Vincent van Gogh Autumn landscape with four trees 1885

Madness. Should never be allowed. Why do you have a pension fund when you are free not to contribute to it?

• 5 Companies That Spent Big On Stock Buybacks As Pension Funding Lagged (MW)

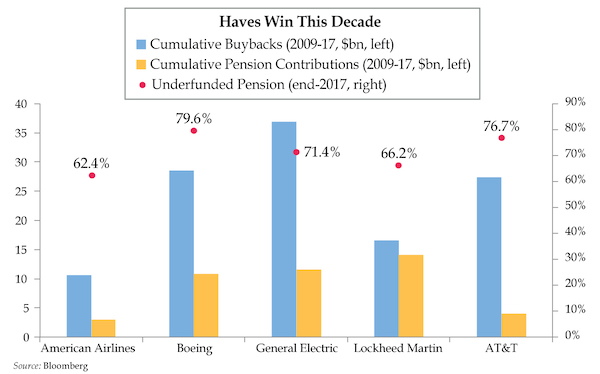

Even as corporate executives engage in a spree of share buybacks to spur stock prices higher, many have eschewed adding to their employee’s pension pots. That’s according to Danielle DiMartino Booth of Quill Intelligence who picked out a few of the more standout firms whose “enthusiasm for funding pensions was subpar compared to buybacks.” She lined up five of the worst offenders to illustrate that in the pursuit of higher stock prices and shareholder value corporations often left other pressing needs to languish. They include the likes of Boeing, General Electric and Lockheed Martin. In the chart below, the amount of buybacks and pension contributions between 2009 and 2017 for the five companies is compared alongside their respective pension funding ratio, which represents how much the company can deliver on its future pension obligations as a percentage of the plan’s total assets.

One case Booth highlights in the chart is American Airlines. Though, the airline carried around $18.3 billion of pension obligations, its pension system was only 62% funded even after a nine-year bull market. Market participants have cited the prevalence of share repurchases to the stock market’s searing rise in the past few years, even as equities retreated from their record highs in October. A report by Goldman Sachs said share buybacks could hit a record $1 trillion this year, nearly doubling last year’s haul.

For now.

• How Everything Has Changed Since Trump Became President (CNBC)

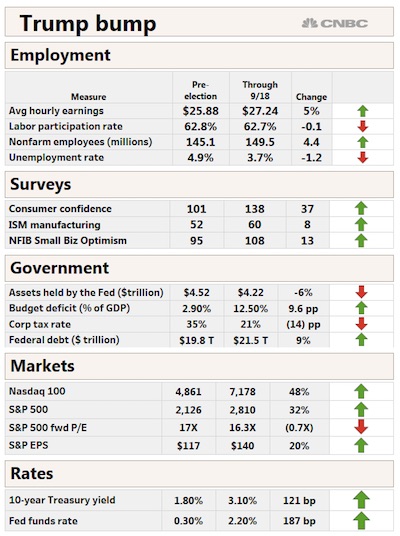

Since Donald Trump won the presidency, he has presided over both one the most tumultuous political times in recent memory, as well as the best economy the country has seen since well before the financial crisis. Consumer and small business confidence is up — but so are both the national debt and budget deficit. The chart below, using mostly data compiled by Goldman Sachs, quantifies just how much things changed from the days just before the election in November 2016 through September 2018. Of course, the stock market has weakened in October, which has been its historically most volatile month. The chart doesn’t include GDP, which has averaged 2.72 percent since Trump took over, compared to the 1.6 percent gain in 2016. But the numbers provide a solid overview of how conditions have evolved during the 45th president’s time in office.

No, it’s the low interest rates that will cause a market crash. It’s the manipulation.

• Trump Right To Blame Fed for Next Market Crash – Dave Janda (USAW)

Radio host Dr. Dave Janda says everybody in Washington knows the next big crash is right around the corner. It’s been 10 years since the Fed reflated the last meltdown, and Dr. Janda says President Trump is already blaming the Federal Reserve for killing the economy that his policies revived. Dr. Janda explains, “President Trump has been pointing the finger at the Fed. He’s been pointing the finger at the Fed, and that is exactly where he should be pointing. The globalist syndicate’s tentacle is the central banking system, and, in particular, in the United States, the Federal Reserve. The Federal Reserve is one of the entities that is directly responsible for this financial mess our country is currently in.

