Raúl Ilargi Meijer

Forum Replies Created

-

AuthorPosts

-

Raúl Ilargi Meijer

KeymasterI find this statement quite objectionable. It seems to me that they think that what cannot be measured is of no value or utility.

Nassim, that’s my point exactly. Bill Gates wants to clone himself in American classrooms, since he sees himself, consciously or not, as the alpha male. No, he really does. Just look at the feathers waving from his asscrack.

So, let’s take an example: how much fun does Bill have in his life? Well, you can’t really measure fun, so Bill doesn’t care. He thinks he has lots, but compared to who? What he does know about fun is only his own experience, which no matter how you look at it, is limited. Does that make fun some sort of side issue? No. It’s just hard to measure.

F**ing bleeping videotaping teachers to see if they do well? Do what well? Raising kids to be like Gates? Might as well turn ’em over to Catholic priests.

Now we need to wonder what the difference is between raising kids to Gates’ standards, and raising them to be the next Mark Twain, Walt Whitman, Rembrandt. Who the f**ing bleeping frozen-over-hell is Bill Gates to decide that? From my point of view, he seems to have very little, if any, affinity with how Samuel Langhorne Clemens became Mark Twain, so maybe the very last person on the planet we should want to have any influence on US education is Bill Gates. Looking at the world today, I’m pretty confident that one single Mark Twain would do us a lot more good than 1000 Bill Gates the Second’s.

The only things that make life worth while are the ones you can NOT measure. That’s the secret, that’s the whole idea: love, sorrow, a just plain happy moment, music that brings back a memory of a long lost loved one, a sunset that evokes eternity.

For that matter, Twain might have been talking about Gates when he said:

To succeed in life, you need two things: ignorance and confidence.

Raúl Ilargi Meijer

Keymasterrcg,

You’re right of course on many counts, but something can be said for more successful species in evolution living longer. From memory, the croc and turtle families have what, 300 million years, while we’re at 100,0000? Not that there’s anything wrong with approaching and defining what success consists of from a more philosophical angle, but most evolutionary accidents don’t have long lives on the grand scale of things, while the better adapted – even if purely accidental – survive.

Raúl Ilargi Meijer

KeymasterCapitalism self-destructs when children are born into it as consumers, not when the money runs out.

Eh, sorry, no. Capitalism self-destructs when growth runs out. And since growth is its most essential element, there’s nothing about it than can be tweaked to localize or moderate it sufficiently.

Raúl Ilargi Meijer

KeymasterMaybe a bit more than 150%:

Raúl Ilargi Meijer

KeymasterDeclining velocity of money in action:

Richmond Fed Index Shows Mammoth Fall In Retail Sales

Retail sales contracted this month, leaving the index at −22, twenty-three points below last month’s reading. Sales of big-ticket items declined slightly, while shopper traffic dwindled. The index for big-ticket sales slipped to −5, a point lower than the June reading, while the index for shopper traffic tumbled twenty-two points to −16. Inventories declined more slowly than last month, with that index settling at −12 compared to −22. Retailers were doubtful about sales in the next six months; the expectations index dropped to −29 from June’s reading of 11.

Raúl Ilargi Meijer

KeymasterOldE,

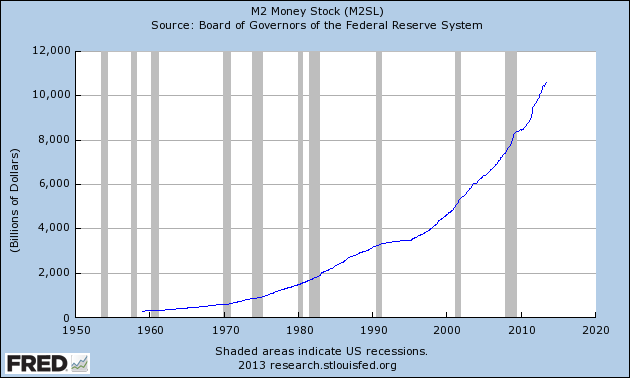

The money supply is not rapidly expanding (M1, or narrow money, is plunging, M2 rises somewhat). The monetary base is. They’re not the same. A useful table to tell M1 from M2, MZM etc. is available here at Wikipedia.

