Henri Matisse Young Woman at the Window, Sunset 1921

I did get up at 4am to watch the debate. Mostly very messy. Wallace looked nothing like a moderator. Biden seemed almost normal, though nowhere near a man to lead a country. Trump to me looked too agressive, many people won’t like that. But Dan Bongino may have a point: Trump did get Biden to say that he doesn’t support Dems’ health care plans, nor the Green New Deal. Which is odd given that his website says he does, and Kamala Harris was one of its main voices.

Bongino

I see it… I get it… pic.twitter.com/ZeGp2t2iL2

— W T (@thirdgenwidget) September 30, 2020

Biden Green New Deal

Biden: “I don’t support the Green New Deal.”

Biden’s own website: https://t.co/XCaN7lQGB1 pic.twitter.com/Z6SQuknCKV

— Guy Benson (@guypbenson) September 30, 2020

Wonder how this is covered in the MSM.

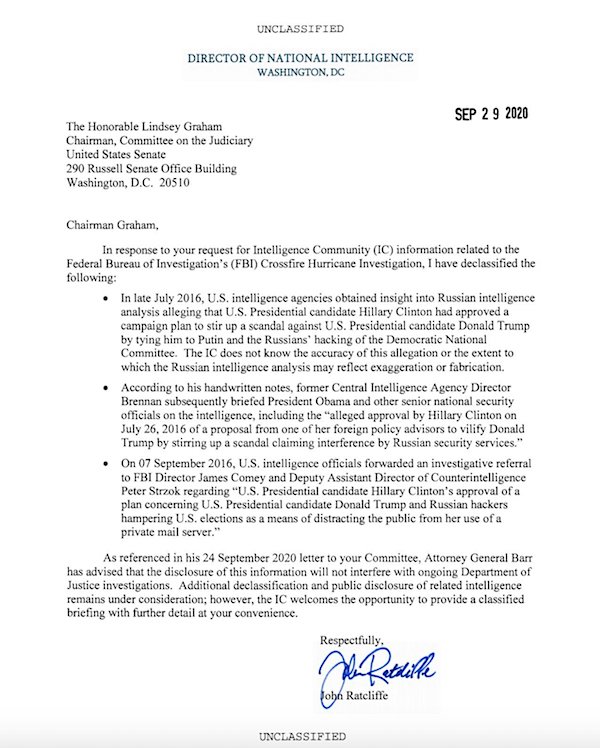

• Hillary Clinton Cooked Up Russiagate To Smear Trump (RT)

Failed presidential candidate Hillary Clinton OK’ed a plan to smear then-rival Donald Trump with accusations about Russian election-hacking to distract from her email scandal, newly-declassified papers appear to show. Clinton approved an advisor’s proposal to “vilify Donald Trump by stirring up a scandal claiming interference by Russian security services” in July 2016, according to information declassified on Tuesday by Director of National Intelligence John Ratcliffe. The bombshell revelation was made public in a letter to Senate Judiciary Committee chair Lindsey Graham (R-S. Carolina), in response to a request for information related to the FBI’s Crossfire Hurricane (i.e. Russiagate) probe.

By the end of July 2016, US intelligence agencies had picked up chatter that their Russian counterparts not only knew of the scheme, but that Clinton was behind it – though the declassified material stresses that the American intelligence community “does not know the accuracy” of the claim that Clinton had green-lighted such a plan, or whether the Russians were exaggerating. However, then-CIA director John Brennan apparently followed up that assessment by briefing then-President Barack Obama on Clinton’s Russian smear scheme, according to his handwritten notes – suggesting the spy agencies were very much aware what was going on.

Here's the moment on July 24th, 2016, when Robby Mook planted the Russia collusion hoax. This is what started it all. As we just learned from @DNI_Ratcliffe, this was immediately followed by Hillary pushing the fabricated scandal that Trump was working with Russia. pic.twitter.com/mRlLtk2CJ4

— Hans Mahncke (@HansMahncke) September 29, 2020

The news made a splash among the president’s supporters and other Russiagate skeptics, one of whom observed the timing of the events described in the declassified material dovetailed seamlessly with the timetable in which Russiagate was unveiled to the public. Clinton staffer Robby Mook appeared on CNN on July 24, 2016 to claim that “Russian state actors broke into the [Democratic National Committee]” and “stole” the campaign’s emails “for the purpose of actually helping Donald Trump.” Former British intelligence agent Christopher Steele filed his report around the same date, accusing the Trump campaign of colluding with Russian security services to hack the DNC and dump the emails via Wikileaks.

