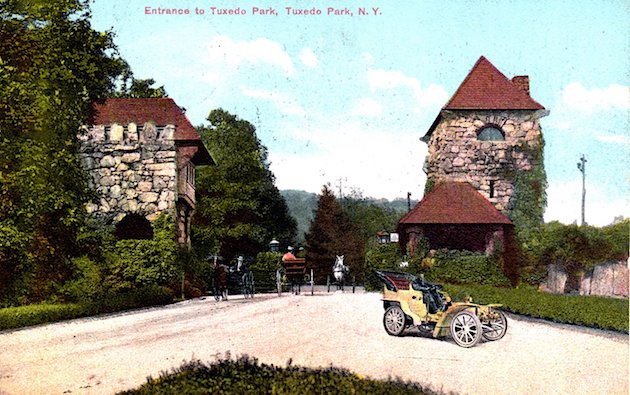

Unknown Mark Twain (center, white suit) and a kitten (brown fur, left of center) at Tuxedo Park 1907

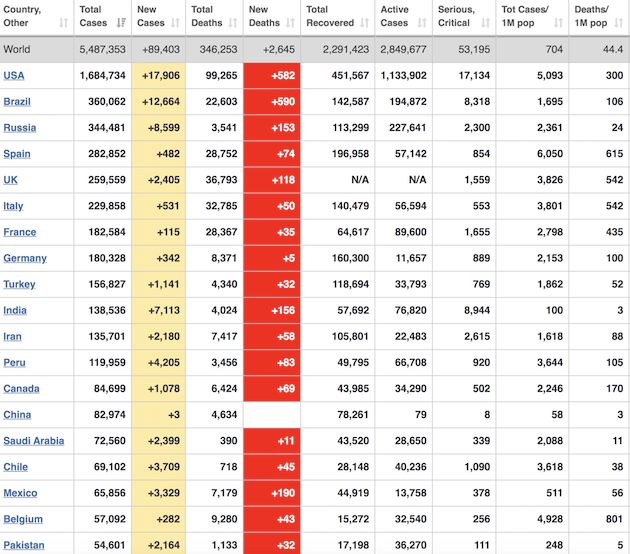

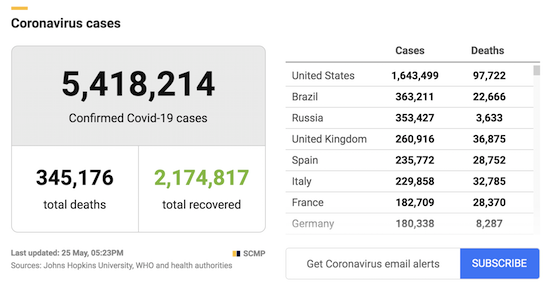

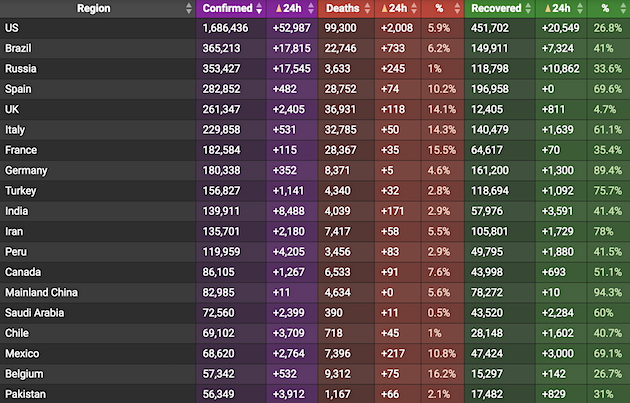

Global new cases in past 24 hours: 101,325

New cases in:

• US + 21,475

• Russia + 8,946

• Brazil + 17,815

• India + 8,488

• Peru + 4,205

• US #coronavirus death toll rises by 638: Johns Hopkins

• https://covid19info.live/ says 2,008 new deaths in past 24 hours. It also says 52,987(!) new cases. That’s not true

But many places still seem to report quite differently over weekends

Scandinaviahttps://t.co/LXO8pSKF9t

— Yaneer Bar-Yam (@yaneerbaryam) May 25, 2020

BREAKING: Coronavirus Outbreak New Winners!

