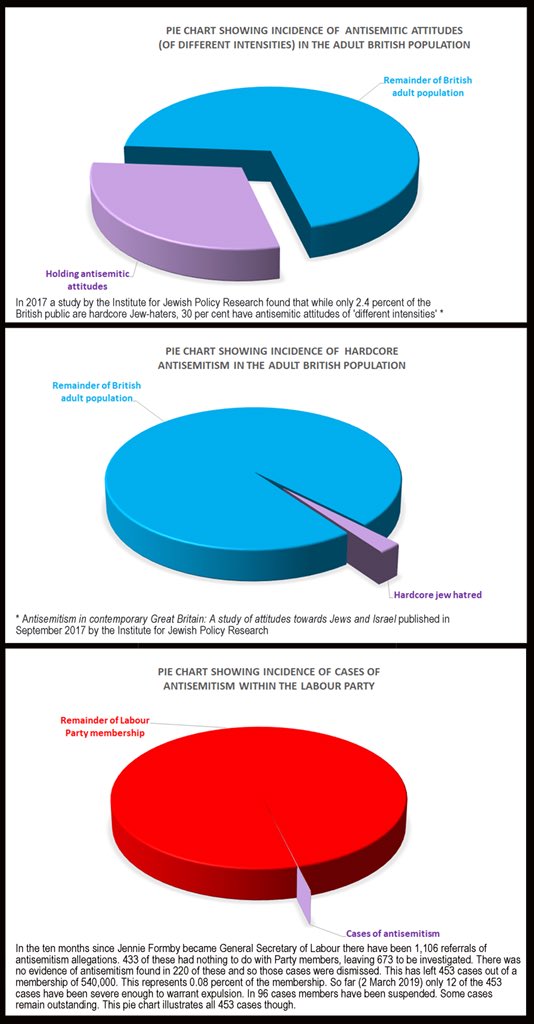

• Labour Party’s Own Senior Staff Acted To Keep Corbyn Out Of Power (ML)

In the June 2017 UK general election, Labour under Jeremy Corbyn came within a whisker of power. If just 2,227 votes had gone the other way, seven Tory knife-edge constituencies would have been won by Labour, putting Corbyn in a strong position to lead a coalition government. Labour achieved 40 per cent in the election, increasing its share of the vote by more than any other of the party’s election leaders since 1945. As we noted at the time, it was one of the most astonishing results in UK political history. A leaked internal Labour report now reveals that senior Labour figures were actively trying to stop Labour winning the general election in order to oust Corbyn as party leader.

The 860-page document, ‘The work of the Labour Party’s Governance and Legal Unit in relation to antisemitism, 2014 – 2019’, first leaked to Sky News, was the product of an extensive internal investigation into the way Labour handled antisemitism complaints. The report includes copious damning examples of email and WhatsApp exchanges among Labour officials expressing contempt for Jeremy Corbyn and anyone who supported him, including other Labour staff, Labour MPs and even the public. The document includes:

• Conversations on election night about the need to hide internal Labour disappointment that Corbyn had done better than expected and would be unlikely to resign

• Regular sneering references to Corbyn-supporting party staff as ‘trots’

• Conversations between senior staff in Labour general secretary Iain McNicol’s office in which they refer to former director of communications Seamus Milne as ‘dracula’, and saying he was ‘spiteful and evil and we should make sure he is never allowed in our Party if it’s last thing we do’

• Conversations in which the same group refers to Corbyn’s former chief of staff Karie Murphy as ‘medusa’, a ‘crazy woman’ and a ‘bitch face cow’ that would ‘make a good dartboard’

• A discussion in which one of the group members expresses their ‘hope’ that a young pro-Corbyn Labour activist, whom they acknowledge had mental health problems, ‘dies in a fire’.

We would like to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks everyone for your wonderful donations to date.

"humanitarian goodness" https://t.co/YA77hM1NrM pic.twitter.com/HfgwxZL4rL

— Maria ⏳ (@ml_1maria) April 8, 2020

Support the Automatic Earth. It’s good for your mental health.