The false information that made up the infamous “peepee dossier” – collected under contract from opposition research firm Fusion GPS – was used to justify securing a FISA warrant for Trump campaign aide Carter Page. That warrant, and others that followed, have since been declared invalid, as it was discovered the Obama administration had “violated its duty of candor” on its application for every warrant. Just a month before the 2016 election, Obama’s intelligence agencies announced that they believed Russia was responsible for hacking the DNC – allegations it has since emerged were made without even examining the server on which the emails were stored. More than a year after the release of special counsel Robert Mueller’s report shocked Russiagate true believers with the absence of the promised proof of collusion, the colossal conspiracy theory has all but unraveled.

She asked Trump not to pardon Flynn. She wants to take everybody to court. Including Hillary and Obama.

• Flynn Lawyer Tells Judge To Recuse Self Over ‘Abject Bias’ (Fox)

In a fiery exchange during Tuesday’s hearing, former national security adviser Michael Flynn’s attorney Sidney Powell claimed that U.S. District Court Judge Emmet Sullivan had displayed “abject bias” in the case and should recuse himself. Powell’s remarks came during oral arguments before Sullivan over whether the judge should grant a request to dismiss Flynn’s criminal case. Sullivan responded to Powell by saying that she was free to submit an argument in writing and should have done so months ago. Powell also admitted on Tuesday that she has spoken to President Trump about Flynn’s criminal case, but that she requested that Trump not grant him a pardon.

“Have you had discussions with the president about this case?” Sullivan asked Powell. Powell at first tried to invoke executive privilege, but upon being reminded that she is not a federal employee, she acknowledged that she had. “I can tell you I spoke one time with the president, one time about this case to inform him of the general status of the case,” Powell said. When asked if she had made any requests, she said, no, “other than he not issue a pardon.” [..] “The scope of the court’s inquiry is going to be significantly limited,” Sullivan said upon kicking off Tuesday’s hearing. Sullivan explained that he would not look at whether he had the authority to appoint Gleeson (saying it was “crystal clear”), or whether Flynn should be held in contempt for perjury.

“So the issues the court will focus on this morning and hear from counsel are as follows,” Sullivan continued. “Whether the court has the discretion to review both opposed and unopposed 48(a)motions for prosecutorial abuse, and whether this court should deny the government leave to dismiss the pending charge against Mr. Flynn.” The Justice Department argued Tuesday that the case should be dismissed because there is no controversy between the parties. Gleeson’s amicus curiae brief in June insisted that not only does Sullivan have the authority to reject the government’s request but he should do so. He alleged that that prosecutors’ reasoning is “riddled with inexplicable and elementary errors of law and fact” and should not justify dismissal.

The DOJ in response asserted that Article II of the Constitution gives the court no power to review the executive branch’s exercise of prosecutorial discretion. In their reasoning for dismissing the case, prosecutors claimed that Flynn’s false statements could not be proven to be material in an FBI investigation, specifically the investigation of Russian election interference and the Trump campaign’s possible ties to it.

Kevin R. Brock, former assistant director of intelligence for the FBI, was an FBI special agent for 24 years and principal deputy director of the National Counterterrorism Center (NCTC).

• The FBI And Special Counsel’s Horrible, Terrible, Miserable Week (Brock)

Albert Einstein had his theory of relativity validated by the atomic bomb. Like it or not, Donald Trump’s widely ridiculed “witch hunt” theory was bolstered by a couple more explosive revelations released last week that once again prove paranoia doesn’t mean they’re not actually out to get you. The first blast revealed that the FBI investigated the primary source of the Steele dossier years ago for being a Russian spy. Amazingly, we’re just learning this now. The second detonation comes from an FBI agent deeply embedded in the Crossfire Hurricane and special counsel investigations who lambasted the exercise as an effort to “get Trump” rather than follow actual evidence. Let’s start with the spy-crafted dossier. If it wasn’t clear before, it’s now nearly inescapable that those at the top of the FBI were not “never Trumpers,” they were “sever Trumpers.”

