Salvator Rosa Lucrezia as poetry 1640-41

A hundred years ago.

• The World’s Witnessing A New Gilded Age (G.)

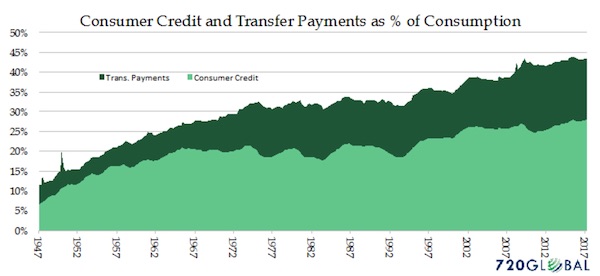

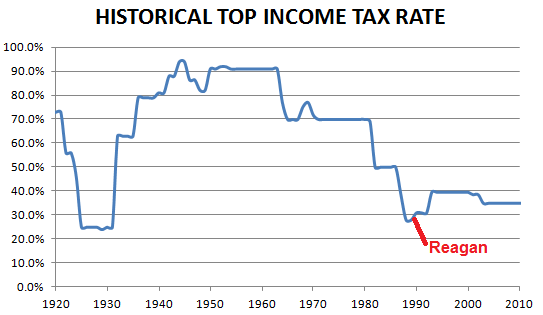

The world’s super-rich hold the greatest concentration of wealth since the US Gilded Age at the turn of the 20th century, when families like the Carnegies, Rockefellers and Vanderbilts controlled vast fortunes. Billionaires increased their combined global wealth by almost a fifth last year to a record $6tn – more than twice the GDP of the UK. There are now 1,542 dollar billionaires across the world, after 145 multi-millionaires saw their wealth tick over into nine-zero fortunes last year, according to the UBS/PwC Billionaires report. Josef Stadler, the lead author of the report and UBS’s head of global ultra high net worth, said his billionaire clients were concerned that growing inequality between rich and poor could lead to a “strike back”. “We’re at an inflection point,” Stadler said. “Wealth concentration is as high as in 1905, this is something billionaires are concerned about.

The problem is the power of interest on interest – that makes big money bigger and, the question is to what extent is that sustainable and at what point will society intervene and strike back?” Stadler added: “We are now two years into the peak of the second Gilded Age.” He said the “$1bn question” was how society would react to the concentration of so much money in the hands of so few. Anger at so-called robber barron families who built up vast fortunes from monopolies in US rail, oil, steel and banking in the late 19th century, an era of rapid industrialisation and growing inequality in America that became known as the Gilded Age, led to President Roosevelt breaking up companies and trusts and increasing taxes on the wealthy in the early 1900s. “Will there be similarities in the way society reacts to this gilded age?,” Stadler asked. “Will the second age end or will it proceed?”

We’re doing so well we need to keep throwing money at bankers.

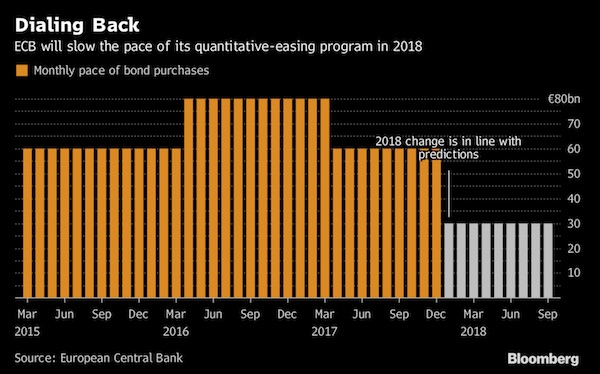

• ECB Sees Option for Ending QE With Short Taper in 2018 (BBG)

European Central Bank policy makers implicitly assume their newly-extended bond-buying program will be tapered to a halt by the end of next year so long as the inflation outlook improves, according to officials with knowledge of the discussions. The Governing Council, which met on Thursday, focused on the first nine months of next year for its quantitative-easing program and didn’t formally debate options for what to do after that, said the people, asking not to be named because the talks are private. While tapering would be possible, extending the program without changing the pace of purchases is also a credible option if inflation doesn’t show sufficient progress, one of them said. Whether to set a firm end-date on the bond-buying program has been a key sticking point for some officials.

The council agreed to cut monthly purchases in half, to €30 billion ($35 billion), and President Mario Draghi said that a “large majority” backed the decision to include a pledge to extend again if needed. He added that “it’s never been our view that things should stop suddenly.” The meeting came after governors were presented with several scenarios at a seminar on Wednesday, according to the people. Those included a reduction to 40 billion euros a month through June, and a 12-month tapering through December, similar to the Federal Reserve’s exit from its own program. The latter scenario wasn’t considered a realistic policy option, one of the people said. Governors also looked at a three-month scenario that would see buying after September tapered in monthly steps to 20 billion euros, 10 billion euros and 5 billion euros, another official said.