Very pleased to announce:

Bosnia is a Winner! Congratulations!

Israel is a Winner! Congratulations!

Tanzania is a Winner! Congratulations!

The Bahamas is a Winner! Congratulations!South Korea made it back! Congratulations! pic.twitter.com/NAOyDQrD1a

— Yaneer Bar-Yam (@yaneerbaryam) May 24, 2020

I cannot live in societies that spend trillions on nuclear weapons yet are incapable of delivering COVID testing to their populations.

The world's pseudosophistication & misallocation of resources have been increasing… pic.twitter.com/9hBjwnRbqg— Nassim Nicholas Taleb (@nntaleb) May 24, 2020

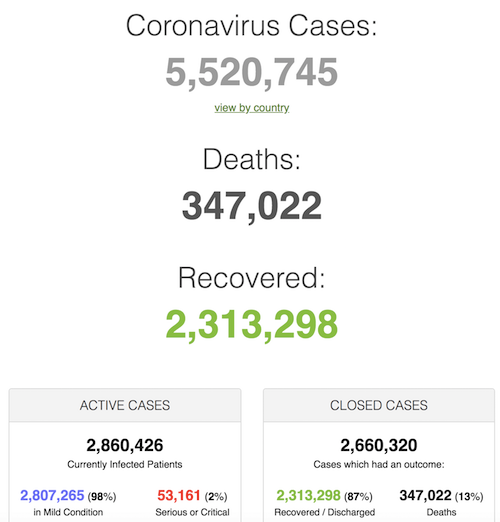

• Cases 5,520,745 (+ 93,190 from yesterday’s 5,427,555)

• Deaths 347,022 (+ 2,605 from yesterday’s 344,417)

From Worldometer yesterday evening -before their day’s close-

From Worldometer

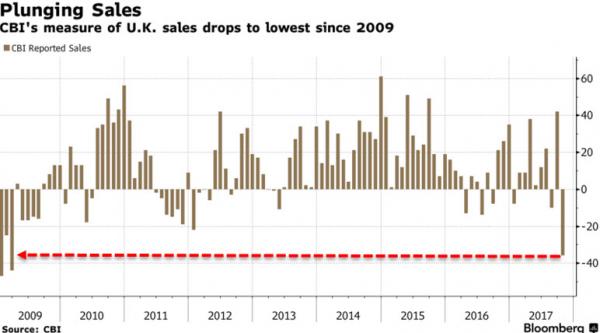

From SCMP:

From COVID19Info.live:

India scares me, despite their HCQ campaign. If you look at the slums in Mumbai or Delhi, how can you ever know what goes on? And India follows the global thread of relaxing lockdowns. While their numbers started rising under the lockdown.

• More Patients Than Beds In Mumbai As India Faces Surge In Virus Cases (R.)

India on Sunday reported 6,767 new coronavirus infections, the country’s biggest one-day increase. Government data shows the number of coronavirus cases in the world’s second-most populous country are doubling every 13 days or so, even as the government begins easing lockdown restrictions. India has reported more than 131,000 infections, including 3,867 deaths. “The increasing trend has not gone down,” said Bhramar Mukherjee, a professor of biostatistics and epidemiology at the University of Michigan, referring to India’s cases. “We’ve not seen a flattening of the curve.” Mukherjee’s team estimates that between 630,000 and 2.1 million people in India – out of a population of 1.3 billion – will become infected by early July.