The more their actions come into corroborated focus, the more apparent was their desire to decapitate the new administration. The front office’s Stop Trump tone was set early on by former agent Peter Strzok’s infamous text to former FBI counsel Lisa Page on Aug. 15, 2016 — “I’m afraid we can’t take that risk” — regarding Trump’s chances of being elected president. The troika at the top — former FBI director James Comey, his deputy director Andrew McCabe, and Strzok — had a problem, though. They feared a Trump presidency but lacked any real evidence to stop him. We know from the communication crafted by Strzok opening the Crossfire Hurricane investigation that he articulated no legal basis to initiate the case.

Not to be deterred, the trio decided to exploit the Steele dossier to continue their unprecedented investigation of a presidential campaign, even though they knew it was paid for by the Clinton campaign, even though Comey himself described it as “salacious and unverified,” even though the primary sub-source admitted he fabricated most of it, and — we now learn — even though the FBI investigated the sub-source years prior as a Russian spy. Any one of those factors would have been enough to prompt a high school civics student to disregard the dossier wholesale. Yet these FBI leaders trundled on, eventually relying on it to invade the privacy of a U.S. citizen — not once but four times, without cause. In essence, the three used the words of a suspected Russian spy to, in the words of the attorney general, “spy” on the Trump campaign. In short, they really, really wanted to believe the dossier.

There is an axiom in law enforcement that you should never concoct a theory and then search for evidence to fit the narrative. No, you follow the evidence and let it tell its own story. The dossier was not evidence, or even anything close to it, but it fit a narrative favored by the trio in the FBI’s front office. Despite its outlandishness, it supported their view that a Trump presidency was too risky. Will they be held accountable for their illicit investigative activities and the massive damage they have done to the reputation of the FBI? That part isn’t clear yet. In the meantime, they all endure the inside-the-Beltway hardship of writing a book apiece and collecting large sums of money; movie stars line up to play them in propaganda films. The FBI trio continues to be the gift that keeps on shivving, slicing up the bureau’s legacy even now.

“Trump paid alternative minimum tax in seven years between 2000 and 2017 — a total of $24.3 million..”

• Trump’s Tax Filings Do Not Reveal What Democrats Had Hoped For (MoA)

Lots of pages have been filled with rumors about President Trump’s income tax filings. The Democrats had hoped that they would reveal criminal behavior or at least prove that Russia had illegitimate influence over him: “Trump says his tax returns reveal nothing that is not already disclosed on his official candidate financial disclosure, called Form 278e. As ethics counsels to the past two presidents, we dealt with both their tax filings and their Form 278’s and so we know that Trump is wrong. His tax filings have an enormous amount of additional information which, in this case, could be critically important to determining whether his business overseas might affect his decision-making as president. That is because Trump’s 12,000-page tax return may tell us a great deal about his Russian and other foreign business ties that is not on his 104-page campaign financial disclosure. It’s now more vital than ever that we get that information in light of Trump’s embrace of Russian hacking, leaking and interference in our election.”

Now the New York Times has obtained Trump’s tax filings. It has made a huge splash out of them. The story starts with this: “Donald J. Trump paid $750 in federal income taxes the year he won the presidency. In his first year in the White House, he paid another $750.He had paid no income taxes at all in 10 of the previous 15 years — largely because he reported losing much more money than he made.” However, down in paragraph 78(!) it reports: “Mr. Trump was periodically required to pay a parallel income tax called the alternative minimum tax, created as a tripwire to prevent wealthy people from using huge deductions, including business losses, to entirely wipe out their tax liabilities. Mr. Trump paid alternative minimum tax in seven years between 2000 and 2017 — a total of $24.3 million, excluding refunds he received after filing.” Reading the details of the 11,000(!) words story one finds that it is largely a bummer for the ‘resistance’, not so much for Trump.

