Salvador Dali Portrait of Gala with Two Lamb Chops Balanced on Her Shoulder 1933

Ilargi: It’s been quite a while since we last heard from Dr. D. He was probably busy growing stuff. But he’s back now, and with something dear to my heart: the craziness of our food production systems. Answers to which are not always what most people think, to put it mildly.

Dr. D:

Eat less meat to save the planet – report (1)

The new diet that could save the planet (2)

What to eat to save the planet: Report urges ‘radical changes’ to world’s diet – less meat, more veggies (3)

These headlines, likely sourced from a recent article from “The Lancet” (4) are a regular feature of our time, in diet, in environmentalism, and in global warming. They are well-researched, sourced by the world’s experts, and put forward with the highest intentions. However, they are also completely wrong – dangerously, ignorantly wrong.

Like most industries, agriculture and food production is a specialty, with its own language and details. I don’t attempt to tell the Lancet how to perform heart surgery, for to do so would be ridiculous, dangerous, outside of my expertise. I wouldn’t tell a geologist how to interpret the magnetic layers of rock, or how oceanographers should properly interpret sea water samples to guide us on fishing or pollution. Yet this is what they do for farmers.

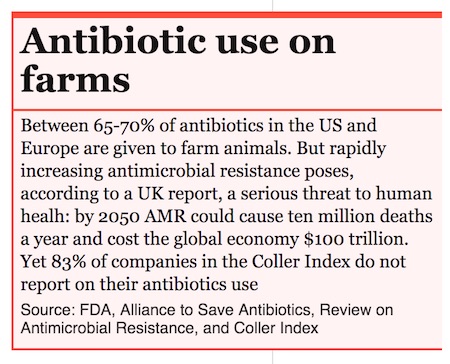

The primary drive of most such articles is that, with so many people, and so much hunger, we find that it takes “2,500 gallons of water, 12 pounds of grain, 35 pounds of topsoil and the energy equivalent of one gallon of gasoline to produce one pound of feedlot beef.” that “64% of US cropland produces livestock feed.” (5) That it takes “20 pounds corn [to make] 1 pound beef.” (6) Or that you can get 15lbs of beef per acre, but 263lbs of soybeans. (7) Also that cattle are the primary reason for deforestation, and a major cause of methane.

From these numbers, it’s simple to see that meat, particularly cattle, is anti-environmental, and even anti-human, and it would be the pinnacle of irresponsibility to encourage or even allow them to be eaten. It is a direct affront to the poor, the hungry, and even other citizens in developed countries like ourselves, even though we may be able to afford such things. Simple. A lock. Slam-dunk. No further research required.

Setting aside that we waste half our food, the food we do have is maldistributed, and that we haven’t tapped a fraction of the land we did in say, WWII Britain, setting aside that the water doesn’t vanish, but returns to the water table to be used again, setting aside that the methane released does not contribute to global warming since it is exclusively carbon captured by the grass earlier that year, setting aside that the argument is the same one Malthus had, 250 years wrong, or that removing cattle would amount to the permanent extinction of more than a thousand breeds of animals with a lineage thousands of years old … even all that aside, their argument shows they don’t know anything about land, food, or the process of creating it.

Some other major concerns of economists and environmentalists are 1) environmental destruction from drilling 2) peak oil, 3) production of toxic waste, 4) plastics packaging, 5) dependence on imported energy, 6) CO2 from cars and transportation, and 7) BTUs per calorie of food eaten, as popularized in Kunstler’s “3,000 mile Caesar salad” (8) and this is where our story starts.

Deck Family Farm

On a farm, one of the major input costs every year is fertilizer, nitrogen, and this is presently produced almost exclusively from a feedstock of natural gas. That is to say, food in the modern agricultural system is literally the eating of unsustainable oil wells. And it’s even worse than that: agriculture is so dependent on synthesized, centralized petroleum fertilizer that it’s no exaggeration to say that without massive, uninterrupted supplies of cheap oil and gas there would be no food. Yields could easily drop by 30%, causing an unprecedented human catastrophe.

What’s more, another of the environmentalists’ grave concerns, topsoil loss and soil depletion would immediately come to the fore, as the only thing keeping today’s depleted fields in production are the artificial inputs directly from oil fields, mostly imported. –And that’s ABOVE the oil needed for the tractors, for the harvesters, for the delivery, for the centralized plant, for the parts, the buildings, food wrapping, for the creation of pesticides, herbicides, the centralized seed production, centralized grain mills…no. For the purposes of this article, we are only talking about cows.