You would never see Obama or the Bushes, or Bill Clinton, point at the Fed and say what Trump has said. Trump said, ‘I think the Fed has gone crazy. I think the Fed is making a mistake. They’re so tight with interest rates. I think the Fed has gone crazy.’ Just the other day, Trump said, ‘My biggest threat is the Fed. . . . The Fed is raising rates too fast, and it’s too independent.’ Now, wait a minute, listen to that. It’s too independent. When was the last time a president of the United States said the Fed was too independent? . . . . Banking groups, that is their priority. So, when the President says the Fed is raising rates too fast, and it’s my biggest enemy, and too independent, what he is saying is they are looking out for their own interests.

They are not looking out for the interests of our country or for you or for me or for any American, and he’s right. I don’t know of any other president that has had the guts to say this.” So, what happens next? Dr. Janda says, “Trump knew this thing was rigged to blow, the economy, the financial system, and when the right time came, he would start pointing the finger at the globalists, the Fed. I believe that’s where we are right now.”

As predicted.

• Democrats Slide In Battle For Senate (Hill)

The battle for control of the Senate is looking worse and worse for Democrats, who just a month ago saw a path to the majority but now increasingly look like they could lose more seats and have a smaller minority next year. Republicans have seen a bump in the polls in several key races since Labor Day. They believe momentum has flipped to their party since the fight over Supreme Court Justice Brett Kavanaugh polarized the electorate, hurting Democrats running for reelection in states where President Trump is popular. Two states where Democrats had hopes of pulling major upsets — Texas and Tennessee — have moved in favor of Republicans.

Races in Nevada and Arizona, two other states where Democrats had hoped to make gains, remain tight, but Republicans feel more confident about their candidates. Meanwhile, the tide has moved against Democratic candidates in a couple of states that Trump won by double digits in 2016. In North Dakota, Democratic Sen. Heidi Heitkamp has fallen behind by double digits. And in Montana, Sen. Jon Tester (D), who seemed poised for victory a month ago, has seen his race tighten amid attacks by the president. There is some good news for Democrats in the polls. Sen. Joe Manchin (D-W.Va.), the only Democrat to back Kavanaugh’s confirmation, has maintained a healthy average lead of 9 points in the polls, despite running in a state that Trump won by a whopping 42 points in 2016.

Do the US and Riyadh know what he knows?

• Erdogan Says Will Reveal Details Of Khashoggi Case Tuesday (DS)

President Recep Tayyip Erdogan said Sunday that he will make important statements on Tuesday at the ruling Justice and Development Party’s (AK Party) parliamentary group meeting regarding the investigation on journalist Jamal Khashoggi’s fate, who was admittedly killed by Saudi authorities. “We seek justice and this will be revealed in all its naked truth, not through some ordinary steps but in all its naked truth. This is not an ordinary case. I will make statements on Tuesday at the AK Party parliamentary group meeting. The incident will be revealed entirely,” said Erdogan at a ceremony in Istanbul.

His comments are likely to heighten speculation that Turkey may be about to reveal some of the results of its investigations into the killing of the dissident journalist [..] Turkish newspapers have released information detailing a 15-member team that purportedly arrived in Istanbul to confront Khashoggi at the consulate. “Why did these 15 people come here (to Istanbul), why were 18 people arrested (in Saudi Arabia)? These need to be explained in detail,” Erdogan said. Saudi Arabia’s public prosecutor on Saturday said 18 people were arrested in connection with the incident. Turkish sources say the authorities have an audio recording purportedly documenting Khashoggi’s murder inside the consulate.

“If the incident transpired as it has been told across the world, there is no way Saudi officials can cover this up by saying a team from Saudi Arabia came and two or three men among them murdered him,” Numan Kurtulmus, deputy chairman of the AK Party, told broadcaster CNN Türk in an interview. “A crime committed in a consulate cannot be carried out without the knowledge of the senior state officials of that country. If this crime was really carried out as has been said, if the evidence really leads to that conclusion, the situation will be dire and this must have very serious legal consequences.”