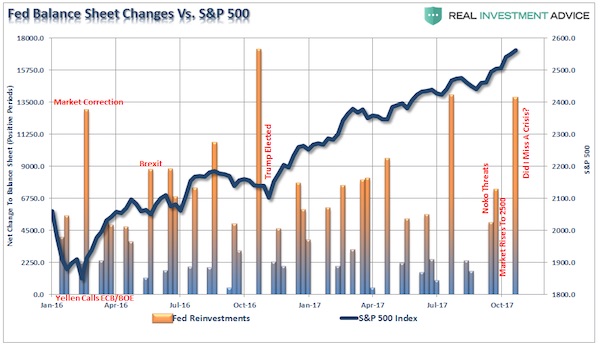

“..In fact, just last week the Fed increased their balance sheet by over $13.5 billion dollars. No wonder the stock market shot higher.”

• The Fed Balance Sheet Unwind Myth (Roberts)

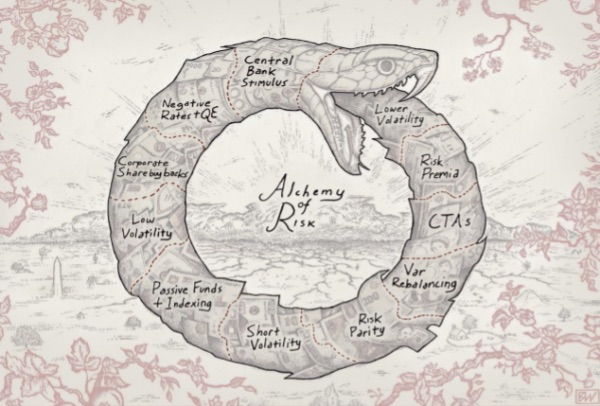

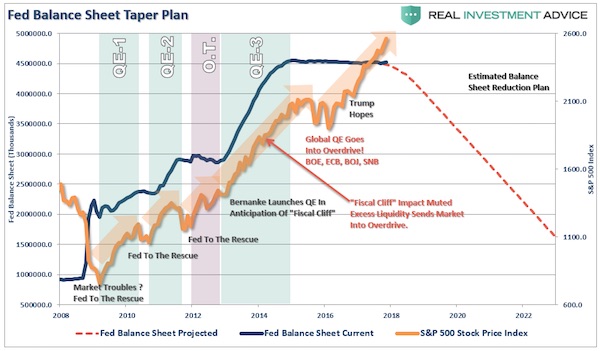

Since the beginning of the year, the Federal Reserve has been heavily discussing, warning rather, they were going to begin to “unwind” their gargantuan balance sheet. As Michael Lebowitz recently penned in his subscription-only article “Draining The Punchbowl:” “Since QE was first introduced, the S&P 500 has gained 1,546 points. All but 355 points were achieved during periods of QE. Of those remaining 355 points, over 80% occurred after Trump’s victory.” That is a pretty amazing set of stats. I have previously noted the high correlation of the financial markets relative to the ongoing liquidity operations of the Federal Reserve. I have updated that analysis to show the reduction in the balance according to the Fed’s proposed schedule.

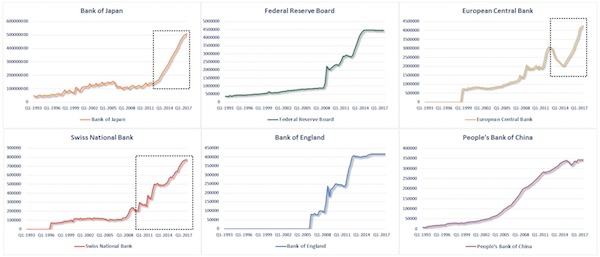

While the market stumbled following the end of QE in the United States, global QE, as shown in the charts of the major global Central Banks picked up the slack.

But now, the ECB has already begun discussing their plans to begin cutting the amount of their QE program by half in the coming year. The hope, of course, by Central Bank officials is that global economies are now humming along at a pace strong enough to withstand the reduction of “emergency measures.” Of course, the real question is whether the Central Bank’s “measures” of economic strength are accurate. While there are certainly indicators such as GDP growth, production, and employment measures which suggests that global economies are indeed on a cyclical upswing, there are also numerous measures which suggest the opposite.