As I wrote in QE, The Velocity of Money And Dislocated Gold (see graphs there):

“The monetary base is the sum of currency circulating in the public and commercial banks’ reserves with the central bank. The money supply – money stock -, on the other hand, is the sum of currency circulating in the public and non-bank deposits with commercial banks”

In other words, the monetary base includes a lot of “money” that doesn’t count towards money supply, since it is not available for circulation.

The ratio used for the velocity of money is, simplefied, GDP/money supply. This is very crude, though, I would specifically include aggregrate transactions, for something like this:

V = ( P * Q ) / M

V = money velocity,

P = aggregate price level,

Q = aggregate quantity of goods and services,

M = money supplyOr you can say:

M * V = P * Q;

Note: P * Q equals nominal GDP.

That makes it much clearer that the aggregate quantity of goods and services (Q) is a determining factor.

Raúl Ilargi Meijer

KeymasterWe have long since conceded that we underestimated the extent to which people would take abuse lying down, so why should we address that yet another time? I think we have made clear enough we’re not here to help people make money, but to prevent them from losing even more.

As for advice for the next decade – and beyond -, it hasn’t changed. The only sensible thing to do still is to try to get out of the way of the storm, and certainly not to think that you can now feel safe to play the game a bit longer.

What’s positive about the prolonged Wile E. moment (and it isn’t anything else) is that it allows a few more people a bit more time to get out of the way with grace. I say a few more people because the majority will not listen no matter what we say.

If you understand to what extent Bernanke et al. are driving your children into debt, how can you not do all you can to make sure they will be able to take care of themselves, that they will have access to basic necessities? You’re not going to do that with gold or silver or stocks, it’s going to take a whole different sort of investment.

Raúl Ilargi Meijer

KeymasterSid et al,

In the end, I think Hazel Henderson defined economics best (and religion in the same vein, since economics is religion):

The problem is, of course, that not only is economics bankrupt but it has always been nothing more than politics in disguise … economics is a form of brain damage.

No, not all religion is economics, true. But all religion very much IS politics. Not in its purest core, perhaps, but certainly as soon as it gets organized.

Raúl Ilargi Meijer

KeymasterGO,

I’m not sure which “sir” you’re addressing, but it’s entirely possible that the author of the piece may not read this comment section.

As for John Williams, I followed him for years, and stopped doing that when he outed himself as a hyperinflationist. That in itself may not make his stats entirely irrelevant, but his interpretation of them certainly is.

And that’s still without even mentioning the fact that equating inflation with (any and all) rising prices is a fundamental flaw that turns any and all stats derived from it into meaningless gibberish.

Raúl Ilargi Meijer

KeymasterIf the US economic recovery keeps its present pace, goldbugs and miners can expect bad news

Since 2000, core inflation in the USA has averaged just 2.5pc per annum (an increase of 38pc) while gold (measured in US dollars) has returned 12.4pc per annum (an increase of 356pc), nearly five times the loss of purchasing power in the dollar.

This fundamental disconnect between inflation and the price of gold cannot be sustained indefinitely: either inflation has to rise dramatically or gold has to fall.

In 1968, gold became freely tradable, having previously been fixed by the US government to the price of the dollar at $35 an ounce. Since 1968, the most credible measure of US inflation – the core consumer price index – has risen by 578pc, an average of 4.4pc per annum, suggesting a loss of purchasing power in the dollar of 85pc. This shows clearly why investors should be concerned about their wealth being eroded by inflation.

However, if we multiply the price of gold in 1968 of $35 per ounce, every year since, by the annual US rate of inflation, then we can calculate a fundamental value of gold based on purchasing power.

Such a calculation results in a fair value for gold today of just $240 an ounce, only a fifth of its current price of $1,280 an ounce. On any fundamental analysis, gold is a grossly overvalued asset.

Raúl Ilargi Meijer

KeymasterPL&L

That comment on 2 trillion in reserves manifesting into 20 trillion in potential credit/loans sent chills. What we could have here is one of the most tightly compressed monetary springs in all of history.