Of course, mankind didn’t start this way, unable to eat a lettuce leaf without a 10,000-mile chain of energy use from foreign, occupied nations and the unwavering support of the worldwide industrial society that supports it. Originally the cows stood on the very grass they ate, eating contentedly, and were butchered and sent to market locally, using not a drop of oil. They did not disturb the fields but indeed enriched them with their foot-traffic and manure. So how did we go from a 0 mile, 0 grain, 0 cost, 0 oil food source to a food that reportedly starves continents and will destroy the world? That is, if cows were good and worked before, maybe the problem lies not with the meat or the cow, but with rabid industrialism?

If petroleum-based fertilizer is our major weakness, the single import that can be shut off to kill billions, surely it’s our duty — a national security emergency even — to close this weakness and find ecological alternatives. And for fertilizer, we have two: one, you can rotate crops to keep fields fallow in rotation, or two, you can replace synthetic fertilizer with animal manure. In fact, synthetic fertilizer is but a poor, harmful replacement for the manure farmers have used for 5,000 years – it has only nitrogen, potassium and potash, and nothing of the thousand other nutrients required of healthy soil.

It has no biosphere, no heat, no water, and no organic matter. The resulting soil depletion is a prime cause of desertification and topsoil loss, to say nothing of constantly lower yields. Its very use destroys the soil in the way steroids destroy health while giving the illusion of strength. They should probably be banned not for environmental reasons, but for long-term efficiency and national security. And there is only one replacement for this toxic, destructive, unreliable, expensive input: animal manure.

Worse, this cannot be chicken, sheep, or pig, adequate as they are. Pig and chicken are too concentrated and toxic and require other petroleum processes to dilute and deliver. Sheep is too mild and not in quantity, for sheep do not favor containment. Home composting could never produce a fraction of the volume needed for the world’s fields without the same massive petroleum inputs in tractors, trucks, chippers, conveyors, and all the factories, railways, and steel mills that create them. That leaves largely one source: cattle.

So in this new ecological world we imagine, we would have to grow cattle simply for the required fertilizer. And these cattle cannot be far! Unlike synthetic fertilizer, manure is wet, heavy, and dilute. It cannot be centralized into today’s poisonous sewage ponds, nor shipped coast to coast: it must be created near the fields that require it. As the world is enormously varied, you must also have breeds attuned to each locality’s weather and needs, perhaps creating a thousand unique varieties.

Tiny Kerry cattle for the bogs of Ireland, bony Longhorns for the deserts of Texas, Alpine Braunvieh for the steep mountains of Switzerland, or a hearty Fjäll for the frozen lands of Sweden. Nor can the farms be concentrated or specialized: without mass inputs of machinery or petroleum, and lacking harmful dry fertilizer, the farms must be small, dispersed, and varied, local in scope, diverse in production, specializing in their region and feeding only people nearby. Once you can’t ship mass quantities virtually for free, from reliable, nearly free energy, there is no other way.

Earth Repair Corps

Now you can’t get that fertilizer for nothing, and we don’t get it for nothing now. You have to have input costs for our fertilizer factory. And for cattle that input is grass; fields and fields of it, probably near 1-2 acres per cow. Is that bad? Irresponsible? How does that compare to drilling in ANWAR, and delivering via the Exxon Valdez? How is the sourcing from Iraq, transported via Syria, or the digging of tar with a payloader in the freshwater swamps of Alberta?

Now you can get 1, 2, even 3 cuttings a year of hay in temperate climates, and the cow is happily producing this valuable fertilizer all the time, without embargoes, financial disruptions, or delivery costs. But nevertheless, 25% of your fields will be put out of service in order to environmentally, sustainably source this necessary input for next year’s grain.

But not to fear! You know what? You can EAT the components of this essential, life sustaining fertilizer production factory! Yes, you can! Even better, you can eat butter, cheese, yogurt and yes, even ice cream! These very things you would NOT have without running this fertilizer mill that you would be forced to run even if they did nothing at all. Even more, you can down-stream the whey from your milk-preservative process to feed pigs! I’m not making this up!

Yes, by the very fact of creating fertilizer you had to produce in any case, you can also eat bacon! And you essentially have to, because otherwise this valuable milk-byproduct will go to waste. Nor can the pigs be far. You must have farms that are small in scale, varied in production, and local to the community. This will, of course, make them especially resilient to every challenge: financial, ecological, or human, be it from global warming or global warring.

The diverse, smaller-scale of these farms unfortunately require smaller business units to run them, such as the millions of local families presently unemployed, and sadly force cattle and other animals to free-range on the fields in the sunshine, as their ancestors did. But we all make sacrifices.

More, this small, diverse, decentralized food production system cannot aggregate mass quantities for mass market. Cows are not all the same, arriving by tens of thousands in the same 100-acre slaughterhouse, but because dissimilarity hampers assembly-line processes, the food would be produced in smaller batches, closer to home, more directly, without the wasting fuel and CO2 to ship them worldwide, and without the 31 flavors of plastics packaging which don’t make economic sense at this scale. –The French market model, as it were, local in the streets of your own town, fresh and unique.