With the Fed trying to raise interest rates, and reduce the balance sheet simultaneously, the “tightening of monetary policy” is a drag on economic growth and ultimately the stock market. But as I stated above, while the Fed is currently “discussing” the reduction of their balance sheet beginning in October, they actually haven’t. In fact, just last week the Fed increased their balance sheet by over $13.5 billion dollars. No wonder the stock market shot higher.

It’s the weather. Too warm to shop.

• Alarm Sounds Over State Of UK High Street As Sales Crash (G.)

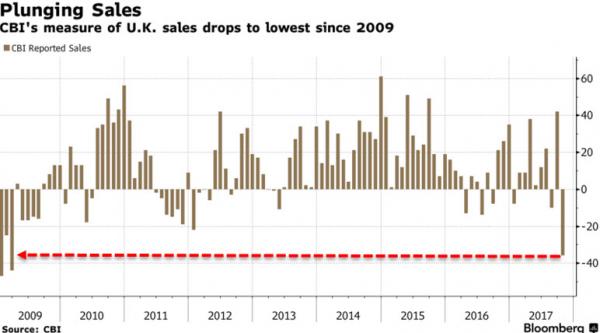

The fastest monthly fall in high street sales since the height of the recession in 2009 has raised fears for the retail sector ahead of the crucial Christmas trading period. A survey by the the CBI found that 50% of retailers suffered declining sales in October while only 15% benefited from an increase, leaving a rounded balance of -36%, the lowest since March 2009. The business lobby group said the survey showed retailers were “feeling the pinch” from rising inflation, which has eaten into consumer incomes and squeezed profit margins. Uncertainty surrounding the outcome of the UK’s Brexit negotiations has also preyed on consumer confidence, which has declined sharply over the past 18 months and depressed spending. Figures estimating GDP growth in the third quarter showed the services sector holding up despite recent declines in wages adjusted for inflation.

However, the construction sector fell into recession. Rain Newton-Smith, the CBI chief economist, said: “While retail sales can be volatile from month to month, the steep drop in sales in October echoes other recent data pointing to a marked softening in consumer demand.” The gloomy CBI survey came as Debenhams warned of an “uncertain” environment on the high street in the run up to Christmas after suffering a 44% dive in profits. [..] Warm autumn weather and low consumer confidence in the wake of the Brexit vote have also combined to deliver a “grim” October, according to the John Lewis boss, Paula Nickolds, who revealed last week that shoppers are continuing to put off expensive household purchases. That comes after the UK retail sector recorded its lowest growth rate in four years for the three months to the end of September, according to official data.

Maube the Bank of England should send them their reports?

• 75% of UK MPs Don’t Know Where Money Comes From (CityAM)

Only 15% of MPs surveyed answered correctly when asked a true/false question on whether banks create money when they make loans. Almost two-thirds of the 50 MPs surveyed by Dods for campaign group Positive Money wrongly thought banks can’t create money, while a quarter admitted they didn’t know. In a far from stellar field Conservative MPs outperformed slightly “in this regard”, with 19% answering correctly, compared to only one in 20 Labour MPs. More than three-quarters of the MPs surveyed incorrectly believed that only the government has the ability to create new money. Some 23% knew this to be false, with Labour performing better than the Conservatives. The Bank of England has previously intervened to point out that most money in the UK begins as a bank loan.

In a 2014 article the Bank pointed out that “whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.” The perception of money creation has been complicated further by the unorthodox use of quantitative easing, in which the government creates money electronically, which is then used to buy financial assets. Fran Boait, executive director of Positive Money, said: “Despite their confidence in telling the public that there is ‘no magic money tree’ to pay for vital services, politicians themselves are shockingly ignorant of where money actually comes from. “There is in fact a ‘magic money tree’, but it’s in the hands of commercial banks, such as Barclays, HSBC and RBS, who create money whenever they make loans.”

The difference between short and long term.

• China’s Minsky Moment (Muir)

Sometimes you have to love the naivety of the markets. At this week’s Communist Party Congress meeting in Beijing, the governor of the PBoC (People’s Bank of China) said the following; “If we are too optimistic when things go smoothly, tensions build up, which could lead to a sharp correction, what we call a ‘Minsky moment’. That’s what we should particularly defend against.” Yet instead of focusing on this dire warning, markets are busy trying to discount the chance of a Powell Fed or a Republican tax cut. Although both of these developments would be important, China is the tail that wags the dog. Full stop. Figure out China, and all the other financial market forecasts become that much easier. Some might argue this “Minsky moment” warning is nothing more than a Central Bank whistling in the wind.