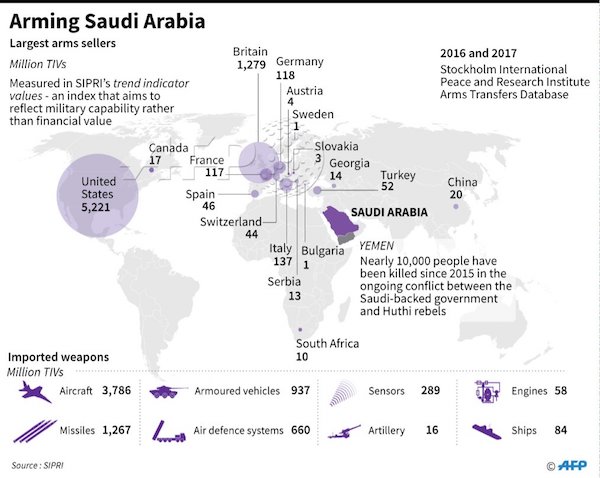

Not that Germany sells all that much.

• No Arms For Riyadh While Khashoggi Questions Remain – Merkel (R.)

Germany will not export arms to Saudi Arabia while the current uncertainty over the fate of journalist Jamal Khashoggi persists, Chancellor Angela Merkel said on Sunday. Campaigning for her party in a regional election, Merkel repeated to a news conference her earlier condemnation of Khashoggi’s killing, which Saudi Arabia admitted had taken place inside its consulate in Istanbul. “First, we condemn this act in the strongest terms,” she said. “Second, there is an urgent need to clarify what happened – we are far from this having been cleared up and those responsible held to account … As far as arms exports are concerned, those can’t take place in the current circumstances.”

But look at the UK. Will they stop arms exports?

• Germany Urges Other EU States To Also Stop Arms Exports To Saudi Arabia

Germany wants other European Union member states to follow its example in stopping arms exports to Saudi Arabia as long as uncertainty remains over the killing of journalist Jamal Khashoggi, Economy Minister Peter Altmaier said on Monday. Riyadh has given multiple and conflicting accounts on what led to Khashoggi’s death on Oct. 2 at its consulate in Istanbul. On Sunday, Foreign Minister Adel al-Jubeir called the killing a “huge and grave mistake” but sought to shield Saudi Arabia’s powerful crown prince. Chancellor Angela Merkel said on Sunday that Germany would stop arms exports to Saudi Arabia as long as the uncertainty around Khashoggi’s death persisted.

Altmaier, a close ally of Merkel, said Riyadh’s explanations on the case so far had not been satisfactory. “The government is in agreement that we will not approve further arms exports for the moment because we want to know what happened,” Altmaier told ZDF broadcaster. So far this year the German government had approved weapons exports worth more than 400 million euros ($462 million) to Saudi Arabia, making it the second-biggest recipient of German arms after Algeria. [..] Altmaier said other EU states should stop arms exports to Saudi Arabia in order to increase pressure on Riyadh over the Khashoggi case. “For me it would be important that we come to a joint European stance,” Altmaier said.

A popular job.

• Merkel to Resign: ‘Wants To Replace Juncker As European Commission Chief’ (VoE)

Bavaria’s state election last weekend proved painful for German Chancellor Angela Merkel. In yet another election next week, Ms. Merkel is expected to see further discomfiture. The German leader could resign from her post at the December CDU party conference in December in order to take another senior European position. “Rumours are swirling in Brussels that Merkel could run for the European Commission next year”, Die Welt’s Stefanie Bolzen tells the BBC. As Jean-Claude Juncker gets ready to retire as European Commission President next year, there have been suggestions that French President Emanuel Macron is considering a run, Italy’s fierce and most popular politician in Italy’s history Deputy Prime Minister Matteo Salvini has also been asked to run, and now Germany’s Chancellor Angela Merkel could potentially be throwing her hat into the ring.

May the best Italian win!

What happens when the vigilantes decide it’s time?