It essentially says: • Trump is a quite rich international real estate investor. • U.S. tax laws allow investors to minimize their reported income by claiming various kinds of deprecations and other gimmicks. • Tax regulations that allows investors to carry forward leftover losses to reduce taxes in future years are especially helpful. • Trump has good accountants and tax lawyers and has used the laws to their full extent to minimize his tax payments. Is any of the above something we did not already knew? What the Times story does NOT say is: • Trump’s tax record reveal that he did something illegal.• The paper had surely hoped for more. It must have been especially bitter for its authors to write this paragraph:

By their very nature, the filings will leave many questions unanswered, many questioners unfulfilled. They comprise information that Mr. Trump has disclosed to the I.R.S., not the findings of an independent financial examination. They report that Mr. Trump owns hundreds of millions of dollars in valuable assets, but they do not reveal his true wealth. Nor do they reveal any previously unreported connections to Russia. This is a dud. It is certainly not the campaign ammunition the Democrats had hoped for.

“We know from history that it is easy to start a conflict, but it is bloody hard to end it.”

• China Still Fears 3 Things About America. The Dollar is One of Them (TM.ch)

Few Western observers know China better than The Honorable Kevin Rudd. As a young diplomat, the Australian, who speaks fluent Mandarin, was stationed in Beijing in the 1980s. As Australia’s Prime Minister and then Foreign Minister from 2007 to 2012, he led his country through the delicate tension between its most important alliance partner (the USA) and its largest trading partner (China). Today Mr. Rudd is President of the Asia Society Policy Institute in New York. In an in-depth conversation via Zoom, he explains why a fundamental competition has begun between the two great powers. He would not rule out a hot war: «We know from history that it is easy to start a conflict, but it is bloody hard to end it», he warns.

The strategic competition between the two countries is the product of both structural and leadership factors. The structural factors are pretty plain, and that is the continuing change in the balance of power in military, economic, and technological terms. This has an impact on China’s perception of its ability to be more assertive in the region and the world against America. The second dynamic is Xi Jinping’s leadership style, which is more assertive and aggressive than any of his post-Mao predecessors, Deng Xiaoping, Jiang Zemin and Hu Jintao. The third factor is Donald Trump, who obsesses about particular parts of the economy, namely trade and to a lesser degree technology.

Would America’s position be different if someone else than Trump was President? No. The structural factors about the changing balance of power, as well as Xi Jinping’s leadership style, have caused China to rub up against American interests and values very sharply. Indeed, China is rubbing up against the interests and values of most other Western countries and some Asian democracies as well. Had Hillary Clinton won in 2016, her response would have been very robust. Trump has for the most part been superficially robust, principally on trade and technology. He was only triggered into more comprehensive robustness by the Covid-19 crisis threatening his reelection. If the next President of the U.S. is a Democrat, my judgement would be that the new Administration will be equally but more systematically hard-line in their reaction to China.

Do you see a world divided into two technology spheres? This is the logical consequence. Assume you have Huawei 5G systems rolled out across the 75 countries that take part in the Belt and Road Initiative, then what follows from that is a series of industry standards that become accepted and compatible within those countries, as opposed to those that rely on American systems. But then another set of questions arises: Let’s say China is effectively banned from purchasing semiconductors based on American technology and is dependent on domestic supply. Chinese semiconductors are slower than their American counterparts, and likely to remain for the decade ahead. Do the BRI countries accept a slower microprocessor product standard for being part of the Chinese technological ecosystem? I don’t know the answer to that, but I think your prognosis of two technology spheres is correct. [..]

How probable is it that Washington would choose to weaponise the Dollar? We don’t know. The Democrats in my judgement do not have a policy on that at present. Perhaps the best way to respond to your question is to say this: There are three things that China still fears about America. The US military, its semiconductor industry, and the Dollar. If you are attentive to the internalities of the Chinese national economic self-sufficiency debate at present, it often is expressed in terms of «Let’s not allow to happen to us in financial markets what is happening in technology markets». But if the U.S. goes into hardline mode against China for general strategy purposes, then the only thing that would deter Washington is the amount of self-harm it would inflict on Wall Street, if it is forced to decouple from the Chinese market. If that would happen, it would place Frankfurt, Zurich, Paris or the City of London in a pretty interesting position.