Didn’t Greenspan caution about a similar concern with his “irrational exuberance” speech? And didn’t that end up being a complete non-event? Yet I would argue that China is not the same as other countries. Although there are market elements to their economy, to a large degree, China is still a command economy. If Chinese leadership wants a particular outcome, they can just demand it, and it will happen. So when the head of the PBoC warns about a “Minsky moment”, it’s probably not a good idea to load up on financial assets. For the longest time, China exported goods and imported developed nation debt and other financial assets. They had already started down the road of re-balancing their economy away from this export driven model, but this recent development confirms that the old playbook should be thrown out the window.

The global financial system is changing, and China is leading the way. Their moves will reverberate for years in the future. The Chinese authorities have just put up the warning flag, and you would be foolish to not believe it. This long term warning coincides with my belief that over the short term, the risks are all to the downside. I have been banging the drum on the fact that the Chinese government have done everything in their power to keep markets stabilized through their Communist Party Congress. They haven’t even hidden this fact. From the big sign above the Shenzhen Securities Exchange building that read “Use every effort to protect the stability of stock market for 20 days,” to the recent release that the Chinese government has asked firms to delay bad result during Congress, the message is clear.

Too many last minute turnarounds. But still explosive.

• Catalonia’s Leader Rules Out Snap Election, Crisis Deepens (R.)

Catalonia’s leader Carles Puigdemont on Thursday said he would not hold a new regional election to break the deadlock between Madrid and separatists wanting to split from Spain, sharpening a political crisis that could turn into direct confrontation. Puigdemont had been expected to announce an election to head off moves by Madrid to take direct control of the autonomous region in the next few days. But, speaking in the courtyard of the regional government headquarters in Barcelona, Puigdemont said the central government had not provided sufficient guarantees that holding an election would prevent the imposition of direct rule. “I was ready to call an election if guarantees were given. There is no guarantee that justifies calling an election today,” Puigdemont said.

He said it was now up to the Catalan parliament to move forward with a mandate to break from Spain following an independence referendum that took place on Oct. 1 – a vote which Madrid had declared illegal and tried to stop. Some independence supporters are pushing him to unilaterally declare independence. Late on Thursday, the regional government’s business head resigned over his opposition to a unilateral declaration, a sign of growing division in the separatist movement. Puigdemont’s stand sets the stage for the Spanish Senate on Friday to approve the take-over of Catalonia’s institutions and police, and give the government in Madrid the power to remove the Catalan president.

But this could spark confrontation on the streets as some independence supporters have promised to mount a campaign of civil disobedience. Spanish Deputy Prime Minister Soraya Saenz de Santamaria, speaking in a Senate committee, said: “The independence leaders have shown their true face – they have promised a dream but are performing tricks.” The aim of Article 155 – the constitutional trigger for direct rule – was to permit any election to take place in a normal and neutral situation, she said. The Spanish government has said it would call such a vote within six months of taking over Catalonia.

Sad.

• Catalan Companies Face Boycott Over Independence Push (AFP)

Calls for a boycott of Catalan food, cars and other goods, to punish the region for its separatist push, are worrying businesses who fear the economy will suffer. “You have to hit them where it hurts the most: the wallet,” a Twitter user wrote under the hashtag #boycottcatalanproducts. “We Spaniards who do not want Spain to be broken up… we can take action by adopting dissuasive steps of an economic nature,” reads a Facebook page calling for consumers to snub Catalan products. Appeals for a boycott have become more urgent since Catalonia’s separatist regional government held a banned independence referendum on October 1 in defiance of Spain’s central government and courts. The campaign targets Catalonia’s key agriculture and food sectors, with consumers urged to shun cava, a sparkling wine, Estrella Damm beer, as well as Vichy Catalan and Font Vella bottled water.

Medicines are also on the list to hurt Catalonia’s important pharmaceutical sector, as well as cars made by Seat, German carmaker Volkswagen’s Spanish unit in the region. Products made by foreign multinationals in Catalonia, including Nestle and Unilever, have also been swept up in the campaign. Mobile phone applications help consumers identify which products come from the rebel region. The impact of the boycott campaign is hard to measure to date. “We have had some clients who have bought less,” especially in Madrid, Rosa Rebula, a manager at cava producer Rosell i Formosa, told AFP. But she said the company will only be able to confirm the trend in November — a peak period for sales of cava ahead of the Christmas holiday season.

CIA/FBI got to Trump? They’ve had 50 years to redact docs, but need 6 months more? Best comment I read: A whole generation knows where they were when Kennedy was shot, except George HW Bush. Turns out he was in Dallas.