More than a fifth of the country’s coronavirus cases are in Mumbai, India’s financial hub and its most populous city, where the Parikhs struggled to find hospital beds for their infected family members. India’s health ministry [..] has said in media briefings that not all patients need hospitalization and it is making rapid efforts to increase the number of hospital beds and procure health gear. The federal government’s data from last year showed there were about 714,000 hospital beds in India, up from about 540,000 in 2009. However, given India’s rising population, the number of beds per 1,000 people has grown only slightly in that time.

India has 0.5 beds per 1,000 people, according to the latest data from the OECD, up from 0.4 beds in 2009, but among lowest of countries surveyed by the OECD. In contrast, China has 4.3 hospital beds per 1,000 people and the United States has 2.8, according to the latest OECD figures. While millions of India’s poor rely on the public health system, especially in rural areas, private facilities account for 55% of hospital admissions, according to government data. The private health sector has been growing over the past two decades, especially in India’s big cities, where an expanding class of affluent Indians can afford private care.

Did Putin get lost in the message?

• How Russia’s Coronavirus Crisis Got So Bad (Pol.eu)

Now, instead of consolidating public support, Putin appears to be losing it. In early May, the Levada Center, Russia’s sole independent polling agency, found that Putin’s approval rating was down to 59 percent. That might sound enviable to Western politicians, but it’s the lowest rating he has had in 20 years. Thirty-three percent of those polled said they did not approve of his performance. Putin’s hold on power doesn’t look as strong as it did a few months ago. His hands-off response to coronavirus might have something to do with it. On a morning talk show in early March, I watched the deputy director of the research institute under Russia’s consumer watchdog agency say the situation in the country was “terrific — we’ve been living for almost three months along a huge border with China and have only five cases, so all the measures we’re taking are clearly effective.”

On other talk shows, where conspiracy theories reign, hosts and guests floated the notion that the virus didn’t exist. It was a hoax invented by the United States to destroy the Chinese economy, or it was made in an American laboratory and planted in China, or Bill Gates invented it so he could then make money on the vaccine. It was just a version of SARS, which in the end turned out to be less dangerous than everyone feared. Besides, 60,000 people die every year from the flu, and no one cares. What’s the big deal? So many people seemed to believe this, or wanted to believe this, that they ignored the increasingly stringent lockdown measures instituted in Moscow beginning March 25.

They didn’t practice social distancing, traveled all over the city, used services that were supposed to be closed, got together with friends, sniffed, sneezed, coughed and even spit in public. In stores, unmasked and barehanded, they squeezed every tomato in a bin before moving on to examine broccoli, then pushed and hovered at the cash register despite social distancing marks on the floor. On television and social media, we all watched Italians singing on balconies and saw Parisians printing out forms every time they left their apartments. COVID was clearly bad outside Russia. But inside Russia? It was hard to figure out.

Stop focusing on businesses, start focusing on people. Millions of businesses will close in the US alone, it’s no use trying to save them if you haven’t taken care of the people, their customers, first.

• Coronavirus Forces 100,000 NY Small Businesses To Close Permanently (Patch)

The coronavirus crisis has forced more than 100,000 small businesses in New York to close permanently, the governor said Friday. The huge swath of closures means main streets will look at lot different when the state is allowed to reopen. At most risk have been businesses that are owned by minorities, Gov. Andrew Cuomo said. “Small businesses are taking a real beating,” he said. “They are 90 percent of New York’s businesses and they’re facing the toughest challengers. “The economic projections, vis-a-vis small business, are actually frightening. More than 100,000 have shut permanently since the pandemic hit. Many small businesses just don’t have the staying power to continue to pay all the fixed costs, the lease, etcetera, when they have no income whatsoever.”

All but essential businesses have now been closed since New York’s shutdown started on March 22. Millions of former employees are now registered as unemployed. Cuomo said New York State was launching its own small business relief program, with more than $100 million that it will make available as loans. “We’re going to focus on true small businesses,” he said. “Twenty or fewer employees, less than $3 million in gross revenues.”

So on the one hand you want a capitalist, neo-liberal system, but on the other you want companies to work for the public good. Make up your mind already.