A story a day.

• Brooklyn Voters On Mislabeled Absentee Ballots: ‘It’s A Major Problem’ (NYP)

Voters across Brooklyn are reporting widespread issues with mislabeled absentee ballots — a problem the city Board of Elections has blamed on an outside vendor. In numerous cases shared with The Post, residents across the borough received ballot return envelopes bearing the wrong name and address, sparking confusion over how to fix the error five weeks ahead of the election. “It’s a major problem. This is not stoking confidence in the election system,” said Brooklyn Heights resident, Jiong Wang, who received a return envelope for his ballot with the name and address of a voter who lives a half-mile away.

Meanwhile, Wang’s wife, Jill Wiehoff, received a ballot return envelope with her husband’s name on it. The same absentee ballot mislabeling issue was experienced by a Downtown Brooklyn voter whose return envelope bore the name of a resident living two blocks away. Because of the snafu, the voter, who spoke on the condition of anonymity, said he now plans to vote in person. “I’m very disappointed,” the voter said, “and I hope the BOE fixes it very f—ing soon.” [..] The city Board of Elections on Monday night acknowledged the matter, attributing it to “an outside vendor error.” They encouraged voters experiencing the problem to reach out, leading to comments from more Brooklyn voters who said they were sent the wrong ballot envelopes.

Thanks, Bill Gates. Well played.

• Less Than 50% Of Americans Would Take Covid-19 Vaccine, Even If Paid $100 (RT)

Mounting skepticism around a Covid-19 vaccine in the US continues, with less than half of respondents saying they’d take one even if they were offered $100, according to a new poll. Of the 1,000-plus adults who participated in the Axios-Ipsos poll, only 44 percent said they’d take a vaccine if offered the incentive of $100. They would be even less likely to get the vaccine if they were the ones who had to pay $100, with only 26 percent saying they’d be willing to take on the cost. More than half, however, said they’d be more “likely” to get it if their health insurance covered the entire cost. The same poll found that people would most trust an endorsement of a vaccine if it came from their personal doctor (62 percent).

Approval from the US Food and Drug Administration (FDA) would make 54 percent more likely to trust a vaccine, while approval from President Donald Trump would only help 19 percent of respondents. Even the majority of those who identify as Republicans (60 percent) said an endorsement from the president would not help their decision of whether or not to get vaccinated. Other recent polling about a potential vaccine has typically shown that less than half of Americans are willing to be first in line to get inoculated, with some showingconcern about the process being rushed amid President Trump’s numerous suggestions one will likely be available before the end of the year.

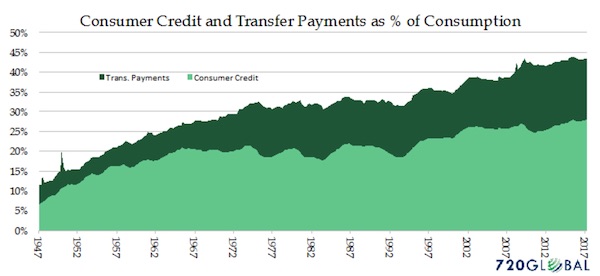

“… the Roosevelts effected a redistribution of wealth and power that nothing short of a revolution could accomplish.”

• The Redistribution Games (Varoufakis)

[..] the greatest proportion of the world’s wealth does not find its way to society’s innovators or maintainers. As wealth accumulates in few hands, the rest of the economy gradually becomes a desert. This is not news. We have always known that exorbitant market power underpins exorbitant wealth, which then feeds back into even greater market power. And this is the crux of the matter: Nothing retards productivity and depresses employment as efficiently as exorbitant market power. To invoke the conservative analogy, not even the fastest runners can win when the wealth commandeered by the ultra-rich turns the track into sand for everyone else. That’s why the most soul-destroying poverty and the largest number of “deaths of despair” are observed in countries where wealth concentration is soaring.