The real chills come when you realize that their hidden losses are far greater than any of these numbers. That’s what these reserves are really for, survival in the face of debt deleveraging. That and highly leveraged bets: you got to make your $100 million a year somewhere, and it won’t come from consumer loans.

Raúl Ilargi Meijer

KeymasterThe attraction to believe in cultural, financial, or ecological Armageddon is deeply compelling. One can even find data to support these beliefs from commentators or scientists that share one’s outlook. However, in over 2,000 years this has never turned out to be the case.

Huh? What?

Raúl Ilargi Meijer

Keymaster… they have an article saying how much oil is flooding the market because of these plays.

Well, actually, they don’t really. They suggest a lot though. The actual numbers are North American, they could largely be Canadian oil. The only thing that does say something sort of numberwise about the US is the little graph to the left, but without actual numbers. Hard to know what to make of that article.

For those who don’t have a WSJ subscription, “Rising U.S. Oil Output Gives Policy Makers More Options” is accessible through Google News.

Raúl Ilargi Meijer

KeymasterUN Charts ‘Unprecedented’ Global Warming Since 2000

The planet has warmed faster since the turn of the century than ever recorded, almost doubling the pace of sea-level increase and causing a 20-fold jump in heat-related deaths, the United Nations said.

The decade through 2010 was the warmest for both hemispheres and for land and sea, the UN’s World Meteorological Organization said today in an e-mailed report examining climate trends for the beginning of the millennium. Almost 94% of countries logged their warmest 10 years on record, it said. [..]

The average global temperature for 2001-2010 was 14.47 degrees Celsius, according to the report. That’s 0.21 degree warmer than 1991-2000 and 0.79 degree warmer than 1881-1890. The increase was recorded even without any “major El Nino” event during the decade, the WMO said.

Sea levels rose at 3 millimeters (0.12 inch) a year, almost double the 20th-century rate of 1.6 millimeters a year.

Raúl Ilargi Meijer

KeymasterThere was a graph there that didn’t show properly (diminishing marginal debt returns). Apologies for that. I had to leave for a few hours. Fixed now. Interesting to note that in the numbers on projected future credit needs, diminishing debt productivity is not yet included. VK sent a few links to numbers as well, will put those in.

Raúl Ilargi Meijer

KeymasterDave,

Of course that’s true, full cycles etc. Just saying that the buy buy buy mania hasn’t exactly paid off so far. The gold cycle itself will return to buying a toga in Rome for a gold coin, and a suit in our world 20 years hence. It’s the meantime that’s the killer.

Raúl Ilargi Meijer

KeymasterJal,

Mike Snyder has a nice list, though a bit obvious at times. We would agree with most. But not with no. 5 : Gold and Silver. With 30% losses over the past 2 years, it is now official that for most people it’s been a bad advice for a long time. Unless, as we’ve always maintained, you can sit on it for 10-20 years, and that is true only for the seriously wealthy.

Raúl Ilargi Meijer

KeymasterSid,

I’m not so delicate. So go ahead. And I’m Ilargi, not Illarghi. By the way, Nicole will arrive here in my temp abode in Holland later today (from New Zealand) and stay for a few weeks, so shoot!

Raúl Ilargi Meijer

KeymasterDave,

Yeah, M1 is a crude measuring stick, but I thought if Ambrose can use it, why not me? I think the velocity graph is the more interesting one. Even with all the hurrahs for home prices, money ain’t moving.

Since all these asset classes have lost so much ground (gold at $1230 as we speak), a lot of the “where did it go” can be answered with covering losses and – more interesting – covering shorts. I quoted the example 3 weeks ago of Treasuries being used to hedge against MBS risk, with a breaking point (bond vortex) at a 2.2 yield for the 10 year. It’s blown way past that at 2.57 now. The financial world is full of hedges like these, and they must now be covered.

Raúl Ilargi Meijer

KeymasterI love the breadth and depth of knowledge that is frequently shared here on TAE, but for it to survive I think there needs to be a transition from WHAT we need to know to HOW we can start doing something about it.