• Big Pharma Rejected EU Plan To Fast-Track Vaccines In 2017 (G.)

The world’s largest pharmaceutical companies rejected an EU proposal three years ago to work on fast-tracking vaccines for pathogens like coronavirus to allow them to be developed before an outbreak, the Guardian can reveal. The plan to speed up the development and approval of vaccines was put forward by European commission representatives sitting on the Innovative Medicines Initiative (IMI) – a public-private partnership whose function is to back cutting-edge research in Europe – but it was rejected by industry partners on the body. The commission’s argument had been that the research could “facilitate the development and regulatory approval of vaccines against priority pathogens, to the extent possible before an actual outbreak occurs”.

The pharmaceutical companies on the IMI, however, did not take up the idea. The revelation is contained in a report published by the Corporate Observatory Europe (COE), a Brussels-based research centre, examining decisions made by the IMI, which has a budget of €5bn, made up of EU funding and in-kind contributions from private and other bodies. The IMI’s governing board is made up of commission officials and representatives of the European Federation of Pharmaceutical Industries (EFPIA), whose members include some of the biggest names in the sector, among them GlaxoSmithKline, Novartis, Pfizer, Lilly and Johnson & Johnson.

A global lack of preparedness for the coronavirus pandemic has already led to accusations in recent weeks that the pharmaceutical industry has failed to prioritise treatments for infectious diseases because they are less profitable than chronic medical conditions. [..] The COE report says that rather than “compensating for market failures” by speeding up the development of innovative medicines, as per its remit, the IMI has been “more about business-as-usual market priorities”. The report’s authors cite a comment posted on the IMI’s website, since removed, selling the advantages of the initiative to big pharma as offering “tremendous cost savings, as the IMI projects replicate work that individual companies would have had to do anyway”.

The European commission’s “biopreparedness” funding proposal in 2017 would have involved refining computer simulations, known as in silico modelling, and improved analysis of animal testing models to give regulators greater confidence in approving vaccines. Minutes of a meeting of the IMI’s governing board from December 2018 reveal that the proposal was not accepted. The IMI also decided against funding projects with the Coalition for Epidemic Preparedness Innovations, a foundation seeking to tackle so-called blueprint priority diseases such as Mers and Sars, both of them coronaviruses.

“Stop being so US-centric.”

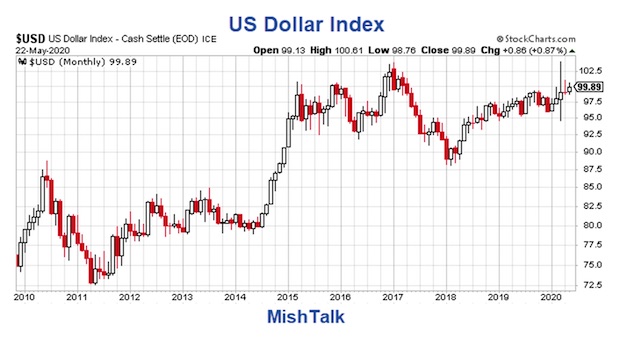

• Why Isn’t the Dollar Collapsing Given Trillions in Printing? (Mish)

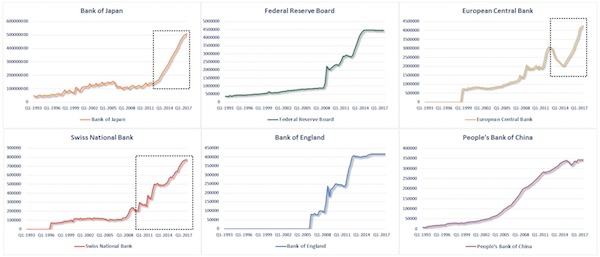

I remain amused by all the calls of hyperinflation and high inflation given the Fed has turned on the printing presses. However, currencies cannot be viewed in isolation. To those expecting a total US dollar collapse, here’s my word of advice. Stop being so US-centric. Please note Japan authorizes another $929 Billion to Battle Pandemic. Japan is considering a fresh stimulus package worth over $929 billion that will consist mostly of financial aid programmes for companies hit by the coronavirus pandemic, the Nikkei newspaper said on Monday. | The package, to be funded by a second extra budget for the current fiscal year beginning in April, would follow a record $1.1 trillion spending plan deployed last month to cushion the economic blow from the pandemic. That is a total of 2 trillion dollars for Japan. Adjusted for the relative size of the economies, that is an amazing amount.