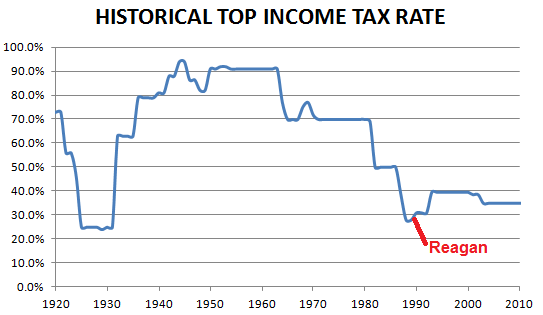

What should we do about highly concentrated wealth? How do we redistribute it fairly and efficiently? A wealth tax is much in vogue today. But no legally and politically feasible wealth tax can reduce substantially the current levels of crushing inequality. Moreover, it enables conservatives to cast doubt on wealth redistribution by asking pertinent questions: Should the state evict the poor heir of a good house if she can’t afford to pay the wealth tax? How do we price an asset, such as a stamp collection, without first auctioning it off? Fortunately, there are proven ways to redistribute wealth without violating anyone’s rights or crossing ethical lines. In 1906, Theodore Roosevelt famously broke up Standard Oil and other cartels despite a chorus of opposition bemoaning his attack on innovation and entrepreneurship.

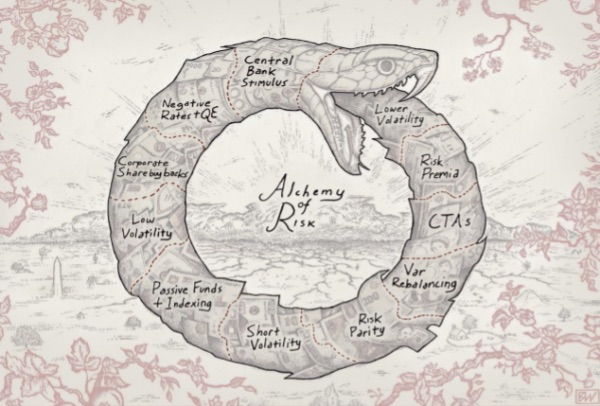

Following the 1929 Wall Street collapse, another Roosevelt, Franklin Delano, faced the same chorus when he put the financial genie in a bottle. With these two moves, the Roosevelts effected a redistribution of wealth and power that nothing short of a revolution could accomplish. Of course, the powerful find ways to shake off such shackles. After the Bretton Woods system collapsed in 1971, Wall Street and the cartels began to dominate again. Today, three megafirms, BlackRock, Vanguard, and State Street, own at least 40% of all American public companies and nearly 90% of those listed on the New York Stock Exchange. Tacit collusion is rampant, because every CEO knows that the parent megafirm is likely to be talking to CEOs of rival companies that it also owns. The result is higher prices, less innovation, lower investment, and, naturally, stagnant wages.

Power was further concentrated after Wall Street imploded in 2008 and central banks began to pump rivers of money into the financial system. Levering up the central bank money, the gargantuan cartels used this liquidity to invent new forms of complex debt and to buy back their own shares, sending share prices (and, naturally, bonuses) into the stratosphere while starving the world of investment in quality jobs and green infrastructure. Megafirms also indulged in another favorite pastime: usurping markets, buying politicians, and capturing regulators – in short, poisoning liberal democracy.

The judge dind’t dare object because the Spanish court had earlier permitted it. Now, “..there is the specter of damning testimony being read in Assange’s extradition case about the CIA planning to kidnap or poison Assange that will go unchallenged by the U.S.”

• Anonymous Witnesses to Detail Alleged CIA Plot to Kill Assange (Lauria)

Judge Vanessa Baraitser has granted anonymity to two witness from the UC Global Spanish security firm to have their testimony read in court on Thursday regarding an alleged Central Intelligence Agency plot to either kidnap or poison Julian Assange. The two witnesses have already testified under protection in a Spanish court case against David Morales, founder and director of UC Global. The company was hired by the Ecuadorian government to provide security at its London embassy, where Assange lived for seven years until his arrest last year. According to press reports the witnesses testimony detailed how Morales was working with “American friends,” allegedly the CIA, to stream 24/7 video and audio from Assange’s chamber to the United States, including surveillance of Assange’s privileged conversations with his lawyers.