To be fair to ourselves, that’s what we set up the Lifeboat section for. And then that sort of bled dry. Sure, there may be something wrong with the format we put it in, and suggestions in that regard are very welcome, but from where I’m sitting it’s the third party input that dried up as we went along. And we’re not the people to write more than the very occasional piece that would fit there.

To recoup, first of all we set up TAE 2.0 on the wrong platform. Joomla is a dinosaur. But we had to leave Blogger because of the incessant and ever meaner attacks on us, plus the fact that Google provides no service to deal with such attacks. We also set up different categories for articles. First, Categories for shorts and Features for longer pieces. This was because in the late days of TAE 1.0, we got in each others way for attention: TAE 1.0 had one piece a time on the front page, and that meant when someone just posted something, someone else had to wait or the first piece would disappear from the front page in no time. We also had Finance, Energy and Earth categories (we won’t anymore).

The way it turned out, however, was that Nicole and I set off on a 3 month trip down under, which was loaded to the brim with lectures, meetings, travel etc. That left Ashvin to hold the fort for a while, which not all our old time readers liked, though he did a great job. Then not long after we got “back” to Europe, at some point both Ashvin and VK (who ran our Twitter and Facebook) left. Then it was basically just me, since Nicole was honing her speaking skills. But I was by then badly in need of hip surgery. Which takes a lot more out of you than just a few hours under the knife, at least in my case. In fact, it took years of pain, and increasingly so, and if you’re me, that makes you real cranky and lots of fun to be around. It’s been 4 months now, and it’ll take a lot longer still to function well.

All this to say we had a bad spell, but we’re on our way back up. Setting up on yet another platform isn’t all that easy, we can’t get it wrong a second time. Plus we have 5.5 years of content to take with us. And no money to hire people to help us do it; we have a programmer volunteering, but that comes with time limits. We’ll get there though, not to worry.

I don’t agree with the assessment that things have already been said when it comes to finance, that’s just as much of an illusion as the entire economic system is. As you’ll see when things turn down once more. When it comes to preparedness, though Nicole is increasingly moving in that direction, and will undoubtedly write about it too, we will need third party input, and we welcome it. As for Nicole, she just did another tour of Oz and NZ, and had no time to write, but she will of course come back.

Raúl Ilargi Meijer

KeymasterPerhaps TAE 3 can take the form of TAE 1, with comments showing below each post.

Believe it or not, but that’s where they are.

For some reason people don’t get that, and I think that’s probably because they’re not on the front page. But should we want them there? That used to bring us complaints from people about having to scroll forever and a day.

Raúl Ilargi Meijer

KeymasterTed,

Central banks don’t control this. Rising interest rates will squeeze most people sooner rather than later. Perhaps the main problem is most will think rising rates equal inflation. What will really happen is they will further stifle the velocity of money.

Raúl Ilargi Meijer

KeymasterWell, Greenfire, what I read in your comment is that you want your pension, even knowing the younger generation, whose own chances of ever getting a pension like the one you want are fast approaching zero, have to pay for it. Fair enough in itself, a choice you make.

Your reasoning is that it’s not the generational drift that wreaks the havoc here (though that by itself doesn’t get the young any closer to getting their pension). In your view, what stands in their way is not the older generation, but the 1%. You want, as far as I can see, for the younger generation to fight the 1% for what’s theirs (a pension, for starters).

My issue with that is that it was your generation that, while building up their pensions (and their homes), allowed that 1% the money and power they have acquired.

And I’m wondering: how is that fair? The older generation have set up things nicely for both themselves and the 1%, and leave the young hung out to dry. If you try to put yourself in their shoes, what would you say they should do?

Raúl Ilargi Meijer

KeymasterJust like to point out something flawed. Should interest rates go up there is no sound theory for deflation. Higher interest rates by definition mean inflation.

No. As interest rates rise, an increasing part of available capital will be needed to serve interest payments, and that will very much drive deflation (defined as money and credit supply x velocity of money).

Once everything settles and you did not take out crazy amounts of debt your country will be at a loss when the whole thing restructures and the debts are erased.