Also note that China unveils US$500 billion fiscal stimulus, but refrains from going all-in. Key Points • China will increase its budget fiscal deficit to a record 3.6 per cent of gross domestic product this year, up from 2.8 per cent in 2019 • This is the first time the ratio has exceeded 3 per cent – a red line for decades. • Beijing will also issue special treasury bonds for the first time since 2007 and increase the local government bond quota as it fights the pandemic Supposedly that is not “All In.” And given what is going on elsewhere it isn’t. But the Yuan is not a component of the US dollar index. And it is important that China is crossing red lines.

On May 10, I noted a Major Court Fight Between Germany and EU Looms Briefly, the German constitutional court ruled that the ECB abused its powers ruling on the ECB asset purchases as implausible, and objectively arbitrary. What Germany fears now and has from the outset is “debt mutualization” in which Germany would bailout Greece, Spain, Portugal, and Italy. And despite the German court ruling, Pablo Iglesias, Spain’s Deputy PM. says a “certain [level of] debt mutualisation is a [necessary] condition of the [continued] existence of the EU”. The EU once again faces a breakup crisis. With negative interest rates in the Eurozone and a breakup risk high and rising, it’s no wonder the Euro is not strengthening.

Kuroda’s still fighting deflation.

• Japan Eyes Stimulus Plan Worth Over $929 Billion To Battle Pandemic (TRT)

Japan is considering a fresh stimulus package worth over $929 billion that will consist mostly of financial aid programmes for companies hit by the coronavirus pandemic, the Nikkei newspaper said on Monday. The package, to be funded by a second extra budget for the current fiscal year beginning in April, would follow a record $1.1 trillion spending plan deployed last month to cushion the economic blow from the pandemic. The second extra budget, worth $929.45 billion (100 trillion yen), will include 60 trillion yen for expanding loan programmes that state-affiliated and private financial institutions offer to firms hit by virus, the paper said.

Another 27 trillion yen will be set aside for other financial aid programmes, including 15 trillion yen for a new programme to inject capital into ailing firms, it said. The government is expected to approve the budget, which will also include subsidies to help companies pay rent and wages as they close businesses, at a cabinet meeting on Wednesday.

Time for an update on the shadow banks.

• China Unveils $500 Billion Fiscal Stimulus, Refrains From Going All-in (SCMP)

The Chinese government has unveiled a fiscal stimulus package of nearly 3.6 trillion yuan (US$506 billion), as Beijing tries to offset the economic shock caused by the coronavirus pandemic and prepare for an “unpredictable” path ahead. Premier Li Keqiang announced details of the plan in his work report at the National People’s Congress on Friday, including an increase of the budget fiscal deficit to a record high of 3.6 per cent of GDP, up from 2.8 per cent last year. It is the first time the ratio has exceeded 3 per cent – a red line for decades – and will add an extra 1 trillion yuan to the budget to bolster the economy after it was lashed by the pandemic.

Beijing will also issue 1 trillion yuan of special treasury bonds for the first time since 2007, though these will not be included in the central government budget and therefore the deficit ratio. The local government special bond quota, another source of infrastructure funding, has been boosted by 1.6 trillion yuan to 3.75 trillion yuan for 2020. While the sum total of new spending and tax cuts is large, it fell short of expectations, reflecting Beijing’s concerns about overspending and worries about debt, analysts said. “The incremental amount [of fiscal stimulus] is small,” said Larry Hu, chief China economist of Macquarie Capital. “Traditionally, China’s stimulus is not released at one go, but step by step … A bigger stimulus will only be seen when numbers are bad enough.”