• Italian Bank Fears Expected To Grow After Debt Downgrade (G.)

Fears that Italy’s banks face a black hole in their finances are expected to grow this week following a debt downgrade that could send the value of bank reserves plummeting. Despite efforts to shore up Italian banks’ reserves, a downgrade by the ratings agency Moody’s on Friday following a row between Rome and Brussels over the government’s budget could send them into freefall again. A senior government official added to the tension on Sunday by issuing a warning that Italy should not ignore the deteriorating financial situation and its effect on the country’s banks, including possible capital needs. Giancarlo Giorgetti said in a newspaper interview that a fire sale of Italian government bonds over the last five months had put huge pressure on bank reserves and could trigger a second crisis in two years.

The budget plans of Italy‘s populist government, which breach EU borrowing rules, have prompted investors to shed €67bn ($77bn) of Italian government bonds since May. The effect has been to push values down and the interest rate on government bonds, referred to as the yield, to more than three percentage points higher than safer German bonds. “The increase in the [bond yield] spread, the amount of public debt banks hold and new European Union banking rules put the industry under pressure and may generate the need to recapitalise the most fragile lenders,” said Giorgetti, who is an influential member of the far-right League, one of the two parties in Italy’s ruling coalition.

But the remaining 5% were always the hardest, so nothing really changed.

• Brexit Deal Is 95% Settled, Theresa May To Tell Commons (G.)

Theresa May will tell the Commons on Monday that 95% of the Brexit withdrawal agreement and its protocols are settled as she seeks to demonstrate to anxious MPs in her own party that she is making headway in the increasingly fraught divorce talks. The prime minister is expected to confirm she has resolved with the EU the future status of Gibraltar, developed a protocol around the UK’s military base in Cyprus and agreed a mechanism for resolving any future disputes with the EU.

Taking the unusual step of briefing planned remarks to the Commons in advance, May will conclude that “taking all of this together, 95% of the withdrawal agreement and its protocols are now settled” in talks that she has until now largely insisted on keeping secret. The prime minister is scheduled to make a statement on Monday afternoon, after intense criticism from the Tory right for appearing to have made no progress other than indicating at last week’s European summit that she was open to extending the post-Brexit transition period, prompting renewed speculation about a leadership challenge.

A clearly rattled Downing Street held two conference calls with cabinet ministers over the weekend to update them on the European summit before a cabinet discussion on Brexit on Tuesday. Concerns were raised about the transition period and time-limiting the Irish backstop. “No one is in the mood to be bounced,” said one cabinet source. May intends to show the progress made by highlighting all the specific areas of agreement already reached, including settling the divorce bill at £39bn, having an implementation period until at least the end of 2020 and recognising the rights of EU citizens living in the UK and vice versa.

Down under goes further down.

• Sydney Property Slowdown Bites As Auction Clearance Rates Tumble (G.)

Sydney’s housing market is facing the toughest conditions since the global financial crisis after auction rates slumped again at the weekend, with analysts predicting that the slowdown could get much worse in the months ahead. Australia’s biggest city saw only 44% of 567 listed properties sold at the weekend, according to Domain, the lowest preliminary clearance rate for a decade. The figure is likely to be revised down below 40%, a level of downturn not seen for a decade. The last time rates were in the 30% range was November 2008, at the peak of the global financial crisis. The two instances before that were May 2004, when New South Wales introduced vendor stamp duty, and July 1989, when interest rates were 17%.

Equally striking is the collapse in the total amount changing hands at auctions across the city, which sank to $160m at the weekend compared with $484m on the same weekend a year ago – a drop of about two-thirds. The decline in the property market, which AMP’s chief economist, Shane Oliver, thinks could fall 20% before bottoming out in 2020, has been most marked in Sydney where prices are down around 6.3% from the peak in 2017 as buyers drop out owing to tougher credit standards and falling confidence. The clearance rate in Melbourne at the weekend was below 50% on a much greater number of properties (nearly 1,000). But the dollar volume of auction sales shows a similar decline across the country, where buyers spent $453m at the weekend compared with $1.3bn the same weekend last year.