There is no UN for erasing everyone’s debt. Japan can hardly take any increase at all in bond yields. Before “everything settles” there will be victims. And they may not be the expected suspects. The entire game is based on an illusion of control that doesn’t actually exist. Because they’re so focused on this illusion, a lot of parties won’t see what’s coming.

Raúl Ilargi Meijer

KeymasterGreat AP report:

Forget Prism : NSA Tapped Straight into Internet Pipeline

Interviews with more than a dozen current and former government and technology officials and outside experts show that, while Prism has attracted the recent attention, the program actually is a relatively small part of a much more expansive and intrusive eavesdropping effort.

Raúl Ilargi Meijer

KeymasterGo,

The greater the desperation, the greater the illusion.

Raúl Ilargi Meijer

KeymasterAl Bartlett, not Barrett. Must study for everyone.

Raúl Ilargi Meijer

KeymasterOne the one hand early in an economic cycle it provides lots of benefits. Later in that cycle, the costs mount, much like nuclear power.

Well, that’s the same as the entire model of perpetual growth, then, isn’t it? Maybe a difference is that we understand the latter a bit more, through physics, while the perpetual element of compound interest has never been that specifically identified.

The question remains: why are we on a perpetual growth path (be it in a general sense, be it in compound interest in specific) when we’ve known for generations that it can only lead to destruction? Is it our short attention span, is it our focus on our individual interests? Are we simply denying what we know to be true because it doesn’t fit with satisfying our immediate desires?

Raúl Ilargi Meijer

KeymasterWell, it’s obvious there’s a large dividing gap between focusing on compound interest on an individual level and looking at the influence it’s having on the societies those individuals live in. And good on ya if you think you understood it at some point and you believe the wealth it’s brought is a good thing, but if you acquired that wealth in a society that increasingly sees its wealth deplete – or concentrate – because of compound interest, maybe it’s a good idea to wonder how that will affect your good fortune down the line. In my view you can only build so many gates around your home before you start to feel uncomfortable, so you will need to seek some sort of balance. And to just sing the praise of compound interest doesn’t seem to be the best way to attain that balance.

Raúl Ilargi Meijer

KeymasterV81,

I don’t know much about such services, but it looks ans smells to me like a bank, building, vaults, security, safe deposit lockers, only with most other services stripped. And it seems entirely possible that a government can simply move in and take all contents in the vaults and lockers. They have from banks in the past, so why not from private vaults?? Easy pickings, methinks. Unless your locker’s in the Bahamas or Luxembourg, maybe, but then you’d need to be there too. The close to your chest the better.

Raúl Ilargi Meijer

KeymasterSouth Ozzie,

Using “local” for all of Oz may be a bit wide?!

I suggest you go to http://www.doingitourselves.org/, run by our dear friend Theo Kitchener, out of Melbourne, who among loads of other things did this great video (which I featured as a post not long ago):

[video width=480 height=315 type=youtube]https://www.youtube.com/watch?feature=player_embedded&v=euhkIesmW7E[/video]

Raúl Ilargi Meijer

Keymasteralan, sid

I haven’t talked to my old friend Chris for a few years (he talks about me in one of his books, I think it’s about my “Law of Receding Horizons”). And though when it comes to energy (and just about anything else, too) between the two of us, Nicole is about 826 times more knowledgeable than I am, there are a few things “even” I notice.

I understand – and applaud- that a grid can be better operated, allowing for the inclusion of more power from intermittent sources. But that can’t be endless, and so 100% renewable remains a strange dream, as far as I can see, molten salt and all. Base load is not a side issue; large grids are very vulnerable. I would for instance like to see data on how stability in Germany is enhanced by French nukes. It’s a bit like how Denmark can run so much wind; it can do so only because the trans-European grid is there to step in when wind is not there. I don’t see German solar do this well without France. In general, talk about “the German grid” or “the French grid” is not very useful, and maybe a bit misleading. It’s like talking about the Kansas grid and then try and include Enron in the story.

I don’t see a huge grid run on renewables, never seen a way to do it. More than 15% renewables for an isolated grid becomes shaky, I think.