The aggregate size of China’s total budget fiscal deficit, which includes the government budget deficit and off-budget debts, was about 8.3 per cent of GDP, above last year’s figure of 5.6 per cent, said Hu, adding market expectations were for a “more proactive fiscal policy”.

Excellent from the Globe and Mail.

• China Racing To Impose New Law Criminalizing Hong Kong Protests (G&M)

Police in Hong Kong cracked down on protesters Sunday, arresting at least 180, in the wake of Beijing’s pledge to move quickly on a new law that will extend China’s concept of justice to those who challenge Communist Party leadership in the territory. They were the first protests since Chinese authorities announced their plans to impose the new law, which will criminalize conduct according to Beijing’s definitions of what constitutes separatism, terrorism, subversion and illegal foreign meddling. The draft decision on establishing and improving the legal system and enforcement mechanisms for Hong Kong on national security also gives mainland China the right to place its own enforcers on Hong Kong soil.

The law is expected to be finalized this week by the National People’s Congress, China’s rubber-stamp parliament, and enacted soon after. It “has become a pressing priority. We must get it done without the slightest delay,” China’s foreign minister Wang Yi said. For nearly a year, the Asian financial centre has been a city of both peaceful demonstration and violent protest. With the law looming on the horizon, protests erupted as the city streets were drenched in tear gas and blocked by makeshift barricades.

On Sunday, police descended swiftly on protesters with a show of force that bloodied the streets. At least four officers were injured in clashes, according to a spokesperson for the Hong Kong government, who issued a lengthy statement late Sunday calling the protesters’ conduct an “outrageous” and ”serious threat to public safety.” Those who waved “Hong Kong Independence” flags on Sunday undermined “the overall and long-term interests of Hong Kong society,” the spokesperson said, adding: “rioters remain rampant, reinforcing the need and urgency of the legislation on national security.” But in a city where most people self-identify as “Hongkonger” rather than Chinese, the space to oppose the move is already diminishing.

Local police have refused to authorize peaceful protest, making street assemblies illegal. Epidemic health rules bar gatherings of more than eight people. And Beijing’s enthusiastic backing has further empowered Hong Kong’s police, already accused by human-rights groups of brutality in their handling of violent protests, to clear the streets. ”Protesters now face graver potential danger and legal consequences,” said Bonnie Leung, a pro-democracy campaigner in the city. “Given the severity and urgency of the national-security law, people will certainly want to return to the street,” said Avery Ng, a pro-democracy activist who is among a group of 15 recently arrested people that Chinese state media call “riot leaders.” But, he said, “I worry that many people cannot return to the street to protest without risking their personal safety.”

Chris Patten negotiated the 1997 transition. Is Europe going to join the US on China?

• China’s New National Security Law Should Be On G7 Agenda – Patten (R.)

The United Kingdom should ensure that China’s efforts to impose a new national security law on Hong Kong are on the agenda for the G7 meeting in June, Chris Patten, the last British governor of Hong Kong wrote in the Financial Times newspaper on Sunday. The last governor of the former British colony said that Britain and its G7 allies should take a stance against Chinese President Xi Jinping’s ‘regime’, which he labeled as “an enemy of open societies”.

“While the rest of the world is preoccupied with fighting COVID-19, he (Xi) has in effect ripped up the Joint Declaration, a treaty lodged at the UN to guarantee Hong Kong’s way of life till 2047”, Patten wrote in the newspaper. China has proposed imposing national security laws on Hong Kong as Communist Party rulers in Beijing on Friday unveiled details of the legislation that critics see as a turning point for the former British colony, which enjoys many freedoms, including an independent legal system and right to protest, not allowed on the mainland.