• New JFK Files Reveal FBI Warning On Oswald And Soviets’ Missile Fears (G.)

The US government released 2,800 documents on Thursday, but President Donald Trump delayed the release of others, saying he had “no choice” but to consider “national security, law enforcement and foreign affairs concerns” raised mostly by the FBI and CIA. One of the first interesting documents to be unearthed, as journalists, scholars and the public pored over them, was a memo written by director J Edgar Hoover that said the FBI had warning of a potential death threat to Oswald, who was then in police custody. “There is nothing further on the Oswald case except that he is dead,” Hoover wrote on 24 November 1963. “Last night we received a call in our Dallas office from a man talking in a calm voice and saying he was a member of a committee organized to kill Oswald.

[..] The files comprise almost the final 1% of records held by the federal government and their publication follows a release in July when the record-keepers, the National Archives, posted 3,801 documents online, mostly formerly released documents with previously redacted portions. An administration official told reporters on Thursday that the files that remain secret have information that “remains sensitive depending on its context”. Trump ordered the agencies to review those redactions over the course of six months, the official said, to ensure more documents reach the public. The next deadline for documents is 26 April 2018. According to the National Archives, 88% of records related to Kennedy’s murder were already fully open and another 11% released but partially redacted. In total, that makes for about 5m pages.

The newly released documents also reveal that Soviet Union leaders considered Oswald a “neurotic maniac who was disloyal to his own country and everything else”, according to an FBI memo documenting reactions in the USSR to the assassination. The Soviet officials feared a conspiracy was behind the death of Kennedy, perhaps organised by a rightwing coup or JFK’s successor Lyndon Johnson. They also feared a war in the aftermath of Kennedy’s death, according to the memo: “Our source further stated that Soviet officials were fearful that without leadership, some irresponsible general in the United States might launch a missile at the Soviet Union.”

How many more?

• Australian Court Rules Deputy PM Ineligible For Parliament (R.)

Australia’s High Court ruled on Friday that Deputy Prime Minister Barnaby Joyce is ineligible to remain in parliament, a stunning decision that cost the government its one-seat parliamentary majority and forced a by-election. The Australian dollar fell a quarter of a U.S. cent after the unexpected decision. Australian Prime Minister Malcolm Turnbull said he accepted the court’s ruling, even though it was “clearly not the outcome we were hoping for”. Turnbull did not name a new deputy leader during a short news conference in Canberra soon after the court’s ruling. The Australian leader had been scheduled to travel to Israel on Saturday for a week-long visit but a spokesman for Turnbull told Reuters his departure has now been delayed. The spokesman said the new travel arrangements are still be finalised.

Turnbull’s center-right coalition is now in a precarious position. His Liberal Party is the senior party in a coalition with the smaller National Party, which Joyce led. He must now win the support of one of three independent lawmakers to keep his minority government afloat, with two sitting weeks of parliament left until it recesses for the year. At least two independent lawmakers have promised their support. Independent MP Bob Katter told Reuters he would support the government, but he may reconsider that if the coalition tried to block renewed efforts for a sweeping investigation into the scandal-ridden financial system. “I think we have the numbers for a commission into the banks and, if the government tries to block that, then I think we will get into murky waters,” Katter said. The opposition Labor Party immediately went on the attack and threatened to launch a legal challenge to every decision made by Joyce since last year’s election.

Great intentions. But she has to talk to Trump, Xi et al.

• ‘I Want The Government … To Bring Kindness Back’ (RNZ)

Shortly before she was sworn in as the new Prime Minister, Jacinda Ardern spoke to Checkpoint with John Campbell as she was on her way to Government House in a Crown car. She said she wants the new government to “feel different”, to be empathetic and kind. There was a significant part of her that was focused on the work that needed to be done, she said. “Once you’re there, get on with it.” She said she wanted the government to feel different. “I want it to feel like we are a government that’s truly focused on everybody. Perhaps I’m more acutely aware of that sense having now led a set of negotiations in our government that brings together a range of parties.

“I know I need to transcend politics in the way that I govern for this next term of Parliament but I also want this government to feel different, I want people to feel that it’s open, that it’s listening and that it’s going to bring kindness back. “I know that will sound curious but to me if people see they have an empathetic government I think they’ll truly understand that when we’re making hard calls that we’re doing it with the right focus in mind.” She said there were tough times during the coalition negotiations. “It’s not about just preserving people’s political careers. It’s not about power. It’s about being in a position to make a difference to people who need it most. “This will be a government that works with others. “There is a lot to do.” Asked if there was a central tenet to her approach to the new role, she said it was empathy.