You see, what they didn’t ask and forgot to research is that in order to grow those 263lbs of soybeans, you have no alternative but to have 1:4 of your fields fallow, resting, doing nothing. That’s now 197lbs per acre. Neither can you do that every year without input, so using another field to add this fertilizer, you have 131lbs/acre, really. The fallow land required of a world without oil inputs means 1/2 of the world’s production is offline at any given time, starving people.

What a drag! But you COULD, if you’re very clever, plant a wild, nitrogen-fixing plant on that fallow ground, creating both green manure for next year’s soybeans, AND running your cattle-driven fertilizer factory at no additional cost! Not only do you get the ONE field green-manured, and ANOTHER field cow-manured, but you could, if you’re very smart, get that otherwise useless, fallow field to grow ANOTHER crop of milk and beef, and downstream, chickens and pigs, absolutely FREE! THREE fields for the price of one.

What would you expect to pay for this richness, this agricultural, ecological magic trick? $1 trillion? $5 trillion for our green-energy, planet-saving, CO2-reducing “Green New Deal”? One that’s proven and can actually work because it follows the laws of thermodynamics? Surely it’s worth any cost if it saves the planet and takes a huge chunk off oil drilling, oil wars, and global warming.

Answer is: nothing. What I’ve just described is western agriculture, as developed since the 1500s. Anyone who’s ever looked at a farm, read a wikipedia entry, or took a history class knows this. Every medieval peasant knows this. Every hillbilly farmer from Iowa knows this. Except for all the modern journalists and The Lancet, all of whom all eat these very foods every day without the slightest spark of where they come from.

Night Owl Farm

You see, it doesn’t matter if cows are less efficient than soybeans, they exist in a SYSTEM, and that system has many inputs and many parameters. Reading a statistic doesn’t grow a plant to market any more than my reading about scalpels makes me a surgeon. There are many other possibilities, requirements, inputs: they speak of overgrazing, such as dry lands in Africa, when in fact, rotational OVERgrazing replenishes the soil and INCREASES the yields.

What’s more, a very great deal of the reported “arable” land on earth is not productive. It is too dry, such as Texas; too steep, such as Colorado; too variable cold, like Montana; or too far from market, like Afghanistan. You can’t grow soybeans or corn there even if you wanted, and you couldn’t ship kale from Kabul to London at cost, so their “statistics” about arable land and production mean nothing. …Worse than nothing, as they are so misleading as to be completely wrong.

Wrong in the way that enormous, world-changing decisions, subsidies, and wars are made, wrong in the way Stalin thought to modernize and mechanize agriculture in the Ukraine to get it out of the 1500s, and killed 7 million people in a single year. Wrong because not every square mile of land is equivalent, and only the crop that grows and has enough value to ship can be produced there. That’s why they make whiskey in the Appalachians and cheese in the Alps: the value to market has to be so much higher, high enough to transport, or no food will be produced at all.

That’s why they grow wild pigs in the Dehesa of Spain: because otherwise those forests would feed no one. But scientists and journalists don’t know this, even though it’s on the Food Channel each night.

What’s more, their scientific white-room system is orders of magnitude less efficient than the medieval method. Hundreds of random foods are wasted on the farm. Should they be dropped, as the labor cost/hour is too high to economically recover them? Should we waste the time and petrol to compost them into biogas? No. Farm waste, and waste through every warehouse, rail car, grocer, and restaurant can be eaten by chickens. Then not only do you get the compost anyway, in manure, not only do you also get a lifetime of eggs, for free, YOU GET A CHICKEN. All from the grass, the seeds, the bugs…and the food waste they already abandon.

But this doesn’t come without a cost. Brace yourself for this, people, because in order to achieve this level of bounty and efficiency, you will have to EAT these animals rather than let them die of old age and disease and be eaten by dogs and beetles. You, yes you, if you want an ecological, happy-animal, local-economy, sustainable, anti-CO2, food-producing world, not only CAN eat meat, but you are REQUIRED to. …As did a thousand generations of your ancestors, back to the very first day of man, slashing and clearing a field so the deer would come.

So try to be at least as smart as an illiterate medieval peasant and grow your food the natural way: locally, seasonally, independently, with happy animals in a rich green world of fields, trees and farms enriched with thousands of subvarieties of biodiversity in hedgerows so rich they have yet to be fully cataloged. A far cry from the hardened, drilled, paved, expensive, destructive, unsustainable, dangerous, lethal, impoverished way promoted by the scientific experts and the journalists who cover them.