Good threadhttps://t.co/fXOR9gZzEV https://t.co/9GftCKlVZG

— Ben Thompson (@benthompson) May 25, 2020

The attack goes full frontal, from Guardian to Daily Mail.

• Boris Johnson Bets Big On Dominic Cummings (Pol.eu)

Boris Johnson is standing by his man — but it’s a political gamble that might yet cost him. After lengthy face-to-face discussions with Dominic Cummings on Sunday afternoon, the British prime minister told the country he was confident that his chief adviser “acted responsibly and legally, and with integrity” despite alleged breaches of the U.K.’s coronavirus lockdown rules. The revelation that Cummings traveled 260 miles from London to Durham to stay at a property close to family, after his wife developed coronavirus symptoms in late March, has led to calls for his resignation from opposition parties and a handful of Conservative MPs.

But Johnson, speaking at the government’s daily coronavirus press conference on Sunday evening, stood four-square behind Cummings — the strategic guru who masterminded the Brexit campaign and Johnson’s path to a thumping election victory. The prime minister said he fully accepted the adviser’s explanation that he had “no alternative” but to travel to guarantee childcare for his four-year-old son should he and his wife become too ill. “I think he followed the instincts of every father and every parent,” Johnson said. The U.K.’s guidance is that those who develop symptoms, as Cummings’ wife did, “must stay at home for at least seven days.” Other members of the household must stay put for 14 days.

But Johnson said the advice was also “absolutely clear that if you have childcare issues, that is a factor that has to be taken into account.” The official guidance advises parents who develop symptoms to “keep following” general advice “the best of your ability,” but acknowledges “not all these measures will be possible.” In short, discretion is limited.

If Cummings & wife had travelled in Italy under lockdown without valid reason they'd be subject to:

€800 to €6k fine each;

1 to 3 years' imprisonment IF they declared a false reason for travel;

3 to 12 years' imprisonment IF they'd tested positive for Covid-19 before travelling https://t.co/aCwsfRHNwA— Nicholas Whithorn (@NickWhithorn) May 25, 2020

Things being said about Cummings:

– He had covid

– His wife had covid

– They self-isolated for 14 days

– His son is autisticThings for which there is no evidence:

– He had covid

– His wife had covid

– They self-isolated for 14 days

– His son is autistic— (((Frances "Cassandra" Coppola))) (@Frances_Coppola) May 25, 2020

You might like this .. pic.twitter.com/9m7d63ltxS"

— Captain SKA (@CaptainSKA) May 24, 2020

The left wing joins in with the right. Not sure that bodes well for Joe.

• Biden Should Be Named in Criminal Probe in Ukraine, Judge Rules (Lauria)

Last month District Court Judge S. V. Vovk in Kiev ruled that police must list Biden as an alleged perpetrator of a crime against Shokin, according to a report on the website Just the News. The possible crime cited is “unlawful interference in Shokin’s work as Ukraine’s chief prosecutor,” the website said, according to an English translation of the investigative judge’s order obtained by the site. The district court had earlier ruled that there was sufficient evidence in Shokin’s criminal complaint to investigate Biden, but the police had withheld Biden’s name, listing him only as an unnamed American.

Shokin first alleged last year in a deposition that Biden had pressured then Ukrainian President Petro Poroshenko to fire Shokin because he was conducting an investigation into Burisma Holdings, the gas company on whose board Biden’s son Hunter was installed shortly after the fall of President Viktor Yanukovych in February 2014. Biden had been appointed the Obama administration’s point man on Ukraine, according to a recorded conversation between then Assistant Secretary of State Victoria Nuland and then U.S. ambassador to Ukraine, Geoffry Pyatt. Nuland and Pyatt discussed how to “midwife” a new Ukrainian government before the democratically-elected Yanukovych was overthrown. Nuland said Biden would help “glue” it all together.