Raúl Ilargi Meijer

KeymasterRates for the US 30-year fixed, courtesy of BI:

Raúl Ilargi Meijer

KeymasterBIS records startling collapse of eurozone interbank loans

Cross-border lending is falling drastically across the western world as banks slash exposure to Europe and bend to tougher capital rules, according to data from the Bank for International Settlements. [..]

The Basel III rules demand higher capital ratios, fewer risky assets, and less reliance on wholesale borrowing. “Pressure to make banks safe is paradoxically causing a contraction of their risk assets and therefore of the money supply, perpetuating feeble demand and high unemployment,” he said. Mr Congdon said quantitative easing in the US and the UK had helped to offset the tougher rules but the European Central Bank is constrained by the lack of a genuine fiscal union

So QE is used simply to offset plans to give banks healthier balance sheets. Question is: are they still healthier afterwards? Or does QE defeat Basel III?

Raúl Ilargi Meijer

KeymasterSame story (as mine today), different tack: “The Bank for International Settlements said central banks’ policies of record low interest rates and monetary stimulus had helped investors “tune out” bad news — every time an economic indicator disappointed, traders simply took that as confirmation that central banks would continue to provide stimulus.”

Easy money policy from leading central banks boost markets, but investors ignore warning signs.

Raúl Ilargi Meijer

KeymasterAnd we’re off!

SOCGEN: This Week’s Jobs Report Is Going To Be Strong, And The 10-Year Treasury Is Heading To 2.75%

Stimulus makes the economy grow, and we’ll see an avalanche of selling US 10-year. Bernanke slows down stimulus, and we’ll see more selling. Just another naked emperor.

Raúl Ilargi Meijer

KeymasterApologies for misspelling the name of the BoJ chief. Corrected.

Raúl Ilargi Meijer

Keymastersouth ozzie,

Should I be doing as Carol and going into the bank and getting my tangible, physical certificates?

Absolutely. One should steer clear of all middlemen, whether they operate through funds or otherwise, as much as one can. Buy sovereign bonds as directly as you can and stash them away under your own control. You don’t need middlemen, and their very existence just raises the risk.

I asked Nicole to respond, but she’s stuck in a very full agenda of travel, interviews and lectures in New Zealand, with limted internet access and an injured shoulder to boot.

Still, all the more because we’ve been covering this very topic since we started TAE, my answers won’t be any different from hers. Get a few months worth of cash, get hard goods, and for any leftover wealth sovereign bonds are fine. Your own country’s bonds, that is; don’t dabble in foreign bonds unless you’re a trader, that’s just more risk than you need.

It’s really not that hard, when you think about it; pretty straightforward.

Raúl Ilargi Meijer

KeymasterLarry,

Nothing there that I haven’t covered. That’s why I used 3 separate quotes. The Great Law doesn’t mention 7 generations, but Oren Lyons has (provided he’s properly quoted). Perhaps that’s just his interpretation of the Law, but being an Onandaga chief, who’s going to say he doesn’t have the right to such an interpretation. Other than that, I am merely interested in the fact that there are ancient laws out there that mention care for future generations in the first place. I don’t think the US constitution does, for instance.

Raúl Ilargi Meijer

KeymasterThe notion that inflation is not going to happen is slowly sinking in, but the reason why is not at all understood yet. Joe Weisenthal quotes the reasons inflation hasn’t come, offered by the incomparably clueless Hale Stewart of Daily Kos fame:

The Most Incorrect Prediction Of The Past 5 Years

• Slack demand from China.

• The US oil boom (abundance produces the opposite of inflation).

• Slow growth (especially in Europe).

• The end of the commodity boom.

• Ongoing reduction of high household debt.Bottom line. The big, ongoing story is the death of inflation all around the world.

It’s all simple nonsense, of course. These fine analysts now tell themselves they were right all along in predicting (hyper)inflation, but something unexpected, unforeseeable got in the way. In reality, the behemoth of debt we built up made deflation inevitable from the get go. It hasn’t hit us full on yet because of the empty credit measures (QE et al) central bankers try on, but it has zero chance of reversing the debt deleveraging. It will just make it worse. I wrote this particular article 7 months a go, buy Nicole and I have been writing about this for 6-7 years now.

-

AuthorPosts