That would mean the government prosecuting Assange had eavesdropped on his defense preparations, an offense that would normally get its case thrown out of court. The Spanish witnesses sought the same protection from Baraitser’s court that they enjoy in the Spanish court because of fear of retaliation from Morales. Spanish police raided his home and found loaded arms with their serial numbers filed off. James Lewis QC, representing the U.S. government told the court he could not get instructions from the Department of Justice on whether to challenge the testimony on Thursday because of a “Chinese Wall” that is supposed to be between the DOJ and other federal agencies, such as the CIA, to prevent prosecutions from being politically motivated. (It is a a wall that has holes. We’ve heard testimony in this case about that).

So there is the specter of damning testimony being read in Assange’s extradition case about the Central Intelligence Agency planning to kidnap or poison Assange that will go unchallenged by the U.S. The prosecution will be informed of the witnesses’ identities and has 24 hours to vet the witnesses. Thursday should be the most explosive and perhaps most decisive day during this proceeding.

Well, at least something’s moving.

• Greece Moves Refugees To Mainland To Ease Crowding At Island Camps (AP)

Greek authorities moved nearly 1,000 refugees from eastern Aegean islands to the mainland Tuesday as part of efforts to improve conditions in overcrowded island refugee camps. Most of the 946 people on a ferry that docked at Lavrio, near Athens, had been at a temporary facility hastily built on the island of Lesvos to replace a camp that was burned down by angry residents three weeks ago. Others came from camps on Kos, Samos, Chios and Leros. The transfer from the Greek islands of people whose asylum bids have been accepted will continue over the coming weeks and months, the country’s Migration Ministry said Tuesday. Just over 26,000 refugees and migrants live in camps on islands, where they arrived after crossing from the nearby Turkish coast in smuggling boats. More than half are on Lesvos.

Greek officials have pledged to drastically reduce the islands’ migrant populations by moving people who have been granted refugee status to mainland accommodations, taking advantage of a drastic drop in arrivals from Turkey that resulted from stronger policing of the sea border. The government has also voiced hopes that all the migrants currently on the islands will have been moved to the mainland within six months. On Tuesday, officials said all unaccompanied teenagers and children living in camps on the islands or on Greece’s land border with Turkey had been moved to appropriate facilities on the mainland. After arriving at Lavrio, the migrants were taken in buses to hotels where they are expected to stay for the next two months. Nearly 13,000 people have entered Greece illegally so far this year, considerably fewer than in 2019.

Do you think our behavior would change if we could live much longer?

• 40% Of World’s Plant Species At Risk Of Extinction (G.)

Two in five of the world’s plant species are at risk of extinction as a result of the destruction of the natural world, according to an international report. Plants and fungi underpin life on Earth, but the scientists said they were now in a race against time to find and identify species before they were lost. These unknown species, and many already recorded, were an untapped “treasure chest” of food, medicines and biofuels that could tackle many of humanity’s greatest challenges, they said, potentially including treatments for coronavirus and other pandemic microbes. More than 4,000 species of plants and fungi were discovered in 2019.

These included six species of Allium in Europe and China, the same group as onions and garlic, 10 relatives of spinach in California and two wild relatives of cassava, which could help future-proof the staple crop eaten by 800 million people against the climate crisis. New medical plants included a sea holly species in Texas, whose relatives can treat inflammation, a species of antimalarial Artemisa in Tibet and three varieties of evening primrose. “We would be able not survive without plants and fungi – all life depends on them – and it is really time to open the treasure chest,” said Prof Alexandre Antonelli, the director of science at the Royal Botanical Gardens, Kew, in the UK. RBG Kew led the report, which involved 210 scientists from 42 countries.

“Every time we lose a species, we lose an opportunity for humankind,” Antonelli said. “We are losing a race against time as we are probably losing species faster than we can find and name them.” The UN revealed last week that the world’s governments failed to meet a single target to stem biodiversity losses in the last decade. The researchers based their assessment of the proportion of species under threat of extinction on the International Union for Conservation of Nature’s Red List. But only a small fraction of the 350,000 known plant species have been assessed, so the scientists used statistical techniques to adjust for biases in the data, such as the lack of fieldwork in some regions.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time.