As booty from the U.S.-backed coup, the sitting vice president’s son, Hunter, within weeks got his seat on Burisma, in what can be seen as a transparently neocolonial maneuver to take over a country and install one’s own people. But Biden’s son wasn’t the only one. A family friend of then Secretary of State John Kerry also joined Burisma’s board. U.S. agricultural giant Monsanto got a Ukrainian contract soon after the overthrow. And the first, post-coup Ukrainian finance minister was an American citizen, a former State Department official, who was given Ukrainian citizenship the day before she took up the post. Shokin has alleged, in the same vein, that the U.S. was running the country’s prosecutors’ office.

Long and great, reading under lockdown.

In a Gilded Age, abstractions are the things we are told represent prosperity. Back then, well, Americans were told that a lot of things represented prosperity. In Twain’s kind of bad story, prosperity was the ability to speculate on land, the freedom to take your shot on building the same kind of fortune as Vanderbilt and Carnegie. Prosperity was walking into the marble and gold edifice of J.P. Morgan’s bank and thinking, in awe, that we Americans could do something like this. Prosperity was the lives that social elites were capable of living, and if you weren’t, then, well, it looks like you might need to brush up on your Social Darwinism to figure out why not.

The excesses empowered by centers of political and social power were not just excesses. They were attempts to apply a layer of gilding to the baser materials underneath – the still vast and unresolved social and economic problems faced by an emerging United States with devastating inequality of both opportunity and circumstance. If it looked and felt like a Golden Age, wasn’t that all that really mattered? Perhaps this all sounds familiar. Perhaps this sounds like the Long Now. That’s because it is.

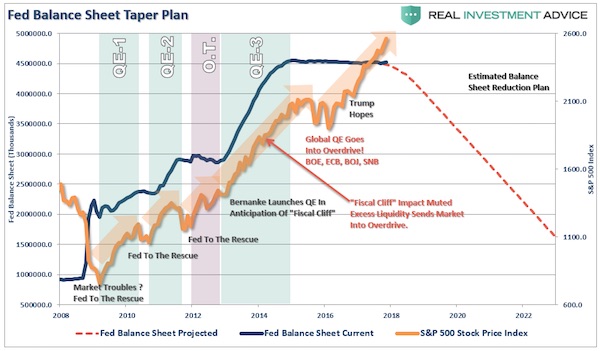

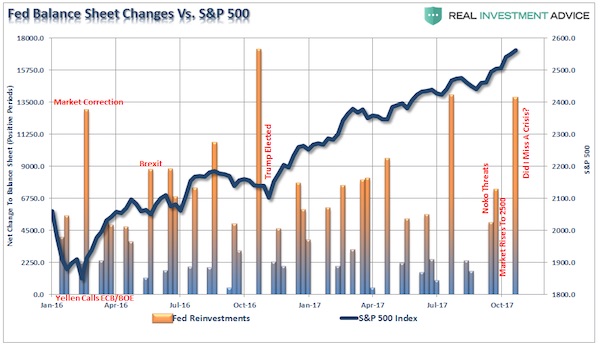

The Long Now IS a New Gilded Age, a top-down imposition of the idea that it is more important for a people to look and feel prosperous than to prosper. Only instead of land speculation and the pretenses of an aristocratic minority, our gilding largely boils down to the current level of the S&P 500 Index. If we wish to understand the arc that these top-down political narratives follow, especially how they die and how they do not die, we will find no better example than in the least golden yet most gilded retreat of late 19th and early 20th century oligarchs. A place that even Twain himself ended up calling home late in life.

Tuxedo Park.

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

It is always interesting to measure this stuff. Many US states have lockdowns in effect and people go out and in places like Tokyo there is no lockdown and everyone stays inside https://t.co/JEhrm7T0bu

— Anonymous Balding 大老板 (@BaldingsWorld) May 25, 2020

https://t.co/Qx7GVZqEp1 pic.twitter.com/9fRPzDJqwk

— Hugh Hendry Eclectica (@hendry_hugh) May 25, 2020

https://twitter.com/i/status/1264632759449985027

Support the Automatic Earth in virustime.